How to Write a Business Plan: Step-by-Step Guide + Examples

Noah Parsons

24 min. read

Updated March 18, 2024

Writing a business plan doesn’t have to be complicated.

In this step-by-step guide, you’ll learn how to write a business plan that’s detailed enough to impress bankers and potential investors, while giving you the tools to start, run, and grow a successful business.

- The basics of business planning

If you’re reading this guide, then you already know why you need a business plan .

You understand that planning helps you:

- Raise money

- Grow strategically

- Keep your business on the right track

As you start to write your plan, it’s useful to zoom out and remember what a business plan is .

At its core, a business plan is an overview of the products and services you sell, and the customers that you sell to. It explains your business strategy: how you’re going to build and grow your business, what your marketing strategy is, and who your competitors are.

Most business plans also include financial forecasts for the future. These set sales goals, budget for expenses, and predict profits and cash flow.

A good business plan is much more than just a document that you write once and forget about. It’s also a guide that helps you outline and achieve your goals.

After completing your plan, you can use it as a management tool to track your progress toward your goals. Updating and adjusting your forecasts and budgets as you go is one of the most important steps you can take to run a healthier, smarter business.

We’ll dive into how to use your plan later in this article.

There are many different types of plans , but we’ll go over the most common type here, which includes everything you need for an investor-ready plan. However, if you’re just starting out and are looking for something simpler—I recommend starting with a one-page business plan . It’s faster and easier to create.

It’s also the perfect place to start if you’re just figuring out your idea, or need a simple strategic plan to use inside your business.

Dig deeper : How to write a one-page business plan

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

- What to include in your business plan

Executive summary

The executive summary is an overview of your business and your plans. It comes first in your plan and is ideally just one to two pages. Most people write it last because it’s a summary of the complete business plan.

Ideally, the executive summary can act as a stand-alone document that covers the highlights of your detailed plan.

In fact, it’s common for investors to ask only for the executive summary when evaluating your business. If they like what they see in the executive summary, they’ll often follow up with a request for a complete plan, a pitch presentation , or more in-depth financial forecasts .

Your executive summary should include:

- A summary of the problem you are solving

- A description of your product or service

- An overview of your target market

- A brief description of your team

- A summary of your financials

- Your funding requirements (if you are raising money)

Dig Deeper: How to write an effective executive summary

Products and services description

This is where you describe exactly what you’re selling, and how it solves a problem for your target market. The best way to organize this part of your plan is to start by describing the problem that exists for your customers. After that, you can describe how you plan to solve that problem with your product or service.

This is usually called a problem and solution statement .

To truly showcase the value of your products and services, you need to craft a compelling narrative around your offerings. How will your product or service transform your customers’ lives or jobs? A strong narrative will draw in your readers.

This is also the part of the business plan to discuss any competitive advantages you may have, like specific intellectual property or patents that protect your product. If you have any initial sales, contracts, or other evidence that your product or service is likely to sell, include that information as well. It will show that your idea has traction , which can help convince readers that your plan has a high chance of success.

Market analysis

Your target market is a description of the type of people that you plan to sell to. You might even have multiple target markets, depending on your business.

A market analysis is the part of your plan where you bring together all of the information you know about your target market. Basically, it’s a thorough description of who your customers are and why they need what you’re selling. You’ll also include information about the growth of your market and your industry .

Try to be as specific as possible when you describe your market.

Include information such as age, income level, and location—these are what’s called “demographics.” If you can, also describe your market’s interests and habits as they relate to your business—these are “psychographics.”

Related: Target market examples

Essentially, you want to include any knowledge you have about your customers that is relevant to how your product or service is right for them. With a solid target market, it will be easier to create a sales and marketing plan that will reach your customers. That’s because you know who they are, what they like to do, and the best ways to reach them.

Next, provide any additional information you have about your market.

What is the size of your market ? Is the market growing or shrinking? Ideally, you’ll want to demonstrate that your market is growing over time, and also explain how your business is positioned to take advantage of any expected changes in your industry.

Dig Deeper: Learn how to write a market analysis

Competitive analysis

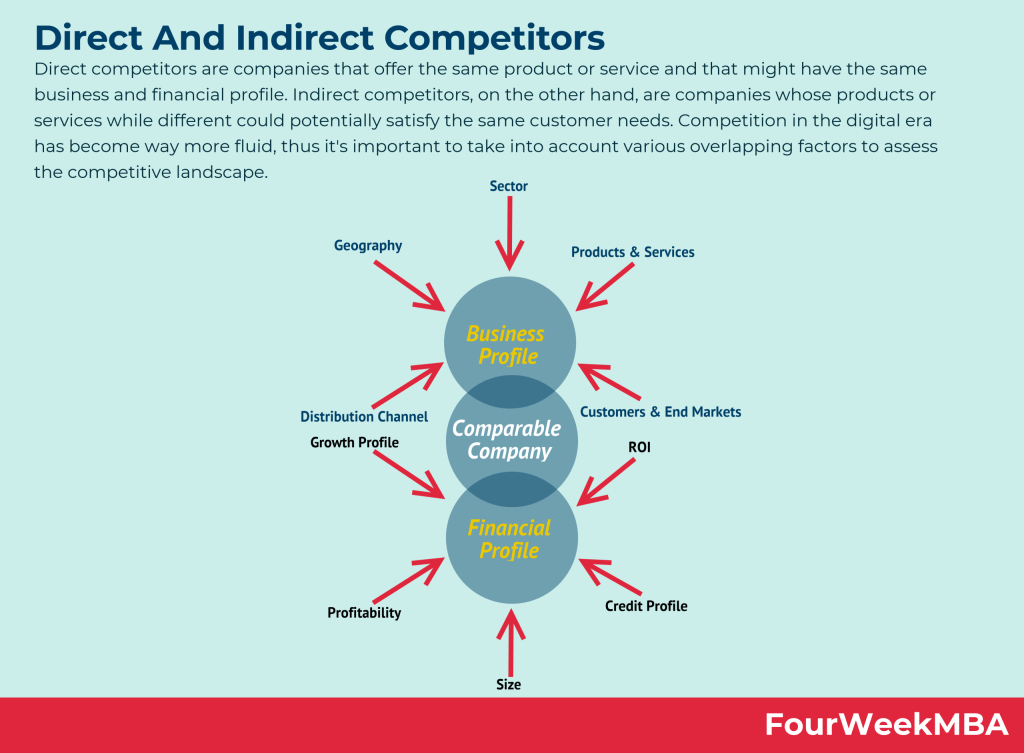

Part of defining your business opportunity is determining what your competitive advantage is. To do this effectively, you need to know as much about your competitors as your target customers.

Every business has some form of competition. If you don’t think you have competitors, then explore what alternatives there are in the market for your product or service.

For example: In the early years of cars, their main competition was horses. For social media, the early competition was reading books, watching TV, and talking on the phone.

A good competitive analysis fully lays out the competitive landscape and then explains how your business is different. Maybe your products are better made, or cheaper, or your customer service is superior. Maybe your competitive advantage is your location – a wide variety of factors can ultimately give you an advantage.

Dig Deeper: How to write a competitive analysis for your business plan

Marketing and sales plan

The marketing and sales plan covers how you will position your product or service in the market, the marketing channels and messaging you will use, and your sales tactics.

