The Ultimate Guide to Project Cost Management with Templates

By Kate Eby | April 25, 2017

- Share on Facebook

- Share on LinkedIn

Link copied

Your organization’s projects are critical to its future. Sound cost management enables you to make optimal use of your resources (time, personnel, equipment, and materials), make data-driven decisions about projects and their risks, measure financial performance, and provide key metrics to senior management. This definitive guide to project cost management includes templates for key activities like cost estimating and creating a cost management plan. You’ll learn important terms, best practices, and subtle distinctions (such as the difference between cost management and strategic cost management), as well as how cost management works in specialized cases, like construction and IT projects.

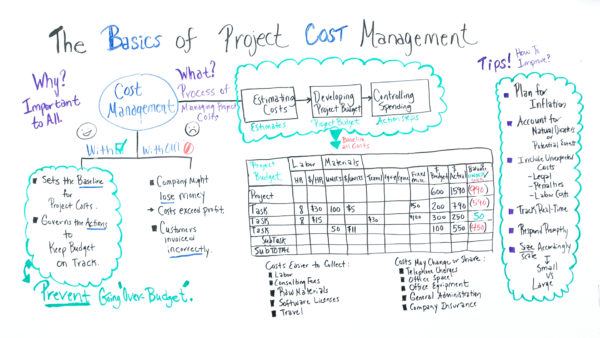

What Is Project Cost Management?

Whether you are developing a new product, designing a facility, or changing a key process, it’s challenging to forecast and manage project costs effectively. In fact, the job is so challenging that half of all large IT projects massively blow their budgets , running on average 45 percent over budget and seven percent over time, according to consultants McKinsey & Co. and the University of Oxford. For projects in other sectors, the news is no better. The Project Management Institute (PMI) reported in 2016 that companies were completing only 53 percent of projects within their original budget. However, strong cost management helps you avoid that fate. So what exactly is cost management? Cost management refers to the activities concerning planning and controlling a project’s budget. Effective cost management ensures that a project is completed on budget and according to its planned scope. Since you assess the success of a project at least in part by its cost performance, cost management is a prime determinant of project outcome. Cost management activities are conducted throughout the project life cycle, from planning and budget allocation to controlling costs during project execution and assessing a project’s cost performance upon completion. Although cost management includes a whole ensemble of activities, it is sometimes referred to in terms of more specific functions, such as spend management, cost accounting, and cost transparency. Cost managers sometimes use these terms as loose synonyms for the broad cost management function.

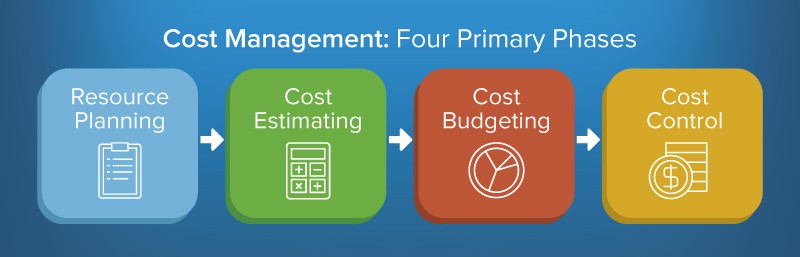

Cost Management: Four Major Steps

The Project Management Body of Knowledge (PMBOK), the bible of project management theory, says cost management is made up of four processes. These generally adhere to the sequence that follows — as a project goes from the planning board to reality.

- Resource Planning: Part of the initiation stage of a project, resource planning uses a work breakdown structure — a hierarchical representation of all project deliverables and the work required to complete them — to calculate the full cost of resources needed to complete a project successfully. Managers typically determine required resources for each work breakdown structure component and then add them to create a total resource cost estimate for all project deliverables.

- Cost Estimating: Cost estimating is an iterative process that uses a variety of estimating techniques to determine the total cost of completing a project. Cost estimating techniques vary widely in their approaches to computing project costs, and stretch from conceptual techniques that draw mainly from historical experience and expert judgment to determinative techniques that estimate costs on a component-by-component basis. We will discuss these techniques in detail later, as they vary in their levels of accuracy. Determinative techniques are the most accurate; however, while the estimator’s job is always to create the most accurate estimate possible, determinative estimating techniques are only an option if you’ve reasonably finalized a project’s scope and deliverables. As such, you use the less accurate estimating techniques during the earliest stages of project planning, and then revise and update estimates as the project continues to be defined. To learn more about cost estimating, read The Ultimate Guide to Project Cost Estimating .

- Cost Budgeting: Once you’ve created satisfactory estimates, you can finalize and approve the project’s budget. Cost managers typically release budgeted amounts in stages according to the level of a project’s progress. These allocations include contingencies and reserves.

- Cost Control: Cost control is the practice of measuring a project’s cost performance according to cost and schedule baselines that provide points of comparison throughout the project life cycle. The specific requirements for effective cost control are set out in the project management plan. The individual in charge of cost management investigates the reasons for cost variations - if they deem cost variations unacceptable, corrective action is likely. Cost control also includes other related responsibilities, such as ensuring that updated project budgets reflect changes to a project’s scope.

Key Components of the Cost Management Plan

The cost management plan guides these four processes. Created during the project planning phase, the cost management plan is a document that defines how you manage, control, and communicate a project’s costs in order to complete the project on budget. Among other things, a cost management plan identifies the individual or group responsible for cost management, details how you will assess a project’s cost performance, and sets rules for how to communicate cost performance to project shareholders. It also establishes the methodologies by which you will control project cost variations. While you can customize a cost management plan to fit your organization’s needs, they generally follow a standard format. Sections often include the cost variance plan, the cost management approach, information on cost estimation, the cost baseline, cost control, and reporting processes, the change control process, the project budget, and approvals. You may also want to include the spending authority levels for key project personnel, specifying which roles can approve costs up to specific thresholds. Let’s look at the sections in greater depth:

- Cost Variance Plan: Cost variance is when the actual amount differs from the budgeted amount. In your cost management plan, you’ll need a section that details the actions you should take, including who is held responsible in the case of a cost variance. The size of the variance usually necessitates different action: a cost variance of less than five percent might result in an explanation of that variance, while a 95-percent-or-greater variance could force the project to be abandoned. To learn how to calculate cost variance, read Hacking the PMP: Studying Cost Variance . For a more detailed template on tracking schedule and budget variances, see this template:

- Cost Management Approach: This section outlines the approach a manager uses for cost management. The level of rigor can vary, but this describes how to establish a cost baseline and how to compare actual costs. You usually track and report costs through control accounts, where you roll up costs of subtasks. This often occurs at the third level of the work breakdown structure, a tool that breaks a project into small components or chunks of work to determine the resources needed to complete a job or project. However, the point at which you track and report depends on the scope of the project.

- Cost Estimation: Here you will define the methods used for estimating project costs, the levels of variation, and the expected precision, accuracy, and risk.

- Cost Baseline: This has a specialized meaning in project management and represents the authorized, time-phased spending plan against which you measure cost performance. It’s the sum of the estimated project cost and contingency reserves.

- Cost Control and Reporting Process: This section establishes how you measure costs and their key metrics during the project. We’ll provide greater detail on this later.

- Change Control Process: This describes the process for making changes to the cost baseline and how to approve those proposed changes.

- Project Budget: The budget builds on the cost baseline by totalling the cost of executing the project (including contingencies for possible risks). It also adds in management reserves, which is an amount to cover unanticipated risks or unidentified events that may arise. An organization will usually set a policy for this, and the amount is often five to 15 percent of the total budget.

Cost Management Activities: Essential Functions at Each Phase

Cost management includes a number of activities conducted at different phases during the project life cycle. It’s important to include the cost management function while developing project plans so that you build solid financial controls into the project structure. Here are some key terms and stages relevant to cost management: Planning: Using the work breakdown structure to determine the resources needed to complete a job or project. Estimating: The act of calculating or predicting the expected total cost of completing a project. Budgeting: The authorization of a budget based on a cost estimate to complete the project. You typically authorize budgets in tandem with schedules, so you can assess cost performance at specific points. Financing and Funding: The process of requesting, authorizing, and receiving money for a project. Cost Management: The general practice of overseeing project expenditures and making cost-related decisions throughout the project life cycle. Controlling: Addressing cost variations to avoid cost overruns. Job Control: Controlling project expenditure by comparing costs predicted by the cost estimate and costs actually being incurred. Scheduling: You can determine a project’s cost performance by using a schedule that compares the expected expenditure to the actual costs the project is incurring at any point in time. Accounting: The practice of recording expenditures and reconciling transactions.

How Accurate Project Cost Estimating Aids Cost Management Efforts

The first step towards robust cost management is having a clear idea of your project’s likely costs. However, it’s futile to track and control costs if you base your spending on unrealistic estimates. Project estimating considers several variables, including the method you use to create the estimate, the stage at which you build your estimate, and the types of cost you include. The first variable is the method you employ. You can produce cost estimates using a variety of estimating techniques, depending on the extent to which you define a project and the type of information you have access to. Here are some common estimation techniques:

Analogous Estimating: This uses historical data from similar past projects to create estimates for new projects. This method works if you have experience with projects of the same type.

Parametric Estimating: This method estimates time and cost by multiplying per unit or per task amounts by the total number expected in the project. The rates are often standard or publicly published rates and can be expressed in hours of work, amount of data entered, or the number of units of a product manufactured. This technique has a reputation for good reliability, but it’s less relevant when output isn’t uniform, such as when writing computer code. Some projects have widely varying or unprecedented tasks, so they do not lend themselves to this method.

Bottom-Up Estimating: This is a determinative estimating technique that estimates costs for work breakdown structure components and adds them together to create a cost estimate for an entire project. The project team members help create the estimate. Since the people who are going to be doing the work are engaged in estimating, professionals consider this method highly accurate, as well as a team commitment builder.

