U.S. Department of the Treasury

Looking for rental assistance.

Renters and landlords can find out what emergency rental assistance covers, how it works, and who’s eligible on the interagency housing portal hosted by the Consumer Financial Protection Bureau (CFPB).

The Department of the Treasury (Treasury) is providing these frequently asked questions (FAQs) as guidance regarding the requirements of the Emergency Rental Assistance program (ERA1) established by section 501 of Division N of the Consolidated Appropriations Act, 2021, Pub. L. No. 116-260 (Dec. 27, 2020) and the Emergency Rental Assistance program (ERA2) established by section 3201 of the American Rescue Plan Act of 2021, Pub. L. No. 117-2 (March 11, 2021).

These FAQs apply to both ERA1 and ERA2, except where differences are specifically noted. References in these FAQs to “the ERA” apply to both ERA1 and ERA2. These FAQs will be supplemented by additional guidance. Grantees must establish policies and procedures to govern the implementation of their ERA programs consistent with the statutes and these FAQs. To the extent that these FAQs do not provide specific guidance on a particular issue, a grantee should establish its own policy or procedure that is consistent with the statutes and follow it consistently. Additions and changes to FAQs are tracked in a change log .

1. Who is eligible to receive assistance under the Act and how should a grantee document the eligibility of a household?

A grantee may only use the funds provided in the ERA to provide financial assistance and housing stability services to eligible households. To be eligible, a household must be obligated to pay rent on a residential dwelling and the grantee must determine that:

- one or more individuals within the household has qualified for unemployment benefits or experienced a reduction in household income, incurred significant costs, or experienced other financial hardship due, directly or indirectly, to the COVID-19 outbreak;

- one or more individuals within the household can demonstrate a risk of experiencing homelessness or housing instability; and

- the household has a household income at or below 80 percent of area median income.

- one or more individuals within the household has qualified for unemployment benefits or experienced a reduction in household income, incurred significant costs, or experienced other financial hardship during or due, directly or indirectly, to the coronavirus pandemic;

- the household is a low-income family (as such term is defined in section 3(b) of the United States Housing Act of 1937 (42 U.S.C. 1437a(b)). 2

While there are some differences in eligibility between ERA1 and ERA2, the eligibility requirements are very similar, and Treasury is seeking to implement ERA2 consistently with ERA1, to the extent possible, to reduce administrative burdens for grantees.

The FAQs below describe the documentation requirements for each of these conditions of eligibility. These requirements provide for various means of documentation so that grantees may extend this emergency assistance to vulnerable populations without imposing undue documentation burdens. As described below, given the challenges presented by the COVID-19 pandemic, grantees may be flexible as to the particular form of documentation they require, including by permitting photocopies or digital photographs of documents, e-mails, or attestations from employers, landlords, caseworkers, or others with knowledge of the household’s circumstances. Treasury strongly encourages grantees to avoid establishing documentation requirements that are likely to be barriers to participation for eligible households, including those with irregular incomes such as those operating small businesses or gig workers whose income is reported on Internal Revenue Service Form 1099. However, grantees must require all applications for assistance to include an attestation from the applicant that all information included is correct and complete.

When documenting eligibility for households to receive housing stability services without any financial assistance, special considerations apply. The ERA1 statute specifies these services may be provided only to “eligible households,” meaning the household must meet all ERA1 eligibility requirements. When housing stability services represent the only ERA1 assistance a household will receive (i.e., no payments using ERA1 funds will be made either to the household, to the landlord, or to a utility provider), grantees are encouraged to rely on a household’s self-attestations for purposes of confirming eligibility. If all eligibility requirements are expressly addressed by the household’s self-attestation, the grantee is not required to collect additional income documentation, past due notices, or other eligibility-verification documents as described above or below. Further, the ERA2 statute does not restrict the provision of housing stability services to “eligible households.” As a result, grantees are not required to document a household’s eligibility if the grantee provides the household with no assistance other than housing stability services paid with ERA2 funds. However, for both ERA1 and ERA2, a grantee must collect any demographic or other information from the household needed to fulfill the grantee’s reporting obligations.

