- Sample Plans

- WHY UPMETRICS?

Upmetrics AI Assistant: Simplifying Business Planning through AI-Powered Insights. Learn How

- 400+ Sample Business Plans

Customers Success Stories

Business Plan Course

Strategic Canvas Templates

E-books, Guides & More

Business consultants

Entrepreneurs and Small Business

Accelerators and Incubators

Educators & Business Schools

Students & Scholars

AI Business Plan Generator

Financial Forecasting

AI Assistance

Ai pitch deck generator

Stratrgic Planning

See How Upmetrics Works →

Small Business Tools

Entrepreneurs & Small Business

Accelerators & Incubators

Business Consultants & Advisors

Strategic Planning

How to Prepare a Financial Plan for Startup Business (w/ example)

Free Financial Statements Template

Ajay Jagtap

- December 7, 2023

13 Min Read

If someone were to ask you about your business financials, could you give them a detailed answer?

Let’s say they ask—how do you allocate your operating expenses? What is your cash flow situation like? What is your exit strategy? And a series of similar other questions.

Instead of mumbling what to answer or shooting in the dark, as a founder, you must prepare yourself to answer this line of questioning—and creating a financial plan for your startup is the best way to do it.

A business plan’s financial plan section is no easy task—we get that.

But, you know what—this in-depth guide and financial plan example can make forecasting as simple as counting on your fingertips.

Ready to get started? Let’s begin by discussing startup financial planning.

What is Startup Financial Planning?

Startup financial planning, in simple terms, is a process of planning the financial aspects of a new business. It’s an integral part of a business plan and comprises its three major components: balance sheet, income statement, and cash-flow statement.

Apart from these statements, your financial section may also include revenue and sales forecasts, assets & liabilities, break-even analysis , and more. Your first financial plan may not be very detailed, but you can tweak and update it as your company grows.

Key Takeaways

- Realistic assumptions, thorough research, and a clear understanding of the market are the key to reliable financial projections.

- Cash flow projection, balance sheet, and income statement are three major components of a financial plan.

- Preparing a financial plan is easier and faster when you use a financial planning tool.

- Exploring “what-if” scenarios is an ideal method to understand the potential risks and opportunities involved in the business operations.

Why is Financial Planning Important to Your Startup?

Poor financial planning is one of the biggest reasons why most startups fail. In fact, a recent CNBC study reported that running out of cash was the reason behind 44% of startup failures in 2022.

A well-prepared financial plan provides a clear financial direction for your business, helps you set realistic financial objectives, create accurate forecasts, and shows your business is committed to its financial objectives.

It’s a key element of your business plan for winning potential investors. In fact, YC considered recent financial statements and projections to be critical elements of their Series A due diligence checklist .

Your financial plan demonstrates how your business manages expenses and generates revenue and helps them understand where your business stands today and in 5 years.

Makes sense why financial planning is important to your startup, doesn’t it? Let’s cut to the chase and discuss the key components of a startup’s financial plan.

Say goodbye to old-school excel sheets & templates

Make accurate financial plan faster with AI

Plans starting from $7/month

Key Components of a Startup Financial Plan

Whether creating a financial plan from scratch for a business venture or just modifying it for an existing one, here are the key components to consider including in your startup’s financial planning process.

Income Statement

An Income statement , also known as a profit-and-loss statement(P&L), shows your company’s income and expenditures. It also demonstrates how your business experienced any profit or loss over a given time.

Consider it as a snapshot of your business that shows the feasibility of your business idea. An income statement can be generated considering three scenarios: worst, expected, and best.

Your income or P&L statement must list the following:

- Cost of goods or cost of sale

- Gross margin

- Operating expenses

- Revenue streams

- EBITDA (Earnings before interest, tax, depreciation , & amortization )

Established businesses can prepare annual income statements, whereas new businesses and startups should consider preparing monthly statements.

Cash flow Statement

A cash flow statement is one of the most critical financial statements for startups that summarize your business’s cash in-and-out flows over a given time.

This section provides details on the cash position of your business and its ability to meet monetary commitments on a timely basis.

Your cash flow projection consists of the following three components:

✅ Cash revenue projection: Here, you must enter each month’s estimated or expected sales figures.

✅ Cash disbursements: List expenditures that you expect to pay in cash for each month over one year.

✅ Cash flow reconciliation: Cash flow reconciliation is a process used to ensure the accuracy of cash flow projections. The adjusted amount is the cash flow balance carried over to the next month.

Furthermore, a company’s cash flow projections can be crucial while assessing liquidity, its ability to generate positive cash flows and pay off debts, and invest in growth initiatives.

Balance Sheet

Your balance sheet is a financial statement that reports your company’s assets, liabilities, and shareholder equity at a given time.

Consider it as a snapshot of what your business owns and owes, as well as the amount invested by the shareholders.

This statement consists of three parts: assets , liabilities, and the balance calculated by the difference between the first two. The final numbers on this sheet reflect the business owner’s equity or value.

Balance sheets follow the following accounting equation with assets on one side and liabilities plus Owner’s equity on the other:

Here is what’s the core purpose of having a balance-sheet:

- Indicates the capital need of the business

- It helps to identify the allocation of resources

- It calculates the requirement of seed money you put up, and

- How much finance is required?

Since it helps investors understand the condition of your business on a given date, it’s a financial statement you can’t miss out on.

Break-even Analysis

Break-even analysis is a startup or small business accounting practice used to determine when a company, product, or service will become profitable.

For instance, a break-even analysis could help you understand how many candles you need to sell to cover your warehousing and manufacturing costs and start making profits.

Remember, anything you sell beyond the break-even point will result in profit.

You must be aware of your fixed and variable costs to accurately determine your startup’s break-even point.

- Fixed costs: fixed expenses that stay the same no matter what.

- Variable costs: expenses that fluctuate over time depending on production or sales.

A break-even point helps you smartly price your goods or services, cover fixed costs, catch missing expenses, and set sales targets while helping investors gain confidence in your business. No brainer—why it’s a key component of your startup’s financial plan.

Having covered all the key elements of a financial plan, let’s discuss how you can create a financial plan for your startup.

How to Create a Financial Section of a Startup Business Plan?

1. determine your financial needs.

You can’t start financial planning without understanding your financial requirements, can you? Get your notepad or simply open a notion doc; it’s time for some critical thinking.

Start by assessing your current situation by—calculating your income, expenses , assets, and liabilities, what the startup costs are, how much you have against them, and how much financing you need.

Assessing your current financial situation and health will help determine how much capital you need for your startup and help plan fundraising activities and outreach.

Furthermore, determining financial needs helps prioritize operational activities and expenses, effectively allocate resources, and increase the viability and sustainability of a business in the long run.

Having learned to determine financial needs, let’s head straight to setting financial goals.

2. Define Your Financial Goals

Setting realistic financial goals is fundamental in preparing an effective financial plan. So, it would help to outline your long-term strategies and goals at the beginning of your financial planning process.

Let’s understand it this way—if you are a SaaS startup pursuing VC financing rounds, you may ask investors about what matters to them the most and prepare your financial plan accordingly.

However, a coffee shop owner seeking a business loan may need to create a plan that appeals to banks, not investors. At the same time, an internal financial plan designed to offer financial direction and resource allocation may not be the same as previous examples, seeing its different use case.

Feeling overwhelmed? Just define your financial goals—you’ll be fine.

You can start by identifying your business KPIs (key performance indicators); it would be an ideal starting point.

3. Choose the Right Financial Planning Tool

Let’s face it—preparing a financial plan using Excel is no joke. One would only use this method if they had all the time in the world.

Having the right financial planning software will simplify and speed up the process and guide you through creating accurate financial forecasts.

Many financial planning software and tools claim to be the ideal solution, but it’s you who will identify and choose a tool that is best for your financial planning needs.

Create a Financial Plan with Upmetrics in no time

Enter your Financial Assumptions, and we’ll calculate your monthly/quarterly and yearly financial projections.

Start Forecasting

4. Make Assumptions Before Projecting Financials

Once you have a financial planning tool, you can move forward to the next step— making financial assumptions for your plan based on your company’s current performance and past financial records.

You’re just making predictions about your company’s financial future, so there’s no need to overthink or complicate the process.

You can gather your business’ historical financial data, market trends, and other relevant documents to help create a base for accurate financial projections.

After you have developed rough assumptions and a good understanding of your business finances, you can move forward to the next step—projecting financials.

