Holding Company Business Plan Template

Written by Dave Lavinsky

Holding Company Business Plan

You’ve come to the right place to create your Holding Company business plan.

We have helped over 10,000 entrepreneurs and business owners create business plans and many have used them to start or grow their Holding Companies.

Sample Business Plan for a Financial Holding Company

Below is a template to help you create each section of your Holding Company business plan.

Executive Summary

Business overview.

Caldwell Corporation, located in Los Angeles, California, is a newly established holding company that was formed to be the controlling stockholder in other companies it has invested in. It will initially control the Caldwell Group (Caldwell Products, Caldwell Entertainment, and Caldwell Technology) but will invest in other companies in the future. Caldwell Corporation will own assets in both public and private companies, ranging from real estate and manufacturing to entertainment and technology. The company solely performs oversight and is not involved in managing or day-to-day operations.

Caldwell Corporation is run by Timothy Caldwell. He has founded and run all the companies in the Caldwell Group with tremendous success. He is starting the Caldwell Corporation to create a more central point of control over his businesses and make it easier to invest in companies that will support the overall Caldwell Corporation mission.

Caldwell Corporation will provide a number of benefits and services to its subsidiaries. Those benefits include risk mitigation, asset protection, tax minimization, central control, flexibility for growth and development, and succession planning.

The primary benefit for Caldwell Corporation is to minimize the risk for its subsidiaries that forming and operating a company entails. If the subsidiary or affiliate company were to be sued, the liability would not exist, as the holding company would assume the risk as it is a controlling shareholder. Risk management is enhanced by dividing its assets across multiple companies.

Customer Focus

The initial focus will be to control the companies in the Caldwell Group. After that, Caldwell Corporation will primarily serve small to midsize companies across the United States. The demographics of these companies are as follows:

- Must have profits of at least $3 million per year

- Must be in business for at least two years

- Must have a board of directors in place

- Must be in a growing industry

- Has not been audited by the IRS or SEC

Caldwell Corporation will target new and growing businesses that show a growing profit margin for its shareholders.

Management Team

Caldwell Corporation is led by Timothy Caldwell. Over the past ten years, Timothy has started and successfully led the Caldwell Group of companies: Caldwell Products, Caldwell Entertainment, and Caldwell Technology. Now, he wishes to create a holding company to develop a more central point of control over his businesses as well as any companies that he will invest in in the future. Since he has run these three companies himself for the past ten years, he has an in-depth knowledge of their operations and financials.

Timothy is assisted by his executive team that runs the Caldwell Group of companies: Taylor Fisher (CFO), Andy Carrell (COO), Shelby Smith (CMO), and Dave Reddings (CTO).

Success Factors

Caldwell Corporation will be able to achieve success by offering the following competitive advantages:

- Senior Leadership: Timothy Caldwell is an active player in the stock market and is adept at studying companies and assessing their financial volatility.

- Oversight: While Caldwell Corporation will not act as an official oversight of leadership of the companies it acquires, the company will be available and able to provide knowledge and expertise when requested.

- Tax Minimization: Caldwell Corporation is skilled at providing tax scenarios for its companies that are more beneficial to the shareholders. It involves moving corporate locations to tax-friendly states, finding loopholes, and maximizing available tax credits.

- Asset Protection: Caldwell Corporation will employ the best legal, tax, and accounting teams to ensure that all entities involved are not burdened with heavy tax fines, lawsuits, or bankruptcies.

