L&T (Larsen & Toubro) Case Study – Business Model, Acquisitions and Performance

- Post author: StockPe

- Post published: June 3, 2023

- Post category: Uncategorized

- Post comments: 0 Comments

L&T (Larsen & Toubro) Case Study – Introduction

After the service sector (53.89%), the industrial sector is the second biggest contributor to India’s GDP with a share of 25.92% followed by the agriculture and allied sectors, which contribute 20.19%. While there are government bodies, L&T is one of the key private players contributing not just to the industrial, but agricultural and manufacturing sectors as well.

Larsen & Toubro Limited, better known as L&T, is one of India’s renowned conglomerates headquartered in Mumbai, India with major business in the EPC (Engineering, Procurement & Construction) segment for industries like minerals, metals, and mining. However, the services and products of L&T are not just limited to engineering and construction but also range to financial and IT services.

This L&T case study comprehensively covers the company’s history, business model, notable acquisitions, and market performance to help you understand how L&T functions and generates revenue.

History and Overview

Larsen & Toubro was established in the lanes of Bombay on 7 th February 1946 by two Danish engineers, Henning Holck-Larsen, and Soren Kristian Toubro. Initially, the company manufactured dairy equipment but with the beginning of the second world war in 1939, the company started manufacturing and repairing industrial and defence tools. Later in 1950, L&T became a public firm with an initial capital of Rs. 20Lakh (equivalent to over 20 crores or $2.42 million in 2023).

Soon L&T became a trustworthy name for government projects and contracts as well with its first-ever association with ISRO in 1970 and later with DRDO in 1985. Since then, the company has expanded its business to various segments – construction, manufacturing, heavy engineering, defence, supply chains and transportation, power and energy, minerals and metals, mining & metallurgy, aerospace, agriculture, IT services and finance.

L&T group has over 93 subsidiaries, 5 associate companies, and 27 joint ventures and has clocked a revenue of 23 billion USD, as of March 2023. Let us now look at L&T Business Model as we move further in this L&T case study.

L&T Business Model

L&T’s business model is one of the most successful business models present today. Let us look at some of the major components of the L&T business model:

Customer Segment

L&T provides multi-segment products and services including infrastructure and construction, manufacturing of machinery and heavy plants, IT services and banking & finance services.

Value Proposition

L&T’s value proposition states that the company focuses on providing high-quality and robust solutions and services to its clients and customers. The company provides services that meet the end goals of its customers. L&T is known for its business model innovation and research and development, where they continuously improve their products and stay ahead of the constitution.

L&T’s channels include the sales team, dealer & distributor network, company website, and social media.

Customer Relationship

The company believes in building strong and familiar relationships with its customers with the help of on-demand training and robust customer support.

Revenue Streams

L&T revenue streams majorly include project-based revenue, revenue from product sales, financial services, and IT & software services.

L&T Revenue & Profit/Loss

As we move ahead with the L&T case study, let us look at the financial report of L&T which will give us a better idea of its performance over the last few years. Here are the Revenue and Profit/Loss stats of L&T for the last 5 years:

*All values in Rs. Cr

L&T’s major sources of generating revenue include the selling of manufactured goods and services and government projects. L&T has been quite efficient in generating revenue over the last 5 years except in 2020-2021, as it was the pandemic year. Overall, L&T has given a CAGR of around 9.27% in its revenue.

Profit/Loss

LTI incurred a loss of around 25% in its Profit in 2022 despite an increase of 15% in revenue majorly because of discontinued operations and exceptional expenses. However, over the last 5 years, the company has managed to generate a CAGR of 9% in profit.

L&T Major Acquisitions

L&T Infotech, an IT services division of Larsen & Toubro Limited has carried out around 9 acquisitions since its listing in 2016 with capital totalling over US$87 million. Let us look at some of its recent notable acquisitions:

Mindtree (2019)

Mindtree started as an Indian multinational technology and consulting services firm in 1999 with a team of ten IT professionals in Bangalore. However, in 2019, L&T acquired the company with an initial stake of 20.4% and an additional stake of 31% afterwards. Later in 2022, LTI and Mindtree merged to form a single entity, which also became the 5 th largest IT firm by market cap. Currently, L&T owns around 61% stake in the company.

Nielson+Partner (2019)

L&T Infotech (now LTIMindtree) acquired the Germany-based IT consulting and software engineering firm Nielson+Partner in a US $32 million deal in 2019. N+P is a leading partner of Temenos, a world leader in banking software from Europe. LTI aimed to provide class-apart services to its banking clients with this acquisition.

Cuelogic Technologies

LTI acquired a 100% share in Pune-based Cuelogic Technologies on July 7, 2021, in a US$8.4 million deal. Cuelogic specializes in developing cloud-based native web and mobile applications and providing outsourcing services.

L&T is one of the biggest and strongest players in the manufacturing, construction, infrastructure, technology, and finance sector. The company holds over 8 decades of presence in the Indian market and serves all sorts of consumers ranging from government bodies to corporate houses and from defence personnel to land farmers. In a nutshell, with a strong customer-centric approach and robust business planning, L&T is expected to contribute significantly to India’s growth in the coming years.

You Might Also Like

How To Transfer Shares From One Demat To Another

Paytm Case Study: The Journey of India’s Leading FinTech Company

Best 5 EV Stocks in India

Leave a reply cancel reply.

Save my name, email, and website in this browser for the next time I comment.

Looking to try stock market fantasy game?

Play on StockPe now to win big rewards with secured withdrawals.

L&T is known for incorporating multiple strategies to retain and increase market share in the long run. Some of these strategies are:

- Activities: Larsen & Toubro Ltd. encompasses manufacturing, designing, and developing its products, as well as offering services to clients.

- Customer Relationships: The company provides extensive support via email and customer care numbers. It believes in building strong, familiar relationships with customers.

- Channels : One of the primary channels of the company is its business development and sales team. The company promotes its offerings through social media pages, advertising, websites, and conference participation.

- Value Proposition: The company creates accessibility by offering its clients a wide variety of options. It focuses on providing high-quality and robust solutions and services to its clients and customers in manufacturing and financial services .

Market Data

Some of the company’s market data is given below:

Financial Highlights

Income statement.

The company’s income statement shows a growing trend as the company’s revenue and profit increased by 17% and 20.7%, respectively in FY23

Balance Sheet

The company’s balance sheet showcases a growing trend in current assets, which is fueled majorly by current liabilities. This approach limits debt growth in the long run.

Cash Flow Statement

The graph and table reveals a lot of turbulence in the company’s operations as it is diverting a significant amount of funds to pay-off debt and invest in new ventures.

Profitability Ratios

The company’s margin trend shows an uptrend, thus revealing a growth in the profitability. This growth is also reflected in ROCE and ROE.

Future Outlook

- The company expects EBITDA margin to be in the range of 8.5%-9% in FY24 from the earlier guidance of ~9%.

- Larsen & Toubro (L&T) aims to double revenue and order inflow by 2025-26 through a five-year strategic plan called Lakshya’26 that aims at exiting non-core operations and expanding the services business.

SWOT Analysis

- L&T Ltd. enjoys the benefits of brand identity and brand value in the construction and manufacturing segment, thus helping to increase trust in its clients.

- The company has a diverse business portfolio , which gives it an advantage in navigating different market conditions and capitalizing on opportunities in multiple industries, such as construction, engineering, and manufacturing.

- The company has a robust financial performance and also observed impressive revenue growth over the years.

- L&T has been battling high debt , which can challenge the company’s financial stability and growth prospects.

- The company heavily depends on the domestic market for revenue; slight fluctuation in the market will also affect the company.

Opportunities

- The company must ensure that each acquisition aligns with its long-term goals and strengthens its core competencies.

- They must explore opportunities in international markets , particularly in some places experiencing rapid infrastructure development.

- L&T operates in a highly competitive atmosphere , facing competition from domestic players and global companies entering the Indian market.

- The company operates in an industry that has a history of exploiting environmental bodies .