Three-Point Estimating: This is a PERT -related statistical method that uses the optimistic (lowest), pessimistic (highest), and most likely cost estimates to create expected values and standard deviations for project expenditures.

Software-Based Estimating: You can use software-based estimating techniques, such as Monte Carlo simulation, to model the effects of risk events on project costs. Another factor influencing the cost estimating is the stage at which you build your cost estimate. As a project progresses, you discover more variables and actual costs, so project estimates become more refined. You can classify cost estimates based on how well you define the project scope at the time of estimation and on the type of estimation technique you use - the latter generally determines the accuracy of an estimate. In order of accuracy, the main classes of cost estimates are: Order of Magnitude Estimates: These are very rough cost estimates based on expert judgment and on adjusting the costs of the current project to reflect the costs of similar, past projects. Created before fully defining projects, they are only used in high-level project screening. Preliminary Estimates: A preliminary estimate uses somewhat-detailed scope information to form estimates based on unit costs. These estimates are accurate enough to use as the basis for budgeting. Definitive Estimates: Created when you’ve fully defined a project’s scope, a definitive estimate uses deterministic estimating techniques, such as bottom-up estimating. Experts agree that definitive estimates are the most accurate and reliable. The final variable affecting project estimation is the type of cost included. Of course, your project budget must include all the relevant costs for labor and materials, but whether you include a portion of your organization’s indirect costs depends on the policies of your organization and the type of project. Here are the terms experts use to distinguish between various types of costs: Direct Costs: Direct costs are those which you can directly associate with a specific cost object. They are billable to specific projects.

Indirect Costs: You cannot associate indirect costs with a specific cost object, and you typically incur indirect costs by a number of projects at the same time. They are not billable to specific projects.

Fixed Costs: Fixed costs are costs you incur during manufacturing that are not associated with the volume of produced output.

Variable Costs: Variable costs are costs you incur during manufacturing that are directly associated with the volume of produced output.

Sunk Cost: A sunk cost is an expense you cannot recoup once it is incurred.

Opportunity Cost: When selecting a course of action, its opportunity cost is the loss of potential benefits from all alternative courses of action.

Costing Techniques Determine How to Account for Project Costs

A costing technique is the way in which you compute the total cost of producing a product or performing a task. Depending on the activity or activities being costed, you may use a variety of techniques. Here are some commons ones: Job Costing: Managers use job costing, also called job-order costing, to determine the cost of a product that is unique or dissimilar to other products. In industries such as construction, it’s extremely rare for two jobs to be identical. Job-order costing uses a unique job-cost record that compiles total labor and resource costs, as well as applicable overheads, for each task or activity completed as part of a task to determine total expenditures for the job. The job-cost record includes both direct and indirect costs. Process Costing: You use process costing to determine costs for products or tasks that are identical. Unlike job costing, it does not compute the total cost of a product by summing up the costs of all tasks and activities that go into creating the product. Instead, process costing looks at the processes included in the mass production that creates products. By dividing the total cost of a process by the number of units output, it is possible to determine the cost per unit of each process. After this, you may total the costs per unit of every process involved in the eventual manufacturing of the product. In this way, you compute the cost per unit of each product on a process-by-process basis. Activity-Based Costing: Activity-based costing (ABC) is an approach to assigning overhead costs to products. Since overhead cost allocation based simply on the number of machine hours needed may be misleading, this costing technique looks at the activities focused on creating a product — testing, machine setup, etc. — and then assigns portions of their costs to all products created using these activities. Products that were not created via these activities do not have shares of these activities’ costs added on. Direct Costing: Direct costing, also called contribution costing or variable costing, is a technique that only assigns variable manufacturing costs to the cost of a product. You do not add fixed manufacturing costs to the cost of creating a product but instead associate those costs with the time period during which you incur them. Life-Cycle Costing: Life-cycle costing is a comparative analysis technique that involves summing the total costs incurred during the life cycles of project options in order to choose the best option. Since starting capital costs may not be an accurate representation of how much a project will eventually cost, life-cycle costing includes all costs associated with ownership — including maintenance and disposal costs — to enable better decision making.

Measuring Project Performance With Cost Management KPIs

Once your budget is approved and your project is under way, you’ll want to benchmark your progress relative to your cost management plan. First, there are some key metrics and performance indicators to understand: Project Cost Performance: A project’s cost performance is an assessment of how actual expenditure on a project compares with planned expenditure as detailed in the project budget. The project manager communicates a project’s cost performance to the project stakeholders, and it may serve as the basis for preventative or corrective actions to avoid cost overruns. Earned Value: Earned value is a method of measuring project cost performance. It is based on the use of planned value (where you allot specific portions of a project’s budget to the project tasks), and earned value (where you measure progress in terms of the planned value that is earned upon completion of tasks). You may contrast the earned value with the actual cost - the expenditure you actually incur up to a certain point in the project schedule - to see how actual project costs compare to expected project costs. Cost Performance Index (CPI): This is a measurement of how earned value compares to actual cost. This ratio measures a project’s cost efficiency at a given point in time by expressing earned value in proportion to actual cost. To calculate CPI, divide earned value by actual cost. A result of 1 means the project is exactly on budget; a number above 1 means it is under budget.

To learn more about KPIs in project management, read All About KPI Dashboards .

How to Control Costs

Effective cost control means performing a number of related activities that all begin by monitoring costs — since you can’t know if costs are greater than planned unless you are tracking actual expenses. Then, project managers need to decide how to respond to cost variances. Here are some key steps and concepts that inform the cost control process: Monitoring Cost Performance: A project manager routinely monitors a project’s cost performance by creating performance reports that summarize current performance and forecast whether you will complete the project on budget. You provide project stakeholders with information about a project’s cost performance. Reviewing Changes: You must amend the cost baseline to reflect all cost-related changes, and you should inform the project shareholders about all changes. Actual Costs versus Budgeted Costs: Upon milestone and entire project completion, you examine the variances between actual costs and budgeted costs. Responses to the cost management plan will depend on the magnitude of the variance and the stage of the plan - this could range from a discussion to changes in the project scope that reduce costs. Reserve Analysis: Use reserve analyses to allocate contingency reserves to projects based on the likelihoods and magnitudes of risk. Cash-Flow Analysis: Used in financial reporting, cash-flow analyses detail cash inflows and outflows over a given period of time, and provide starting and ending balances. Learning-Curve Theory: The learning-curve theory applies to the relationship between the time spent producing a unit and the number of units produced. According to the theory, the time spent on each unit should decrease as workers gain experience and therefore produce units faster.

Cost Management vs. Strategic Cost Management

While cost management reduces expenses regardless of their cause or purpose, strategic cost management is a sub-discipline that strives to manage cost while also making the organization stronger. Robin Cooper, Professor of Management at Claremont’s Peter F. Drucker Graduate Management Center and Regine Slagmulder, Professor of Management Accounting at Tilberg University in the Netherlands, define strategic cost management as the “application of cost management techniques so that they simultaneously improve the strategic position of a firm and reduce costs.” Strategic cost management centers on the idea that cost reduction initiatives can affect an organization’s strategic position. Strategic cost management emphasizes considering the strategic and financial impact of cost management techniques. Cooper and Slagmulder classify cost management initiatives as one of three types based on how the initiative affects the organization: Strengthen: An example of an initiative that strengthens competitive positioning is a taxi service that replaces its phone booking system and team of booking agents with an app that allows people to book taxis using their mobile devices. An initiative like this both reduces costs and gives a company a strategic advantage, as it makes it easier to book taxis on short notice. No effect: An initiative that has no effect on competitiveness might concern a publishing house that outsources proofreading tasks to international freelancers who accept lower wages. While this increases the company’s profitability, it does not affect its strategic positioning. Weaken: Finally, an initiative that actively harms competitive positioning might involve the taxi company decreasing the frequency of regular vehicle maintenance, a move which, while saving costs initially, will result in cars breaking down more often. Strategic cost management also comprises a number of important strategies: Relevant Cost Strategies: Use relevant cost strategies to compare and decide between alternative courses of action. Relevant costs are costs you can reduce by adopting a particular course of action. They are different from sunk costs (which you cannot recoup once spent) and fixed overhead costs (which are the same for all potential courses of action). When you make decisions, a relevant costs strategy focuses only on costs that vary among options. Evaluating Opportunity Costs: Evaluating opportunity costs is a more holistic approach to decision making that considers not only all the monetary aspects of alternative courses of action, but also all the intangible aspects. For example, a company providing vehicle repair services might have to decide between two qualities of engine oil, taking into account both that one is more expensive than the other and that the more expensive engine oil also preserves engine health in the long term. Balanced Scorecard Strategy: A balanced scorecard strategy allows businesses to assess the impact of cost management initiatives across four key areas: financial results, customer impact, internal business processes, and employee growth and development. It provides a framework for thorough consideration of the impacts of cost management initiatives.

Getting Into the Details: Cost Accounting in Project Cost Management

Cost accounting involves the recording and classification of costs associated with a project. It is an internal practice that supports managerial decision making and is a primary discipline concerning cost management.