The best place to start with a marketing plan is with a positioning statement .

This explains how your business fits into the overall market, and how you will explain the advantages of your product or service to customers. You’ll use the information from your competitive analysis to help you with your positioning.

For example: You might position your company as the premium, most expensive but the highest quality option in the market. Or your positioning might focus on being locally owned and that shoppers support the local economy by buying your products.

Once you understand your positioning, you’ll bring this together with the information about your target market to create your marketing strategy .

This is how you plan to communicate your message to potential customers. Depending on who your customers are and how they purchase products like yours, you might use many different strategies, from social media advertising to creating a podcast. Your marketing plan is all about how your customers discover who you are and why they should consider your products and services.

While your marketing plan is about reaching your customers—your sales plan will describe the actual sales process once a customer has decided that they’re interested in what you have to offer.

If your business requires salespeople and a long sales process, describe that in this section. If your customers can “self-serve” and just make purchases quickly on your website, describe that process.

A good sales plan picks up where your marketing plan leaves off. The marketing plan brings customers in the door and the sales plan is how you close the deal.

Together, these specific plans paint a picture of how you will connect with your target audience, and how you will turn them into paying customers.

Dig deeper: What to include in your sales and marketing plan

Business operations

The operations section describes the necessary requirements for your business to run smoothly. It’s where you talk about how your business works and what day-to-day operations look like.

Depending on how your business is structured, your operations plan may include elements of the business like:

- Supply chain management

- Manufacturing processes

- Equipment and technology

- Distribution

Some businesses distribute their products and reach their customers through large retailers like Amazon.com, Walmart, Target, and grocery store chains.

These businesses should review how this part of their business works. The plan should discuss the logistics and costs of getting products onto store shelves and any potential hurdles the business may have to overcome.

If your business is much simpler than this, that’s OK. This section of your business plan can be either extremely short or more detailed, depending on the type of business you are building.

For businesses selling services, such as physical therapy or online software, you can use this section to describe the technology you’ll leverage, what goes into your service, and who you will partner with to deliver your services.

Dig Deeper: Learn how to write the operations chapter of your plan

Key milestones and metrics

Although it’s not required to complete your business plan, mapping out key business milestones and the metrics can be incredibly useful for measuring your success.

Good milestones clearly lay out the parameters of the task and set expectations for their execution. You’ll want to include:

- A description of each task

- The proposed due date

- Who is responsible for each task

If you have a budget, you can include projected costs to hit each milestone. You don’t need extensive project planning in this section—just list key milestones you want to hit and when you plan to hit them. This is your overall business roadmap.

Possible milestones might be:

- Website launch date

- Store or office opening date

- First significant sales

- Break even date

- Business licenses and approvals

You should also discuss the key numbers you will track to determine your success. Some common metrics worth tracking include:

- Conversion rates

- Customer acquisition costs

- Profit per customer

- Repeat purchases

It’s perfectly fine to start with just a few metrics and grow the number you are tracking over time. You also may find that some metrics simply aren’t relevant to your business and can narrow down what you’re tracking.

Dig Deeper: How to use milestones in your business plan

Organization and management team

Investors don’t just look for great ideas—they want to find great teams. Use this chapter to describe your current team and who you need to hire . You should also provide a quick overview of your location and history if you’re already up and running.

Briefly highlight the relevant experiences of each key team member in the company. It’s important to make the case for why yours is the right team to turn an idea into a reality.

Do they have the right industry experience and background? Have members of the team had entrepreneurial successes before?

If you still need to hire key team members, that’s OK. Just note those gaps in this section.

Your company overview should also include a summary of your company’s current business structure . The most common business structures include:

- Sole proprietor

- Partnership

Be sure to provide an overview of how the business is owned as well. Does each business partner own an equal portion of the business? How is ownership divided?

Potential lenders and investors will want to know the structure of the business before they will consider a loan or investment.

Dig Deeper: How to write about your company structure and team

Financial plan

Last, but certainly not least, is your financial plan chapter.

Entrepreneurs often find this section the most daunting. But, business financials for most startups are less complicated than you think, and a business degree is certainly not required to build a solid financial forecast.

A typical financial forecast in a business plan includes the following:

- Sales forecast : An estimate of the sales expected over a given period. You’ll break down your forecast into the key revenue streams that you expect to have.

- Expense budget : Your planned spending such as personnel costs , marketing expenses, and taxes.

- Profit & Loss : Brings together your sales and expenses and helps you calculate planned profits.

- Cash Flow : Shows how cash moves into and out of your business. It can predict how much cash you’ll have on hand at any given point in the future.

- Balance Sheet : A list of the assets, liabilities, and equity in your company. In short, it provides an overview of the financial health of your business.

A strong business plan will include a description of assumptions about the future, and potential risks that could impact the financial plan. Including those will be especially important if you’re writing a business plan to pursue a loan or other investment.

Dig Deeper: How to create financial forecasts and budgets

This is the place for additional data, charts, or other information that supports your plan.

Including an appendix can significantly enhance the credibility of your plan by showing readers that you’ve thoroughly considered the details of your business idea, and are backing your ideas up with solid data.

Just remember that the information in the appendix is meant to be supplementary. Your business plan should stand on its own, even if the reader skips this section.

Dig Deeper : What to include in your business plan appendix

Optional: Business plan cover page

Adding a business plan cover page can make your plan, and by extension your business, seem more professional in the eyes of potential investors, lenders, and partners. It serves as the introduction to your document and provides necessary contact information for stakeholders to reference.

Your cover page should be simple and include:

- Company logo

- Business name

- Value proposition (optional)

- Business plan title

- Completion and/or update date

- Address and contact information

- Confidentiality statement

Just remember, the cover page is optional. If you decide to include it, keep it very simple and only spend a short amount of time putting it together.

Dig Deeper: How to create a business plan cover page

How to use AI to help write your business plan

Generative AI tools such as ChatGPT can speed up the business plan writing process and help you think through concepts like market segmentation and competition. These tools are especially useful for taking ideas that you provide and converting them into polished text for your business plan.

The best way to use AI for your business plan is to leverage it as a collaborator , not a replacement for human creative thinking and ingenuity.

AI can come up with lots of ideas and act as a brainstorming partner. It’s up to you to filter through those ideas and figure out which ones are realistic enough to resonate with your customers.

There are pros and cons of using AI to help with your business plan . So, spend some time understanding how it can be most helpful before just outsourcing the job to AI.

Learn more: 10 AI prompts you need to write a business plan

- Writing tips and strategies

To help streamline the business plan writing process, here are a few tips and key questions to answer to make sure you get the most out of your plan and avoid common mistakes .

Determine why you are writing a business plan

Knowing why you are writing a business plan will determine your approach to your planning project.

For example: If you are writing a business plan for yourself, or just to use inside your own business , you can probably skip the section about your team and organizational structure.

If you’re raising money, you’ll want to spend more time explaining why you’re looking to raise the funds and exactly how you will use them.

Regardless of how you intend to use your business plan , think about why you are writing and what you’re trying to get out of the process before you begin.

Keep things concise

Probably the most important tip is to keep your business plan short and simple. There are no prizes for long business plans . The longer your plan is, the less likely people are to read it.

So focus on trimming things down to the essentials your readers need to know. Skip the extended, wordy descriptions and instead focus on creating a plan that is easy to read —using bullets and short sentences whenever possible.

