Hard Money Lending Business Plan [Sample Template]

By: Author Tony Martins Ajaero

Home » Business Plans » Financial Services

A hard money lending business is a type of lending activity where loans are provided to borrowers based on the collateral they offer, rather than the borrower’s creditworthiness.

These loans are typically short-term and are secured by real estate or other valuable assets. Hard money lenders are private individuals or organizations that specialize in these types of loans.

Hard money lending is commonly used by real estate investors and developers who need quick access to funds for property purchases, renovations, or other time-sensitive projects.

While it can be a valuable source of financing for those who may not qualify for traditional loans, borrowers should carefully consider the higher costs and risks associated with hard money loans.

Additionally, hard money lenders should conduct thorough due diligence on the collateral and borrower to mitigate potential risks.

Steps on How to Write a Hard Money Lending Business Plan

Executive summary.

Jared Moore® Hard Money Lending, Inc. is a reputable and dynamic hard money lending firm headquartered in Detroit, Michigan.

Established with a commitment to providing efficient and flexible financing solutions, our company specializes in short-term loans secured by real estate assets.

Detroit, Michigan, presents a unique and burgeoning real estate market, with increasing demand for flexible financing options.

As the city undergoes revitalization and development, Jared Moore® Hard Money Lending, Inc. is strategically positioned to contribute to the growth of local businesses and real estate ventures.

Company Profile

A. our products and services.

Jared Moore® Hard Money Lending, Inc. offers a range of hard money lending services tailored to the unique needs of our clients, including:

- Short-Term Real Estate Loans: Providing swift and hassle-free financing solutions for real estate investments, acquisitions, and development projects.

- Collateral-Based Financing: Evaluating loan eligibility primarily based on the value of the collateral, allowing for a more inclusive approach to lending.

- Quick Approval and Funding: Streamlining the lending process to ensure rapid approval and timely disbursement of funds, supporting our clients’ time-sensitive projects.

- Flexible Terms: We offer customized loan structures, repayment schedules, and conditions to accommodate the diverse needs of our borrowers.

b. Nature of the Business

Jared Moore® Hard Money Lending, Inc. operates through a multi-faceted business model. We will work with individuals and businesses.

c. The Industry

Jared Moore® Hard Money Lending, Inc. will operate in the broader financial services industry, specifically, within the subsector of alternative or non-traditional lending services.

d. Mission Statement

At Jared Moore® Hard Money Lending, Inc., our mission is to empower real estate investors and developers by providing swift and reliable access to capital through collateral-based lending.

We are dedicated to facilitating the success of our client’s projects by offering efficient and flexible financing solutions. With a commitment to integrity, transparency, and customer satisfaction, we strive to be a trusted partner in their journey towards achieving their real estate goals.

e. Vision Statement

Our vision at Jared Moore® Hard Money Lending, Inc. is to be the premier hard money lending institution, recognized for innovation, excellence, and unwavering commitment to our clients. We aspire to set industry standards by consistently delivering fast, reliable, and tailored financing solutions.

Through strategic partnerships and a deep understanding of the real estate market, we aim to be a driving force behind the success of diverse projects, playing a pivotal role in the transformation and revitalization of communities.

f. Our Tagline (Slogan)

“Empowering Visions, Fueling Progress: Jared Moore® Hard Money Lending, Inc.”

g. Legal Structure of the Business (LLC, C Corp, S Corp, LLP)

Jared Moore® Hard Money Lending, Inc. will be formed as a Limited Liability Company (LLC).

h. Our Organizational Structure

- Chief Operating Officer (Owner)

- General Manager

- Compliance Manager

- Loan Advisors (Loan Officers)

- Sales and Marketing Officer

- Customer Service Representatives

i. Ownership/Shareholder Structure and Board Members

- Jared Moore (Owner and Chairman/Chief Executive Officer) 56 Percent Shares

- Joel Davids (Board Member) 14 Percent Shares

- Edmond Hankins (Board Member) 10 Percent Shares

- Robinson Gatwick (Board Member) 10 Percent Shares

- Christiana Samson (Board Member and Secretary) 10 Percent Shares.

SWOT Analysis

A. strength.

- A team of seasoned professionals with extensive knowledge in hard money lending, real estate, and financial services.

- Ability to offer customized and flexible loan structures tailored to meet the diverse needs of clients.

- Streamlined processes for rapid approval and disbursement of funds, providing a competitive advantage in time-sensitive real estate transactions.

- In-depth understanding of the Detroit real estate market, allowing for informed decision-making and strategic lending.

- Commitment to integrity, transparency, and customer satisfaction, fostering strong and lasting relationships with clients.

b. Weakness

- Reliance on collateral-based lending may lead to higher interest rates, potentially limiting the market to borrowers willing to accept these terms.

- Vulnerability to fluctuations in the real estate market, economic downturns, or adverse local economic conditions.

- As a localized business, expansion into new markets may be challenging, limiting growth opportunities.

c. Opportunities

- Capitalizing on the growth potential of the Detroit real estate market and emerging opportunities in revitalization projects.

- Exploring additional financial products or services to diversify revenue streams and mitigate risks.

- Implementing technology solutions for enhanced efficiency in loan processing, risk assessment, and customer relationship management.

- Collaborating with real estate developers, brokers, or other industry players to expand market reach and increase the volume of loan opportunities.

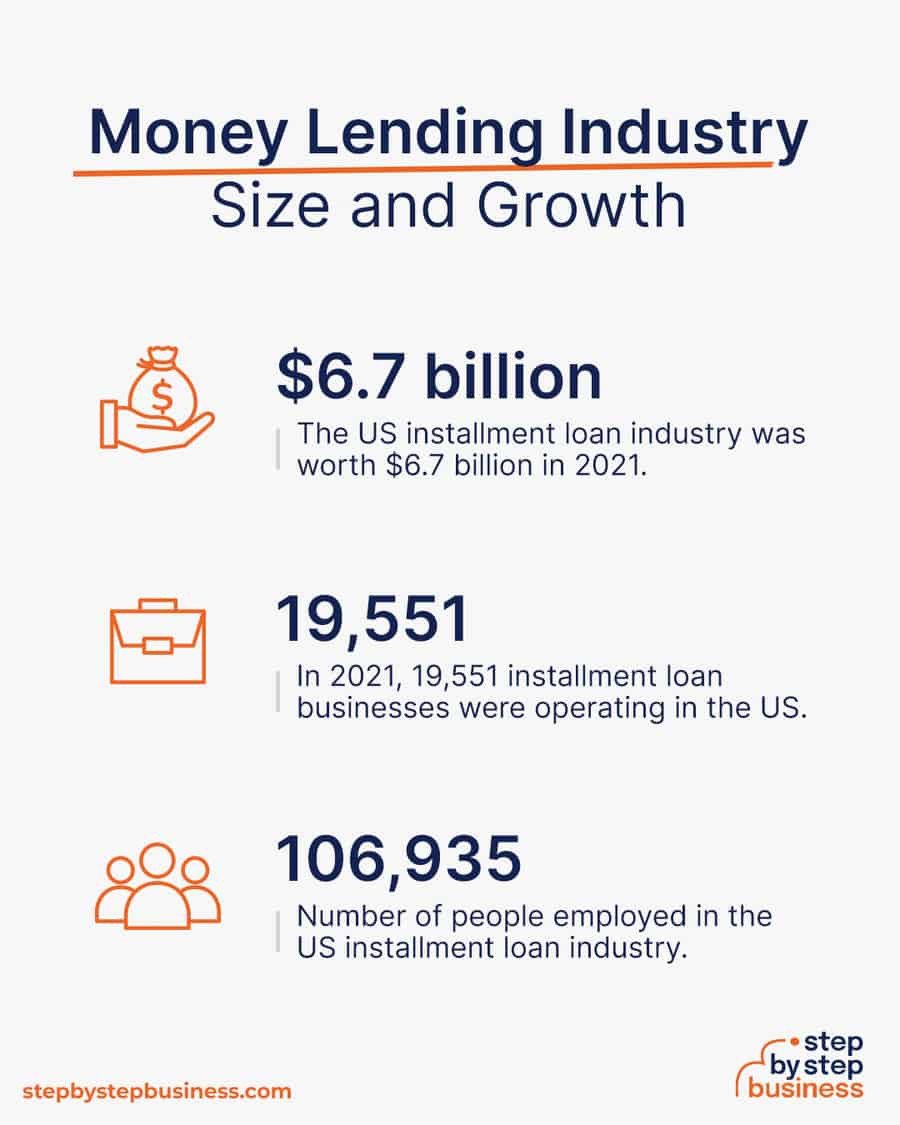

i. How Big is the Industry?