In all cases, grantees must document their policies and procedures for determining a household’s eligibility to include policies and procedures for determining the prioritization of households in compliance with the statute and maintain records of their determinations. Grantees must also have controls in place to ensure compliance with their policies and procedures and prevent fraud. Grantees must specify in their policies and procedures under what circumstances they will accept written attestations from the applicant without further documentation to determine any aspect of eligibility or the amount of assistance, and in such cases, grantees must have in place reasonable validation or fraud-prevention procedures to prevent abuse.

2 As of the date of these FAQs, the definition of “low-income families” in 42 U.S.C. 1437a(b) is “those families whose incomes do not exceed 80 per centum of the median income for the area, as determined by the Secretary [of Housing and Urban Development] with adjustments for smaller and larger families, except that the Secretary may establish income ceilings higher or lower than 80 per centum of the median for the area on the basis of the Secretary’s findings that such variations are necessary because of prevailing levels of construction costs or unusually high or low family incomes.”

Updated on July 6, 2022

Updated on May 7, 2021

2. How should applicants document that a member of the household has qualified for unemployment benefits, experienced a reduction in income, incurred significant costs, or experienced other financial hardship during or due to the COVID-19 outbreak?

A grantee must document that one or more members of the applicant’s household either (i) qualified for unemployment benefits; or (ii) (a) for ERA1, experienced a reduction in household income, incurred significant costs, or experienced other financial hardship due, directly or indirectly, to the COVID-19 outbreak or (b) for ERA2, experienced a reduction in household income, incurred significant costs, or experienced other financial hardship during or due, directly or indirectly, to the coronavirus pandemic. 3 If the grantee is relying on clause (i) for this determination, or if the grantee is relying on clause (ii) in ERA2, the grantee is permitted to rely on either a written attestation signed by the applicant or other relevant documentation regarding the household member’s qualification for unemployment benefits. If the grantee is relying on clause (ii) for this determination in ERA1, the statute requires the grantee to obtain a written attestation signed by the applicant that one or more members of the household meets this condition.

While grantees relying on clause (ii) in ERA1 must show financial hardship “due, directly or indirectly, to” COVID-19, grantees in ERA2 are also permitted to rely on financial hardship “during” the pandemic. It may be difficult for some grantees to establish whether a financial hardship experienced during the pandemic is due to the COVID-19 outbreak. Therefore, Treasury strongly encourages grantees to rely on the self-certification of applicants with regard to whether their financial hardship meets these statutory eligibility requirements. Further, because the standard in ERA2 is broader than the standard in ERA1, any applicant that self-certifies that it meets the standard in ERA1 should be considered to meet the standard for purposes of ERA2.

3 Treasury is interpreting the two different statutory terms (“the COVID-19 outbreak” and “the coronavirus pandemic”) as having the same meaning.

3. How should a grantee determine that an individual within a household is at risk of experiencing homelessness or housing instability?

The statutes establishing ERA1 and ERA2 both require that one or more individuals within the household can demonstrate a risk of experiencing homelessness or housing instability. Such a demonstration may include (i) a past due utility or rent notice or eviction notice, (ii) unsafe or unhealthy living conditions (which may include overcrowding), or (iii) any other evidence of risk, as determined by the grantee. Grantees may establish alternative criteria for determining whether a household satisfies this requirement, and should adopt policies and procedures addressing how they will determine the presence of unsafe or unhealthy living conditions and what evidence of risk to accept in order to support their determination that a household satisfies this requirement. A grantee may rely on an applicant’s self-certification identifying the applicable risk factor or factors, without further documentation, if other documentation is not immediately available.

Updated on August 25, 2021

4. The statutes establishing ERA1 and ERA2 limit eligibility to households based on certain income criteria. How is household income defined for purposes of the ERA? How will income be documented and verified?

Definition of Income : With respect to each household applying for assistance, grantees may choose between using the Department of Housing and Urban Development’s (HUD) definition of “annual income” in 24 CFR 5.609 and using adjusted gross income as defined for purposes of reporting under Internal Revenue Service Form 1040 series for individual federal annual income tax purposes.