Have someone review your business plan

Writing a business plan in a vacuum is never a good idea. Sometimes it’s helpful to zoom out and check if your plan makes sense to someone else. You also want to make sure that it’s easy to read and understand.

Don’t wait until your plan is “done” to get a second look. Start sharing your plan early, and find out from readers what questions your plan leaves unanswered. This early review cycle will help you spot shortcomings in your plan and address them quickly, rather than finding out about them right before you present your plan to a lender or investor.

If you need a more detailed review, you may want to explore hiring a professional plan writer to thoroughly examine it.

Use a free business plan template and business plan examples to get started

Knowing what information you need to cover in a business plan sometimes isn’t quite enough. If you’re struggling to get started or need additional guidance, it may be worth using a business plan template.

If you’re looking for a free downloadable business plan template to get you started, download the template used by more than 1 million businesses.

Or, if you just want to see what a completed business plan looks like, check out our library of over 550 free business plan examples .

We even have a growing list of industry business planning guides with tips for what to focus on depending on your business type.

Common pitfalls and how to avoid them

It’s easy to make mistakes when you’re writing your business plan. Some entrepreneurs get sucked into the writing and research process, and don’t focus enough on actually getting their business started.

Here are a few common mistakes and how to avoid them:

Not talking to your customers : This is one of the most common mistakes. It’s easy to assume that your product or service is something that people want. Before you invest too much in your business and too much in the planning process, make sure you talk to your prospective customers and have a good understanding of their needs.

- Overly optimistic sales and profit forecasts: By nature, entrepreneurs are optimistic about the future. But it’s good to temper that optimism a little when you’re planning, and make sure your forecasts are grounded in reality.

- Spending too much time planning: Yes, planning is crucial. But you also need to get out and talk to customers, build prototypes of your product and figure out if there’s a market for your idea. Make sure to balance planning with building.

- Not revising the plan: Planning is useful, but nothing ever goes exactly as planned. As you learn more about what’s working and what’s not—revise your plan, your budgets, and your revenue forecast. Doing so will provide a more realistic picture of where your business is going, and what your financial needs will be moving forward.

- Not using the plan to manage your business: A good business plan is a management tool. Don’t just write it and put it on the shelf to collect dust – use it to track your progress and help you reach your goals.

- Presenting your business plan

The planning process forces you to think through every aspect of your business and answer questions that you may not have thought of. That’s the real benefit of writing a business plan – the knowledge you gain about your business that you may not have been able to discover otherwise.

With all of this knowledge, you’re well prepared to convert your business plan into a pitch presentation to present your ideas.

A pitch presentation is a summary of your plan, just hitting the highlights and key points. It’s the best way to present your business plan to investors and team members.

Dig Deeper: Learn what key slides should be included in your pitch deck

Use your business plan to manage your business

One of the biggest benefits of planning is that it gives you a tool to manage your business better. With a revenue forecast, expense budget, and projected cash flow, you know your targets and where you are headed.

And yet, nothing ever goes exactly as planned – it’s the nature of business.

That’s where using your plan as a management tool comes in. The key to leveraging it for your business is to review it periodically and compare your forecasts and projections to your actual results.

Start by setting up a regular time to review the plan – a monthly review is a good starting point. During this review, answer questions like:

- Did you meet your sales goals?

- Is spending following your budget?

- Has anything gone differently than what you expected?

Now that you see whether you’re meeting your goals or are off track, you can make adjustments and set new targets.

Maybe you’re exceeding your sales goals and should set new, more aggressive goals. In that case, maybe you should also explore more spending or hiring more employees.

Or maybe expenses are rising faster than you projected. If that’s the case, you would need to look at where you can cut costs.

A plan, and a method for comparing your plan to your actual results , is the tool you need to steer your business toward success.

Learn More: How to run a regular plan review

Free business plan templates and examples

Kickstart your business plan writing with one of our free business plan templates or recommended tools.

Free business plan template

Download a free SBA-approved business plan template built for small businesses and startups.

Download Template

One-page plan template

Download a free one-page plan template to write a useful business plan in as little as 30-minutes.

Sample business plan library

Explore over 500 real-world business plan examples from a wide variety of industries.

View Sample Plans

How to write a business plan FAQ

What is a business plan?

A document that describes your business , the products and services you sell, and the customers that you sell to. It explains your business strategy, how you’re going to build and grow your business, what your marketing strategy is, and who your competitors are.

What are the benefits of a business plan?

A business plan helps you understand where you want to go with your business and what it will take to get there. It reduces your overall risk, helps you uncover your business’s potential, attracts investors, and identifies areas for growth.

Having a business plan ultimately makes you more confident as a business owner and more likely to succeed for a longer period of time.

What are the 7 steps of a business plan?

The seven steps to writing a business plan include:

- Write a brief executive summary

- Describe your products and services.

- Conduct market research and compile data into a cohesive market analysis.

- Describe your marketing and sales strategy.

- Outline your organizational structure and management team.

- Develop financial projections for sales, revenue, and cash flow.

- Add any additional documents to your appendix.

What are the 5 most common business plan mistakes?

There are plenty of mistakes that can be made when writing a business plan. However, these are the 5 most common that you should do your best to avoid:

- 1. Not taking the planning process seriously.

- Having unrealistic financial projections or incomplete financial information.

- Inconsistent information or simple mistakes.

- Failing to establish a sound business model.

- Not having a defined purpose for your business plan.

What questions should be answered in a business plan?

Writing a business plan is all about asking yourself questions about your business and being able to answer them through the planning process. You’ll likely be asking dozens and dozens of questions for each section of your plan.

However, these are the key questions you should ask and answer with your business plan:

- How will your business make money?

- Is there a need for your product or service?

- Who are your customers?

- How are you different from the competition?

- How will you reach your customers?

- How will you measure success?

How long should a business plan be?

The length of your business plan fully depends on what you intend to do with it. From the SBA and traditional lender point of view, a business plan needs to be whatever length necessary to fully explain your business. This means that you prove the viability of your business, show that you understand the market, and have a detailed strategy in place.

If you intend to use your business plan for internal management purposes, you don’t necessarily need a full 25-50 page business plan. Instead, you can start with a one-page plan to get all of the necessary information in place.

What are the different types of business plans?

While all business plans cover similar categories, the style and function fully depend on how you intend to use your plan. Here are a few common business plan types worth considering.

Traditional business plan: The tried-and-true traditional business plan is a formal document meant to be used when applying for funding or pitching to investors. This type of business plan follows the outline above and can be anywhere from 10-50 pages depending on the amount of detail included, the complexity of your business, and what you include in your appendix.

Business model canvas: The business model canvas is a one-page template designed to demystify the business planning process. It removes the need for a traditional, copy-heavy business plan, in favor of a single-page outline that can help you and outside parties better explore your business idea.

One-page business plan: This format is a simplified version of the traditional plan that focuses on the core aspects of your business. You’ll typically stick with bullet points and single sentences. It’s most useful for those exploring ideas, needing to validate their business model, or who need an internal plan to help them run and manage their business.

Lean Plan: The Lean Plan is less of a specific document type and more of a methodology. It takes the simplicity and styling of the one-page business plan and turns it into a process for you to continuously plan, test, review, refine, and take action based on performance. It’s faster, keeps your plan concise, and ensures that your plan is always up-to-date.

