- Open access

- Published: 19 June 2018

The newsvendor model revisited: the impacts of high unit holding costs on the accuracy of the classic model

- Shaolong Tang 1 ,

- Stella Cho 1 ,

- Jacqueline Wenjie Wang 2 &

- Hong Yan 3

Frontiers of Business Research in China volume 12 , Article number: 12 ( 2018 ) Cite this article

8966 Accesses

2 Citations

Metrics details

The newsvendor problem has been applied in various business settings. It is often assumed that the decision variable, i.e., order-up-to level, has no impacts on the holding costs for average inventory cycled in a given period, which is the difference between beginning and ending inventory levels on hand in that period. The average holding cost for this portion of inventory is conveniently and approximately calculated as half the product of the unit holding cost and the expectation of the demand in one period if it is assumed that the inventory is approximately evenly consumed. It is a good approximation when the unit holding cost is significantly lower than the unit backorder cost as this optimal solution to inventory level is able to guarantee a low probability of understocking. However, if this condition does not hold, the approximation may deviate from the actual cost and cannot measure the expected holding cost for this portion of inventory. This paper examines the impact of the cycle stock holding cost on the newsvendor model and the conditions under which this portion of cost is not negligible.

Introduction

The newsvendor model is fundamental for stochastic inventory management theories, which has been studied and applied in various business settings (e.g., Erlebacher, 2000 ; Mieghem, 2007 ; Olivares et al., 2008 ; Petruzzi et al., 2009 ; Krishnan et al., 2010 ). Consider a typical single period newsvendor model. An optimal inventory level is determined to minimize the expected cost, usually including the ordering cost, and the expected overstocking and shortage costs. Ordering too many items can incur overstocking costs, while ordering too few can cause shortage costs. In this typical model, it is often assumed that the decision variable, i.e., order-up-to level, has no impacts on the holding cost for the average inventory consumed in a specific period, which is the difference between beginning and ending inventory levels at hand in that period. Consumed stocks are items that are sold or used by the holder in a particular period. In the classic model, the average holding cost for this portion of inventory is conveniently and approximately calculated as half the product of the unit holding cost and the expectation of the demand in that period, if it is assumed that the inventory is approximately evenly consumed. It is a good approximation when the unit holding cost is much lower than the unit shortage cost because the optimal inventory level of the classic newsvendor model can lessen the possibility of understocking. However, if this condition does not hold, the approximation may deviate from the actual cost and cannot measure the expected holding cost for this portion of inventory accurately. In fact, the unit holding cost for certain products may experience a quick increase. Factors that determine the unit inventory holding cost usually include storage space costs, handling and service costs, risk costs and capital costs. One or more of the above factors may lead to a high unit holding cost. For example, luxury products usually have a high capital cost due to their high ordering costs, and a high risk cost for insurance. Goods that require specific storage conditions, e.g., isoperibol, refrigeration, temporary control or air conditioning may also incur a high unit holding cost. For instance, in Qingdao, a city in North China which is well-known as a seafood distribution center, the rent for cold warehouses for seafood has continuously increased for the past two years. This is mainly because cold storage units are being charged heavily for pollution violations by the local Environmental Protection Bureau. With the ratification of the Paris Climate Agreement in 2015, many countries have committed to cutting greenhouse gas emissions significantly by 2030. Carbon charging has been implemented in several pilot markets in China including Qingdao and will be implemented nation-wide in the near future. Prices for CO 2 emitted by energy consumption for storage are likely to continue its increase as a way to address global warming. Indeed, such pricing has already been in effect in a number of industries in the European Union for many years. These kinds of policies push up the unit holding cost for storage, which in turn affects the accuracy of the traditional newsvendor model. Other factors can also drive up holding costs. In modern warehouses armed with advanced technologies, to smooth the process, many goods are labeled with RFID tags. As is well-known, RFID can greatly enhance the efficiency and effectiveness of warehouse management, although it incurs much higher costs compared to traditional bar coding systems. Overall, holding costs have been experiencing a sharp increase recently in some specific industries.

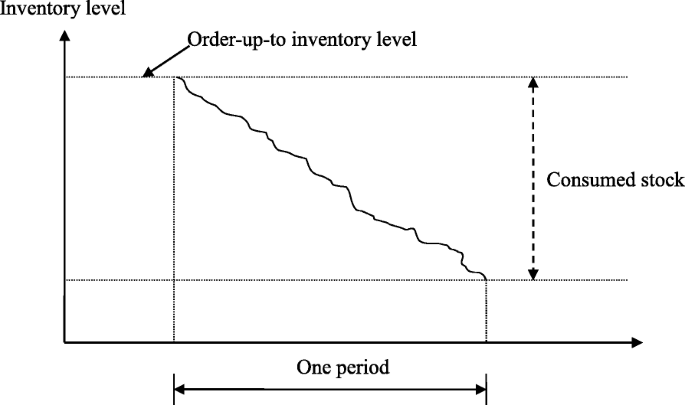

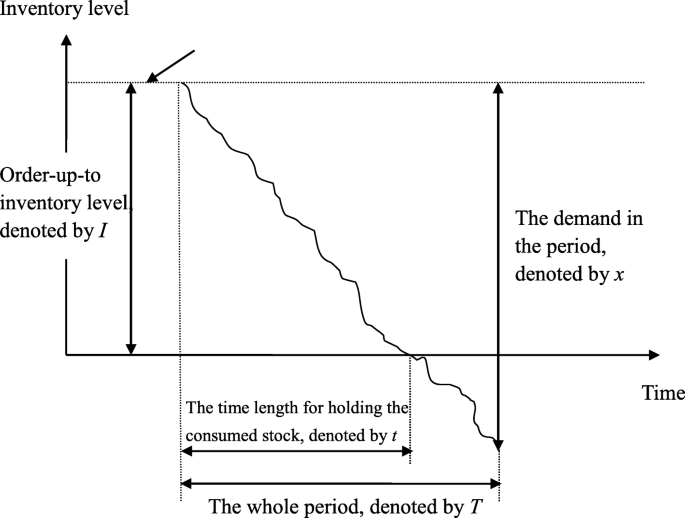

To examine the inaccuracy of the classic newsvendor model when the unit holding cost is high, we analyze two scenarios with different inventory levels at the end of one period in Figs. 1 and 2 . Figure 1 shows the scenario where overstocking occurs at the end of the period, and the consumed inventory used to meet customers’ demand is the difference between the beginning and ending inventory levels. In contrast, Fig. 2 shows the scenario where understocking takes place at the end of the period, the consumed inventory equals the beginning inventory level and there is unsatisfied demand at the end of the period. The unit holding cost is defined as the cost for one item held in the warehouse for the whole period. In the first scenario (Fig. 1 ), all demand in the period is satisfied, and the average consumed inventory approximately equals half the demand if it is assumed that the inventory is approximately evenly consumed. The approximation works well herein. In contrast, in the second scenario (Fig. 2 ) with unsatisfied demand, inventory has been used up before the end of the period. Then it is not appropriate to take half the demand as the approximation of the average consumed inventory. In this scenario the approximation is not very accurate and the degree of deviation greatly depends on the critical ratio of the newsvendor model. We can also observe that the decision variable, i.e., order-up-to level, does influence the holding cost for consumed inventory.

The situation where overstock occurs at the end of one period

The situation where out-of-stock occurs at the end of one period (with notation)

In the literature, most prior research has not considered the holding cost for consumed inventory in the cost (objective) function and has employed the approximation. There are two possible reasons. First, if the unit holding cost is much lower than the unit shortage cost, the optimal inventory level that is derived from the cost function considering ordering, overstocking and shortage costs can lessen the possibility of understocking, and the approximation is an accurate one to measure the holding cost for consumed goods. In this situation, whether this portion of the holding cost is added to the cost function does not affect the optimal inventory level much. A detailed explanation is also shown in the numerical experiment of this paper. Second, the newsvendor model, without considering the holding cost for consumed goods, can provide a compactly analytic solution, which is convenient for further analysis such as multi-echelon problems and multi-tier supply chain problems. For many cases where the ratio of unit holding cost to unit shortage cost is low, the approximation is accurate and skipping the holding cost for consumed inventory in the cost function is acceptable. However, when the unit holding cost is not much lower or even higher than the unit shortage cost, it may cause a non-ignorable deviation from the actual optimal inventory level that minimizes the sum of the expected ordering cost, shortage cost and holding cost for consumed and overstocked items. In such cases, we cannot ignore the consumed inventory holding cost in the cost function for simplification and should seriously consider it when we determine the optimal inventory level.

The rest of this paper is organized as follows. Section “ Literature Review ” reviews the related literature on newsvendor models. In Section “ Newsvendor Models with Consumed Inventory Holding Cost ”, the model that includes the consumed inventory holding cost is constructed and analyzed. In Section “ Numerical Experiments ”, numerical experiments are conducted to analyze the cases where the holding cost for consumed inventory becomes non-ignorable. Section “ Conclusion ” concludes the whole paper and extends the discussion.