Cost accounting is different than general financial accounting. Financial accounting concerns reporting an organization’s past financial performance and does not delve into extensive detail. Since you carry out cost accounting for a specific area of activity within a company — such as a particular project or geographical region — it focuses on more granular aspects and may include projections of future costs. Cost accounting involves preparing reports for an organization’s management (these reports are not distributed externally). By contrast, financial accounting deals with standardized reports that may be distributed to a variety of stakeholders and regulators. As such, you typically perform cost accounting on an as-needed basis, such as during a strategic project, and it does not follow a mandated format. Financial accounting, on the other hand, is a mandated and regulated formal process, and you must create financial reports according to international financial reporting standards. There are a few commonly used cost accounting approaches: Standard Cost Accounting: This is based on the concept of efficiencies , or ratios that compare the time and resource costs of actually completing an activity with the costs of completing the activity under standard conditions. Variance analysis is a core element of standard cost accounting. However, since the idea of efficiencies is based on a paradigm in which labor costs contribute substantially to manufacturing — which is no longer the case — standard cost accounting is somewhat outdated. Activity-Based Costing: This is an approach to assigning overhead costs that examines activities that provide a service, execute a task, or create a product, and then assigns portions of their costs to output. Resource Consumption Accounting (RCA): This approach emerged around 2000, and assigns costs based on the consumption of resources. It uses a German cost management system known as GPK and activity-based costing, a cost allocation method. Throughput Accounting: This is an accounting approach that aims to maximize profitability by increasing the rate of production of goal units and minimizing operating expenses and investment costs. Life-Cycle Costing: This is a method of analyzing project alternatives that focuses on total costs of ownership and selecting the most cost-effective option based on more than simple capital costs. Environmental Accounting: Reporting the environmental costs incurred by a company or project’s activities. Target Costing: This uses a predetermined market price and preferred profit margin to determine how much money can be used to create a product or service. The target cost is the maximum amount you can spend on production without affecting the profit margin. Cost Coding: To make cost accounting easier, most organizations have adopted a method of identifying costs with a code, usually a number. The root of the code usually represents the type of expense, cost center, or business unit involved. This makes it easier to group and find related expenses in financial reports. Individual projects may be assigned their own code. A common structure in an enterprise or very large organization is a top-level, four-digit code that relates to the accounting entity (for example, a subsidiary company). The next numbers pertain to department, followed by a number for the cost, which can be a cost center, profit center, work-breakdown-structure element, fund, or internal order. This facilitates the cost management process by aligning the cost codes with the work breakdown structure, which makes it easier to calculate financial performance. In addition, costs in cost accounting may be classified by:

- Traceability: Direct and indirect costs

- Behavior: Fixed or variable costs

- Controllability: Controllable or uncontrollable costs

- Time Incurred: Historical or predetermined costs

- Normality: Normal or abnormal costs

- Functions: The organizational function by which you incur a cost

Cost accounts make it easy to identify cost overruns in specific sectors that might otherwise be lost in a budget overview. However, managing a large number of cost accounts — up to several hundred accounts and sub-accounts on larger projects — comes with its own challenges. It demands a higher degree of organization in accounting, for one, and classifying costs becomes more time consuming. In addition, the system of categorization you use for a project’s cost accounts may not match up with the system of categorization you use for an organization’s cost accounts. This complicates the creation of a project budget from a final cost estimate, and is likely to happen when you create cost accounts using a system of categorization different than the performing organization uses.

Aside from recording historical expenditure, project managers must also forecast expected activity costs to ensure that they remain under control. Managers can do this through the use of tables that classify costs for individual cost accounts and cost modeling techniques that indicate whether work associated with a particular activity is due to be completed on budget.

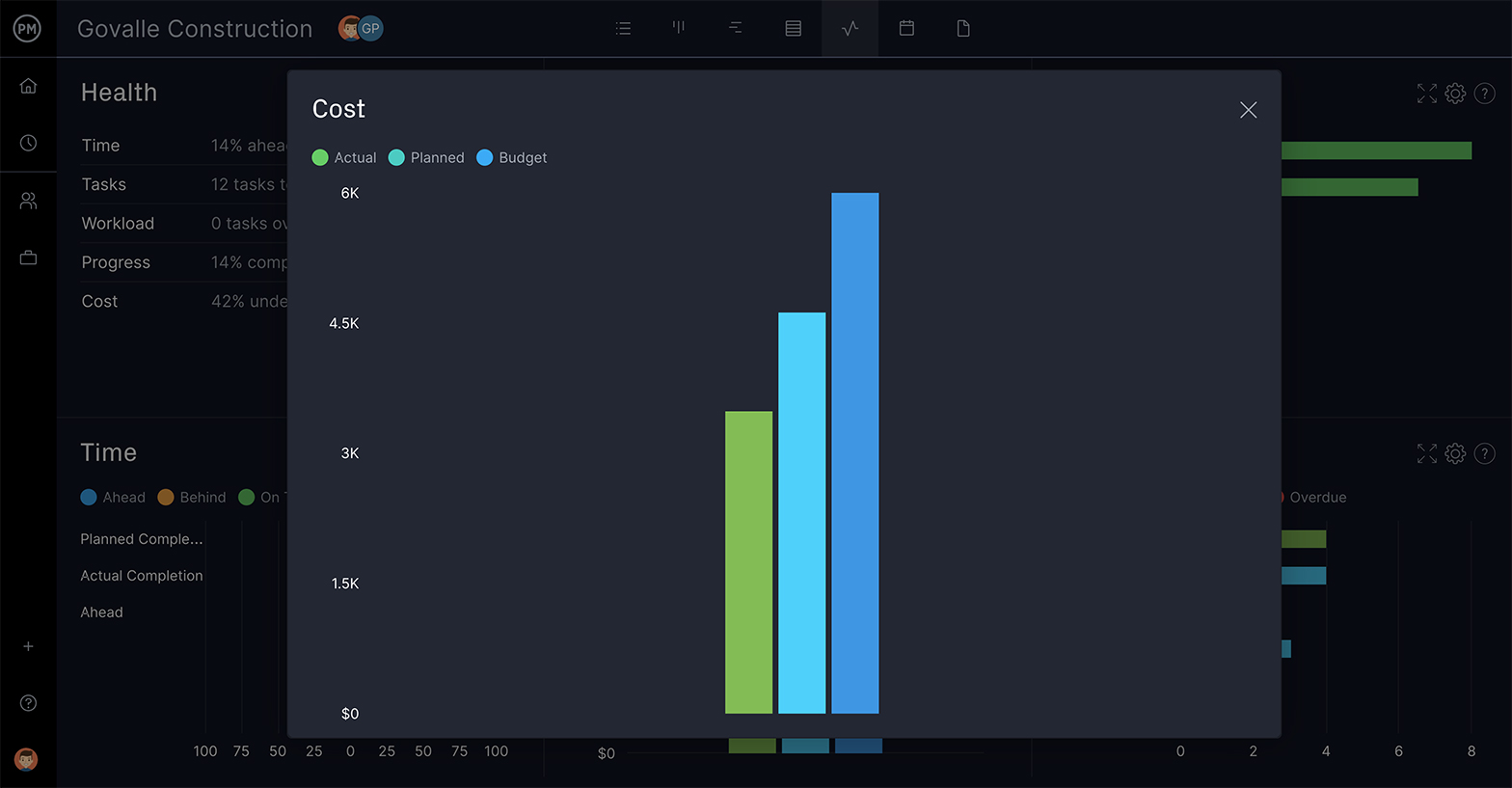

Software’s Role in Project Cost Management

Cost management software simplifies and expedites project cost management activities. This can ease the burden on project cost managers and make it easier to extract insights, such as the cost performance index. Some of the common functionalities include: Project-Tree Building: A visual representation of a work breakdown structure. This can be useful when employing deterministic estimating techniques.

Cost Estimation: Cost management software can provide powerful estimation capabilities such as using project trees to record activity costs, or running regression analyses to determine cost-estimate relationships in historical data. Project Cost Management Templates: For projects that are similar, cost management ]templates can expedite cost management activities. Budgeting: Cost management software can make it easier for project managers to conduct budget planning activities and allocate funding.

Keep Projects On-Budget Using a Cost Management Template

One tool that can help with project cost management is Smartsheet, a collaborative work management and automation platform. As a cloud-based platform, you can share and collaborate on your cost management activities with internal and external stakeholders, and access the information from anywhere, on any device.

Plus, with a pre-built, customizable template in Smartsheet, you can get started faster than ever. Track project and budget performance all in one sheet. Use symbols to quickly identify tasks that may be at risk of going over budget, and bring visibility to status of estimated versus actual labor, materials, and other costs. Set up alerts and reminders to notify you as costs change, and attach documents like invoices and purchase orders directly to tasks, to keep details in context.

Try one or all of the following templates to help ensure your next project stays on budget:

