Outsourcing Proposal Letter Sample: Free & Customizable

Through this article, I’ll share my expertise to guide you step by step in writing an effective outsourcing proposal letter, supplemented with a customizable template and invaluable tips from my own experiences.

Key Takeaways Understand Your Client: Tailor your proposal to address the specific needs and challenges of the prospective client. Highlight Your Unique Value Proposition: Clearly articulate what sets your services apart from competitors. Detail Your Approach and Methodology: Demonstrate how your processes align with the client’s objectives. Showcase Success Stories: Include case studies or testimonials to build credibility. Be Clear and Concise: Ensure your proposal is easily comprehensible and to the point. Provide a Clear Call to Action: Encourage the client to take the next step in the engagement process.

Step-by-Step Guide to Writing an Outsourcing Proposal Letter

Step 1: research and understand your client.

Before penning your proposal, invest time in understanding your potential client’s business, industry, and specific needs. This knowledge will enable you to tailor your letter to resonate with the client’s objectives and challenges.

- Research the client’s business and industry.

- Identify their needs and how your services can address them.

Step 2: Start with a Strong Introduction

Your opening paragraph should grab the client’s attention, introduce your company, and succinctly state why you’re reaching out.

- Introduce your company and its core services.

- Briefly mention how your services align with the client’s needs.

Step 3: Outline Your Services and Value Proposition

Clearly articulate what you offer and why your services are superior to competitors. Highlight your unique selling points and how they benefit the client.

- List your services related to the client’s needs.

- Detail your unique value proposition.

Step 4: Detail Your Approach and Methodology

Demonstrate your understanding of the client’s challenges and outline how your approach and methodology will address these issues.

- Describe your process and how it aligns with the client’s objectives.

- Mention any innovative techniques or tools you utilize.

Step 5: Provide Case Studies or Testimonials

Build credibility by showcasing success stories or testimonials from previous clients, particularly those in similar industries or with similar needs.

- Include relevant case studies or client testimonials.

- Highlight the results achieved.

Step 6: Include Pricing Information (Optional)

If appropriate, provide a clear and transparent pricing structure, ensuring the client understands the value they’re receiving.

- Detail your pricing model.

- Highlight any included value-adds or guarantees.

Step 7: Call to Action

Conclude with a strong call to action, encouraging the client to take the next step, whether it’s scheduling a meeting, requesting further information, or moving forward with your services.

- Encourage the client to contact you for further discussion.

- Provide clear contact information.

Outstanding Outsourcing Proposal Letter Template

[Your Company Letterhead or Contact Information]

[Client’s Name] [Client’s Title] [Client’s Company] [Client’s Company Address]

Dear [Client’s Name],

Introduction: I hope this letter finds you well. My name is [Your Name], and I am the [Your Position] at [Your Company], where we specialize in [briefly describe your core services]. We have followed your company’s journey and are impressed with [something specific about the client’s company or industry].

I am reaching out to propose a partnership where [Your Company] can support [Client’s Company] through our specialized outsourcing services, particularly in [mention relevant services].

Understanding Your Needs: We understand that [Client’s Company] is looking to [mention the specific needs or challenges the client is facing], and we believe that our services align perfectly with your objectives.

At [Your Company], we prioritize [mention a key company value that aligns with the client’s values or needs], ensuring that our clients receive [mention the benefit or result of your service].

Our Services and Value Proposition: [Your Company] offers a comprehensive suite of services designed to [mention the main goal or outcome of your services]. What sets us apart is our [mention your unique value proposition], which ensures [mention the specific benefit or result for the client].

Our team of [mention your experts or professionals] is adept at [mention a key process or methodology], which has proven effective for clients in [mention an industry or sector, if relevant].

Our Approach and Methodology: We approach each project with [mention your approach, e.g., a client-centric mindset], ensuring that our solutions are tailored to meet your specific needs.

Our methodology involves [describe your methodology in a few steps or key points], which allows us to [mention the outcome or benefit of your methodology].

Success Stories: We have had the privilege of working with [mention a general description of previous clients, e.g., various Fortune 500 companies or small to medium enterprises] where we achieved [mention a key achievement or result].

For instance, in our recent project with [mention a generic client or case study], we were able to [mention a specific result], resulting in [mention the impact].

Next Steps: We are eager to discuss how [Your Company] can support [Client’s Company] in achieving [mention a specific goal or outcome]. I would be delighted to arrange a meeting or call to explore this potential partnership further and answer any questions you may have.

Please feel free to reach out to me directly at [Your Phone Number] or [Your Email]. I look forward to the possibility of working together to achieve [mention a shared goal or outcome].

Thank you for considering [Your Company] as your outsourcing partner. We are committed to delivering [mention a key benefit or value] and are excited about the prospect of contributing to [Client’s Company]’s continued success.

[Your Name] [Your Position] [Your Company] [Your Contact Information]

Personal Tips from Experience

- Be Personal: While maintaining professionalism, personalize the letter to make the client feel valued and understood.

- Clarity is Key: Avoid jargon or overly complex language; ensure your proposal is clear and easy to understand.

- Follow Up: Don’t hesitate to follow up after sending your proposal. A gentle reminder can sometimes make all the difference.

Crafting an effective outsourcing proposal letter is a blend of art and science. By understanding the client’s needs, highlighting your unique value, and clearly articulating your approach, you can create a compelling proposal that stands out.

Remember, your proposal is not just a sales pitch; it’s an opportunity to start building a relationship with your potential client.

I’d love to hear about your experiences with writing outsourcing proposal letters or any questions you might have. Feel free to share your thoughts or ask for advice in the comments below.

Frequently Asked Questions (FAQs)

Q: What is an outsourcing proposal letter?

Answer: An outsourcing proposal letter is a formal document or correspondence sent by one company (typically a service provider) to another company, detailing an offer or proposal to handle specific tasks or operations on their behalf.

This letter aims to explain why outsourcing is beneficial and why the sender is the best choice for the job.

Q: Why is an outsourcing proposal letter essential for businesses?

Answer: An outsourcing proposal letter is crucial because it serves as a professional approach to offering specialized services. This document not only showcases the provider’s capabilities but also demonstrates their understanding of the potential client’s needs. In essence, a well-crafted outsourcing proposal letter can open doors to new business opportunities and collaborations.

Q: What should be included in an effective outsourcing proposal letter?

Answer: An effective outsourcing proposal letter should contain a clear introduction stating the purpose, details about the service provider (such as experience and past successes), a comprehensive list of the services offered, a financial breakdown, personalized content catering to the recipient’s needs, and a call-to-action.

Additionally, it’s advisable to maintain a professional tone and format throughout the letter to make a lasting impression.

Q: How can one make their outsourcing proposal letter stand out from competitors?

Answer: To make an outsourcing proposal letter stand out, it’s essential to demonstrate a deep understanding of the prospective client’s industry, challenges, and needs.

Personalization, real-life success stories, client testimonials, and a unique value proposition can also differentiate one’s outsourcing proposal letter from the rest.

Q: How often should businesses update their outsourcing proposal letter templates?

Answer: Businesses should periodically review and update their outsourcing proposal letter templates to keep them current with industry trends, their evolving service offerings, and feedback from potential clients.

A fresh perspective and up-to-date content can enhance the effectiveness of an outsourcing proposal letter.

Q: Can an outsourcing proposal letter also serve as a contractual agreement?

Answer: While an outsourcing proposal letter outlines the services a company offers and the terms under which they propose to work, it typically doesn’t serve as a legally binding contract.

However, once both parties agree upon the terms mentioned in the outsourcing proposal letter, they can formalize the agreement in a separate, detailed contract.

Q: How should a business respond if their outsourcing proposal letter is rejected?

Answer: If an outsourcing proposal letter is rejected, businesses should first seek feedback to understand the reasons behind the decision. This feedback can be invaluable for refining future proposals.

It’s also crucial to maintain professionalism in the response, expressing gratitude for the consideration and openness to potential future collaborations.

Related Articles

Electrical proposal letter: how to write it right, sample business proposal letter for coffee shop: free & effective, sample proposal letter for cctv camera installation: free & effective, sample letter of request for cleaning services: free & effective, sample lawn care proposal letter: free & effective, sample request letter for tree planting: free & effective, leave a comment cancel reply.

Your email address will not be published. Required fields are marked *

Resume Builder

- Resume Experts

- Search Jobs

- Search for Talent

- Employer Branding

- Outplacement

Outsourcing Manager Cover Letter

15 outsourcing manager cover letter templates.

How to Write the Outsourcing Manager Cover Letter

In response to your job posting for outsourcing manager, I am including this letter and my resume for your review.

Previously, I was responsible for financial services expertise involving tax research and application of specialize industry knowledge and accounting principles.

Please consider my experience and qualifications for this position:

- Manage and train internal staff and clients

- Efficient and effective management of client account

- Meeting with committees to report on project progress and ensuring management report packs are completed and distributed monthly

- Manage client environments and resources to troubleshoot any issues arising

- Manage team dynamics and individual performance

- Manage all risks related to program development to ensure confidentiality of client information

- Ongoing evaluation of security risks and changes to programs to minimize risk

- Monitor that team meet all deadlines relating to internal processes expense claims, timesheets, leave, absences

Thank you for considering me to become a member of your team.