Literature review

The newsvendor model is one of the fundamental models for Operations Research and Management Science. Porteus ( 1990 ) summarizes the typical newsvendor model for one-period and multi-period cases. The ordering cost, and overstocking and understocking costs are considered in the cost function and the unsatisfied demand at the end of one period is either lost or backlogged. The critical ratio that is the optimal probability of not stocking out is the ratio of the unit underage cost to the sum of the unit underage and overage costs. Arrow et al. ( 1951 ) give the first derivation of the optimal inventory level and reorder point as a function of the demand distribution, the cost of making an order, and the overstocking and understocking costs. Arrow and Karlin ( 1958a , 1958b ) analyze the optimality of the base stock policy for one stage inventory models with uncertain demand. The optimal inventory level can be determined by examining the derivative of the objective function. Concerning the batch ordering problem of the newsvendor model, Veinott ( 1965a ) shows that a base stock policy, with which the stock is replenished to a certain level if possible, is still optimal. For a single period model with convex objective function and setup cost for ordering, an ( s , S ) policy is optimal. Karlin (1958a) and Porteus ( 1971 , 1972 ) examine the conditions under which a generalized ( s, S ) policy is optimal. Porteus ( 1971 , 1972 ) and Heyman and Sobel ( 1984 ) further show that an ( s, S ) policy will still be optimal if the objective function is a quasi- K -convex for some K that is less than the fixed ordering cost. Hadley and Whitin ( 1963 ) consider the newsvendor model with a single linear constraint on the initial inventory levels for multiple products. Evans ( 1967 ) analyzes a newsvendor model with a linear constraint on the total order and shows that the optimal policy is a base stock policy. Veinott ( 1965b ) examines the optimal policy for the multi-period problem and shows that a myopic base stock policy is optimal under a set of conditions and can be found as a solution to the single period newsvendor model with modified unit overstocking and understocking costs. Li and Lin ( 2006 ) examine the affecting factors for information sharing and information quality in supply chain management. Ferguson et al. ( 2007 ) analyze an extension of the economic order quantity model where the cumulative holding cost is a nonlinear function of time. Berling ( 2008 ) examines the problem with a stochastic holding cost. He considers a single-item inventory model with a fixed set-up cost and stochastic purchase price, and assumes the holding cost is the product of interest rates and purchase price. Shi and Yan ( 2017 ) analyze features of the heterogeneity of consumer preferences and address the multiple equilibrium of retail formats. In sum, prior research has analyzed the optimal solutions of the basic newsvendor model and has provided extensions that consider the setup cost, batch ordering, linear constraints on the total order and initial inventory levels for multi-product cases, etc. The ordering cost, overstocking and understocking costs are considered in the cost function. To our knowledge, no research addresses the consumed inventory holding cost in the objective function and its impact on the optimal inventory level, while this portion of holding costs does occur. This research aims to narrow this gap. Correia et al. ( 2013 ) develop performance measures for a multi-period, two-echelon supply chain network.

Newsvendor models with consumed inventory holding cost

The newsvendor model with instantaneous receipt.

In this section, we first formulate the newsvendor model with instantaneous receipt by considering inventory holding costs for consumed inventory in the cost function. At the beginning of the period, an order-up-to inventory level is determined to minimize the sum of the expected cost. At the end of the period, there are two possible scenarios: overstocking or understocking. Figures 1 and 2 show the changes in inventory level when overstocking or understocking occurs respectively. The unsatisfied demand is backlogged if there is understocking. The stocking out cost is the backordering cost. The inventory level determined at the beginning of the period affects the overstocking and understocking costs, as well as the holding cost for consumed inventory during the period. The model is described by the following parameters and variables:

h the unit inventory holding cost;

π the unit backordering cost if shortage occurs;

x the random demand in the period, which follows a normal distribution;

μ the mean of the demand distribution in the period;

σ the standard deviation of the demand distribution in the period;

I the order-up-to inventory level at the beginning of the period;

C ( I ) the inventory cost when the order-up-to level is I;

φ (•) the probability density function of the demand in the period;

Φ(•) the standard normal distribution function;

E (•) the expected value of a random variable.

Then the objective function of the newsvendor model with instantaneous receipt is

The first and second terms in the objective function represent the expected overstocking and understocking costs. The third term is the expected inventory holding cost for consumed inventory if there are items left at the end of the period. This situation is also shown in Fig. 1. The fourth term is the expected consumed inventory holding cost if out-of-stock occurs, which can be derived from the plane-geometry as follows. In Fig. 2, it can be shown that the holding cost for consumed stock is

We can show that \( \frac{t}{T}=\frac{I}{x} \) Then we have

By rearranging Program P1, we get

The sum of the first three terms in Program P2 is the total inventory cost if we use half the product of the unit holding cost and the expectation of the demand in the period to approximate the consumed inventory holding cost, which is usually used in classic newsvendor models. With this approximation, the decision variable I affects the first two terms (i.e., overstocking and understocking costs), but has no impact on the third term, and the optimal inventory level is determined by minimizing the sum of the first two terms, and can be expressed as.

However, when we consider the consumed inventory cost in a more accurate way, there is another term \( h{\int}_I^{+\infty}\left({I}^2/x-x\ \right)\ \varphi (x)\ dx/2 \) in the cost function, which is also affected by the decision variable I . Then the optimal inventory level for Program P2 is different with the one given in (3.1). We take the first-order and second-order derivatives of the objective function with respect to I in Program P2, and we have.

(3.3) shows that the second-order derivative is greater than 0, and therefore the objective function is convex. It should be noted that, due to the second and third terms of the first-order derivative in (3.2), a closed form solution cannot be derived. Denote the solution of C ′ ( I ) = 0 by I ∗ , which is the optimal inventory level of Program P2. From (3.2) and (3.3), we can obtain the following theorems.

Theorem 1 The optimal solution to P2, i.e., I ∗ , is less than I ∗ ′ in (3.1).

Proof: We need to prove I ∗ ′ > I ∗ . Substituting I ∗ ′ into (3.2), we have.

\( {C}^{\prime}\left({I}^{\ast \prime}\right)={hI}^{\ast \prime }{\int}_{I^{\ast \prime}}^{+\infty}\frac{1}{x}\varphi (x)\ dx \) as \( -\pi +\left(h+\pi \right){\int}_0^{I^{\ast \prime }}\varphi (x)\ dx=0 \) .

Noting \( {C}^{\prime}\left({I}^{\ast \prime}\right)={hI}^{\ast \prime }{\int}_{I^{\ast \prime}}^{+\infty}\frac{1}{x}\varphi (x)\ dx>0 \) , C ′ ( I ∗ ) = 0 and C (•) is convex, we can obtain.

I ∗ ′ > I ∗ .

In words, for a single-period newsvendor model, when the expected overstocking and shortage costs at the end of the period and the consumed inventory cost are considered in the cost function, the optimal inventory level for this cost function decided at the beginning of the period is lower than the optimal solution that only minimizes the sum of the expected overstocking and shortage costs at the end of the period.

Theorem 2 The optimal solution to P2, i.e., I ∗ , is a decreasing function of the unit holding cost h .

Proof: From (3.2), we obtain

From this implicit function, we can show

Then the optimal inventory level I ∗ for this cost function decreases with the unit holding cost.

Theorem 3 The optimal solution to P2, i.e., I ∗ , is an increasing function of the unit backordering cost π .

Then the optimal inventory level I ∗ for this cost function increases as the unit backordering cost.

In section “ Numerical Experiments ”, we conduct the numerical experiments to get I ∗ , and the expected average inventory cost per period C ( I ∗ ), then compare it with C ( I ∗ ′ ).

The newsvendor model without instantaneous receipt

In this section, we further consider the newsvendor model without instantaneous receipt for an infinite planning horizon. The demand in each period follows a normal distribution with mean μ and variance σ 2 . Suppose there is a delay of L periods between ordering goods and receiving them. At the beginning of each period, goods ordered L periods ago arrive. During the whole period, the on-hand inventory is consumed approximately evenly to meet customers’ demands, and the unsatisfied demand is backlogged if stocking out occurs. Demands are independent over time. The order-up-to level I m is determined at the end of the period. We still let h and π denote the unit holding and shortage cost per period, and use the following parameters to formulate the model:

D 1 the demand in one period;

D L the sum of demand in L periods;

D L + 1 the sum of demand in L + 1 periods;

φ 1 (•) the probability density function of the demand in one period;

φ L (•) the probability density function of the demand in L periods;

φ L + 1 (•) the probability density function of the demand in L + 1 periods;

I m the order-up-to level in one period;

C m ( I m ) the expected average inventory cost when the order-up-to level is I m .

Then the newsvendor problem without instantaneous receipt can be modeled as

In Program P3, the objective function is the expected average inventory cost including overstocking costs, shortage costs and consumed inventory holding costs. Similar to Program P1, the first two terms are the expected overstocking and shortage costs. The third term is the expected inventory holding cost for consumed inventory if there are items left at the end of the period. The last term is a little complicated, which represents the expected holding cost for consumed inventory if there is unsatisfied and backlogged demand in the period. The value of this term is determined by the on-hand inventory level at the beginning of the period that is the difference between the order-up-to level decided L periods ago and the demand satisfied during the preceding L periods, and the demands that will be experienced in the coming period. Then there are two sources of uncertainty in the last term and a double integral is needed to quantify them.

By rearranging Program P3, we can get

For the third and fourth terms in Program P4, we cannot differentiate the objective function with respect to I m and get the first-order and second-order derivatives analytically. Numerical experiments are conducted in next section to get the optimal solution for Program P4.

In contrast, if we use the approximation only, i.e., half the product of the unit holding cost and the expectation of the demand in the period, to represent the holding cost for consumed inventory, the order-up-to level I m only affects the expected average overstocking and shortage costs (the first two terms in Program P4). In such a scenario, the optimal order-up-to level is.