The hard money line of business is not considered a big industry in the United States. However, it’s important to note that the industry is relatively niche compared to the broader lending market.

ii. Is the Industry Growing or Declining?

The hard money lending industry has seen growth in recent years, driven by various factors, including increased real estate investment activities, a need for quick and flexible financing, and a growing number of real estate developers and investors seeking alternative funding sources.

iii. What are the Future Trends in the Industry?

Increased use of technology for loan processing, underwriting, and customer relationship management. Automation and digital tools may streamline operations, enhance efficiency, and improve the overall borrower experience.

Growing reliance on data analytics and sophisticated risk assessment models to evaluate collateral and borrower creditworthiness. This trend can contribute to more accurate lending decisions and risk mitigation.

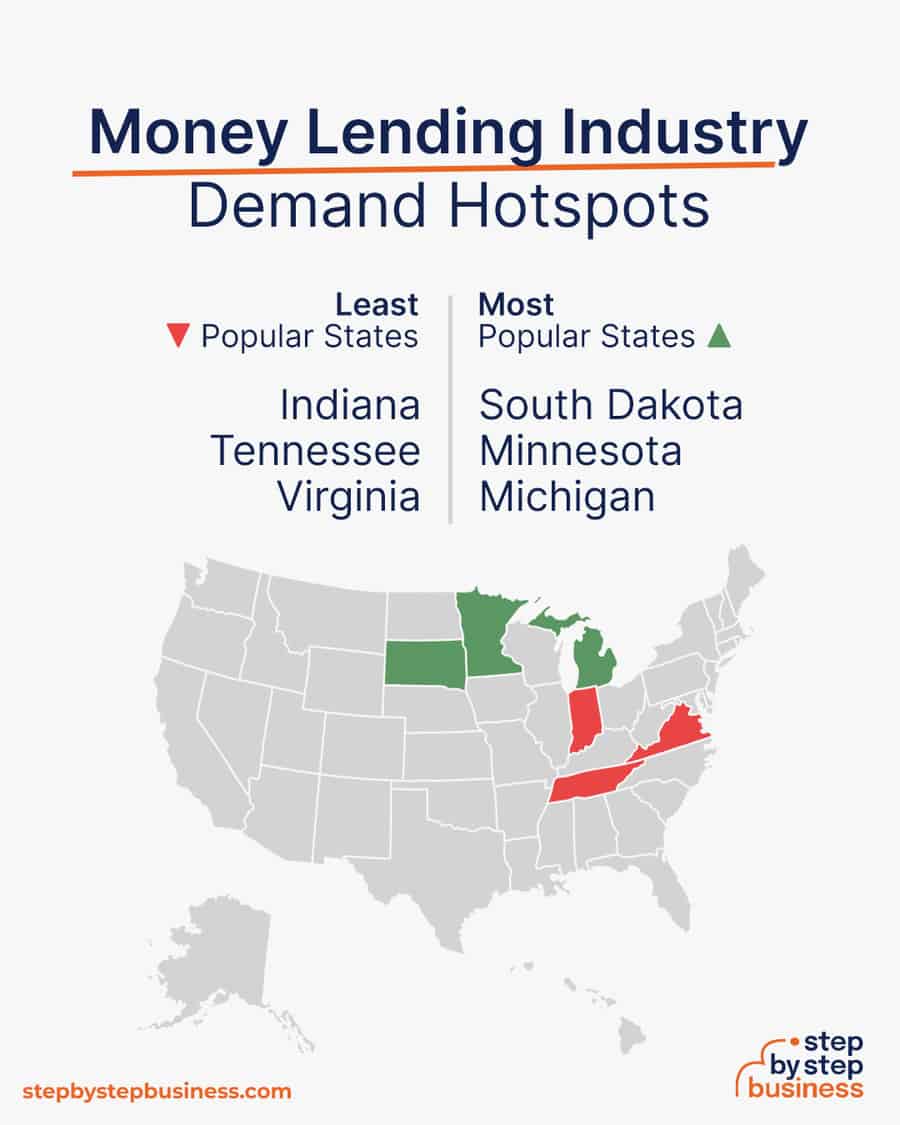

Continued expansion into new geographical markets as hard money lenders seek opportunities beyond their traditional locations. This may be driven by the identification of emerging real estate markets and the need for diversification.

Collaboration between hard money lenders and financial technology (FinTech) companies to leverage innovative solutions, such as blockchain for secure transactions or smart contracts for automated and transparent loan agreements.

Exploration of alternative assets beyond real estate as collateral for hard money loans. This could include intellectual property, equipment, or other valuable assets.

Economic conditions and interest rate fluctuations will continue to influence the industry. Changes in economic outlooks may impact borrower demand and the overall health of the hard money lending sector.

iv. Are There Existing Niches in the Industry?

No, there are no existing niches when it comes to a hard money lending business because a hard money lending business is a niche idea in the financial services industry.

v. Can You Sell a Franchise of Your Business in the Future?

Jared Moore® Hard Money Lending, Inc. has the plan to sell franchises shortly and we will target larger cities all across the United States of America and Canada.

- Exposure to economic downturns may impact the ability of borrowers to repay loans and the value of collateral.

- Changes in regulations related to lending, interest rates, or real estate transactions could impact business operations.

- Intense competition from other hard money lenders, traditional financial institutions, or alternative financing options.

- Fluctuations in interest rates may affect the cost of capital and the attractiveness of hard money loans for borrowers.

i. Who are the Major Competitors?

- LendingHome

- Lima One Capital

- CoreVest Finance

- Patch of Land

- RCN Capital

- Anchor Loans

- Walnut Street Finance

- Temple View Capital

- Do Hard Money

- ABL (Asset Based Lending)

- Sherman Bridge Lending

- Zeus Mortgage

- BridgeWell Capital

- Kennedy Funding Financial

- Socotra Capital

- Visio Lending

- Stratton Equities

- Streamline Funding

- Center Street Lending.

ii. Is There a Franchise for Hard Money Lending Business?

No, there are no franchise opportunities for hard money lending businesses.

iii. Are There Policies, Regulations, or Zoning Laws Affecting Hard Money Lending Business?

Yes, there are various policies, regulations, and zoning laws that can affect the operation of hard money lending businesses in the United States.

However, it is important to note that the regulatory environment may vary by state, and new regulations can be introduced or existing ones amended.

Each state has its usury laws that dictate the maximum interest rate a lender can charge. Hard money lenders must be aware of and comply with these laws to avoid legal issues.

Federal law requires lenders to disclose key terms and costs of a loan to borrowers. Compliance with the Truth in Lending Act (TILA) is crucial for transparency in lending practices.

Dodd-Frank Wall Street Reform and Consumer Protection Act (this federal law) introduced regulations aimed at preventing predatory lending practices and ensuring consumer protection. Some provisions of Dodd-Frank may impact hard money lending activities.

Lenders are required to implement Anti-Money Laundering (AML) programs to detect and prevent money laundering activities.

Compliance with Anti-Money Laundering (AML) regulations is crucial for financial institutions, including hard money lenders.

Zoning regulations can impact the use of properties as collateral. Hard money lenders should be aware of local zoning laws to assess the feasibility of real estate projects.

Laws such as the Equal Credit Opportunity Act (ECOA) and the Fair Housing Act prohibit discrimination in lending practices. Hard money lenders need to ensure that their lending decisions comply with fair lending laws.

If a hard money loan is considered a security, it may be subject to federal and state securities laws. Understanding these regulations is important to ensure compliance.