What’s the difference between a business plan and a strategic plan?

A business plan covers the “who” and “what” of your business. It explains what your business is doing right now and how it functions. The strategic plan explores long-term goals and explains “how” the business will get there. It encourages you to look more intently toward the future and how you will achieve your vision.

However, when approached correctly, your business plan can actually function as a strategic plan as well. If kept lean, you can define your business, outline strategic steps, and track ongoing operations all with a single plan.

See why 1.2 million entrepreneurs have written their business plans with LivePlan

Noah is the COO at Palo Alto Software, makers of the online business plan app LivePlan. He started his career at Yahoo! and then helped start the user review site Epinions.com. From there he started a software distribution business in the UK before coming to Palo Alto Software to run the marketing and product teams.

Table of Contents

- Use AI to help write your plan

- Common planning mistakes

- Manage with your business plan

- Templates and examples

Related Articles

6 Min. Read

How to Get and Show Initial Traction for Your Business

How to Write Your Business Plan Cover Page + Template

8 Min. Read

How to Forecast Personnel Costs in 3 Steps

5 Min. Read

How To Write a Business Plan for a Life Coaching Business + Free Example

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Write a Business Plan, Step by Step

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

What is a business plan?

1. write an executive summary, 2. describe your company, 3. state your business goals, 4. describe your products and services, 5. do your market research, 6. outline your marketing and sales plan, 7. perform a business financial analysis, 8. make financial projections, 9. summarize how your company operates, 10. add any additional information to an appendix, business plan tips and resources.

A business plan outlines your business’s financial goals and explains how you’ll achieve them over the next three to five years. Here’s a step-by-step guide to writing a business plan that will offer a strong, detailed road map for your business.

ZenBusiness

A business plan is a document that explains what your business does, how it makes money and who its customers are. Internally, writing a business plan should help you clarify your vision and organize your operations. Externally, you can share it with potential lenders and investors to show them you’re on the right track.

Business plans are living documents; it’s OK for them to change over time. Startups may update their business plans often as they figure out who their customers are and what products and services fit them best. Mature companies might only revisit their business plan every few years. Regardless of your business’s age, brush up this document before you apply for a business loan .

» Need help writing? Learn about the best business plan software .

This is your elevator pitch. It should include a mission statement, a brief description of the products or services your business offers and a broad summary of your financial growth plans.

Though the executive summary is the first thing your investors will read, it can be easier to write it last. That way, you can highlight information you’ve identified while writing other sections that go into more detail.

» MORE: How to write an executive summary in 6 steps

Next up is your company description. This should contain basic information like:

Your business’s registered name.

Address of your business location .

Names of key people in the business. Make sure to highlight unique skills or technical expertise among members of your team.

Your company description should also define your business structure — such as a sole proprietorship, partnership or corporation — and include the percent ownership that each owner has and the extent of each owner’s involvement in the company.

Lastly, write a little about the history of your company and the nature of your business now. This prepares the reader to learn about your goals in the next section.

» MORE: How to write a company overview for a business plan

The third part of a business plan is an objective statement. This section spells out what you’d like to accomplish, both in the near term and over the coming years.

If you’re looking for a business loan or outside investment, you can use this section to explain how the financing will help your business grow and how you plan to achieve those growth targets. The key is to provide a clear explanation of the opportunity your business presents to the lender.

For example, if your business is launching a second product line, you might explain how the loan will help your company launch that new product and how much you think sales will increase over the next three years as a result.

» MORE: How to write a successful business plan for a loan

In this section, go into detail about the products or services you offer or plan to offer.

You should include the following:

An explanation of how your product or service works.

The pricing model for your product or service.

The typical customers you serve.

Your supply chain and order fulfillment strategy.

You can also discuss current or pending trademarks and patents associated with your product or service.

Lenders and investors will want to know what sets your product apart from your competition. In your market analysis section , explain who your competitors are. Discuss what they do well, and point out what you can do better. If you’re serving a different or underserved market, explain that.

Here, you can address how you plan to persuade customers to buy your products or services, or how you will develop customer loyalty that will lead to repeat business.

Include details about your sales and distribution strategies, including the costs involved in selling each product .

» MORE: R e a d our complete guide to small business marketing

If you’re a startup, you may not have much information on your business financials yet. However, if you’re an existing business, you’ll want to include income or profit-and-loss statements, a balance sheet that lists your assets and debts, and a cash flow statement that shows how cash comes into and goes out of the company.

Accounting software may be able to generate these reports for you. It may also help you calculate metrics such as:

Net profit margin: the percentage of revenue you keep as net income.

Current ratio: the measurement of your liquidity and ability to repay debts.

Accounts receivable turnover ratio: a measurement of how frequently you collect on receivables per year.

This is a great place to include charts and graphs that make it easy for those reading your plan to understand the financial health of your business.

This is a critical part of your business plan if you’re seeking financing or investors. It outlines how your business will generate enough profit to repay the loan or how you will earn a decent return for investors.

Here, you’ll provide your business’s monthly or quarterly sales, expenses and profit estimates over at least a three-year period — with the future numbers assuming you’ve obtained a new loan.

Accuracy is key, so carefully analyze your past financial statements before giving projections. Your goals may be aggressive, but they should also be realistic.

NerdWallet’s picks for setting up your business finances:

The best business checking accounts .

The best business credit cards .

The best accounting software .

Before the end of your business plan, summarize how your business is structured and outline each team’s responsibilities. This will help your readers understand who performs each of the functions you’ve described above — making and selling your products or services — and how much each of those functions cost.

If any of your employees have exceptional skills, you may want to include their resumes to help explain the competitive advantage they give you.

Finally, attach any supporting information or additional materials that you couldn’t fit in elsewhere. That might include:

Licenses and permits.

Equipment leases.

Bank statements.

Details of your personal and business credit history, if you’re seeking financing.

If the appendix is long, you may want to consider adding a table of contents at the beginning of this section.

How much do you need?

with Fundera by NerdWallet

We’ll start with a brief questionnaire to better understand the unique needs of your business.

Once we uncover your personalized matches, our team will consult you on the process moving forward.

Here are some tips to write a detailed, convincing business plan:

Avoid over-optimism: If you’re applying for a business bank loan or professional investment, someone will be reading your business plan closely. Providing unreasonable sales estimates can hurt your chances of approval.

Proofread: Spelling, punctuation and grammatical errors can jump off the page and turn off lenders and prospective investors. If writing and editing aren't your strong suit, you may want to hire a professional business plan writer, copy editor or proofreader.

Use free resources: SCORE is a nonprofit association that offers a large network of volunteer business mentors and experts who can help you write or edit your business plan. The U.S. Small Business Administration’s Small Business Development Centers , which provide free business consulting and help with business plan development, can also be a resource.

On a similar note...

Find small-business financing

Compare multiple lenders that fit your business

How to Build a Detailed Business Plan That Stands Out [Free Template]

Updated: March 29, 2022

Published: March 11, 2022

While starting a company may seem easier now than ever before, entrepreneurs have an uphill battle from the moment they start a business. And without a clear, actionable business plan for selling, marketing, finances, and operations, you're almost destined to face significant challenges.

This is why crafting a business plan is an essential step in the entrepreneurial process.

