Stock Research Report for Varun Beverages Ltd

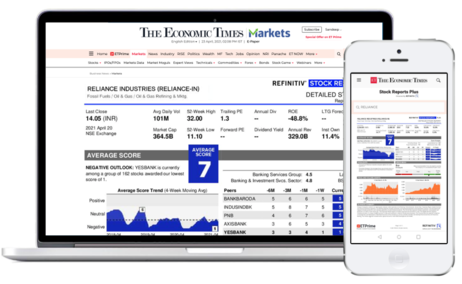

Stock score of Varun Beverages Ltd moved up by 3 in 3 months on a 10 point scale (Source: Refinitiv). Get detailed report on Varun Beverages Ltd by subscribing to ETPrime .

Get 4000+ Stock Reports worth ₹ 1,499* with ETPrime at no extra cost for you

*As per competitive benchmarking of annual price. T&C apply

Make Investment decisions

with proprietary stock scores on earnings, fundamentals, relative valuation, risk and price momentum

Find new Trading ideas

with weekly updated scores and analysts forecasts on key data points

In-Depth analysis

of company and its peers through independent research, ratings, and market data

Varun Beverages Limited is an India-based company, which is a franchisee of PepsiCo. It produces and distributes a range of carbonated soft drinks (CSDs), as well as a large selection of non-carbonated beverages (NCBs), including packaged drinking water sold under trademarks owned by PepsiCo. PepsiCo CSD brands produced and sold by it include Pepsi, Pepsi Black, Mountain Dew, Sting, Seven-Up, Mirinda Orange, Seven-Up Nimbooz Masala Soda and Evervess. PepsiCo NCB brands produced and sold by it include Tropicana Slice, Tropicana Juices (100% and Delight), Seven-Up Nimbooz, Gatorade as well as packaged drinking water under the brand Aquafina. It has approximately 34 manufacturing plants in India and over six manufacturing plants in international geographies (two in Nepal and one each in Sri Lanka, Morocco, Zambia and Zimbabwe). Its subsidiaries include Varun Beverages (Nepal) Private Limited, Varun Beverages Lanka (Private) Limited, The Beverage Company Proprietary Limited, and others.

- Share Market News

- e-ATM Order

- FindYourMojo

- Relax For Tax

- Budget 2024

- Live Webinar

- One Click Mutual Fund

- Retirement Solutions

- Execution Algos

- One Click F&O

- Apply IPO through UPI

- Life Insurance

- Health Insurance

- Group Health Insurance

- Bike Insurance

- SME Insurance

- Car insurance

- Home Insurance

- Sovereign Gold Bonds

- New Bonds on Offer

- Government Securities

- Exchange Traded Bonds

- ICICI Bank FD

- Top Performing NPS Schemes

- NPS Calculator

- NPS Important FAQ and Disclosures

- Equity Trending News

- Self learning

- Customer Service

- Corporate Services

- Open Account

- Masters of the Street

- Features and Products

- Will Drafting

- Goal Planner

- Retirement Planning

- Brokerage Fees and Charges

- Business Partner

- Business Partner Opportunity

- Business Partner Earning Calculator

- Business Partner App

- Partner Universe

- Insurance – POSP

- Global Invest

- Company Snapshot

- Report Details

Varun Beverages Ltd Research Report Q4CY21

- SECTOR : FMCG

- BSE : 540180

Chg: -1.4 (-0.10 %)

Entry Price

Recommend date.

Varun Beverages reported healthy results with 9.1% revenue growth & 48.8% growth in operating profit. The strong revenue growth was aided by 5.7% organic volume growth & 3.2% realisation growth. The company sold 87 million cases in Q4CY20, which constitutes 63% carbonated soft drinks (CSD), 5% juices & 32% water. With substantial improvement in out of home activity & opening up of HORECA segment, the company saw strong recovery in volumes in H2CY20. Operating profit increased 48.8% to | 172.2 crore led by 472 bps improvement in gross margins & 91 bps saving in employee spends. The lower PET chips prices & stable sugar prices aided gross margins. Other overhead increased 218 bps as percentage of sales. Operating margins improved 345 bps to 12.9%. The company reported net loss of | 7.2 crore during the quarter vs. loss of | 53.9 crore in the corresponding quarter. We believe consolidation of south & west geographies has helped the company to reduce losses in non-peak season. The reduction in losses was also aided by lower interest cost & tax reversals.