Larsen & Toubro Ltd has a strong presence in the global market. It has a diverse portfolio and has achieved impressive financial performance. The company aims to double its revenue and order inflow by 2025-26 through a strategic plan called Lakshya’26. While the majority of the indicators point towards the company’s prosperous future, it is advised that you perform your analysis before investing your hard-earned money.

Frequently Asked Questions (FAQs)

- Who was the founder of Larsen & Toubro Ltd?

Ans. Henning Holck-Larsen and Soren Kristian Toubro are the founders of L&T.

- What are the services L&T provides?

Ans. The main services of the company are manufacturing, technology engineering, construction, information technology, military, and financial services.

- Where was L&T founded?

Ans. L&T started its operation in Mumbai, Maharashtra, in 1938.

- What is the plan of L&T in 2026?

Ans. L&T Financial Services aims to complete its transformation into a digitally enabled retail powerhouse by the end of the Lakshya 2026 strategic plan.

- What is the market cap of L&T?

Ans As of 10th April 24, the market cap of L&T is ₹ 529,488 Cr.

Disclaimer: The securities, funds, and strategies mentioned in this blog are purely for informational purposes and are not recommendations.

Related Posts

Kotak Mahindra Bank: Business Model and SWOT Analysis

Mahindra & Mahindra Case Study: Products, Financials, KPIs, and SWOT Analysis

Ullu Digital Case Study: Business Model, Financials, and SWOT Analysis

We are a concern of pace group. pocketful is an investing platform that helps people be better investors. pocketful unlocks the discoverability of new investment and trading ideas., quick links.

- Open an Account

- Pocketful Web

- Pocketful App

- Investment Tool

- Trading Tool

- Support Portal

- Referral Program

- Calculators

- Stocks Pages

- Government Schemes

- Index Heat Map

- Stock Screener

- Mutual Funds

- Terms & Conditions

- Policies & Procedures

- Privacy Policy

- Press & Media

- Success Story

- Entertainment

- Health & Fitness

- Travels & Tales

Larsen & Toubro Case Study – The Multinational Company With $17 Billion Capitalization

Larsen & Toubro Limited, or L&T, is an Indian corporation with global interests in technology, engineering, construction, manufacturing, and financial services. Henning Holck-Larsen and Soren Kristian Toubro, two Danish engineers, created Larsen & Toubro in Mumbai in 1938. The company headquarters is in Mumbai, India.

Larsen & Toubro Limited, or L&T, is an Indian corporation with global interests in technology, engineering, construction, manufacturing, and financial services. Mumbai, Maharashtra, India, is the company's headquarters. The company's commercial activities include basic and heavy engineering, construction, real estate, capital goods manufacture, information technology, and financial services. Sabyasachi Das has been named the CEO of L&T EduTech, which will provide a variety of engineering and technology-related courses. But, first, let's get to know the success story of this fantastic company.

Larsen & Toubro - Company Highlights

- Startup Name - Larsen & Toubro Limited

- Founded - February 7, 1938

- Founders - Henning Holck-Larsen, Søren Kristian Toubro

- CEO - S. N. Subrahmanyan

- Headquarters - Mumbai, India

- Industry - Conglomerate

- Website - www.larsentoubro.com

Larsen & Toubro – India’s Top Conglomerate

Larsen & Toubro Limited ('Larsen & Toubro' or 'L&T') is a multinational technology, engineering, construction, projects, manufacturing, and financial services corporation with a market capitalization of USD 17 billion. Infrastructure, hydrocarbon, construction, power, defense, heavy engineering, shipbuilding, aircraft, electrical & automation, mining, and metallurgy are critical areas that solve vital demands.

Larsen & Toubro - Founders

Henning Holck-Larsen and Soren Kristian Toubro, two Danish engineers, created Larsen & Toubro in Mumbai in 1938.

Larsen & Toubro - Business Model

- Customer Segments : With a specific customer sector, L&T has a niche market business model. The company's services got aimed at businesses in the industrial sector.

- Value Proposition : The company's value proposition provides a wide range of options, making it more accessible. L&T is a multibillion-dollar corporation with operations in various product and service sectors, including technology, engineering, construction, manufacturing, and financial services.

- Subsidiaries and Partnerships : Because of its success, the corporation has developed a strong brand with more than 130 subsidiaries and 15 partner companies. It is one of the world's top five fabrication corporations. In addition, it claims to be India's largest engineering and construction company and one of the country's major multinational corporations.

- Advertisements : The key route for L&T is its business development team. The company advertises its services on its website, social media pages, promotions, and conferences.

- Customer Relationships : The majority of L&T's customer relationships get based on human support. Customers receive full training as well as extended phone and email support from the company.

- Designing, developing, manufacturing, and providing services : These all are part of L&T's business model.

- Key Partners : To provide best-in-class services to its clients, L&T maintains technical alliances (e.g., joint ventures) with various companies. The companies are from multiple industries, including power, construction, and hydrocarbons. For example, GULF Interstate Engineering, Chiyoda Corporation of Japan, Sargent & Lundy, and Valdez are specific partners.

Fun Fact - Larsen & Toubro has named SN Subrahmanyan its new Chief Executive Officer and Managing Director. On July 1, 2017, he took over the reins from Mr. Anil Manibhai Naik.

Larsen & Toubro - Acquisitions

Larsen & Toubro Limited has purchased two companies MindTree & Spectrum. MindTree was their most recent acquisition, which occurred on June 3, 2019.

Note - On December 1, 2006, Larsen & Toubro Limited invested in City Union Bank. The Post-IPO Equity - City Union Bank investment got valued at $450 million.

Larsen & Toubro - Competitors

L&T's main competitors are:

- Aditya Birla Group

- Tata Projects

- LANCO Group

Larsen & Toubro - Challenges Faced

Some of the main challenges of the company are as follows:

- Fewer Workers - With the lifting of the lockdown, India's largest engineering and construction firm, Larsen and Toubro (L&T), is looking to re-start work at its construction sites. During the lockdown, over one lakh workers — nearly half of the company's workforce — went home to their homes in Uttar Pradesh, Bihar, Jharkhand, West Bengal, and Orissa.

- Execution - The Corporation has reopened most of its operations and over half of the 1,000-plus project locations, but implementation remains an issue.

- Competitors – L&T has many competitors in the market, and most of them are significant players. It is one of the main challenges of the company to overshadow its competitors.

Fun Fact : L&T expects to hire many workers from the Gulf region who have got laid off due to the sharp drop in oil prices.

Larsen & Toubro - Future Plans

Some of the upcoming plans of the company are as follows:

- Larsen & Toubro (L&T) is a few months away from releasing its 'Lakshya 2021' business plan, in which it set a revenue target of INR 2-trillion.

- The company developed an in-house digital platform that provides seamless connectivity to its many processes, increasing productivity and cutting decision-making time.

- L&T is taking this commitment to the next level with its new strategic initiative, aptly dubbed 'L&T-Nxt,' which will employ new technologies, digitization, and analytics to commercially provide industrial solutions by capitalizing on opportunities as firms progress toward 'Industry 4.0.'

Larsen & Toubro - Conclusion

L&T works in high-impact sectors of the economy, and our integrated skills cover the whole 'design to delivery' spectrum. They have unmatched expertise across Technology, Engineering, Construction, Infrastructure Projects, and manufacturing and maintain a leadership position in all of our major lines of business, thanks to 8 decades of a robust, customer-focused approach and a never-ending quest for world-class quality.

Digital Yug is an Indian digital media platform that posts real life stories, events, news, and blogs about startups, entrepreneurs, and successful people. The company was founded by Dr Anil Diggiwal in 2018 and is currently a privately owned, bootstrapped organization. This Jaipur based company publishes & focuses on undiscovered, small startup stories.