In this post, we'll walk you through the process of filling out your business plan template, like this free, editable version :

Download a free, editable one-page business plan template.

We know that when looking at a blank page on a laptop screen, the idea of writing your business plan can seem impossible. However, it's a mandatory step to take if you want to turn your business dreams into a reality.

That's why we've crafted a business plan template for you to download and use to build your new company. You can download it here for free . It contains prompts for all of the essential parts of a business plan, all of which are elaborated on, below.

This way, you'll be able to show them how organized and well-thought-out your business idea is, and provide them with answers to whatever questions they may have.

.webp)

Free Business Plan Template

The essential document for starting a business -- custom built for your needs.

- Outline your idea.

- Pitch to investors.

- Secure funding.

- Get to work!

You're all set!

Click this link to access this resource at any time.

Building a Successful Business Plan

In the next section, we'll cover the components of a business plan , such as an executive summary and company description. But before we get to that, let's talk about key elements that should serve as building blocks for your plan.

For some entrepreneurs, the thought of writing a business plan sounds like a chore — a necessary means to an end. But that's a bad take.

A solid business plan is a blueprint for success . It's key to securing financing, presenting your business, outlining your financial projections, and turning that nugget of a business idea into a reality.

At the core, your business plan should answer two questions: why your business and why now?

Investors want to know why your business is entering the market, i.e. what problem it's solving and how it's different from what's currently out there. They also want to know why now is the right time for your type of product or service.

At a minimum, your plan should:

- Be more realistic than idealistic: Too often, business plans focus too much on how things could be instead of how they are. While having a vision is important, your plan needs to be rooted in research and data.

- Legitimize your business idea : If an idea fails on paper, it's a signal to go back to the drawing board. In doing so, you avoid losing precious time or money chasing an unrealistic idea.

- Position your business for funding: To get your business off the ground, chances are you'll need financial backing. Even with a solid business idea, investors, lenders, and banks still need convincing. An effective business plan will outline how much money you need, where it's going, what targets you will hit, and how you plan to repay any debts.

- Lay the foundation: Investors focus on risk – if anything looks shaky, it could be a dealbreaker. Ideally, your business plan will lay down the foundation for how you'll operate your business — from operational needs to financial projections and goals.

- Communicate your needs: It's nearly impossible to communicate your needs if you don't know what they are first. Of course, a business’ needs are always changing — but your plan should give you a well-rounded view of how your business will work in the short and long term.

So back to the question of why and why now – consider three things:

- Your industry – How does your product or service fit within your industry? Are you targeting a specific niche? Where do you see the industry going in the next five to 10 years?

- Your target audience – Who are you targeting? What challenges are they facing? How will your product or service help them in their daily lives?

- Your unique selling proposition (USP) – What sets you apart from your competitors? Is it your product/service features? Your company values? Price?

Once you know the answers to these questions, you'll be equipped to answer the question: why your business and why now.

How to Build a Business Plan

- Executive Summary

- Company and Business Description

- Product and Services Line

- Market Analysis

- Marketing Plan

- Legal Notes

- Financial Considerations

Featured Resource: Free Business Plan Template

1. cover page.

Your business plan should be prefaced with an eye-catching cover page. This means including a high-resolution image of your company logo, followed by your company's name, address, and phone number.

Since this business plan will likely change hands and be seen by multiple investors, you should also provide your own name, role in the business, and email address on the cover page.

At the bottom of this page, you can also add a confidentiality statement to protect against the disclosure of your business details.

The statement can read as follows: " This document contains confidential and proprietary information created by [your company name]. When receiving this document, you agree to keep its content confidential and may only reproduce and/or share it with express written permission of [your company name] ."

Remember to keep your cover page simple and concise — and save the important details for other sections.

Why it matters: First impressions are everything, and a clean cover page is the first step in the right direction.

Example of a Cover Page

2. Executive Summary

The executive summary of your business plan provides a one- to two-page overview of your business and highlights the most crucial pieces of your plan, such as your short-term and long-term goals.

The executive summary is essentially a boiled-down version of your entire business plan, so remember to keep this section to the point and filled only with essential information.

Typically, this brief section includes:

- A mission statement.

- The company's history and leadership model.

- An overview of competitive advantage(s).

- Financial projections.

- Company goals.

- An ask from potential investors.

Why it matters: The executive summary is known as the make-or-break section of a business plan. It influences whether investors turn the page or not — so effectively summarizing your business and the problem it hopes to solve is a must.

Think of the Summary as a written elevator pitch (with more detail). While your business plan provides the nitty-gritty details, your Summary describes — in a compelling but matter-of-fact language — the highlights of your plan. If it's too vague, complicated, or fuzzy, you may need to scrap it and start again.

Example of an Executive Summary Introduction

"The future looks bright for North Side Chicago, particularly the Rock Hill Neighborhood. A number of high-end commercial and residential developments are well on their way, along with two new condo developments in nearby neighborhoods.

While the completion of these developments will increase the population within the neighborhood and stimulate the economy, the area lacks an upscale restaurant where residents and visitors can enjoy fine food and drink. Jay Street Lounge and Restaurant will provide such a place."

3. Company & Business Description

In this section, provide a more thorough description of what your company is and why it exists.

The bulk of the writing in this section should be about your company's purpose – covering what the business will be selling, identifying the target market, and laying out a path to success.

In this portion of your business plan, you can also elaborate on your company's:

- Mission statement

- Core values

- Team and organizational structure

Why it matters: Investors look for great structures and teams in addition to great ideas. This section gives an overview of your businesses' ethos. It's the perfect opportunity to set your business apart from the competition — such as your team's expertise, your unique work culture, and your competitive advantage.

Example of a Values/Mission Statement

"Jay Street Lounge and Restaurant will be the go-to place for people to get a drink or bite in an elegant, upscale atmosphere. The mission is to be North Side's leading restaurant, with the best tasting food and the highest quality service."

3. Product & Services Line

Here's where you'll cover the makeup of your business's product and/or services line. You should provide each product or service's name, its purpose, and a description of how it works (if appropriate). If you own any patents, copyrights, or trademarks, it's essential to include this info too.

Next, add some color to your sales strategy by outlining your pricing model and mark-up amounts.

If you're selling tangible products, you should also explain production and costs, and how you expect these factors to change as you scale.

Why it matters: This section contains the real meat of your business plan. It sets the stage for the problem you hope to solve, your solution, and how your said solution fits in the market.

There's no one-size-fits-all formula for this section. For instance, one plan may delve into its ability to market in a more cost-effective way than the competition, whereas another plan focuses on its key products and their unique features and benefits.

Regardless of your angle, it's critical to convey how your offerings will differ from the competition.

Example of a Product/Service Offering

"The menu at Jay Street Lounge and Restaurant will focus on Moroccan cuisine. The stars of the menu (our specialties) are the Moroccan dishes, such as eggplant zaalouk, seafood bastilla, tagine, and chickpea stew. For those who enjoy American dishes, there will also be a variety of options, from burger sliders and flatbread pizza to grilled steak and salads.

The food at Jay Street will have premium pricing to match its upscale atmosphere. During the summer months, the restaurant will have extra seating on the patio where clients can enjoy a special summer menu. We will be open on all days of the week."