Copyright© 2022. All rights Reserved. ICICI Securities Ltd. ®trademark registration in respect of the concerned mark has been applied for by ICICI Bank Limited

- VARUN BEVERAGES LTD.

- SECTOR : FOOD BEVERAGES & TOBACCO

- INDUSTRY : NON-ALCOHOLIC BEVERAGES

Varun Beverages Ltd.

NSE: VBL | BSE: 540180

/100 Valuation Score : 11 /100 Momentum Score : 63 /100 "> Expensive Star

1397.20 -1.40 ( -0.10 %)

103.23% Gain from 52W Low

1.7M NSE+BSE Volume

NSE 01 Apr,2024 03:31 PM (IST)

- Share on Facebook

- Share on LinkedIn

- Share via Whatsapp

Broker average target upside potential%

Broker 1Year buys

4 active buys

Broker 1Year sells

1 active sells

Broker 1Year neutral

2 active holds

Broker 1M Reco upgrade

0 Broker 1M Reco upgrade

Varun Beverages Ltd. share price target

View 22 reports from 7 analysts offering long term price targets for varun beverages ltd.. varun beverages ltd. has an average target of 1298.50. the consensus estimate represents a downside of -7.06% from the last price of 1397.2000..

- Recent Upgrades

- Recent Downgrades

- Sector Updates

- Most Recent

COMMENTS

View 22 reports from 7 analysts offering long term price targets for Varun Beverages Ltd.. Varun Beverages Ltd. has an average target of 1298.50. The consensus estimate represents a downside of -7.16% from the last price of 1398.6000. Reco - This broker has downgraded this stock from it's previous report.

Varun Beverage saw strong revenue growth of 26.2% to Rs 2827.5 crore led by 18.7% volume growth & 6.3% realisation growth. The company clocked a volume of 180 million cases during the quarter, which includes 70% volumes from carbonated drinks (CSD), 7% from juices & 23% from water.

Reports 20-97 Sustainability Report 01-19 Corporate Overview 98 Board's Report 115 Corporate Governance Report 135 Management Discussion & Analysis 143 Business Responsibility and Sustainability Report 02 Sustainably Refreshing. Refreshingly Sustainable. 04 We Are Varun Beverages Limited 06 Our Journey of Evolution 08 Chairman's Message 10 ...

Varun Beverages witnessed robust volume growth of 24%. Sales were up 32.5% YoY led by low base and strong growth in underpenetrated territories; ... ICICI Securities encourages independence in research report preparation and strives to minimize conflict in preparation of research report. ICICI Securities or its associates or its analysts did ...

See 22 latest analyst research reports for VBL, BSE:540180 Varun Beverages Ltd.. Upvote, discuss and comment with all investors for free. ... Axis Direct increased Buy price target of Varun Beverages Ltd. to 1550.0 on 20 Mar, 2024. Varun Beverages Ltd. 15 Feb 2024. 1401.70-.05%. Strong volume growth to continue due to capacity, distribution ...

Stock Research Report for Varun Beverages Ltd. Stock score of Varun Beverages Ltd moved up by 3 in 3 months on a 10 point scale (Source: Refinitiv). ... Varun Beverages Limited is an India-based company, which is a franchisee of PepsiCo. It produces and distributes a range of carbonated soft drinks (CSDs), as well as a large selection of non ...

with long-term bottling partners, Varun entered into the Pepsio India TA pursuant to Sales volume growth between 2016 & 2018 Source: Company Data, SMIFS Research Varun on behalf of Pepsio continues to make all endeavours to implement new brand and product launches. Dairy based beverages are an example.200 Varun operates franchises for various

Varun Beverages (VBL) reported strong revenue growth of 38% YoY in 1QCY23, led by robust growth in volumes (up 24.7% YoY) with realization touching INR174/unit (up ~11% YoY). Savings in raw material prices and an improved product mix led to a YoY improvement of 90bp in gross margins. Gross margin/unit case grew 12%

Varun beverages splendid results with volume growth of 96.9%. Sales were up 102.3% YoY on led by extreme summer, low base & strong growth in underpenetrated territories ... ICICI Securities encourages independence in research report preparation and strives to minimize conflict in preparation of research report. ICICI Securities or its ...