Definition of Area Median Income : For purposes of ERA1, the area median income for a household is the same as the income limits for families published by the Department of Housing and Urban Development (HUD) in accordance with 42 U.S.C. 1437a(b)(2), available under the heading for “Access Individual Income Limits Areas” . When determining area median income with respect to Tribal members, Tribal governments and TDHEs may rely on the methodology authorized by HUD for the Indian Housing Block Grant Program as it pertains to households residing in an Indian area comprising multiple counties (see HUD Office of Native American Programs, Program Guidance No. 2021-01, June 22, 2021).

Methods for Income Determination : The statute establishing ERA1 provides that grantees may determine income eligibility based on either (i) the household’s total income for calendar year 2020, or (ii) sufficient confirmation of the household’s monthly income at the time of application, as determined by the Secretary of the Treasury (Secretary).

If a grantee in ERA1 uses a household’s monthly income to determine eligibility, the grantee should review the monthly income information provided at the time of application and extrapolate over a 12-month period to determine whether household income exceeds 80 percent of area median income. For example, if the applicant provides income information for two months, the grantee should multiply it by six to determine the annual amount. If a household qualifies based on monthly income, the grantee must redetermine the household income eligibility every three months for the duration of assistance.

For ERA2, if a grantee uses the same income determination methodology that it used in ERA1, it is presumed to be in compliance with relevant program requirements; if a grantee chooses to use a different methodology for ERA2 than it used for ERA1, the methodology should be reasonable and consistent with all applicable ERA2 requirements. In addition, if a household is a single family that the grantee determined met the income requirement for eligibility under ERA1, the grantee may consider the household to be eligible under ERA2, unless the grantee becomes aware of any reason the household does not meet the requirements for ERA2. Finally, if multiple families from the same household receive funding under an ERA2 program, the grantee should ensure that there is no duplication of the assistance provided.

Documentation of Income Determination : Grantees in ERA1 and ERA2 must have a reasonable basis under the circumstances for determining income. A grantee may support its determination with both a written attestation from the applicant as to household income and also documentation available to the applicant, such as paystubs, W-2s or other wage statements, tax filings, bank statements demonstrating regular income, or an attestation from an employer. In appropriate cases, grantees may rely on an attestation from a caseworker or other professional with knowledge of a household’s circumstances to certify that an applicant’s household income qualifies for assistance.

Alternatively, a grantee may rely on a written attestation without further documentation of household income from the applicant under three approaches:

- Self-attestation Alone – Provided that a grantee’s policies and procedures permitted the use of self-attestation alone to establish income as of May 11, 2023, the grantee may rely on a self-attestation of household income without further verification if the applicant confirms in their application or other document that they are unable to provide documentation of their income. If a written attestation without further verification is relied on to document the majority of the applicant’s income, the grantee must reassess the household’s income every three months, by obtaining appropriate documentation or a new self-attestation. Income attestations should specify the monthly or annual income claimed by the household to ensure that the household meets the applicable ERA requirements and to enable appropriate reporting. Under this approach, grantees are encouraged to incorporate self-attestation to demonstrate income eligibility into their application form. Similarly, grantees may rely on self-attestations to demonstrate applicants’ financial hardship and risk of homelessness or housing instability as described above in FAQs 2 and 3 above. Thus, grantees may allow for self-attestation for income eligibility as specified above and are encouraged to allow self-attestation to demonstrate applicants’ financial hardship and risk of homelessness or housing instability as described above in FAQs 2 and 3 .

- Categorical Eligibility – If an applicant’s household income has been verified to be at or below 80 percent of the area median income (for ERA1) or if an applicant’s household has been verified as a low-income family as defined in section 3(b) of the United States Housing Act of 1937 (42 U.S.C. 1437a(b)) (for ERA2) in connection with another local, state, or federal government assistance program, grantees are permitted to rely on a determination letter from the government agency that verified the applicant’s household income or status as a low-income family, provided that the determination for such program was made on or after January 1, 2020.