- Larsen & Toubro

- Share on Facebook

- Share on Twitter

Your email address will not be published. Required fields are marked *

GoKwik: Revolutionizing Digital Payments – A Startup Saga of Innovation and Growth

Skyroot Aerospace: Pioneering the Indian Space Odyssey – From Ideation to Orbit Dominance

Pocket FM: Unveiling the Sonic Revolution – A Startup Odyssey from Idea to Auditory Triumph

Ditto Insurance: Redefining Coverage in the Digital Age – A Startup Journey from Concept to Triumph

BluSmart: Electrifying Urban Mobility – A Sustainable Startup Success Story

Udaan : Connecting India's Businesses to Success

DealShare : Revolutionizing Indian E-Commerce Through Innovation and Community Building

काइबर फ्रॉड: डिजिटल दुनिया में भारत में हो रहे धोखाधड़ी के प्रकार - ऐसे करें बचाव

Top Healthcare Management Courses for Working Professionals

Honoring the Ink of Change: Dr. Sunil Kumar Verma Awarded Prestigious Doctorate

Learn to be Grateful after Difficulties: Muniba Mazari Story

Preeti Chhipa Life Story: Woman Entrepreneur & Philanthropist

Success Story of Coca-Cola Company : Complete Case Study

Foodpanda Case Study: How the Billion Dollar Startup Model Failed?

Mountaineer Arunima Sinha – A True Tale of Will Power & Positive Attitude

BoAt : Lifestyle Brand's Full Analysis & Useful Information

Kishore Biyani’s Big Bazaar and the Story of its Rise, Fall, and Controversial Journey

Sugar Cosmetics Success Story – The Cruelty-Free Beauty Brand

Ralegan Sidhi Story: Inspirational Water Model for India

How this Simple CricBuzz Cricket News App Generated $7.8 Million in Revenue?

Login With DigitalYug

By signing up for yourstory you agree to the Terms of Service and Privacy Policy of the platform.

[{"value":"utm_source","text":"00N0I00000KT1fD"},{"value":"utm_medium","text":"00N0I00000KT1fI"},{"value":"campaignname","text":"00N0I00000KT1fN"},{"value":"uterm","text":"00N0I00000KT1fS"},{"value":"adgroupname","text":"00N0I00000KT1md"},{"value":"keyword","text":"00N0I00000KT1mx"},{"value":"creative","text":"00N0I00000KT1nR"},{"value":"devicemodel","text":"00N0I00000KT1ng"},{"value":"placement","text":"00N0I00000KT1nq"},{"value":"target","text":"00N0I00000KT1ot"},{"value":"device","text":"00N0I00000KT1o0"},{"value":"network","text":"00N0I00000KT1o5"},{"value":"matchtype","text":"00N0I00000KT1oA"},{"value":"gclid","text":"00N0I00000KT1oF"},{"value":"campaignname","text":"00N0I00000KT1nM"},{"value":"term","text":"00N0I00000KT1n7"}]

ISB Experience Tailored to you

Help us tailor the website experience to your taste. Make some selections to let the website work better for you.

I am Interested in

- ENTREPRENEUERSHIP

- GENERAL MANAGEMENT

- POLICY MAKING

- IT & ANALYTICS

- FAMILY BUSINESS

Suggestions for You

Research Centre

Published Papers

View Complete Profile

Search Management ReThink

No record found

- Management ReThink

- Survive Disruptions, Accelerate Impact: Leadership Approaches to Unlock Success

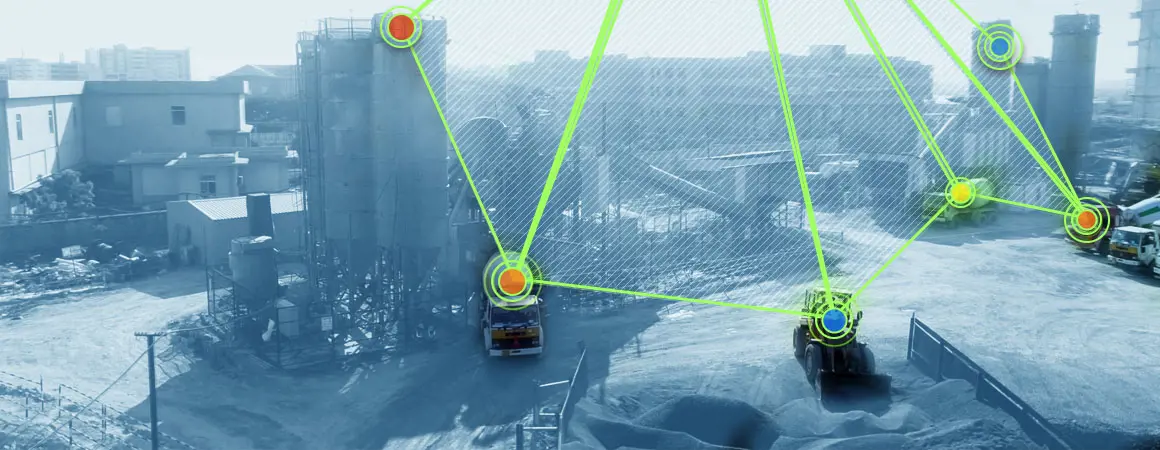

Digital Transformation at L&T

By Harish Raichandani, Founder & CEO, Potentia | S. Ramnarayan, Professor of Practice, Organisational Behaviour, Indian School of Business. | Jan 06, 2022

Case in Point

Convinced that a traditional organisation like L&T should utilise the transformative potential of digital technologies to compete at a global level, the CEO and MD embarked on a journey of digitalisation in 2016. From conception to implementation, this case revolves around the digitalisation process that took place at L&T over the next few years. With the increasing need to constantly embrace new technologies, we present insights from two experts on some of the unique facets of digital transformation and what approaches would be needed to take L&T to the next level of growth.

Please click on the + to read the content from respective sections.

Case study:.

This case is an abridged version of the case series Digital Transformation at L&T (A) & (B) – ISB271 & ISB272 , written by Professor S Ramnarayan and Sunita Mehta at the Indian School of Business.

S.N. Subrahmanyan (SNS), the CEO and MD of Larsen & Toubro (L&T), an Indian engineering and construction conglomerate with presence in over 30 countries, was convinced that a traditional organisation like L&T should utilise the transformative potential of digital technologies to compete at a global level. In 2016, SNS decided on initiating digital in L&T Construction, the largest business of L&T. The digital transformation of the business unit made progress over the next two years and delivered many benefits. It laid the blueprint for the digitalisation of other business units of the L&T group. Reflecting on how they started, SNS said:

“Unlike the past industrial revolutions where one could get by with incremental change and adopt technologies at a slower pace, the pace of innovation with Industry 4.0 had to be much faster. Industry 4.0 does not lie in some distant future; it is already here. L&T is adopting digital technologies to future-proof its businesses.”

INITIAL STEPS

In 2015, SNS, then the CEO designate, had visited the US and witnessed how digital technology was profoundly changing businesses across different industries and creating a huge impact on profit, productivity, and performance. He felt: “L&T was performing well as an organisation, but if we wanted to move further, we needed to do something about using digital technologies.”

In 2016, SNS, who had been appointed CEO of L&T, initiated digitalisation first at L&T Construction, L&T’s largest business with a revenue of around US$ 11 billion. A study of the state of digitalisation revealed that digitalisation in the construction industry was ranked low in terms of investments. This indicated that L&T Construction would have to embark on its digitalisation journey with few existing models and benchmarks.

SNS invited Anantha Sayana (Anantha), Head of Information Systems and Head of the Corporate IT Programme and designated him as the Head of Digital in 2016.

L&T had been an early adopter of IT solutions and had invested heavily in IT, implementing enterprise resource planning (ERP) in all its business units from 1999 to 2001. Anantha stated, “Information technology is used to provide solutions to existing problems. Digital is used not only to solve existing problems but also to exploit opportunities created by new technologies.”

Recognising that digital was different from IT, the company created a separate department called the Digital Hub, which was responsible for the conceptualisation, ideation, creation, selection, development, and architecture of digital solutions. The teams were set up on a different floor and comprised people who had business, domain and technological expertise.

WHERE TO BEGIN?

The primary goal of digital was to improve operational effectiveness to optimise resource utilisation, save costs, improve productivity and efficiency, reduce execution time, maintain quality, and ensure safe operations. Anantha said that execution did not follow the copybook approach:

“We did not conduct meetings of various business leaders across cities, do town halls, involve people across levels and functions, hold discussions on what digital means, and ask them where we could go digital, collect ideas, and spend many months figuring out what the business wants. We believed that digital would be understood by our people only when they started to see it.”