4. Market Analysis

It helps to reference your market research documentation in this section, like a Porter's Five Forces Analysis or a SWOT Analysis ( templates for those are available here ). You can also include them in your appendix.

If your company already has buyer personas, you should include them here as well. If not, you can create them right now using the Make My Persona Tool .

Why it matters: Having an awesome product is, well, awesome — but it isn't enough. Just as important, there must be a market for it.

This section allows you to dig deeper into your market, which segments you want to target, and why. The "why" here is important, since targeting the right segment is critical for the success and growth of your business.

It's easy to get lost (or overwhelmed) in a sea of endless data. For your business plan, narrow your focus by answering the following questions:

- What is my market? In other words, who are my customers?

- What segments of the market do I want to target?

- What's the size of my target market?

- Is my market likely to grow?

- How can I increase my market share over time?

Example of a Market Analysis

"Jay Street Lounge and Restaurant will target locals who live and work within the Rock Hill Neighborhood and the greater North Side Chicago area. We will also target the tourists who flock to the many tourist attractions and colleges on the North Side.

We will specifically focus on young to middle-aged adults with an income of $40,000 to $80,000 who are looking for an upscale experience. The general demographics of our target market are women between 20 to 50 years old.

A unique and varied Moroccan-American menu, along with our unique upscale atmosphere, differentiates us from competitors in the area. Jay Street will also set itself apart through its commitment to high-quality food, service, design, and atmosphere."

5. Marketing Plan

Unlike the market analysis section, your marketing plan section should be an explanation of the tactical approach to reaching your aforementioned target audience. List your advertising channels, organic marketing methods, messaging, budget, and any relevant promotional tactics.

If your company has a fully fleshed-out marketing plan, you can attach it in the appendix of your business plan. If not, download this free marketing plan template to outline your strategy.

Free Marketing Plan Template

Outline your company's marketing strategy in one simple, coherent plan.

- Pre-Sectioned Template

- Completely Customizable

- Example Prompts

- Professionally Designed

Why it matters: Marketing is what puts your product in front of your customers. It's not just advertising — it's an investment in your business.

Throwing money into random marketing channels is a haphazard approach, which is why it's essential to do the legwork to create a solid marketing plan.

Here's some good news — by this point, you should have a solid understanding of your target market. Now, it's time to determine how you'll reach them.

Example of a Marketing Plan Overview

"Our marketing strategy will focus on three main initiatives:

- Social media marketing. We will grow and expand our Facebook and Instagram following through targeted social media ads.

- Website initiatives. Our website will attract potential visitors by offering updated menus and a calendar of events.

- Promotional events. Jay Street will have one special theme night per week to attract new clients."

6. Sales Plan

It doesn't matter if your sales department is an office full of business development representatives (BDR) or a dozen stores with your products on their shelves.

The point is: All sales plans are different, so you should clearly outline yours here. Common talking points include your:

- Sales team structure, and why this structure was chosen.

- Sales channels.

- Sales tools, software, and resources.

- Prospecting strategy.

- Sales goals and budget.

Like with your marketing plan, it might make sense to attach your completed sales plan to the appendix of your business plan. You can download a template for building your sales plan here .

Why it matters: Among other things, investors are interested in the scalability of your business — which is why growth strategies are a critical part of your business plan.

Your sales plan should describe your plan to attract customers, retain them (if applicable), and, ultimately, grow your business. Be sure to outline what you plan to do given your existing resources and what results you expect from your work.

Example of a Sales Plan Overview

"The most important goal is to ensure financial success for Jay Street Lounge and Restaurant. We believe we can achieve this by offering excellent food, entertainment, and service to our clients.

We are not a low-cost dining option in the area. Instead, the food will have premium pricing to match its upscale feel. The strategy is to give Jay Street a perception of elegance through its food, entertainment, and excellent service."

7. Legal Notes

Your investors may want to know the legal structure of your business, as that could directly impact the risk of their investments. For example, if you're looking for business partners to engage in a non-corporation or LLC partnership, this means they could be on the line for more than their actual investment.

Because this clarification is often needed, explain if you are and/or plan to become a sole proprietor, partnership, corporation, LLC, or other.

You should also outline the steps you have taken (or will need to take) to operate legally. This includes licenses, permits, registrations, and insurance.

The last thing your investor wants to hear after they've sent you a big chunk of change is that you're operating without proper approval from the local, state, or federal government.

Why it matters: The last thing your investor wants to hear after they've sent you a big chunk of change is that you're operating without proper approval from the local, state, or federal government.

Example of Legal Notes

"Jay Street Lounge and Restaurant is up-to-date on all restaurant licenses and health permits. Our business name and logo are registered trademarks, presenting the possibility of expanding locally."

8. Financial Considerations

Ultimately, investors want to know two things:

- When they will earn their money back.

- When they will start seeing returns on their initial investment.

That said, be clear, calculated, and convincing in this section. It should cover:

- Startup costs.

- Sales forecasts for the next several months/quarters.

- Break-even analysis for time and dollars.

- Projected profit and loss (P&L) statement.

Facts and figures are key here, so be as specific as possible with each line item and projection. In addition, explain the "why" behind each of these sections.

However, keep in mind that information overload is a risk, especially when it comes to data. So, if you have pages upon pages of charts and spreadsheets for this section, distill them into a page or two and include the rest of the sheets in the appendix. This section should only focus on key data points.

Why it matters: One of the most important aspects of becoming "investor ready" is knowing your numbers. More importantly, you need to understand how those numbers will enhance your business.

While it's easy to write a number down on paper, it's more important to understand (and communicate) why you need capital, where it's going, and that your evaluation makes sense.

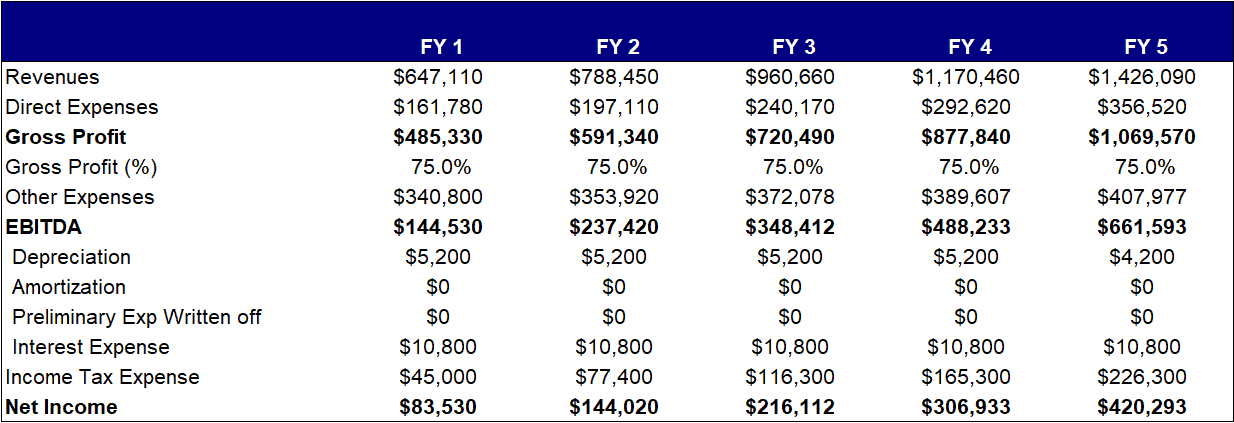

Example of Financial Projections

"Based on our knowledge and experience in the restaurant industry, we have come up with projections for the business.