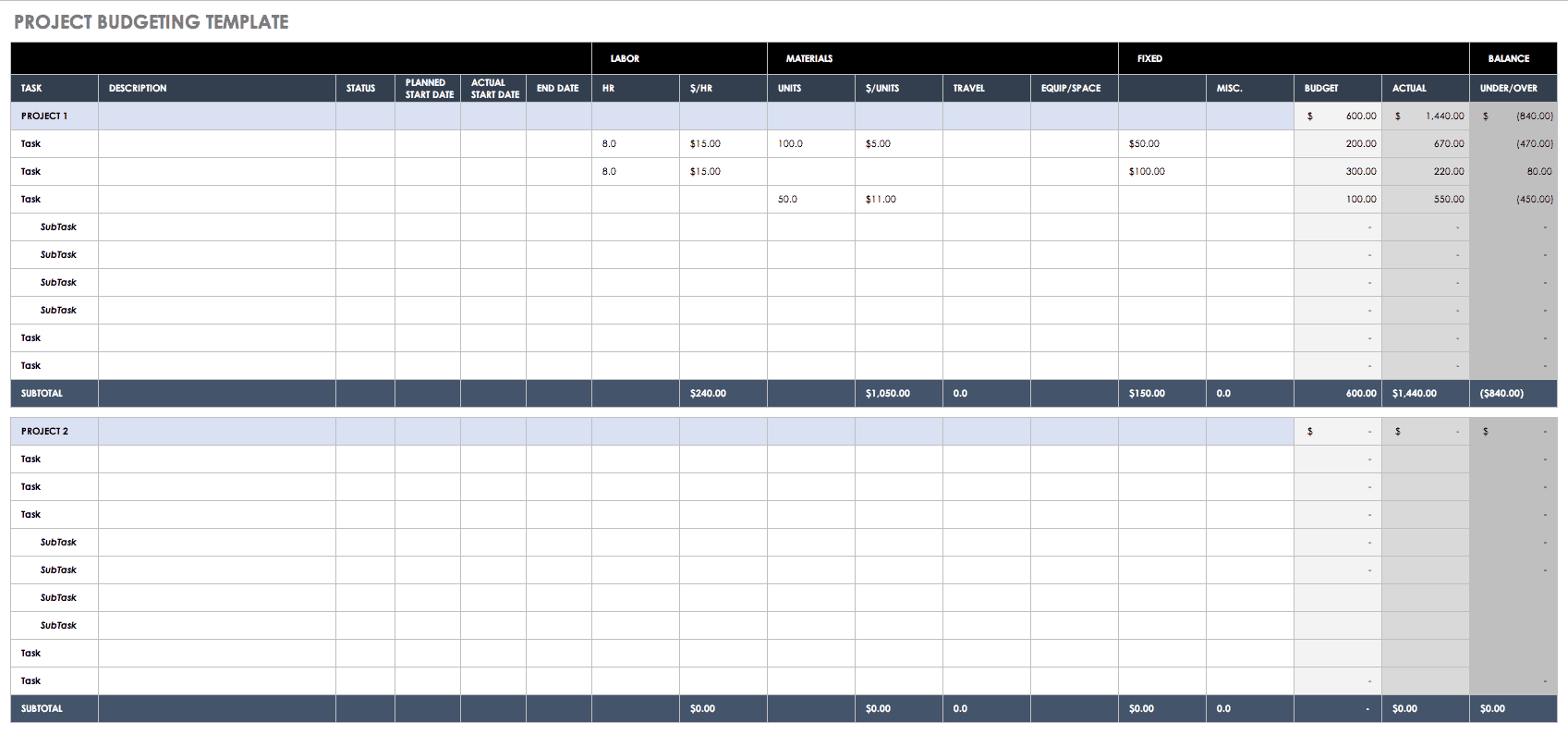

Project Budget Template

Download Project Budget Template

Excel | Smartsheet

Cost Management Plan Template

Download Project Cost Management Template

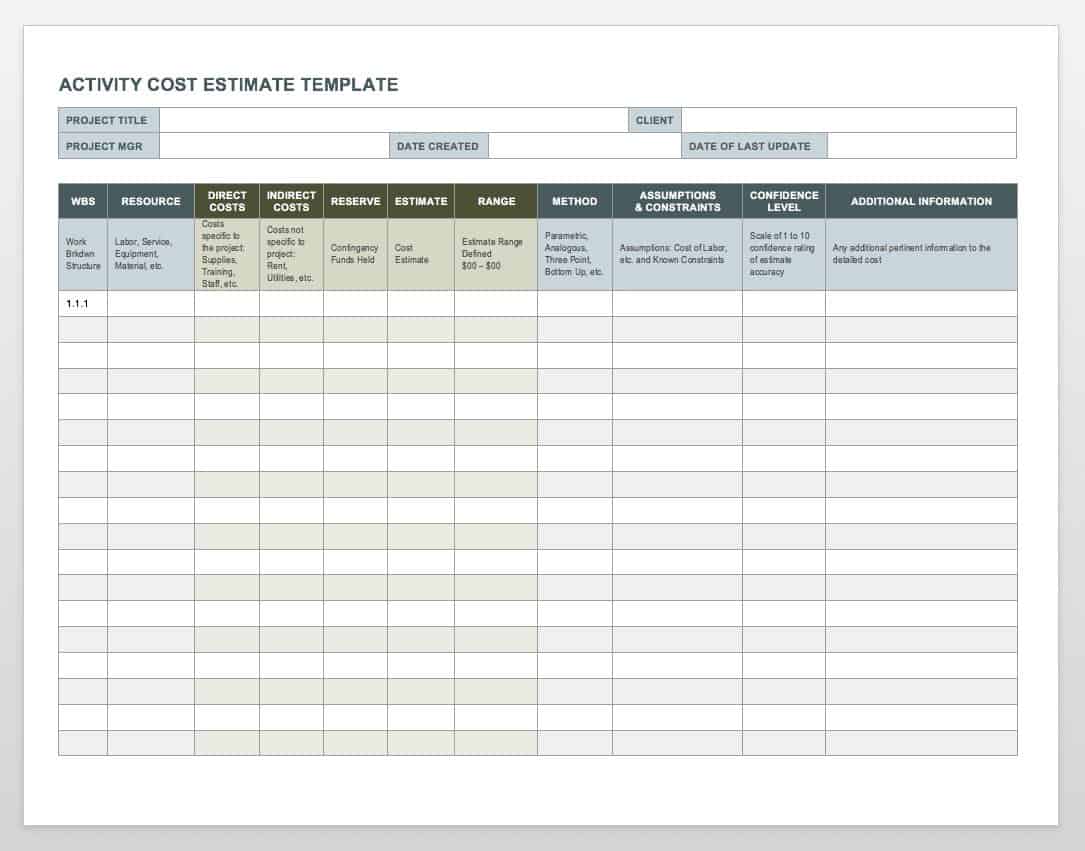

Activity Cost Estimate Template

Download Activity Cost Estimate Template

Smartsheet Project with Schedule & Budget Variance Template

Cost Management for IT Projects

IT project costs are notorious for going over budget, mainly because of development approaches that allow scope creep during the product development life cycle. There is also a tendency for IT cost estimates to be less fixed than those of hard projects in fields such as construction and engineering, where maturity in planning and estimating is higher. In Information Technology Project Management , Kathy Schwalbe suggests that the people creating cost estimates for IT projects lack experience compared to specialist cost surveyors who create cost estimates for construction projects. Furthermore, given how multifaceted these projects tend to be and how quickly IT evolves, IT projects often suffer from the “first-time, first-use penalty,” which means that it is hard to form accurate estimates when a project or project elements have not been attempted before. This makes documenting lessons learned crucial for IT projects. The U.S. research and advisory firm Gartner creates a research report for the project and portfolio management market that categorizes vendors into four categories based on their ability to understand market needs and to drive the acceptance of new technologies. These are graphed on axes labeled “completeness of vision” and “ability to execute,” respectively. The “magic quadrant” is the upper right of this graph in which leaders in both areas cluster.

Cost Management in Construction Projects

Construction project cost managers, or quantity surveyors, oversee cost estimation and cost control while maintaining a project’s profitability. They are responsible for ensuring that a project remains within budget while meeting its scope, quality, and performance requirements. Though the majority of construction projects are not subject to the “first-time, first-use penalty,” they are still highly complex. And as hard projects, their design, scope, and budgetary requirements must be planned before work begins. Experience and formal training are essential for quantity surveyors. The evaluation and recommendation of bids is one of the quantity surveyor’s primary responsibilities, though they may be engaged in a project from inception to conclusion. In fact, quantity surveyors get their name from the bill of quantities , a cost estimate prepared by the surveyor and by which contractors’ tenders are assessed.

To aid cost management for large, complex projects, quantity surveyors or project managers may use cost codes discussed earlier to set up multiple cost accounts. These accounts are essentially portions of budget marked for specific expenses such as labor, construction materials, architectural design, etc.