The focus of the Digital Hub team’s first initiative was on connecting assets using the Internet of Things (IoT) to optimise equipment and machinery utilisation. The dashboard provided detailed information on the utilisation of the machines. For instance: the amount of concrete produced by a particular concrete batching plant in a day, the time at which the machine started, average production of concrete in the previous month, amount of fuel consumed, etc. When this real-time data about equipment and machine utilisation was shared, it made team members anxious about its visibility to those outside the project site. Visibility of machine utilisation was not a problem that needed to be solved; instead, L&T wanted to use digital to exploit an opportunity.

There were stray pockets of resistance from the people at the operations level at project sites. Anantha elaborated:

“We were not getting data from a few sites. On investigation, we found that in some cases, wires connecting the gateway to the sensors had been clipped with a pair of scissors. In other cases, people were resentful that machine utilisation data had become transparent; they sent us data to prove that the information on our dashboards was wrong.”

To build credibility of the new technology, the Digital Hub fixed all bugs and provided accurate and consistent data on machine utilisation. In 2-3 sites, manual recording of machine utilisation was done; it was tallied with the information provided by the dashboards for a few weeks to ensure that people relied on the dashboard.

To gain the buy-in of those at the site, the Digital Hub emphasised that it was just providing information and that the business managers were the experts in their respective domains. Therefore, they had the freedom to infer whether the machine’s performance was good or bad. Anantha added:

“When people started looking at the information provided on the dashboard, the need to change and improve utilisation became automatic. This started a dialogue. Then, we worked with the business verticals to help translate these insights into optimal asset utilisation.”

Improving machine utilisation was not just a matter of making a machine work for a longer time; rather, the ecosystem had to gear up to facilitate the additional work efficiently.

INITIATIVES TO SUPPORT TRANSFORMATION

SNS emphasised the need for digitalisation at every opportunity and used every platform to drive this message. He even viewed regular business reviews as an opportunity to monitor progress on digitalisation.

The central Digital Hub, comprising over 60 people, was involved in digital strategy, solution conceptualisation, architecture, technology choice, partner selection, and solution implementation. Every business vertical had a digital office and a team of digital officers, drawn from the business and involved in demand generation, engagement with stakeholders, and solution implementation. Every project site had digital champions who reported to an officer at the vertical, who, in turn, was guided by the officers at the central Hub. The leaders knew it was important for the team to appreciate the problems faced by the people working on site and not allow themselves to be led by “technology arrogance” in pushing a solution.

The digital team was careful to ensure that any new technology it delivered was used for the purpose for which it was deployed. The solution was designed with a clear focus on its benefit.

The agile development of the product based on user feedback, built people’s trust in digital technologies to improve the quality of their work.

In consultation with the Digital Hub, HR designed a leadership programme for developing digital capabilities, which included analytical capabilities and insights from data. This was made compulsory for people who aspired to take on leadership positions. L&T also had to rebrand itself to attract candidates with a digital background who would have otherwise preferred to join software companies.

L&T was aware that acquiring internal expertise in all the technologies would be unrealistic and inefficient. Therefore, it partnered with over 45 micro, small, and medium enterprises (MSMEs) and start-ups within India and overseas to develop various solutions using different technologies.

EXTENDING TO THE OTHER BUSINESS UNITS

In early 2018, L&T extended the digitalisation programme to several business units (BU). Each BU created a team of five to six people to lead its initiatives. The central digital group brought them up to speed on their activities and the solutions they had developed at L&T Construction.

One of the initiatives of the leadership to drive change at L&T was the creation of a Digital Council, a confluence of leaders from all the group businesses, under the aegis of Anantha. It met every month and provided a platform to share ideas, understand challenges, adopt best practices, and leverage technologies and solutions across the different businesses.

As of 2018, over 50 digital solutions were in production, used by thousands of operating staff at hundreds of project sites. Digitalisation had enhanced operational efficiency, safety of personnel, and the digital skills of employees. Every year, the MD and CEO recognised and awarded the best use of digital in the sites, projects, and innovative solutions.

THE WAY FORWARD

Given the strategic importance of digital transformation in the current environment and in the post-COVID era, SNS knew that the way forward for L&T would be challenging. Disruption had become the new order, with the need to constantly embrace new technologies to take L&T to the next level of growth.

What are the unique aspects of bringing in digital transformation? What are some approaches that you find useful for dealing with such unique aspects?

What are the key leadership characteristics and approaches that are required for a successful digital transformation, commentary: .

The experts bring in their perspective as they respond to the key questions the case poses.

Harish Raichandani, Founder & CEO, Potentia

As an organisational development catalyst, business coach, and corporate governance steward, Raichandani brings 30 years of experience. He currently works with upper echelons to catalyse organisational transformations and board evaluations. His accreditations in appreciative inquiry, emotional intelligence, and coaching from ICF help him make a difference to individuals and institutions. The entrepreneurial perspective of organisational dynamics allows him to contribute to business success stories and C-suite coaching. His passion for teaching brings him close to graduate students as a visiting faculty at business schools.

Changing consumer preferences, unfulfilled client demands, or competition from digital natives often pushes many companies towards digitalisation. It is laudable to see the giant builder of the nation undertake a digital transformation journey with no apparent market pressure. L&T's initiative appears to be an attempt to step up their own game, viz. to improve utilisation of capital equipment that locks up billions of dollars in assets. The attempt by SNS to democratise the information on resource utilisation and productivity, needs to be seen in the context of the organisation and industry practices.

In a hierarchy-driven culture, the resources at one's command enhance perceived power; managers measure their self-worth by the assets they control. An initiative like this is bound to stir the hornet's nest, as is evident by the anxiety of the people at project sites, finding ways to resist data transmission by clipping wires.

Leaders should remain undeterred by the side-effects and unseduced by the low-hanging fruits. A leader like SNS is driven by a beacon with a definitive long-term digitalisation agenda.

At L&T, it could have been speedier to mobilise capital equipment, increase utilisation, or establish a new profit centre that serves internal and external needs for nation-building projects.

I see two unique aspects:

Firstly, it needs to be strategy-led. Digital transformation needs to be triggered by a desire that encompasses more than digitalising the information at the source or aggregating it at multiple sources. Those are the essential nuts and bolts, but not the results. Automating data collection and information flow may be the most visible parts of the digitalisation initiative, but an organisation must set objectives beyond that.

Secondly, for it to be termed 'transformation', it needs to be an iterative process characterised by the reinforced learning between the 'strategy' and 'digital assets'. Double-loop learning can enrich the business model by leveraging the information, even as the touchpoints multiply basis the changing strategy. Rita McGrath and Ryan McManus [1] call it an incremental experimental approach.

The change cart that brings about digital transformation requires the culture wheel and the technology wheel . A successful approach would take cognisance of both these aspects. The cultural aspects contributing to customer-centricity or timely project completion cannot be ignored while pursuing a digitalisation programme. Despite visible lacunae, the organisation must delay gratification to fix the operational metrics while pursuing the long-term agenda. An obsession with improving short-term performance may create a high decibel resistance, jeopardising the initiative. L&T's use of Digital Hubs for information assimilation, and not for questioning the project managers' expertise is an example. Leaders like SNS, when focussed on transformation, do not succumb to pressures of transactions which occur during the implementation phase.

The technology aspects at the heart of successful digitalisation are 'ease of use' and 'relative stability'. The legacy companies must appreciate the spirit behind digital natives' obsession with user interface design (UI) and user experience design (UX). Early adopters of digitalisation can turn saboteurs if the 'ease of use' is not considered by the 'Digital Hubs’ equivalents.

The other crucial aspect is the choice of technology; while an outdated technology would warrant frequent changes, the evolving neo-technology may present interface issues. In either case, it impacts early adopters' morale and prevents them from becoming ambassadors for digital transformation initiatives.