- Fact-specific proxy – A grantee may rely on a written attestation from the applicant as to household income if the grantee also uses any reasonable fact-specific proxy for household income, such as reliance on data regarding average incomes in the household’s geographic area.

Grantees also have discretion to provide waivers or exceptions to this documentation requirement to accommodate disabilities, extenuating circumstances related to the pandemic, or a lack of technological access. In these cases, the grantee is still responsible for making the required determination regarding the applicant’s household income and documenting that determination. Treasury encourages grantees to partner with state unemployment departments or entities that administer federal benefits with income requirements to assist with the verification process, consistent with applicable law.

Updated on May 10, 2023

5. ERA funds may be used for rent and rental arrears. How should a grantee document where an applicant resides and the amount of rent or rental arrears owed?

Grantees must obtain, if available, a current lease, signed by the applicant and the landlord or sublessor, that identifies the unit where the applicant resides and establishes the rental payment amount. If a household does not have a signed lease, documentation of residence may include evidence of paying utilities for the residential unit, an attestation by a landlord who can be identified as the verified owner or management agent of the unit, or other reasonable documentation as determined by the grantee. In the absence of a signed lease, evidence of the amount of a rental payment may include bank statements, check stubs, or other documentation that reasonably establishes a pattern of paying rent, a written attestation by a landlord who can be verified as the legitimate owner or management agent of the unit, or other reasonable documentation as defined by the grantee in its policies and procedures.

Written Attestation : If an applicant is able to provide satisfactory evidence of residence but is unable to present adequate documentation of the amount of the rental obligation, grantees may accept a written attestation from the applicant to support the payment of assistance up to a monthly maximum of 100 percent of the greater of the Fair Market Rent or the Small Area Fair Market Rent for the area in which the applicant resides, as most recently determined by HUD and made available at https://www.huduser.gov/portal/datasets/fmr.html . In this case, the applicant must also attest that the household has not received, and does not anticipate receiving, another source of public or private subsidy or assistance for the rental costs that are the subject of the attestation. This limited payment is intended to provide the most vulnerable households the opportunity to gather additional documentation of the amount of the rental obligation or to negotiate with landlords in order to avoid eviction. The assistance described in this paragraph may only be provided for three months at a time, and a grantee must obtain evidence of rent owed consistent with the above after three months in order to provide further assistance to such a household; Treasury expects that in most cases the household would be able to provide documentation of the amount of the rental obligation in any applications for further assistance.

6. ERA funds may be used for “utilities and home energy costs” and “utilities and home energy costs arrears.” How are those terms defined and how should those costs be documented?

Utilities and home energy costs are separately stated charges related to the occupancy of rental property. Accordingly, utilities and home energy costs include separately stated electricity, gas, water and sewer, trash removal, and energy costs, such as fuel oil. Payments to public utilities are permitted.

All payments for utilities and home energy costs should be supported by a bill, invoice, or evidence of payment to the provider of the utility or home energy service.

Utilities and home energy costs that are covered by the landlord will be treated as rent.

7. The statutes establishing ERA1 and ERA2 allow the funds to be used for certain "other expenses," as defined by the Secretary. What are some examples of these "other expenses"?

Under the statute establishing ERA1, funds used for “other expenses” must be related to housing and “incurred due, directly or indirectly, to the novel coronavirus disease (COVID-19) outbreak.” In contrast, the statute establishing ERA2 requires that “other expenses” be “related to housing” but does not require that they be incurred due to the COVID-19 outbreak.

For both ERA1 and ERA2, other expenses related to housing include relocation expenses (including prospective relocation expenses), such as rental security deposits, and rental fees, which may include application or screening fees. It can also include reasonable accrued late fees (if not included in rental or utility arrears), and Internet service provided to the rental unit. Internet service provided to a residence is related to housing and is in many cases a vital service that allows renters to engage in distance learning, telework, and telemedicine and obtain government services. However, given that coverage of Internet would reduce the amount of funds available for rental assistance, grantees should adopt policies that govern in what circumstances that they will determine that covering this cost would be appropriate. In addition, rent or rental bonds, where a tenant posts a bond with a court as a condition to obtaining a hearing, reopening an eviction action, appealing an order of eviction, reinstating a lease, or otherwise avoiding an eviction order, may also be considered an eligible expense.