Shae Hackett

- Microsoft Word (.docx) .DOCX

- PDF Document (.pdf) .PDF

- Image File (.png) .PNG

Responsibilities for Outsourcing Manager Cover Letter

Outsourcing manager responsible for technical knowledge and leadership to the project team in relation to tax and accounting principles in relation to superannuation and managed investment scheme’s reporting.

Outsourcing Manager Examples

Example of outsourcing manager cover letter.

I would like to submit my application for the outsourcing manager opening. Please accept this letter and the attached resume.

In the previous role, I was responsible for tax advice and guidance to the Finance Team on the Tax treatment of accounting transactions e.g.

Please consider my qualifications and experience:

- Participate in broader outsourcing teams to understand offerings

- In-depth knowledge of SAGE X3 and broad knowledge of ERP systems

- Good working knowledge of MS Excel, Word

- Sound Consulting experience

- Global team contribution - Contribute to the Global CWS(Contingent Workforce Solution) team by leading internal projects, new initiatives to make greater impact and increase contribution to the CWS team performance and evolvement to its next performance level

- Excellent communication skills in both verbal and written in English and Mandarin

- Assist the internal clients to manage contract changes by providing support for contract amendments, monitoring, tracking, and execution, and for periodic reports on contract changes

- Are capable of solving complex strategic problems related to financial, business and technological aspects

Thank you in advance for reviewing my candidacy for this position.

Campbell Daugherty

In my previous role, I was responsible for support to other departments AP, Reimbursement, Accounting, Clinical Operations as needed regarding accruals, accounting, requests and other administrative matters.

- Highly developed written, verbal and listening skills

- Proactive and self-motived

- Game Outsourcing relevant experience

- Master advance notions in Excel

- Professional attitude and excellent interpersonal skills

- Excellent analytical, negotiation and business communication skills

- Proficient with word processing, spreadsheet and database software, and clinical and financial systems

- Sound background in financial/controlling issues

Thank you in advance for taking the time to read my cover letter and to review my resume.

Hayden Crooks

I submit this application to express my sincere interest in the outsourcing manager position.

In my previous role, I was responsible for input to the investment plan, help align processes and financial reporting between CRO, and Finance Colleagues and perform change order management where required.

My experience is an excellent fit for the list of requirements in this job:

- Experience in drug development in the pharmaceutical industry or with a CRO or laboratory

- Detailed understanding of the clinical development process and robust understanding of the management of clinical trials

- Knowledge of GCP guidelines

- Procurement /category management expertise (preferably in a clinical research services)

- Strong customer focus, results driven orientation, & ethics

- Expert skills in Microsoft Office Suite applications

- Process Improvement certification (Kaizen or Lean/Six Sigma)

- A sincere passion and obsession for our Customers

Thank you for taking your time to review my application.

Stevie Rutherford

In the previous role, I was responsible for business valuations services for matrimonial settlements, estate tax purposes, gift planning, shareholder disputes, buy/sell agreements, and complex forensic accounting projects.

- Demonstrated record of achieving process improvement results through technology change and process changes

- Experience developing or enhancing written procedures for operations processes is preferred

- BS, MS, Ph.D, PharmD

- Drug development knowledge with moderate to strong understanding of R&D functions including Pre-Clinical, Clinical, Regulatory, Safety and Compliance

- Knowledge of clinical supplier relationship management practices, contract negotiation and collaboration agreements

- Familiarity/experience with Project Management principles/tools

- Interfaces effectively with all levels of management (internal and external)

- Distinguish proper balance between strategic and tactical thinking and react to Clinical/R&D Franchise needs

Rory Hessel

In my previous role, I was responsible for oversight to Senior Clinical Trial Associate in developing automated systems for improved workflow.

- Computer literate, with a good understanding of Microsoft Powerpoint, Visio, Excel and Word

- Manages outsourced analytical and quality control testing activities for small molecule active pharmaceutical ingredients and drug products

- Develops strategy for management of outsourced testing needs, considering timelines, risk mitigation and business priorities

- Develops, executes and ensures compliance to procedures for outsourced testing oversight

- Manages a team to coordinate and monitor GMP sample shipments to and from contract organizations

- Develops effective strategies for the evaluation and selection of contract organizations

- Coordinates with legal and quality assurance groups to establish confidentiality/nondisclosure agreements, service terms and conditions, and quality agreements

- Reviews and facilitate approval of proposals, work orders, and changes of scope

Greer Stroman

Related Cover Letters

Create a Resume in Minutes with Professional Resume Templates

Create a Cover Letter and Resume in Minutes with Professional Templates

Create a resume and cover letter in minutes cover letter copied to your clipboard.

Privacy preference center

We care about your privacy

When you visit our website, we will use cookies to make sure you enjoy your stay. We respect your privacy and we’ll never share your resumes and cover letters with recruiters or job sites. On the other hand, we’re using several third party tools to help us run our website with all its functionality.

But what exactly are cookies? Cookies are small bits of information which get stored on your computer. This information usually isn’t enough to directly identify you, but it allows us to deliver a page tailored to your particular needs and preferences.

Because we really care about your right to privacy, we give you a lot of control over which cookies we use in your sessions. Click on the different category headings on the left to find out more, and change our default settings.

However, remember that blocking some types of cookies may impact your experience of our website. Finally, note that we’ll need to use a cookie to remember your cookie preferences.

Without these cookies our website wouldn’t function and they cannot be switched off. We need them to provide services that you’ve asked for.

Want an example? We use these cookies when you sign in to Kickresume. We also use them to remember things you’ve already done, like text you’ve entered into a registration form so it’ll be there when you go back to the page in the same session.

Thanks to these cookies, we can count visits and traffic sources to our pages. This allows us to measure and improve the performance of our website and provide you with content you’ll find interesting.

Performance cookies let us see which pages are the most and least popular, and how you and other visitors move around the site.

All information these cookies collect is aggregated (it’s a statistic) and therefore completely anonymous. If you don’t let us use these cookies, you’ll leave us in the dark a bit, as we won’t be able to give you the content you may like.

We use these cookies to uniquely identify your browser and internet device. Thanks to them, we and our partners can build a profile of your interests, and target you with discounts to our service and specialized content.

On the other hand, these cookies allow some companies target you with advertising on other sites. This is to provide you with advertising that you might find interesting, rather than with a series of irrelevant ads you don’t care about.

Sourcing Specialist Cover Letter Sample

Enhance your career prospects and learn to perfect your new cover letter with our free, expertly drafted Sourcing Specialist cover letter sample. Copy-paste this cover letter sample at no cost or try to redesign it using our sleek cover letter creator.

Related resume guides and samples

Write the ideal account manager resume with this quick guide

Craft the ideal business development resume

How to build a professional consulting resume

How to write a fantastic entrepreneur resume

Write the ideal investor resume with this simple guide

How to write a job-winning procurement resume

How to craft the perfect startup resume (+resume samples)

Sourcing Specialist Cover Letter Sample (Full Text Version)

Eline Bossink

Dear Sir/Madam,

With more than four years of extensive industry experience and well-developed field expertise, I am excited to be submitting my application for the Sourcing Specialist job within YR International, LLC in London as advertised on LinkedIn.com. I am confident that I am a perfect candidate and I am also certain that I would meet and exceed all your expectations for this role.

As stated in my attached CV, I am a Certified Strategic Resourcing Professional with excellent leadership skills and the crucial ability to solve complex problems. At AR Resourcing, Ltd., I was known for my pro-active approach and excellent work ethic. There, I was mainly in charge of coordinating multiple business projects, identifying and evaluating founding opportunities, and communicating with clients and business partners. Additionally, I completed professional market research, maintained relevant documents and records, and analyzed the company's procurement needs. For constantly performing excellent work, I won the Employee of the Month Award.

Next, I am the University of Warwick graduate with a degree in Business Administration. Possessing the experience with all software programs necessary for the role, including Hub Planner, Mavenlink, and MS Office, I would appreciate the opportunity to meet with you in person to discuss the job and my qualifications in more detail. I can be reached in confidentiality at 555-555-5555 or via email at [email protected]. Thank you for your time and consideration and I look forward to speaking with you in the near future.

Kind regards,

Milan Šaržík, CPRW

Milan’s work-life has been centered around job search for the past three years. He is a Certified Professional Résumé Writer (CPRW™) as well as an active member of the Professional Association of Résumé Writers & Careers Coaches (PARWCC™). Milan holds a record for creating the most career document samples for our help center – until today, he has written more than 500 resumes and cover letters for positions across various industries. On top of that, Milan has completed studies at multiple well-known institutions, including Harvard University, University of Glasgow, and Frankfurt School of Finance and Management.

Edit this sample using our resume builder.