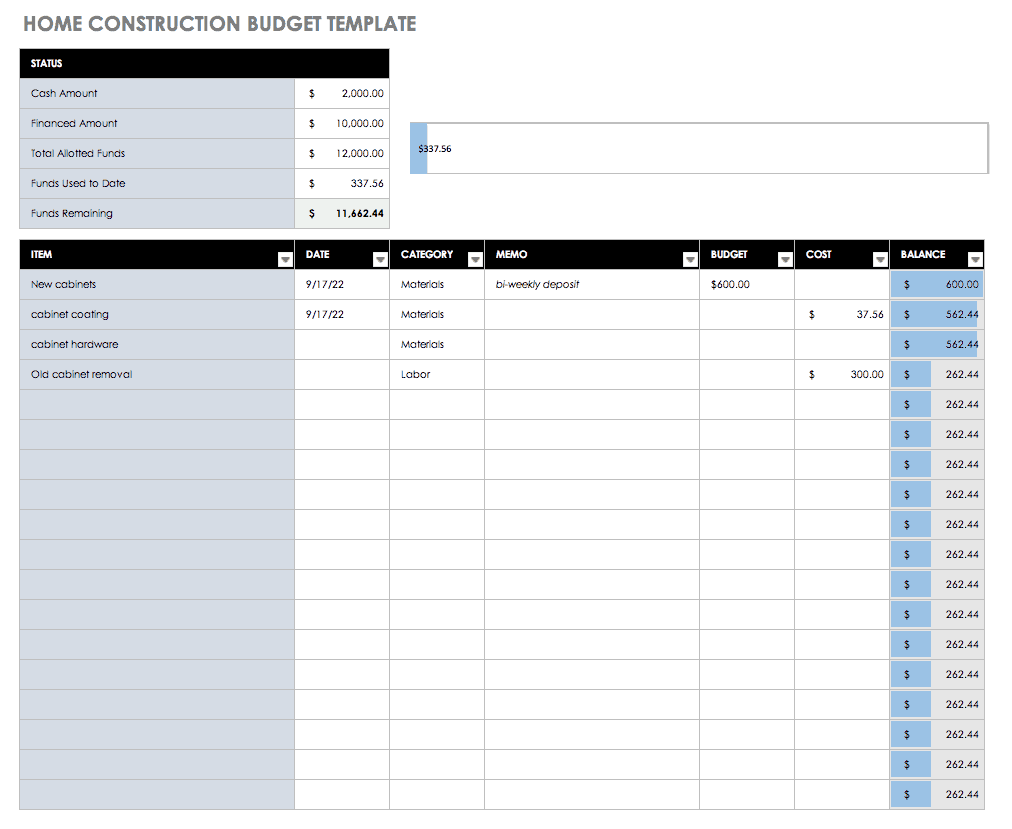

Home Construction Budget Template

Download Construction Budget Template

Excel | Smartsheet

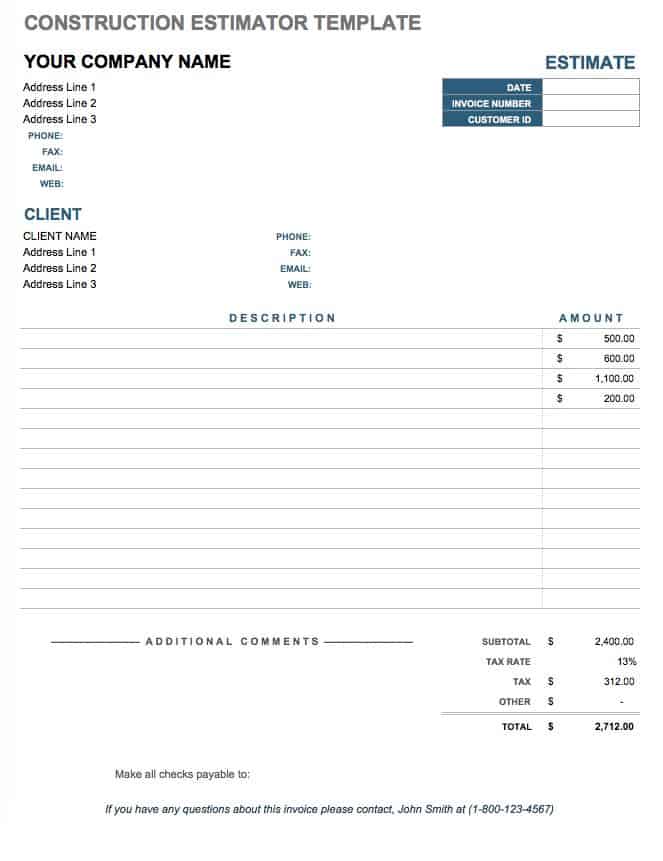

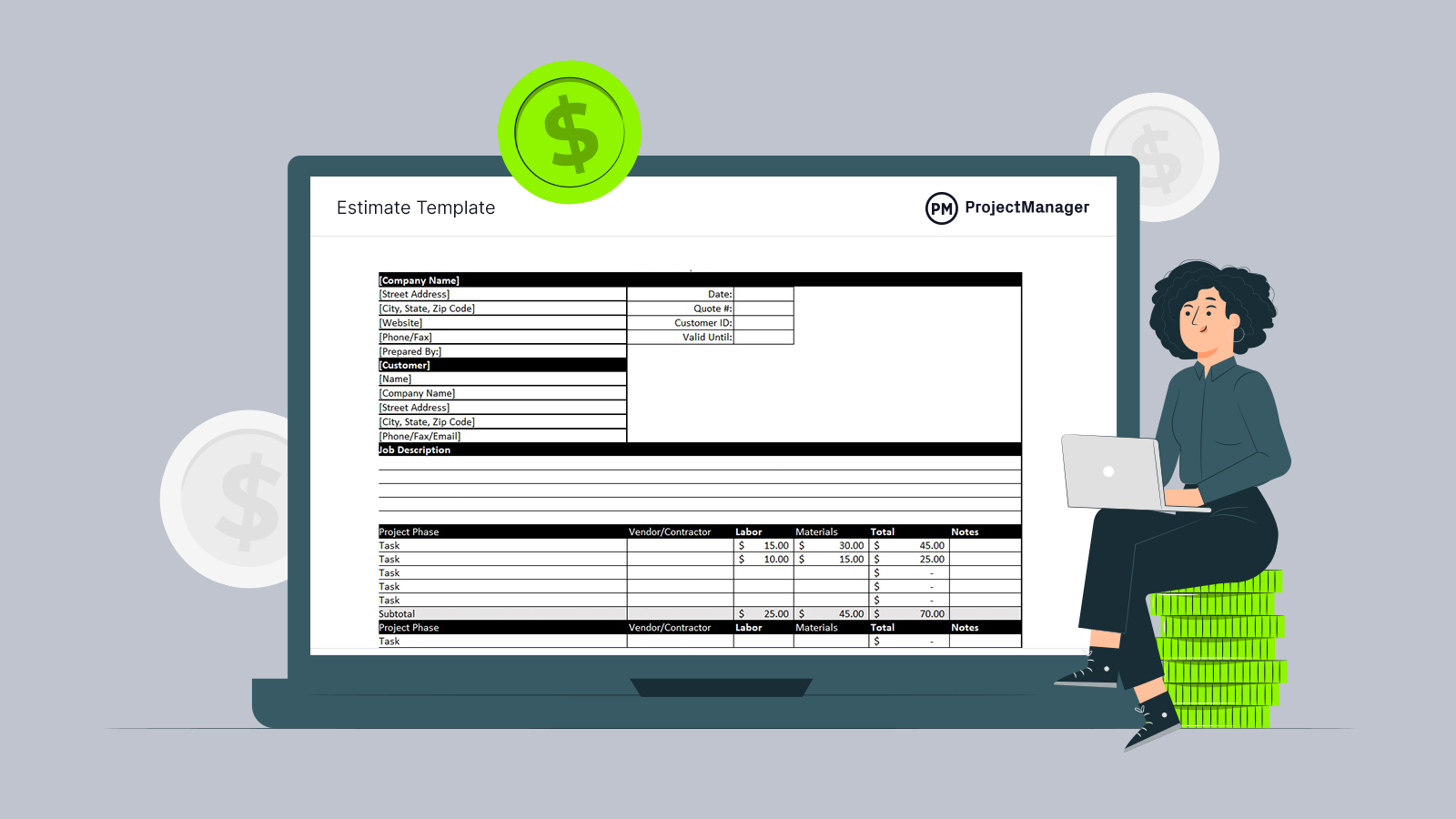

Construction Estimator Template

Download Construction Estimator Template

Excel | Word | PDF | Smartsheet

Exploring Cost Management as a Career

Professional cost managers, sometimes called quantity surveyors, work on large projects (such as construction). But project managers also need an understanding of cost management strategies and techniques to perform their duties. Cost management requires creative problem-solving skills and a thorough understanding of the factors that affect project costs. As such, cost managers are in high demand and have opportunities to progress to lead project managers. One popular cost management profession is cost accounting, which is determining the costs focused on creating a product or providing a service. Cost accountants deal with budget preparation and profitability analysis, and their main responsibilities include collecting and communicating cost-related data to aid management decision-making and create financial transparency. Cost accountants typically study accounting or finance at the undergraduate level, and many pursue master’s degrees in business administration or finance with a specialization in accounting. They typically need a license to advance their careers, which can be obtained after meeting some combination of work and educational requirements.

How Smartsheet Can Help with Cost Management Across Your Projects

The best marketing teams know the importance of effective campaign management, consistent creative operations, and powerful event logistics -- and Smartsheet helps you deliver on all three so you can be more effective and achieve more.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Improve your marketing efforts and deliver best-in-class campaigns.

- Product overview

- All features

- App integrations

CAPABILITIES

- project icon Project management

- Project views

- Custom fields

- Status updates

- goal icon Goals and reporting

- Reporting dashboards

- workflow icon Workflows and automation

- portfolio icon Resource management

- Time tracking

- my-task icon Admin and security

- Admin console

- asana-intelligence icon Asana AI

- list icon Personal

- premium icon Starter

- briefcase icon Advanced

- Goal management

- Organizational planning

- Campaign management

- Creative production

- Content calendars

- Marketing strategic planning

Resource planning

- Project intake

- Product launches

- Employee onboarding

- View all uses arrow-right icon

- Project plans

- Team goals & objectives

- Team continuity

- Meeting agenda

- View all templates arrow-right icon

- Work management resources Discover best practices, watch webinars, get insights

- What's new Learn about the latest and greatest from Asana

- Customer stories See how the world's best organizations drive work innovation with Asana

- Help Center Get lots of tips, tricks, and advice to get the most from Asana

- Asana Academy Sign up for interactive courses and webinars to learn Asana

- Developers Learn more about building apps on the Asana platform

- Community programs Connect with and learn from Asana customers around the world

- Events Find out about upcoming events near you

- Partners Learn more about our partner programs

- Support Need help? Contact the Asana support team

- Asana for nonprofits Get more information on our nonprofit discount program, and apply.

Featured Reads

- Project planning |

- Project cost management: Definition, st ...

Project cost management: Definition, steps, and benefits

Cost management is the process of planning, budgeting, and reporting project spend in order to keep teams on budget and overall costs reasonable. In this article, we'll go over the four functions of cost management and explain exactly how to use them to improve your project's bottom line.

What is cost management?

Cost management is the process of estimating, budgeting, and controlling project costs. The cost management process begins during the planning phase and continues throughout the duration of the project as managers continuously review, monitor, and adjust expenditures to ensure the project doesn't go over the approved budget.

Why is cost management important?

Have you ever wondered what happens when a project goes significantly over budget? The consequences can be severe—from strained relationships with clients to financial losses. Let's consider an example:

A small software development team was tasked with creating a custom application for a client. Midway through, they realized the project was quickly exceeding the initial budget. They faced a common dilemma: continue as planned and absorb the extra costs or re-evaluate their approach.

