Advantages and Disadvantages of Money

Looking for advantages and disadvantages of Money?

We have collected some solid points that will help you understand the pros and cons of Money in detail.

But first, let’s understand the topic:

What is Money?

Money is a medium of exchange that is widely accepted in transactions for goods and services. It can take the form of physical currency or electronic currency.

What are the advantages and disadvantages of Money

The following are the advantages and disadvantages of Money:

Advantages of Money

- Facilitates trade and commerce – One of the primary advantages of money is that it enables us to buy and sell goods and services. Before money, people used to barter, which meant trading goods or services directly with each other. This process was often difficult and time-consuming. However, with money, people can exchange it for any goods or services they need quickly and easily.

- Provides a measure of value – Money serves as a standard measure of value that can be used to compare the worth of different goods and services. For example, we can compare the value of a house to a car using money as the common denominator. This standardization allows us to make informed decisions about how we spend our money and allocate our resources.

- Promotes savings and investment – Money allows people to save and invest for the future. When we save money, we can use it to make purchases later on. When we invest money, we can earn more money over time. Savings and investment are important because they allow us to plan for our future, such as retirement or buying a house.

- Enables financial transactions – Money is essential for financial transactions like paying bills, loans, taxes, and salaries. Electronic transactions such as wire transfers, online banking, and mobile payments have made financial transactions more efficient and secure. With money, we can easily transfer funds between accounts or make purchases using credit or debit cards.

- Empowers individuals – Finally, money gives individuals a sense of independence and control over their lives. Having money means that we can make choices about how we spend our time and what we buy. It allows us to provide for ourselves and our families, pursue our passions and hobbies, and support causes that we care about.

Also check:

- 10 Lines on Money

- Essay on Money

- Speech on Money

Disadvantages of Money

- It can make people greedy – When people have a lot of money, they can become greedy and selfish. They may not care about others as much and prioritize their own wants and needs.

- It can lead to theft – Money is valuable and desirable, which means that some people will try to steal it. People may be robbed, and thieves may steal money from stores and banks.

- It can cause inflation – When there’s too much money in circulation, prices can rise rapidly, which is known as inflation. This can make it difficult for people who don’t have much money to afford the things they need.

- It can create debt – When people borrow money, they have to pay it back with interest, which means they end up owing more than they originally borrowed. This can lead to debt, which can be stressful and difficult to manage.

- It can create social inequality – Money can create a divide between the rich and the poor. People who have more money may have more opportunities and privileges, while those who have less may struggle to get by.

- Advantages and disadvantages of K-Map

- Advantages and disadvantages of Map

- Advantages and disadvantages of Government Job

You can view other “advantages and disadvantages of…” posts by clicking here .

If you have a related query, feel free to let us know in the comments below.

Also, kindly share the information with your friends who you think might be interested in reading it.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

CBSE Library

Advantages and Disadvantages of Money | What is Money?, Importance, Types, Pros and Cons

Advantages and Disadvantages of Money: Money itself has no intrinsic value, but it’s still one of the most valuable things around. Money has become so important in our society that we even have a word for the fear of being without it – monophobia – and few things will motivate people more than the fear of poverty or deprivation. And that raises some interesting questions about money itself, including whether or not you can actually have too much of it and if it really does buy happiness after all. So, what are the advantages and disadvantages of money? Let’s take a look at some of these issues below.

Students can also find more Advantages and Disadvantages articles on events, persons, sports, technology, and many more.

Advantages of Money

Disadvantages of money, comparison table for advantages and disadvantages of money, faq’s on advantages and disadvantages of money, why is it so hard to save money.