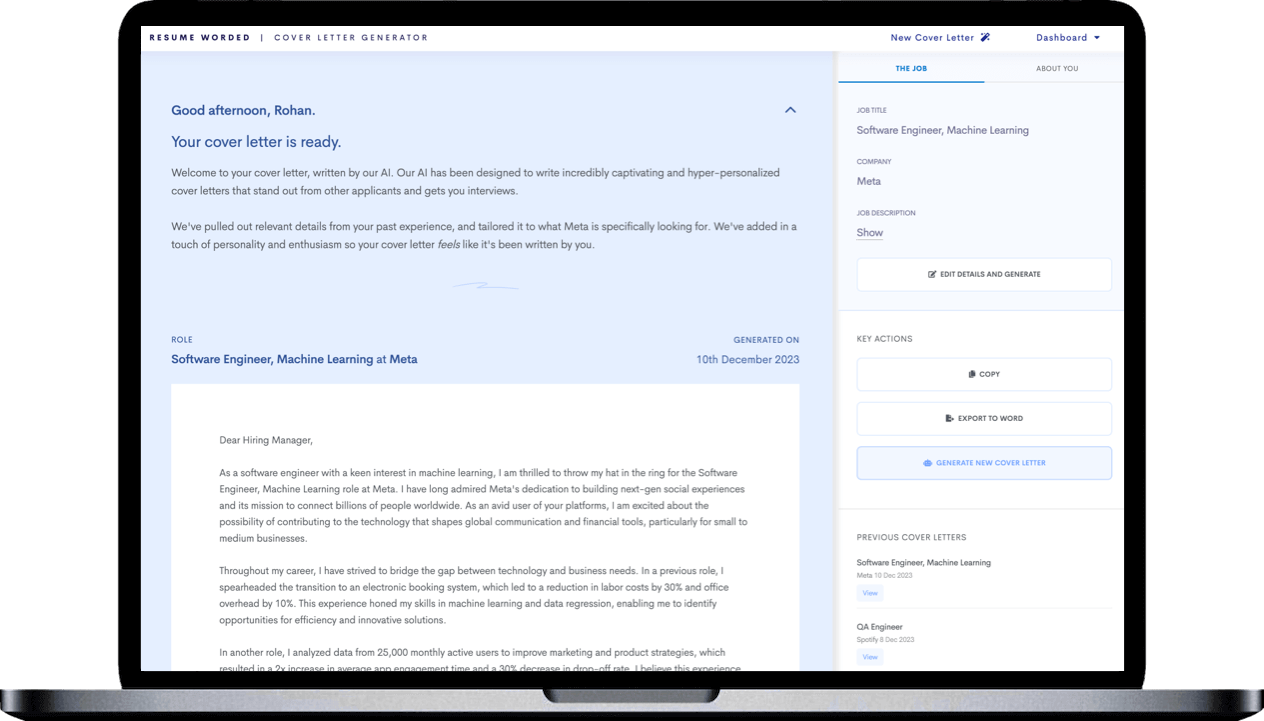

Don’t struggle with your cover letter. artificial intelligence can write it for you..

Similar job positions

Startup Business Development Account Manager Investor Consulting Entrepreneur / Business Owner Procurement

Related procurement resume samples

Related business cover letter samples

Let your resume do the work.

Join 5,000,000 job seekers worldwide and get hired faster with your best resume yet.

How to Write a Proposal Letter for Outsourcing

- Small Business

- Business Communications & Etiquette

- Writing Business Proposals

- ')" data-event="social share" data-info="Pinterest" aria-label="Share on Pinterest">

- ')" data-event="social share" data-info="Reddit" aria-label="Share on Reddit">

- ')" data-event="social share" data-info="Flipboard" aria-label="Share on Flipboard">

An Outline to Pitch an Idea to a Company

What are the causes of outsourcing failures, the advantages of fixed price contracts.

- How to Fire an Employee Who Never Returns to Work

- Can My Employee Freelance?

Outsourcing is enjoying a surge in respectability now that businesses of all types and sizes are striving to contain costs and operate more efficiently. Making the case for outsourcing often crosses the desk of a business owner when she seeks a business loan and must explain the rationale in a proposal letter. Treat the exercise as one part problem-solution writing, one part argumentative writing, which requires you to anticipate and address possible objections. Choose your words with clarity and precision and then watch your proposal come to fruition.

Assess your company’s experience with outsourcing and plot your proposal accordingly. For example, if your company has outsourced job functions in the past with positive results, you may face an “easy sell.” If it has outsourced functions with negative outcomes, you would be smart to address how your proposal would eliminate past disappointments. And if your company has never outsourced a job function, you would be wise to break down resistance and provide greater specifics about why this “novel concept” is worth implementing. Anticipating responses will help you formulate a more compelling letter.

Research outsourcing options in the interest of answering a key question: How will your company find a competent person to fulfill the need at hand? Gather information and document cost estimates. To sell your outsourcing proposal, you must be sold on it yourself.

Begin your proposal letter with an acknowledgement of the problem or issue at hand and your sound belief in the solution: outsourcing. Let’s say you are running a growing remodeling business that must submit timely bids to potential customers. Your team of contractors are busy meeting with clients and taking measurements but have no time to write up professional proposals with itemized costs. The work is sporadic – frenetic some weeks and virtually non-existent during others. In this case, your thought-provoking opening paragraph might say, “As my company enjoys a profitable resurgence, it behooves me to look at ways that I can continue to provide the premier customer service my company is known for while containing costs. In this spirit, I believe I should outsource the task of writing up bids and sending client letters to an independent contractor.”

Take a step back from your proposal and describe the problem – in this case, that your team of contractors are struggling to provide timely bids. Illustrate the problem in real, tangible terms with anecdotes. In this example, you might explain how your contractors are trying to be responsive to client calls but cannot keep up with the follow-through: submitting timely project bids.

Describe the consequences of the present situation. In this case, you might detail how your contractors are chalking up overtime hours but are still failing to submit timely project bids. Calculate how much these “lost” bids are worth to your company in real dollars.

Present your case for outsourcing and emphasize the positives – in this case underscoring that the independent contractor you hire will afford your company the value of responding promptly to peak periods of activity while restoring greater profitability to your company. Explain the “mechanics” of the outsourcing arrangement, estimating the projected costs and the talent pool you will draw from, based on your research. Make the point that unlike an employee, a contractor is not entitled to medical and other health benefits, which makes the arrangement a cost-saver right from the start.

Anticipate and address objections to your proposal, based on your company’s culture and track record with independent contractors. In this example, you might cede the obvious tack of hiring a part- or full-time employee but then point out the wastefulness of paying this employee during lulls in the business. Remember that outsourcing allows you flexibility as well as the ability to outline your specific terms in a written contract. Emphasize that you can clearly outline these terms in an agreement that can be voided upon written notice.

Express your conviction that outsourcing is the best and most cost-efficient option to solve the problem your company faces. Remain open-minded to modifications to your proposal and express your wish to discuss the issue in a constructive forum. Thank the letter recipient for her time and consideration.

- Letters from the Homeroom: Sample Letters: Persuasion Letters

- Colorado State University: Writing Guide: Business Letters

- The Writing Center at the University of North Carolina-Chapel Hill: Writing Concisely

- Writing Arguments; John Ramage, John Bean and June Johnson; 2001

- The New St. Martin’s Handbook; Andrea Lunsford and Robert Connors; 1999.

- Purdue University Online Writing Lab: Writing the Basic Business Letter

- After writing your proposal, put it aside for a few days so you can review it with a fresh pair of eyes and a renewed desire for specificity. Be your own worst critique before you allow others to assume that role.

With education, health care and small business marketing as her core interests, M.T. Wroblewski has penned pieces for Woman's Day, Family Circle, Ladies Home Journal and many newspapers and magazines. She holds a master's degree in journalism from Northern Illinois University.

Related Articles

How to conduct an outsourcing interview, how to write a winning transportation industry business proposal, fixed price agreements, what is a cost-plus contract in construction, how to outsource jobs overseas to foreign countries, closing a proposal, how to send a proposal that will be met with open arms, how to write a bid rejection letter, how to write up a bid for a contract, most popular.

- 1 How to Conduct an Outsourcing Interview

- 2 How to Write a Winning Transportation Industry Business Proposal

- 3 Fixed Price Agreements

- 4 What Is a Cost-Plus Contract in Construction?

How to Write a Cover Letter in 2024 + Examples

After weeks of heavy job search, you’re almost there!

You’ve perfected your resume.

You’ve short-listed the coolest jobs you want to apply for.

You’ve even had a friend train you for every single interview question out there.

But then, before you can send your application and call it a day, you remember that the job ad requires a cover letter.

Now you’re stuck wondering how to write a cover letter ...

Don’t panic! We’ve got you covered. Writing a cover letter is a lot simpler than you might think.

In this guide, we’re going to teach you how to write a cover letter that gets you the job you deserve.

- What’s a cover letter & why it’s important for your job search

- How to write a convincing cover letter that gets you the job (step-by-step!)

- How to perfect your cover letter with the Novoresume free checklist

- What excellent cover letter examples look like

New to cover letter writing? Give our resumes 101 video a watch before diving into the article!

So, let’s get started with the basics!

What is a Cover Letter? (and Why It’s Important)

A cover letter is a one-page document that you submit as part of your job application (alongside your CV or Resume).

Its purpose is to introduce you and briefly summarize your professional background. On average, your cover letter should be from 250 to 400 words long .

A good cover letter can spark the HR manager’s interest and get them to read your resume.

A bad cover letter, on the other hand, might mean that your application is going directly to the paper shredder. So, to make sure this doesn’t happen, it’s essential to know how to write a convincing cover letter.