Digital transformation is essentially an agenda with a long-term impact. I refrain to term it as one, if the digitalisation plan does not accomplish at least one significant outcome such as: (a) business process improvement that reduces customer friction or lead time, (b) evolve/establish a new business model, or (c) a culture change contributing tangibly, such as an improvement in perceived value proposition of the brand, increase in the unfair selling advantage enjoyed by the company, or speed of innovation.

Therefore, first and foremost, at least one long-term payoff must be envisaged without which the digital transformation would remain a non-starter. In determining the approach, the crucial element is the strategic intent. A formula-driven approach could be suicidal.

It must be commensurate with the leader's style and the business/industry. The adopted path must direct the efforts towards the intended long-term payoffs. Temptations to pluck low-hanging fruits could turn out to be distractions which derail the journey. In the L&T case, the distraction could have been to make the ‘Digital Hubs’ the policemen, monitoring the expertise of capital equipment users. The central idea is to minimise the strategy-execution gap.

A successful digital transformation would entail disrupting deeply entrenched habits. The CEO must pivot the initiative by creating a dedicated team that does only one task—focus on the initiative. As a leader, one will need to display three important characteristics.

In an era where unhesitant moves and velocity have assumed primacy, leaders should do well to remember overcoming the power of inertia requires tact and patience . The internal and external stakeholders and their interests being served through an existing mechanism cause disequilibrium. The leader needs to display firmness with humility –the former will ensure that the core of the transformation initiative remains intact. In contrast, humility helps to convert critics into champions. Besides, the CEO must ensure that the change team remains humble. Finally, I advocate expanding the comfort zone . A leader who expands their own comfort zone inspires others to do the same. The stakeholders involved in digital transformation must step outside their fears to unlock their individual and collective potential.

The three characteristics would add to the credibility of the leader, the initiative, and the organisation; further, it is bound to increase the commitment of employees involved in adopting the ‘new now’.

S. Ramnarayan, Professor of Practice, Organisational Behaviour, Indian School of Business; Visiting Faculty, University of Bamberg and Case Western Reserve University

Ramnarayan has served on the boards of business organisations and educational and social service institutions. He has written books on topics of leading change, altering mindsets, organisation development, strategic management of public enterprises, and managerial dilemmas. He has been a manager, consultant, and professor at different stages of his career, and has carried out research assignments funded by the US Office of Personnel Management, Ford Foundation, World Bank, Commonwealth Secretariat, Department for International Development, and German Sciences Foundation.

Digital transformation involves the whole organisation in creating value in new ways and transforming business methods. [2] But when the digital strategy becomes disconnected from the organisational strategy, the agenda degenerates to being a mere “digital upgrade”, where the use of digital technology is limited to increasing the efficiency of certain things that the firm is already doing. To enable a transformation of this scale, the top leadership’s wholehearted support is critical.

For effective digital transformation, the focus must be on both “digital” and “transformation”. The digital focus would imply: (a) developing specialised expertise in exploring new technologies; (b) right choice of digital initiatives in consultation with the business leaders; (c) effective solutions architecture; (d) competent implementation of impactful solutions; and so on.

The transformation focus would be reflected in (a) a clear and compelling larger direction of future-proofing the business by being more efficient, productive, competent, competitive, and profitable; (b) energising the businesses and technologists to work together to implement digital initiatives across the value chain at speed and scale; (c) building and sustaining new work habits and decision-making approaches, greater agility, working across boundaries that help instil a data-driven decision-making culture in the organisation.

When L&T began its journey of digital transformation, the direction was set as “opening the doors to new ways of working”. It was a grand vision of achieving global competitiveness. The CEO asked the digital team not to bother with pilot projects or proofs of concepts. Within six months, several machines were connected to generate real-time data on different parameters. Bugs were quickly fixed, and accurate and credible data started flowing in another six months. Then, conversations were facilitated among the concerned people on how the information could generate insights that could translate into optimal asset utilisation. People realised that improving machine utilisation was not simply a matter of making machines work for a longer time. The entire ecosystem had to gear up to facilitate the additional work. It required materials, engineering drawings, and labour. Roles and processes were appropriately changed. The leadership ensured that there was a shared purpose that guided the digital team and the business managers. There was neither the “technology arrogance” of pushing a solution from the digital team, nor resistance from the businesses to experiment with new methods.

Digital transformation is a journey through complexity and uncertainty. It requires attention to technical and social/organisational aspects. This includes:

- Scanning the environment quickly and methodically to explore new technologies

- Establishing a process that allows high-potential ideas to rise and weak ideas to sink

- Bringing in the right talent and partnering with other organisations to develop solutions

- Fostering communication, collaboration, and community building

- Creating the right team structure and ownership across levels to promote demand and idea generation from across the organisation.

Sustaining the momentum requires effective monitoring, making the results visible, and ensuring that employees feel engaged, involved, and empowered in the process of change.

The leadership must address digital and transformation challenges. Thus, two broad areas of capabilities are required.

One set of capabilities addresses the technology challenges through deep expertise. These experts evaluate the business processes where technology could be leveraged and assess the organisation's infrastructure preparedness. They conduct pilots without waiting for the ideal solution, then roll out the solution and engage in continual iterations to address emerging challenges and achieve the intended outcome. Technology leaders tend to be higher in self-oriented competencies, such as adaptability, managing ambiguity, and nimble learning. They display openness to experimentation and testing ideas with real users rather than spending days debating a concept’s validity.

The second set of capabilities deals with transformation challenges. These leaders create a shared understanding of the change; integrate digital strategy with the larger organisational vision and strategy; build collaborative networks; partner with other organisations for technology expertise; influence stakeholders without authority; manage conflicts; communicate and inspire people, and develop talent.

Successful digital transformation also requires careful attention to all the coordination issues through effective choreographing of the change. This requires business leaders to focus on creating the requisite capabilities; reshaping the processes to better align them with strategy; developing key capabilities for making the right decisions; defining new roles, accountabilities, and ways of working; sequencing of steps; and defining how the whole effort will be led. These leaders also need to constantly monitor and review the progress of digital initiates to sustain momentum. Culture can be one of the biggest barriers to successful transformation, and therefore, another critical aspect that requires attention is creating new mindsets and cultures. The new mindsets include the notion of iteration, of constantly reinventing the core, and constantly cannibalising what the group may have done before.

The characteristics of digital culture are agility, high-risk appetite, data-driven decision-making, distributed leadership, and collaborative work style. A key challenge is to create a sub-culture in the digital organisation and keep it buffered from the larger organisation. Finally, successful digital transformation requires a partnership approach, emphasising dialogue, discussions, and collaborative working.

To sum up, successful digital transformation requires entrepreneurial leadership that energises the organisation to pursue opportunity-seeking and advantage-seeking behaviours. [3] A study of entrepreneurial leaders has examined their mindsets—cognitive filters used to act—that influence their actions and decisions. [4] This study found that entrepreneurial leaders develop and practise three mindsets in parallel—people-oriented, purpose-oriented, and learning-oriented—making them adept at handling uncertainty and ambiguity. The people-oriented mindset is about being inclusive, open, positive, and appreciative. The purpose-oriented mindset focusses on purpose/intention and patience with the change journey. The learning-oriented mindset is about listening and picking signals from all around to take risks and experiment. The mindsets play an important role in the successful implementation of strategic entrepreneurship.

[1] 2020 HBR (May June) “Discovery-Driven Digital-Transformation”

[2] libert, b., beck, m., & wind, y. (j). (2016, july 14). 7 questions to ask before your next digital transformation. harvard business review., [3] ireland, r. d., hitt, m. a., & sirmon, d. g. (2003). a model of strategic entrepreneurship: the construct and its dimensions. journal of management, 29(6), 963–989., [4] ramnarayan subramaniam and raj krishnan shankar. (2020). three mindsets of entrepreneurial leaders. the journal of entrepreneurship, 1-31., write to us at [email protected].