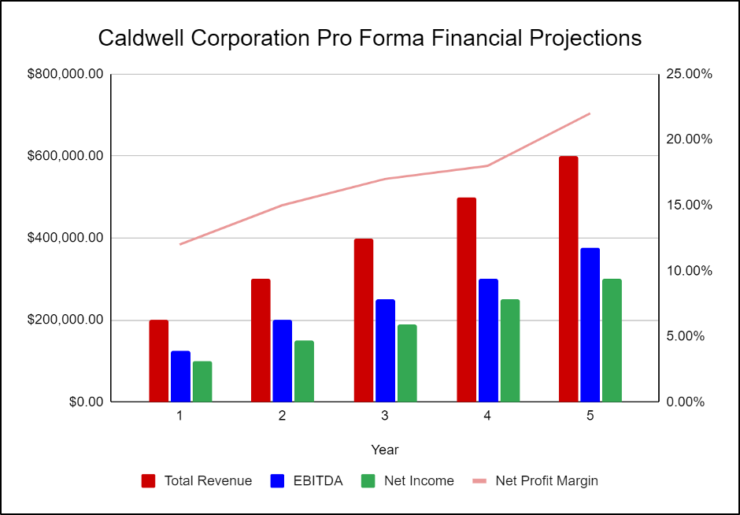

Financial Highlights

Caldwell Corporation is seeking a total funding of $300,000 of debt capital to launch. The capital will be used for funding office build out, legal fees, overhead expenses, and working capital.

- Office design/build-out: $50,000

- Legal fees and retainer: $50,000

- Three months of overhead expenses (payroll, rent, utilities): $150,000

- Working capital: $50,000

Company Overview

Who is caldwell corporation, caldwell corporation history.

Timothy Caldwell incorporated Caldwell Corporation as an S-Corporation on 1/10/2023. Soon after, he found an office location that will serve as the headquarters of the company.

Since its incorporation, Caldwell Corporation has achieved the following milestones:

- Found an office location and signed a Letter of Intent to lease it

- Developed the company’s name, logo, and website

- Engaged a legal and accounting team

Caldwell Corporation Services

The primary benefit for Caldwell Corporation is to minimize the risk for the company’s subsidiaries that forming and operating a company entails. If the subsidiary company were to be sued, the liability would not exist, as the holding company would assume the risk as it is a controlling shareholder. Risk management is enhanced by dividing its assets across multiple companies.

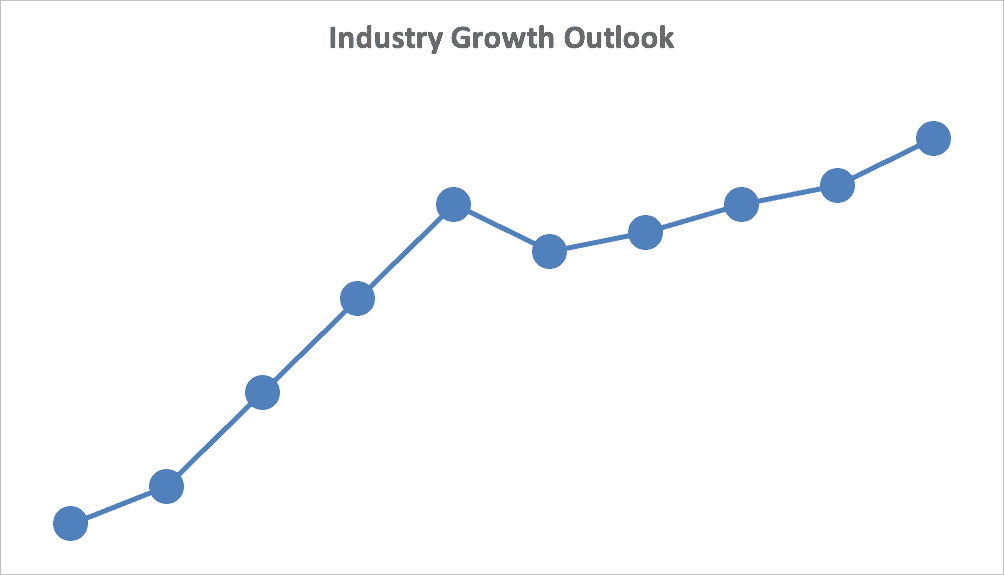

Industry Analysis

Holding companies have fared well for decades and are expected to continue to perform well for the foreseeable future. Success will be driven by strong company leadership, robust and efficient operational models, and talent management.