5. Prepare Realistic Financial Projections

It’s a no-brainer—financial forecasting is the most critical yet challenging aspect of financial planning. However, it’s effortless if you’re using a financial planning software.

Upmetrics’ forecasting feature can help you project financials for up to 7 years. However, new startups usually consider planning for the next five years. Although it can be contradictory considering your financial goals and investor specifications.

Following are the two key aspects of your financial projections:

Revenue Projections

In simple terms, revenue projections help investors determine how much revenue your business plans to generate in years to come.

It generally involves conducting market research, determining pricing strategy , and cash flow analysis—which we’ve already discussed in the previous steps.

The following are the key components of an accurate revenue projection report:

- Market analysis

- Sales forecast

- Pricing strategy

- Growth assumptions

- Seasonal variations

This is a critical section for pre-revenue startups, so ensure your projections accurately align with your startup’s financial model and revenue goals.

Expense Projections

Both revenue and expense projections are correlated to each other. As revenue forecasts projected revenue assumptions, expense projections will estimate expenses associated with operating your business.

Accurately estimating your expenses will help in effective cash flow analysis and proper resource allocation.

These are the most common costs to consider while projecting expenses:

- Fixed costs

- Variable costs

- Employee costs or payroll expenses

- Operational expenses

- Marketing and advertising expenses

- Emergency fund

Remember, realistic assumptions, thorough research, and a clear understanding of your market are the key to reliable financial projections.

6. Consider “What if” Scenarios

After you project your financials, it’s time to test your assumptions with what-if analysis, also known as sensitivity analysis.

Using what-if analysis with different scenarios while projecting your financials will increase transparency and help investors better understand your startup’s future with its best, expected, and worst-case scenarios.

Exploring “what-if” scenarios is the best way to better understand the potential risks and opportunities involved in business operations. This proactive exercise will help you make strategic decisions and necessary adjustments to your financial plan.

7. Build a Visual Report

If you’ve closely followed the steps leading to this, you know how to research for financial projections, create a financial plan, and test assumptions using “what-if” scenarios.

Now, we’ll prepare visual reports to present your numbers in a visually appealing and easily digestible format.

Don’t worry—it’s no extra effort. You’ve already made a visual report while creating your financial plan and forecasting financials.

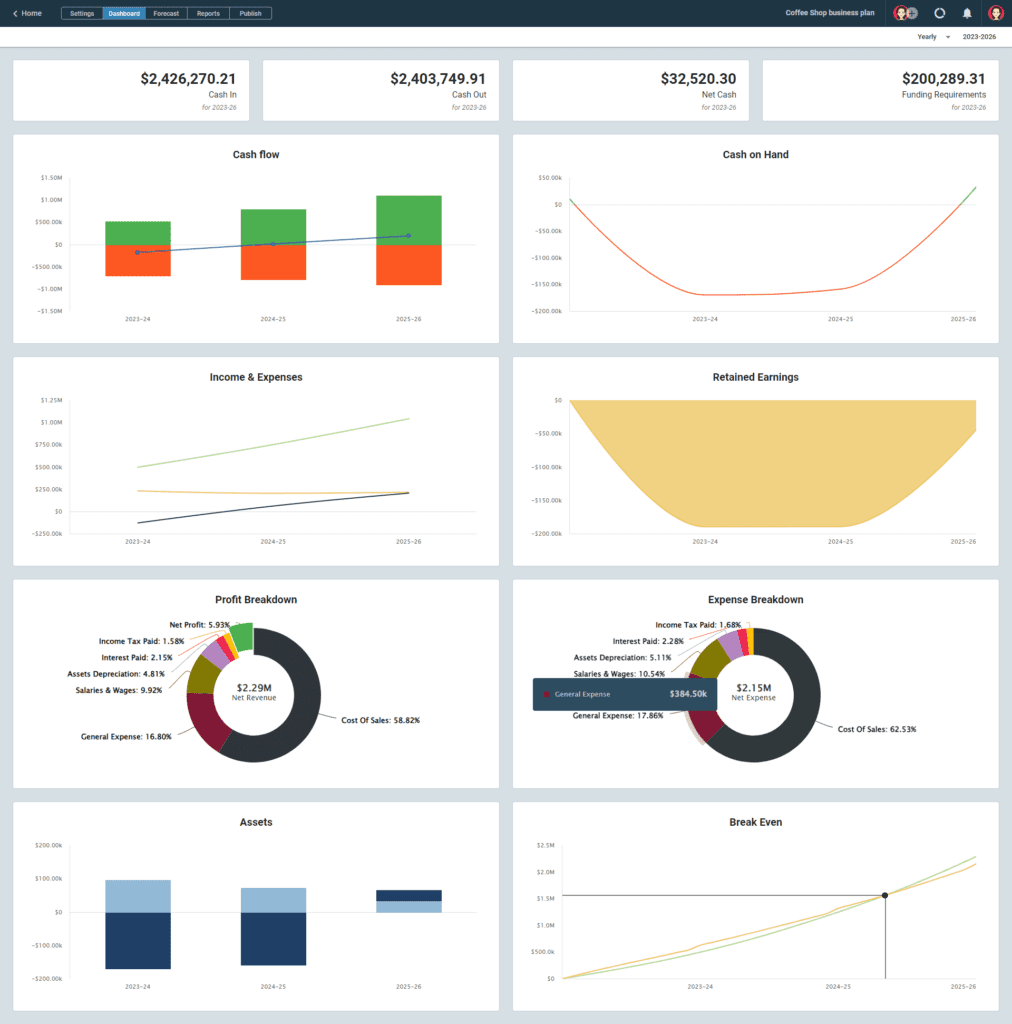

Check the dashboard to see the visual presentation of your projections and reports, and use the necessary financial data, diagrams, and graphs in the final draft of your financial plan.

Here’s what Upmetrics’ dashboard looks like:

8. Monitor and Adjust Your Financial Plan

Even though it’s not a primary step in creating a good financial plan, it’s quite essential to regularly monitor and adjust your financial plan to ensure the assumptions you made are still relevant, and you are heading in the right direction.

There are multiple ways to monitor your financial plan.

For instance, you can compare your assumptions with actual results to ensure accurate projections based on metrics like new customers acquired and acquisition costs, net profit, and gross margin.

Consider making necessary adjustments if your assumptions are not resonating with actual numbers.

Also, keep an eye on whether the changes you’ve identified are having the desired effect by monitoring their implementation.

And that was the last step in our financial planning guide. However, it’s not the end. Have a look at this financial plan example.