All payments for housing-related expenses must be supported by documentary evidence such as a bill, invoice, or evidence of payment to the provider of the service. If a housing-related expense is included in a bundle or an invoice that is not itemized (for example, internet services bundled together with telephone and cable television services) and obtaining an itemized invoice would be unduly burdensome, grantees may establish and apply reasonable procedures for determining the portion of the expense that is appropriate to be covered by ERA. As discussed in FAQ 26 , under certain circumstances, the cost of a hotel stay may also be covered as an “other expense.”

Updated on March 16, 2021

8. Must a beneficiary of the rental assistance program have rental arrears?

No. The statutes establishing ERA1 and ERA2 permit the enrollment of households for only prospective benefits. For ERA1, if an applicant has rental arrears, the grantee may not make commitments for prospective rent payments unless it has also provided assistance to reduce the rental arrears; this requirement does not apply to ERA2.

9. May a grantee provide assistance for arrears that have accrued before the date of enactment of the statute?

Yes, but not for arrears accrued before March 13, 2020, the date of the emergency declaration pursuant to section 501(b) of the Robert T. Stafford Disaster Relief and Emergency Assistance Act, 42 U.S.C. 5191(b).

10. Is there a limit on how many months of financial assistance a tenant can receive?

Yes. In ERA1, an eligible household may receive up to twelve (12) months of assistance (plus an additional three (3) months if necessary to ensure housing stability for the household, subject to the availability of funds). The aggregate amount of financial assistance an eligible household may receive under ERA2, when combined with financial assistance under ERA1, must not exceed 18 months.

In ERA1, financial assistance for prospective rent payments is limited to three months based on any application by or on behalf of the household, except that the household may receive assistance for prospective rent payments for additional months (i) subject to the availability of remaining funds currently allocated to the grantee, and (ii) based on a subsequent application for additional assistance. In no case may an eligible household receive more than 18 months of assistance under ERA1 and ERA2, combined.

11. Must a grantee pay for all of a household’s rental or utility arrears?

No. The full payment of arrears is allowed up to the limits established by the statutes, as described in FAQ 10 . A grantee may structure a program to provide less than full coverage of arrears. Grantees are encouraged to consider whether payments of less than the full amount of arrears may result in a significant disincentive for landlord participation in the ERA program. Moreover, consistent with FAQ 32 , grantees should consider methods for avoiding evictions for nonpayment or utility cutoffs in cases where arrearages are paid only in part.

12. What outreach should be made by a grantee to a landlord or utility provider before determining that the landlord or utility provider will not accept direct payment from the grantee?

Treasury expects that in general, rental and utility assistance can be provided most effectively and efficiently when the landlord or utility provider participates in the program. However, in cases where a landlord or utility provider does not participate in the program, the only way to achieve the statutory purpose is to provide assistance directly to the eligible household.

In ERA1, grantees must make reasonable efforts to obtain the cooperation of landlords and utility providers to accept payments from the ERA program. Outreach will be considered complete if (i) a request for participation is sent in writing, by mail, to the landlord or utility provider, and the addressee does not respond to the request within seven calendar days after mailing; (ii) the grantee has made at least three attempts by phone, text, or e-mail over a five calendar-day period to request the landlord or utility provider’s participation; or (iii) a landlord confirms in writing that the landlord does not wish to participate. The final outreach attempt or notice to the landlord must be documented. The cost of contacting landlords would be an eligible administrative cost.

ERA2 does not require grantees to seek the cooperation of the landlord or utility provider before providing assistance directly to the tenant. However, if an ERA2 grantee chooses to seek the cooperation of landlords or utility providers before providing assistance directly to tenants, Treasury strongly encourages the grantee to apply the same ERA1 requirements as described above.

13. Is there a requirement that the eligible household have been in its current rental home when the public health emergency with respect to COVID-19 was declared?

No. There is no requirement regarding the length of tenure in the current unit.