Source: Company, RSec Research 1. Varun Beverages Ltd. (VBL) produces a wide range of carbonated soft drinks (CSDs), non-carbonated beverages (NCBs) and packaged drinking water under licensed ... Please refer to Page no. 30 at the end of the report. CMP* (Rs) 921 Upside/ (Downside) (%) 24 Bloomberg Ticker VBL IN Market Cap. (Rs bn) 265 Free ...

VBL's revenue grew 21% YoY to INR26.7b (est. in line), driven by healthy volume (+18% YoY to 156m cases), while realization grew 2% YoY to INR171/case.

Plot No. 31, Institutional Area, Sector - 44, Gurgaon - 122002, Haryana, India +91-124-4643100

Varun Beverages Limited as a Public Limited Company • PepsiCo acquired 26% stake in Devyani Beverages Limited* (*Merged with VBL in 2004) • Sub-territories of Goa, three districts of Maharashtra and North-East India were consolidated, subsequent to merger of a Group company • Also, three companies having the territories of Nepal, Sri

Varun Beverage's share price has given 6.3x return (from ₹ 195 in February 2018 to ₹ 1221 in February 2023). We estimate 10% volume CAGR & sustainable operating margins above 21%. This would lead to earning CAGR of 12.1% between CY22-24E. We maintain our HOLD recommendation on the stock. Target Price and Valuation.

Date : 17-02-2021. Varun Beverages reported healthy results with 9.1% revenue growth & 48.8% growth in operating profit. The strong revenue growth was aided by 5.7% organic volume growth & 3.2% realisation growth. The company sold 87 million cases in Q4CY20, which constitutes 63% carbonated soft drinks (CSD), 5% juices & 32% water.

Varun Beverages. 9 Mach 2023 2. To address the cost pressures faced in CY22, VBL increased prices of select SKUs and rationalized discounts and schemes. This, along with a prudent raw material sourcing strategy, limited the impact of a surge in preform prices (over 30% YoY) on gross margin (down 180bps YoY).

Varun Beverages (VBL) reported a strong operating performance on the back of higher volume growth across the Carbonated Soft Drinks (CSD) and Non-Carbonated Beverages (NCB) segments. Volumes increased 32% YoY to 151m unit-cases. This was primarily led by an increase in out-of-home

Varun Beverages Ltd. The company had been on an acquisition spree for last few years, which impacted its Free Cash Flow (FCF). However, with already 90% volumes of the PepsiCo's India beverage under VBL, the growth for VBL in the future would be largely led by organic route in India.

See 23 recent research reports for VBL, BSE:540180 Varun Beverages Ltd. from 7 source(s) with an average share price target of 1279.

Varun Beverages Limited 06An Increasing Geographical Footprint 10 Our Incredible Journey ... Statutory Reports 26 Board's Report 46 Corporate Governance Report 80 Management Discussion & ... Invests in research and development - product and packaging innovation Undertakes brand development

Varun Beverages 2 August 2021 2 Valuation and view We expect robust demand going forward, driven by a) the resumption of services, with the impact of the lockdown gradually subsiding; b) a pickup in volumes in the southern and western regions; c) strong demand traction in newly launched products; d) the growing penetration of refrigeration in

Varun Beverages Limited - Q3 9M CY2017 Earnings Call Transcript. Varun Beverages Limited - Q3 9M 2017 Press Release. Varun Beverages Limited - Q3 & 9M 2017 Earnings Presentation. Varun Beverages Limited - Q3 FY 2017 Earnings Call Invite. Financial Results for the 3rd Quarter and Nine Months Ended September 30, 2017

Annual Report 2020 Varun Beverages Limited Steady. Go. Contents pg# 10 pg# 23 Corporate Overview 01-24 02. Healthy. Steady. Go. 04. Serving ~1/6th of the world's population 06. progress never Stops at varun beverages 08. Driving Agility. Delivering increased footprint. 10. Attaining operational excellence. Accomplishing business efficacy. 12 ...