Startup Financial Plan Example

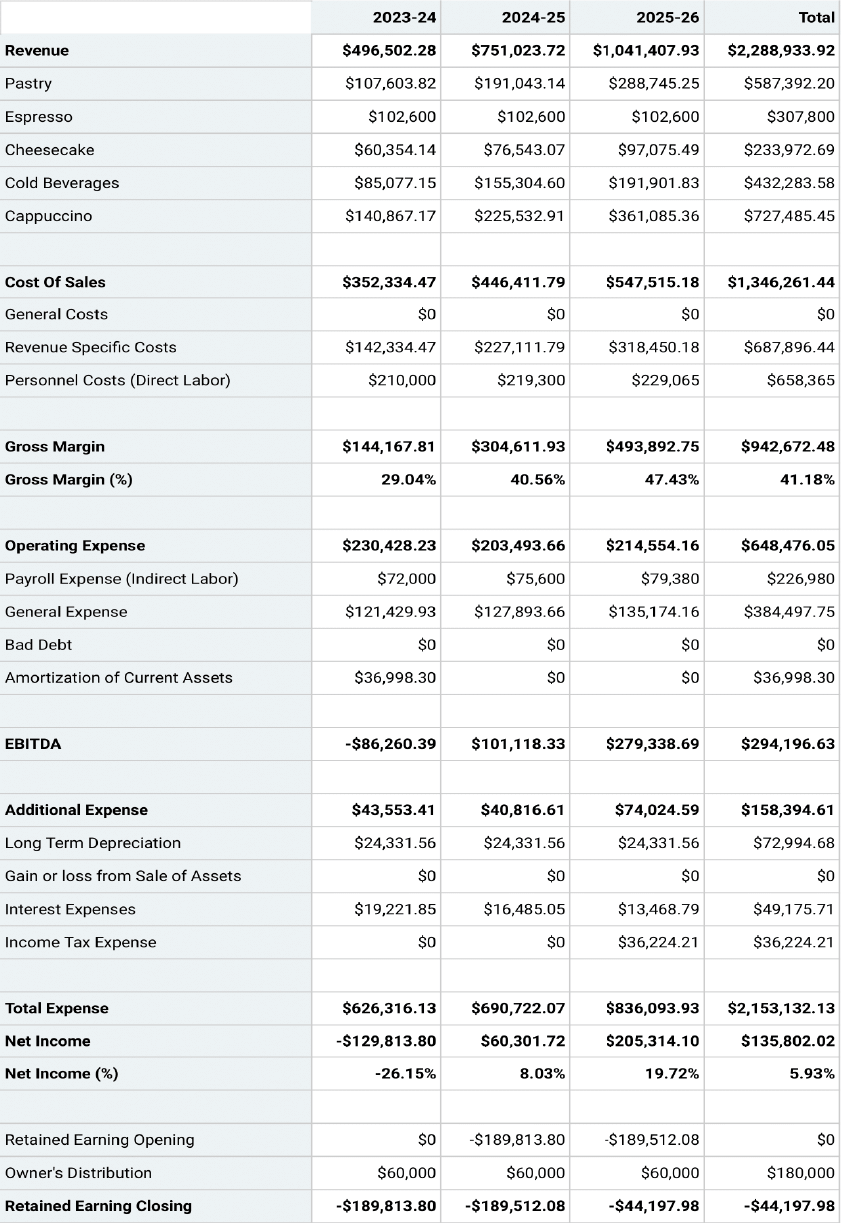

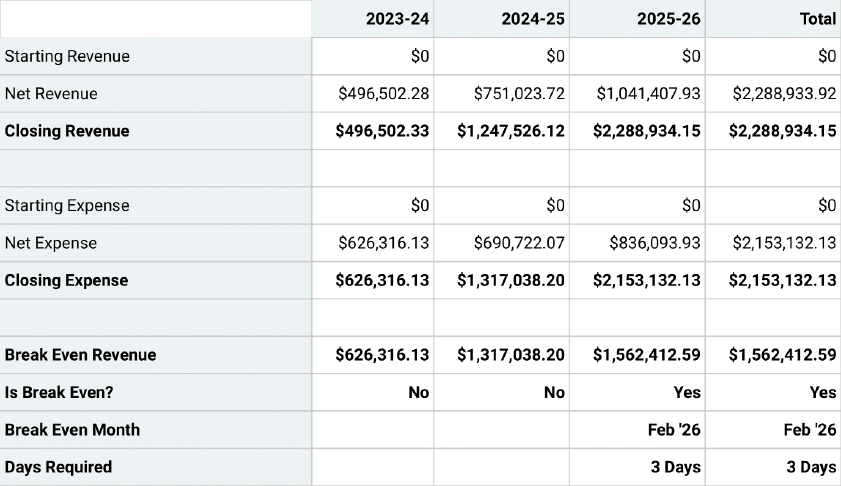

Having learned about financial planning, let’s quickly discuss a coffee shop startup financial plan example prepared using Upmetrics.

Important Assumptions

- The sales forecast is conservative and assumes a 5% increase in Year 2 and a 10% in Year 3.

- The analysis accounts for economic seasonality – wherein some months revenues peak (such as holidays ) and wanes in slower months.

- The analysis assumes the owner will not withdraw any salary till the 3rd year; at any time it is assumed that the owner’s withdrawal is available at his discretion.

- Sales are cash basis – nonaccrual accounting

- Moderate ramp- up in staff over the 5 years forecast

- Barista salary in the forecast is $36,000 in 2023.

- In general, most cafes have an 85% gross profit margin

- In general, most cafes have a 3% net profit margin

Projected Balance Sheet

Projected Cash-Flow Statement

Projected Profit & Loss Statement

Break Even Analysis

Start Preparing Your Financial Plan

We covered everything about financial planning in this guide, didn’t we? Although it doesn’t fulfill our objective to the fullest—we want you to finish your financial plan.

Sounds like a tough job? We have an easy way out for you—Upmetrics’ financial forecasting feature. Simply enter your financial assumptions, and let it do the rest.

So what are you waiting for? Try Upmetrics and create your financial plan in a snap.

Build your Business Plan Faster

with step-by-step Guidance & AI Assistance.

Frequently Asked Questions

How often should i update my financial projections.

Well, there is no particular rule about it. However, reviewing and updating your financial plan once a year is considered an ideal practice as it ensures that the financial aspirations you started and the projections you made are still relevant.

How do I estimate startup costs accurately?

You can estimate your startup costs by identifying and factoring various one-time, recurring, and hidden expenses. However, using a financial forecasting tool like Upmetrics will ensure accurate costs while speeding up the process.

What financial ratios should startups pay attention to?

Here’s a list of financial ratios every startup owner should keep an eye on:

- Net profit margin

- Current ratio

- Quick ratio

- Working capital

- Return on equity

- Debt-to-equity ratio

- Return on assets

- Debt-to-asset ratio

What are the 3 different scenarios in scenario analysis?

As discussed earlier, Scenario analysis is the process of ascertaining and analyzing possible events that can occur in the future. Startups or businesses often consider analyzing these three scenarios:

- base-case (expected) scenario

- Worst-case scenario

- best case scenario.

About the Author

Ajay is a SaaS writer and personal finance blogger who has been active in the space for over three years, writing about startups, business planning, budgeting, credit cards, and other topics related to personal finance. If not writing, he’s probably having a power nap. Read more

Related Articles

How to Write a Business Plan Complete Guide

How to Calculate Business Startup Costs

20+ Financial Advisor Statistics You Must Know in 2024

Reach your goals with accurate planning.

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Popular Templates

How to Write a Small Business Financial Plan

Noah Parsons

3 min. read

Updated January 3, 2024

Creating a financial plan is often the most intimidating part of writing a business plan. It’s also one of the most vital. Businesses with well-structured and accurate financial statements in place are more prepared to pitch to investors, receive funding, and achieve long-term success.

Thankfully, you don’t need an accounting degree to successfully put your budget and forecasts together. Here is everything you need to include in your financial plan along with optional performance metrics, specifics for funding, and free templates.

- Key components of a financial plan

A sound financial plan is made up of six key components that help you easily track and forecast your business financials. They include your:

Sales forecast

What do you expect to sell in a given period? Segment and organize your sales projections with a personalized sales forecast based on your business type.

Subscription sales forecast

While not too different from traditional sales forecasts—there are a few specific terms and calculations you’ll need to know when forecasting sales for a subscription-based business.

Expense budget

Create, review, and revise your expense budget to keep your business on track and more easily predict future expenses.

How to forecast personnel costs

How much do your current, and future, employees’ pay, taxes, and benefits cost your business? Find out by forecasting your personnel costs.

Profit and loss forecast

Track how you make money and how much you spend by listing all of your revenue streams and expenses in your profit and loss statement.

Cash flow forecast

Manage and create projections for the inflow and outflow of cash by building a cash flow statement and forecast.

Balance sheet

Need a snapshot of your business’s financial position? Keep an eye on your assets, liabilities, and equity within the balance sheet.

What to include if you plan to pursue funding

Do you plan to pursue any form of funding or financing? If the answer is yes, then there are a few additional pieces of information that you’ll need to include as part of your financial plan.

Highlight any risks and assumptions

Every entrepreneur takes risks with the biggest being assumptions and guesses about the future. Just be sure to track and address these unknowns in your plan early on.

Plan your exit strategy

Investors will want to know your long-term plans as a business owner. While you don’t need to have all the details, it’s worth taking the time to think through how you eventually plan to leave your business.

- Financial ratios and metrics

With all of your financial statements and forecasts in place, you have all the numbers needed to calculate insightful financial ratios. While these metrics are entirely optional to include in your plan, having them easily accessible can be valuable for tracking your performance and overall financial situation.

Common business ratios

Unsure of which business ratios you should be using? Check out this list of key financial ratios that bankers, financial analysts, and investors will want to see.

Break-even analysis

Do you want to know when you’ll become profitable? Find out how much you need to sell to offset your production costs by conducting a break-even analysis.

How to calculate ROI

How much could a business decision be worth? Evaluate the efficiency or profitability by calculating the potential return on investment (ROI).

- Financial plan templates and tools

Download and use these free financial templates and calculators to easily create your own financial plan.

Sales forecast template

Download a free detailed sales forecast spreadsheet, with built-in formulas, to easily estimate your first full year of monthly sales.

Download Template

Accurate and easy financial forecasting

Get a full financial picture of your business with LivePlan's simple financial management tools.