By implementing rigorous cost management strategies, the team was able to identify areas where expenses were ballooning. They streamlined their project management processes, prioritized essential features, and renegotiated terms with subcontractors. This approach not only brought the project back within budget but also improved their working relationship with the client, who appreciated their transparency and commitment to delivering value.

This scenario highlights how effective cost management can transform a potentially disastrous situation into a success story.

How to create a cost management plan

Cost management is a continuous, fluid process. However, there are four main elements or functions that can be found in any cost management plan:

Cost estimating

Cost budgeting, cost control.

Because new expenses can appear and project scope can be adjusted, cost managers need to be prepared to perform all four functions at any time throughout the project life cycle. Your workflow will vary according to the project’s needs.

Here, we'll break down each of the four elements in greater detail and explain what is required from the cost manager at each stage.

![cost management assignment [Inline Illustration] cost management (infographic)](https://assets.asana.biz/transform/817309ee-ddc4-405a-90ce-3090369ac44d/inline-project-planning-cost-management-1-2x?io=transform:fill,width:2560&format=webp)

The very first step in any cost management process is resource planning, which is when the cost manager reviews the project's scope and specs to figure out what resources the project will require.

A resource is anything that helps you complete a project—including tools, money, time, equipment, and even team members. To create the most accurate resource plan possible, consult directly with team leads and stakeholders about what resources they will need during the project. People with hands-on experience in each project department will have a better understanding of what resources will be required.

For this step, you'll need:

Clearly defined project objectives

A high-level project roadmap or a work breakdown structure (WBS) , depending on the complexity of the project

A tentative resource management plan

A project scope statement

Once you have a list of necessary resources, the next step is to estimate what it will cost to procure them. The key to this step is to gather as much pricing information as possible so that you can make informed cost estimates.

For tangible resources like tools, supplies, and equipment, get real price quotes from sellers to inform your cost estimate. For labor costs, get multiple price quotes from potential contractors to help give you a realistic idea of what the work you require will actually cost. Keep in mind that some time may pass between when you make your estimate and when these items will be purchased, so you should build in some room in case prices rise.

In addition to building in a cushion for each individual cost, you'll also need to add a buffer of 5–10% to your cost total to account for unexpected expenses. If this is your first time working with this project team, find out if the previous cost manager generated budget reports at the end of past projects.

You can take a look at how much previous projects' final costs deviated from their initial estimates and use this cost data as a benchmark to estimate how much of a margin you need to build into your estimation report.

In the estimation stage , you'll need:

Project schedule or a PERT chart , depending on the complexity of the project

A list of your project deliverables

Clearly defined success metrics

Now that you have general estimates for your project needs and resource requirements, you can begin to work on your project budget . Your project budget is a detailed plan of how much you plan to spend during the project, for what, and by when.

Depending on the complexity of your project, the “when” may significantly influence your cost management strategy. For multi-year projects, you may want to specify cost allocations so that no more than 30% of your budget should be spent in the first year, etc. This can prevent cost overruns later down the road.

In this stage, you'll need:

A project budget document

A project stakeholder analysis

The bulk of the cost management process is made up of cost control . This is the process of recording and accounting costs as the project progresses, making adjustments, and alerting stakeholders to problems when they occur. The goal of the cost control step is to compare actual project costs with original budgets and estimates and take steps to make sure the project stays as close to plan as possible.

The frequency with which you review this will depend on your project. Sometimes you’ll want to review costs in real time. In other cases, you may check in monthly or even quarterly. Share cost updates as necessary through project status reports so the entire project team is on the same page.

Keep in mind that any changes to the project scope will impact the project budget and costs, so keep a close eye on scope creep. If the project cost deviates too much from what you budgeted, let your stakeholders know so you can proactively come up with an action plan.

Project management tool

Universal reporting tool

![cost management assignment [inline illustration] cost management (infographic)](https://assets.asana.biz/transform/6f7dd800-aa58-4efe-bb4b-fad7043488c1/inline-project-planning-cost-management-2-2x?io=transform:fill,width:2560&format=webp)

Post-project cost accounting

Once the project is over, it’s time to calculate cost variance and evaluate how far your project deviated from your original budget and estimates. What were the project’s total costs? How did your actual costs compare to your estimated costs?

A successful project ends close to (but under) the forecasted project budget. If you spent too much money, you either underestimated your project budget or had too many unforeseen expenses. If this happens, hold a project post-mortem meeting to evaluate why that happened and prevent it from happening in the future.

On the flip side, spending too little of your budget is also not ideal. You estimated these costs for a reason, and if you came in significantly under budget, your cost-budgeting process was inaccurate. Log this information as historical data and keep it in mind for future projects, so you can increase your accuracy during the cost estimation phase.

How to calculate project costs

To ensure that your project stays profitable and within budget, it is essential to have a solid understanding of how to calculate project costs.

Project managers have a variety of cost management methods to choose from, and picking the best one depends on the specific needs and scope of your project. Consider factors like project complexity, the predictability of tasks, client expectations, and the level of flexibility you'll need to achieve your cost-performance goals.

Calculating project costs on an hourly basis involves paying for the amount of work done, measured in hours. This method is particularly effective for projects where the scope is flexible or uncertain because it allows for adaptability as the project progresses.

For example, consider a software development project. The development team's cost is calculated based on the number of hours they spend on the project. If the team works 100 hours a month at a rate of $100 per hour, the project costing for that month would be $10,000. This method provides flexibility and can accommodate changes in the project's scope effectively.

A flat rate, or fixed price, approach involves agreeing on a total project cost upfront. This method is ideal for projects with a well-defined scope and deliverables. This gives both parties a clear understanding of the total cost.

Imagine a marketing campaign. The agency and the client agree on a fixed price of $20,000 for the entire campaign. This price covers all aspects of the project, from planning to execution. The advantage here is predictability in budgeting, as the client knows exactly how much the project will cost, irrespective of the time and resources utilized.

The cost-plus method involves charging the actual costs of the project plus a markup or additional fee. This approach is often used in long-term projects where the costs cannot be accurately estimated at the start. It ensures that all project costs are covered and includes a profit margin.

For instance, in a construction project, the contractor charges for the actual costs incurred (like materials and labor) plus a fixed percentage as profit. If the material and labor costs amount to $50,000 and the agreed markup is 20%, the total charge to the client would be $60,000. This cost management method aligns the interests of the client and the contractor, as both parties aim for optimal cost performance.

Value-based pricing

Value-based pricing focuses on the value or benefit the client receives rather than the cost of the project itself. This estimation method is ideal for projects where the outcome has a high perceived value, regardless of the actual cost of delivery.

Consider a scenario where a consulting firm is helping a client increase their annual revenue. If the consultant's strategies result in a $1 million revenue increase, the consultant may charge a fee based on a percentage of the revenue increase, say 10%, which would be $100,000. Value-based pricing ensures that the pricing reflects the value delivered.

Effective project cost management methods

One of the most persistent challenges faced by teams across various industries is controlling and preventing budget overruns. These overruns not only strain financial resources but can also lead to compromised project quality, delayed timelines, and even project failure.

Effective cost management is the key to tackling this challenge because it makes certain that projects are delivered within their allocated budgets while maintaining high standards of quality and efficiency.

Choosing the best cost-management method is key to addressing these financial challenges head-on. For further cost optimization, teams can leverage automation, management software, and dashboards that offer real-time cost analysis, cash flow, and future cost visualization. This will ultimately contribute to the success of your project.

Top-down estimating

Top-down estimating is a method where the overall project cost is estimated first, and then individual costs are deduced from this total. This approach is beneficial in the early stages of project planning, when detailed information is not yet available. It gives a quick and rough idea of how much the project will cost.

For example, in a new software development project, the project manager might estimate the total project cost at $200,000 based on previous similar projects. This total cost is then broken down into smaller segments like design, coding, testing, and deployment, each allocated a portion of the total budget. This method is effective for providing a preliminary cost framework and guiding early project decision-making.

Bottom-up estimating

Bottom-up estimating is the reverse of the top-down approach. It involves estimating individual tasks or components of the project first and then adding them up to get the total project cost. This estimation method is more accurate and reliable, especially for projects with a well-defined scope, as it considers detailed cost information.

Consider a construction project where each part of the project, such as foundation laying, framing, plumbing, and electrical work, is estimated individually based on detailed analysis. After estimating all these components, the costs are summed up to determine the overall project budget. Bottom-up estimating is ideal for teams that need precise control over each aspect of the project's costs.

Earned value management

Earned value management (EVM) is a sophisticated approach to cost management that combines measurements of project performance in terms of scope, schedule, and cost. EVM provides a comprehensive view of the project's progress and its alignment with the original project planning.

For instance, in a large infrastructure project, EVM would be used to track the following:

Budgeted cost of work scheduled (BCWS)

Actual cost of work performed (ACWP)

Budgeted cost of work performed (BCWP)

By comparing these figures, project managers can gauge the project's cost performance and take corrective action if necessary.

Three-point estimating

Three-point estimating is used to determine a more realistic estimate by considering three scenarios:

Most optimistic (best-case)

Most pessimistic (worst-case)

Most likely

This cost management method provides a range of possible outcomes, which can increase the predictability and cost performance of a project.

Take, for example, a new product development project. The project manager might estimate that the design phase could take 30 days (optimistic), 45 days (most likely), or 60 days (pessimistic). Using these three points, they calculate an average or weighted average duration, which helps in setting realistic timelines and budgets.

FAQ about cost management

What is the first step in project cost management.

The first step in project cost management is to define the baseline for your project's budget. This involves identifying all potential costs and inputs related to the project, including labor, materials, equipment, and any other expenses. Creating a baseline is essential because it provides the framework for monitoring and controlling expenses during the lifecycle of a project.