Holding companies offer numerous benefits to their subsidiaries. These include risk mitigation, asset protection, tax minimization, central control, flexibility for growth and development, and succession planning. With so many benefits, numerous companies join or create holding companies every year.

Some of the most high-profile companies benefit from a holding company. Some examples include Google, which is controlled by Alphabet, and the high-profile companies (like Dairy Queen and Duracell) that are controlled by Berkshire Hathaway. With so many profitable companies benefiting from the arrangement, holding companies are bound to continue to succeed in the future.

Customer Analysis

Demographic profile of target market.

Caldwell Corporation will primarily serve small to midsize companies across the United States. There are numerous startup businesses or organizations that have been in business for at least two years that have already achieved profits exceeding at least $2 million. These companies are in industries such as entertainment, technology, and real estate.

Customer Segmentation

Caldwell Corporation will primarily target the following three customer segments:

- Technology companies

- Entertainment companies

- Real estate ventures

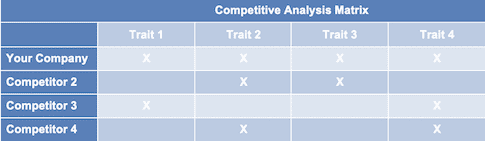

Competitive Analysis

Direct and indirect competitors.

The following businesses have the same business profile as Caldwell Corporation, thus providing either direct or indirect competition for customer clients:

Lithium Holdings

Lithium Holdings buys and grows mid-sized technology companies. Upon acquiring technology companies, Lithium Holdings delivers high-quality equipment along with janitorial and technology supplies. As a veteran-owned company, they are able to tap into the veteran and military-owned community. Lithium offers a much-needed layer of oversight for mid-sized technology companies that do not have the operational expertise or bank account for operational expenses. Lithium Holdings has the financial backing and creditworthiness to apply for small business loans for the technology companies it acquires. The company is able to provide a strategic growth plan for a technology company that it otherwise does not have. At this time, the company focuses on companies in the southwestern United States but may grow to other regions as their geographic footprint allows.

Deer Holdings

In business for over 50 years, Deer Holdings has acquired, invested in, grown, and sold companies across various industries. Today, Deer Holdings invests in businesses that operate within the real estate, infrastructure, and financial services space. Deer’s real estate companies are specifically focused on infrastructure assets, single-family rentals, federal and state low-income housing, tax credits, large living communities, mixed-use communities, development, and military communities.

Deer’s financial services companies focus on providing debt capital to owners of multifamily, senior housing, office, retail, technology, and self-storage properties through proprietary loan products as well as products offered through Fannie Mae, Freddie Mac, and FHA. They also focus on companies that deliver high-quality investment ideas and investment banking services to institutional investors and corporate clients. In addition to real estate and banking, Deer has invested in a multitude of companies that are within the energy and utility industries. One of their most successful companies is an electrical contractor and owner of utility systems that specializes in the provision of services to the military under privatization contracts.

Greenfield Companies

Greenfield Companies is a multinational conglomerate that operates in the United States. Headquartered in Los Angeles, Greenfield prefers to invest in companies in long-term investments in publicly traded companies and has recently begun to invest in wholly-owned subsidiaries. Their diverse range of businesses includes confectionery, retail, railroads, home furnishings, home products, jewelry, retail clothing, and several regional electric and gas utilities.

Greenfield was established over a hundred years ago when it got its start investing in textile manufacturers and railroads. The company was one of the few large shareholder companies that were able to survive the Great Depression, despite it being a freshman company at the time. Throughout the decades, Greenfield has maintained being a family-led company, with the great great great grandson of Benjamin Greenfield now at the company’s helm.

Greenfield Companies is a major player in the stock market and is often studied as a model of how to ride market volatility during recessions and instability in the national economy.