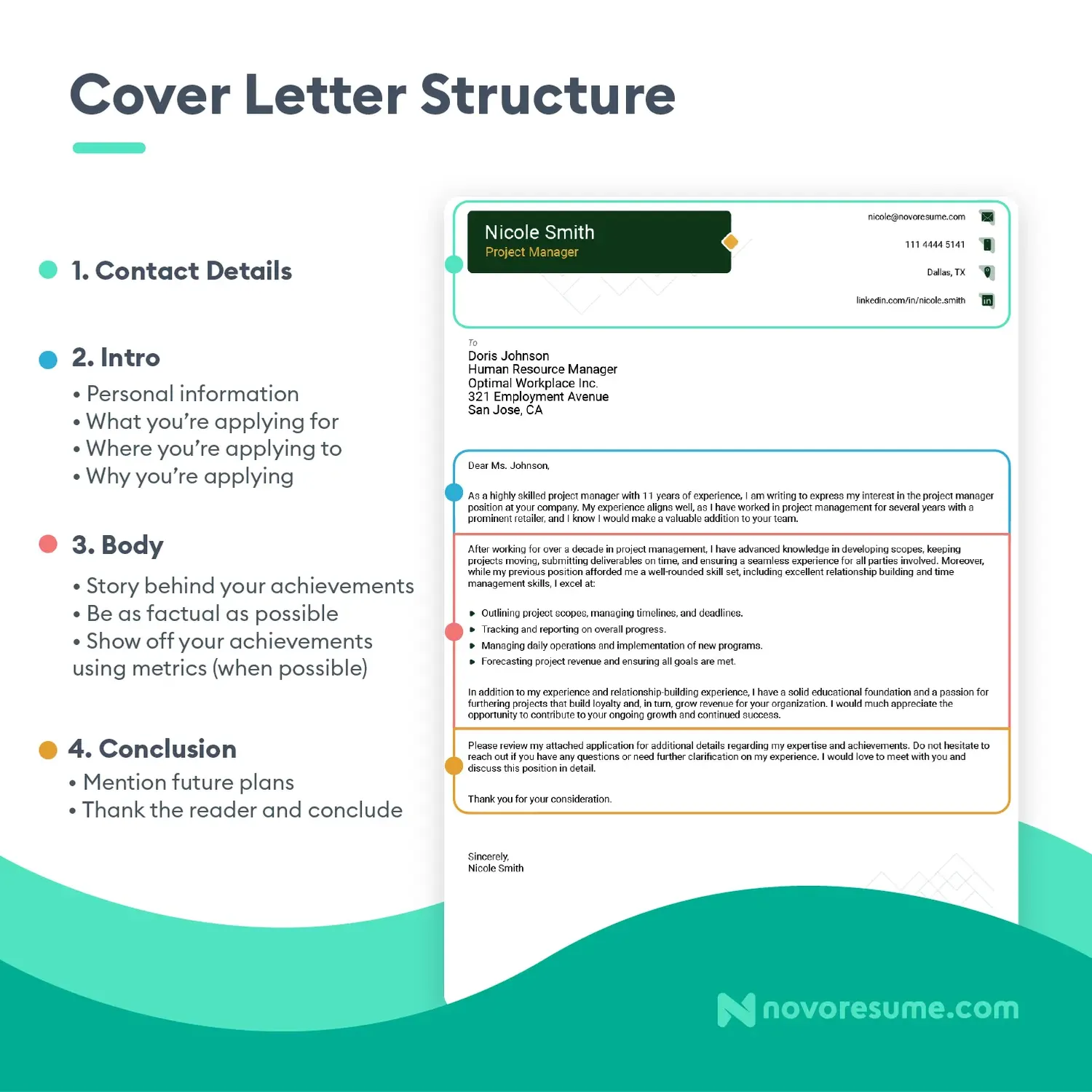

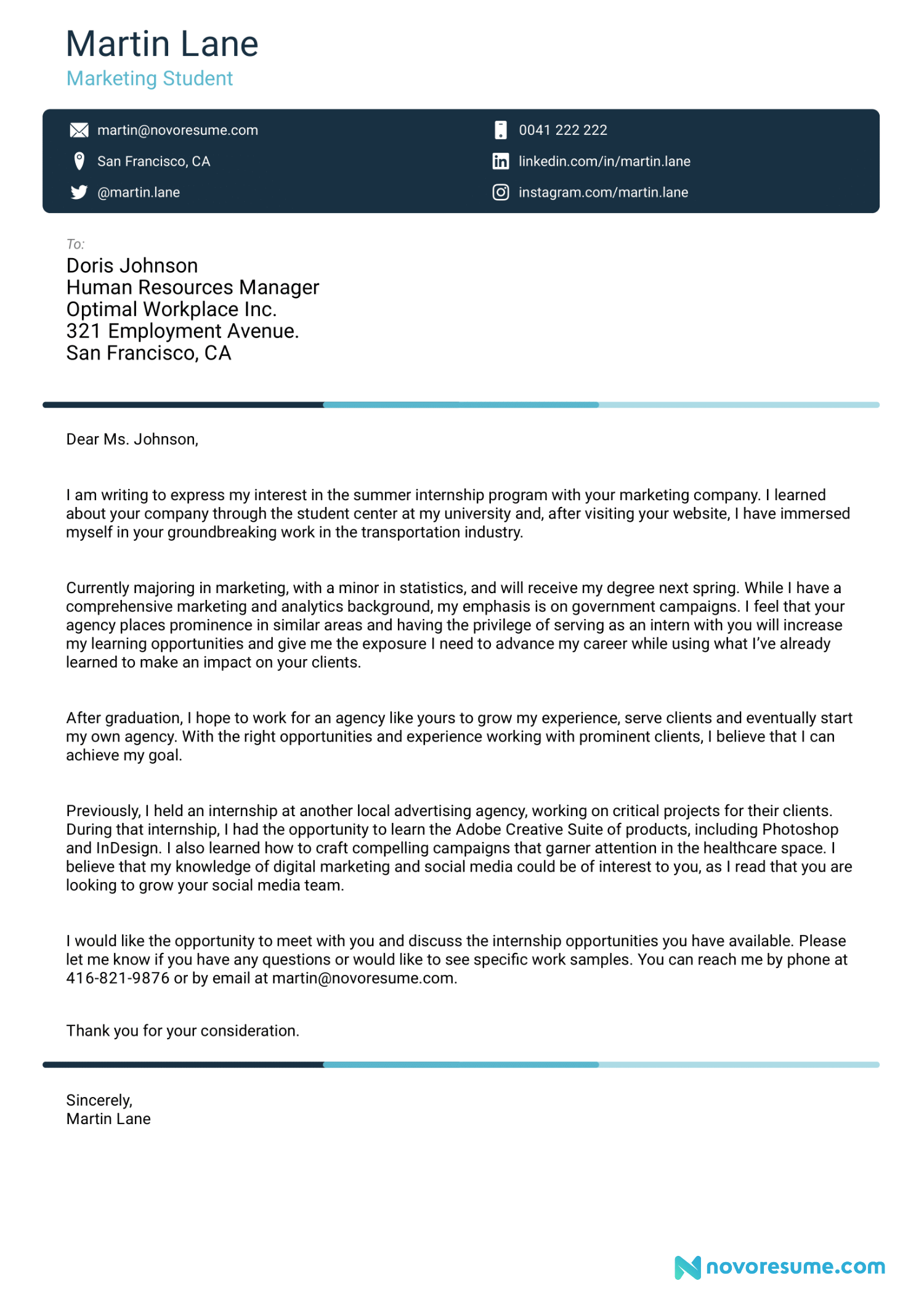

How does a good cover letter look, you might ask. Well, here’s an example:

Keep in mind, though, that a cover letter is a supplement to your resume, not a replacement. Meaning, you don’t just repeat whatever is mentioned in your resume.

If you’re writing a cover letter for the first time, writing all this might seem pretty tough. After all, you’re probably not a professional writer.

The thing is, though, you don’t need to be creative, or even any good at writing. All you have to do is follow a tried-and-tested format:

- Header - Input contact information

- Greeting the hiring manager

- Opening paragraph - Grab the reader’s attention with 2-3 of your top achievements

- Second paragraph - Explain why you’re the perfect candidate for the job

- Third paragraph - Explain why you’re a good match for the company

- Formal closing

Or, here’s what this looks like in practice:

How to Write the Perfect Cover Letter (And Get Hired!)

Now that we’ve got the basics out of the way, we’re going to guide you through the process of writing a cover letter step by step.

Step #1 - Pick the Right Cover Letter Template

A good cover letter is all about leaving the right first impression.

So, what’s a better way to leave a good impression than a well-formatted, visual template?

You can simply pick one of our hand-picked cover letter templates , and you’ll be all set in a jiffy!

As a bonus, our AI will even give you suggestions on how to improve your cover letter on the go.

Step #2 - Start the Cover Letter with a Header

As with a resume, it’s important to start your cover letter with a Contact Information section:

Here, you want to include all essential information, including:

- Phone Number

- Name of the hiring manager / their professional title

- Name of the company you’re applying to

In certain cases, you might also consider adding:

- Social Media Profiles - Any type of profile that’s relevant to your field. Social Profiles on websites like LinkedIn, GitHub (for developers), Medium (for writers), etc.