What are the 5 functions of cost management?

The five key functions of cost management are:

Cost estimation: Determining the total cost required for completing the project.

Cost budgeting: Allocating the overall cost estimate to individual work items to establish a baseline for measuring performance.

Cost control: Monitoring project expenses and implementing measures to keep costs within the approved budget.

Cash flow management : Ensuring there is adequate cash flow to meet project needs, which is critical for maintaining project momentum.

Procurement management: Managing the procurement of goods and services, ensuring that everything is obtained at the best possible cost and meets project needs.

What is cost management in project management?

Cost management in project management is the process of planning, estimating, budgeting, and controlling costs with the aim of completing the project within the approved budget. It involves a continuous process of measuring and monitoring project activities and expenses and implementing necessary adjustments to ensure that the project's financial resources are used effectively.

Improve your project performance with cost management

Cost management has a lot of moving parts. But as long as your team has visibility into project costs, you can prevent cost overruns and ensure you’re finishing your project under budget every time.

To keep track of all of your project’s information, use a work management platform like Asana. From project costing and kickoff to post-mortem, Asana helps you stay in sync with your project team members and stakeholders during the entire project process.

Related resources

Data-driven decision making: A step-by-step guide

How Asana uses work management for employee onboarding

4 ways to establish roles and responsibilities for team success

Cost control: How to monitor project spending to increase profitability

This browser is no longer supported.

Upgrade to Microsoft Edge to take advantage of the latest features, security updates, and technical support.

Assign access to Cost Management data

- 5 contributors

For users with Azure Enterprise (EA) agreements, a combination of permissions granted in the Azure portal define a user's level of access to Cost Management data. For users with other Azure account types, defining a user's level of access to Cost Management data is simpler by using Azure role-based access control (RBAC). This article walks you through assigning access to Cost Management data. After the combination of permissions is assigned, the user views data in Cost Management based on their access scope and on the scope that they select in the Azure portal.

The scope that a user selects is used throughout Cost Management to provide data consolidation and to control access to cost information. When scopes are used, users don't multi-select them. Instead, they select a larger scope that child scopes roll up to and then they filter-down to what they want to view. Data consolidation is important to understand because some people shouldn't access a parent scope that child scopes roll up to.

Watch the Cost Management controlling access video to learn about assigning access to view costs and charges with Azure role-based access control (Azure RBAC). To watch other videos, visit the Cost Management YouTube channel . This video mentions the Azure EA portal, which is retired. However, equivalent functionality that's available in the Azure portal is also discussed.

Cost Management scopes

Cost management supports various Azure account types. To view the full list of supported account types, see Understand Cost Management data . The type of account determines available scopes.

Azure EA subscription scopes

To view cost data for Azure EA subscriptions, a user must have at least read access to one or more of the following scopes.

| Billing account¹ | • Enterprise Admin • Enrollment reader (Enterprise admin read-only) | None | All subscriptions from the enterprise agreement | |

| Department | Department Admin | enabled | All subscriptions belonging to an enrollment account that is linked to the department | |

| Enrollment account² | Account Owner | enabled | All subscriptions from the enrollment account | |

| Management group | Cost Management Reader (or Contributor) | enabled | All subscriptions below the management group | |

| Subscription | Cost Management Reader (or Contributor) | enabled | All resources/resource groups in the subscription | |

| Resource group | Cost Management Reader (or Contributor) | enabled | All resources in the resource group |

¹ The billing account is also referred to as the Enterprise Agreement or Enrollment.

² The enrollment account is also referred to as the account owner.

Enterprise administrators can assign the billing account, department, and enrollment account scope in the Azure portal . For more information, see Azure portal administration for direct Enterprise Agreements .

Other Azure account scopes

To view cost data for other Azure subscriptions, a user must have at least read access to one or more of the following scopes:

- Management group

- Subscription

- Resource group

Various scopes are available after partners onboard customers to a Microsoft Customer Agreement. Cloud solution providers (CSP) customers can then use Cost Management features when enabled by their CSP partner. For more information, see Get started with Cost Management for partners .

Enable access to costs in the Azure portal

If you have a Microsoft Customer Agreement (MCA) or an Enterprise agreement, you can enable access to costs in the Azure portal. The required setting varies by scope. Use the following information to enable access to costs in the Azure portal.

Enable MCA access to costs

The Azure charges setting is used to enable access to costs for MCA subscriptions. The setting is available in the Azure portal at the billing account scope. You must have Billing Profile Owners permission to enable the setting. Otherwise, you won't see the setting.

To enable the setting, follow these steps:

- Sign in to the Azure portal with an account with Billing Profile Owners permission.

- Select the Cost Management + Billing menu item.

- Select Billing scopes to view a list of available billing scopes and billing accounts.

- Select your Billing Account from the list of available billing accounts.

- In the left navigation pane, select Billing profiles .

- Select the billing profile.

- In the left navigation pane, select Policies .

Enable EA access to costs

The department scope requires the Department admins can view charges (DA view charges) option set to On . Configure the option in the Azure portal. All other scopes require the Account owners can view charges (Account owner (AO) view charges) option set to On . You must have the Enterprise Administrator role to enable the setting. Otherwise, you won't see the setting.

To enable an option in the Azure portal:

- Sign in to the Azure portal with an enterprise administrator account.

After the view charge options are enabled, most scopes also require Azure role-based access control (Azure RBAC) permission configuration in the Azure portal.

Enterprise administrator role

By default, an enterprise administrator can access the billing account (Enterprise Agreement/enrollment) and all other scopes, which are child scopes. The enterprise administrator assigns access to scopes for other users. As a best practice for business continuity, you should always have two users with enterprise administrator access. The following sections are walk-through examples of the enterprise administrator assigning access to scopes for other users.

Assign billing account scope access

Access to the billing account scope requires enterprise administrator permission. The enterprise administrator can view costs across the entire EA enrollment or multiple enrollments. The enterprise administrator can assign access to the billing account scope to another user with read only access. For more information, see Add another enterprise administrator .

It might take up to 30 minutes before the user can access data in Cost Management.

Assign department scope access

Access to the department scope requires department administrator (DA view charges) access. The department administrator can view costs and usage data associated with a department or to multiple departments. Data for the department includes all subscriptions belonging to an enrollment account that are linked to the department.

Enterprise administrators can assign department administrator access. For more information, see Add a department administrator .

Assign enrollment account scope access

Access to the enrollment account scope requires account owner (AO view charges) access. The account owner can view costs and usage data associated with the subscriptions created from that enrollment account. Enterprise administrators can assign account owner access. For more information, see Add an account owner in the Azure portal .

Assign management group scope access

Access to view the management group scope requires at least the Cost Management Reader (or Reader) permission. You can configure permissions for a management group in the Azure portal. You must have at least the User Access Administrator (or Owner) permission for the management group to enable access for others. And for Azure EA accounts, you must also enable the AO view charges setting.

You can assign the Cost Management Reader (or reader) role to a user at the management group scope. For more information, see Assign Azure roles using the Azure portal .

Assign subscription scope access

Access to a subscription requires at least the Cost Management Reader (or Reader) permission. You can configure permissions to a subscription in the Azure portal. You must have at least the User Access Administrator (or Owner) permission for the subscription to enable access for others. And for Azure EA accounts, you must also enable the AO view charges setting.

You can assign the Cost Management Reader (or reader) role to a user at the subscription scope. For more information, see Assign Azure roles using the Azure portal .

Assign resource group scope access

Access to a resource group requires at least the Cost Management Reader (or Reader) permission. You can configure permissions to a resource group in the Azure portal. You must have at least the User Access Administrator (or Owner) permission for the resource group to enable access for others. And for Azure EA accounts, you must also enable the AO view charges setting.

You can assign the Cost Management Reader (or reader) role to a user at the resource group scope. For more information, see Assign Azure roles using the Azure portal .

Cross-tenant authentication issues

Currently, Cost Management provides limited support for cross-tenant authentication. In some circumstances when you try to authenticate across tenants, you may receive an Access denied error in cost analysis. This issue might occur if you configure Azure role-based access control (Azure RBAC) to another tenant's subscription and then try to view cost data.

To work around the problem : After you configure cross-tenant Azure RBAC, wait an hour. Then, try to view costs in cost analysis or grant Cost Management access to users in both tenants.

- If you haven't read the first quickstart for Cost Management, read it at Start analyzing costs .

Was this page helpful?

Coming soon: Throughout 2024 we will be phasing out GitHub Issues as the feedback mechanism for content and replacing it with a new feedback system. For more information see: https://aka.ms/ContentUserFeedback .

Submit and view feedback for

Additional resources

Total with VAT: {{CartWithDetails.cartMaster.total_after_vat}} {{currency}}

Your cart is empty.

Project Cost Management: Process, Importance, Examples, And Plan, And Tools

Written By : Bakkah

Table of Content

What is Cost management definition?

Importance and benefits of project cost management, project cost management best practices, project cost management process, project cost management template, what are cost management tools, how to create a cost management plan, effective project cost management methods, how to calculate project costs, who is responsible for project cost management, project cost management examples, challenges of cost management , project management cost with bakkah learning:, popular articles.

PRINCE2 Methodology - 2024 Full Guide About Advantages and Disadvantages

Prosci Methodology - Change Management Methodology

Application of PMO in government entities in Saudi Arabia

Project Cost Management is the process of planning, estimating, budgeting, financing, funding, managing, and controlling costs so that the project can be completed within the approved budget. Project Cost Management includes activities such as cost estimation, budget development, cost control, and monitoring expenditures throughout the project lifecycle. Effective cost management is crucial for budget control, resource optimization, risk mitigation, stakeholder confidence, competitive advantage, and project success.