Competitive Advantage

Caldwell Corporation enjoys several advantages over its competitors. Those advantages include the following:

Marketing Plan

Caldwell Corporation seeks to position itself as a premier holding company in the Los Angeles area. Subsidiaries can expect to place their interests in the companies’ hands, so they can focus on providing the specific products and services that it intends to specialize in.

Brand & Value Proposition

The Caldwell Corporation brand will focus on the company’s unique value proposition:

- Proven leadership

- Complete asset protection

- Beneficial tax scenarios

- Oversight and accountability

- Knowledgeable team of experts

Promotions Strategy

Caldwell Corporation expects its primary target market to be companies operating in certain industries. The company’s promotion strategy to reach these companies includes:

Industry Publications

Caldwell Corporation will invest in strategically placing ads in industry publications such as newsletters, magazines, and journals. The target audience for these publications usually includes the decision-makers in their companies.

Social Media

Caldwell Corporation will invest heavily in a social media advertising campaign. The brand manager will create the company’s social media accounts and invest in ads on social media. It will use targeted marketing to appeal to the target demographics. It will focus mainly on LinkedIn social media accounts rather than other social media channels like Facebook and Instagram.

Website/SEO

Caldwell Corporation will invest heavily in developing a professional website that displays all of the benefits the holding company has to offer. It will also invest heavily in SEO so that the brand’s website will appear at the top of search engine results.

Industry Conferences

Caldwell Corporation will participate in all of the industry conferences and trade shows to network with decision-makers of certain companies. This will be done to increase brand awareness and recognition.

Operations Plan

The following will be the operations plan for Caldwell Corporation.

Operation Functions:

- Timothy Caldwell will be the CEO of Caldwell Corporation. He will continue to run his other companies while handling the general operations of Caldwell Corporation.

- Taylor Fisher has been Tim’s CFO for several years and will take on this role for Caldwell Corporation. He will handle all the concerns related to finances, investments, and taxes.

- Andy Carrell is the COO of Tim’s other companies and will assist Caldwell Corporation with the operations and administrative aspects of the business.

- Shelby Smith has been Tim’s CMO for several years and will expand her role to help with the marketing efforts for Caldwell Corporation.

- Dave Reddings has been Tim’s CTO for several years and will handle all the major decisions and actions relating to technology.

Milestones:

The following are a series of steps that lead to our vision of long-term success. Caldwell Corporation expects to achieve the following milestones in the following six months:

4/202X Finalize lease agreement

5/202X Design and build out Caldwell Corporation

6/202X Hire and train initial staff

7.202X Kickoff of promotional campaign

8/202X Launch Caldwell Corporation

9/202X Reach break-even

Financial Plan

Key revenue & costs.

Caldwell Corporation’s revenues will come primarily from its stockholder distributions. The company will acquire various subsidiaries. It will position itself to be the majority stockholder and will receive quarterly and annual distributions.