- Personal Website - If you have a personal website that somehow adds value to your application, you can mention it. Let’s say you’re a professional writer. In that case, you’d want to link to your blog.

And here’s what you shouldn’t mention in your header:

- Your Full Address

- Unprofessional Email - Make sure your email is presentable. It’s pretty hard for a hiring manager to take you seriously if your email address is “[email protected].” Whenever applying for jobs, stick to the “[first name] + [last name] @ email provider.com” format.

Step #3 - Greet the Hiring Manager

Once you’ve properly listed your contact information, you need to start writing the cover letter contents.

The first thing to do here is to address the cover letter to the hiring manager .

That’s right, the hiring manager! Not the overly popular “Dear Sir or Madam.” You want to show your future boss that you did your research and are really passionate about working with their team.

No one wants to hire a job seeker who just spams 20+ companies and hopes to get hired in any of them.

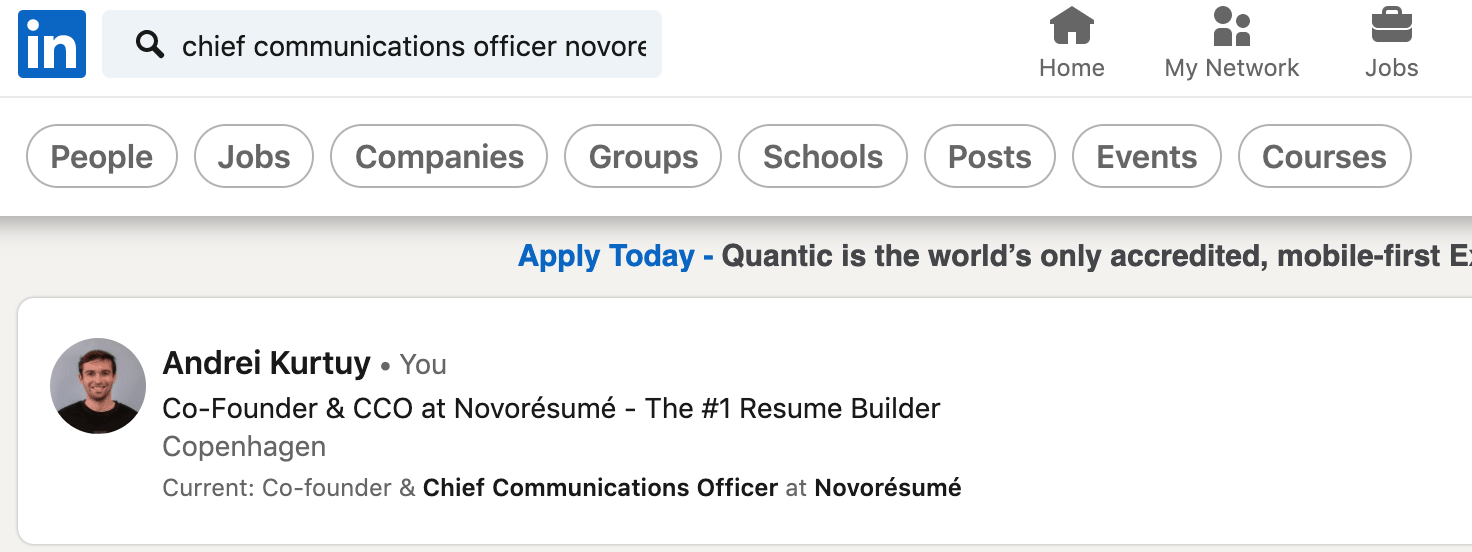

So, how do you find out who’s the hiring manager? There are several ways to do this.

The simplest option is to look up the head of the relevant department on LinkedIn. Let’s say you’re applying for the position of a Communication Specialist at Novoresume. The hiring manager is probably Head of Communications or Chief Communications Office.

So, you do a quick lookup on LinkedIn:

And voila! You have your hiring manager.

Or let’s say you’re applying for the position of a server. In that case, you’d be looking for the “restaurant manager.”

If this doesn’t work, you can also check out the “Team” page on the company website; there’s a good chance you’ll at least find the right person there.

Here are several other greetings you could use:

- Dear [Department] Hiring Manager

- Dear Hiring Manager

- To whom it may concern

- Dear [Department] Team

Step #4 - Write an Attention-Grabbing Introduction

First impressions matter, especially when it comes to your job search.

Recruiters get hundreds, sometimes even thousands, of applications. Chances are, they’re not going to be reading every single cover letter end-to-end.

So, it’s essential to catch their attention from the very first paragraph .

The #1 problem we see with most cover letter opening paragraphs is that they’re usually extremely generic. Most of them look something like this..

- Hey, my name is Jonathan and I’d like to work as a Sales Manager at XYZ Inc. I’ve worked as a sales manager at MadeUpCompany Inc. for 5+ years, so I believe that I’d be a good fit for the position.

See the issue here? This opening paragraph doesn’t say pretty much anything except the fact that you’ve worked the job before.

Do you know who else has similar work experience? All the other applicants you’re competing with.

Instead, you want to start off with 2-3 of your top achievements to really grab the reader’s attention. Preferably, the achievements should be as relevant as possible to the position.

So now, let’s make our previous example shine:

My name’s Michael and I’d like to help XYZ Inc. hit and exceed their sales goals as a Sales Manager. I’ve worked with Company X, a fin-tech company, for 3+ years. As a Sales Representative, I generated an average of $30,000+ in sales per month (beating the KPIs by around 40%). I believe that my previous industry experience, as well as excellence in sales, makes me the right candidate for the job.

See the difference between the two examples? If you were the hiring manager, which sales manager would you hire, Jonathan or Michael?

Now that we’ve covered the introduction, let’s talk about the body of your cover letter. This part is split into two paragraphs: the first is for explaining why you’re the perfect person for the job, and the latter is for proving that you’re a good fit for the company.

So, let’s get started...

Step #5 - Explain why you’re the perfect person for the job

This is where you show off your professional skills and convince the HR manager that you’re a better fit for the job than all the other applicants.

But first things first - before you even write anything, you need to learn what the most important requirements for the role are. So, open up the job ad and identify which of the responsibilities are the most critical.

For the sake of the example, let’s say you’re applying for the position of a Facebook Advertiser. You scan the job ad and see that the top requirements are:

- Experience managing a Facebook ad budget of $10,000+ / month

- Some skills in advertising on other platforms (Google Search + Twitter)

- Excellent copywriting skills

Now, in this section, you need to discuss how you fulfill these requirements. So, here’s how that would look for our example:

In my previous role as a Facebook Marketing Expert at XYZ Inc. I handled customer acquisition through ads, managing a monthly Facebook ad budget of $20,000+ . As the sole digital marketer at the company, I managed the ad creation & management process end-to-end. Meaning, I created the ad copy , images, picked the targeting, ran optimization trials, and so on.

Other than Facebook advertising, I’ve also delved into other online PPC channels, including:

- Google Search

Are you a student applying for your first internship? You probably don’t have a lot of work experience to show off in this section. Learn how to write an internship cover letter here.

Step #6 - Explain why you’re a good fit for the company

Once you’ve written the last paragraph, you might be thinking - I’m a shoo-in for the job! What else do I need to write? I’ll just wrap up the cover letter and hit that sweet SEND button.

Well, no. You’re not quite there yet.

The HR manager doesn’t only look at whether you’ll be good at the job or not. They’re looking for someone that’s also a good fit for the company culture.

After all, employees that don’t fit in are bound to quit, sooner or later. This ends up costing the company a ton of money, up to 50% of the employee’s annual salary .

Meaning, you also need to convince the HR manager that you’re really passionate about working with them.

How do you do this? Well, as a start, you want to do some research about the company. You want to know things like:

- What’s the company’s business model?

- What’s the company product or service? Have you used it?

- What’s the culture like? Will someone micro-manage your work, or will you have autonomy on how you get things done?

So, get to Googling. Chances are, you’ll find all the information you need either on the company website or somewhere around the web.

Then, you need to figure out what you like about the company and turn that into text.

Let’s say, for example, you’re passionate about their product and you like the culture of innovation / independent work in the organization.

You’d write something like:

I’ve personally used the XYZ Smartphone, and I believe that it’s the most innovative tech I’ve used in years. The features such as Made-Up-Feature #1 and Made-Up-Feature #2 were real game changers for the device.

I really admire how Company XYZ thrives for excellence for all its product lines, creating market-leading tech. As someone that thrives in a self-driven environment, I truly believe that I and Company XYZ will be a great match.

What you don’t want to do here is be super generic for the sake of having something to write. Most job seekers tend to mess this one up. Let’s take a look at a very common example we tend to see (way too often):

I’d love to work for Company XYZ because of its culture of innovation. I believe that since I’m super creative, I’d be a good fit for the company. The company values of integrity and transparency really vibe with me.

See what’s wrong here? The example doesn’t really say anything about the company. “Culture of Innovation” is something most companies claim to have.

The same goes for “values of integrity and transparency” - the writer just googled what the values for the organization are, and said that they like them.

Any hiring manager that reads this will see through the fluff.

So, make sure to do a lot of research and come up with good reasons why you're applying.