By substituting (3.4) into the objective function of Program P4 for I m , we can get the inventory cost when the order-up-to level is \( {I_m^{\ast}}^{\prime } \) . Denote the optimal solution of I m in Program P4 by \( {I}_m^{\ast } \) . In the next section, we first conduct numerical experiments to get \( {I}_m^{\ast } \) , then compare the difference between \( {C}_m\left({I}_m^{\ast}\right) \) and \( {C}_m\left({I_m^{\ast}}^{\prime}\right) \) in different situations.

Numerical experiments

In section “ Newsvendor Models with Consumed Inventory Holding Cost ”, we formulate models considering the consumed inventory holding cost in the cost function with and without instantaneous receipt. Now numerical experiments are designed to get their optimal solutions that cannot be derived analytically, and examine the difference of the average inventory costs for the cases with and without the consumed inventory cost considered in the objective function. In experiments, we set the unit holding cost h = 2.5, and unit shortage cost π = 8. We set the expected value and the standard deviation of the demand in one period μ = 100 and σ = 20, respectively. For the model without instantaneous receipt, we set the leadtime L = 4.

We first obtain the optimal solutions I ∗ and \( {I}_m^{\ast } \) for Programs P2 and P4 with numerical experiments. By changing one parameter and holding others constant, we examine the impact of the factor on the differences of I ∗ and I ∗ ′ , \( {I}_m^{\ast } \) and \( {I_m^{\ast}}^{\prime } \) , C ( I ∗ ) and C ( I ∗ ′ ), \( {C}_m\left({I}_m^{\ast}\right) \) and \( {C}_m\left({I_m^{\ast}}^{\prime}\right) \) respectively. MATLAB 7.0.1 is employed to calculate the integrals in the cost functions.

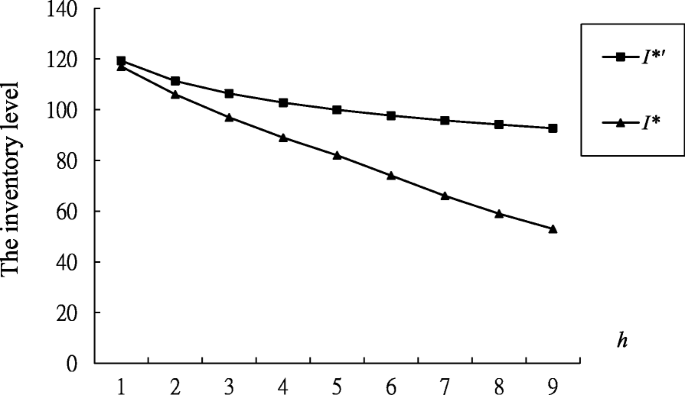

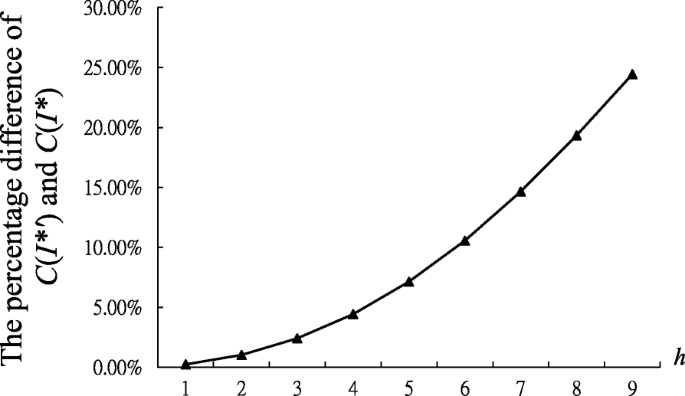

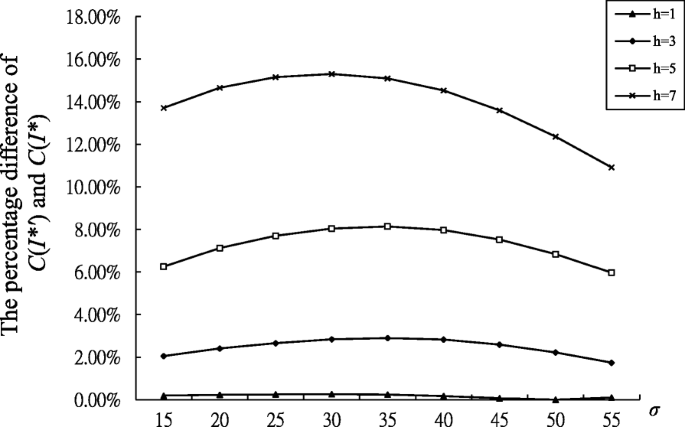

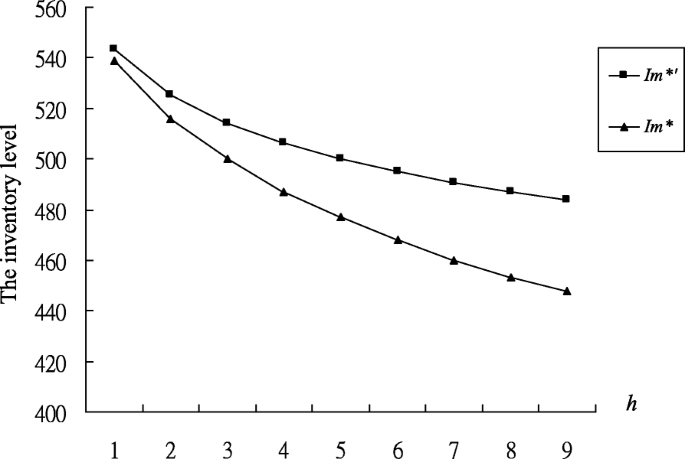

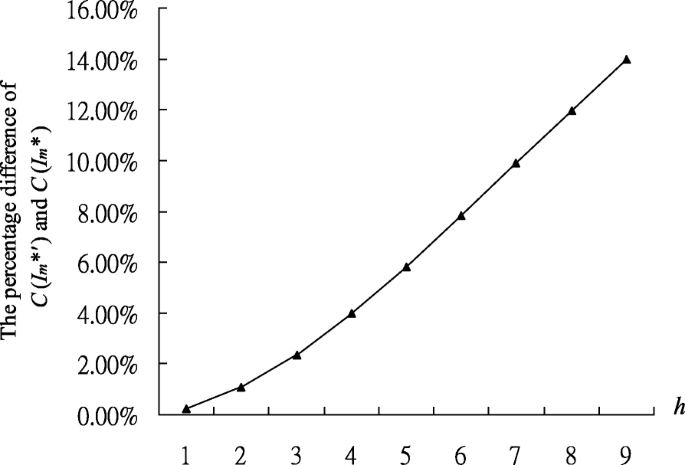

The single-period model is studied first. Note that in (3.3) the second-order derivative of the objective function in Program P2 is greater than 0, and thus the objective function is convex. To get the optimal solution of Program P2 ( I ∗ ), we just find the value of I that make C ′ ( I ) in (3.2) equal 0 with numerical experiments. Figures 3 and 4 examine the differences of I ∗ and I ∗ ′ as well as C ( I ∗ ) and C ( I ∗ ′ ) respectively when we change the unit holding cost h from 1 to 9 and keep all the other parameters constant. In Fig. 3 , I ∗ is always less than I ∗ ′ , which is consistent with Theorem 1. It also shows that the difference between I ∗ ′ and I ∗ increases as the unit holding cost increases. It can be explained as follows. As the unit holding cost increases, both I ∗ ′ and I ∗ decrease (Theorem 2), and the scenario in Fig. 2 will have a greater chance to occur. Then the inventory cost for consumed products weighs more in the cost function. Since the deviation between I ∗ ′ and I ∗ is mainly caused by this term, the difference tends to increase with the unit holding cost. Figure 4 shows that the percentage difference of C ( I ∗ ′ ) and C ( I ∗ ), i.e.,[ C ( I ∗ ′ ) − C ( I ∗ )]/ C ( I ∗ ), increases as the unit holding cost increases. Figure 4 is consistent with Fig. 3 , which shows that as the unit holding cost increases, the scenario in Fig. 2 will have more of a chance to occur and the inventory cost for consumed products in the cost function plays a more important role. In Figs. 3 and 4 , with a low unit holding cost, the difference of the cases with and without the consumed inventory cost in the objective function, in terms of the inventory level and expected average inventory cost, is not significant. In such a scenario, I ∗ ′ does not deviate from I ∗ much and is a good approximation of I ∗ for it has the analytical form expressed in (3.1). It can greatly facilitate the analysis of more complicated situations. However, we can also observe in Figs. 3 and 4 that when the unit holding cost is relatively high, the deviation of I ∗ ′ from I ∗ becomes non-ignorable. In this situation, I ∗ ′ is not suitable as the approximation of I ∗ otherwise it can cause the expected average cost C ( I ∗ ′ ) to deflect from the actual minimum expected inventory cost C ( I ∗ ) significantly. Numerical experiments may help in such a situation to derive the optimal inventory level as well as the minimum inventory cost. In Fig. 5 , let the standard deviation of the demand distribution vary under different unit holding costs, and fix the values of all the other parameters. It shows that with a higher unit holding cost, the volatility of the demand has an upward bending relation with the percentage difference of C ( I ∗ ′ ) and C ( I ∗ ). In contrast, with a lower unit holding cost, the impact of the demand volatility on this percentage is much lower or even ignorable. The insensitivity of the percentage difference to the demand variation for a low unit holding cost also demonstrates that I ∗ ′ is a suitable approximation of I ∗ in such situations. The inverse U-shape of the curves in Fig. 5 can be explained as follows. Note that the difference between I ∗ and I ∗ ′ is mainly determined by the fourth term in Program P2. When the degree of demand uncertainty is low, the first, second and fourth terms in P2are relatively small, compared to the third term. In this situation, the small weight of the fourth term in the total cost function only leads to a small difference between I ∗ and I ∗ ′ . Consequently, the percentage cost difference is also small. Then the percentage cost difference initially increases as the degree of demand uncertainty increases from a very low level. When the degree of demand uncertainty goes beyond a certain high level, the weight of overstocking and understocking costs, i.e., the first two terms in P2, tend to be larger. Then the fourth term in P2 in this situation tends to be less important in the cost function. It leads to smaller differences between I ∗ and I ∗ ′ and lower percentage cost differences.