Starting with an expenditure of $400,000 in year 1, we forecast sales of $1,500,000 and $2,800,000 for years two and three. We expect to achieve a net profit of 15% by year three."

9. Appendix

A detailed and well-developed business plan can range anywhere from 20 to 50 pages, with some even reaching upward of 80.

In many cases, the appendix is the longest section. Why? Because it includes the supportive materials mentioned in previous sections. To avoid disrupting the flow of the business plan with visuals, charts, and spreadsheets, business owners usually add them in the last section, i.e. the appendix.

Aside from what we've already mentioned – marketing plan, sales plan, department budgets, financial documents – you may also want to attach the following in the appendix:

- Marketing materials

- Market research data

- Licensing documentation

- Branding assets

- Floor plans for your location

- Mockups of your product

- Renderings of your office space or location design

Adding these pieces to the appendix enriches the reader's understanding of your business and proves you've put the work into your business plan without distracting from the main points throughout the plan.

Why it matters: An appendix helps the reader do their due diligence. It contains everything they need to support your business plan.

Keep in mind, however, that an appendix is typically necessary only if you're seeking financing or looking to attract business partners.

Use a Business Plan Template to Get Started

Writing a business plan shouldn't be an insurmountable roadblock to starting a business. Unfortunately, for all too many, it is.

That's why we recommend using our free business plan template. Pre-filled with detailed section prompts for all of the topics in this blog post, we're confident this template will get your business plan started in the right direction.

Editor's note: This post was originally published in June 2017 and has been updated for comprehensiveness.

Don't forget to share this post!

Related articles.

![the highlights of business plan How to Calculate Your Lead Generation Goals [Free Calculator]](https://blog.hubspot.com/hubfs/lead-generation-goal-calculator_5.webp)

How to Calculate Your Lead Generation Goals [Free Calculator]

What Are Direct Costs & How Do They Differ From Indirect Costs?

![the highlights of business plan How to Write a Business Plan: A Step-by-Step Guide [Examples + Template]](https://blog.hubspot.com/hubfs/how%20to%20write%20a%20business%20plan.jpg)

How to Write a Business Plan: A Step-by-Step Guide [Examples + Template]

9 Handy Business Calculators That’ll Make Your Life Easier

![the highlights of business plan The Definition of CAC [In Under 100 Words]](https://blog.hubspot.com/hs-fs/hub/53/file-1053926490-jpg/calculate_CAC_%28blog%29.jpg)

The Definition of CAC [In Under 100 Words]

![the highlights of business plan How to Calculate Next Month's Lead Gen Goal [Quick Tip]](https://blog.hubspot.com/hs-fs/hub/53/file-703140114-jpg/Blog_Thinkstock_Images/calculate_monthly_goals.jpg)

How to Calculate Next Month's Lead Gen Goal [Quick Tip]

![the highlights of business plan How to Calculate the Value of Your Social Media Followers [CALCULATOR]](https://blog.hubspot.com/hs-fs/hub/53/file-23155342-png/blog/images/voal-snapshot.png)

How to Calculate the Value of Your Social Media Followers [CALCULATOR]

![the highlights of business plan A Simple Calculator to Determine Your Monthly Traffic & Leads Goals [Template]](https://blog.hubspot.com/hs-fs/hub/53/file-23127769-png/blog/images/leads-goal-calculator1.png)

A Simple Calculator to Determine Your Monthly Traffic & Leads Goals [Template]

How to Calculate & Track a Leads Goal That Sales Supports

2 Essential Templates For Starting Your Business

Marketing software that helps you drive revenue, save time and resources, and measure and optimize your investments — all on one easy-to-use platform

How to Write a Business Plan in 2024

Written by Dave Lavinsky

Whether you’re looking to secure $5,000, $50,000, $500,000 or $5 million for your business, you’ll need a business plan. Knowing how to write a business plan that captures the attention of lenders and investors can pay big. While entrepreneurs and startup owners often feel overwhelmed at the thought of writing a business plan, don’t worry, we walk you through what a prospective lender or investor expects in this step-by-step guide. Better yet, it’s based on 20 years of experience helping companies, just like yours, not only create their business plan, but land their ideal funding arrangement and improve their strategies for long-term success. If you read this article and still feel overwhelmed, using a business plan template is likely a good choice.

Download our Ultimate Business Plan Template here

Your business plan highlights your unique value to the market, your strategy for business success and your financial outlook. It communicates that your business is meeting a need for which there is a demand. It conveys that your product or service demand is sustainable and your business is uniquely positioned to capture an increasing share of the market year-over-year. That means consistent business growth and profitability. This is achieved by describing your company, your product or service and your marketing strategy. Within your business plan, you’ll also specify your funding request and provide financial reports including projections.

Writing a Business Plan

The following is an overview of each segment of a business plan and how to confidently craft the document to showcase a business strategy.

You can also download our how to write a business plan pdf to help you get started.

1. Executive Summary

An executive summary is where you impress the reader by highlighting a businesses’ market strengths and qualities. In one-to-two pages, establish a reason for the investor or lender to consider your funding request. Because the executive summary is an overview, you’ll write it last. This way you are consolidating the key messages from throughout the plan in one place.

An effective business plan executive summary defines your mission and lays out your strategy for success. It communicates that you have a firm grasp of the market. It also explains what you expect from the reader. But most of all, it captivates the reader’s attention and persuades them to strongly consider becoming your funding source.

2. Company Analysis

Now it’s time to describe the nuts and bolts of your venture through a company description and analysis. Investors are interested in your company’s mission, history, structure and achievements. They are assessing who you are and what your capabilities are. The mission statement within your business plan summarizes why you are operating and describes the effect your company has on its clients and in society. Mission statements are short and impactful. A mission statement for a new day care center might read: At XYZ Day Care, our mission is to care for children from tot to toddler in a safe, fun and loving environment.

A company history includes some basic information such as your inception date and location. The value of this section of your business plan lies in sharing your origin story. Investors are interested in knowing how you developed the business concept and took it to market. For start-ups, this section may be brief. Established organizations can expand this section to highlight major accomplishments since inception.

Here’s an example of a company history for a restaurant:

You’ll also specify the legal structure of your company in the company analysis. A business can be a sole-proprietorship, a partnership, a corporation, a limited liability firm or a non-profit organization.

3. Industry Analysis

Your company is not operating in a vacuum, and your business plan needs to reflect that through a market analysis business plan . There are socio-economic factors that have implications for your business’ performance in the marketplace. An industry analysis or market analysis sheds light at a local, national or global level of how all firms offering similar products or services are performing. This section identifies historical trends that have shaped the industry and pinpoints recent developments that must be considered when creating your business strategy. Research from credible sources is central to your industry analysis. Review both past and present reports to form the broadest understanding of all external factors.

Some key statistics to include in the market analysis section of your business plan are:

- total market size

- relevant market size

- historical market growth

- future growth estimates

You’ll also want to include your market share estimates. While many sources provide a total market size, it may take some additional work to calculate the relevant market size. That’s because this figure is based upon your niche rather than the entire industry market.