Marketing Plan

A. who is your target audience.

i. Age Range: 18 to 65 years old, with a focus on adults aged 25 to 55 who may require short-term financial assistance.

ii. Level of Education: Minimum high school education; preference for those with some college education or vocational training.

iii. Income Level: Middle to high-income individuals or businesses with the financial capacity for real estate investment or development projects.

iv. Ethnicity: No specific ethnic targeting; services available to a diverse range of individuals and businesses.

v. Language: English proficiency is preferred due to the nature of legal and financial transactions.

vi. Geographical Location: Primarily focused on the Detroit metropolitan area, but may consider opportunities in other strategic real estate markets within the United States.

vii. Lifestyle: Targeting real estate investors, developers, and businesses with an entrepreneurial mindset.

b. Advertising and Promotion Strategies

- Use FOMO to Run Photo Promotions.

- Share Your Events in Local Groups and Pages.

- Turn Your Social Media Channels into a Resource

- Host Themed Events That Catch Attention.

- Tap Into Text Marketing.

- Develop Your Business Directory Profiles

- Build Relationships with Other Businesses in our Area

i. Traditional Marketing Strategies

- Broadcast Marketing -Television & Radio Channels.

- Marketing through Direct Mail.

- Print Media Marketing – Newspapers & Magazines.

- Out-of-Home” marketing (OOH marketing) – Public Transits like Buses and Trains, Billboards, Street Furniture, and Cabs.

- Direct sales, direct mail (postcards, brochures, letters, fliers), tradeshows, print advertising (magazines, newspapers, coupon books, billboards), referral (also known as word-of-mouth marketing), radio, and television.

ii. Digital Marketing Strategies

- Social Media Marketing Platforms.

- Influencer Marketing.

- Email Marketing.

- Content Marketing.

- Search Engine Optimization (SEO) Marketing.

- Pay-per-click (PPC).

- Affiliate Marketing

- Mobile Marketing.

iii. Social Media Marketing Plan

- Create a personalized experience for our customers.

- Create an efficient content marketing strategy.

- Create a community for our audience.

- Start using chatbots.

- Gear up our profiles with a diverse content strategy.

- Use brand advocates.

- Create profiles on the relevant social media channels.

- Run cross-channel campaigns.

c. Pricing Strategy

Jared Moore® Hard Money Lending, Inc. employs a competitive pricing strategy, offering interest rates and fees that align with market standards. Our transparent and straightforward fee structure ensures clarity for borrowers, fostering trust and satisfaction.

While rates may reflect the risk associated with collateral-based lending, our commitment to flexibility allows for tailored solutions, accommodating the diverse financial needs of real estate investors and developers.

Sales and Distribution Plan

A. sales channels.

Jared Moore® Hard Money Lending, Inc. maximizes its market reach through a multi-faceted sales approach. Our primary channels include a robust online platform for loan applications, providing clients with convenient access and rapid response times.

Additionally, our seasoned team of relationship managers actively engages with real estate professionals, attending industry events and networking to build strategic partnerships.

We leverage digital marketing to enhance brand visibility and attract potential borrowers. Emphasizing a client-centric approach, our sales channels aim to offer personalized service, comprehensive information, and efficient processes, ensuring a seamless experience for real estate investors and developers seeking tailored hard money lending solutions.

b. Inventory Strategy

Jared Moore® Hard Money Lending, Inc. optimizes its inventory strategy by maintaining a diverse portfolio of collateralized assets, predominantly focusing on real estate properties. Rigorous due diligence ensures the quality and market potential of the assets.

We proactively monitor market trends and adjust our inventory to align with emerging opportunities and mitigate risks. The strategy includes a careful balance between risk and return, allowing us to adapt to evolving market conditions.

c. Payment Options for Customers

- Bank Transfers

- Credit or Debit Card

- Electronic Payment Systems such as PayPal or Venmo.

d. Return Policy, Incentives and Guarantees

Return policy:.

Jared Moore® Hard Money Lending, Inc. is committed to transparency and fair dealings. Our return policy is aligned with industry standards, specifying interest rates and fees.

In the event of loan prepayment or early settlement, borrowers benefit from a pro-rata interest adjustment, ensuring equitable terms. We prioritize flexibility, allowing borrowers to explore refinancing options if their financial circumstances change.

Incentives:

To reward our valued clients, Jared Moore® Hard Money Lending, Inc. offers competitive incentives, including reduced fees for repeat borrowers and favorable terms for long-term partnerships. Our loyalty program aims to recognize and appreciate the trust placed in our services, fostering enduring relationships.

Guarantees:

Jared Moore® Hard Money Lending, Inc. assures a commitment to ethical lending practices. Our guarantees include transparent communication, adherence to regulatory requirements, and diligent risk management.

We guarantee a client-focused approach, ensuring that each borrower receives personalized attention and tailored solutions.

While we mitigate risks through thorough due diligence, our commitment to resolving issues promptly underscores our dedication to client satisfaction.

c. Customer Support Strategy

Jared Moore® Hard Money Lending, Inc. prioritizes an unwavering commitment to customer support, aiming for excellence in every interaction.

Our strategy revolves around accessibility, offering multiple communication channels for swift responses to inquiries or concerns.

A dedicated team of knowledgeable and empathetic customer service representatives ensures a seamless experience throughout the lending process.

We proactively engage with clients, providing regular updates and fostering open communication. Embracing a client-centric ethos, we prioritize problem resolution, aiming for customer satisfaction and trust.

Continuous feedback mechanisms and personalized assistance underscore our dedication to delivering a superior customer support experience.

Operational Plan

Jared Moore® Hard Money Lending, Inc. executes a comprehensive operational plan to ensure efficiency and excellence in hard money lending.

Central to our strategy is the seamless integration of technology, automating processes for quick approvals, and streamlined transactions.

Rigorous risk management protocols guide our lending decisions, emphasizing thorough due diligence on collateral and borrowers.

Our skilled team of professionals, specializing in real estate and finance, implements market-responsive strategies. Regular training programs ensure staff expertise in evolving industry trends.

Focused on compliance, we adapt swiftly to regulatory changes. This operational agility, combined with a commitment to transparency, positions us to deliver tailored and secure lending solutions, fostering success for our clients.

a. What Happens During a Typical Day at a Hard Money Lending Business?

A typical day at Jared Moore® Hard Money Lending, Inc. involves a dynamic blend of activities. The team engages in market research to stay abreast of real estate trends, assesses potential projects, and conducts due diligence on collateral and borrowers.

Loan processing is streamlined through technology, facilitating quick approvals. Relationship managers actively collaborate with clients and industry professionals, attending to inquiries and fostering partnerships.

The day includes adherence to regulatory requirements, risk management reviews, and team training to maintain expertise. Each day revolves around efficient, client-centric operations, driving success in hard money lending.

b. Production Process

There is no production process.

c. Service Procedure

Jared Moore® Hard Money Lending, Inc. executes a streamlined service procedure to ensure a seamless experience for clients. The process is initiated with an intuitive online application, leveraging technology for swift initial assessments.

Thorough due diligence follows, with our team conducting rigorous collateral and borrower evaluations. Transparent communication is paramount, providing clients with regular updates on their loan status.

Upon approval, funds are disbursed promptly. Throughout the lifecycle, dedicated relationship managers offer personalized support, addressing inquiries and fostering strong client relationships.

Our service procedure prioritizes efficiency, transparency, and client satisfaction, positioning Jared Moore® as a trusted partner in facilitating the financial success of real estate investors and developers.

d. The Supply Chain

Jared Moore® Hard Money Lending, Inc. has an efficient supply chain focused on financial services. Our sourcing involves strategic partnerships, and utilizing technology for streamlined loan processing.

Emphasizing transparency and adaptability, our supply chain ensures the swift and secure provision of hard money lending solutions, positioning us as a reliable financial partner for real estate investors and developers.

e. Sources of Income

The sources of income for Jared Moore® Hard Money Lending, Inc. are primarily generated through the following avenues:

- Interest Rates

- Late Payment Fees

- Loan Renewal Fees

- Repossession and Sale of Collateral

- Default Interest and Penalties

- Volume of Loans.

Financial Plan

A. amount needed to start your hard money lending company business.

Jared Moore® Hard Money Lending, Inc. would need an estimate of $15 million to successfully set up our hard money lending company in the United States of America. Note that this amount includes the salaries of all the staff for the first month of operation.

b. What are the Costs Involved?

- Business Registration Fees – $750.

- Legal expenses for obtaining licenses and permits – $2,300.