Step #7 - Wrap up with a call to action

Finally, it’s time to finish up your cover letter and write the conclusion.

In the final paragraph, you want to:

- Wrap up any points you couldn't in the previous paragraphs. Do you have anything left to say? Any other information that could help the hiring manager make their decision? Mention it here.

- Thank the hiring manager for their time. It never hurts to be courteous, as long as you don’t come off as too needy.

- Finish the cover letter with a call to action. The very last sentence in your cover letter should be a call to action. You should ask the hiring manager to take some sort of action.

And now, let’s turn this into a practical example:

So to wrap it all up, thanks for looking into my application. I hope I can help Company X make the most out of their Facebook marketing initiatives. I'd love to further discuss how my previous success at XYZ Inc. can help you achieve your facebook marketing goals.

Step #8 - Use the right formal closing

Once you’re done with the final paragraph, all you have to do is write down a formal “goodbye” and you’re good to go.

Feel free to use one of the most popular conclusions to a cover letter:

- Best Regards,

- Kind Regards,

And we’re finally done! Before sending off the cover letter, make sure to proofread it with software like Grammarly, or maybe even get a friend to review it for you.

Does your cover letter heading include all essential information?

- Professional email

- Relevant Social Media Profiles

Do you address the right person? I.e. hiring manager in the company / your future direct supervisor

Does your introductory paragraph grab the reader's attention?

- Did you mention 2-3 of your top achievements?

- Did you use numbers and facts to back up your experience?

Do you successfully convey that you’re the right pro for the job?

- Did you identify the core requirements?

- Did you successfully convey how your experiences help you fit the requirements perfectly?

Do you convince the hiring manager that you’re passionate about the company you’re applying to?

- Did you identify the top 3 things that you like about the company?

- Did you avoid generic reasons for explaining your interest in the company?

Did you finalize the conclusion with a call to action?

Did you use the right formal closure for the cover letter?

5+ Cover Letter Examples

Need some inspiration? Read on to learn about some of the best cover letter examples we’ve seen (for different fields).

College Student Cover Letter Example

Middle Management Cover Letter Example

Career Change Cover Letter Example

Management Cover Letter Example

Senior Executive Cover Letter Example

Want to discover more examples AND learn what makes them stand out? Check out our guide to cover letter examples .

Next Steps in Your Job Search - Creating a Killer Resume

Your cover letter is only as good as your resume. If either one is weak, your entire application is for naught.

After all, a cover letter is just an introduction. Imagine going through all this effort to leave an amazing first impression, but flopping at the end because of a mediocre resume.

...But don’t you worry, we’ve got you covered on that end, too.

If you want to learn more about Resumes & CVs, we have a dedicated FREE guide for that. Check out our complete guide on how to make a resume , as well as how to write a CV - our experts will teach you everything you need to know in order to land your dream job.

Or, if you’re already an expert, just pick one of our resume templates and get started.

Key Takeaways

Now that we’ve walked you through all the steps of writing a cover letter, let’s summarize everything we’ve learned:

- A cover letter is a 250 - 400 word document that convinces the hiring manager of your competence

- A cover letter goes in your job application alongside your resume

- Your introduction to the cover letter should grab the hiring manager’s attention and keep it all the way until the conclusion

- There are 2 main topics you need to include in your cover letter: why you’re the perfect candidate for the job & why you’re passionate about working in the company you’re applying to

- Most of the content of your cover letter should be factual , without any fluff or generalizations

At Novorésumé, we’re committed to helping you get the job you deserve, every step of the way! Follow our blog to stay up to date with the industry-leading advice. Or, check out some of our top guides…

- How to Write a Motivational Letter

- How to Write a Resume with No Work Experience

- Most Common Interview Questions and Answers

To provide a safer experience, the best content and great communication, we use cookies. Learn how we use them for non-authenticated users.

Researched by Consultants from Top-Tier Management Companies

Powerpoint Templates

Icon Bundle

Kpi Dashboard

Professional

Business Plans

Swot Analysis

Gantt Chart

Business Proposal

Marketing Plan

Project Management

Business Case

Business Model

Cyber Security

Business PPT

Digital Marketing

Digital Transformation

Human Resources

Product Management

Artificial Intelligence

Company Profile

Acknowledgement PPT

PPT Presentation

Reports Brochures

One Page Pitch

Interview PPT

All Categories

Top 10 Outsourcing Proposal Templates with Samples and Examples

Mohammed Sameer

"Do what you do best and outsource the rest." - Peter Drucker (American consultant, educator, and author)

In today's business, delegation has become a strategic necessity, allowing companies to allocate their resources wisely and concentrate on what they do best. As business landscapes evolve at the speed of thought, management has to strike a balance between in-house excellence and external expertise. Some of the biggest and most renowned players in the corporate arena have taken to outsourcing, reaping the dividends of handing over their operations to specialized partners. Let's take a closer look at how global giants like Apple, IBM, and Amazon have used outsourcing to enhance efficiency, reduce costs, and excel.

Apple Inc. , a name synonymous with innovative technology, has long recognized the power of outsourcing. The manufacturing of Apple's iconic products, such as the iPhone and iPad, is entrusted to companies like Foxconn and Pegatron. After doing this, Apple can direct its expertise toward product design and software development, using the manufacturing proficiency of these outsourcing partners. The result? High-quality devices that have redefined industries and set new standards in innovation.

IBM , a pioneer in the world of information technology, has a history of outsourcing IT services to industry leaders like Tata Consultancy Services (TCS) and Wipro. This strategic decision has allowed IBM to provide cost-effective solutions to clients while zeroing in on its core competencies, such as research and development. With outsourcing, IBM has cemented its status as a trusted global technology partner.

Meanwhile, e-commerce giant Amazon has outsourced its customer service operations to third-party call centers in many countries. This approach has been instrumental in Amazon's ability to offer around-the-clock customer support, even as it also focuses on expanding its e-commerce empire and dominating the cloud services market. It's a testament to Amazon's commitment to delivering unparalleled customer experiences.

These examples illustrate the profound impact that outsourcing can have on a company's success. These underline the importance of concentrating on core competencies and relying on specialists to handle ancillary functions. As your journey through this blog unfolds, you'll discover how outsourcing proposal templates can empower businesses of all sizes to follow in the footsteps of these industry giants, grab new opportunities, and streamline operations.

The 100% editable and customizable nature of these PowerPoint Templates provides you with the structure and the desired flexibility to edit your presentations.

Let's explore!

Template 1: Executive Summary Outsourcing Proposal PPT Bundle

Creating an effective executive summary for your outsourcing PowerPoint Presentation has never been more convenient. This comprehensive outsourcing PPT Slideshow enables you to articulate your company's mission and vision and the meeting's agenda to your workforce, facilitating a deeper comprehension of the organization's objectives. The presentation covers executive dashboards, sales performance, financial metrics, target markets, market share objectives, key potential clients, customer growth strategies, and specific focus areas. The deck includes slides on unique selling propositions, value proposition expansion, feedback mechanisms, potential pricing, and profit margins. To ensure a comprehensive proposal, we have also included creative executive summary business plan PowerPoint Designs covering product sales volume, critical areas of focus, identified issues and bottlenecks, action plans, desired outcomes, and potential solutions. It also includes informative charts such as clustered columns, bar graphs, bubble charts, stacked line graphs, and filled radar charts. Download now!

Download this template

Template 2: Payroll Outsourcing Proposal Template

To present your services to potential clients in a compelling and confidence-inspiring manner, we offer our specialized Payroll Outsourcing Proposal Template. This resource empowers you to craft an impressive cover letter, differentiating yourself from competitors and capturing your audience’s attention. This includes articulating the objectives of payroll services, outlining its timeframe, presenting payroll files and reports, offering a summary of payroll service costs, and detailing terms and conditions, among other essential components. This PPT Set enables you to articulate your services, encompassing total tax service, deduction tracking and reporting, new hire reports, employee self-service, custom reports, electronic payroll reports, timekeeping systems, and direct deposits. Besides, the template helps showcase your company's accounting services, including year-end tax statements and summaries, quarterly tax payment reports, ledger maintenance, inventory account balancing, and yearly accounting reconciliations. Download now!

Template 3: Human Resource Outsourcing Services Proposal

Human Resource Outsourcing (HRO) is a strategic approach to address organizational challenges and achieve specific goals. This PPT Deck offers a platform to convey the benefits of HRO. This presentation underlines your expertise in business plan development, policy and procedure creation, employee recruitment, onboarding, and more. It also highlights your successful track record and team's capabilities, strengthening your credibility. The interactive HRO services slide allows transparent cost discussions with prospective clients. Get it today!

Template 4: Information Technology Outsourcing Services Proposal

Businesses outsource to secure top-tier talent for their permanent information technology positions. This strategic decision opens doors to growth prospects by redistributing some operational responsibilities to external staffing experts. This PPT Bundle offers a cost-effective solution tailored to your needs. Staffing agencies can tweak their offerings based on the duration and category of employees required, and whether full-time and part-time. This template provides a comprehensive framework for creating a dynamic pool of staff. This proposal includes a detailed action plan, allocation of resources, and establishing clear objectives, elevating the quality of staffing services. The proposal also delves into strategies for talent retention, mitigating organizational stress, and strengthening workforce stability. It offers a transparent breakdown of the costs associated with the staffing process. Get it today!