Your relevant market size is an estimate of the annual revenue your business could attain if it realized 100% market share. You calculate it by multiplying the following two figures:

- Estimate the number of people who might be interested in purchasing your products or services each year.

- Estimate the dollar amount these customers might be willing to spend, on an annual basis, on your products or services.

Let’s look at a partial industry analysis example for a startup food truck business:

4. Customer Analysis

An effective customer analysis describes your target market, whether a business or consumer, and their specific needs. For starters, a potential funding source is ascertaining how well you understand the buying behaviors and patterns of your customers. They are also assessing the proximity of your business to the customers and the size of the potential customer pool.

In addition, the customer analysis section of your business plan answers two key questions: what is the problem your customer is experiencing and how are you solving it? Customer problems, or pain points, are myriad. You’ll need to hone in on the vital ones you are resolving with your products and services. For example, customers may be looking to reduce time or costs to complete projects, or they may want to work with an organization that has a good reputation for customer service.

One approach to writing your customer analysis is to develop an ideal client avatar or persona. An avatar is a figure that represents your client. It defines their age (or years in business), behaviors, values, aspirations, needs and concerns.

Here’s a potential client avatar for a nail salon business:

5. Competitive Analysis

As previously mentioned, your business is not operating in a vacuum. There are other firms, competing for your ideal client, offering similar products and services. That’s why you need a competitive analysis business plan . A crucial section for a small business, startup or entrepreneur, the competitive analysis outlays your strengths as compared to other firms. It unequivocally answers the question, “why this business?” for prospective customers and more importantly potential investors or lenders.

The competitive analysis communicates how you will outperform the competition. This is the place for you to highlight your advantages – your strengths and the opportunities you can seize in the marketplace. Keep in mind that your strengths can be related to people, products, services, processes as well as intellectual property.

Competitors can be direct or indirect. A direct competitor offers a similar product or service to satisfy a customer need. An indirect competitor offers a different product, service or approach that may meet the same customer need as your business. For instance, an indirect competitor for a coffee shop could be a gas station, fast food restaurant or a donut shop.

To write your competitive analysis, you may prepare a competitor profile or a matrix. The profile focuses on a single company while the matrix provides a high-level comparison of the revenues, products, services, pricing, strengths and weaknesses for each key competitor.

Here’s an example of a competitor profile for a real estate agent:

6. Marketing Plan

Let’s face it, people need to know that your business exists. People also need to know the benefits of your products and services. A sales and marketing section or marketing plan section is where your marketing and sales plan is showcased within your business plan. A marketing plan lays out your strategy for communicating this information. It convinces investors and lenders that you know how to reach your ideal client and generate sales. In some cases, your marketing plan may be a separate document from your business plan.

The marketing plan has three components: products and services, promotions and distribution. Begin with thoroughly defining your products and services. Spell out the features and benefits. Features are the attributes of your product and service, while benefits communicate the value of your product or service to the customer. Be sure to also include your pricing in this section.

A marketing plan for a coffee shop could list coffee, espresso and tea as its products. The shop may sell additional products such as mugs, coasters, pastries and sandwiches. A beauty salon may have shampoo, dry, trim and curl as its primary services. They may provide complementary services including manicures, pedicures and eyebrow waxing.

Once your products and services are defined. You’ll focus on getting the word out. This is your promotion plan – your strategy for attracting customers. Are you using social media or content marketing? Are you advertising, and if so what are the best advertising channels for your business? Will you have periodic sales and product giveaways? What about referral bonuses? What market segment are you going to target with what promotional activity? In developing your promotional plan within your business plan, make sure you convey which channels are most effective for your ideal client. A strong marketing and promotional can be a source of the important competitive advantages you need.

Promotions are how you communicate. Distribution is how you sell. You need both to succeed in business. So now that you’ve laid out your promotion plan, it’s time to focus on getting your products and services to the client. Three common distribution channels are retail, wholesale and direct. In retail and wholesale distribution, you are selling your product to another entity who then sells to the customer. Your strategy should include how you’ll best fulfill the needs of your select retailers and wholesalers.

With direct distribution, the customer buys from you either online, by telephone or at your physical location. When developing your distribution plan, study the purchasing tendencies of your ideal client. Do they shop in certain geographies? Are they primarily online shoppers? How long will it take for the package to arrive? Armed with this information, you can effectively determine which distribution mode will get you the greatest results.

Consider an example from ABC Planners, an e-commerce business:

7. Operations Plan

Successful businesses have a strong operations foundation. As a result, the operations plan is a key part of the business planning process and business plan.

Defined processes, metrics and milestones are essential to ensure you will effectively manage the business and its associated costs. A thorough operations plan conveys to investors your business results are intentional. It also demonstrates you’ve considered what could go wrong and have preventative and recovery plans intact.

The operations plan can cover a number of functions from human resources and product development to legal. Your business operations are interconnected. Each operation supports how you sell your product or service. Give adequate attention to your production process and quality control. Production describes how you make your product or service. Quality control measures how effectively and efficiently you produce your product or deliver your service. Depending on the size of your business, some of the functions may be outsourced to specialty providers. In this case, you may list your suppliers.

Strategic planning is an internal part of operations. Here’s where you’ll detail your key milestones for the next three years. Milestones can be related to all aspects of your business: financial, products and services as well as operations.

A sample operations plan for a start-up bakery follows:

- Secure building lease by month, year

- Remodel space for modern bakery operations by month, year

- Hire bakery manager and staff by month, year

- Achieve $xx in sales by month, year

8. Management Team

Just as investors want to be assured you have a viable product or service, they are especially interested in who’s running the business. Plans spell out your intentions, and it is the management team business plan that provides a comprehensive roadmap for achieving those intentions. People carry out those plans. The caliber of your team and business partners conveys a great deal about your ability to achieve your business goals. That’s why investors need to know who’s on the team and what expertise they bring to the table.

Here you’ll provide the names and biographies of your management team members and indicate any management gaps. If it applies, you may also highlight your Board of Directors. The background information may contain the individual’s educational achievements, relevant work experience, skills and accomplishments. Sharing personal details helps investors to get to know your management team and provides another layer of transparency. According to the Small Business Administration, some business plans, may also include supplementary organization charts.

At the writing of your business plan, it’s possible to have openings on your management team. In this case, you’ll list the position, define the job responsibilities and specify the hiring requirements for the ideal candidate.

For example, the background for a software company’s president may read:

9. Financial Plan

Remember, an important part of securing funding for your business is conveying it will be financially sound and you can repay the potential funding source in the near future. This is why the financial plan is critical to your business plan. It presents your revenue model, financial projections and funding requirements. You are basically sharing the different ways you will generate income, your plans for financial solvency and your rationale for your funding request.

The revenue model describes how you make money. Some common revenue models are subscriptions, advertising, affiliate marketing, markups, direct sales and commissions.

Financial highlights are essential. Your plan must include a three-to-five-year financial forecast that presents your projected income and expenses while painting a realistic picture of your profitability. It will highlight several reports with the details included in your Appendix. The financial reports include your projected income statement, balance sheet and cash flow statement. Established businesses may choose to include historical financial data. Charts and graphs work well for depicting your financial highlights.

Lastly, you will detail your funding request. Specify how much funding you’ll require and how you will use the funding. Some potential uses are to purchase equipment, pay bills and salaries, rent office space or conduct marketing research for product development.