- Marketing, Branding, and Promotions – $5,000.

- Business Consultant Fee – $2,500.

- Insurance – $15,400.

- Rent/Lease – $120,000.

- Other start-up expenses including, commercial satellite TV subscriptions, stationery ($500), and phone and utility deposits ($2,800).

- Operational Cost (salaries of employees, payments of bills et al) – $40,000

- Working Capital – $14 million

- Store Equipment (cash register, security, ventilation, signage) – $4,750

- Website: $600

- Opening party: $3,000

- Miscellaneous: $2,000

c. Do You Need to Build a Facility? If YES, How Much Will It Cost?

Jared Moore® Hard Money Lending, Inc. will not build a new facility for our hard money lending company.

d. What are the Ongoing Expenses for Running a Hard Money Lending Business?

- Employee compensation, including salaries, wages, and benefits for loan officers.

- Monthly rent or lease payments for storefront locations or office space where the business operates.

- Expenses related to marketing campaigns, advertising materials, online advertising, and community outreach efforts to attract and retain customers.

- Costs associated with utilities, such as electricity, water, and internet services, as well as office supplies like paper, ink, and office equipment maintenance.

- Subscription fees or licensing costs for loan management software and ongoing IT services.

- Expenses for legal counsel, compliance experts, and regulatory consultants to ensure compliance with state and federal lending regulations.

- Insurance coverage to protect against potential losses, including liability insurance and insurance on repossessed property or collateral.

- Fees for property appraisal and inspection services

- Expenses associated with repossessing property, including auction fees, in cases of loan default.

- Costs associated with obtaining and renewing business licenses, permits, and regulatory fees required to operate legally within a state.

e. What is the Average Salary of Your Staff?

- Chief Operating Officer (Owner) – $85,000 Per Year

- General Manager – $65,000 Per Year

- Compliance Officer – $58,000 Per Year

- Accountant – $50,000 Per Year

- Loan Advisors (Loan Officers) – $55,000 Per Year

- Sales and Marketing Officer – $35,000 Per Year

- Customer Service Representative – $34,100 Per Year

f. How Do You Get Funding to Start a Hard Money Lending Business?

- Raising money from personal savings and sale of personal stocks and properties

- Raising money from investors and business partners

- Sell shares to interested investors

- Applying for a loan from your bank/banks

- Pitching your business idea and applying for business grants and seed funding from the government, donor organizations, and angel investors

- Source for soft loans from your family members and friends.

Financial Projection

A. how much should you charge for your product/service.

Hard money lending businesses typically charge borrowers through interest rates and fees. The exact amount a hard money lending business charges can vary widely depending on various factors, including state regulations, the loan amount, the value of the property used as collateral, and the specific terms negotiated between the lender and the borrower.

Note that hard money lending interest rates are often stated as an annual percentage rate (APR). The APR can vary significantly but is generally higher than traditional loans. It is not uncommon for hard money lending APRs to range from 100% to 300% or more.

b. Sales Forecast?

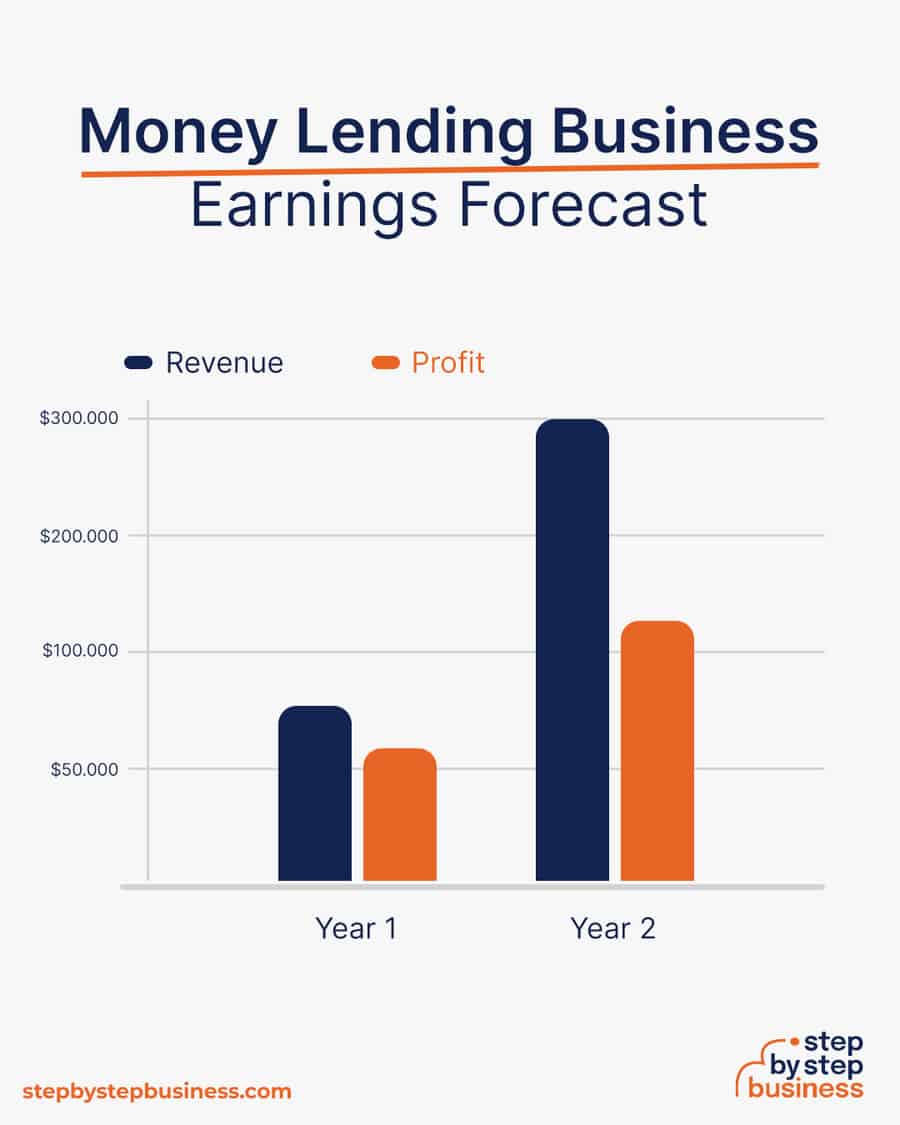

Jared Moore® Hard Money Lending, Inc. anticipates steady growth in loan originations and profitability over the next three years.

Our financial projections are based on a prudent risk management approach and a commitment to maintaining a strong and diversified portfolio of collateralized assets.

- First Fiscal Year (FY1): $4 million

- Second Fiscal Year (FY2): $7 million

- Third Fiscal Year (FY3): $10 million

c. Estimated Profit You Will Make a Year?

Jared Moore® Hard Money Lending, Inc. is projecting to make.

- First Fiscal Year (FY1): (5% of revenue generated)

- Second Fiscal Year (FY2): (15% of revenue generated)

- Third Fiscal Year (FY3): (20% of revenue generated)

d. Profit Margin of a Hard Money Lending Company Business

The profit margin of a hard money lending company business is not fixed. It could range from 5 percent to 20 percent depending on some unique factors.

Growth Plan

A. how do you intend to grow and expand by opening more retail outlets/offices or selling a franchise.

Jared Moore® Hard Money Lending, Inc. will grow our hard money lending company by first opening other outlets in key cities in the United States of America, and Canada within the first seven years of establishing the business and then will start selling franchises from the seventh year.

b. Where do you intend to expand to and why?

Jared Moore® Hard Money Lending, Inc. plans to expand to

- Portland, Oregon

- Minneapolis, Minnesota

- Denver, Colorado

- Tampa, Florida

- San Diego, California

- Nashville, Tennessee

- Charlotte, North Carolina

- Phoenix, Arizona

- Dallas, Texas

- Atlanta, Georgia.

Internationally, we plan to expand to Canada. The reason we intend to expand to these geographic locations is the fact that available statistics show that the cities listed above have a growing market for hard money lending businesses.

Jared Moore® Hard Money Lending, Inc. plans to exit the business via family succession. We have positioned structures and processes in place that will help us achieve our plan of successfully transferring the business from one family member to another and from one generation to another without difficulties.