Get Started

See why 1.2 million entrepreneurs have written their business plans with LivePlan

Noah is the COO at Palo Alto Software, makers of the online business plan app LivePlan. He started his career at Yahoo! and then helped start the user review site Epinions.com. From there he started a software distribution business in the UK before coming to Palo Alto Software to run the marketing and product teams.

Table of Contents

- What to include for funding

Related Articles

10 Min. Read

How to Write the Company Overview for a Business Plan

How to Write a Competitive Analysis for Your Business Plan

How to Set and Use Milestones in Your Business Plan

24 Min. Read

The 10 AI Prompts You Need to Write a Business Plan

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

How to Write a Financial Analysis Report for Your Business

In this Article

Is your business worth investing in? For most of you, the answer is a definitive 'Yes.' But in the business world, talk is cheap. So if you want to attract investors, you'll need to be able to walk the talk, i.e., put your money where your mouth is.

There's no better way to do that than with a financial analysis report. After all, numbers don't lie. They're the smoking gun investors need before investing in your business.

Want to learn how to write a financial analysis report that attracts investors? This article covers six simple steps to follow. But first:

What is a financial analysis report?

A financial analysis report shows the financial performance of your business over a specified period of time, usually on a quarterly or yearly basis. It's like a medical report but for your business's financial health.

In several countries, financial reporting is a requirement. The Securities and Exchange Commission requires companies to disseminate these digital reports to their shareholders in the United States. In addition, these financial reports are usually made available to the public if they're publicly-listed companies

A financial analysis report is invaluable to both you and your stakeholders. Let's discuss why you need it in the next section.

How does a financial analysis report help?

To make the right financial decisions for your business, you need data. This helps you lay a solid foundation for future performance and economic growth opportunities.

However, you need to be able to keep track of and make sense of all your financial data. That's where a financial analysis report comes in. It helps you organize, analyze, and paint a clearer picture of your business's cash flow and allows for seamless management of business expenses too.

Aside from those, here are a couple of more reasons why you need a financial analysis report:

Ensures transparency

A financial analysis report is easy on the eyes. It's a watered-down version of your finances that communicates essential data you need to make financial decisions.

You ensure the transparency your stakeholders want, too.

Tracks cash flow

Generally, financial reports help you understand cash inflows and outflows . For example, if you know your affiliate sales and operating expenses, the cost of getting links to increase website traffic , social media marketing campaign expenditure, and the money coming in, you can make better financial decisions.

The information can help with debt ratios, budgeting, debt-to-asset financial ratio analysis, and calculating profit margins.

Suggested Reads: 10 Ways to Improve Your Business's Finance Position

Allows for data-driven forecasting

Historical and real-time financial data help create financial models to predict future financial performance. These reports help you identify trends, patterns, and problems. As a result, you can plan for them early enough.

Simplifies taxation

To create a financial analysis report, you must have all your data in a single document. It becomes easier for you to do your taxes, saves you time, and reduces the chances of making errors. Moreover, it's an official document that the Internal Revenue Service can use to calculate your taxes.

At the end of the day, the goal of a financial report is to provide insight into your organization's finances. Then, using both historical and current data, you can set SMART business goals to make better decisions for future performance.

Finally, it's essential to consider the ongoing nature of financial analysis and the need for periodic reviews. Implementing a project review process allows you to regularly assess the financial health of your business, identify any emerging trends or issues, and make informed adjustments to your financial strategies. This continuous evaluation ensures that your financial analysis remains up-to-date and relevant, providing you and your stakeholders with accurate insights into your business's performance.

Suggested Reads: 2022 Business Expense Categories Cheat Sheet: Top 15 Tax-Deductible Categories

Benefits of a periodic financial analysis

Financial analysis makes it easy for you to identify the strengths and weaknesses of your business. Using that information will not only help your business grow but also thrive. What's more, doing financial analysis over specific periods helps you stay on top of your game by:

Helping manage debts

A periodic financial analysis includes a financial ratio analysis; specifically, a Liquidity Ratio called the Current Ratio Analysis. The Current Ratio is the sum of all your current assets divided by the sum of your current liabilities. It shows if you're liquid enough to meet your upcoming debts. So, if you aren't, you can adjust your financial strategy the soonest.

Determining profitability

When you perform a periodic financial analysis, you can determine your company's profitability and make regular adjustments. A profitability ratio is a financial metric that can help you cut production costs and boost your bottom line.

You can use a profitability ratio (featured below) to determine your profit margin on sales, i.e., your gross profit margin. Here's the formula.

It's your sales revenue minus the total cost of goods sold (COGS) divided by revenue.

Managing inventory

Another perk of doing financial analysis over a specific period is that it helps you better manage inventory . This way, you ensure it's always enough to meet projected sales. You do this using a financial management ratio called the Inventory Turnover Ratio.

Calculate the Turnover Ratio by dividing your total sale by your inventory.

Checking stability and revenue growth

The results of a periodic financial analysis yield your debt-to-equity ratio, too. It's a financial metric that shows how you've raised capital for your business. You want to check your stability and revenue growth every step of the way to determine whether your business is viable in the long run.

The debt-equity ratio is calculated by dividing your total liabilities by your shareholder's equity. It's usually included when you write a financial analysis report.

Generally speaking, the higher your debt-equity ratio, the higher the risk, and vice versa. Investors use this financial metric to check your company's stability and ability to raise money to grow.

Optimizing for growth

Financial analysis over specific periods helps you identify opportunities to optimize operational efficiency for revenue growth. That is, regular annual reports help you spot patterns and trends. This allows you to nip problematic areas in the bud and prepare in advance.

For instance, you can adjust seasonal sales fluctuations, variable costs, etc.

How to write a financial analysis report

Now that you understand a financial analysis report's 'what' and 'why,' it's time to look at the 'how.'

Here's how to write a financial analysis report:

1. Give an overview of the company

The first section of your financial analysis report is the company overview. Here, you want to highlight the potential of your business. It's pretty much what you do in a business plan . Investors rely on your company overview to understand your competitive edge.

The question you want to answer here is - is your business worth the investment you're asking for? Think of the introductions in business plans or on Shark Tank to give you a better idea. As a general rule of thumb, you want to use plain language when writing your description.

You want to share, in brief, your history, business model, type of organization, description, etc. You can share what sector you're in as well as the size and scale of your business.

Featured below is an excellent example of a fictional company's overview.

Start by reviewing your quarterly or yearly financing activities, financial data, and statements. Then go through published business studies and industry-specific trade journals.

You should consider adding a snippet about how you compare to the industry average among your competitors. Like a business plan, you want to show potential investors why they should choose you. You can use Porter's Five Forces model to analyze your competition.

2. Write sales forecast and other vital sections

It pays to be as precise and comprehensive as possible when writing the main content. So, you’ll need to organize your data and, sometimes, make some calculations yourself. For instance, when writing your sales forecast , you need your sales data for the past three years before you organize it in financial reporting software or spreadsheets. Tally the data on a yearly, monthly (for the 1st year), and quarterly (for the last two years) basis.

You can write this part using a spreadsheet. But feel free to use financial reporting software if spreadsheets aren’t your cup of tea.

There are other sections you should create for your report’s main body.

Let’s look at them one by one:

- Expense budget

With your sales forecast in place, it's time to figure out how much it'll cost. When setting up your expense budget , ensure it includes variable costs like your marketing budget and fixed costs like rent. In addition, you'll need to create an estimate for items like interest and taxes.

- Cash flow statement

A cash flow statement summarizes all the money or its equal coming in (cash inflow) or leaving (cash outflow) a business. To create one, you need historical financial data or project it one year ahead if you're starting. Don't forget your cash flow statement is connected to your invoice.

- Estimate for net profit

Tally your net profit using your sales forecast, expense budget, and cash flow statement data. Your net profit margin is your gross margin less taxes, interest, and expenses. Try and be as precise as possible since this can stand in as your profit and loss (P&L) statement .

- Estimate for assets and liabilities

Your next step is to calculate your company's net worth. How? By managing your assets and liabilities, i.e., those items that don't appear in your P&L statement.

To do that, ballpark your monthly cash on hand. That is, equipment, inventory, land, and accounts receivable. Then sum up your liabilities, i.e., outstanding loan debts and accounts payable.

- Break-even point

The last step in writing a company financial analysis report is calculating your break-even point. That's where your business expenses match your sales volume. Use the formula below to find your three-year sales forecast; this will help you find your break-even point.