- Digital Engineering

- Consumer IoT

- Enterprise Devices

- Personal Devices

- Medical Device & Life Sciences

- Pharma & CRO

- Healthcare Providers

- Industrial Products

- Media & Entertainment

- NexGen Comms

- Discrete Manufacturing

- Metals & Mines

- Oil & Gas

- Semiconductors

- Software & Platforms

- Aerospace Engineering

- Rail Transportation

- Travel & Hospitality

- Trucks & Off-Highway Vehicles

- Public Infrastructure & Smart Cities

- Artificial Intelligence

- Security Monitoring

- Security Services

- Security Solutions

- Immersive Experiences

- Industry 4.0

- Product Consulting

- Sustainability Engineering

- Sustainable Smart World

- Cloud Engineering

- Engineering Analytics

- Sustenance & Maintenance

- User Experience

- Voice Innovations

- Embedded Systems

- Wearables Engineering

- CAE & CFD

- CAx Automation

- Integrated Design, Validation & Testing

- Lab as a Service

- Accelerated Operations

- Digital Factory & Simulations

- Plant Design & Engineering

- Sourcing & Procurement

- Line Expansion & Transfer

- Manufacturing Automation

- New Product Development

- PLM on Cloud

- Agile Supply Chain

- Content Engineering

- Material & Parts Management

- CAPEX Project E/EPCM Services

- Operational Excellence

- Plant Sustenance & Management

- Regulatory Compliance Engineering

- AiCE Artificial Intelligence Clinical Evaluation

- AiKno™ Machine Learning, NLP & Vision Computing

- AnnotAI AI Based Data Annotation Tool

- ARC Asset Reliability Centre

- Asset Health Framework Robust Asset Health Manager

- Avertle ® AI Predictive Maintenance Solution

- CHEST-rAi ™ AI Chest X-Ray Radiology Assist Suite

- Connected Security Integrative Zero Trust Architecture

- EDGYneer Accelerated Edge Intelligence Solution

- ESM Energy and Sustainability Manager

- EvQUAL Next-Gen Quality Engineering Platform

- FlyBoard ® Advanced Digital Signage Solution

- Fusion Pre-integrated City Operating System

- i-BEMS Intelligent Building Experience Management

- Nliten Content Delivery Framework

- nBOn nB-IoT Protocol Stack

- Plant Safety Management End-to-end Safety Management Solution

- Semiconductor IP For Security, Communication & Verification

- SENSOR & GATEWAY SOLUTION Smart solution for conveyance

- UBIQWeise 2.0 Device to Cloud IoT Platform

- DevOps in Healthcare Industry: An LTTS Perspective

- Digital Twins to Unlock Overall Efficiency of Line Operations

- Video Ad Insertion Methodologies Part 2: An OTT/CTV Playbook Series

- How 5G Networks Are Spurring the Onset of Holographic Communication

- LTTS Collaborates With NVIDIA to Unveil Gen AI and Advanced Software-Defined Architecture for Medical Devices

- LTTS to partner with Google Cloud to develop state-of-the-art Dev X platform

- LTTS Accelerates Transition to Smart Vehicles with Generative AI on AWS

- AI Makes Software Testing Irrelevant or Does it?

- Understanding DevTestOps: Toward Leveraging an Exciting Software Journey

- Vehicle-to-Everything (V2X) Enabling Smarter, Safer, and Greener Transportation

- Will 5G Technologies Drive a New Future for Media & Entertainment?

- The Road to Autonomous Mobility

- Vehicle Electrification

- The Art of Cyberwar

- Digital Twin - The Future of Manufacturing

- Digital Engineering Explained

- Board of Directors

- Engineering The Change

- Events & Webinars

- Nearshore Centers

- News & Media

- Quality Management

- Sustainability

- Testimonials

- Our Successes

- Our Capabilities

- Whitepapers

- Insights / Thought Leadership

- What Analysts say

- Listen to our Podcast

- Overseas Opportunities

Navigating Success: How LTTS Helped a Marine Vehicles Manufacturer Expand Their Business?

Load Testing for Audio and Video Streaming App Service

Wearable Testing & Certification Support

Test Automation of Automotive Infotainment System

Test Automation of Web Apps for Industrial Analytics Platform

Pioneering 5G Connectivity in Automotive: A Case Study on Next-gen Telematics Control Unit and Connectivity Platform Testing

Optimized NC Programming With Vacuum Fixture

Revitalizing Machining Operations With Numerical Control Programming

Comprehensive Scenario-Based Testing for an Autonomous Vehicle Platform

- Conferences

- Knowledge Base

- Alternative Fuels

- Privacy & Cookie Policy

- Trial subscription

Larsen & Toubro - Innovative turnkey solutions - A case study

Larsen & Toubro (L&T) is a US$13.5bn Indian conglomerate with business interests in engineering, construction, manufacturing goods, information technology and financial services. It has its corporate office in Mumbai, India and predominantly serves the Indian, Middle Eastern, East Asian and South East Asian markets. L&T is one of the largest and most respected companies in India's private sector with 75 years of customer commitment.

Introduction

L&T was founded in Mumbai, India in 1938 by two Danish engineers, Henning Holck-Larsen and Soren Kristian Toubro. Both were strongly committed to developing India's engineering capabilities to meet the demands of its industries.

More than seven decades of a strong, customer-focused approach and the continuous quest for world-class quality have enabled L&T to attain and sustain leadership in all its major lines of business. L&T has an international presence, with a global spread of offices. The company continues to grow its global footprint, with offices and manufacturing facilities in multiple countries.

L&T's businesses are supported by a wide marketing and distribution network and have established a reputation for strong customer support. L&T believes that progress must be achieved in harmony with the environment. A commitment to community welfare and environmental protection are also integral parts of its corporate vision.

L&T Construction

L&T's construction arm, L&T Construction, is the largest construction organisation in India. It has high rankings in various international contractor surveys, ranking fourth in a Newsweek list of 'green' companies and ninth most innovative by Forbes International. It also won the Infrastructure Company of the Year award at the EPC World Awards in December 2012.

L&T Construction's cutting edge capabilities cover every discipline of construction, be it civil, mechanical, electrical or instrumentation engineering as well as services extending to large industrial and infrastructure projects from concept to commissioning. It has played a prominent role in India's industrial and infrastructure development by executing several projects across the length and breadth of the country and around the globe.

L&T's Project Management expertise has repeatedly demonstrated its ability to deliver projects, even under critical conditions and stringent timelines. Its high standards of professionalism with its clients have helped it win over many difficult situations that would have otherwise caused bottlenecks in execution and successful commissioning.

Indian cement industry

L&T Construction's association with the cement industry dates back to the very early days of the industry and continues today with cutting-edge technology that covers every discipline of construction.

L&T Construction has an impeccable record in the cement plant construction for the design and construction of major cement plants on an engineering, procurement and construction (EPC) basis, meeting the complete requirements of its clients to world-class standards with speed, economy, quality and safety.

Being a pioneer in the construction industry, L&T Construction has constructed cement plants with a total capacity of about 80Mt/yr. In 2012 alone L&T added 12.8Mt/yr of cement production capacity to the Indian cement industry to international standards. Some of the recently executed Indian cement projects include:

- Vicat Sagar Cement, Karnataka.

- UltraTech Rajashree, Karnataka.

- Wonder Cements, Rajasthan.

- KCP Cement Plant, Andhra Pradesh.

- Zuari Cement, Yerraguntla, Andhra Pradesh.

- India Cements, Rajasthan.

First cement plant for Vicat Sagar Cements

A case study is presented here in its entirety, displaying the core competencies of L&T in the execution of a state-of-the-art cement plant. The superior technology implemented by L&T and the initiatives taken thereby provide an analytical frame for completion of plant erection within stipulated schedules. This ensures the highest standards of quality and safety.

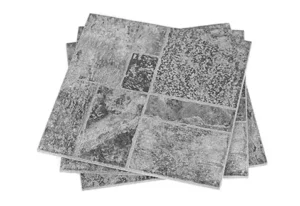

Vicat Sagar Cement Plant constructed by L&T

Vicat Sagar Cement Pvt. Ltd., (VSCPL) a joint venture between the Vicat Group of France and Sagar Cements Limited of India, put up its first integrated greenfield cement plant at Chatrasala Village in Gulbarga District of Karnataka, India. The plant has a cement capacity of 2.75Mt/yr along with waste heat recovery (WHR) system.