The company has successfully developed a detailed transition plan to smoothly hand over responsibilities to the new successor.

This includes transferring ownership, training key personnel, and communicating with employees, customers, and suppliers about the change.

Related Posts:

- Micro Lending Business Plan [Sample Template]

- Merchant Cash Advance Business Plan [Sample Template]

- Check Cashing Business Plan [Sample Template]

- Private Wealth Management Business Plan [Sample Template]

- Private Equity Firm Business Plan [Sample Template]

- Search Search Please fill out this field.

- Building Your Business

- Business Financing

Can You Finance a Business With a Hard Money Loan?

A hard money loan may be an option when traditional financing is not

What Are Hard Money Loans?

- How To Qualify

- Interest Rates and Other Terms

Hard Money Lenders

Frequently asked questions (faqs).

eclipse_images / Getty Images

Hard money loans are non-conventional, alternative sources of small business financing. They are typically associated with real property financing and are easier to obtain than conventional loans. However, hard money loans are riskier than conventional loans.

A hard money loan can be used to finance your business, such as if your business has a bad credit rating and you need cash to buy or renovate a property. But before obtaining a hard money loan, you need to know how it works and the underlying risk it poses.

Key Takeaways

- Yes, you can use a hard money loan to finance a business, but there are risks.

- Your creditworthiness is not a primary factor for a hard money loan. Instead, hard money loans collateralize the subject property.

- Compared to conventional loans, hard money loans have higher interest rates and shorter terms.

- It is easier to qualify for hard money loans, but they pose more risk than conventional loans.

Typically, hard money loans are associated with real estate investors who buy properties, quickly repair them, and put them back on the market, a practice known as “flipping.”

Obtaining a conventional loan relies heavily on the borrower’s creditworthiness. But hard money loans use the subject property as collateral, enabling the investor to get the money they need quickly and without the drawn-out approval process of a conventional loan. These types of loans pose a lower risk for the lender, but a higher risk for the borrower since their property serves as collateral.

Hard money loans have short repayment terms, sometimes as little as four months. Many lenders prefer the term to be short (such as less than 24 months) so they can get the money back quickly.

While hard money loans are a popular funding option for house flipping projects, businesses also use them to fund construction projects and land purchases.

How To Qualify for a Hard Money Loan

Hard money loans are based on the value of the subject property, which serves as collateral, not your credit score. So if a property’s market value is $500,000, and you’re able to borrow up to 70% in the form of a hard money loan, the loan would be worth $350,000. This is the loan-to-value ratio (LTV)—a percentage of the property's value.

Hard money lenders often do not offer loans for all types of properties. For example, a lender may offer hard money loans for purchases of single-family homes, office buildings, and warehouses, but will not finance a home used as the borrower’s primary residence or ground-up construction.

Borrowers must also meet the lender’s down payment or equity requirements. For instance, a lender may require a 25% to 40% down payment for property purchases.

Loan-to-Value Ratio

Lenders calculate the LTV based on the loan amount and the property’s value. The higher the ratio, the more difficult it is to get a loan. A loan’s LTV is a measure of the lender’s risk. Loans with low LTVs pose a lower risk for the lender, and vice versa.

The LTV calculation is simple:

Loan amount / property’s appraised value = LTV

Let's say that Company ABC wants to buy a building for $100,000. They can put down $30,000 as a down payment but need to borrow the remaining $70,000. The LTV for the loan is 70%.

Interest Rates and Other Terms on Hard Money Loans

Typically, hard money loans have higher interest rates than conventional loans because hard money loans pose higher risk for the lender. For example, if the average rate for a 30-year fixed-rate mortgage is 4.98%, you may pay an interest rate of 6.95% or higher for a hard money loan. Some interest rates could be as high as 10% or 12%.

Repayment terms on a hard money loan are also less favorable than on conventional loans . Hard money loans are short-term loans, some with terms as short as four months, 12 months, or just typically less than 24 months. Such short terms can create high risk for the borrower.

Hard money loans can require you to pay an origination fee, closing costs, and points. Oftentimes, hard money costs run higher than those of a conventional loan.

Hard money lenders are individuals or companies that fund investments. To be a hard money lender, they must be flexible and able to move quickly to take advantage of opportunities in the marketplace. They are not restricted to the rigid criteria of traditional business loans and traditional business sources.

A simple internet search can yield hundreds of hard money lenders. Before taking out a hard money loan, do your research to make sure you are dealing with a reputable lender. Call them, check with others who may have used the company in the past, and ask real estate developers or agents in your area for any opinions.

Try starting your search for a hard money loan—or less risky options—by asking a trusted real estate agent or mortgage broker for recommendations.

What is a hard money loan for real estate?

A hard money loan for real estate is a type of loan that is not based on your credit score. Instead, it’s based on the value of the property. The loan is collateralized by the subject property and its value is based on the loan-to-value ratio. Hard money loans for real estate are usually short-term loans with high interest rates that are used for flipping houses.

How do you pay back hard money loans?

Hard money loans require full repayment within a very short amount of time, usually 12 months or at least less than three years. They also have higher interest rates than conventional loans, which can make the monthly payments steep. This increases the risk for the borrower. For example, if you obtain a hard money loan to flip a house and cannot resell it before the end of the term, the lender can take the property.

Consumer Financial Protection Bureau. " I Was Told I’m Buying a Home That Was Flipped and That I Have To Get a Second Appraisal. How Does That Work? "

Rehab Financial Group. " 100% Premier ."

Peer Street. " Hard Money Lenders for New Jersey Real Estate ."

West Forest Capital. " Hard Money Lenders NJ ."

How to Set Up a Hard Money Lending Business

- Small Business

- Setting Up a New Business

- Setting up a Business

- ')" data-event="social share" data-info="Pinterest" aria-label="Share on Pinterest">

- ')" data-event="social share" data-info="Reddit" aria-label="Share on Reddit">

- ')" data-event="social share" data-info="Flipboard" aria-label="Share on Flipboard">

How to Create a Lending Business

How do i assess the value of a new business venture, how to make financial statements for a startup construction company.

- What Is the Role of a Business Plan in Getting Venture Capital Funding?

- What Types of Stock Should a Forming Company Issue?

The hard money lending business is a hard asset (real estate) based business. You will need to consider several factors while structuring your company. One factor is whether you will be using your money or seeking investors. A second factor is whether you will be making loans locally, nationally or internationally. Third, you will need to determine what you are investing in -- real estate, start-up companies or early stage businesses. The fourth factor is the type of businesses that you will lend money to, such as technology, real estate development, construction, residential or commercial.

Using Your Money

Start by naming your company and obtaining a corporate address, phone and fax number. These are essential regardless of how you legally structure your business because your legal documents will need a corporate address. Contact the secretary of state's office, on your state's website, to reserve your company name.

Meet with a lawyer to determine the legal structure of you hard money lending business. The most likely legal structure will be a limited liability company. Your attorney needs to be an expert in business and real estate. Discuss with your attorney the appropriate state of incorporation, tax issues, licensing and the different legal issues concerning residential and commercial lending. Have your attorney set up your employer identification number with the IRS.

Research your particular investment focus. Perhaps you have an expertise in small apartment buildings or tech companies. You will want to focus on what you know and learn what the markets are doing in your space. For instance, if you are investing in apartment buildings, you need to know the rents in the area, property values, comps (values of similar properties nearby), business environment and other factors that affect the current and future value of the property and the ability of the borrower to repay.

Purchase business planning software and draft your business plan and underwriting criteria based on the types of loans you will be making. Develop such items as your loan to value parameters, minimum and maximum investment amounts, interest rates charged, property types such as manufacturing plants, office buildings, strip malls or apartment buildings, and payback periods. Think of your business plan as your road map that keeps you on track.

Put together your financial projections. Regardless of the fact that you are investing your own money, you need to know the break-even points, projected monthly and annual income based on various interest rates charged, monthly expenses, legal costs and other expenses. You will need to develop a balance sheet, income and cash flow statements, and a profit and loss statement.

Buy your domain name, set up your website and launch your business. Have the website professionally done and put an intake form on the site so you can pre-qualify projects online. Make certain to request information such as project type, loan requested, length of loan, value of property, location, and other important factors based on your lending criteria.