Needless to say, if you're operating a profitable business model, then your company's revenue should be higher than your operating expenses. Again, this information helps reassure potential investors of your business' stability and revenue growth potential.

Refrain from assuming that people know the concepts you'll discuss in your report. Instead, define them in general terms first before you start talking about specifics.

3. Determine the company's valuation

The company valuation part is one of the most critical sections of your financial analysis report. Why? Because it helps potential investors see the value of investing in your company.

To determine your business' valuation is to find your company's value. You do this by analyzing your company data, including all the data you have discussed. There are three main ways to do it, i.e., using the following:

- Discounted Cash Flow (DCF) Analysis

- Book Value Analysis

- Relative Value Method

The goal here is to outline your current assets and liabilities. Moreover, the above techniques help you determine your business' stocks and current value. To do this, most accountants or financial officers use insights from and final average accounts of your balance sheet.

4. Perform risk analysis

Risk analysis helps potential investors see your company's investment potential. That includes both current and future risks. You can start risk analysis by running a SWOT analysis .

But remember that your SWOT analysis is microscopic. So for the best results in your valuation, combine it with other techniques. For example, doing a PESTLE analysis . Here's a template you can use for that:

A PESTLE analysis gives you more details and offers two main benefits. First, it helps you understand your marketing environment and other macro factors that affect your company's financials.

5. Include summaries of financial statements

When writing the financial analysis report of a company, you need to include a brief overview of your company's financial statements. To do this, summarize each component of the 3-statement model:

Let's discuss each of them:

Cash flow statement. Potential investors look at your cash flow statement summary for two reasons. One, it lets them see if you make enough money to settle your debts. Two, it helps them decide whether your company is worth investing in.

Income statement . A summary of this does two things. First, it shows you gaps in increasing operating profit by allowing you to boost sales revenue , reduce cost, or both. It's also an income statement showing how effective your strategies are at the start of your financial year.

Balance sheet. The balance sheet shows your debt coverage and asset liquidity in real time. The difference between assets and liabilities gives you the 'owner's equity.' Here's an example of a balance sheet:

Note that summarizing each of these three components doesn't mean just including tables in your report. Instead, explain what the data means in paragraph form, too.

6. Summarize the entire report

The last section of the financial analysis report of a company is a summary. You want to share your final views about the company and your opinion on whether it's a profit or loss. That said, be sure to substantiate all your claims.

That means having evidence containing factual data, financial accounts, and proven financial theories. You can also include the outlook of the company. That is the type of organization, industry trends, economic growth strategies, and how they'll affect the company.

In conclusion

By now, you should understand the value of a company financial analysis report and how to write one. Not only does it show you the financial health status of a company, but it's also the smoking gun investors look for before investing in any business.

To any organization, a financial analysis report is a compass to optimize operational efficiency for growth. It is also a crucial part in portfolio management especially when you need to open your business up to other stakeholders.

Summarising, to write a financial analysis report, you need to:

Write your company overview , sales forecast, and other essential sections. Once those are out of the way, you can perform company valuation and risk analysis. Then, all that's left is to summarize what was discussed.

Daryl Bush is the Business Development Manager at Authority.Builders . The company helps businesses acquire more customers through improved online search rankings. He has extensive knowledge of SEO and business development.

How to Write a Financial Analysis Report in 6 steps

Stay updated with fyle by signing up for our newsletter.

What Are Real-Time Feeds, and Why Do They Matter

Automating expense management: what cxos and cpas really worry about (and how to solve them).

Amex Corporate Gold Card: Control, Rewards, & Peace of Mind

The Challenges In Expense Management: What's Really Bothering CXOs and CPAs

Close books faster with Fyle. Schedule a demo now.

Call Us (877) 968-7147

Most popular blog categories

- Payroll Tips

- Accounting Tips

- Accountant Professional Tips

How to Craft the Financial Section of Business Plan (Hint: It’s All About the Numbers)

Writing a small business plan takes time and effort … especially when you have to dive into the numbers for the financial section. But, working on the financial section of business plan could lead to a big payoff for your business.

Read on to learn what is the financial section of a business plan, why it matters, and how to write one for your company.

What is the financial section of business plan?

Generally, the financial section is one of the last sections in a business plan. It describes a business’s historical financial state (if applicable) and future financial projections. Businesses include supporting documents such as budgets and financial statements, as well as funding requests in this section of the plan.

The financial part of the business plan introduces numbers. It comes after the executive summary, company description , market analysis, organization structure, product information, and marketing and sales strategies.

Businesses that are trying to get financing from lenders or investors use the financial section to make their case. This section also acts as a financial roadmap so you can budget for your business’s future income and expenses.

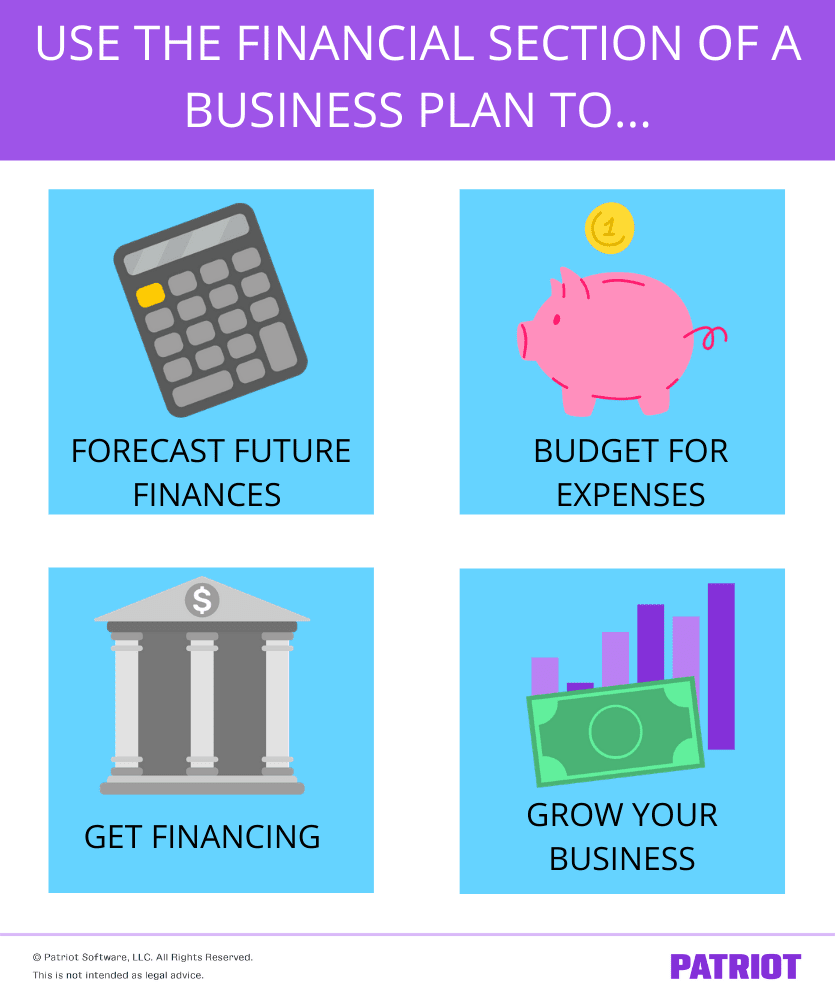

Why it matters

The financial section of the business plan is critical for moving beyond wordy aspirations and into hard data and the wonderful world of numbers.

Through the financial section, you can:

- Forecast your business’s future finances

- Budget for expenses (e.g., startup costs)

- Get financing from lenders or investors

- Grow your business

- Growth : 64% of businesses with a business plan were able to grow their business, compared to 43% of businesses without a business plan.

- Financing : 36% of businesses with a business plan secured a loan, compared to 18% of businesses without a plan.

So, if you want to possibly double your chances of securing a business loan, consider putting in a little time and effort into your business plan’s financial section.

Writing your financial section

To write the financial section, you first need to gather some information. Keep in mind that the information you gather depends on whether you have historical financial information or if you’re a brand-new startup.

Your financial section should detail:

- Business expenses

Financial projections

Financial statements, break-even point, funding requests, exit strategy, business expenses.

Whether you’ve been in business for one day or 10 years, you have expenses. These expenses might simply be startup costs for new businesses or fixed and variable costs for veteran businesses.