The inventory level vs. the unit holding cost for the model with instantaneous receipt

The percentage difference of C ( I ∗ ′ ) and C ( I ∗ ) vs. the unit holding cost for the model with instantaneous receipt

The percentage difference of C ( I ∗ ′ ) and C ( I ∗ ) vs. the standard deviation of the demand distribution under different unit holding costs for the model with instantaneous receipt

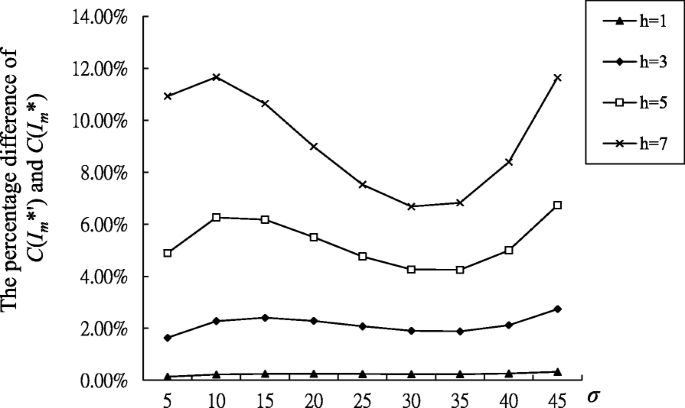

Next we examine the model without instantaneous receipt. Due to the form of the objective function in Program P4, we cannot derive the closed-form optimal solution. Thus we first conduct numerical experiments to get the optimal solution of Program P4, and examine the impacts of factors on the differences of \( {I}_m^{\ast } \) and \( {I_m^{\ast}}^{\prime } \) as well as \( {C}_m\left({I}_m^{\ast}\right) \) and \( {C}_m\left({I_m^{\ast}}^{\prime}\right) \) respectively. In general, numerical results for the model without instantaneous receipt are similar to those with instantaneous receipt. More specifically, Figs. 6 and 7 reveal similar patterns to Figs. 3 and 4 , respectively. In Figs. 6 and 7 , with a low unit inventory holding cost, the deviations of the cases with and without the consumed inventory cost considered in the objective function, in terms of the inventory level and expected average inventory cost, are trivial, while they are noteworthy with a high unit holding cost. In Fig. 8 , let the standard deviation of the demand distribution vary under different unit holding costs, with other things constant. It shows some interesting patterns that cannot be revealed by examining the objective function of Program P4. A group of wave curves under different unit holding costs are graphed in this figure, and the amplitude of fluctuation increases as the unit holding cost increases. It indicates that the demand uncertainty has alternate positive and negative impacts on the difference of \( {C}_m\left({I}_m^{\ast}\right) \) and \( {C}_m\left({I_m^{\ast}}^{\prime}\right) \) in the model without instantaneous receipt.

The inventory level vs. the unit holding cost for the model without instantaneous receipt

The percentage difference of C ( I ∗ ′ m ) and C ( I ∗ m ) vs. the unit holding cost for the model without instantaneous receipt

The percentage difference of C ( I ∗ ′ m ) and C ( I ∗ m ) vs. the standard deviation of the demand distribution under different unit holding costs for the model without instantaneous receipt

Moreover, to exam whether above results are robust, we have further conducted.

In numerical experiments for different values of \( \frac{\pi }{h+\pi } \) , the shapes of curves are very close to the above results.

Our numerical experiments show that there exist differences in optimal inventory levels with and without the holding cost for consumed stock in the total cost function. A suboptimal solution is obtained if the cost for consumed stock is excluded in the cost function when making decisions. The numerical experiments indicate that this inventory level difference and associated total cost difference increase as the unit holding cost increases and can be affected by the degree of demand uncertainty. These findings provide some useful insights for practitioners. When the unit holding cost is relatively high compared to the unit backordering cost, there is more chance to have understock at the end of the period. That is, the scenario in Fig. 2 will have a greater chance to happen. In this situation, the decision on inventory level will remarkably affect the holding cost for consumed items. Our analysis shows that the inventory level considering the holding cost for consumed stock will be lower than the one determined by the model further taking into account such holding costs. In other words, the former one is inferior to the latter one when the total inventory cost function includes understocking costs, overstocking costs and holding costs for consumed stock. The difference in the inventory levels will lead to associated cost differences. Such cost difference also increases with the unit holding cost, and can be affected by the degree of demand uncertainty. Since the unit inventory holding cost usually covers storage space costs, handling and service costs, risk costs and capital costs, one or more such factors may cause a high unit holding cost. For example, luxury products or products requiring specific storage conditions may have a high unit holding cost. When inventory decisions are made for these products, the holding cost for consumed items should be included in the total cost function to obtain the optimal inventory level. Otherwise, a suboptimal solution will be obtained.

In this work, we revisit the newsvendor model by considering the consumed stock holding cost in the cost function. In the classic model, we assume the inventory level has no impact on the holding cost for consumed stock during one period, where the average holding cost for this portion of inventory is usually approximated as half the product of the unit holding cost and the expectation of the demand in that period. It works when the ratio of unit holding cost to the unit shortage cost is low. However, without this condition, the approximation can deviate significantly from the actual expected cost. The higher unit holding cost can be attributed to the high capital cost, insurance cost, holding cost for specific storage conditions, and, more prominently, coming carbon charges. With today’s trends of price-based policies for reduction of greenhouse gas emissions, as well as the advance of technologies in warehouse management, holding costs have been rising significantly in some industries. To mitigate the potential shortcomings of the classic model, we add the holding cost for consumed inventory into the cost function. The models with and without instantaneous receipt are formulated and analyzed.

For the model with instantaneous receipt, analysis shows that the optimal inventory level is lower if the consumed inventory cost is considered in the cost function, other things being constant. The relationships between the optimal inventory level and the unit holding cost as well as the unit backordering cost are shown. Numerical experiments are conducted to examine the factors that affect this deviation. Other things being constant, the deviation increases as the unit inventory holding cost increases, for both models. The uncertainty of demand, which is measured by its standard deviation, has either positive or negative impacts on the deviation depending on the specific circumstance. Both analyses and numerical experiments indicate the deviation caused by ignoring the holding cost for consumed inventory is unacceptable in some circumstances. The approximation, i.e., half the product of the unit holding cost and the expectation of the demand in the period, can lead to the closed-form expression of optimal inventory level (or position) and facilitate analyses of more complicated problems. In such situations, well-designed numerical experiments and simulations should be employed to conduct further research.

Arrow, K. J., Harris, T., & Marschak, J. (1951). Optimal inventory policy. Econometrica, 19 (3), 250–272.

Article Google Scholar

Arrow, K. J., & Karlin, S. (1958a). Smoothed production plans. In K. J. Arrow, S. Karlin, & H. Scarf (Eds.), Studies in the Mathematical Theory of Inventory and Production (pp. 61–69). Stanford: Stanford University Press.

Google Scholar

Arrow, K. J., & Karlin, S. (1958b). Smoothed production plans. In K. J. Arrow, S. Karlin, & H. Scarf (Eds.), Studies in the Mathematical Theory of Inventory and Production (pp. 70–85). Stanford: Stanford University Press.

Berling, P. (2008). The capital cost of holding inventory with stochastically mean-reverting purchase price. European Journal of Operational Research, 16 (2), 620–636.

Correia, I., Melo, T., & Saldanha-da-Gama, F. (2013). Comparing classical performance measures for a multi-period, two-echelon supply chain network design problem with sizing decisions. Computers & Industrial Engineering, 64 (1), 366–380.

Erlebacher, S. J. (2000). Optimal and heuristic solutions for the multi-item newsvendor problem with a single capacity constraint. Production and Operations Management, 9 (3), 303–318.

Evans, R. V. (1967). Inventory control of a multiproduct system with a limited production resource. Naval Research Logistics Quarterly, 14 (2), 173–184.

Ferguson, M., Jayaraman, V., & Souza, G. C. (2007). Note: An application of the EOQ model with nonlinear holding cost to inventory management of perishables. European Journal of Operational Research, 180 (1), 485–490.

Hadley, G., & Whitin, T. M. (1963). G. Analysis of Inventory Systems . Englewood Cliffs: Prentice-Hall.

Heyman, D. P., & Sobel, M. J. (1984). Stochastic models in operations research (Vol. Vol. II). New York: McGraw-Hill.

Krishnan, H., & Winter, R. A. (2010). Inventory dynamics and supply chain coordination. Management Science, 56 (1), 141–147.