Launching a Hard Money Lending Business Using Investors

Complete all the above steps, coupled with a discussion with legal on the documents required to raise capital for your business. You need to determine in what states you will be seeking investors. Your attorney will need to be versed in "blue sky law," which are state laws to protect investors from fraud. Direct your attorney to draft the stock subscription, stock purchase and shareholder rights agreements.

Hire an experienced management team. You will need a team that has been successful in the past and knows the real estate and banking sector. Team experience adds credibility and makes raising investment capital easier.

Draft a two-page executive summary and 20-page investor focused PowerPoint presentation. The executive summary needs to make clear the amount of capital you are seeking and clearly captures the essence of the business model. The PowerPoint needs to include use of funds and the returns that investors can expect. Edit and review your PowerPoint at least five times.

Develop your risk management and underwriting program. This protects you and your investors. You have a responsibility to investors to manage risk appropriately in order to protect them and to protect you from litigation should loans go bad or the business fails.

Begin raising money and looking for projects to fund. Having a network of commercial real estate brokers will bring you a great deal of business. By having projects that are undergoing the pre-funding due diligence process, while seeking capital, provides you a portfolio of projects that will attract investors.

- Foreclosure University: The Truth About Hard Money Lenders

- Bank Rate; 'Hard Money' The Source for Last-Resort Loans; Michael D. Larson; April 27, 2001

- US Small Business Administration: Follow These Steps to Starting a Small Business

- Winter and Company

- When raising capital from investors, it is the law that they be accredited investors -- individuals with more than $300,000 in annual income and assets over $1 million, excluding their home. You must follow the Securities Act of 1932 and various regulations such as Reg D.

Grant Houston has been writing since 2000, covering various political, business and market events. With a Bachelor of Arts in economics and political science, he has written articles for "Political Economic Review," UmarKit, LLC and Shadow Company. Houston has also authored business plans and consulted with companies on capital acquisition strategies.

Related Articles

Raising money for a privately held company, how to become a registered lending company, how to draw up a legal contract for a business investment, how to make money with hard-money loans, structuring a small business investor deal, the importance of a business plan, how to raise capital for real estate using a business model, methods for financing capital projects, how to get funding for your corporation, most popular.

- 1 Raising Money for a Privately Held Company

- 2 How to Become a Registered Lending Company

- 3 How to Draw Up a Legal Contract for a Business Investment

- 4 How to Make Money With Hard-Money Loans

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Is a Hard Money Loan Right for Your Business?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

A hard money business loan is a type of loan backed by property, such as commercial real estate or land.

Because these loans rely heavily on the value of your collateral — as opposed to more traditional loan requirements — they’re often used by business owners who can’t qualify for other small-business loan options. However, hard money loans can be risky, with high interest rates and short repayment terms.

Here’s what you need to know about hard money business loans, how they work and what to note before choosing one for your financing needs.

How much do you need?

with Fundera by NerdWallet

We’ll start with a brief questionnaire to better understand the unique needs of your business.

Once we uncover your personalized matches, our team will consult you on the process moving forward.

How hard money business loans work

Hard money loans are usually offered by private investors or lenders, as opposed to banks or credit unions. These lenders underwrite your application based largely on the value of your collateral, instead of focusing on more traditional criteria, such as your credit score and business finances.

The value of your collateral also impacts your loan amount. Hard money lenders generally use the loan-to-value ratio , or LTV, to determine how much capital you’re eligible to receive and to assess the risk of lending to your business.

LTV is calculated by dividing the loan amount you borrow by the value of your collateral . For example, say your collateral is worth $100,000. To avoid taking on too much risk, the lender decides to offer you a $65,000 loan. That would make your LTV 65%: $65,000 / $100,000 = 0.65, or 65%.

Hard money lenders typically offer loan amounts with LTVs that range from 50% to 75%, whereas traditional lenders may offer 80% to 90%.

Because these loans are tied directly to the value of your assets, hard money loans are usually considered riskier than other types of business loans. As a result, they tend to have high interest rates and short repayment terms.

» MORE: Compare the best business loans for bad credit

Pros and cons of hard money business loans

Can be used for a variety of purposes. Although hard money loans are often used in real estate projects, like fix and flip loans , they can serve different short-term purposes. You can use a hard money loan for working capital, debt refinancing or consolidation, as well as bridge financing.

Fast access to funds. Some hard money lenders may be able to approve your application within 24 hours and provide funding in as little as one to two business days. Traditional bank loans, on the other hand, can take several weeks or even months to qualify. Banks also tend to require document-heavy applications and may require you to apply in person. Many hard money lenders offer streamlined, online applications with minimal documentation.

Easy to qualify. Hard money business loan requirements are largely based on the value of your collateral. Although lenders may look at your credit score, time in business and business finances, they don’t typically weigh these factors as heavily when underwriting your application. Businesses with bad credit and startups, therefore, may be able to qualify for hard money loans.

Risk level. Hard money loans can be a risky type of financing. Your loan is based largely on the value of the property you use to secure your loan. And if you can’t repay, the lender has the right to seize that collateral.

High interest rates and short repayment terms. Hard money lenders typically charge high interest rates to offset their risk of lending to potentially less-qualified borrowers. These loans also tend to have short repayment terms, anywhere from a few months to a few years. High rates combined with short terms can make these loans more difficult to repay than other financing options.

Down payment. Your lender may ask you to provide a down payment of 10% to 30% (or more) on your hard money loan. Generally, the stronger your credit and financial qualifications, the less of a down payment you’ll need to provide. However, a larger down payment may help you access better rates and terms.

>> MORE: What is a high-risk business loan?

Alternatives to hard money business loans

If you’re thinking about applying for a hard money loan, but you don’t need the funds immediately, you might consider taking a step back and trying to build your credit and cash flow. This way, you’ll improve your qualifications and hopefully be able to get a more competitive loan when you do apply.

On the other hand, if you need funds more quickly, you might look into some other business funding options, such as:

Invoice factoring

Invoice factoring can be a good choice for business-to-business companies with cash tied up in unpaid invoices. Factoring is another type of asset-based financing that can be accessible to borrowers who may not qualify for traditional loan options.

With invoice factoring , you sell your outstanding invoices to a factoring company at a discount. The company pays you a percentage of the invoice upfront and then assumes responsibility for collecting payment from your customers.

Similar to hard money loans, lenders often focus on the value of your invoices and your customer’s payment history when evaluating your application. For this reason, invoice factoring can also be a good option for startup companies and borrowers with bad credit.

» MORE: Best startup business loans for entrepreneurs

Equipment financing

Like hard money loans and invoice factoring, equipment financing is also a type of asset-based financing. With an equipment loan, you can get funding equal to up to 100% of the value of the equipment you’re looking to purchase. You repay the loan over time, with interest, and the equipment you buy serves as collateral.

Equipment financing can be an affordable way to purchase machinery for your business — and it can be easier to qualify for than other business loans. Although equipment lenders will check your personal credit and business finances, they may rely more heavily on the value of the equipment you’re looking to buy.

Short-term loans

Short-term loans offer fast capital that can be used for a variety of purposes. These loans are available from online lenders and typically have terms of up to 18 months.

Like hard money loans, short-term business loans tend to have flexible qualification requirements — but these loans aren’t so reliant on collateral. You may be able to qualify for a short-term loan with a minimum credit score of 500 and at least six months in business. Many short-term loans don’t require physical collateral at all, and instead are secured by a UCC lien and personal guarantee.

Find the right business loan

The best business loan is generally the one with the lowest rates and most ideal terms. But other factors — like time to fund and your business’s qualifications — can help determine which option you should choose. NerdWallet recommends comparing small-business loans to find the right fit for your business.

A hard money loan can have a high interest rate and short repayment terms, but it can offer fast cash for borrowers who can’t qualify for other financing options. However, if you can’t repay the loan, your lender can seize your property to recoup its losses.

Based on the state of your business and your financial needs, you’ll need to determine if the potential rewards of a hard money loan outweigh the risks.

Many, but not all, hard money lenders will require a down payment. You may need to provide a down payment of 10% to 30% or more depending on your credit, finances and business history.

Yes. Because lenders rely so heavily on your collateral to evaluate your hard money loan application, they often accept borrowers with bad or fair credit.