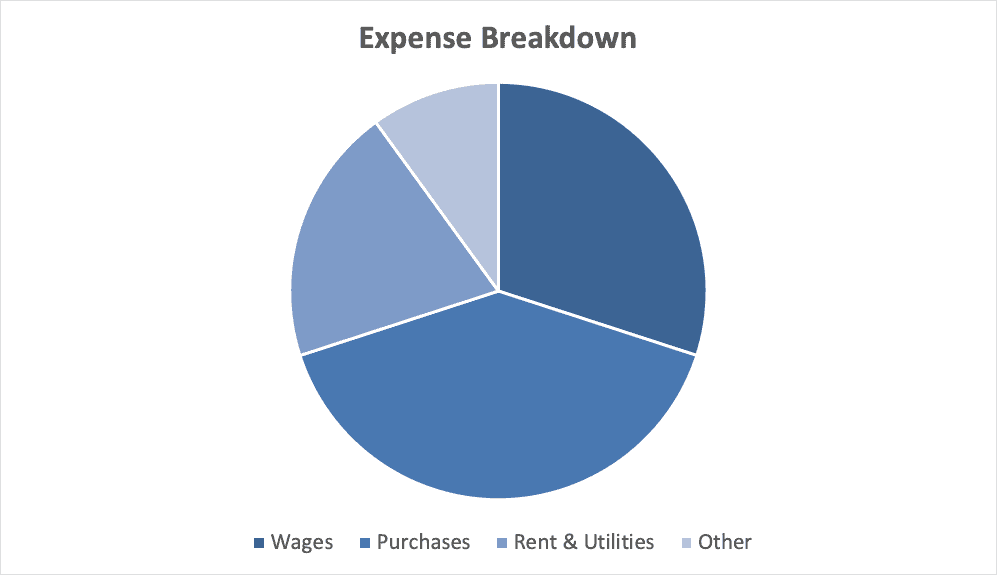

The office lease, office equipment, supplies, and labor expenses will be the key cost drivers of Caldwell Corporation. The major cost drivers for the company’s operation will consist of salaries, equipment, lease, taxes, and overhead expenses. Ongoing marketing expenditures are also notable cost drivers for Caldwell Corporation.

Funding Requirements and Use of Funds

Caldwell Corporation is seeking a total funding of $300,000 of debt capital to open the holding company. The capital will be used for funding office build out, legal fees, overhead expenses, and working capital.

Key Assumptions

Below are the key assumptions required in order to achieve the revenue and cost numbers in the financials and to pay off the startup business loan.

- Annual office lease: $20,000

Financial Statements

Income statement, balance sheet, cash flow statement, holding company business plan faqs, what is a holding company business plan.

A holding company business plan is a plan to start and/or grow your holding company business. Among other things, it outlines your business concept, identifies your target customers, presents your marketing plan and details your financial projections.

You can easily complete your Holding Company business plan using our Holding Company Business Plan Template here .

What are the Main Types of Holding Companies?

There are a number of different kinds of holding companies, some examples include: Pure Holding Company, Mixed Holding Company, Immediate Holding Company, or Intermediate Holding Company.

What are the Steps To Start a Holding Company Business?

Starting a holding company business can be an exciting endeavor. Having a clear roadmap of the steps to start a business will help you stay focused on your goals and get started faster.

1. Develop A Holding Company Business Plan – The first step in starting a business is to create a comprehensive business plan that outlines all aspects of the venture. This should include potential market size and target customers, the services or products you will offer, pricing strategies and a detailed financial forecast.

2. Choose Your Legal Structure – It’s important to select an appropriate legal entity for your holding company business. This could be a limited liability company (LLC), corporation, partnership, or sole proprietorship. Each type has its own benefits and drawbacks so it’s important to do research and choose wisely so that your holding company business is in compliance with local laws.

3. Register Your Holding Company Business – Once you have chosen a legal structure, the next step is to register your holding company business with the government or state where you’re operating from. This includes obtaining licenses and permits as required by federal, state, and local laws.

4. Identify Financing Options – It’s likely that you’ll need some capital to start your holding company business, so take some time to identify what financing options are available such as bank loans, investor funding, grants, or crowdfunding platforms.

5. Choose a Location – Whether you plan on operating out of a physical location or not, you should always have an idea of where you’ll be based should it become necessary in the future as well as what kind of space would be suitable for your operations.

6. Hire Employees – There are several ways to find qualified employees including job boards like LinkedIn or Indeed as well as hiring agencies if needed – depending on what type of employees you need it might also be more effective to reach out directly through networking events.

7. Acquire Necessary Holding Company Equipment & Supplies – In order to start your holding company business, you’ll need to purchase all of the necessary equipment and supplies to run a successful operation.

8. Market & Promote Your Business – Once you have all the necessary pieces in place, it’s time to start promoting and marketing your holding company business. This includes creating a website, utilizing social media platforms like Facebook or Twitter, and having an effective Search Engine Optimization (SEO) strategy. You should also consider traditional marketing techniques such as radio or print advertising.