Take a look at some common business expenses you may need to include in the financial section of business plan:

- Licenses and permits

- Cost of goods sold

- Rent or mortgage payments

- Payroll costs (e.g., salaries and taxes)

- Utilities

- Equipment

- Supplies

- Advertising

Write down each type of expense and amount you currently have as well as expenses you predict you’ll have. Use a consistent time period (e.g., monthly costs).

Indicate which expenses are fixed (unchanging month-to-month) and which are variable (subject to changes).

How much do you anticipate earning from sales each month?

If you operate an existing business, you can look at previous monthly revenue to make an educated estimate. Take factors into consideration, like seasonality and economic ups and downs, when basing projections on previous cash flow.

Coming up with your financial projections may be a bit trickier if you are a startup. After all, you have nothing to go off of. Come up with a reasonable monthly goal based on things like your industry, competitors, and the market. Hint : Look at your market analysis section of the business plan for guidance.

A financial statement details your business’s finances. The three main types of financial statements are income statements, cash flow statements, and balance sheets.

Income statements summarize your business’s income and expenses during a period of time (e.g., a month). This document shows whether your business had a net profit or loss during that time period.

Cash flow statements break down your business’s incoming and outgoing money. This document details whether your company has enough cash on hand to cover expenses.

The balance sheet summarizes your business’s assets, liabilities, and equity. Balance sheets help with debt management and business growth decisions.

If you run a startup, you can create “pro forma financial statements,” which are statements based on projections.

If you’ve been in business for a bit, you should have financial statements in your records. You can include these in your business plan. And, include forecasted financial statements.

You’re just in luck. Check out our FREE guide, Use Financial Statements to Assess the Health of Your Business , to learn more about the different types of financial statements for your business.

Potential investors want to know when your business will reach its break-even point. The break-even point is when your business’s sales equal its expenses.

Estimate when your company will reach its break-even point and detail it in the financial section of business plan.

If you’re looking for financing, detail your funding request here. Include how much you are looking for, list ideal terms (e.g., 10-year loan or 15% equity), and how long your request will cover.

Remember to discuss why you are requesting money and what you plan on using the money for (e.g., equipment).

Back up your funding request by emphasizing your financial projections.

Last but not least, your financial section should also discuss your business’s exit strategy. An exit strategy is a plan that outlines what you’ll do if you need to sell or close your business, retire, etc.

Investors and lenders want to know how their investment or loan is protected if your business doesn’t make it. The exit strategy does just that. It explains how your business will make ends meet even if it doesn’t make it.

When you’re working on the financial section of business plan, take advantage of your accounting records to make things easier on yourself. For organized books, try Patriot’s online accounting software . Get your free trial now!

Stay up to date on the latest accounting tips and training

You may also be interested in:

Need help with accounting? Easy peasy.

Business owners love Patriot’s accounting software.

But don’t just take our word…

Explore the Demo! Start My Free Trial

Relax—run payroll in just 3 easy steps!

Get up and running with free payroll setup, and enjoy free expert support. Try our payroll software in a free, no-obligation 30-day trial.

Relax—pay employees in just 3 steps with Patriot Payroll!

Business owners love Patriot’s award-winning payroll software.

Watch Video Demo!

Watch Video Demo

- Search Search Please fill out this field.

- Building Your Business

- Becoming an Owner

- Business Plans

Writing a Business Plan—Financial Projections

Spell out your financial forecast in dollars and sense

Creating financial projections for your startup is both an art and a science. Although investors want to see cold, hard numbers, it can be difficult to predict your financial performance three years down the road, especially if you are still raising seed money. Regardless, short- and medium-term financial projections are a required part of your business plan if you want serious attention from investors.

The financial section of your business plan should include a sales forecast , expenses budget , cash flow statement , balance sheet , and a profit and loss statement . Be sure to follow the generally accepted accounting principles (GAAP) set forth by the Financial Accounting Standards Board , a private-sector organization responsible for setting financial accounting and reporting standards in the U.S. If financial reporting is new territory for you, have an accountant review your projections.

Sales Forecast

As a startup business, you do not have past results to review, which can make forecasting sales difficult. It can be done, though, if you have a good understanding of the market you are entering and industry trends as a whole. In fact, sales forecasts based on a solid understanding of industry and market trends will show potential investors that you've done your homework and your forecast is more than just guesswork.

In practical terms, your forecast should be broken down by monthly sales with entries showing which units are being sold, their price points, and how many you expect to sell. When getting into the second year of your business plan and beyond, it's acceptable to reduce the forecast to quarterly sales. In fact, that's the case for most items in your business plan.

Expenses Budget

What you're selling has to cost something, and this budget is where you need to show your expenses. These include the cost to your business of the units being sold in addition to overhead. It's a good idea to break down your expenses by fixed costs and variable costs. For example, certain expenses will be the same or close to the same every month, including rent, insurance, and others. Some costs likely will vary month by month such as advertising or seasonal sales help.

Cash Flow Statement

As with your sales forecast, cash flow statements for a startup require doing some homework since you do not have historical data to use as a reference. This statement, in short, breaks down how much cash is coming into your business on a monthly basis vs. how much is going out. By using your sales forecasts and your expenses budget, you can estimate your cash flow intelligently.

Keep in mind that revenue often will trail sales, depending on the type of business you are operating. For example, if you have contracts with clients, they may not be paying for items they purchase until the month following delivery. Some clients may carry balances 60 or 90 days beyond delivery. You need to account for this lag when calculating exactly when you expect to see your revenue.

Profit and Loss Statement

Your P&L statement should take the information from your sales projections, expenses budget, and cash flow statement to project how much you expect in profits or losses through the three years included in your business plan. You should have a figure for each individual year as well as a figure for the full three-year period.

Balance Sheet

You provide a breakdown of all of your assets and liabilities in the balances sheet. Many of these assets and liabilities are items that go beyond monthly sales and expenses. For example, any property, equipment, or unsold inventory you own is an asset with a value that can be assigned to it. The same goes for outstanding invoices owed to you that have not been paid. Even though you don't have the cash in hand, you can count those invoices as assets. The amount you owe on a business loan or the amount you owe others on invoices you've not paid would count as liabilities. The balance is the difference between the value of everything you own vs. the value of everything you owe.

Break-Even Projection

If you've done a good job projecting your sales and expenses and inputting the numbers into a spreadsheet, you should be able to identify a date when your business breaks even—in other words, the date when you become profitable, with more money coming in than going out. As a startup business, this is not expected to happen overnight, but potential investors want to see that you have a date in mind and that you can support that projection with the numbers you've supplied in the financial section of your business plan.

Additional Tips

When putting together your financial projections, keep some general tips in mind:

- Get comfortable with spreadsheet software if you aren't already. It is the starting point for all financial projections and offers flexibility, allowing you to quickly change assumptions or weigh alternative scenarios. Microsoft Excel is the most common, and chances are you already have it on your computer. You can also buy special software packages to help with financial projections.

- Prepare a five-year projection . Don’t include this one in the business plan, since the further into the future you project, the harder it is to predict. However, have the projection available in case an investor asks for it.

- Offer two scenarios only . Investors will want to see a best-case and worst-case scenario, but don’t inundate your business plan with myriad medium-case scenarios. They likely will just cause confusion.

- Be reasonable and clear . As mentioned before, financial forecasting is as much art as science. You’ll have to assume certain things, such as your revenue growth, how your raw material and administrative costs will grow, and how effective you’ll be at collecting on accounts receivable. It’s best to be realistic in your projections as you try to recruit investors. If your industry is going through a contraction period and you’re projecting revenue growth of 20 percent a month, expect investors to see red flags.

Plan Smarter, Grow Faster:

25% Off Annual Plans! Save Now

0 results have been found for “”

Return to blog home

How to Conduct a Strategic Financial Analysis for Your Business

Posted may 25, 2021 by noah parsons.

How often do you review your business numbers? If you look at the financial performance of your business at least once a month or perhaps even more frequently , you’re in good shape—and better off than most businesses.

Unfortunately, too many businesses review their books only every few months, and frankly, that’s not a great strategy. It gives those businesses fewer opportunities to see if things are going well or not. The more frequently you review your business finances, the more chances you have to find opportunities for growth .

But how do you approach reviewing your financials? What documents should you analyze? What exactly should you be looking for? Let’s try to answer those questions by introducing you to a process known as a strategic financial analysis.

What is a strategic financial analysis?

A strategic financial analysis is a review framework where you analyze performance, assess your goals, and make adjustments to your forecasts and strategy based on actual results. In short, this is where you connect the dots between your numbers and the actions that you’re taking. The intention is to identify any potential problems or opportunities within your financials and turn them into strategic steps for growth.