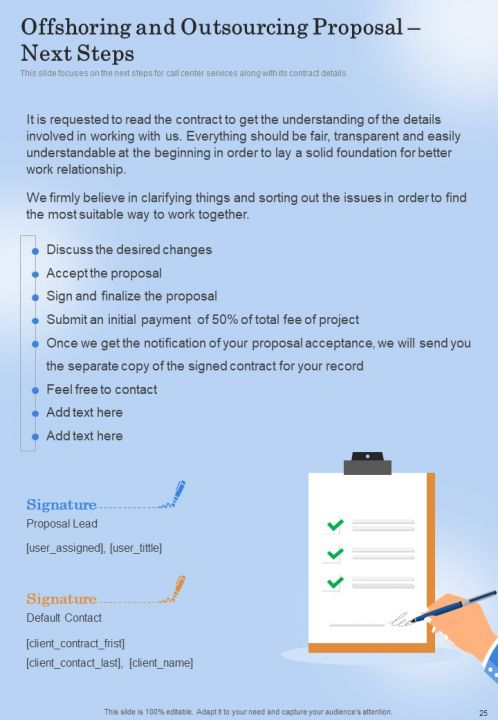

Template 5: Offshoring and Outsourcing Proposal

This PPT Template is a comprehensive proposal tool designed to streamline the B2B sales process, bridging the interaction between the seller and the prospective buyer. This proposal serves a dual purpose by providing essential knowledge and delivering a compelling sales pitch, persuading the buyer. Tailored for the benefit of businesses and professionals operating in the contact center industry, this PPT Set is a strategic resource for crafting superior proposals. Within this presentation, we have incorporated a range of carefully-curated slides, each serving a specific purpose:

1. Cover Letter

2. Project Context and Objectives

3. Scope of Work

4. Key Deliverables

5. Plan of Action

6. Contact Center Price Packages

7. Company Overview

These slides present a comprehensive overview of your organization, the services you offer, and the caliber of your team, supported by client testimonials, real-world case studies, and a detailed statement of work.

We also offer a clear roadmap of the next steps in the engagement process and provide contact information for further inquiries. Download now!

These were the comprehensive Presentation Sets on Outsourcing Proposals. Now, we’ll discuss the slides you shouldn’t ignore while crafting yours.

Template 6: Your Investment

In the "Your Investment" slide, you present a comprehensive breakdown of the financial aspect of our proposal. This slide is designed to offer a detailed look at the investment proposition and pricing packages designed to suit your specific outsourcing needs. It goes beyond just numbers; it explains the value behind your investment, showcasing the options, service inclusions, and flexible pricing structures to help stakeholders make an informed decision. For instance, in the template below, these are labeled as Essential, Business Plus, Enterprise, and Premium. Download now!

Template 7: Company Overview

The "Company Overview" slide serves as the foundational introduction to your organization. It encapsulates three key components: "Why Us," where you highlight the advantages of choosing your services; "About Us," providing insights into your company's mission, history, and values; and "Our Team," introducing the individuals who will be steering your clients' project toward success. This slide is designed to give you a holistic understanding of your company, its culture, and the team's expertise. Download now!

Template 8: Past Experience

‘Past Experience’ is where you demonstrate our credibility and proven track record. It presents the voice of your satisfied clients through Client Testimonials, offering real-world evidence of your service quality and customer satisfaction. Additionally, it features a detailed Case Study that dives into the challenges, solutions, and successful outcomes of a previous project. This slide provides a deep dive into your ability to deliver results, instilling confidence in your capabilities. Get it today!

Template 9: Statement of Work

The ‘Statement of Work and Contract’ slide is where you lay out your partnership’s legal and operational framework. It explains the terms of service, payment structures, and outlines contract-related specifics such as termination conditions, notice periods, and renewal options. This slide ensures that stakeholders have a clear understanding of the legal and operational aspects of your collaboration, promoting transparency, accountability, and trust. Download now!

Template 10: Next Steps

The "Next Steps" slide serves as a roadmap for what comes after the proposal review. While labeled as a general 'Next Steps' slide, it is crucial as it outlines the precise action plan for moving forward with your proposal. It summarizes the key actions, deadlines, and milestones that will help you transition from the proposal stage to the implementation phase. Download now!

Outsource to Outperform: Crafting Success the Strategic Way

Strategic outsourcing isn’t just a business tactic; it’s a recipe for success. This approach isn't confined to mere efficiency and cost savings; it's a crucible for innovation. Through the lens of outsourcing proposal templates, businesses, regardless of their scale, now hold the blueprint to mirror these triumphs. Download today!

Related posts:

- How to Design the Perfect Service Launch Presentation [Custom Launch Deck Included]

- Quarterly Business Review Presentation: All the Essential Slides You Need in Your Deck

- [Updated 2023] How to Design The Perfect Product Launch Presentation [Best Templates Included]

- 99% of the Pitches Fail! Find Out What Makes Any Startup a Success

Liked this blog? Please recommend us

Top 10 RFP Response Templates with Examples and Samples

Must-have Vendor Proposal Templates with Samples and Examples

This form is protected by reCAPTCHA - the Google Privacy Policy and Terms of Service apply.

Digital revolution powerpoint presentation slides

Sales funnel results presentation layouts

3d men joinning circular jigsaw puzzles ppt graphics icons

Business Strategic Planning Template For Organizations Powerpoint Presentation Slides

Future plan powerpoint template slide

Project Management Team Powerpoint Presentation Slides

Brand marketing powerpoint presentation slides

Launching a new service powerpoint presentation with slides go to market

Agenda powerpoint slide show

Four key metrics donut chart with percentage

Engineering and technology ppt inspiration example introduction continuous process improvement

Meet our team representing in circular format

How to Write a Payroll Specialist Cover Letter (With Template)

.jpg)

Key takeaways

- A cover letter can be the most important element in a job application. Ensuring your profile stands out to recruiters is crucial to your professional success.

- A well-tailored cover letter should provide relevant information clearly and concisely. Focus on detailing your skills and why you are the right person for that specific role.

- The included Payroll Specialist cover letter template provides an easy starting point to craft your own cover letters. Adapt and personalize it to fit your profile.

A well-written cover letter is key to quickly getting the attention of prospective employers. Among countless job seekers, resumes, and application letters, yours need to stand out on first impression if you want to ensure your job search translates to a new role .

In this post, you will discover:

- Reasons why a well-crafted cover letter is key to professional success, from entry-level roles to senior positions

- Cover letter do’s and dont’s

- A Payroll Specialist sample cover letter you can easily adapt and personalize

A well-tailored cover letter : The key to job application success

Ensuring you know how to write a cover letter that is clear, informative, and tailored to the role you are applying to will benefit you in many ways. Well-crafted cover letters have many benefits, which include:

- Showcasing relevance: Tailoring your cover letter allows you to emphasize the most relevant skills, experiences, and achievements that align with the specific job requirements. This immediately captures the attention of the talent acquisition team, recruiters, or human resources reps.

- Demonstrating research: A good cover letter conveys your understanding of the organization's needs and illustrates how you can contribute to its success, signaling to potential employers that you've done your homework.

- Telling your story: Each job application is unique, and a tailored cover letter enables you to craft a personalized narrative. It lets you connect your professional journey with the role's specific challenges and opportunities, making your application more compelling.

- Highlighting cultural fit: Your cover letter allows you to address the company's values, mission, and culture. By aligning your experiences and values with those of the organization, you demonstrate a cultural fit and convey your enthusiasm for being part of the team.

- Addressing specific requirements: Job postings often include specific skills or qualifications the employer is seeking. Tailoring your cover letter enables you to address these requirements directly, showcasing how you possess the desired attributes and can meet the company's expectations.

Cover letter tips

A great cover letter should reflect your professional profile and personality. However, no matter what your cover letter's content is, the tips below will help ensure the message you want to convey is clear and easily accessible to hiring managers.

- Keep it concise: Aim for a cover letter length of 250-400 words. Be succinct in presenting your qualifications and experiences.

- Use a clean layout: Opt for a professional and clean cover letter format with a standard font (e.g., Arial, Calibri, or Times New Roman) and a font size of 10-12 points.

- Include contact information : Provide your contact information at the top of the cover letter, including your name, phone number, and professional email address.

- Use headers and sections: Organize your cover letter into clear sections with headers such as Introduction, Work Experience, and Achievements for easy readability.

- Maintain a professional tone: Keep the tone of your cover letter professional and upbeat. Avoid overly casual language, and focus on showcasing your skills and experiences.

- Use keywords: Incorporate relevant keywords from the Agile Project Manager job description and company website into your cover letter. This can help your application pass through applicant tracking systems (ATS) used by many employers.

- Highlight achievements with bullet points: Use bullet points to list specific accomplishments or notable projects. This makes it easier for the reader to grasp your accomplishments quickly.

- Use quantifiable data: Whenever possible, include quantifiable data to demonstrate the impact of your achievements. Numbers provide concrete evidence of your contributions.

- Match company tone: Adapt your writing style to match the tone of the company and industry. Research the company's culture to strike the right balance between professionalism and personality.