Holding Company Business Plan Template

Written by Dave Lavinsky

Over the past 20+ years, we have helped over 1,000 entrepreneurs and business owners create business plans to start and grow their holding companies. On this page, we will first give you some background information with regards to the importance of business planning. We will then go through a holding company business plan template step-by-step so you can create your plan today.

Download our Ultimate Business Plan Template here >

What is a Holding Company Business Plan?

A business plan provides a snapshot of your holding company as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategy for reaching them. It also includes market research to support your plans.

Why You Need a Business Plan for a Holding Company

If you’re looking to start a holding company, or grow your existing holding company, you need a business plan. A business plan will help you raise funding, if needed, and plan out the growth of your holding company in order to improve your chances of success. Your holding company business plan is a living document that should be updated annually as your company grows and changes.

Sources of Funding for Holding Companies

With regards to funding, the main sources of funding for a holding company are personal savings, credit cards, bank loans and angel investors. With regards to bank loans, banks will want to review your business plan and gain confidence that you will be able to repay your loan and interest. To acquire this confidence, the loan officer will not only want to confirm that your financials are reasonable, but they will also want to see a professional plan. Such a plan will give them the confidence that you can successfully and professionally operate a business.

Finish Your Business Plan Today!

How to Write a Business Plan for a Holding Company

If you want to start a holding company or expand your current one, you need a business plan. Below are links to each section of your holding company business plan template:

Executive Summary

Your executive summary provides an introduction to your business plan, but it is normally the last section you write because it provides a summary of each key section of your plan.

The goal of your Executive Summary is to quickly engage the reader. Explain to them the type of holding company you are operating and the status. For example, does your holding company include multiple startups or does it include established companies?

Next, provide an overview of each of the subsequent sections of your plan. For example, give a brief overview of the industry in which you’re competing. Discuss the businesses you are operating. Detail your direct competitors. Give an overview of your target customers. Provide a snapshot of your marketing plan. Identify the key members of your team. And offer an overview of your financial plan.

Company Analysis

In your company analysis, you will detail the type of holding company you are operating.

For example, you might operate one of the following types of holding companies:

- Pure Holding Company : this type of holding company owns a controlling interest in one or more other companies but does not itself produce goods or services, or participate in any additional business operations.

- Mixed Holding Company: this type of holding company owns a controlling interest in one or more other companies and also operates its own business, providing goods or services.

- Immediate Holding Company: this type of business owns controlling interest in one or more other companies, and is itself controlled by another holding company.

- Intermediate Holding Company: this type of business owns controlling interest in one or more other companies, and is a subsidiary of a larger corporation.

In addition to explaining the type of holding company you will operate, the Company Analysis section of your business plan needs to provide background on the business.

Include answers to question such as:

- When and why did you start the business?

- What milestones have you achieved to date? Milestones could include the number of customers served, amount of monthly revenue, etc.

- Your legal structure. Are you incorporated as an S-Corp? An LLC? A sole proprietorship? Explain your legal structure here.

Industry Analysis

While this may seem unnecessary, it serves multiple purposes.

First, researching the holding company industry educates you. It helps you understand the market in which you are operating.

Secondly, market research can improve your strategy, particularly if your research identifies market trends.

The third reason for market research is to prove to readers that you are an expert in your industry. By conducting the research and presenting it in your plan, you achieve just that.

The following questions should be answered in the industry analysis section of your holding company business plan:

- How big are the industry(ies) in which you’re competing (in dollars)?

- Is the market declining or increasing?

- Who are the key competitors in the market?

- Who are the key suppliers in the market?

- What trends are affecting the industry?

- What is the industry’s growth forecast over the next 5 – 10 years?

- What is the relevant market size? That is, how big is the potential market for your holding company? You can extrapolate such a figure by assessing the size of the market in the entire country and then applying that figure to your local population.

Customer Analysis

The customer analysis section of your holding company business plan must detail the customers you serve and/or expect to serve.

The following are examples of customer segments: individual businesses such as banks and restaurants, other holding companies and larger corporations.