Li, S., & Lin, B. (2006). Accessing information sharing and information quality in supply chain management. Decision Support Systems, 42 (3), 1641–1656.

Mieghem, J. A. V. (2007). Risk mitigation in newsvendor networks: Resource diversification, flexibility, sharing, and hedging. Management Science, 53 (8), 1269–1288.

Olivares, M., Terwiesch, C., & Cassorla, L. (2008). Structural estimation of the newsvendor model: An application to reserving operating room time. Management Science, 54 (1), 41–57.

Petruzzi, N. C., Wee, K. E., & Dada, M. (2009). The newsvendor model with consumer search costs. Production and Operations Management, 18 (6), 693–704.

Porteus, E. L. (1971). On the optimality of generalized (s, S ) policies. Management Science, 17 (7), 411–426.

Porteus, E. L. (1972). The optimality of generalized ( s, S ) policies under uniform demand densities. Management Science, 18 (11), 644–646.

Porteus, E. L. (1990). Stochastic inventory theory. In D. P. Heyman & M. J. Sobel (Eds.). North Holland: Elsevier Science Publishers.

Shi, M., & Yan, X. (2017). Heterogeneous consumers, search and retail formats. Frontiers of Business Research in China, 11 (4), 525–544.

Veinott, A. F. (1965a). Computing optimal (s, S) inventory policies. Management Science, 11 (5), 525–552.

Veinott, A. F. (1965b). Optimal policy for a multi-product, dynamic, non-stationary inventory problem. Management Science, 12 (3), 206–222.

Download references

Acknowledgements

The research is partially supported by Natural Science Foundation of Guangdong (2015A030313823), Zhuhai Outstanding Discipline Project-Accounting and UIC college research grant.

Author information

Authors and affiliations.

Division of Business and Management, Beijing Normal University-Hong Kong Baptist University, United International College, 2000 JinTong Road, Tangjiawan, Zhuhai, Guangdong, China

Shaolong Tang & Stella Cho

School of Accounting and Finance, The Hong Kong Polytechnic University, HKSAR, Hong Kong, China

Jacqueline Wenjie Wang

Department of Logistics and Maritime Studies, The Hong Kong Polytechnic University, HKSAR, Hong Kong, China

You can also search for this author in PubMed Google Scholar

Contributions

ST carried out models setup and analysis; SC helped draft the manuscript and made the figures in the draft; JWW helped conduct the literature review and drafted the manuscript; HY helped construct models and conducted numerical experiments. All four authors read and approved the final manuscript.

Corresponding author

Correspondence to Shaolong Tang .

Ethics declarations

Competing interests.

The authors declare that they have no competing interests.

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License ( http://creativecommons.org/licenses/by/4.0/ ), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

Reprints and permissions

About this article

Cite this article.

Tang, S., Cho, S., Wang, J.W. et al. The newsvendor model revisited: the impacts of high unit holding costs on the accuracy of the classic model. Front. Bus. Res. China 12 , 12 (2018). https://doi.org/10.1186/s11782-018-0034-x

Download citation

Received : 06 January 2018

Accepted : 25 May 2018

Published : 19 June 2018

DOI : https://doi.org/10.1186/s11782-018-0034-x

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Newsvendor model

- Inventory control

- Stochastic model

- Open access

- Published: 03 January 2018

Comparing validity of risk measures on newsvendor models in open innovation perspective

- Sungyong Choi 1 ,

- KyungBae Park ORCID: orcid.org/0000-0003-0900-609X 2 &

- Sang-Oh Shim 3

Journal of Open Innovation: Technology, Market, and Complexity volume 4 , Article number: 1 ( 2018 ) Cite this article

3524 Accesses

2 Citations

1 Altmetric

Metrics details

In the era of Industry 4.0, firms are facing with greater uncertainty. Accordingly, it is important to select quality risk measures to analyze newsvendor problems under risk. Then, open innovation can be a good remedial option for such risk-averse newsvendors because open innovation can offset the profit losses from risk aversion by sharing revenues in supply chains. To find such risk measures in newsvendor problems, we review various risk measures of risk-averse inventory models and existing articles in inventory management literature. Then we provide a logical reasoning and axiomatic framework to evaluate validity of each risk measure in newsvendor problems - consistency to the four axioms in coherent risk measures. In this framework, the underlying assumptions and managerial insights to the newsvendor problems are examined for each risk measure. Consequently, exponential utility function and coherent measures of risk are selected as two plausible risk measures to analyze multi-product risk-averse newsvendor models.

Introduction

In the era of Industry 4.0, firms are facing with greater uncertainty. Accordingly, we cannot always expect that similar outcomes may be repeated in random situations. The first few outcomes may turn out to be very bad such that they might be unacceptable losses. Then, open innovation can be a good remedial option for such risk-averse newsvendors because open innovation can offset the profit losses from risk aversion by sharing revenues in supply chains (refer to Yoon and Jeong ( 2017 )).

In the literature of inventory management, the (single- or multi-product) newsvendor model, initiated by Arrow et al. ( 1951 ), is a well-known classical stochastic inventory replenishment problem in supply chain management literature. In this model, there may exist perishable products with random demand in a single-selling season. Then a newsvendor should decide his optimal ordering quantity for each product in this single-period model before demand realization. Because the product demand is only given as a probability distribution, the objective function is represented as a random outcome. If the newsvendor orders too much for any product, all the leftover items are sold at a discounted price; if the newsvendor orders too little, it will lose sales opportunity.

The original model by Arrow et al. ( 1951 ) maximizes the expected value of profits without resource constraints and demand substitution. Then the multi-product model is decomposable into multiple single-product models in each product and has a simple analytical closed-form optimal solution for each product. This solution is known as a fractile, described with overage and underage profits, of the arbitrary (cumulative) demand distribution function. Thus, it can characterize the optimal solution effectively with underage and overage profits as well as its solvability as a closed-form solution. Owing to its simple solution with trade-off analysis between underage and overage profits, it has many applications in industries such as overbooking problems or facility capacity problems.

Since Arrow et al. ( 1951 ), many variations of multi-product newsvendor models have been studied in literature. Hadley and Whitin ( 1963 ) add a resource constraint and suggest solution methods using Lagrangian multipliers. Van Ryzin and Mahajan ( 1999 ) study a multi-product newsvendor with demand substitution. In both of Hadley and Whitin ( 1963 ) and van Ryzin and Mahajan ( 1999 ), multi-product models is not decomposable, so we need to consider all the products simultaneously. In that sense, a multi-product newsvendor model considers heterogeneous expectations in each product at a time and such setting has been found quite common in literature (refer to Lee and Lee ( 2015 )).

Again Arrow et al. ( 1951 ) and its variations focus on maximizing the expected (random) profit. That is, the newsvendor selects his optimal solution based on the expected value of the random outcome. Thus, the original model and its variations can be said to be expected-value optimization models and also equivalently risk-neutral models under uncertainty. However, risk neutrality guarantees the best decision only on average . It may be justified by the Law of Large Numbers. However, we cannot expect that the actual single realization is sufficiently close to its expected value. In fact, when the single realization is very much deviated from its expected value, risk-neutral models will lose their validity. Then risk-averse decision making can be a good alternative, instead of risk-neutral decision making.

To overcome drawbacks of risk-neutral models, various risk preferences have been studied in literature. Lee et al. ( 2016 ) argues that degree of ambiguity may affect decision makers’ risk preferences. More specifically, consumers tend to be more risk-averse with more ambiguous situations and vice versa. In risk-averse models, inventory managers consider the variability of the outcome as well as its expected value. That is, under risk aversion, a risk-averse inventory manager may prefer more stable outcome even if the outcome is worse on average . Schweitzer and Cachon ( 2000 ) conducted two empirical experiments to show risk preferences of inventory managers. By the experiments, they showed that inventory managers may be risk-averse for short life-cycle or high-value products. Therefore, risk aversion can capture the decision making of inventory managers at a different angle from risk neutrality and both of them are consistent with rational decision makers. Because risk aversion significantly affects the optimal choices of inventory managers, it is a very interesting and important factor to analyze the optimal choices of inventory managers. In particular, risk aversion has a very good fit to conservative decision makers. Some good industrial examples are energy, environment and sustainability where risk measurement is very important.

This paper aims to extend the series of previous works, Choi and Ruszczyński ( 2008 ), Choi et al., 2011 and Choi and Ruszczyński ( 2011 ). In those three papers, they conducted the extensive literature review for various risk measures used in the inventory management literature and categorized the risk measures into four typical approaches. Then they selected coherent measures of risk as quality risk measures in Choi and Ruszczyński ( 2008 ) and Choi et al. ( 2011 ) and an exponential utility function in Choi and Ruszczyński ( 2011 ), respectively. In each paper, a logical justification was given for using such specific risk measure selected. Then the optimal policy of the newsvendor models was studied by providing several analytical propositions and numerical insights. On the other hand, we examine such logical justifications in those papers more comprehensively and deeply. As a result, we provide a logical reasoning and then axiomatic framework to compare the validity of such risk measures in multi-product newsvendor models by analyzing the underlying assumptions and managerial insights.