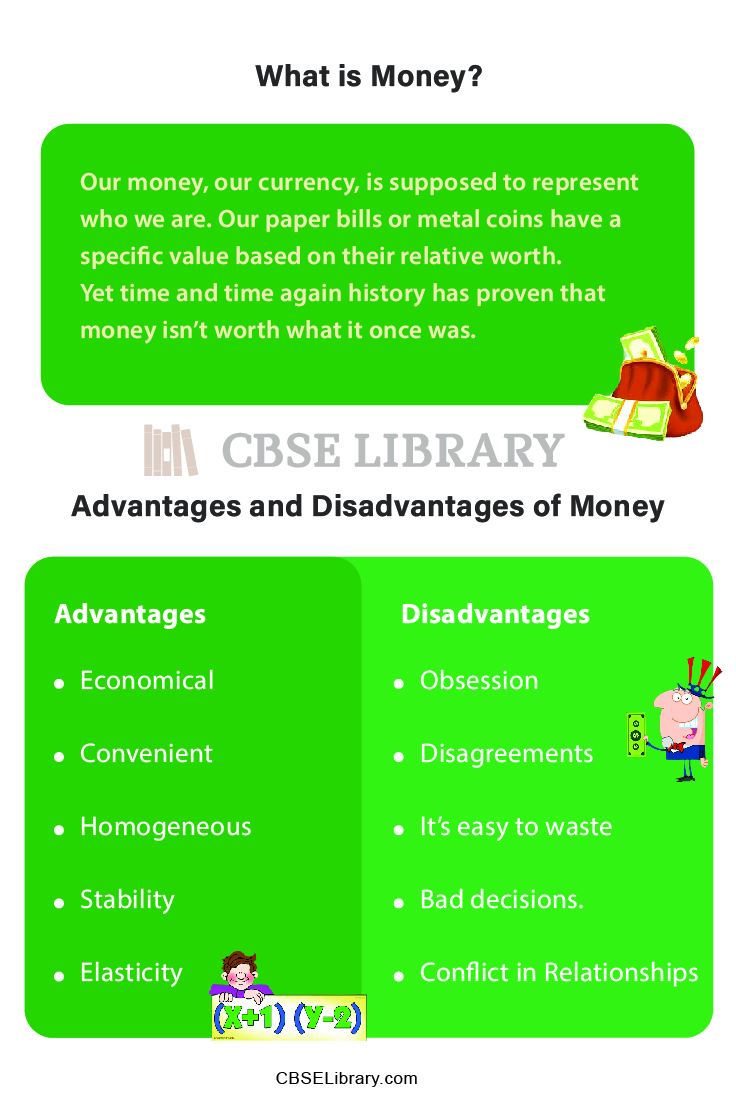

Our money, our currency, is supposed to represent who we are. Our paper bills or metal coins have a specific value based on their relative worth. Yet time and time again history has proven that money isn’t worth what it once was. The history of money is particularly interesting because its origins have long been thought to be derived from gold or silver. However, over time we find that paper bills become commonly used in trade as opposed to actual precious metals such as gold or silver.

- The role of money in our lives is crucial.

- We need it to buy things that we can’t produce ourselves, whether it be a physical or intellectual good.

- It is used as a form of currency in trade for goods or services. Unfortunately, money isn’t always easy to get.

- The most common way of getting money is through employment where you work for someone else and they pay you with their money.

There are a lot of advantages to having money. When you have more money than you need, life becomes easier. You can afford to pay someone else to do your chores for you. Having enough cash makes it possible for you to take a vacation from time to time without having to save up all year first.

Economical: Having money makes it easier to buy things. For example, if you need a new car, but don’t have enough cash on hand to pay for it, you’ll have to save up for months or years before you can afford one. If you do have enough money in your bank account, however, you can simply go out and buy a car right away.

Convenient: When you have enough money, you can pay someone else to do your chores for you. For example, if you don’t have time to mow your lawn or shovel your snow, you can hire a teenager down the street to do it for a small fee.

Homogeneous: When you have enough money, you can take a vacation from time to time. If you don’t have any money saved up, however, you’ll have to save up for months or years before you can afford a trip. In other words, having money makes it possible for you to escape your daily routine every once in a while.

Stability: Having money makes it possible for you to weather financial storms. For example, if you lose your job, having a lot of cash in your bank account will help you pay your bills until you find another job. If you don’t have any money saved up, however, losing your job could put you in dire straits financially.

Elasticity: If you have enough money, you can use it to pay off your debts. For example, if you owe $20,000 on your credit card, having a lot of cash in your bank account will help you pay that debt off faster. If you don’t have any money saved up, however, paying off that debt will take years.

The biggest disadvantage to money is its ability to distract you from what matters. Having a steady income can quickly become addicting, making you less likely to step back and evaluate your life as a whole.

Obsession: A lot of people are obsessed with money. They constantly talk about it, read about it, think about it, and make decisions based on how they can earn more. This obsession can be a problem because you might start to measure your self-worth by how much money you have in your bank account.

Disagreements: Another problem with money is that it can cause disagreements between friends, family members, or business partners. For example, if you’re in a partnership with someone who makes significantly more than you do, there’s a good chance they’ll start to feel like they deserve more say in how your company is run.

It’s easy to waste: Money is easy to waste. All you have to do is buy something you don’t need or make a decision that doesn’t align with your values. It’s a lot harder to waste time because time only moves forward—you can’t get it back once it’s gone. But money can disappear in an instant if you spend it on things that aren’t important to you.

It can cause you to make bad decisions: Having a lot of money can also cause you to make bad decisions. For example, if you’re desperate for cash, you might take on a job that’s unethical or immoral—even if it pays well. Or maybe you have too much money in your bank account and decide to spend it on something frivolous instead of saving it for an emergency.

It can cause conflict in your relationships: The final disadvantage to money is that it can cause conflict in your relationships. For example, if you’re married or in a relationship with someone who makes significantly more than you do, there’s a good chance that person will want to make all of the decisions about how your money is spent.

Question 1. What are the 4 types of money?

Answer: In economics, money is anything that is generally accepted as payment for goods and services and repayment of debts in a given country or socio-economic context. Four Types of Money are:

- Commodity money

- Representative money

- Digital currency.

Question 2. Why is it called money?

Answer: Money is simply called money as a sort of common man’s language for identifying all forms. Money has also been used to refer to any form of currency, including specie, but it is now often understood to refer only to fiat currency. However, many things can be used as money that is not legal tender: checks, credit cards, raffle tickets, IOUs, etc.

Question 3. What is fiat money?

Answer: Fiat money is a currency without intrinsic value established as money by government regulation or law. The term derives from the Latin fiat (meaning let it be done). The dollar, for instance, has no intrinsic value, but has legal tender status in all US territories and federal districts; however, its value is still maintained partly by convention (i.e., agreement within society) that it must be accepted as payment for debts.

Question 4. Why is money so important?

Answer: Money is so important because it helps us to do transactions in a very easy way. For example, if you want to buy something, you just need to pay money and get what you want. If you want to rent a house or apartment, you need to pay money as a deposit for that apartment or house so that owner will give it to you for rent.

Conclusion on Advantages and Disadvantages of Money

Leave a comment cancel reply.

IMAGES

VIDEO