VSCPL awarded the civil execution, structural, plate-work and equipment erection contract to L&T. The scope of work included the construction of all major process buildings including eight silos; one 16,000t blending silo, two 60,000t clinker silos, one 6000t fly ash silo and four 10,000t cement silos.

Innovations and construction methodology

To cater to the erection activity within the stringent time schedules of the cement industry, L&T implemented certain innovations and new technologies during construction to enhance productivity. Many advantages by the successful implementation of the new measures at Vicat Sagar have convinced L&T to use the technologies for other new and upcoming cement plant projects as well.

1. Mast Climbing System for silo post tensioning: The standard practice for silo post tensioning stressing works includes the use of staging and side tower arrangement. This standard practice involves movement of labour and post tensioning equipment to a height of around 50–60m, a laborious and time consuming process. Furthermore, labour productivity is low, owing to extensive scaffolding arrangements and in the construction of temporary platforms.

Thus, a new initiative for the silo post tensioning was taken up. A Mast Climbing System was provided for uninterrupted and smooth access to the stressing locations at both sides of the ribs.

In this arrangement, a rack-and-pinion system was assembled, along with a working platform to enable movement of the working platform to the full height of the silo. This contributed to higher labour productivity, reducing the costs related to scaffolding and additional manpower mobilisation.

Worker safety was better ensured by an auto-locking mechanism. The productivity increased to such a level that the post tensioning for the 60m-high silo was completed within a period of 15 days.

2. Optimised use of plant and machinery: L&T has consistently utilised tower cranes for equipment erection at elevated levels. The 165m-high preheater, which is the tallest structure in the plant, was the right location for effectively utilising tower cranes for equipment erection. This enabled completion of preheater mechanical erection in a short time-span.

To achieve the timelines, meticulous micro-level planning was performed which laid out activities right from the foundation stage to commissioning.

Two tower cranes, one 25t crane for mechanical erection and another 16t crane for civil works, were deployed right from the beginning of the project, which has helped in achieving the progress of both the civil and mechanical activities. The tower cranes positioned at the preheater also catered to the erection of other structures in the raw mill and coal mill building. Thereby, equipment in the adjacent buildings was also erected within a short period of time ensuring effective and optimum utilisation of plant and machinery resources.

3. Parallel progress of both civil and mechanical works in the preheater: In the preheater, mechanical erection clearance will be issued only after completion of de-staging and de-shuttering of the slab. This procedure was being followed for all the slabs in the preheater, leading to a delay in initiating the mechanical erection activities.

Considering the time impact this procedure has on the project schedules, the L&T formwork design team prepared a detailed staging and shuttering plan where the cyclones are erected before the staging works starts for the next slab. Subsequent slab staging was done using L&T's heavy duty towers around the cyclones where the structural members are used for supporting the entire slab shuttering arrangement.

This staging arrangement has a smaller footprint in the lower slab where the cyclone erection is carried out. This technique has yielded considerable reductions in time and labour. To implement this new system L&T's formwork team made a detailed implementation plan considering workers' safety and other execution issues.

4. Slip-form angle bracket for clinker silo ring beam: The standard practice for casting the ring beam in a clinker silo is by scaffolding. This demands shuttering and de-shuttering works that are not only very labour intensive but also call for an extensive lead time.

A new technique using slip-form angle bracket for the ring beam was initiated to cut down the huge costs incurred in mobilising these resources. The usage of a crane facilitated mechanised construction and reduced costs.

5. Automation in fabrication yard: The nature of the soil and regular rainfall obstructed crane and machinery movement inside the plant during construction. L&T therefore implemented micro-planning to enable maximum fabrication within the yard premises and customised the plant and machinery in order to suit the local soil conditions.

A modern gantry crane was installed, similar to that in a factory, to obtain the required output on time and easy movement of raw as well as finished material on site. The set-up was on a par with any self-reliant factory setup to meet the complete structural and plate fabrication requirement. This implementation enabled uninterrupted supply of fabricated items to the work site, speeding up the scope of mechanical works.

Safety standards

L&T has adopted and implemented various Quality Plans and Safety Plans to maintain and achieve benchmark results in quality and safety.

With over 172 acres of plant area, a workforce of more than 3100 and an average working height of 40m, L&T was able to successfully maintain its reputation of having the highest safety standards at its cement plants by clocking over 15 million injury-free safe man hours. This is L&T's second project site where it has received the most prestigious British Safety Council Award.

Achievements

The project was executed using advanced L&T formwork systems. L&T was able to mobilise 2600t of formwork material exclusively for this project while construction activity was at its peak. The formwork system was utilised efficiently to complete the civil works with high standards of quality and safety within the stipulated time schedule.

It was a momentous occasion when L&T was able to set the record for erecting the 467t, 4.75m-diameter, 74m-long rotary kiln shells in 23hr 35min.

The project achieved all the major milestones sequentially and has successfully despatched its first cement bag on 16 January 2013.

Cement trends in India

L&T consistently evaluates the problems faced by customers and initiates action plans to identify economical solutions for those issues. Due to various environmental factors, cement manufacturers are under continuous pressure to operate their plants at lower emission levels and reduce their specific energy consumption.

The market scenario also plays a major role in this area. India, one of the fastest growing economies, attracts foreign investment in cement production due to current policies and the country's future potential. Yet the per capita of cement consumption in India is still as low as 150kg/capita/yr, compared to the global average of 350kg/capita/yr.

Indian cement consumption has to improve if the economy is set to achieve high growth rates. This creates stiff competition in the domestic market making cement producers explore ways to cut their operational costs. The entire Indian cement industry is on an upgrade spree ranging from plant capacity enhancements, process optimisation, reduced emission control levels and implementation of alternate fuel firing systems, WHR systems and captive power plants. These upgrade activities will enable the manufacturers to stay competitive even in an environment where the demand is very low.

The environmental ministry has also implemented strict norms in terms of emissions and energy consumption levels where manufacturers would have to pay a penalty if the required government standards are not being met. These are the prime areas of focus for L&T's design team to provide solutions that suit Indian customers.

Cement plant upgrades are expected to be carried out without affecting production; hence plant manufacturers favour technologies that require the least down-time. These are the critical challenges in implementing upgradation projects, which L&T is gearing up to address.

Substantial progress has been achieved in construction areas where cutting edge machineries are deployed to speed up the construction progress and reduce time and labour. The first major step in reducing plant implementation time is to construct plants on an EPC basis.

EPC concept – The future

EPC concept came into existence many decades ago and is widely employed in thermal power plants, nuclear reactors, oil refineries and cross-country pipe lines. The EPC concept paved the way for faster completion of the project, thereby reducing project cost and break-even periods for the customer. In a volatile market scenario, customers do not have the privilege of absorbing the additional cost for delayed projects. The timelines need to be met, shareholders shown good returns and funds repaid to lenders. With such demanding scenarios, even the time available for decision making is very short.

Implementing a project despite all these constraints is becoming more complex day by day, thus making the EPC concept the answer to all these challenges. The entire project concept, engineering, procurement, supply-chain, erection and commissioning is completed faster if a single entity is entrusted with all these activities.

However the Indian cement industry has traditionally ordered equipment in packages, where all equipment is ordered by the client directly and the interlinking between departments is entrusted to the client. This methodology appears to be the choice for cost-effectiveness but the final figures show a completely different story. Direct ordering may be cost-effective during the initial stages of the project, but ultimately most of the projects end up spending more than the budgeted value due to various factors, including delays.

If any one of the following issues such as interfacing between different equipment suppliers, scope of each vendor, delivery of equipment and operation of the plant are not handled properly, the total project cost is expected to reach levels beyond the estimated budget, due to ever-increasing interest rates for the acquired capital.

Many cement projects are still under implementation four years from their start date, due to lack of funds, which is the kind of situation every customer wants to avoid. This risk is mitigated in EPC by pegging the project cost on the date the contract is signed. Hence customers can plan their cash flow according to the stages of the project, which are fixed in the past and no cost escalation can be possible.