In order to find plausible risk models in newsvendor problems, we focus on the measures based on risk aversion. Then we consider risk neutrality for a reference purpose only. For this purpose, the well-known Prospect Theory and loss aversion, initiated by Kahneman and Tverski ( 1979 ), are not considered in this paper. The Prospect Theory assumes that people are risk-averse for their gains, but risk-seeking for their losses. It can explain why sometimes people may buy lottery and insurance together, which was not explained by expected utility theory. This situation may be consistent to individual decision makers, but not inventory managers in a company because inventory managers do not have to carry the products incurring losses. Loss aversion is a concept introduced first by Kahneman and Tverski ( 1979 ). It refers to the tendency of an individual decision maker who prefers avoiding losses to obtaining gains. However, in a successive work in the Prospect Theory, Tverski and Kahneman, 1992 revealed that loss aversion does not occur in routine transactions (refer to Novemsky and Kahneman ( 2005 )), which describe typical inventory decision-making situations.

The remainder of this paper is organized as follows: First, we briefly review the four typical approaches in §1. Second, we conduct a literature review in risk-averse inventory models in § 2. Third, we discuss the validity of risk measures for newsvendor problems in §3. Forth, we show newsvendor problem formulations in §4. Lastly, we conclude this paper by summarizing the main results and suggesting some extensions of the paper in §5.

Risk measures

Due to the aforementioned reasons in §1, risk-averse newsvendor models have been recently studied very actively with various risk measures in inventory management literature. Choi et al. ( 2011 ) had an attempt to categorize the risk measures of risk-averse inventory models in inventory Management literature. Then the authors summarize the typical approaches of risk measures into four groups. They are expected utility theory, stochastic dominance, chance constraints and mean-risk analysis. Although these four categories of risk measures are different from each other, they are closely related and consistent to some extent. In this paper, we continue to use this four-group classification in Choi et al. ( 2011 ).

Expected utility theory

In the utility function approach, inventory managers optimize the expected value of their utility function, instead of the expected outcomes. Then the optimization model of utility function approach can be represented as follows:

Consider an optimization model where the decision vector x affects a random performance measure, ϕ x . Here, for all x ∈ ℵ with ℵ being a vector space, ϕ x : Ω → ℝ is a measurable function on a probability space \( \left(\varOmega, \mathcal{F},P\right) \) where Ω is the sample space, \( \mathcal{F} \) is a σ–algebra on Ω and P is a probability measure on Ω . Then, the modern theory of the expected utility by von.

von Neumann and Morgenstern ( 1944 ) derives, from simple axioms, the existence of a nondecreasing utility function, which transforms (in a nonlinear way) the observed outcomes. That is, each rational decision maker has a nondecreasing utility function u (∙) such that he prefers random outcome ϕ 1 over ϕ 2 if and only if [ u ( ϕ 1 )]> \( \mathbb{E}\left[u\left({\phi}_2\right)\right] \) , and then he optimizes, instead of the expected outcome, the expected value of the utility function. Therefore, the decision maker solves the following optimization model.

where ϕ x is an (measurable) outcome function. From now on, ϕ x denotes a profit function in this paper. When the performance measure is defined as a profit function, a risk-averse decision maker is consistent to the second-order stochastic dominance and he has a concave and nondecreasing utility function. Since Eeckhoudt et al. ( 1995 ), an approach of utility functions has been popular in risk-averse newsvendor models. In Eeckhoudt et al. ( 1995 ), nondecreasing and concave utility function are used to analyze risk-averse newsvendor models.

In this paper, we select an exponential utility function among various nondecreasing and concave utility functions. Choi and Ruszczyński ( 2011 ) point out that.

Exponential utility function is a particular form of a nondecreasing and concave utility function. It is also the unique function to satisfy constant absolute risk aversion (CARA) property. For those reasons, exponential utility function has been used frequently in finance and also in the supply chain management literature such as Bouakiz and Sobel ( 1992 ) and Chen et al. ( 2007 ) .

Stochastic dominance

Stochastic dominance is the sequence of the partial orders defined on the space of random variables in a nested way such as the first-order, the second-order, the higher-orders than the second and so on. This sequence of relations allow pairwise comparison of different random variables (see Lehmann ( 1955 ) and Hadar and Russell ( 1969 )) and lower-orders are stronger relations in the sequence. In the sequence of the relations, the second-order stochastic dominance is consistent to risk aversion.

Then an important property of stochastic dominance relations is its consistency to utility functions. That is, a random variable ϕ 1 dominates ϕ 2 by a stochastic dominance relation is equivalent that the expected utility of ϕ 1 is better than that of ϕ 2 for all utility functions in a certain family of utility functions. For the first- and second-order stochastic dominance relations, this property is represented as follows:

\( {\phi}_1{\succcurlyeq}_{(1)}{\phi}_2\iff \mathbb{E}\left[u\left({\phi}_1\right)\right]\ge \) \( \mathbb{E}\left[u\left({\phi}_2\right)\right] \) , for every nondecreasing U [∙].

\( {\phi}_1{\succcurlyeq}_{(2)}{\phi}_2\iff \mathbb{E}\left[u\left({\phi}_1\right)\right]\ge \) \( \mathbb{E}\left[u\left({\phi}_2\right)\right] \) , for every nondecreasing and concave U [∙]

In spite of such nice properties, stochastic dominance does not have a simple computational method unfortunately for its implementation by itself. Thus, it has been mainly used as a reference criterion to evaluate the legitimacy of risk-averse inventory models.

Chance constraints

Chance constraints add some constraints on the probabilities that measure the risk such as:

where η is a fixed target value and α ∈ (0, 1) is the maximum level of risk of violating the stochastic constraint, ϕ x ≥ η . Then, we consider the following optimization model.

subject to P ( ϕ x ≥ η ) ≥ 1 − α

In finance, chance constraints are very popular as the name of VaR (Value-at-Risk). For consistency to stochastic dominance, VaR is a relaxed version of the first-order stochastic dominance, but might violate the second-order stochastic dominance.

Mean-risk analysis

Mean-risk analysis provides efficient solutions and quantifies the problem in a clear form of two criteria: the mean (the expected value of the outcome) and the risk (a scalar measured variability of the outcome). In mean-risk analysis, one uses a specified functional \( r:\aleph \to \mathbb{R} \) , where ℵ is a certain space of measurable functions on a probability space \( \left(\varOmega, \mathcal{F},P\right) \) to represent variability of the random outcomes, and then solves the problem:

Here, λ is a nonnegative trade-off constant between the expected outcome and the scalar-measured value of the variability of the outcome. This allows a simple trade-off analysis analytically and geometrically.

In the minimization context, one selects from the universe of all possible solutions those that are efficient: for a given value of the mean he minimizes the risk, or equivalently, for a given value of risk he maximizes the mean. Such an approach has many advantages: it allows one to formulate the problem as a parametric optimization problem, and it facilitates the trade-off analysis between mean and risk. However, for some popular dispersion statistics used as risk measures, the mean-risk analysis may lead to inferior conclusion. Thus, it is of primary importance to decide a good risk measure for each type of the decision models to be considered. The two important examples are mean-variance (or mean-standard deviation) model and coherent risk measures.

Mean-variance model

Since the seminal work of Markowitz ( 1952 ), mean-variance model has been actively used in the literature and it used the variance of the return as the risk functional, i.e.

Since its introduction, many authors have pointed out that the mean-variance model is, in general, not consistent with stochastic dominance rules. It may lead to an optimal solution which is stochastically dominated by another solution. Thus, to overcome drawbacks of mean-variance model, the general theory of coherent measures of risk was initiated by Artzner et al. ( 1999 ) and extended to general probability spaces by Delbaen ( 2002 ).

Coherent measures of risk

Coherent measures of risk are extensions of mean-risk model to put different variability measures r [∙] (e.g. deviation from quantile or semideviation) instead of variance. A formal definition of the coherent measures of risk is presented by following the abstract approach of Ruszczyński and Shapiro ( 2005 and 2006a ).

Let \( \left(\varOmega, \mathcal{F}\right) \) be a certain measurable space. A uncertain outcome is represented by a measurable function ϕ x : Ω → ℝ . We specify the vector space \( \mathcal{Z} \) of the possible functions of ϕ x ; in this case it is sufficient to consider \( \mathcal{Z}={\mathcal{L}}_{\infty}\left(\varOmega, \mathcal{F},P\right) \) .

A coherent measure of risk is a functional \( \rho :\mathcal{Z}\to \mathbb{R} \) satisfying the following axioms:

Convexity: ρ(α ϕ 1 + (1 − α) ϕ 2 ) ≤ αρ( ϕ 1 ) + (1 − α)ρ( ϕ 2 ), for all \( {\phi}_1,{\phi}_2\in \mathcal{Z} \) and all α ∈ [0, 1];

Monotonicity: If \( {\phi}_1,{\phi}_2\in \mathcal{Z} \) and ϕ 1 ≽ ϕ 2 , then ρ ( ϕ 1 ) ≤ ρ ( ϕ 2 );

Translation Equivariance: If a ∈ ℝ and \( {\phi}_1\in \mathcal{Z} \) , then ρ ( ϕ 1 + a ) = ρ ( ϕ 1 ) − a ;

Positive Homogeneity: If t ≥ 0 and \( {\phi}_1\in \mathcal{Z} \) , then ρ ( tϕ 1 ) = tρ ( ϕ 1 ).