- Showcase company knowledge: Demonstrate your understanding of the company by referencing its values, mission, or recent achievements. Explain why you're excited about the opportunity to work for this specific organization.

- Address employment gaps (if applicable): If you have employment gaps, briefly address them in a positive light, focusing on any skills or experiences gained during those periods.

- Proofread thoroughly: Eliminate typos and grammatical errors by proofreading your cover letter multiple times. Consider using tools like Grammarly to catch any overlooked mistakes and ensure your English (or any language you use) is correct.

- Include a call to action : Conclude your cover letter with a call to action, expressing your enthusiasm for the opportunity and indicating your readiness for an interview.

- Follow submission instructions: If there are specific instructions for submitting the cover letter, such as naming conventions or document formats, ensure that you adhere to them.

- Save as a PDF: Save your cover letter as a PDF before submitting it. This ensures that the formatting remains consistent across different devices and software.

While understanding the correct steps to write a cover letter is crucial to your professional success, knowing what mistakes to avoid is equally important. The best cover letter can easily be made useless by a tiny blunder. Avoid making the mistakes listed below; you will be halfway to your new job.

- Don't use a generic greeting: Avoid generic salutations like "To whom it may concern," “Dear sir or madam, “ or “Dear hiring manager.“ Whenever possible, address the cover letter to a specific person.

- Don't repeat your resume: An effective cover letter should complement your resume, not duplicate it. Focus on specific experiences and achievements that showcase your qualifications for the role.

- Don't exaggerate or lie: Be truthful in your cover letter. Exaggerating your qualifications or providing false information can harm your chances and damage your professional reputation.

- Don't use unprofessional email addresses: Ensure that the email address you use in your contact information is professional. Avoid using nicknames or unprofessional terms.

- Don't include irrelevant information: Keep your cover letter focused on the job. Avoid including unrelated personal details or experiences that do not contribute to your suitability for the role.

- Don't use jargon unnecessarily: While demonstrating your knowledge is essential, avoid unnecessary jargon that may confuse the reader. Use clear and straightforward language.

- Don't sound overly eager: Expressing enthusiasm is positive but can easily feel unauthentic if overdone.

Remember, the goal of a practical cover letter is to present your qualifications in a clear, organized, and compelling manner while adhering to professional standards.

How to structure your Payroll Specialist cover letter

Convey your sincere interest in the Payroll Specialist position in the opening paragraph. Clearly express your passion for payroll management and your eagerness to contribute to an efficient and accurate payroll process. If applicable, mention any referrals that have influenced your decision to apply for this specific role.

About your current role

Highlight your achievements and strategies in payroll management that have contributed to the financial success of your current team. Emphasize your role in implementing specific payroll procedures or tools that have streamlined processes, demonstrating your proficiency in maintaining accurate and timely payroll records.

Use this section to outline your current responsibilities and ongoing projects, emphasizing how they align with the requirements and objectives of the Payroll Specialist role.

About your experience

Detail your hands-on experience in payroll tasks, underscoring your commitment to accuracy and your contribution to the overall financial health of the organization. Communicate that your payroll skills and readiness for the role are well-established. This section is also an opportunity to highlight the number of years you've spent as a Payroll Specialist and any additional skills acquired throughout your career path .

Notable achievements

Highlight notable accomplishments that showcase your effectiveness as a Payroll Specialist. Whether you played a crucial role in implementing efficient payroll systems, resolving complex payroll discrepancies, or improving the efficiency of payroll processes, use this section to concisely mention your achievements, how they were measured, and their impact on the financial stability of the team or organization.

Why you want to work there

Express your interest in the company by highlighting specific aspects of its payroll practices, mission, and values that resonate with you. Convey how these align seamlessly with your professional goals and how you envision contributing to the company's success through your expertise in payroll management. Be concise but articulate about your motivations.

Specific projects or initiatives that motivated you to apply

Demonstrate your understanding of the organization by referencing specific payroll-related projects or initiatives that have captured your interest. Draw connections between these initiatives and your skills and experiences, emphasizing how your contributions align with the company's payroll goals. This shows your genuine interest and proactive approach to aligning with the company's mission.

In the closing paragraph, reiterate your enthusiasm to contribute to the company's financial success as a Payroll Specialist. Express your eagerness to discuss how your skills align with the company's payroll objectives and invite the reader to reach out with any questions they may have. Sign off with a professional salutation.

Payroll Specialist cover letter template

Dear [Hiring Manager’s name],

I am writing to express my strong interest in the Payroll Specialist position at [Company Name], as advertised. With a solid background in payroll management and a proven track record of ensuring accurate and timely payroll processing, I am confident in my ability to contribute effectively to your organization.

About my current role

In my current position as a Payroll Specialist at [Current Company], I have:

- Successfully managed end-to-end payroll processes, including timekeeping, deductions, and tax compliance, ensuring accurate and timely disbursement of employee payments.

- Collaborated with HR and finance teams to address payroll-related queries and discrepancies, fostering effective communication and resolution.

- Stayed updated on payroll regulations and tax laws to ensure compliance with relevant legal requirements.

About my Payroll Specialist experience

My experience extends to:

- Utilizing payroll software, such as [specific software], to process payroll efficiently and maintain accurate records.

- Conducting regular audits to identify and correct discrepancies, ensuring payroll accuracy.

- Providing support during internal and external audits related to payroll processes.

Some of my notable achievements include:

- Implementing a streamlined payroll processing system that reduced errors by [percentage] and improved overall efficiency.

- Successfully managing the transition to a new payroll software, ensuring a smooth and error-free migration.

- Developing and delivering employee training programs on payroll-related matters, improving overall understanding, and reducing queries.

Why I want to work for [Company]

I am particularly drawn to [Company Name] due to its [mention aspects unique to the company and are a core part of its mission and values such as commitment to accuracy in payroll, dedication to employee satisfaction, growth,...]. I am excited to apply my payroll management skills to contribute to [Company Name]'s success in ensuring seamless and accurate payroll processes.

Specific projects or initiatives of [Company] that motivated me to apply

In researching [Company Name], I was impressed by your recent initiatives in [specific payroll-related project or achievement]. I believe my experience in payroll management aligns seamlessly with your organizational objectives. My commitment to maintaining accurate payroll records and my dedication to delivering high-quality results would make me a valuable addition to your team.

Thank you for considering my application. I am eager to further discuss how my skills and experiences align with the Payroll Specialist role at [Company Name]. I look forward to the possibility of contributing to your team's success.

[Your Full Name]

Get your career rolling with Deel

Your job application is your chance to tell your professional story, and a well-tailored cover letter is your narrative's opening chapter. Remember that personalization is key. Make each word count, emphasizing how your background uniquely positions you as the ideal candidate, and get your dream job.

Looking for even more inspiration? Discover how to write a stellar cover letter in 5 steps .

Discover more tips and tools to help boost your career further and climb the steps to your dream job on the get-hired content hub .

Deel makes growing remote and international teams effortless. Ready to get started?

Legal experts

- Hire Employees

- Hire Contractors

- Run Global Payroll

- Integrations

- For Finance Teams

- For Legal Teams

- For Hiring Managers

- Deel Solutions - Spain

- Deel Solutions - France

- Support hub

- Global Hiring Guide

- Partner Program

- Case Studies

- Service Status

- Worker Community

- Privacy Policy

- Terms of Service

- Whistleblower Policy

- Cookie policy

- Cookie Settings

Resume Worded | Career Strategy

5 business process specialist cover letters.

Approved by real hiring managers, these Business Process Specialist cover letters have been proven to get people hired in 2024. A hiring manager explains why.

Table of contents

- Business Process Specialist

- Senior Business Process Specialist

- Senior Business Process Analyst

- Alternative introductions for your cover letter

- Business Process Specialist resume examples

Business Process Specialist Cover Letter Example

Why this cover letter works in 2024, project management success.

By highlighting a specific accomplishment in process improvement, this cover letter demonstrates the candidate's ability to make a tangible impact. Quantifying the success (25% reduction) adds credibility to the claim.

Applying Expertise to Microsoft

Connecting past experience to how it can benefit the company shows that the candidate is not just focused on themselves, but also on contributing to the company's success.

Training Program Initiative

Sharing an accomplishment that showcases initiative and problem-solving skills helps position the candidate as someone who can identify and address gaps in a company's processes.

Training Program Results

Providing specific results (40% decrease) from the training program initiative emphasizes the candidate's ability to create value for the company, making them a strong fit for the role.

Draw on personal experiences with the company

In your cover letter, try to connect your personal experience with the company's products or services. This shows your genuine interest in the company and demonstrates that you already understand their offerings. For instance, if you've used IBM's Watson for a college project, do mention it. It shows you are already familiar with their products, which is a huge bonus.

Detailing specific achievements

When you mention projects you led that resulted in clear, quantifiable benefits, it gives me a concrete idea of what you can achieve. You've reduced time-to-market by 30% - that's impressive and shows that you can deliver results. This is what recruiters want to see.

Understanding the bigger picture

Here, you're showing that you understand how your role fits into the overall business. By stating that you understand the value of data-driven decision making and efficient processes, you're demonstrating that you're not just focused on your tasks, but on how they impact the company's success.

Aligning personal drive with company's goals