On a similar note...

Hard money business loans: What to know

Advertiser disclosure.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

- Share this article on Facebook Facebook

- Share this article on Twitter Twitter

- Share this article on LinkedIn Linkedin

- Share this article via email Email

- • Life insurance

- • Homeowner’s insurance

- Connect with Mandy Sleight on Twitter Twitter

- Connect with Mandy Sleight on LinkedIn Linkedin

- Get in contact with Mandy Sleight via Email Email

- • Small business loans

- • Funding inequality

- Connect with Emily Maracle on LinkedIn Linkedin

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money .

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy.

Our banking reporters and editors focus on the points consumers care about most — the best banks, latest rates, different types of accounts, money-saving tips and more — so you can feel confident as you’re managing your money.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

New businesses and startups can sometimes struggle to get approved for a business loan — especially if they haven’t established business credit or have bad credit.

Although it’s a risky alternative , a hard money business loan may be an option if you need financing but can’t get it with a traditional or online lender. Understanding how a hard money loan works, the pros and cons and how they compare to other business loans can help you decide if this option is the right choice.

What is a hard money business loan?

A hard money business loan is a secured loan that uses a company’s property or assets as collateral. Hard money business loans usually have high interest rates and short repayment periods, like short-term business loans .

Hard money loans are riskier than business loans since they don’t use traditional factors to determine eligibility and terms, like:

- Time in business

- Business or personal credit

- Annual revenue

- Debt-to-asset-ratio

If you default on hard money small business loans, you could lose the business property you use as collateral . Still, this type of short-term business loan may be an alternative for startups and businesses with bad credit or no credit if they lack other options.

Hard money business loan vs. traditional business loan

A hard money business loan is generally easier to get than a traditional business loan , which may require good credit, years in business and sufficient cash flow to qualify, plus collateral. However, traditional loans typically have longer repayment terms with lower interest rates and fees than hard money loans.

Depending on the loan type , traditional lenders may require a down payment as low as 10 percent or as high as 30 percent. But private hard money lenders may expect 30 percent or more as a down payment.

Traditional, alternative or online lenders finance small business loans . Hard money lenders are typically small organizations, private individuals, businesses or funding groups willing to take on more risk.

How a hard money business loan works

Private lenders and investors are the most common options for hard money lending as the loans mainly rely on the value of property or collateral you use.

Hard money lenders have fewer regulations than traditional lenders, making financing requirements unclear, but often easier to qualify for. Expect loans with high interest rates and short repayment terms to reduce the lender’s risk.

To assess risk, lenders use the loan-to-value ratio of the collateral asset. The ratio is the collateral value compared to the loan amount. While traditional lenders often go as high as a 90 percent loan-to-value ratio for business loans, hard money lenders may only offer up to 75 percent loan-to-value ratio.

Pros and cons of hard money business loans

Alternatives to hard money business loans.

There are alternative small business lending options you might consider besides hard money loans. Consider your financing needs, loan amount, credit and other factors to determine which alternative financing is right for your business:

- Equipment financing/loans : If you need equipment like a vehicle, office furniture, machinery or other assets, equipment financing may be a better option. Equipment loans usually come with additional fees besides interest, so compare your options carefully for the best deal.

- Invoice factoring : If you have outstanding customer invoices, you can sell them to an invoice factoring company for fast funding. Rather than use assets or property as collateral, invoice factoring companies use your customer’s creditworthiness.

- Term loan : A secured business term loan also requires collateral and may offer more favorable terms than a hard money business loan. If you have a good relationship with a bank or lender and show on-time payment history, you may still be eligible, even with bad credit.

- Line of credit : A business line of credit works like a credit card but provides a lump sum of cash. You can draw money for a specified period and only pay interest on the funds you draw. As you pay the money back, the amount you can draw increases.

Other less risky alternatives , like grants, special credit programs, microloans or peer-to-peer lending, may better fit your funding needs. Looking closely at your business’s health, funding needs and repayment abilities can help you find the right business loan.

The bottom line

Hard money lending is an option for startups or businesses with bad credit but have assets or property they can use as collateral. This option is usually riskier than other alternatives, like peer-to-peer lending, since you risk losing your property if you default on payments. If you need fast funding, weigh the costs of hard money business loans compared to other short-term lending options.

Frequently asked questions

What credit score is needed for a hard money loan, what are the requirements for a hard money business loan, why are hard money business loans risky, related articles.

How to get a business loan with bad credit

Best small business loans for $100,000 or less

Where to get a bad credit business loan

Best low-interest business loans for bad credit

Qualification Requirements for Hard Money Business Loans Explained

As a dedicated CEO and business owner navigating the complex terrain of financing options, I recognize the importance of understanding the qualification requirements for hard money business loans.

These loans are a crucial lifeline for companies seeking swift, flexible funding without the stringent requirements of traditional bank loans. In this comprehensive guide, we will break down the qualification requirements for hard money business loans, offering you a clear roadmap to securing this alternative form of financing.

From credit scores and collateral to business revenue and loan-to-value ratios, we’ll cover all the critical factors lenders consider.

My goal is to demystify the process, providing you with the knowledge and confidence to explore hard money loans as a viable option for your business growth and development. Join us as I simplify the qualifications, empowering you to make informed decisions that align with your company’s financial strategies and goals.

When it comes to securing financing for your business, there are various options available. One type of loan that might be suitable for your needs is a hard money business loan. Unlike traditional loans, hard money loans are backed by the value of the property being used as collateral rather than the borrower’s creditworthiness.

However, before diving into the world of hard money lending, it’s crucial to understand the qualification requirements for hard money business loans. In this article, we will explore the key factors for qualifying, the requirements for a loan, and the eligibility criteria that need to be met.

Table of Contents

Understanding the Qualification Requirements for Hard Money Business Loans Explained

Securing a hard money business loan requires meeting specific qualification criteria . While hard money lenders are generally more flexible compared to traditional lenders, they still have guidelines that borrowers must satisfy.

When applying for a hard money loan, it’s important to understand the key factors that lenders consider in the qualification process. While credit scores and financial history are less significant, lenders primarily focus on the value of the property being used as collateral, the borrower’s exit strategy, and their experience and expertise.

Key Factors for Qualifying for a Loan – Requirements for Hard Money Business Loans

The Loan-to-Value Ratio (LTV) is a crucial factor for hard money lenders. This ratio represents the percentage of the property’s value that lenders are willing to lend. To qualify for a loan, the property must have sufficient value to support the loan amount being requested. This ensures that lenders have a comfortable margin of safety in case of default .

Another key factor is the borrower’s exit strategy. Lenders need reassurance that borrowers have a clear plan for repaying the loan. They will assess factors such as the borrower’s ability to generate sufficient cash flow or the potential for refinancing in the future. Having a well-thought-out exit strategy can increase your chances of qualifying for a hard money loan.

Experience and expertise also play a role in the qualification process. Lenders may consider the borrower’s industry knowledge and track record. Demonstrating that you have the necessary skills and expertise to succeed in your business venture can strengthen your loan application and instill confidence in the lender.

Meeting the Eligibility Criteria for a Loan

In addition to the key factors mentioned above, there are specific eligibility criteria that borrowers need to meet to qualify for a hard money business loan:

- Property Type: Most hard money lenders focus on real estate as collateral. Residential, commercial, and industrial properties are typically accepted. However, lenders may have preferences on the types of property they will fund. It’s important to check with the lender to ensure that your property type meets their criteria.

- Property Valuation: The property used as collateral will undergo a detailed appraisal to determine its value. Lenders will often require borrowers to provide a professional appraisal to ensure accuracy. This step helps both the lender and the borrower in determining the appropriate loan amount based on the property’s market value.

- Loan Term: Hard money loans are usually short-term loans, lasting from months to a few years. Borrowers should have a clear understanding of the loan term and be prepared to meet the repayment schedule. It’s essential to have a solid plan in place to repay the loan within the agreed-upon timeframe.

By understanding and meeting these eligibility criteria, borrowers can increase their chances of qualifying for a hard money business loan. Remember, while hard money lenders offer more flexibility, it’s still important to demonstrate your ability to meet the lender’s requirements for hard money business loansmand provide a solid repayment plan.