An optional axiom in coherent measures of risk is law-invariance. A coherent measure of risk ρ (∙) is called law-invariant , if the value of ρ ( ϕ 1 ) depends only on the distribution of ϕ 1 , that is ρ ( ϕ 1 )= ρ ( ϕ 2 ) if ϕ 1 and ϕ 2 have identical distributions. Acerbi ( 2004 ) summarizes the meaning of this property that a law-invariant coherent measure of risk gives the same risk for empirically exchangeable random outcomes . Law-invariance looks so obvious that it is no wonder even if most risk practitioners take it for granted. However, it also implies that, for a coherent measure of risk ρ which is not law-invariant, ρ ( ϕ 1 ) and ρ ( ϕ 2 ) may be different even if ϕ 1 and ϕ 2 have same probability distribution. This apparent paradox can be resolved by reminding the formal definition of random variables. Actually, one needs to determine simultaneously “probability law” and “field of events” endowed with a σ -algebra structure to define a random variable. Thus, the two random variables with same probability distributions can be different and may have different values of ρ . An example of the coherent measure of risk which is not law-invariant is the so-called worst conditional expectation WCE α defined in Artzner et al. ( 1999 ).

The infimum of conditional expectations \( \mathbb{E}\left[{\phi}_1|A\right] \) is taken on all the events A with probability larger than α in the σ–algebra \( \mathcal{A} \) . However, under certain conditions on nonatomic probability space, this risk measure becomes law-invariant and coincides with a famous risk measure CVaR (Conditional Value-at-Risk). For more technical details, see Acerbi and Tasche ( 2002 ), Delbaen ( 2002 ) and Kusuoka ( 2003 ).

Because coherent measures of risk are any functionals to satisfy the four axioms above, their functional forms are not determined uniquely. The two popular examples are obtained to put deviation-from-quantile, r β [∙] with λ ∈ [0, 1], or semideviation of order k ≥ 1, σ k [∙] with λ ∈ [0, 1/ β ], into r [∙], variability of the outcome:

The optimal η in the eq. (5) is the β -quantile of ϕ 1 . Then CVaR is a special case of mean-deviation-from-quantile when λ = 1/ β . All these results can be found at Ruszczyński and Shapiro ( 2006a ) and Choi ( 2009 ) with a sign adjustment.

Literature review

Choi et al. ( 2011 ) also provided a comprehensive literature review in risk-averse inventory models since the seminal works of Lau ( 1980 ) and Eeckhoudt et al. ( 1995 ). In this paper, we provide a summary of literature of the risk-averse newsvendor models studied after Choi et al. ( 2011 ) at Table 1 where we classify and tabulate the literature by model types (as columns) and risk measures used (as rows). The key research question from the literature is the impact of degree of risk aversion to the optimal ordering quantity with parametric and comparative static analysis. A common finding from literature is that higher degree of risk aversion results in fewer optimal ordering quantities because higher ordering quantity implies higher variability of the profits. Then, risk-averse newsvendor tends to decrease ordering quantity to avoid higher risk.

Yang et al. ( 2008 ) consider a single-product risk-averse newsvendor with a capacity constraint for ordering quantity. They select two risk measures, CVaR (Conditional Value-at-Risk) and VaR (Value-at-Risk), for their models. As a result, they provide closed-form optimal solution with both risk measures and confirm their results with numerical examples. Chen et al. ( 2009 ) study a single-product newsvendor of stochastic price-dependent demand with CVaR. That is, their models are joint models of ordering quantity and price. The key research questions are to characterize the optimal order quantity and prices and to conduct comparative statics analysis with respect to model parameters for additive and multiplicative demand cases. In addition, they compare their results with those in the corresponding risk-neutral models of stochastic price-dependent demand. Özler et al. ( 2009 ) consider a multi-product newsvendor with a Value-at-Risk constraint. They also consider a single-product newsvendor as a special case. For a single-product system, they obtain the closed-form optimal ordering quantity which is the same result of Gan et al. ( 2004 ). Their biggest contribution to the literature is that for a two-product system, they obtain the mathematical formulation of mixed integer programming where the objective function is nonlinear and the constraints are mixed linear and nonlinear functions. Then, they conducted their numerical analysis to confirm their analytical results under multi-variate exponential demands.

Discussion of validity of risk measures in newsvendor models

Four axioms in coherent measures of risk.

The four axioms (Convexity, Monotonicity, Translation Equivariance and Positive Homogeneity) in coherent measures of risk have attractive features and implications to analyze newsvendor problems and thus the axioms make coherent measures of risk worth considering. Although these four axioms are briefly discussed at the previous studies in literature, none of them had an attempt to consider all of the four axioms in a comparative sense. More specifically, based on the four axioms, we develop them as an axiomatic framework to analyze the validity of newsvendor problems. The optional axiom, Law-Invariance, does not have a practical meaning, so we do not consider it in this section.

Convexity axiom means that the global risk of a portfolio should be equal or less than the convex combination of its partial risks. Because lower measured risk is better in coherent measures of risk, this axiom is consistent with the diversification effects.

In the Monotonicity axiom, ϕ 1 ≽ ϕ 2 means that ϕ 1 is always preferred to ϕ 2 for all possible scenarios. Thus, this axiom means that if portfolio 1 always has better values than portfolio 2 under all possible scenarios, then the measured risk of the portfolio 1 should be less than the measured risk of portfolio 2. By satisfying this axiom, coherent measures of risk are consistent with the second-order stochastic dominance.

Translation Equivariance axiom means that the existence of a constant cost (or gain) is equivalent to equally decreasing (or increasing) the vendor’s performance measure.

Thus, fixed parts can be separated equivalently from the vendor’s random performance measure at every possible state of nature. Thus, this axiom allows one to draw a comparison between the only random parts of different random performance measures and thus rank risk properly (see Artzner et al. ( 1999 )). However, this axiom is contradictory to initial endowment effects (refer to Choi et al. ( 2011 )).

Positive Homogeneity axiom guarantees that the optimal solution is invariant to rescaling of units such as currency (e.g., from dollars to pounds) or considering the total profit or the average profit per product. In addition, this axiom guarantees no diversification effects in a limiting case when the multivariate demand has a perfect positive correlation (see Choi et al. ( 2011 )).

These features are derived regardless of any specific problem formulations in multi-product newsvendor problems. That is, these features and implications can be directly applied in any type newsvendor problems with different formulations to evaluate the validity of risk measures.

The axiomatic framework

In this subsection, we compare the validity of various risk measures in newsvendor problems by our axiomatic framework based on the four axioms of coherent risk measures. The axiomatic approach provides a clear standard to evaluate risk measures in risk-averse newsvendor models. (Table 2 ).

Stochastic dominance is a reference criterion to give pairwise comparison between different random outcome. Thus, it is not directly implemented for its application.

Chance constraints have been actively used in finance historically. In financial terms, they are intuitive and easy to understand. However, they generally violate Convexity, which implies that chance constraints may penalize diversification instead of encouraging it. Historically, the Convexity has been a controversial axiom in finance literature due to the popularity of VaR in financial markets. However, such situations may be justified in finance literature such as insurance industry, but very different from that in newsvendor problems. In fact, the Convexity axiom is especially valid in newsvendor models. Each product is very likely to have some nonzero value in newsvendor models because very small amounts will be sold almost always for each product (refer to Choi et al. ( 2011 ) and Choi and Ruszczyński ( 2011 )).

Mean-variance and mean-standard deviation model have been very well-known since the seminal work of Markowitz ( 1952 ). The mean-variance model satisfies the Translation Equivariance axiom only. Mean-standard deviation model satisfies additionally Positive Homogeneity as well as Translation Equivariance, but not Convexity and Monotonicity.

Since its introduction, many authors have pointed out that the mean-variance and mean-standard deviation models are, in general, not consistent with stochastic dominance rules, nor the Monotonicity axiom. Because both models consider over-performance and under-performance equally, they are not so-called downside risk measures and may lead to an optimal solution which is stochastically dominated by another solution. Thus, to overcome drawbacks of mean-variance model, the general theory of coherent measures of risk was initiated by Artzner et al. ( 1999 ) and extended. We provide a specific and simple counterexample that a mean-variance model violate the monotonicity axiom in Table 3 .

In Table 3 , we set up Ω = { ω 1 , ω 2 } and P ( ω 1 ) = P ( ω 2 ) = 0.5. Then larger value is always preferred to smaller value in this table. Each random variable ϕ 1 and ϕ 2 has a value for any possible states of nature, ω 1 and ω 2 , and ϕ 1 ( ω ) is always better than ϕ 2 ( ω ) for all ω ∈ Ω . Thus, ϕ 1 dominates ϕ 2 by the rule of statewise dominance and this table is a good example where an efficient solution (in the sense from mean-risk analysis) is dominated by another solution. Clearly, ϕ 1 may be preferred to ϕ 2 . However, \( \mathbb{E}\left({\phi}_2\right)-1\bullet \mathbb{V}\mathrm{ar}\left({\phi}_2\right)=-1>-3=\mathbb{E}\left({\phi}_1\right)-1\bullet \mathbb{V}\mathrm{ar}\left({\phi}_1\right). \) This implies that ϕ 2 is more preferable to ϕ 1 under mean-variance criterion, which is inconsistent with the Monotonicity axiom.

Selection of risk measures in newsvendor problems

In summary, expected utility theory and coherent risk measures share the Convexity and Monotonicity axioms when a newsvendor has a nondecreasing and concave function. However, expected utility theory does not satisfy the Translation Equivariance and Positive Homogeneity. General coherent measures of risk are consistent to the first- and second-order stochastic dominance relations and satisfy all the four axioms. Thus, Translation Equivariance and Positive Homogeneity axioms are crucial to decide which one is better to use between utility function approach and coherent measures of risk.