Best practices of Project Cost Management include comprehensive planning, regular monitoring and reporting, risk management, clear communication, cost control measures, change management, continuous improvement, and the utilization of technology.

Successful project cost management involves the collaboration of project managers, finance teams, and other relevant stakeholders to develop realistic budgets, identify cost-saving opportunities, and mitigate financial risks . By implementing robust cost management practices, organizations can optimize resource allocation, enhance project performance, and maximize return on investment.

Additionally, continuous evaluation and adjustment of cost management strategies based on project progress and changing circumstances are essential to adapt to unforeseen challenges and ensure the project's financial viability.

Cost management involves a series of activities aimed at ensuring that the project is completed within the allocated financial resources while delivering the intended value and meeting stakeholders' expectations.

This process encompasses various stages, including cost estimation, budget development, cost control, and monitoring of expenditures throughout the project lifecycle. Effective cost management requires accurate forecasting, diligent tracking of expenses, proactive risk management and regular reporting to stakeholders to ensure transparency and accountability.

Project cost management is crucial for several reasons:

1. Budget Control:

Effective cost management ensures that a project stays within its allocated budget. By accurately estimating costs, tracking expenses, and implementing cost-saving measures, organizations can prevent overspending and avoid financial risks, ensuring the project's financial health and viability.

2. Resource Optimization:

Proper cost management enables organizations to optimize resource allocation, including finances, manpower, materials, and equipment. By identifying and eliminating inefficiencies, reallocating resources as needed, and prioritizing spending, projects can operate more efficiently, enhancing productivity and reducing waste.

3. Risk Mitigation:

Cost management helps identify and mitigate financial risks that may impact project outcomes. By proactively identifying potential cost overruns, fluctuations in resource prices, or unexpected expenses, organizations can develop contingency plans and strategies to mitigate these risks, minimizing the impact on the project's timeline and budget.

4. Stakeholder Confidence:

Transparent and effective cost management builds trust and confidence among project stakeholders, including clients, investors, and sponsors. Providing regular updates on budget status, demonstrating prudent financial management practices, and delivering projects within budget constraints enhance stakeholder satisfaction and credibility, fostering positive relationships and future opportunities.

5. Competitive Advantage:

Efficient cost management can give organizations a competitive edge by allowing them to deliver projects more cost-effectively than their competitors.

6. Project Success:

Ultimately, successful project cost management contributes to the overall success of the project. By ensuring that the project is completed within budget, on time, and according to quality standards, organizations can achieve their objectives, deliver value to stakeholders, and sustain competitiveness in the marketplace. Effective cost management is therefore essential for achieving project goals, maximizing return on investment, and driving organizational success.

Some best practices for project cost management include:

1. Planning :

Begin with comprehensive planning that includes detailed cost estimation and budgeting. Break down the project into manageable tasks, identify all potential costs, and develop a realistic budget based on accurate estimates.

2. Regular Monitoring and Reporting:

Implement a robust system for monitoring project costs regularly. Track expenses against the budget, identify variances and analyze the reasons behind them. Provide timely and accurate reports to stakeholders to keep them informed about the project's financial status.

3. Risk Management:

Anticipate potential cost risks and develop strategies to mitigate them. Identify common cost drivers, such as resource shortages, scope changes, or market fluctuations, and develop contingency plans to address them effectively.

4. Clear Communication:

Foster open and transparent communication among project team members, stakeholders, and relevant departments. Ensure that everyone understands the budget constraints, cost objectives, and their roles in managing project costs effectively Cost Control

5. Measures :

Implement cost control measures to optimize spending and prevent cost overruns. This may include negotiating better prices with suppliers, implementing cost-saving initiatives, or reevaluating the scope to align with the budget.

6. Change Management:

Establish a formal change management process to handle scope changes or variations that may impact project costs. Assess the financial implications of proposed changes, obtain approval from relevant stakeholders, and update the budget and plans accordingly.

7. Continuous Improvement:

Regularly review project cost management processes and performance to identify areas for improvement. Collect feedback from team members, conduct post-project reviews, and incorporate lessons learned into future projects to enhance cost management practices.

8. Utilization of Technology:

Leverage project management software and cost-tracking tools to streamline cost-management processes, automate reporting, and improve accuracy. Utilizing technology can also facilitate real-time collaboration and decision-making among project stakeholders.

By following these best practices, organizations can effectively manage project costs, minimize financial risks, and increase the likelihood of project success.

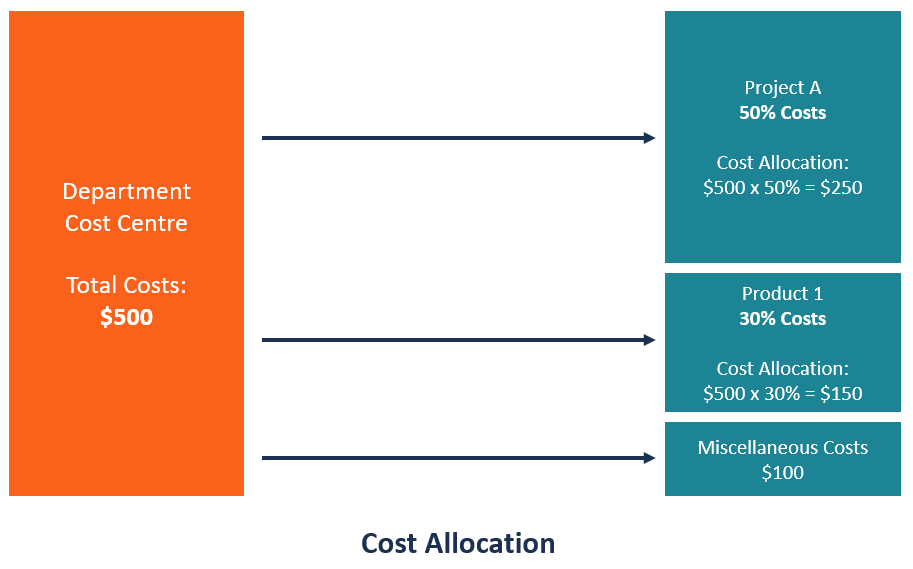

Project cost management is the process of planning, estimating, budgeting, financing, funding, managing, and controlling costs so that the project can be completed within the approved budget. It involves several key processes:

1. Cost Estimation:

This involves estimating the costs of the resources (such as labor, materials, equipment) needed to complete the project activities.

2. Cost Budgeting:

Once the costs are estimated, a budget is developed, which outlines how much will be spent on each activity or work package

3. Cost Control:

During the execution phase, cost control involves monitoring project costs to ensure they stay within the approved budget. This includes tracking expenses, identifying variances, and taking corrective actions if necessary to keep costs in line.

4. Resource Planning:

Efficiently planning and allocating resources to minimize costs while meeting project objectives.

5. Risk Management:

Identifying and assessing potential risks that could impact project costs, and developing strategies to mitigate these risks.

6. Procurement Management:

Managing the procurement process to obtain goods and services needed for the project at the best possible price.

Overall, effective cost management helps ensure that the project is completed within budget constraints while delivering the expected results.

A project cost management template typically includes sections for various aspects of cost management throughout the project lifecycle. Here's a basic template outline:

Project Cost Estimation:

- Identify all resources needed for the project (labor, materials, equipment, etc.).

- Estimate the cost of each resource.

- Use historical data, expert judgment, and other estimation judgment, and other estimation techniques

Cost Baseline Development:

- Develop a baseline budget that outlines the total cost of the project.

- Break down the budget by phase, deliverable, or work package.

Cost Tracking and Monitoring:

- Establish a system for tracking actual costs incurred during project execution.

- Compare actual costs to the baseline budget regularly.

- Identify and address any cost variances promptly.

Cost Control Measures:

- Implement measures to control costs and prevent budget overruns.

- Define thresholds for acceptable cost variances.

- Develop a process for approving and managing changes to the budget.

Resource Allocation:

- Allocate resources based on project needs and budget constraints.

- Ensure resources are utilized efficiently to minimize costs.

Risk Management:

- Identify potential cost risks and their impact on the project.

- Develop strategies to mitigate cost risks and minimize their likelihood of occurrence.

Procurement Management :

- Identify procurement needs for goods and services required for the project.

- Develop procurement plans and strategies to obtain goods and services at the best possible cost

Financial Reporting:

- Generate regular reports on project financials, including budget status, actual costs, and cost variances.

- Communicate financial status to stakeholders and project team members.

Documentation and Lessons Learned:

- Maintain documentation related to project costs, including estimates, budgets, and cost reports.

- Document lessons learned regarding cost management for future projects.

Continuous Improvement:

- Review cost management processes regularly and identify areas for improvement.

- Implement changes to enhance cost management effectiveness for future projects.

Cost management tools are software applications or platforms designed to assist project managers and teams in planning, tracking, analyzing, and controlling project costs effectively. These tools typically offer a range of features to streamline various aspects of cost management. Some common cost management tools include:

1. Project Management Software:

Comprehensive project management platforms often include built-in features for cost management, such as budget tracking, expense management, and reporting. Examples include:

- Microsoft Project

2. Spreadsheet Software :

Spreadsheet programs are commonly used for cost management due to their flexibility and familiarity. They can be customized to create budget templates, track expenses, and perform cost calculations. Examples include:

- Microsoft Excel

- Google Sheets

- Apple Numbers

3. Cost Estimation Software :

These tools specialize in helping project managers estimate project costs accurately. They may use historical data, industry benchmarks, and mathematical models to generate cost estimates. Examples include:

4. Expense Management Tools:

These tools streamline the process of tracking and managing project expenses, including reimbursable costs, invoices, and receipts. Examples include:

- Zoho Expense

5. Financial Management Software: