Property Tax Name Change Application Letter Formats

Whenever you purchase a new property (or) if your name is wrongly spelled in the property tax bills (or) in case of inheritance, you need to change/correct your name in the municipal records. It is the responsibility of both buyer and seller to ensure the name change, if you don’t change your name then all the property tax bills will be generated on the wrong name.

You need to write a request letter to your municipal corporation to change the name of the property’s owner.

Here you can find sample request letters, which you can use to change or correct names in property tax bills.

Property Tax Name Change Letter 1 (To Correct misspelled Name)

The Municipal Commissioner,

___________(Municipal Corporation).

Sub: Application for the name change in the property tax bill.

Respected Sir/Madam,

My name is ___________ (your name) resident of ________________________________________ (your address).

In my property tax bill my name is wrongly spelled as ______________ (wrong name) .

Here I would like to request you to please correct my name to ______________ (your correct name) in my property tax bill and please find the attached copies of my ID proof and address proof.

I shall be obliged to you in this matter.

Thanks in advance.

Yours sincerely,

(Mobile no.)

Property Tax Name Change Letter 2 (To correct wrong name)

Sub: Application for name correction in the property tax bill.

I am _________ (your name) , owner of plot no _________ located at street no _______ and sector ______ at _________ (district name & pin code) .

While checking my property tax bill I have noticed that my name is wrongly mentioned on it. My actual name is _____________ but in the tax bill it is mentioned as___________ (wrong name) .

So I would like to request you to kindly correct my name to ___________ and I am enclosing all the required documents of mine along with this letter like sale deed, id proof, and address proof.

I shall be grateful to you in this regard.

Thanking you.

Property Tax Name Change Letter 3 by Legal Heirs (After the Death of the Owner/inheritance)

________ (Municipal Corporation),

Sub: Name change request in the property tax bill.

My name is_______________ (your name) , resident of _______________________________________ (your address). My father Late Sri ___________ (your father’s name) has a plot measuring _____ sq yards located at ______ (area name) of plot no _________, street no __________ and sector no.__________.

As a sole legal heir, the property has been transferred to my name by the revenue department, but I want to change the name in municipal records also, so kindly change the name to ___________ (your name) in municipal corporation records.

And please find the enclosed documents along with this letter, which includes 1. Death certificate of my father 2. Legal heir certificate 3. The latest property tax paid bill and 4. NOC from registrar’s office.

Property Tax Name Change Letter 4 ( to Transfer Name to the New Owner).

_________ Municipal Corporation,

Sub: Application for name change in the property tax bill.

My name is ____________ (your name) , purchased a plot/house no.__________ located at ___________ (address of the plot/house) .

The plot/house has been transferred to my name by the concerned authority as per all the legal compliances.

Here I want to apply for the name change in the municipal records so that I can pay the taxes on my name.

So kindly change the name of the property owner to ____________ (your name) in municipal records.

And find the enclosed documents along with this letter which includes 1. Sale deed 2. NOC from registrar office 3. My ID & address proofs.

I shall be thankful to you in this regard.

(Mobile no)

1. What is a mutation of property?

Mutation of property means changing of owner’s name in both the revenue department and also in municipal corporation records so that the new owner will become liable to pay the property tax.

2. Can I change my property tax bill online?

If your municipal corporation website provides an option to name change online then you can do that otherwise you need to do it manually by visiting your municipal corporation office.

3. How much time will it take to change the name on the property tax bill?

It will take 15-30 days.

- SBI home loan closure letter format in Word.

- Complaint letter format to electricity department.

Leave a Comment Cancel reply

Application For Change Of Name In Property Tax Bill – Property Tax Bill Name Correction Application

To, The Municipal Corporation, ___________ (Address)

Date: __/__/____ (Date)

From, ___________ (Name), ___________ (Address)

Subject: Request to change name in the property tax bill

Respected Sir/Madam,

With due notice, I would like to state, my name is ____________ (Name) and I live at _____________ (address).

I am writing this letter to request a change in the bill in the column of name. The reason for the name is ____________ (Reason in brief). The name to be replaced is ___________ (New Name) from ____________ (Old name).

Please let me know about the detailed procedures for the change in name. I would be attaching new documents for your reference.

Thanking You,

Yours ____________ (Sincerely/Faithfully), _____________ (Signature) _____________ (Name), _____________ (Contact Number)

- Copy of Property Tax Bill

- ID/ Address Proof

- ________ (Any other supporting documents)

Incoming Search Terms:

- property tax bill name change application letter

- property tax name change bill application letter format

- sample property tax bill name change application letter format

By letterskadmin

Related post, internship request letter – how to write an application for internship | sample letter.

Salary Increment Request Letter – Sample Request Letter for Salary Increment

Request letter for outdoor fitness equipment installation in parks – sample letter requesting for outdoor fitness equipment installation in parks, leave a reply cancel reply.

You must be logged in to post a comment.

Application for Half Day Leave – Sample Leave Application to Principal for Half Day Leave

Simple leave application in office – sample request letter for leave of absence.

Application Letter For Name Correction In Property Tax (3+ Samples).

SAMPLE 1 : Property tax name change application letter .

25/Kanpur Mumbai - 700241 India. To, The Municipal Corporation Address of the office Pin code & State. Date : 19th September, 2021. Subject, Request for name change in property tax. Respected Sir, I'd like to mention, with proper notice, that my name is Manoj Kumar, and I live in Kanpur, Mumbai. This letter is to seek a change to the bill in the column of name. The name was chosen since I have a different name on my birth certificate, which may cause me problems. Manoranjan Kumar will take the position of Manoj Kumar. Please inform me of the specific processes for changing my name. I'll attach some fresh docs for your review. Thank you very much. Yours Faithfully, Signature : [_____________] Contact Number [____________]. Name : [_____________].

- Application for education loan.

- Write a Letter to the Editor About Rising Prices of Petrol and Diesel .

- Write A Letter To The Newspaper Editor Protesting About A Factory.

- Letter to the Editor on Rising Price.

SAMPLE 2: Application letter for name correction in property tax.

Sender address Pin code & State. To, The Municipal Corporation 24 - Karoline Street Mumbai - 700921 India. Subject : Application for correction of name in property tax. Respected Sir/ Madam, With all due respect, I regret to inform you that the name on my property tax is misspelt. I'm writing to ask that you correct my name in your records. I'd like to change my name in municipal records so that I may pay taxes under my own name. My legal name is L Nampui, however the name on file with you is Nampui L. Please update the property owner's name in the municipal records to L Nampui as soon as feasible. Please call me at 9876**321 if you have any more questions. Yours faithfully, Name : Anita Paul Signature : _______________. Enclosure :- 1. _______________ 2. _______________ 3. _______________.

ALSO READ • How To Write A Letter To Bank Manager For Refund Money .

SAMPLE 3 : Application letter for name change in property tax.

From, ______________ ______________ To The Municipal Corporation ____________________________ ____________________________ ____________________________ Date: DD/MM/YYYY. Subject, Application for name change in property tax. Sir/Madame, I, Priyanka Sharma, a resident of Old Colony and the daughter of Suraj Sharma, am writing to request that the name on the property tax be changed. I'd want to notify you that my name is spelled Priyanka Sharma on the property tax records, not Praaiyanka Sharma as it appears on the documents. Please fix the spelling of my name and take action as soon as possible. I thus declare that if the above-mentioned information is proven to be incorrect, I will be held responsible. I've sent all of the needed paperwork, as well as the fully completed name correction request form. I eagerly await your thoughtful response. Thanking you, Name : [___________________] Signature : [_______________] Contact number : [________].

MUST READ| Letter To Bank Manager For Deduction Of Loan Amount From Account.

Recommend article,

- How To Write A Letter To MLA In English?

- How to write application for gas transfer?

- Application To Police Station For Lost Of Mobile Phone.

You may like these posts

Post a comment.

Made with Love by

- Privacy Policy

- Terms and Conditions

Contact form

- Property for Sale in India

- Ready to Move Flats in India

- Furnished Properties for Sale

- Semi-Furnished Properties for Sale

- Under Construction Properties for Sale

- Property for Sale in Mumbai

- Property for Sale in Delhi

- Property for Sale in Noida

- Property for Sale in Gurgaon

- Property for Sale in Pune

- Property for Sale in Bangalore

- Property for Sale in Hyderabad

- Property for Sale in Thane

- Property for Sale in Navi Mumbai

- Property for Sale in Greater Noida

- Flats for Sale in Mumbai

- Flats for Sale in Delhi

- Flats for Sale in Noida

- Flats for Sale in Gurgaon

- Flats for Sale in Pune

- Flats for Sale in Bangalore

- Flats for Sale in Hyderabad

- Flats for Sale in Thane

- Flats for Sale in Navi Mumbai

- Flats for Sale in Greater Noida

- Independent House for Sale in Mumbai

- Independent House for Sale in Delhi

- Independent House for Sale in Noida

- Independent House for Sale in Gurgaon

- Independent House for Sale in Pune

- Independent House for Sale in Bangalore

- Independent House for Sale in Hyderabad

- Independent House for Sale in Thane

- Independent House for Sale in Navi Mumbai

- Independent House for Sale in Greater Noida

- Builder Floor for Sale in Mumbai

- Builder Floor for Sale in Delhi

- Builder Floor for Sale in Noida

- Builder Floor for Sale in Gurgaon

- Builder Floor for Sale in Pune

- Builder Floor for Sale in Bangalore

- Builder Floor for Sale in Hyderabad

- Builder Floor for Sale in Thane

- Builder Floor for Sale in Navi Mumbai

- Builder Floor for Sale in Greater Noida

- Villa for Sale in Mumbai

- Villa for Sale in Delhi

- Villa for Sale in Noida

- Villa for Sale in Gurgaon

- Villa for Sale in Pune

- Villa for Sale in Bangalore

- Villa for Sale in Hyderabad

- Villa for Sale in Thane

- Villa for Sale in Navi Mumbai

- Villa for Sale in Greater Noida

- Studio Apartment for Sale in Mumbai

- Studio Apartment for Sale in Delhi

- Studio Apartment for Sale in Noida

- Studio Apartment for Sale in Gurgaon

- Studio Apartment for Sale in Pune

- Studio Apartment for Sale in Bangalore

- Studio Apartment for Sale in Hyderabad

- Studio Apartment for Sale in Thane

- Studio Apartment for Sale in Navi Mumbai

- Studio Apartment for Sale in Greater Noida

- Penthouse for Sale in Mumbai

- Penthouse for Sale in Delhi

- Penthouse for Sale in Noida

- Penthouse for Sale in Gurgaon

- Penthouse for Sale in Pune

- Penthouse for Sale in Bangalore

- Penthouse for Sale in Hyderabad

- Penthouse for Sale in Thane

- Penthouse for Sale in Navi Mumbai

- Penthouse for Sale in Greater Noida

- Plot for Sale in Mumbai

- Plot for Sale in Delhi

- Plot for Sale in Noida

- Plot for Sale in Gurgaon

- Plot for Sale in Pune

- Plot for Sale in Bangalore

- Plot for Sale in Hyderabad

- Plot for Sale in Thane

- Plot for Sale in Navi Mumbai

- Plot for Sale in Greater Noida

- Owner Properties for Sale in Mumbai

- Owner Properties for Sale in Delhi

- Owner Properties for Sale in Noida

- Owner Properties for Sale in Gurgaon

- Owner Properties for Sale in Pune

- Owner Properties for Sale in Bangalore

- Owner Properties for Sale in Hyderabad

- Owner Properties for Sale in Thane

- Owner Properties for Sale in Navi Mumbai

- Owner Properties for Sale in Greater Noida

- Interior Designers

- Living Room Designs

- Modular Kitchen Designs

- Wardrobe Designs

- Master Bedroom Designs

- Shops for Sale in Mumbai

- Shops for Sale in Delhi

- Shops for Sale in Noida

- Shops for Sale in Gurgaon

- Shops for Sale in Pune

- Shops for Sale in Bangalore

- Shops for Sale in Hyderabad

- Shops for Sale in Thane

- Shops for Sale in Navi Mumbai

- Shops for Sale in Greater Noida

- Office Space for Sale in Mumbai

- Office Space for Sale in Delhi

- Office Space for Sale in Noida

- Office Space for Sale in Gurgaon

- Office Space for Sale in Pune

- Office Space for Sale in Bangalore

- Office Space for Sale in Hyderabad

- Office Space for Sale in Thane

- Office Space for Sale in Navi Mumbai

- Office Space for Sale in Greater Noida

- Property for Rent in India

- Furnished Properties for Rent

- Semi-Furnished Properties for Rent

- Property for Rent in Mumbai

- Property for Rent in Delhi

- Property for Rent in Noida

- Property for Rent in Gurgaon

- Property for Rent in Pune

- Property for Rent in Bangalore

- Property for Rent in Hyderabad

- Property for Rent in Thane

- Property for Rent in Navi Mumbai

- Property for Rent in Greater Noida

- Flats for Rent in Mumbai

- Flats for Rent in Delhi

- Flats for Rent in Noida

- Flats for Rent in Gurgaon

- Flats for Rent in Pune

- Flats for Rent in Bangalore

- Flats for Rent in Hyderabad

- Flats for Rent in Thane

- Flats for Rent in Navi Mumbai

- Flats for Rent in Greater Noida

- Independent House for Rent in Mumbai

- Independent House for Rent in Delhi

- Independent House for Rent in Noida

- Independent House for Rent in Gurgaon

- Independent House for Rent in Pune

- Independent House for Rent in Bangalore

- Independent House for Rent in Hyderabad

- Independent House for Rent in Thane

- Independent House for Rent in Navi Mumbai

- Independent House for Rent in Greater Noida

- Builder Floor for Rent in Mumbai

- Builder Floor for Rent in Delhi

- Builder Floor for Rent in Noida

- Builder Floor for Rent in Gurgaon

- Builder Floor for Rent in Pune

- Builder Floor for Rent in Bangalore

- Builder Floor for Rent in Hyderabad

- Builder Floor for Rent in Thane

- Builder Floor for Rent in Navi Mumbai

- Builder Floor for Rent in Greater Noida

- Villa for Rent in Mumbai

- Villa for Rent in Delhi

- Villa for Rent in Noida

- Villa for Rent in Gurgaon

- Villa for Rent in Pune

- Villa for Rent in Bangalore

- Villa for Rent in Hyderabad

- Villa for Rent in Thane

- Villa for Rent in Navi Mumbai

- Villa for Rent in Greater Noida

- PG in Mumbai

- PG in Delhi

- PG in Noida

- PG in Gurgaon

- PG in Bangalore

- PG in Hyderabad

- PG in Thane

- PG in Navi Mumbai

- PG in Greater Noida

- Owner Properties for Rent in Mumbai

- Owner Properties for Rent in Delhi

- Owner Properties for Rent in Noida

- Owner Properties for Rent in Gurgaon

- Owner Properties for Rent in Pune

- Owner Properties for Rent in Bangalore

- Owner Properties for Rent in Hyderabad

- Owner Properties for Rent in Thane

- Owner Properties for Rent in Navi Mumbai

- Owner Properties for Rent in Greater Noida

- Penthouse for Rent in Mumbai

- Penthouse for Rent in Delhi

- Penthouse for Rent in Noida

- Penthouse for Rent in Gurgaon

- Penthouse for Rent in Pune

- Penthouse for Rent in Bangalore

- Penthouse for Rent in Hyderabad

- Penthouse for Rent in Thane

- Penthouse for Rent in Navi Mumbai

- Penthouse for Rent in Greater Noida

- Studio Apartment for Rent in Mumbai

- Studio Apartment for Rent in Delhi

- Studio Apartment for Rent in Noida

- Studio Apartment for Rent in Gurgaon

- Studio Apartment for Rent in Pune

- Studio Apartment for Rent in Bangalore

- Studio Apartment for Rent in Hyderabad

- Studio Apartment for Rent in Thane

- Studio Apartment for Rent in Navi Mumbai

- Studio Apartment for Rent in Greater Noida

- Plots for Rent in Mumbai

- Plots for Rent in Delhi

- Plots for Rent in Noida

- Plots for Rent in Gurgaon

- Plots for Rent in Pune

- Plots for Rent in Bangalore

- Plots for Rent in Hyderabad

- Plots for Rent in Thane

- Plots for Rent in Navi Mumbai

- Plots for Rent in Greater Noida

- Office Space for Rent in Mumbai

- Office Space for Rent in Delhi

- Office Space for Rent in Noida

- Office Space for Rent in Gurgaon

- Office Space for Rent in Pune

- Office Space for Rent in Bangalore

- Office Space for Rent in Hyderabad

- Office Space for Rent in Thane

- Office Space for Rent in Navi Mumbai

- Office Space for Rent in Greater Noida

- Shops for Rent in Mumbai

- Shops for Rent in Delhi

- Shops for Rent in Noida

- Shops for Rent in Gurgaon

- Shops for Rent in Pune

- Shops for Rent in Bangalore

- Shops for Rent in Hyderabad

- Shops for Rent in Thane

- Shops for Rent in Navi Mumbai

- Shops for Rent in Greater Noida

- New Projects In Mumbai

- New Projects In Delhi

- New Projects In Noida

- New Projects In Gurgaon

- New Projects In Pune

- New Projects In Bangalore

- New Projects In Hyderabad

- New Projects In Thane

- New Projects In Navi Mumbai

- New Projects In Greater Noida

- Ready To Move Projects In Mumbai

- Ready To Move Projects In Delhi

- Ready To Move Projects In Noida

- Ready To Move Projects In Gurgaon

- Ready To Move Projects In Pune

- Ready To Move Projects In Bangalore

- Ready To Move Projects In Hyderabad

- Ready To Move Projects In Thane

- Ready To Move Projects In Navi Mumbai

- Ready To Move Projects In Greater Noida

- Under Construction Projects In Mumbai

- Under Construction Projects In Delhi

- Under Construction Projects In Noida

- Under Construction Projects In Gurgaon

- Under Construction Projects In Pune

- Under Construction Projects In Bangalore

- Under Construction Projects In Hyderabad

- Under Construction Projects In Thane

- Under Construction Projects In Navi Mumbai

- Under Construction Projects In Greater Noida

- New Launch Projects In Mumbai

- New Launch Projects In Delhi

- New Launch Projects In Noida

- New Launch Projects In Gurgaon

- New Launch Projects In Pune

- New Launch Projects In Bangalore

- New Launch Projects In Hyderabad

- New Launch Projects In Thane

- New Launch Projects In Navi Mumbai

- New Launch Projects In Greater Noida

- Affordable Housing Mumbai

- Affordable Housing Delhi

- Affordable Housing Noida

- Affordable Housing Gurgaon

- Affordable Housing Pune

- Affordable Housing Bangalore

- Affordable Housing Hyderabad

- Affordable Housing Thane

- Affordable Housing Navi Mumbai

- Affordable Housing Greater Noida

- Luxury Apartments In Mumbai

- Luxury Apartments In Delhi

- Luxury Apartments In Noida

- Luxury Apartments In Gurgaon

- Luxury Apartments In Pune

- Luxury Apartments In Bangalore

- Luxury Apartments In Hyderabad

- Luxury Apartments In Thane

- Luxury Apartments In Navi Mumbai

- Luxury Apartments In Greater Noida

- Builders In Mumbai

- Builders In Delhi

- Builders In Noida

- Builders In Gurgaon

- Builders In Pune

- Builders In Bangalore

- Builders In Hyderabad

- Builders In Thane

- Builders In Navi Mumbai

- Builders In Greater Noida

- Godrej Properties

- Prestige Group

- Signature Global

- Lodha Group

- TATA Housing

- Mahindra Lifespace

- Jaypee Greens

- Puravankara

- Indiabulls Real Estate

- Kolte Patil

- Oberoi Realty

- Real Estate Agents in India

- Real Estate Agents In Mumbai

- Real Estate Agents In Delhi

- Real Estate Agents In Noida

- Real Estate Agents In Gurgaon

- Real Estate Agents In Pune

- Real Estate Agents In Bangalore

- Real Estate Agents In Hyderabad

- Real Estate Agents In Thane

- Real Estate Agents In Navi Mumbai

- Real Estate Agents In Greater Noida

- Property Legal Services

- Real Estate Services

- Vastu Consultation

- Property Inspection

- Check your Credit Score

- Buyer Guide

- Online Rent Agreement

- Rent Receipt Generator

- Packers & Movers

- Rental Furniture

- Rental Appliances

- Tenant Guide

- Sell/Rent Property Online

- Property Management

- Home Interiors

- Home Painting Services

- Solar Rooftop

- Seller Guide

- Tools 3D Real Estate Platform Heatmaps Recommendations Price vs Size Rent Receipt Property Tax Calculator Stamp Duty Calculator Capital Gains Calculator Circle Rate

- Solutions Prime Connect (For Property Developers) Prop VR (For Property Developers) Square Connect (For Agents) Smart Agent (For Agents) Azuro (For Property Owners) Props AMC (For Property Owners)

- Blog Blog Home Awards & Recognition Media Coverage Real Estate Information Legal & Tax Celebrity Homes Decor Vastu Research Gold Rate in India Smart City

- Land Reforms MP Bhulekh Banglarbhumi Bhulekh Odisha Bhulekh Bihar Jharbhoomi Mahabhulekh Patta Chitta Bhulekh UK CG Bhuiya Bhoomi RTC Online Mee Bhoomi

- Home Interior Services Living Room Design Modular Kitchen Design Wardrobe Design Master Bedroom Design Kids Room Design Kitchen Wall Tiles Design Kitchen False Ceiling Design Balcony Design TV Unit Design Bathroom Design

- Credit Score Credit Score Pan Card EPF GST Income Tax Fixed Deposit Rera Gratuity Aadhaar Card

- Conversion Meter to Feet CM to Inches Inches to CM Inches to Feet Square meter To Square Feet Hectare to Dismil Decimal to Katha Gallons to Liters Dhur to Sq Meter to CM

- Property Rates Property Rates in Mumbai Property Rates in Bangalore Property Rates in Navi Mumbai Property Rates in Thane Property Rates in Noida Property Rates in Greater Noida Property Rates in Gurgaon Property Rates in Pune Property Rates in Ghaziabad Property Rates in Hyderabad

- Guide Buyer Guide Seller Guide NRI Guide Tenant Guide

- Real Estate Q&A Forum

- Sell or Rent Property

- Cent to Square Feet

- Meter to Yard

- Cent to Square Yard

- Kattha to Square Feet

- Hectare to Dismil

- Cent to Ground

- Square Inch to Square Meter

- Square Feet to Marla

- Kanal to Square Feet

- Square Mile to Acre

- Millimeter to Feet

- Mile to Kilometer

- Meter to Centimeter

- Meter to Inch

- Centimeter to Millimeter

- Millimeter to Inch

- Feet to Centimeter

- Centimeter to Inch

- Millimeter to Meter

- Feet to Mile

- Kilogram to Pound

- Gram to Kilogram

- Milligrams to Gram

- Ton to kilogram

- Gallons to Liter

- Liter to Milliliter

- Kilogram to Metric Ton

- Gram to Milligram

- Cubic Meter to Liter

- Carat to Gram

- Billion to Million

- Billion to Rupee

- Billion to Crore

- Million to Rupee

- Million to Lakh

- Crore to Million

- Crore to Lakh

- Trillion to Crore

- Million to Crore

- Lakh to Crore

- Equity Shares

- Sensex India

- List of Stock Exchanges India

- SBI Share Price

- IOC Share Price

- Wipro Share Price

- Reliance Share Price

- Adani Enterprises Share Price

- Tata Motors Share Price

- Infosys Share Price

- Adani Share Price

- Mindtree Share Price

- Tata Steel Share Price

- Union Budget of India

- Nirmala Sitharaman and her Team

- Union Budget 2022-23: Important Facts

- Will Budget 2022-23 Affect Tax Benefits on Home Loan

- Budget 2022-23: More Reforms Needed in Tax and Policy Stability

- Mannat House

- Mukesh Ambani House

- Drake House

- Lionel Messi House

- Salman Khan House

- Rihanna House

- Vijay House

- Gautam Adani House

- Amitabh Bachchan House

- Johnny Depp House

- 7 Horses Painting

- East Facing House Vastu Plan

- Pooja Room Vastu

- Vastu Shastra - Detailed Guide

- Vastu Tips for Mirror

- Wall Clock Vastu

- North-West Facing House Vastu

- Staircase Direction Vastu

- Vastu for Bedroom

- Study Table Vastu

- Smart Cities Mission

- Smart City Karnataka

- Smart City Ranchi

- Smart City Dholera

- Smart City Bangalore

- Smart City Bhopal

- Smart City Indore

- Smart City Delhi

- Cooperative Housing Society

- Smart City Dehradun

- Cottage House

- Cabin House

- Kutcha House

- Duplex House

- Types of Houses

- Service Apartment

- Shelter Home

- Rural Housing List

- Rural Housing Scheme

- Rural Housing Loan

- Rural Housing

- Banglarbhumi

- Patta Chitta

- Bhulekh Odisha

- Mahabhulekh

- e-District Delhi

- Lucknow Development Authority

- Slum Rehabilitation Authority

- SSP ICAI Portal

- BBMP Property Tax

- GHMC Property Tax

- KMC Property Tax

- PCMC Property Tax

- MCD Property Tax

- GVMC Property Tax

- PMC Property Tax

- Tamilnadu Property Tax

- KDMC Property Tax

- Sanchaya Property Tax

- NPCI Aadhaar Link

- Aadhaar Self Service Update Portal

- Jan Aadhaar Card Rajasthan

- Aadhaar Card Password

- Wbpds Aadhaar Link

- Aadhar Card Scanner

- NSEIT Aadhaar Exam

- Aadhaar Card Correction Form

- Aadhar Card Name Change

- Rama Setu Adams Bridge

- Qutub Minar

- Konark Sun Temple

- Jaisalmer Fort

- Vivekananda Rock Memorial

- Sanchi Stupa

- Hazarduari Palace

- Golconda Fort

- Bibi Ka Maqbara

- National Highway 44

- Ram Setu Adams Bridge

- National Highway 48

- Delhi Metro Phase 4

- National Highway 66

- KMP or Western Peripheral Expressway

- National Highway 1

- Samruddhi Mahamarg

- Agra Lucknow Expressway

- Eastern Peripheral Expressway

- RERA Gujarat

- RERA Maharashtra

- RERA Odisha

- RERA Tamilnadu

- RERA West Bengal Hira

- RERA Andhra Pradesh

- RERA Uttrakhand

- PAN Card India

- PAN Card Status

- PAN Verification

- PAN Card Forms

- PAN Card Application

- About UTIITSL

- PAN Card Online

- Types of PAN Card

- EPF Interest Rate

- EPFO PAN Card Link Online

- EPF Withdrawal

- EPF Passbook

- Public Provident Fund

- How to Open SBI PPF Account

- PPF Interest Rate

- SBI PPF Account

- PPF Account Opening

- Post Office PPF Account

- Fixed Deposit

- FD Interest Rates

- SBI FD Interest Rates

- PNB FD Interest Rate

- Axis Bank FD Rates

- HDFC FD Interest Rates

- Post Office FD Interest Rates

- Yes Bank FD Rates

- Tax Saver FD

- Bank of Baroda FD Interest Rate

- Savings Account

- Zero Balance Account

- Cancelled Cheque

- SBI Balance Check

- PNB Net Banking Login

- Union Bank Corporate Login

- HDFC Net banking

- PNB Net Banking

- IDBI Net Banking

- Union Bank of India Net Banking

- Income Tax e-filing

- Income Tax Calculator

- Income Tax Refund

- Income Tax Slab

- Income Tax Return Due Date

- Online Tax Payments

- Income Tax Act

- Income Tax Refund Status

- Dearness Allowance

- GST Portal Login

- GST Eway Bill

- Goods And Service Tax

- GST Calculator

- GST Payments

- GST Registrations

- Eway Bill Login

- Stamp Duty in Maharashtra

- Stamp Duty in Tamilnadu

- Stamp Duty on Rental Agreement

- Stamp Duty in Telangana

- Stamp Duty in Uttar Pradesh

- Stamp Duty in Andhra Pradesh

- Stamp Duty in West Bengal

- Stamp Duty in Punjab

- Stamp Duty in Bangalore

- Stamp Duty in Rajasthan

- Parivahan Sewa

- Sarathi Parivahan

- Parivahan Maharashtra

- Vahan Parivahan

- Sarathi Driving Licence Download

- Parivahan Gujarat

- UP Parivahan

- echallan Haryana

- Parivahan Odisha

- Gold Bars vs Gold Jewellery

- Gold Price in Stock Market

- Buying Gold Online vs Offline

- Gold Jewellery Buying Tips

- Gold Price Determined in India

- Buying Gold Online

- Gold Prices in Different States

- Invest Gold

- High Gold Prices Reasons

- Digital Gold Investment

- Check Free Business Credit Score

- Check Credit Score without PAN

- Effects of Pan Card on Cibil Score

- CIBIL Registration

- Personal Loans for Cibil Defaulters

- Personal Loan Without CIBIL Verification

- DPD in Cibil Report

- CIBIL Dispute and Resolution

- Buying Car with Low CS

- Cibil Score Effects in Employment

- Gold Rate Today in India

- Gold Rate Today in Delhi

- Gold Rate Today in Mumbai

- False Ceiling Design for Bedroom

- Single Floor House Design

- Window Grill Design

- Bedroom Door Design

- Two Colour Combination

- Main Door Design

- Modern TV Unit Design

- Bedroom Cupboard Design

- PVC False Ceiling Design

- Wardrobe Colour Combination

Home » Legal & Tax » Property Tax Name Change Online: A Handy Guide

Property Tax Name Change Online: A Handy Guide

Last Updated -- August 29th, 2023

Buying a house is an auspicious and quite exciting event. Given all the struggle that goes in, once you have It under your name, that feeling is ecstatic. However, with a new house under your name, there are several new responsibilities that come your way, and it is better if you understand them instead of just trying your luck every time. Any inconsistency in the legal department can quickly change the ecstatic feeling into discomfort given the strictness of the bureaucratic setup of India. There is no denying that buying a property is a tiring process, but it gets even harder when you add the piles of paperwork associated with it.

Thinking about how to change the name in property tax online ? While this is a common query posted by several people across online and offline channels, you should rest assured that it is quite a simple process. Many people get flustered or anxious at this prospect owing to wrongful perceptions. However, you should not procrastinate or put it off any longer. The procedure will pass through seamlessly in case you possess all the vital documents that are needed. A majority of home buyers focus only on obtaining the registered sale deed as proof of property ownership.

However, property tax documentation is often missed out by home buyers. Yet, you should always be aware that updating official records of the municipal corporation is really essential and should not be missed out on. This is essential for both sellers and buyers of any property. Until and unless the new property buyer gets the name changed in official tax records for property, old receipts of taxes will be generated in the name of the previous buyer. From a legal perspective, the previous buyer will have the liability to pay these dues since they will not have informed the municipal authorities about the transaction. Buyers should also make sure that all receipts which include water, electricity, and property tax bills should be in their names instead of the earlier owner.

How to change name in property tax online?

It is not prudent to keep postponing an important property tax name change if it is required. Does the property tax bill still have the name of the earlier owner of the property or the developer? You should then get the same changed right away. The procedure may appear a little complex and exhausting although if you have all the documents that are required, getting the name changed will be a breeze.

This is the procedure that you need to follow if you are wondering about how to change name in property tax records. Prior to applying for any change in the name on property tax bills, you should ensure that you have all vital documents in place. These include the following:

- Receipts of taxes that have been paid last.

- NOC (no objection certificate) from the housing society .

- Attested copy of the sale deed or deed of sale transaction that is in your name.

- Filled up application form along with your signature.

The documents and the application form for the name change should be submitted to the Commissioner of Revenue. This is answer to your query for how to change name in property tax records. The application will be verified upon submission and the name change in the property tax records will attain approval within a period of 15-30 days on an average.

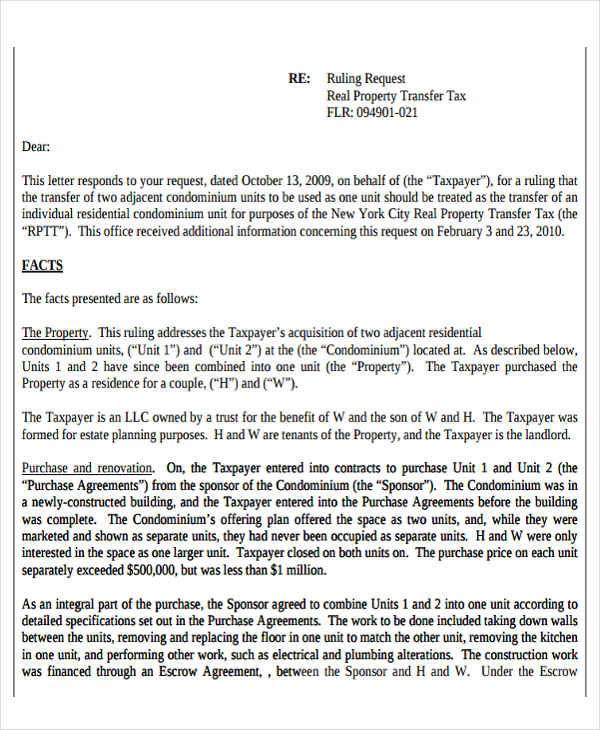

Property Mutation- Some basics that you should know

Apart from knowing how to change the name in property tax online, you should also focus on mutation for any property. This procedure enables owners of the property to seamlessly change ownership of the title post buying the property or inheriting any property. The No Outstanding Certificate for the property may be needed before applying for mutation of the same. If the property has been inherited, the original death certificate (in case of death of the property owner) and the affidavit will also be needed. The filled up mutation form can be submitted with all necessary documents for changing the ownership of the title. The property mutation procedure will help municipal authorities update the records of property taxes to reflect the name of the rightful owner and issue suitable documents of taxation accordingly.

Approval process

Firstly you should know that the government lives up to its reputation when it comes to house tax documentation. The whole process of approval is rather simple and straightforward, and with the right steps can be quite quick as well. You should start by gathering a copy of the following documents to initiate the property name transfer procedure.

- A receipt of the last time the tax was paid.

- A properly filled application for tax name change form with the right signatures

- An attested copy of the deed denoting the sale transaction

- A No objection Certificate signed by the relevant housing society

With these four documents ready, you are all set to get your name correction in property documents. You have to submit these documents to the Commissioner of Revenue and wait until it has been approved. The verification process usually takes 15 days to a month.

Property Tax Record Name Change- After Owner’s Death

With the value of real estate assets increasing every day, it has become very important for legal heirs to file a ptin name change once the registered owner has passed away. While the legal formalities for how to change the name of property that you are buying and inheriting remain relatively similar, there are a few subtle differences that you should keep in mind. These formalities mainly differ based on your rights over it, the nature of the inheritance, and how many legal heirs it has. If you are in a similar situation and wondering how to change property owner name, keep reading this article.

Title Transfer

To start with the transfer process, you will need to gather all legal documents that prove your claim to the inheritance and your rights. The overall process is considerably simpler if there is a will to write. A will is essentially legal to prove with the wishes of the deceased, stating how the property will be divided. Executors need to consult this will and administer the property. However, legal heirs are allowed to challenge the will if it contradicts the law. For example, the deceased can only pass down a particular property through a will if it was self-acquired and not inherited. If it is an inherited property, the law of succession comes to play, which can further complicate the whole process.

More often than not, in cases of untimely death or other unforeseeable causes, there are no wills present. This kind of situation can further lead to certain complexities in the process of how to change property name. The whole task becomes a whole lot easier if the legal heirs consult among themselves and divide the shares equally. This distribution can be as basic as a writing of the settlement, which should then be registered, and the shares will be divided accordingly. However, that is not always the case, in which case the law of succession comes into play.

Documents needed

Some of the documents you need for the same are further mentioned here. Once the rights, shares, and liabilities of the beneficiaries are decided, you need to change the house number to name. For the same, you are required to apply for a property transfer with the sub-registrar’s office. Usually, you need a property ownership document and the will with a probate succession certificate or probate in the case of an owner’s death.

In case no will has been generated, you have to prepare an affidavit, in addition to a NOC (no objection certificate) from all of the other legal heirs and/or their successors. If you have already paid the consideration fees to acquire the same shares, this should be mentioned in the transfer papers as well.

However, with this, only half of the process is complete; after that, you will need to register the documents in your name and apply for the mutation of the property title. This further helps keep a legal record of the transfer of the property Inland revenue records. This is mainly required to ensure that your name is mentioned for property taxes and when you need to apply any utility connection in the new owner’s name.

As mentioned above, mutation of a property record usually takes place in the relevant municipal authority office. The fees for the mutation and documents required usually differ from state to state.

While this information should help you simplify the process of changing your property tax name, it can sometimes be quite cumbersome for a first-timer. There are many services that provide not only legal help but also assist you with the rest of the procedure so that you do not have to do it all along. Hiring professional and legal help significantly quickens the process and saves you a lot of money as well. Further mentioned below are some frequently asked questions that you can go through to quickly learn about the basics of how do you change names on house deeds.

You Might Also Like

- What is an Inheritance and who is an Heir?

- Property Mutation: Everything You Need to Know

- What is the Tnreginet Inspector General of registration?

- #YoungAt69: How Real Estate has changed over time!

There are some basic steps that you require for an online property tax name change. Along with the necessary documents (mentioned in the article above), you also have to indulge in property mutation. This will allow you to transfer the property to your name.

With the right steps and documents, changing your taxpayer name is a rather easy task. All you have to do is inform the IRS about the EIN number change name via an attested notification. However, you must remember if you are changing your name right after an annual tax return, you usually do not have to file for a new EIN; you can simply submit the name change.

If you are wondering how to change the name on property tax online, there is a simple, straightforward way to do that. You have to start by visiting the official online portal, http://www.mcg.gov.in/ Here you will find all the necessary options, including one labelled ‘correction in property ownership.’ Clicking on that will take you to a link, where you have to press the search button and enter the relevant information, like the property ID, mobile number, owner name, and other similar things. Here you can apply for a change in property name as well as check the property tax name change status .

The process mentioned above is the same one you can use for changing your name on property tax documents online. However, since Haryana has a different jurisdiction, some basic facts like the official website and navigating through the website might be different. Once you have reached the official website, you have to fill out the application form for property mutation with the relevant details. With that, the process is complete, and all you have to do now is wait for the application to be catered to by the official organization.

With the relevant details, mainly receipts of already paid taxes, a NOC from the said housing complex, the attested copy of the deed of sale in your name, and a filled-up application found online with a present signature; this process is simple. There are official websites you can find on the internet that give you in-depth steps about the process.

- Legal & Tax

- Super Quick & Easy

- Stamped & E-Signed

- Delivered Directly in Mailbox

Exploring Options for Buying or Renting Property

- Municipal Corporation

The Howrah Municipality was officially established in the year 1862. Later, it was given the standing of a municipal corporation.…

Thane Municipal Corporation is a civic body that governs the city of Thane in the state of Maharashtra. This municipal…

Bhavnagar Municipal Corporation or BMC is a civic authority that has been executed to provide individuals with infrastructure facilities in…

In 2008, the Government of Haryana formed Municipal Corporation of Gurgaon or MCG. This was done keeping in mind the…

Asansol Municipal Corporation holds the responsibility for organizing the civic infrastructure & administration of Asansol, a city in the West…

Durgapur is considered to be a large 2nd tier industrial wen & municipal corporation in the district Paschim Bardhhaman situated…

The Municipal Corporation of Delhi (MCD) recently released concerning figures regarding property tax collection during the financial year 2023-24. According…

Merger Approved: Hinduja Group Combines Healthcare and Real Estate Entities The National Company Law Tribunal (NCLT) has granted approval for…

With April approaching, cement companies are gearing up for price hikes in response to the soaring costs of raw materials…

Edelweiss Group, a leading financial services company, has recently announced a substantial investment of ?7.75 billion in Prateek Realtors and…

Blackstone, one of the world's leading investment firms, has announced plans to invest a staggering $25 billion in India's private…

Fly91, a prominent player in aviation services, has signed a significant Engine Maintenance, Repair, and Overhaul (MRO) agreement with world-leading…

No LTCG Tax If Property Redeveloped Within 3 YearsIn a recent development, experts have stated that there will be no…

Hyderabad’s housing market in India has demonstrated a continuous growth trend in value appreciation. One of the most populated metropolises…

One of the inherent subjects when buying a house of your own is Stamp Duty. This can be considered an…

Buying a home can be both exciting and tedious. While the feeling of purchasing your own home in Mumbai is…

In Chhattisgarh, registration is mandatory if you wish to own a property here. This entails paying the state government for…

Buying a home in Kerala is a dream of numerous people. The state is rich in natural beauty. Moreover, it…

- Passport Application Status

- Passport Police Verification

- Reschedule Passport Appointment

- Apply For New Passport

- Passport Address Change

- Passport Renewal

- Types of Passport

- Rejection of Passport

- Tatkal Passport

- Property Tax Name Change

- Kdmc Property Tax Payment

- Housing GST

- Property Tax Delhi

- Property Tax Panvel MC

- Property Tax Bhavnagar MC

- Commercial Property Tax

- Lucknow Property Tax

- Parivahan Haryana

- Parivahan Kerala

- Parivahan Rajasthan

- eChallan Surat Online

- Parivahan MP

- Sarathi Parivahan HP

- Vahan 4 Login

- eChallan Karnataka

- eChallan Surat

- Saksham Yuva Yojana

- Basava Vasati Yojana

- PM Krishi Sinchai Yojana Pmksy

- PM Gram Sadak Yojana

- Kanya Sumangala Yojana

- Pm Kisan Samman Nidhi

- Pradhan Mantri Awas Yojana

- Atal Pension Yojna

- Bine Mulya Samajik Surksha Yojna

- PM Kisan Aadhaar Link

- mAadhaar App

- PVC Aadhaar Card

- Udyog Aadhaar

- Lost Aadhaar Card

- Aadhar Enable Payment System

- Aadhaar Card Download

- Aadhaar Virtual ID

- Feng Shui Items

- Feng Shui and Vastu

- Feng Shui Plants

- Feng Shui Bagua

- Feng Shui Bedroom

- Vastu vs Feng Shui

- Wall Colour Combiation

- Bathroom Tiles Design

- Purple Colour Combination

- Kitchen Colour Combination

- Simple Rooftop Design

- House Colour Outside

- Main Gate Design

- POP Plus Minus Design

- Door Grill Design

- Double Door Design

- Proptech Market Size In India

- Proptech Platform And Solution For Real Estate

- Best Proptech & Real Estate Startups To Watch

- Top Proptech Companies In India

- Proptech Trends In India

- Proptech Startup Investors India

- Proptech Software And Solution In India

- AI Tools for Real Estate Agents

- Future of Digitization in Real Estate

404 Not found

All Formats

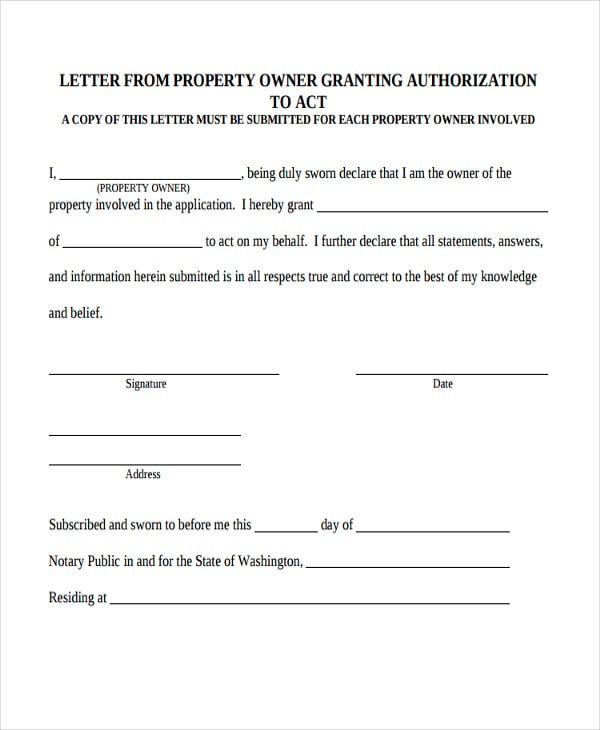

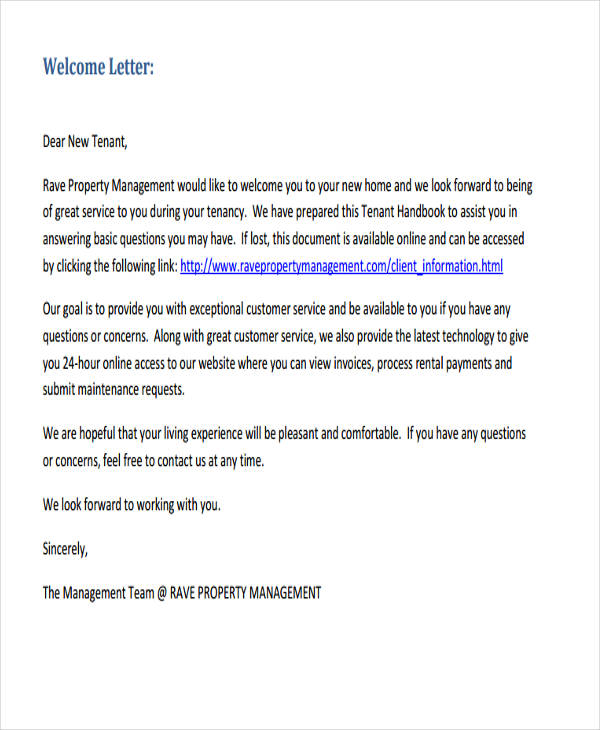

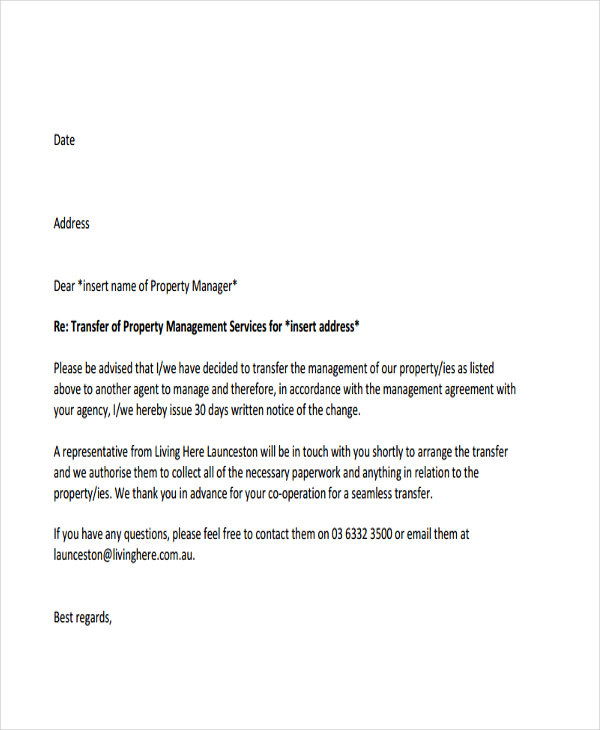

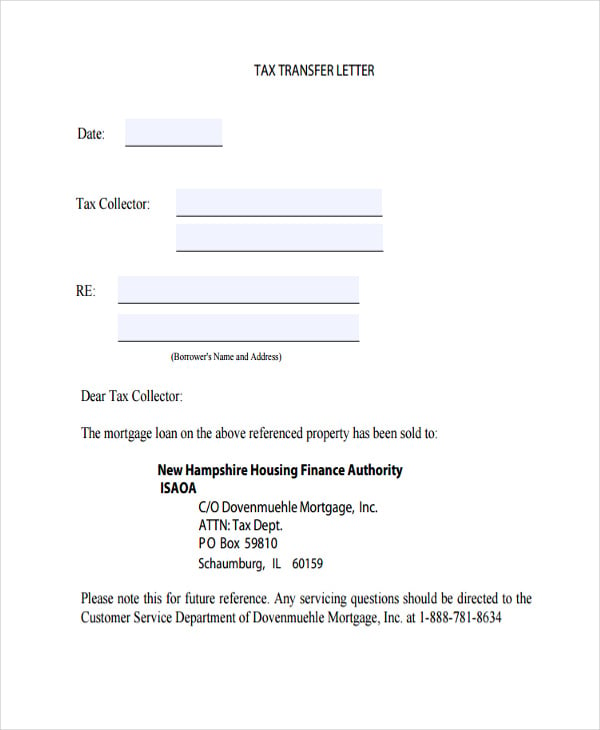

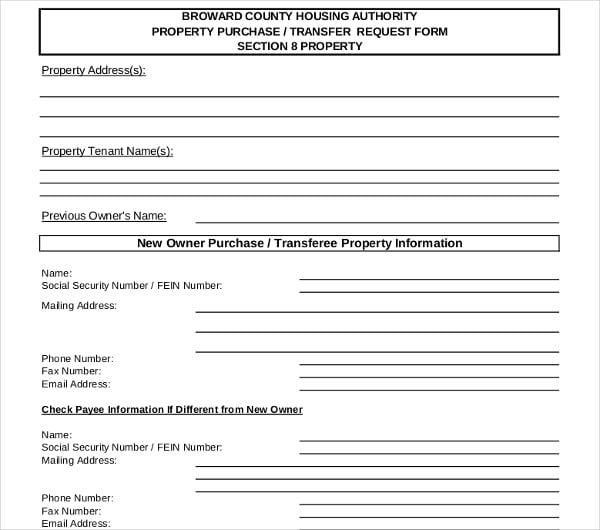

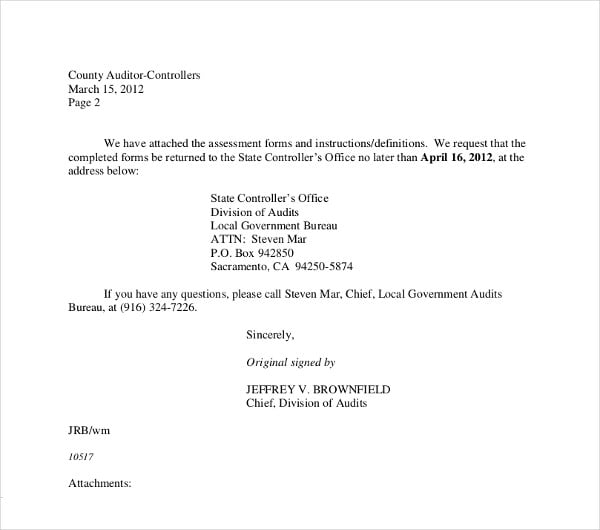

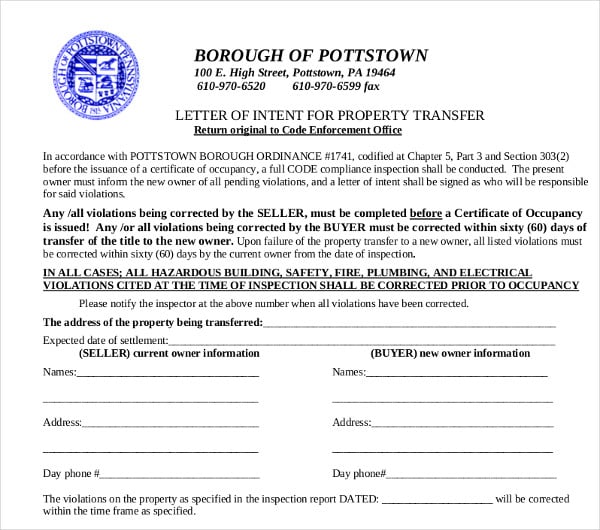

15+ Property Transfer Letter Templates

Need to make a change of land as a gift? Need to grant authorization to a tenant for a plot of land? Just like how one needs to go through a legal process to have a name change to their husband’s surname and relocation of life in society, you need a property transfer letter to facilitate this turnover of ownership with no objection. On the search for Transfer Letter Template that can guide you in making property-related transfer letters? Ones that are high quality and contain accurate details that enable you to make a correct type of document? You’re in luck because on our design website, we here provide you with different property transfer letter templates that you can choose from and use. We provide free of charge, simple, and easy-to-use templates that are available to download and can be used for multiple property-related issues. With these templates, you can save valuable time. Check them out now and let us be able to help you get started. You may also see property transfer letters in word .

Letter Of Transfer Of Ownership Of Property Template

- Google Docs

Property Transfer Letter Template

- Microsoft Word

- Apple Pages

Letter to Property Insurance Company Template

Letter to Property Manager Template

Society Intellectual Property Transfer Letter

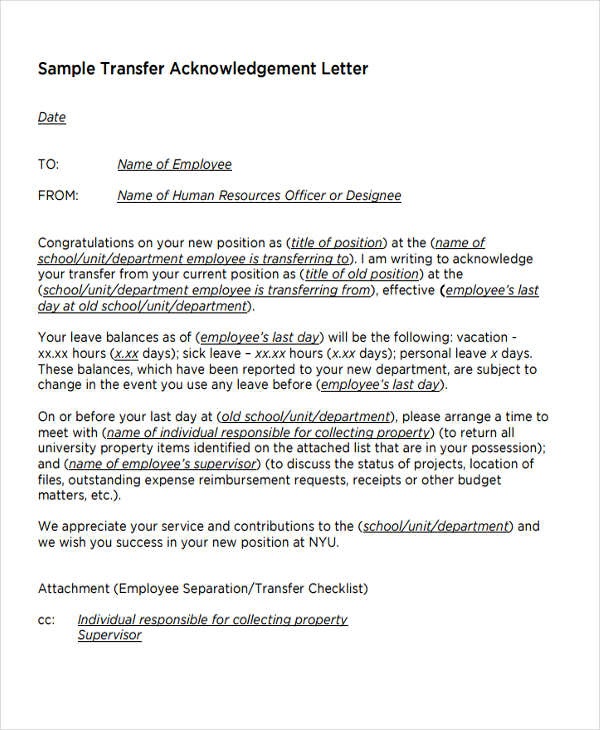

Transfer Acknowledgement Letter Format

Transfer of Property Relocation Letter Template

Property Ownership Authorization Transfer Letter

What Are Transfer Letters?

What is a property transfer letter, tenant plot property management transfer letter.

Turnover Property Name Change Transfer Letter

Property Change of Land Transfer Request Letter

Gift Property Tax Transfer Letter Template

No Objection House Property Transfer Letter

Real Estate Asset Transfer Assessment Letter

Property Land Transfer Letter of Intent

Property Transfer Letter with Husbands Name

Content of a Transfer Letter

- Start by addressing the higher authority to which it is addressed, the date, and the name of the employee.

- State the proper subject line to present the kind of transfer that is anticipated. It should be precise to the point.

- Mention the need for transfer, which helps the higher authority identify the necessity for transfer.

- The approach should be gracious, honest, and with utmost professionalism.

- Balance your skills and assets with the needs of the company. You may also see transfer request letter templates here.

- Show off your angles but should not sound arrogant.

- Be thankful for the organization and what the company has contributed to you. You may also see ownership transfer letter templates.

Why Request for Property Transfer?

- Significant life changes that let the owner of such property need to sell.

- Family inheritance in which a property is to be passed on to someone in the family hence needs the property ownership transfer. You may also see department transfer letter templates.

- Aging or illness of the owner may lead to the transfer of ownership.

- The need for new management in the company or property.

More in Letters

Property rent receipt template, landlord property management template, real estate property management template, property management inspection checklist template, rental property management template, printable property management template, facility management template, real estate investment property template, multifamily property analyzer template, property rental invoice template.

- FREE 26+ Covid-19 Letter Templates in PDF | MS Word | Google Docs

- Thank You Letter for Appreciation – 19+ Free Word, Excel, PDF Format Download!

- 69+ Resignation Letter Templates – Word, PDF, IPages

- 12+ Letter of Introduction Templates – PDF, DOC

- 14+ Nurse Resignation Letter Templates – Word, PDF

- 16+ Sample Adoption Reference Letter Templates

- 10+ Sample Work Reference Letters

- 28+ Invitation Letter Templates

- 19+ Rental Termination Letter Templates – Free Sample, Example Format Download!

- 23+ Retirement Letter Templates – Word, PDF

- 12+ Thank You Letters for Your Service – PDF, DOC

- 12+ Job Appointment Letter Templates – Google DOC, PDF, Apple Pages

- 21+ Professional Resignation Letter Templates – PDF, DOC

- 14+ Training Acknowledgement Letter Templates

- 49+ Job Application Form Templates

File Formats

Word templates, google docs templates, excel templates, powerpoint templates, google sheets templates, google slides templates, pdf templates, publisher templates, psd templates, indesign templates, illustrator templates, pages templates, keynote templates, numbers templates, outlook templates.

Andhra Pradesh - Change Name in Property Tax

- 1 Procedure

- 2 Required Documents

- 3 Office Locations & Contacts

- 4 Eligibility

- 7 Documents to Use

- 8 Sample Documents

- 9 Processing Time

- 10 Related Videos

- 11 Instructions

- 12 Required Information

- 13 Need for the Document

- 14 Information which might help

- 15 Other uses of the Document/Certificate

- 16 External Links

Procedure [ edit ]

Apply Online

- The applicant shall visit the following online portal to apply online Link

- In the given page, please click on the “ONLINE SERVICES” menu and choose “Property Tax > File Your Mutation (Transfer Of Ownership)” to reach the “Transfer Of Ownership” page.

- Here, please select the respective district and the respective option from the dropdown list provided against “District” and “Corporation/Muncipality/NP” as appropriate and click on the “Submit” button to reach a new page.

- The applicant shall enter the assessment number at the prompted space and click on the “Search” button to get a new page (If there is any tax due for the particular assessment number, then the “Tax Dues” page will be provided with respective due listed).

- If the tax are paid up to date, a new page will be provided. Please click on the checkbox for “Registration already done” to get the “Transfer Details Page”.

- Please complete the page prompts as appropriate. Make sure to provide the claimant details as per the sale deed. Please upload the documents as applicable. Please make sure to select the applicable option from the dropdown list for the “Forward To” section.

- Once the mandatory details are filled in, please click on the “Forward” button to get the “transfer of Ownership Acknowledgement” page. Here, please click on the “Generate Acknowledgement” button to get the system generated acknowledgement receipt.

- Please save it or take a print out of it for future reference. Please click on the “Close” button to close it.

- ”SMS” triggered update on application status will be sent to the applicant’s mobile. So, keep track of the notification from the department.

- This application will be processed further. Concerned authorities will verify the applicant’s details and documents.

- Once the documents are verified, a designated authority from the revenue department will inspect the property to ascertain the details mentioned in the application.

- Once the above said steps are complete, particulars furnished and the document produced are found correct. A transfer order will be issued within 15 to 30 working days or as per the timeline provided by the department.

- The status, viz. Approval or Rejection, if any, will be conveyed to the applicant through an “SMS” or by post as per norms.

- The certificate will be hand-delivered or delivered through post or as per applicable norms.

- Please refer to the “Fees” section of this page for fee requirements.

Apply In-Person:

- In order to change the name in property tax and in the concerned revenue department records, the new owner of the property should approach the concerned office of the municipal corporation / municipalities / panchayat office having jurisdiction over the area as appropriate.

- Contact Link in the given page, please select the respective district from the dropdown list against “District” and then click on the “Apply” button for respective contact details AND Link1 in the given page, select your district and zone to view your respective Tahsildar details AND link for district please select “About AP > Districts“ menu to get next page. Here please select the respective district from the left part of the screen to get the respective district portal. In this page please select “DEPARTMENTS > Social Welfare” AND “DIRECTORY > PUBLIC UTILITIES > Municipalities” AND Panchayat please use the excel sheet hyperlink against your state/UT for a new page. Here, please process the page prompts as appropriate and click on the “Sign In” button to get the file downloaded.

- Please visit the respective office and consult with the designated authority. The authority will provide the details for applying. The applicant shall meet the designated authority as advised and collect the application form or write on a plain A4 sheet as advised.

- Please complete the application form. Attach the documents as per the “Required Documents” section of this page along with the appropriate payment of fees as per acceptable mode (challan/DD) and submit it to the designated receiving authority as advised.

- After receiving the application, the authorities will examine the application and other documents furnished. If all are in place, the application will be accepted and an acknowledgement receipt will be provided. Please keep it safe for future reference.

Required Documents [ edit ]

- Application form

- Address proof of the applicant (PAN Card /Driving Licence / Bank Passbook / Electricity Bill / Telephone Bill)

- Identity proof of the applicant (Voter ID / Passport / Aadhaar card / Driving licence)

- A requisition letter

- Attested copy of the registered document (sale deed) that is in applicant’s name

- Encumbrance (EC) certificate reflecting the sale and the applicant's name as owner of the property

- Encumbrance (EC) certificate reflecting the name of the demised parent as applicable

- Original death certificate of the deceased people

- Legal heir certificate

- An affidavit may also be needed

- NOC certificate from the other legal heirs to change the name in the property tax

- Copy of the will as per requirement

- Up-to-date Property tax or vacant land tax paid receipt

- Property card as per requirement

- Aadhaar card

- NOC from the housing society as per requirement

- In case the applicant is a minor, then the guardian should provide their Aadhaar card

- Apart from the above documents, the authorities may ask for additional information or documents. Please provide them for processing.

Office Locations & Contacts [ edit ]

Commissioner & Director of Municipal Administration , Prime Hill Crest, 4th Floor, Near DGP Office, Beside Ultratech Ready Mix Plant, Vaddeswaram Village, Mangalagiri, Andhra Pradesh, Pincode: 522502. Phone: 0863-2250477 Fax: 0863-2260477 Email: [email protected] Contact Link in the given page, please select the “CONTACTS” menu and choose “CDMA Contacts“ option for a new page with contact information at the bottom. Ministry of Finance , Department of Revenue, Room No. 48C, New Delhi - 110001 (India). Phone: 91-11-23092686 Email: [email protected] Contact Link

Eligibility [ edit ]

- Applicant should be a citizen of India.

- The new owner of the property is eligible to apply.

- The application should be submitted within 3 months from the date of registration of the title deed and within 12 months in case of inheritance.

- Applicant should be the owner of the property for which the name transfer is required from its past owner.

- The property should be free from any legal litigation.

- The property tax for the particular property should be paid up to date.

- In case the applicant is a minor, then the guardian or the power of attorney shall jointly apply.

Fees [ edit ]

- Each state has different fees structure. So, it is advisable to pay as per authorities quote at the time of applying.

- The applicant needs to pay the processing fee derived by the department. The amount is based on the property.

- Please follow the mode of payment as applicable.

Validity [ edit ]

- The sale of the property.

- The transfer of ownership.

- The transfer to legal heir in case of death of property owner.

- The transfer for other reasons (family property partition etc).

Documents to Use [ edit ]

Sample documents [ edit ], processing time [ edit ].

- The property tax name change can be completed within 15 to 30 working days or as per the timeline provided by the department.

Related Videos [ edit ]

Instructions [ edit ].

- Whenever a property is acquired after executing a sale deed and registered, the owner of the property should change the name in the property tax.

- The ex-owner of the property should insist the new owner of the property to change the name in the property tax as appropriately to avoid liabilities.

- When buying a property, the buyer should pay attention to check the name on the property tax.

- Incomplete application will be rejected.

- Avoid spelling mistakes while filling the application form.

Required Information [ edit ]

- Property tax assessment number

- Zone, Ward etc.

- Door number of the property

- Existing owner name

- Applicant Name

- Nature of transaction

- Value of the property

- Name of the owner as per revenue records

- Address for correspondence

- Name of the transferor

- Name of transferee

- Complete address of the applicant

- Mobile number

- Aadhaar Number

Need for the Document [ edit ]

- The name change in the property tax arises due to purchase of a property from a seller or due to family property transferred as a result of property partition or due to inheritance due to dismissal of the parent.

- It is mandatory to have the property tax in the name of the present owner name in order to exercise true ownership.

Information which might help [ edit ]

- Always pay the property tax on time and clear all dues.

Other uses of the Document/Certificate [ edit ]

External links [ edit ], others [ edit ], navigation menu, personal tools.

- Not logged in

- Contributions

- Create account

- View history

- Recent changes

- Random page

- What links here

- Related changes

- Special pages

- Printable version

- Permanent link

- Page information

- This page was last edited on 3 November 2022, at 05:05.

- Content is available under Creative Commons Attribution unless otherwise noted.

- Privacy policy

- About Wikiprocedure

- Disclaimers

- Products and Cancellation

An official website of the United States government

Here’s how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( Lock Locked padlock icon ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

How to change your name and what government agencies to notify

You might change your name through marriage, divorce, or court. Update your new name with Social Security, the motor vehicle office, and other government agencies.

How to legally change your name

The process of changing your name through marriage, divorce, or a court order can vary between states.

Before you get married, you must apply for a marriage license. After you apply for the license and get married, your new name will be reflected on your marriage certificate. Contact the local government where you are getting married to learn about applying for a marriage license and how to change your name.

When you file for divorce, you can change your name back to the name you used before you got married. In most states, you may do so when you apply for your divorce decree. Contact your local government to learn more about changing your name when you file for divorce.

Court order

In most cases, you must file a petition with your local court to change your name. To do so, you may need to file paperwork and appear before a judge to complete the process. Find your local government website and contact your circuit court to get information about how you can legally change your name.

Government agencies to notify when you change your name

Use certified copies of marriage and divorce certificates or name change orders as proof to notify these federal and state agencies that you changed your name.

Social Security card

Notify the Social Security Administration (SSA) early. Other agencies learn of name changes through the SSA.

Driver’s license or state ID card

Contact your state motor vehicle office . Having an updated license or state ID will make changing your name with other agencies easier.

Tax returns

Every name on your tax return must match Social Security Administration records. The IRS says it is critical to update names with the SSA before filing your tax return .

U.S. passport

Report your name change to the State Department as soon as possible to get an updated passport.

Naturalization certificate and certificate of citizenship

Complete a USCIS application online or by mail to update the name on your naturalization or citizenship certificate.

Veterans benefits

If you receive veterans health care or benefits, notify the Department of Veterans Affairs (VA) .

Voter registration

Update your state voter registration:

- Online through vote.gov or

- By mail using the National Mail Voter Registration form

Postal service

Report your name change to the local post office that delivers your mail.

State benefits programs

Contact your state's social services office if you receive SNAP (food stamps), TANF (welfare), or other public assistance.

State and property taxes

Notify your state taxing authority .

If you own a home, notify the city or county property tax office.

LAST UPDATED: February 2, 2024

Have a question?

Ask a real person any government-related question for free. They will get you the answer or let you know where to find it.

Article Sample

- bee movie script

- hills like white elephants

- rosewood movie

- albert bandura

- young goodman brown

Customer Reviews

How to Order Our Online Writing Services.

There is nothing easier than using our essay writer service. Here is how everything works at :

- You fill out an order form. Make sure to provide us with all the details. If you have any comments or additional files, upload them. This will help your writer produce the paper that will exactly meet your needs.

- You pay for the order with our secure payment system.

- Once we receive the payment confirmation, we assign an appropriate writer to work on your project. You can track the order's progress in real-time through the personal panel. Also, there is an option to communicate with your writer, share additional files, and clarify all the details.

- As soon as the paper is done, you receive a notification. Now, you can read its preview version carefully in your account. If you are satisfied with our professional essay writing services, you confirm the order and download the final version of the document to your computer. If, however, you consider that any alterations are needed, you can always request a free revision. All our clients can use free revisions within 14 days after delivery. Please note that the author will revise your paper for free only if the initial requirements for the paper remain unchanged. If the revision is not applicable, we will unconditionally refund your account. However, our failure is very unlikely since almost all of our orders are completed issue-free and we have 98% satisfied clients.

As you can see, you can always turn to us with a request "Write essay for me" and we will do it. We will deliver a paper of top quality written by an expert in your field of study without delays. Furthermore, we will do it for an affordable price because we know that students are always looking for cheap services. Yes, you can write the paper yourself but your time and nerves are worth more!

The first step in making your write my essay request is filling out a 10-minute order form. Submit the instructions, desired sources, and deadline. If you want us to mimic your writing style, feel free to send us your works. In case you need assistance, reach out to our 24/7 support team.

1035 Natoma Street, San Francisco

This exquisite Edwardian single-family house has a 1344 Sqft main…

What is the best essay writer?

The team EssaysWriting has extensive experience working with highly qualified specialists, so we know who is ideal for the role of the author of essays and scientific papers:

- Easy to communicate. Yes, this point may seem strange to you, but believe me, as a person communicates with people, he manifests himself in the texts. The best essay writer should convey the idea easily and smoothly, without overloading the text or making it messy.

- Extensive work experience. To start making interesting writing, you need to write a lot every day. This practice is used by all popular authors for books, magazines and forum articles. When you read an essay, you immediately understand how long a person has been working in this area.

- Education. The ideal writer should have a philological education or at least take language courses. Spelling and punctuation errors are not allowed in the text, and the meaning should fit the given topic.

Such essay writers work in our team, so you don't have to worry about your order. We make texts of the highest level and apply for the title of leaders in this complex business.

Writing my essay with the top-notch writers!

The writers you are supposed to hire for your cheap essay writer service are accomplished writers. First of all, all of them are highly skilled professionals and have higher academic degrees like Masters and PhDs. Secondly, all the writers have work experience of more than 5 years in this domain of academic writing. They are responsible for

- Omitting any sign of plagiarism

- Formatting the draft

- Delivering order before the allocated deadline

Customer Reviews

Our Team of Essay Writers.

Some students worry about whether an appropriate author will provide essay writing services to them. With our company, you do not have to worry about this. All of our authors are professionals. You will receive a no less-than-great paper by turning to us. Our writers and editors must go through a sophisticated hiring process to become a part of our team. All the candidates pass the following stages of the hiring process before they become our team members:

- Diploma verification. Each essay writer must show his/her Bachelor's, Master's, or Ph.D. diploma.

- Grammar test. Then all candidates complete an advanced grammar test to prove their language proficiency.

- Writing task. Finally, we ask them to write a small essay on a required topic. They only have 30 minutes to complete the task, and the topic is not revealed in advance.

- Interview. The final stage is a face-to-face interview, where our managers test writers' soft skills and find out more about their personalities.

So we hire skilled writers and native English speakers to be sure that your project's content and language will be perfect. Also, our experts know the requirements of various academic styles, so they will format your paper appropriately.

Courtney Lees

What is the best custom essay writing service?

In the modern world, there is no problem finding a person who will write an essay for a student tired of studying. But you must understand that individuals do not guarantee you the quality of work and good writing. They can steal your money at any time and disappear from sight.

The best service of professional essay writing companies is that the staff give you guarantees that you will receive the text at the specified time at a reasonable cost. You have the right to make the necessary adjustments and monitor the progress of the task at all levels.

Clients are not forced to pay for work immediately; money is transferred to a bank card only after receiving a document.

The services guarantee the uniqueness of scientific work, because the employees have special education and are well versed in the topics of work. They do not need to turn to third-party sites for help. All files are checked for plagiarism so that your professors cannot make claims. Nobody divulges personal information and cooperation between the customer and the contractor remains secret.

IMAGES

VIDEO

COMMENTS

Property Tax Name Change Application Letter Formats. Whenever you purchase a new property (or) if your name is wrongly spelled in the property tax bills (or) in case of inheritance, you need to change/correct your name in the municipal records. It is the responsibility of both buyer and seller to ensure the name change, if you don't change ...

Most courteously, I would like to inform you that my name mentioned in the property tax documents is ______ (Name) whereas the actual name spelling is ______ (Correct Name). I request you to kindly correct the name spelling and do the needful at the earliest. I am attaching all required documents along with the duly filled request form for the ...

Subject: Request to change name in the property tax bill. Respected Sir/Madam, With due notice, I would like to state, my name is _____ (Name) and I live at _____ (address). I am writing this letter to request a change in the bill in the column of name. The reason for the name is _____ (Reason in brief).

In this video, you will find a sample application for change of name in property tax bill.How to write a sample letter to request change of name.To read the ...

In this video we will see how to write application letter for change of name in property tax bill sample format.DOWNLOAD & READ MORE: http://bit.ly/3J0yxLDCO...

REQUEST TO CORRECT NAME OR ADDRESS ON A REAL PROPERTY ACCOUNT Account Number: Tax Year: Instructions You may use this form to ask the Harris County Appraisal District to correct the owner's name or the mailing address on a real property account. After completing the form mail it back to the Harris County Appraisal District at the address above.

personallyknown to me to be the same person who executed the foregoing Application for Change of Name or Address of Cook County Real Estate Tax Bill,appearedbefore me this day in person,and executedthe foregoingdocument,under oath, as his/her free and voluntary act for the usesand purposes therein set forth.

The Municipal Corporation. 24 - Karoline Street. Mumbai - 700921. India. Subject : Application for correction of name in property tax. Respected Sir/ Madam, With all due respect, I regret to inform you that the name on my property tax is misspelt. I'm writing to ask that you correct my name in your records.

The documents and the application form for the name change should be submitted to the Commissioner of Revenue. This is answer to your query for how to change name in property tax records. The application will be verified upon submission and the name change in the property tax records will attain approval within a period of 15-30 days on an average.

2. Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing. 3. Edit property tax name change form pdf.

To. One Municipal Agent, _____ Municipal Corporation, Address. Sub: Application on name change in the property tax bill. Respected Sir/Madam, My designate is _____(your name), purchased a plot/house no._____ located with _____ (address of the plot/house). The plot/house has past transferred to my get until the concerned authority as per all the legal compliances.

Execute Property Tax Name Change Application Letter in just several minutes by using the instructions listed below: Choose the document template you require from the collection of legal forms. Click on the Get form button to open the document and move to editing. Fill in all of the required fields (these are yellowish).

9+ Trainee Appointment Letters. Create a Property Transfer Letter for Cases Such as Change of Land Ownership, Turnover of a House, Name Change Request of a Real Estate Plot, or Tax Reasons. Here, We Have Free Download Sample Templates to Choose From. Each Doc Example is Available in PDF, Word, and Google Docs Format.

Instructions for Form W-7 (Rev. November 2021) - IRS If your ITIN wasn't included on a U.S. federal tax return at least once for tax years 2018, 2019, and 2020, your. ITIN will expire on December 31, 2021. ITINs ... Address Name Change Form (PDF) This change will affect the assessment roll only. Steps must be taken to change legal title to the property.

The ex-owner of the property should insist the new owner of the property to change the name in the property tax as appropriately to avoid liabilities. When buying a property, the buyer should pay attention to check the name on the property tax. Incomplete application will be rejected. Avoid spelling mistakes while filling the application form ...

After the documents and application are submitted and verified, the change will reflect in the records within 15 to 30 days. Mutation of the Property. Apart from the change of name in the property tax, mutation of the property is also necessary for the seamless transfer of the title of ownership to the new owner. For this, the NOC of the ...