The initial endowment effects , firstly theorized by Thaler ( 1980 ) in behavioral economics, mean that the initial states of the variables may affect the optimal decision. Sometimes the effects may have a significant role for inventory managers. Therefore, if a newsvendor takes initial endowment effects strongly, then coherent measures of risk may not be preferred by this newsvendor. Such effects can be captured by utility function approach, but not by coherent measures of risk. Thus, if newsvendors show initial endowment effects significantly, utility function approach is better to use to analyze the newsvendor problems. More specifically, exponential utility function is a particular form of a nondecreasing and concave utility function. It is also the unique function to satisfy constant absolute risk aversion property. For those reasons, exponential utility function has been used frequently in finance and also in supply chain management literature such as Bouakiz and Sobel ( 1992 ), Chen et al. ( 2007 ) and Choi and Ruszczyński ( 2011 ). However, the existence of initial endowment effects is still controversial (see Hanemann ( 1991 ) and Shogren et al. ( 1994 )).

On the other hand, Positive Homogeneity implies invariance of the optimal solution from denomination of the currency to guarantee consistence to rational risk-averse decision making. Choi et al. ( 2011 ) provide a numerical example where they compare solutions of a single-product newsvendor model with coherent measures of risk, exponential utility function and mean-variance. They initially select parameters in each risk measure so that they have the same optimal solution when the unit of profit is measured as one dollar. Then they change the unit of profit continuously by denomination. Then the optimal solution with coherent measures of risk is unchanged, but the solutions significantly change with the other risk measures. Because utility functions are not compatible with Positive Homogeneity, they also have some drawbacks to analyze newsvendor problems.

In conclusion, considering relative advantages and disadvantages of using each type risk measure, exponential utility function approach and coherent measures of risk are two plausible risk measures to analyze newsvendor model by the consideration with the axiomatic approach.

In this paper, we have examined various risk measures in newsvendor problems. By focusing on the four axioms of coherent risk measures, we have compared the four typical approaches; expected utility theory, stochastic dominance, chance constraints and mean-risk analysis. As a result, an exponential utility function and coherent risk measures are selected as two quality risk measures for newsvendor problems.

It is natural that the newsvendors are risk-averse when they are in a preliminary transition stage to open innovation. Then, in order to handle risk aversion properly, it is necessary to find a quality risk measures for such cases. Due to this reason, we consider the validity of risk measures for the risk-averse newsvendor models when their levels of open innovation are relatively low. Finally, our contributions to literature are can be summarized as follows: First, we conduct an extensive and rigorous literature review in risk measures and newsvendor problems in a perspective of open innovation. Second, we discuss the relationship between two conflicting risk preferences, risk aversion and neutrality, with open innovation. Last, we provide an axiomatic framework to verify the validity of various risk measures used in real world as well as the literature of this research stream.

We believe that there is an important extension that can be addressed in this axiomatic framework. In this paper, we discuss meaning and implications of the four axioms in coherent risk measures in newsvendor models. For a multi-period case, dynamic version of coherent risk measures were also analyzed in the literature (refer to Riedel ( 2004 ), Kusuoka and Morimoto ( 2004 ), Cheridito et al. ( 2006 ) and Ruszczyński and Shapiro ( 2006b )). Then, with appropriate adjustments, this axiomatic approach can be a good starting point of constructing another axiomatic framework to compare the validity of various risk measures for a multi-period case.

Acerbi, C. (2004). Coherent representation of subjective risk aversion. In G. Szegö (Ed.), Risk measures for the 21st century (pp. 147–207). Chichester: Wiley.

Google Scholar

Acerbi, C., & Tasche, D. (2002). On the coherence of expected shortfall. Journal of Banking and Finance, 26 (7), 1487–1503.

Article Google Scholar

Arrow, K., Harris, T., & Marschak, J. (1951). Optimal inventory policy. Econometrica, 19 (3), 250–272.

Artzner, P., Delbaen, F., Eber, J., & Heath, D. (1999). Coherent measures of risk. Mathematical Finance, 9 (3), 203–228.

Bouakiz, M., & Sobel, M. (1992). Inventory control with an exponential utility criterion. Operations Research, 40 (3), 603–608.

Chen, X., Sim, M., Simchi-Levi, D., & Sun, P. (2007). Risk aversion in inventory management. Operations Research, 55 , 828–842.

Chen, Y., Xu, M., & Zhang, Z. (2009). A risk-averse newsvendor model under the CVaR criterion. Operations Research, 57 (4), 1040–1044.

Cheridito, P., Delbaen, F., & Kupper, M. (2006). Dynamic monetary risk measures for bounded discrete-time processes. Electronic Journal of Probability, 11 , 57–106.

Choi, S. (2009). The risk-averse newsvendor models, ph.D. Dissertation, Rutgers University.

Choi, S., & Ruszczyński, A. (2008). A risk-averse newsvendor with law-invariant coherent measures of risk. Operations Research Letters, 36 , 77–82.

Choi, S., & Ruszczyński, A. (2011). A risk-averse newsvendor with exponential utility function. European Journal of Operational Research, 214 , 78–84.

Choi, S., Ruszczyński, A., & Zhao, Y. (2011). A multiproduct risk-averse newsvendor with law-invariant coherent measures of risk. Operations Research, 59 (2), 346–364.

Delbaen, F. (2002). Coherent risk measures on general probability space. In K. Sandmann & P. J. Schönbucher (Eds.), Advances in finance and Stochastics (pp. 1–37). Heidelberg: Springer.

Eeckhoudt, L., Gollier, C., & Schlesinger, H. (1995). The risk-averse (and prudent) newsboy. Management Science, 41 (3), 786–794.

Gan, X., Sethi, S. P., & Yan, H. (2004). Coordination of supply chains with risk-averse agents. Production and Operations Management, 14 (1), 80–89.

Hadar, J., & Russell, W. (1969). Rules for ordering uncertain prospects. The American Economic Review, 59 , 25–34.

Hadley, G., & Whitin, T. M. (1963). Analysis of inventory systems . Englewood Cliffs: Prentice-Hall.

Hanemann, W. M. (1991). Willingness to pay and willingness to accept: How much can they differ. The American Economic Review, 81 (3), 635–647.

Kahneman, D., & Tverski, A. (1979). Prospect theory: An analysis of decision under risk. Econometrica, 47 , 263–291.

Kusuoka, S. (2003). On law invariant coherent risk measures. Adv. Math. Econ., 3 , 83–95.

Kusuoka, S. & Morimoto, Y. (2004). Homogeneous law invariant coherent multiperiod value measures and their limits. Working Paper, Graduate School of Mathematical Science, University of Tokyo.

Lau, H. (1980). The newsboy problem under alternative optimization objectives. The Journal of the Operational Research Society, 31 (6), 525–535.

Lee, S., & Lee, K. (2015). Heterogeneous expectations leading to bubbles and crashes in asset markets: Tipping point, herding behavior and group effect in an agent-based model. Journal of Open Innovation: Technology, Market, and Complexity, 1 (11). https://doi.org/10.1186/s40852-015-0014-8 .

Lee, S., Workman, J. E., & Jung, K. (2016). Brand relationships and risk: Influence of risk avoidance and gender on brand consumption. Journal of Open Innovation: Technology, Market, and Complexity, 2 (14). doi: 10.1186/s40852-016-0041-0 .

Lehmann, E. (1955). Ordered families of distributions. Annals of Mathematical Statistics, 26 , 399–419.

Markowitz, H. (1952). Portfolio selection. Journal of Finance, 7 , 77–91.

Novemsky, N., & Kahneman, D. (2005). The boundaries of loss aversion. Journal of Marketing Research, 42 , 119–128.

Özler, A., Tan, B., & Karaesmen, F. (2009). Multi-product newsvendor problem with value-at-risk constraints. International Journal of Production Economics, 117 , 244–255.

Riedel, F. (2004). Dynamic coherent risk measures. Stochastic Processes and their Applications, 112 , 185–200.

Ruszczyński, A., & Shapiro, A. (2005). Optimization of risk measures. In G. Calafiore & F. Dabbene (Eds.), Probabilistic and randomized methods for design under uncertainty (pp. 117–158). London: Springer-Verlag.

Ruszczyński, A., & Shapiro, A. (2006a). Optimization of convex risk functions. Mathematics of Operations Research, 31 (3), 433–452.

Ruszczyński, A., & Shapiro, A. (2006b). Conditional risk mappings. Mathematics of Operations Research, 31 (3), 544–561.

Schweitzer, M., & Cachon, G. (2000). Decision bias in the newsvendor problem with a known demand distribution: Experimental evidence. Management Science, 46 (3), 404–420.

Shogren, J. F., Shin, S., Hayes, D. J., & Kliebenstein, J. B. (1994). Resolving differences in willingness to pay and willingness to accept. The American Economic Review, 84 (1), 255–270.

Thaler, R. (1980). Toward a positive theory of consumer choice. Journal of Economic Behavior and Organization, 1 , 39–60.

Tverski, A., & Kahneman, D. (1992). Advances in prospect theory: Cumulative representation of uncertainty. Journal of Risk and Uncertainty, 5 , 297–323.

van Ryzin, G. J., & Mahajan, S. (1999). On the relationship between inventory cost and variety benefits in retail assortments. Management Science, 45 , 1496–1509.

von Neumann, J., & Morgenstern, O. (1944). Theory of games and economic behavior . Princeton: Princeton University Press.