EPC has been proven to be very cost-effective in the long run where better monitoring of the project progress is possible. The EPC provider will be held responsible for completing the project on time. The entire engineering, manufacturing and supply process becomes faster in EPC as the supplier is bound to perform, considering the responsibility he is vested with in order to avoid demurrages. This driving factor ensures timely completion of the project and insulates the customer from the effects of project delays and loss of revenue.

Innovative EPC solutions – One-stop shop

Only a few organisations have the capability to provide EPC solutions to the cement industry in which L&T Construction is a leader. It offers a wide range of turn-key solutions to cement plant customers on an EPC basis.

In-order to address the concerns and provide quality solutions to the cement and process industry, L&T has established an office in Hyderabad called 'L&T Cement & Process Plants.' It is dedicated to providing turnkey solutions for cement plants along with offerings to the food, paper, sugar and chemical industries. L&T Cement & Process Plants division specialises in providing turnkey solutions for total construction, balance of plant (BOP) and EPC.

This division's engineering department, with its multi-disciplinary approach to design and integrated solutions has a team of professionals with vast experience in cement and process plants. The team provides solutions from concept to commissioning on EPC basis to satisfy the needs of individual customer right from the enquiry stage. With the domain knowledge, requisite expertise and wide-ranging experience to undertake EPC/BOP of cement plants, L&T's specialisation extends to cost-effective and optimised design solutions.

In 2012, L&T Cement & Process Plants introduced retrofit specialisation to its profile, through which it can provide retrofits for the existing cement plants right from plant study to complete replacement and commissioning of equipment. This makes L&T a capable partner for simplifying cement plant solutions.

Subscribe to Global Cement Magazine

Subscribe to Global Cement Magazine to receive a print copy, high-resolution PDFs and price information.

Subscribe >

- Conferences & Webinars >>

- Global CemBoards

- Global CemCCUS

- Global CemEnergy

- Global CemFuels

- Global CemPower

- Global CemProcess

- Global CemProducer

- Global Cement Quality Control

- Global CemTrans

- Global ConChems

- Global Concrete

- Global FutureCem

- Global Gypsum

- Global GypSupply

- Global Insulation

- Global Slag

- Global Synthetic Gypsum

- Global Well Cem

- African Cement

- Asian Cement

- American Cement

- European Cement

- Middle Eastern Cement

- Magazine >>

- Latest issue

- Editorial programme

- Contributors

- Back issues

- Photography

- Register for free copies

- The Last Word

- Websites >>

- Pro Global Media

- PRoIDS Online

- Social >>

© 2024 Pro Global Media Ltd. All rights reserved.

JavaScript seems to be disabled in your browser. For the best experience on our site, be sure to turn on Javascript in your browser.

We use cookies to make your experience better. To comply with the new e-Privacy directive, we need to ask for your consent to set the cookies. Learn more .

- Compare Products

Digital Transformation at L&T (A)

The case describes the digitalization of L&T Construction, the largest business of L&T, from conception to implementation. The CEO and MD of L&T believed that the organization-wide implementation of digital at L&T Construction would have a significant impact on the business. As a project organization with a limited number of high-value customers and relatively few customer touch points, the primary goal of digitalization in its case would be to improve operational effectiveness. It created a separate digital department and identified digital officers and champions across projects and sites for effective implementation. The transformation was championed from the top and the digital team initiated a variety of initiatives to facilitate digital at L&T. Within two years, they had developed and deployed a large number of solutions across hundreds of project sites, completely transforming the way work was performed. Buoyed by the success of the digitalization effort at L&T Construction, it was decided to extend it to other group companies.

Learning Objective

- Understand the various contributors to the success of DT in a traditional organization

- Appreciate that DTs require an entrepreneurial mindset

- Understand what approaches can be used to manage the effective implementation of digital solutions

- Appreciate the leadership competencies required for DT

- Recognize the need for building capabilities to support transformation

- Examine the nuances of scaling up digitalization to other BUs

- Explore ways to create a new mindset and culture

It provides an overview of the digitalization of other BUs of the L&T group. The digital teams in the various BUs were organized in a decentralized manner; they reported to the CEOs of their respective businesses. At the same time, strong processes and mechanisms were set up to foster coordination, knowledge sharing, and mentoring from the central digital hub. Over the next few months, the non- construction businesses were able to move quickly and successfully implement several digital initiatives. These included solutions that were designed to facilitate the safety of people in work locations during the COVID-19 pandemic. Having reached this juncture, L&T turned its focus to two key agenda items: Diffusing and strengthening the digital mindset and culture in the organization, and Systematic tracking of benefit realization across BUs. CEO was also keen to look at different options to enhance digital effectiveness.

Brought to you by:

Digital Transformation at L&T (A)

By: S. Ramnarayan, Sunita Mehta

The case describes the digitalization of L&T Construction, the largest business of L&T, from conception to implementation. The CEO and MD of L&T believed that the organization-wide implementation of…

- Length: 15 page(s)

- Publication Date: Jul 22, 2021

- Discipline: Organizational Behavior

- Product #: ISB271-PDF-ENG

What's included:

- Teaching Note

- Educator Copy

$4.95 per student

degree granting course

$8.95 per student

non-degree granting course

Get access to this material, plus much more with a free Educator Account:

- Access to world-famous HBS cases

- Up to 60% off materials for your students

- Resources for teaching online

- Tips and reviews from other Educators

Already registered? Sign in

- Student Registration

- Non-Academic Registration

- Included Materials

The case describes the digitalization of L&T Construction, the largest business of L&T, from conception to implementation. The CEO and MD of L&T believed that the organization-wide implementation of digital at L&T Construction would have a significant impact on the business. As a project organization with a limited number of high-value customers and relatively few customer touch points, the primary goal of digitalization in its case would be to improve operational effectiveness. It created a separate digital department and identified digital officers and champions across projects and sites for effective implementation. The transformation was championed from the top and the digital team initiated a variety of initiatives to facilitate digital at L&T. Within two years, they had developed and deployed a large number of solutions across hundreds of project sites, completely transforming the way work was performed. Buoyed by the success of the digitalization effort at L&T Construction, it was decided to extend it to other group companies.

Learning Objectives

Understand the various contributors to the success of DT in a traditional organization

Appreciate that DTs require an entrepreneurial mindset

Understand what approaches can be used to manage the effective implementation of digital solutions

Appreciate the leadership competencies required for DT

Recognize the need for building capabilities to support transformation

Examine the nuances of scaling up digitalization to other BUs

Explore ways to create a new mindset and culture

Jul 22, 2021

Discipline:

Organizational Behavior

Industries:

Construction and engineering

Indian School of Business

ISB271-PDF-ENG

We use cookies to understand how you use our site and to improve your experience, including personalizing content. Learn More . By continuing to use our site, you accept our use of cookies and revised Privacy Policy .

- Group Websites

L&T Group Websites

- Corporate – Arabic

- Heavy Engineering

- Hydrocarbon

- LTIMindtree

- L&T Construction

- L&T Construction & Mining Machinery

- L&T Finance

- L&T Howden

- L&T Hydraulics

- L&T Infrastructure Development Projects Limited

- L&T Infrastructure Finance Company Limited

- L&T Institute of Project Management

- L&T Technology Services

- L&T Kuwait Construction

- L&T MBDA Missile Systems Limited

- L&T Metro Rail (Hyderabad) Limited

- L&T-MHI Power Boilers

- L&T-MHI Power Turbine Generators

- L&T Realty

- L&T-Sargent & Lundy Limited

- L&T Special Steels and Heavy Forgings

- L&T-SuFin

- L&T Valves Limited

- Nabha Power Limited

- L&T Public Charitable Trust

- Rubber Processing Machinery

- Shipbuilding

- L&T Skill Trainers Academy

About L&T Group

Technology for growth, awards & recognition, annual review, video gallery, experience centre - mumbai, group chairman's address - 78th agm, corporate policies, our businesses, sustainability, environment, health & safety, community engagement, green businesses, sustainability updates, integrated report, sustainable development goals, products and services, current openings, learning & development, diversity, equity & inclusion, recruitment caution, campus recruitment, renew: career re-entry for women.