Try to break out your target customers in terms of their demographic and psychographic profiles. With regards to demographics, include a discussion of the ages, genders, locations and income levels of the customers you seek to serve.

Psychographic profiles explain the wants and needs of your target customers. The more you can understand and define these needs, the better you will do in attracting and retaining your customers.

Finish Your Holding Company Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Competitive Analysis

Your competitive analysis should identify the indirect and direct competitors your business faces and then focus on the latter.

Direct competitors are other businesses that provide the same products and services as your company.

Indirect competitors are other options that customers have to purchase from that aren’t direct competitors.

With regards to direct competition, you want to describe the other businesses with which you compete.

For each such competitor, provide an overview of their businesses and document their strengths and weaknesses. Unless you once worked at your competitors’ businesses, it will be impossible to know everything about them. But you should be able to find out key things about them such as:

- What types of customers do they serve?

- What types of businesses do they control?

- What are they good at?

- What are their weaknesses?

With regards to the last two questions, think about your answers from the customers’ perspective. And don’t be afraid to ask your competitors’ customers what they like most and least about them.

The final part of your competitive analysis section is to document your areas of competitive advantage. For example:

- Will you provide better services?

- Will you provide services that your competitors don’t offer?

- Will you provide better customer service?

- Will you offer better pricing?

Think about ways you will outperform your competition and document them in this section of your plan.

Marketing Plan

For a holding company business plan, your marketing plan should include the following:

Product : In the product section, you should reiterate the type of holding company that you documented in your Company Analysis. Then, detail the specific products and services you will be offering.

Price : Document the prices you will offer and how they compare to your competitors. Essentially in the product and price sub-sections of your marketing plan, you are presenting the products and services you offer and their prices.

Promotions : The final part of your holding company marketing plan is the promotions section. Here you will document how you will drive customers to your location(s). The following are some promotional methods you might consider:

- Advertising

- Partnering with applicable websites

- Social media marketing

Operations Plan

While the earlier sections of your business plan explained your goals, your operations plan describes how you will meet them. Your operations plan should have two distinct sections as follows.

Everyday short-term processes include all of the tasks involved in running your businesses, including running individual businesses, scouting companies to buy interest in, meeting with potential clients, and managing any legal and financial responsibilities for the companies you currently control.

Long-term goals are the milestones you hope to achieve. These could include the dates when you expect to acquire your first and second controlling interests, or when you hope to reach $X in revenue. It could also be when you expect to expand your holding company to form multiple subsidiary companies or parent groups.

Management Team

To demonstrate your holding company business’ ability to succeed, a strong management team is essential. Highlight your key players’ backgrounds, emphasizing those skills and experiences that prove their ability to grow a company.

Ideally you and/or your team members have direct experience in managing holding or investment companies and individual operating companies. If so, highlight this experience and expertise. But also highlight any experience that you think will help your business succeed.

If your team is lacking, consider assembling an advisory board. An advisory board would include 2 to 8 individuals who would act like mentors to your business. They would help answer questions and provide strategic guidance. If needed, look for advisory board members with experience in managing holding and/or investment companies or successfully running legal or financial businesses.

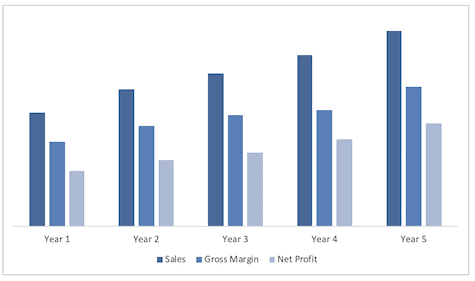

Financial Plan

Your financial plan should include your 5-year financial statement broken out both monthly or quarterly for the first year and then annually. Your financial statements include your income statement, balance sheet and cash flow statements.

Income Statement

An income statement is more commonly called a Profit and Loss statement or P&L. It shows your revenues and then subtracts your costs to show whether you turned a profit or not.