In some cases, this analysis may also include a deeper look at your business model, comparisons against your competitors , and even different forecast scenarios.

What financial statements should I review when conducting a strategic financial analysis?

When you’re reviewing your business financials, you’ll want to check these three key reports:

- Profit and loss (also known as an income statement)

- Balance sheet

Each report will tell you different things about your business. Put together, they’ll provide you with nearly everything you’ll want to know about your business performance. By the end, you should be able to bring your forecasts for these statements up to speed based on your actual results .

How to conduct a strategic financial analysis

Here are the five steps you’ll want to take when conducting a strategic analysis of your financial statements.

1. Compare your forecast to your actuals monthly

So, if you’re reviewing your business financials regularly, you’re off to a good start.

But to get even more value out of that financial review, you need to start comparing your actuals —how your business performed—to your forecast.

Ideally, compare your plan to what actually happens in a monthly meeting with your key staff. You’ll want to have your forecast handy as well as reports from your accounting software so you can compare the two and see if you’re on track.

If you’re using LivePlan, the software will do all of the number-crunching and comparison work for you—no spreadsheets required—and you’ll be able to compare everything in a simple financial dashboard .

2. Identify where you’re off track or exceeding projections

When you’re forecasting, you’re making educated guesses. This means that your actual financial performance in a given month will vary.

You’ll typically either be off track and performing worse than expected. On track and sitting fairly close to expectations. Or, outperforming your forecasts and exceeding expectations.

What does comparing my plan to my actual results do for me?

If you just review what happened in the past, you’ll get a good idea of what happened during the past month of your business. But, it’s difficult to know if your performance is good or bad if you’re not comparing your actual results against your plan.

- How do you know if you’re meeting your sales goals?

- Can you tell that you’re keeping your spending within your budget?

- Are you keeping as much cash in the bank as you need to?

Even more importantly, if you have plans to grow your business or make significant investments, you’ll want to know if it makes financial sense to spend the money. Should you invest now or should you wait for a better time? Should you open a second location or hold off?

By reviewing your plan and comparing it to your actual results, you’ll get a better sense of when you should look to expand, and when you should be reining things in. Make a mistake and invest in your business at the wrong time and you could create a cash flow crunch that could sink your business.

3. Review your Income statement (profit and loss or P&L)

Your income statement (also called profit and loss or P&L) documents your income and your expenses. When you compare this statement to your forecast, you’ll see if your sales are meeting your goals and if you’re keeping your expenses in line with your budget.

If you’re not sure what’s included in an income statement or what types of information you’ll find there, start with this guide to reading a profit and loss or income statement that will help orient you to each line item.

You can also download an income statement example to help you better visualize the information. For a more dynamic solution that displays actual results for completed periods right into your forecasted Profit and Loss statement, check out LivePlan’s LiveForecast feature . No more hours spent inputting accounting information. Just you spending more time digging into what is and isn’t working for your business.

When you’re ready to dive deeper and start your income statement analysis, use this income statement analysis guide for your monthly financial review. It walks you through typical questions that might come up as you’re doing your review. That way, you can use your findings to make better strategic decisions for the health and growth of your business.

4. Analyze your cash flow statement

Your cash flow statement will tell you exactly how cash moved into and out of your business. Comparing this statement to your cash flow forecast will tell you if you’re on track to grow your bank balance the way you had planned, and why you might be off track if things aren’t going the way you had hoped.

Check out this article on how to read a cash flow statement for a line-by-line explanation of how it works. And download our cash flow statement example PDF and Excel spreadsheet if you’re looking for a sample to work from as you review your own.

When you’re ready to start comparing your actual cash flow to your forecast, this guide to cash flow analysis will help you get started.

5. Review your balance sheet

Your balance sheet will give you a complete overview of your financial position. How much money are you owed and how much money do you owe? What assets does your business have? Your balance sheet analysis will help you understand if you’re collecting money from your customers at the right rate, and if you’re taking on more debt than planned.

If you’re new to balance sheet review, this article offers more insight on how a balance sheet is set up, and what you need to know about each line. You can also download a balance sheet example to help you visualize it better.

When you’re ready to do your monthly review, this balance sheet analysis guide will help you get started.

Look beyond your financials for more insights

Doing a monthly financial statement analysis—comparing your actuals to your plan or forecast—helps you keep a finger on the pulse of your business finances.

Additionally, it’s wise to look at industry benchmarks , financial shifts in your industry, and any other external factors that may be affecting your financial performance. Use your initial comparison to actual performance to jumpstart this market analysis and help you define the next steps.

When you identify a gap or variance between what you forecast and what actually happened, use that information to help you make strategic shifts in your business so you can quickly address challenges and take advantage of opportunities.

Editors’ note: This article was originally published in 2019 and updated for 2021.

Like this post? Share with a friend!

Noah Parsons

Posted in growth & metrics, join over 1 million entrepreneurs who found success with liveplan, like this content sign up to receive more.

Subscribe for tips and guidance to help you grow a better, smarter business.

You're all set!

Exciting business insights and growth strategies will be coming your way each month.

We care about your privacy. See our privacy policy .

- Customer Reviews

- Net 30 Account

- Wise Services

- Steps & Timeline

- Work at a Glance

- Market Research at a Glance

- Business Plan Writing Services

- Bank Business Plan

- Investor Business Plan

- Franchise Business Plan

- Cannabis Business Plan

- Strategic Business Plan

- Corporate Business Plan

- Merge and Acquisition Business Plan (M&A)

- Private Placement Memorandums (PPM)

- Sample Business Plans

- Professional Feasibility Study

- PowerPoint Presentations

- Pitch Deck Presentation Services

- Business Plan Printing

- Market Research

- L-1 Business Plan

- E-2 Business Plan

- EB-5 Business Plan

- EB-5 Regional Centers

- Immigration Attorneys

- Nonprofit Business Plan

- Exit Business Planning

- Business Planning

- Business Formation

- Business License

- Business Website

- Business Branding

- Business Bank Account

- Digital Marketing

- Business Funding Resources

- Small Business Loans

- Venture Capital

- Net 30 Apply

- Frequently Asked Questions

- Business Credit Cards

- Talk to Us 1-800-496-1056

How to Write the Financial Section of a Business Plan

When you are starting a small business or a startup, you will need to make financial projections for your business.

What is Financial Plan in Business Plan?

How to write a business plan financial section, profit and loss statement.

- Cash Flow Statement

- Balance Sheet

- Sales Forecast

- Personnel Plan

Breakeven Analysis and Business Ratios

Use financial plan as a tool for business management, frequently asked questions (faqs).

Financial plan in business plan helps understand the chances of your business becoming a financial success. Investors want to see a financial plan to know how much money they’ll invest and what the expected return over investment is for them.

We have briefly discussed the process of writing a financial plan in business plan. One thing that can make or break your financial plan in business plan is your honesty about numbers.

Try not to be over-optimistic. See the growth pattern of similar businesses and project closely to them. Don’t overestimate the effects of your competitive advantage.

Want to write a business plan?

Hire our top business plan writers now!

A financial plan in business plan is an overview of your business financial projections.

Business plan financial projections include financial reports including Profit & Loss, cash flow statement, and balance sheet.

A financial plan will also discuss sales forecast, employees’ salaries and other expenses forecast, business breakeven analysis, and important business rations that help measure growth.

A business plan financial section is about making simple forecasts and creating a few financial reports. You don’t need to know accounting, nor is it necessary for creating financial projections.

We have outlined and simplified the process of creating a financial plan for business plan. Simply follow the process and take help from our examples and templates to write an excellent financial plan section of a business plan.

Review your Business Goals and Strategic Plan

You have set business goals in your business plan. A strategic plan is how you will navigate to financial success.

Everything in a business plan that contributes toward your business goals. Before writing financial projections, consider these goals and milestones:

- Expansion plans

- Adding more people to your team

- Resources required to meet your business goals

- Cash flow needs of your business in the short and long term

- Financing needs to meet business goals

Create Financial Projections

Financial projections in a business plan will include the following:

- Profit and loss statement

Cash Flow Statement

Sales forecast .

- Business Ratios and Breakeven Analysis

We will explore each in detail in the following section. By the end of the article, you will fully understand how to create financial plan in business plan.

A profit and loss statement is the first financial report you will create when writing financial plan in business plan.

A profit and loss statement reports your business income or loss over a certain period of time.