14. What data should a grantee collect regarding households to which it provides rental assistance in order to comply with Treasury’s reporting and recordkeeping requirements?

Treasury provided interim guidance to ERA1 grantees regarding reporting requirements covering the period January through May 2021. The interim guidance required grantees to report limited data elements for the first quarter of 2021, as well as monthly for April to August. A grantee’s failure to submit required reports to Treasury on a timely basis may constitute a violation of the ERA award terms.

Treasury has provided grantees with additional guidance regarding quarterly reporting requirements. Grantees are required to submit reports in accordance with the additional guidance beginning with the first quarter of 2021 for ERA1 and the second quarter of 2021 for ERA2, with the first reports under the additional guidance being due in October 2021.

ERA1 grantees will be required to submit monthly reports from September to December 2021, which will be consistent with monthly reports that were previously required for April to August.

Treasury’s Office of Inspector General may require the collection of additional information in order to fulfill its oversight and monitoring requirements. 6 Grantees under ERA1 must comply with the requirement in section 501(g)(4) of Division N of the Consolidated Appropriations Act, 2021, to establish data privacy and security requirements for information they collect; grantees under ERA2 are also encouraged to comply with those requirements. 7

The assistance listing number assigned to the ERA is 21.023.

6 Note that this FAQ is not intended to address all reporting requirements that will apply to the ERA but rather to note for grantees information that they should anticipate needing to collect from households with respect to the provision of rental assistance.

7 Specifically, the statute establishing ERA1 requires grantees to establish data privacy and security requirements for certain information regarding applicants that (i) include appropriate measures to ensure that the privacy of the individuals and households is protected; (ii) provide that the information, including any personally identifiable information, is collected and used only for the purpose of submitting reports to Treasury; and (iii) provide confidentiality protections for data collected about any individuals who are survivors of intimate partner violence, sexual assault, or stalking.

Updated on June 24, 2021

15. The statute establishing ERA1 requires that payments not be duplicative of any other federally funded rental assistance provided to an eligible household. Are tenants of federally subsidized housing, e.g., Low Income Housing Credit, Public Housing, or Indian Housing Block Grant-assisted properties, eligible for the ERA?

An eligible household that occupies a federally subsidized residential or mixed-use property or receives federal rental assistance may receive assistance in the ERA, provided that ERA1 funds are not applied to costs that have been or will be reimbursed under any other federal assistance. Grantees are required to comply with Title VI of the Civil Rights Act (which prohibits discrimination on the ground of race, color, or national origin in programs or activities receiving federal financial assistance) and Section 504 of the Rehabilitation Act of 1973 (which prohibits discrimination because of disability in programs or activities receiving federal financial assistance), and should evaluate whether their policies and practices regarding assistance to households that occupy federally subsidized residential or mixed-use properties or receive federal rental assistance comply with Title VI and Section 504. In addition, grantees are required to comply with the Fair Housing Act, which prohibits discrimination in housing because of race, color, national origin, sex (including gender identity and sexual orientation), religion, disability, and having, expecting, adopting, or fostering a child under the age of 18. With respect to ERA2, grantees must not refuse to provide assistance to households on the basis that they occupy such properties or receive such assistance, due to the disproportionate effect such a refusal could have on populations intended to receive assistance under the ERA and the potential for such a practice to violate applicable law, including Title VI, Section 504, and the Fair Housing Act.

If an eligible household participates in a HUD-assisted rental program or lives in certain federally assisted properties (e.g., using a Housing Choice Voucher, Public Housing, or Project-Based Rental Assistance) and the tenant rent is adjusted according to changes in income, the renter household may receive ERA1 assistance for the tenant-owed portion of rent or utilities that is not subsidized. Grantees are encouraged to confirm that the participant has already reported any income loss or financial hardship to the Public Housing Authority or property manager and completed an interim re-examination before assistance is provided.

Treasury encourages grantees to enter into partnerships with owners of federally subsidized housing to implement methods of meeting the statutory requirement to prioritize assistance to households with income that does not exceed 50 percent of the area median income for the household, or where one or more individuals within the household are unemployed as of the date of the application for assistance and have not been employed for the 90-day period preceding such date.