In developing your income statement, you need to devise assumptions. For example, will you purchase controlling interest in one new company per quarter or per year? And will sales grow by 2% or 10% per year? As you can imagine, your choice of assumptions will greatly impact the financial forecasts for your business. As much as possible, conduct research to try to root your assumptions in reality.

Balance Sheets

Balance sheets show your assets and liabilities. While balance sheets can include much information, try to simplify them to the key items you need to know about. For instance, if you spend $150,000 on acquiring a business, this will not give you immediate profits. Rather it is an asset that will hopefully help you generate profits for years to come. Likewise, if a bank writes you a check for $150,000, you don’t need to pay it back immediately. Rather, that is a liability you will pay back over time.

Cash Flow Statement

In developing your Income Statement and Balance Sheets be sure to include several of the key costs needed in starting or growing a holding company business:

- Location build-out including design fees, construction, etc.

- Cost of equipment and supplies

- Payroll or salaries paid to staff

- Business insurance

- Taxes and permits

- Legal expenses

Attach your full financial projections in the appendix of your plan along with any supporting documents that make your plan more compelling. For example, you might include your office location lease or plans you are working on for controlling another business.

Putting together a business plan for your own holding company is a worthwhile endeavor. If you follow the template above, by the time you are done, you will truly be an expert. You will really understand the industry, your competition, and your customers. You will have developed a marketing plan and will really understand what it takes to launch and grow a successful holding company business.

Don’t you wish there was a faster, easier way to finish your Holding Company business plan?

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success. See how Growthink’s professional business plan consulting services can create your business plan for you.

Other Helpful Business Plan Articles & Templates

Free Download

Holding Company Business Plan Template

Download this free holding company business plan template, with pre-filled examples, to create your own plan..

Or plan with professional support in LivePlan. Save 50% today

Available formats:

What you get with this template

A complete business plan.

Text and financials are already filled out and ready for you to update.

- SBA-lender approved format

Your plan is formatted the way lenders and investors expect.

Edit to your needs

Download as a Word document and edit your business plan right away.

- Detailed instructions

Features clear and simple instructions from expert business plan writers.

All 100% free. We're here to help you succeed in business, no strings attached.

Get the most out of your business plan example

Follow these tips to quickly develop a working business plan from this sample.

1. Don't worry about finding an exact match

We have over 550 sample business plan templates . So, make sure the plan is a close match, but don't get hung up on the details.

Your business is unique and will differ from any example or template you come across. So, use this example as a starting point and customize it to your needs.

2. Remember it's just an example

Our sample business plans are examples of what one business owner did. That doesn't make them perfect or require you to cram your business idea to fit the plan structure.

Use the information, financials, and formatting for inspiration. It will speed up and guide the plan writing process.

3. Know why you're writing a business plan

To create a plan that fits your needs , you need to know what you intend to do with it.

Are you planning to use your plan to apply for a loan or pitch to investors? Then it's worth following the format from your chosen sample plan to ensure you cover all necessary information.

But, if you don't plan to share your plan with anyone outside of your business—you likely don't need everything.

More business planning resources

Industry Business Planning Guides

Simple Business Plan Outline

10 Qualities of a Good Business Plan

How to Write a Business Plan

How to Start a Business With No Money

Business Plan Template

How to Create a Business Plan Presentation

How to Write a Business Plan for Investors

Download your template now

Need to validate your idea, secure funding, or grow your business this template is for you..

- Fill-in-the-blank simplicity

- Expert tips & tricks

We care about your privacy. See our privacy policy .

Not ready to download right now? We'll email you the link so you can download it whenever you're ready.

Download as Docx

Download as PDF

Finish your business plan with confidence

Step-by-step guidance and world-class support from the #1 business planning software

Our biggest savings of the year

Black Friday Save 60%

for life on the #1 rated business plan software

on the #1 rated business plan software

on the #1 Business Planning Software

IMAGES

VIDEO