Applying for a Hard Money Loan Made Easy

Once you have familiarized yourself with the qualification requirements for hard money business loans, the next step is the application process. Applying for a hard money loan doesn’t have to be a daunting task. By following a step-by-step guide and keeping a few tips in mind, you can increase your chances of a successful loan application.

Step-by-Step Guide to Applying for a Loan

When applying for a hard money loan, being organized and well-prepared is important. Follow these steps to streamline the application process:

- Gather the Necessary Documentation: Prepare all the required documentation, such as a business plan, financial statements, property information, and proof of identification.

- Research and Select Lenders: Explore different hard money lenders and compare their terms, interest rates, and reputation. Choose a lender that aligns with your financing needs.

- Submit a Loan Application: Complete the lender’s application form, providing accurate and detailed information. Attach the necessary documentation to support your application.

- Review and Negotiate Loan Terms: Once the lender reviews your application, they will present you with loan terms. Review them carefully, and if needed, negotiate specific terms to suit your requirements for hard money business loans.

- Complete Due Diligence: Upon acceptance of the loan terms, the lender will conduct due diligence to ensure the property’s value and your ability to repay the loan.

- Closing the Loan: If everything aligns, you will proceed to the loan closing stage. Review all the loan documents thoroughly and sign the necessary agreements to finalize the loan.

Tips for a Successful Loan Application

Increasing your chances of a successful loan application involves paying attention to detail and taking strategic steps. Consider the following tips:

- Prepare a Comprehensive Business Plan: Provide a well-structured business plan that showcases your objectives, strategies, and financial projections. This document will give lenders confidence in your ability to repay the loan.

- Establish Relationships with Hard Money Lenders: Networking and building relationships with reputable hard money lenders can open doors to potential financing opportunities.

- Maintain a Good Relationship with the Lender: Communicate openly and honestly with your lender throughout the loan process. Clear communication can help address any concerns or issues that may arise.

Furthermore, it is essential to understand the loan terms and conditions thoroughly. Take the time to review the fine print and seek clarification on any clauses or provisions that you find confusing. This will help you make informed decisions and avoid any surprises down the line.

Consulting with professionals specializing in hard money loans can also be beneficial. These experts can provide valuable insights and guidance throughout the application process. They can help you navigate the complexities of the requirements for hard money business loans, ensuring that you present a strong application that stands out to lenders.

Demystifying Hard Money Loans

Now that we have covered the qualification requirements for hard money business loans and the loan application process, let’s explore the ins and outs of hard money loans. Understanding the specific aspects of hard money lending will empower you to make informed decisions.

Exploring the Ins and Outs of Hard Money Loans

Hard money loans are a unique financing type that caters to borrowers who may not qualify for traditional bank loans. Consider the following aspects:

- Speed and Flexibility: Hard money loans offer a quick funding solution, with less emphasis on lengthy approval processes. This speed and flexibility can be advantageous for time-sensitive business opportunities.

- Higher Interest Rates and Fees: Hard money loans generally come with higher interest rates and fees compared to traditional loans. This compensates for the increased risk the lender assumes by not focusing solely on the borrower’s creditworthiness.

- Short-Term Nature: Hard money loans typically have shorter terms, ranging from a few months to a couple of years. It’s essential to have a clear understanding of the repayment schedule.

- Funding for Unique Situations: Hard money loans can be a viable option for borrowers in unique circumstances, such as those with poor credit, incomplete financial documentation, or properties that do not qualify for traditional loans.

Understanding the Basic Requirements for Hard Money Business Loans

It’s crucial to grasp the fundamentals of hard money lending to make strategically sound decisions when pursuing this type of financing. Consider the following basic elements:

- Loan-to-Value Ratio (LTV): The LTV ratio determines the maximum loan amount a hard money lender is willing to provide. It is calculated by dividing the loan amount by the property’s appraised value.

- Loan Term: Hard money loans have shorter terms than traditional loans, typically six months to three years.

- Interest Rates and Fees: The interest rates on hard money loans are higher than those of conventional loans. Additionally, borrowers may incur loan origination, processing, and servicing fees.

Now, let’s delve deeper into the intricacies of hard money loans. One aspect that sets hard money loans apart is the collateral requirement. Unlike traditional loans, hard money lenders focus more on the value of the property being used as collateral rather than the borrower’s credit history. This means that even if you have a less-than-perfect credit score, you may still be eligible for a hard money loan if the property you are using as collateral has a high appraised value.

Another important factor to consider is the loan-to-value ratio (LTV). This ratio determines the maximum loan amount a hard money lender is willing to provide based on the property’s appraised value. Typically, hard money lenders offer loans with an LTV ratio ranging from 60% to 75%. This means that if the property’s appraised value is $100,000, the maximum loan amount you can expect to receive would be between $60,000 and $75,000.

Furthermore, it’s essential to understand the role of the exit strategy in hard money lending. Since these loans are typically short-term, lenders want to ensure borrowers have a clear plan to repay the loan. Common exit strategies include selling the property, refinancing with a traditional loan, or using other sources of funds to repay the hard money loan. Having a well-thought-out exit strategy is crucial to successfully navigating the world of hard money lending.

The Regulatory Landscape of Hard Money Lenders

Now that we have delved into the intricacies of hard money loans, it’s essential to understand who oversees and regulates the activities of hard money lenders. Familiarizing yourself with the regulatory landscape can help you make informed decisions and ensure compliance.

Who Oversees Hard Money Lenders?

Hard money lenders are typically private entities or individuals rather than traditional banks. As such, they are subject to different regulations depending on the jurisdiction in which they operate. Regulatory oversight may vary, but common governing bodies include state regulatory agencies and financial licensing authorities.

Compliance and Regulations in the Hard Money Industry

The hard money lending industry operates within a regulatory framework that governs lending practices, disclosure requirements, and consumer protection. Compliance with these regulations helps maintain transparency and ensure fair dealings with borrowers. Working with reputable lenders that uphold the necessary compliance standards is important.

Let’s take a closer look at some of the specific regulations that hard money lenders must adhere to. One key aspect is the requirement for lenders to disclose all terms and conditions of the loan to borrowers. This includes interest rates, fees, and potential penalties or charges. By providing this information upfront, borrowers can make informed decisions and avoid any surprises down the line.

In addition to disclosure requirements, hard money lenders must also comply with anti-discrimination laws. These laws prohibit lenders from discriminating against borrowers based on factors such as race, gender, religion, or national origin. This ensures that borrowers are treated fairly and have equal access to financing opportunities.

Furthermore, many jurisdictions require hard money lenders to obtain the necessary licenses and permits to operate legally. These licenses often involve a thorough vetting process to ensure that lenders are financially stable and have the expertise to provide loans responsibly. By working with licensed lenders, borrowers can have peace of mind knowing that they are dealing with reputable professionals.

Lastly, consumer protection is a top priority in the hard money lending industry. Some jurisdictions have implemented specific regulations to safeguard borrowers from predatory lending practices. These regulations may include restrictions on interest rates, fees limits, and lenders’ requirements to assess a borrower’s ability to repay the loan. By enforcing these regulations, authorities aim to protect borrowers from falling into cycles of debt and ensure that the lending process is fair and transparent.

How Hard Money Loans Work: A Comprehensive Guide

To understand hard money loans , it’s vital to grasp the process of obtaining and repaying these financing solutions. By familiarizing yourself with the ins and outs, you can navigate the lending landscape more confidently.

The Process of Obtaining and Repaying a Hard Money Loan

The process of obtaining and repaying a hard money loan typically involves several steps:

- Loan Application: Complete the necessary paperwork and submit your loan application, along with the required documentation.

- Property Appraisal: The lender will assess the property’s value through an appraisal conducted by a professional appraiser.

- Loan Approval and Offer: After evaluating the application and property valuation, the lender will determine if they can approve the loan. They will present the borrower with a loan offer outlining the terms, interest rates, and fees.

- Loan Agreement and Repayment: If the borrower accepts the loan offer, they will proceed to sign the loan agreement, which details the repayment schedule. The borrower is then responsible for repaying the loan according to the agreed-upon terms.

- Loan Termination: Once the borrower repays the loan in full, the loan is terminated, and the lender releases any liens on the property.

Key Features and Terms of the Requirements for Hard Money Business Loans