Profit and loss statement is also known by other names including its short form i.e., P & L statement, income statement, and pro forma income statement.

A profit and loss statement includes total revenues, expenses, and costs. A P&L statement is made for different time intervals like quarterly, bi-annual and annual. It shows net income after the cost of goods sold, expenses, taxes, depreciation, and amortization.

Before creating a P&L statement for your business, you may need to look for the right format for your business structure. For example, you will need a different format for a profit and loss statement for a sole proprietorship and a different one for an LLC.

Check income statement examples to understand and create one yourself.

Profit and Loss Statement Template

Download our free profit and loss statement templates & examples, and make a professional income statement for financial plan in business plan.

Parts of a Profit and Loss Statement

Every profit and loss statement includes the following elements:

- Total Revenues

- Cost of Sales or Cost of Goods Sold

- Gross Margin

Depending on the business type, a P&L statement may include insurance, taxes, depreciation, and amortization. Make sure to include a forecast for all heads in financial plan in business plan.

Calculate Operating Income

Start your profit and loss statement by calculating operating income; use this formula.

Gross Margin – Operating Expenses = Operating Income

Typically, operating income is equal to EBITDA (earnings before interest, taxes, depreciation, and amortization).

Operating income is also called the gross profit and it does not deduce taxes or other accounting adjustments from the income.

Calculate Net Income

Use this formula to calculate net income.

Operating Income – (Interest + Taxes + Depreciation + Amortization Expenses) = Net Income

Access our free sample business plans now!

A cash flow statement is typically prepared every month. You can create monthly and quarterly cash flow statement in financial plan in business plan.

A cash flow statement informs about the cash your business brought income, the cash it paid out, and how much is still available with the bank.

A cash flow statement gives an understanding of your income sources and expenses. When you forecast your financial reports, a cash flow statement will show your expected income sources and expenses.

A cash flow statement will help potential lenders and investors understand how you plan to make money. It provides reliable data about cash in and cash out. Keep it realistic and in line with the industry number for the most part. An exception may be an innovation or a breakthrough you bring to the market.

Your profit and cash flow are not the same. It is possible to have a cashless, profitable business or a business in loss with plenty of cash. A good cash flow helps you keep your business open and turn things around.

A cash flow statement also reflects your behavior with money. It shows if you spend on spur of the moment or think strategically. When creating a cash flow statement in a business plan, you will need to understand two basic concepts of accounting; cash accounting and accrual accounting.

Professional Business Templates for Small Businesses

Check our extensive library of business templates for small businesses and make use of the templates and examples in writing your business plan.

Difference between Cash and Accrual Accounting

The difference between cash and accrual accounting is Accrual accounting records revenues/income and expenses when they occur while cash accounting records income/revenue and expenses when the money actually changes hands.

You will need to decide if you will use cash accounting or accrual accounting. However, the final choice will depend on your business type and product.

For example, you are selling tickets to a show or you are taking preorders for your new product. Under cash accounting, you will record all income now and expenses when you have actually shipped the product or organized the show.

However, with accrual accounting, you will record both income and expenses when you have shipped the product or held the show.

Here, cash accounting will show the months with cash abundance as profitable and the months of spending, like shipping of the products of event organization, as a loss. It is hard to see a pattern and get actionable insight with cash accounting.

It is a good time to decide about the accounting method you will use when you are writing a financial plan in business plan.

Check with your accounting consultant and discuss accrual and cash accounting to select the one most suitable for your business.

Balance Sheet

A balance sheet is a summary of the financial position of your business.

A balance sheet includes assets, liabilities, and equity. A balance sheet is based on this formula and it is always equal on both sides of the equation.

Assets = Liabilities + Equity

Here, Assets include your inventory, cash at hand and bank, property, vehicles, accounts receivables, etc. Liabilities are debts, loans and account payables. Equity includes shares proceeds, retained earnings, and owner’s money.

Download Balance Sheet Template from WiseBusinessPlan and make a balance sheet easy.

A sales forecast is your projection about the sales you will make in a certain time. Investors and lenders will be interested in seeing your sales forecast. They will estimate your chances of meeting the forecast and projections.

Keep your sales forecast consistent with the financial reports like the cash flow statement and profit & loss statement.

How To Make A Sales Forecast For A Business Plan?

First, decide the period for the sales forecast, like one month or a quarter. Then, do the following steps to make a sales forecast for that period.

- List goods or services your business sells

- Forecast sales for each product or service

- Set per unit price for your goods or services

- Find sales volume by multiplying units sold with unit price

- Calculate the cost of goods sold

- Multiply the cost of goods sold by the number of units sold, this is your total cost

- Take the total cost amount from the total sales amount

Need Business Plan Cover Page?

Download our business plan cover page now!

Personnel Plan

A personnel plan shows the costs and value of the employees you will hire.

Very small businesses, startups, or solopreneurs may not need a personnel plan but any business with employees, or plans to hire employees, will need this.

Forecast the cost of each employee and the value they will provide. You don’t need to discuss everything about employees, just do a short cost-benefit analysis for each position or employee.

Breakeven analysis tells you the number of sales you need to bring in to cover all of your business expenses.

Use this formula to calculate the breakeven point for your business.

Break-Even Point (units) = Fixed Costs / (Sales price per unit – Variable costs per unit)

Business ratios are like signals for your business. You can quickly spot a growth or fall with a ratio. Some business ratios also help you see business health.

You are not required to include business ratio forecasts however, it is good to know about them when writing a business plan.

Here are some of the most used business ratios.

- Gross margin

- Return on sales

- Return on assets

- Return on investment

- Debt-to-equity

- Current ratio

- Working capital

- gross margin

- return on investment (ROI)

- Debt-to-equity.

One mistake that most people make is thinking that building a business plan is a one time thing.

Your business plan and your financial projections can help you measure your business growth. You can use these numbers as a yard stick to see if you are meeting your projections or not.

Here is how you can your business plan as a management tool for your business.

Schedule monthly and quarterly business review meetings. Compare your actual data for that period with your forecast data and see how you are moving towards your business goals. Adjust your forecast or projections with the help of actual data to keep your growth trajectory in the right direction.

Hire our professional who can help write a business plan !

The financial section of a business plan should include key financial statements such as the income statement, balance sheet, and cash flow statement. It should also provide details on projected sales, expenses, and profitability, along with any assumptions or financial ratios used.

Forecasting sales and revenue involves analyzing market research, understanding your target audience, and considering factors such as pricing, competition, and marketing strategies. Utilize historical data, industry benchmarks, and realistic growth assumptions to estimate future sales figures.

In addition to sales and revenue projections, the financial section should include projected expenses, such as operational costs, marketing expenses, and overheads. It should also outline anticipated profits, cash flow projections, and return on investment (ROI) calculations.

Yes, including a break-even analysis is important as it helps determine the point at which your business will start generating profits. It identifies the sales volume needed to cover all expenses and provides insights into the viability of your business.

Supporting documents may include historical financial statements, tax returns, cash flow statements, balance sheets, and any other relevant financial records. Additionally, include details about any loans, investments, or funding sources that contribute to the financial projections.

Loving the information on this web site, you have done great job on the content.

I thought of the same thing before reading this blog that a business plan is a one-time thing but now I know that a business plan and financial projections can really help you measure business growth. Let me just change my stance from now onward.

Leave a Reply

Your email address will not be published. Required fields are marked *

Quick Links

- Investor Business Plans

- M&A Business Plan

- Private Placement

- Feasibility Study

- Hire a Business Plan Writer

- Business Valuation Calculator

- Business Plan Examples

- Real Estate Business Plan

- Business Plan Template

- Business Plan Pricing Guide

- Business Plan Makeover

- SBA Loans, Bank Funding & Business Credit

- Finding & Qualifying for Business Grants

- Leadership for the New Manager

- Content Marketing for Beginners

- All About Crowdfunding

- EB-5 Regional Centers, A Step-By-Step Guide

- Logo Designer

- Landing Page

- PPC Advertising

- Business Entity

- Business Licensing

- Virtual Assistant

- Business Phone

- Business Address

- E-1 Visa Business Plan

- EB1-A Visa Business Plan

- EB1-C Visa Business Plan

- EB2-NIW Business Plan

- H1B Visa Business Plan

- O1 Visa Business Plan

- Business Brokers

- Merger & Acquisition Advisors

- Franchisors

Proud Sponsor of

- 1-800-496-1056

- (613) 800-0227

- +44 (1549) 409190

- +61 (2) 72510077