Pursuant to section 501(k)(3)(B) of Division N of the Consolidated Appropriations Act, 2021, and 2 CFR 200.403, when providing ERA1 assistance, the grantee must review the household’s income and sources of assistance to confirm that the ERA1 assistance does not duplicate any other assistance, including federal, state, or local assistance provided for the same costs.

Grantees may rely on an attestation from the applicant regarding non-duplication with other government assistance in providing assistance to a household. Grantees with overlapping or contiguous jurisdictions are particularly encouraged to coordinate and participate in joint administrative solutions to meet this requirement. The requirement described in this paragraph does not apply to ERA2; however, to maximize program efficacy, Treasury encourages grantees to minimize the provision of duplicative assistance.

16. In ERA1, may a Tribe or Tribally Designated Housing Entity (TDHE) provide assistance to Tribal members living outside Tribal lands?

Yes. Tribal members living outside Tribal lands may receive ERA1 funds from their Tribe or TDHE, provided they are not already receiving ERA assistance from another Tribe or TDHE, state, or local government.

17. In ERA1, may a Tribe or TDHE provide assistance to non-Tribal members living on Tribal lands?

Yes. A Tribe or TDHE may provide ERA1 funds to non-Tribal members living on Tribal lands, provided these individuals are not already receiving ERA assistance from another Tribe or TDHE, state, or local government.

18. May a grantee provide assistance to households for which the grantee is the landlord?

Yes. A grantee may provide assistance to households for which the grantee is the landlord, provided that the grantee complies with the all provisions of the statute establishing ERA1 or ERA2, as applicable, the award terms, and applicable ERA guidance issued by Treasury, and that no preferences (beyond the prioritization described in FAQ 22 ) are given to households that reside in the grantee’s own properties.

19. May a grantee provide assistance to a renter household with respect to utility or energy costs without also covering rent?

Yes. A grantee is not required to provide assistance with respect to rent in order to provide assistance with respect to utility or energy costs. For ERA1, the limitations in section 501(c)(2)(B) of Division N of the Consolidated Appropriations Act, 2021, limiting assistance for prospective rent payments do not apply to the provision of utilities or home energy costs.

20. May a grantee provide ERA assistance to homeowners to cover their mortgage, utility, or energy costs?

No. ERA assistance may be provided only to eligible households, which is defined by statute to include only households that are obligated to pay rent on a residential dwelling. However, homeowners may be eligible for assistance under programs using funds under the Homeowner Assistance Fund, which was established by Treasury under the American Rescue Plan Act of 2021.

21. May grantees administer ERA programs by using contractors, subrecipients, or intergovernmental cooperation agreements?

Yes. Grantees may use ERA payments to make subawards to other entities, including non-profit organizations and local governments, to administer ERA programs on behalf of the grantees. The subrecipient monitoring and management requirements set forth in 2 CFR 200.331-200.333 will apply to such entities. Grantees may also enter into contracts using ERA payments for goods or services to implement ERA programs. Grantees must comply with the procurement standards set forth in 2 CFR 200.317-200.327 in entering into such contracts. Grantees are encouraged to achieve administrative efficiency and fiduciary responsibility by collaborating with other grantees in joint administrative solutions to deploying ERA resources.

22. ERA requires a prioritization of assistance for households with incomes less than 50 percent of area median income or households with one or more individuals that have not been employed for the 90-day period preceding the date of application. How should grantees prioritize assistance?

Grantees should establish a preference system for assistance that prioritizes assistance to households with incomes less than 50 percent area median income 8 and to households with one or more members that have been unemployed for at least 90 days. Grantees should document the preference system they plan to use and should inform all applicants about available preferences.

Treasury will require grantees to report to Treasury on the methods they have established to implement this prioritization of assistance and to publicly post a description of their prioritization methods, including on their program web page if one exists, by July 15, 2021.

8 For the definition of area median income, see FAQ 4 .

23. ERA1 and ERA2 both allow for up to 10 percent of the funds received by a grantee to be used for certain housing stability services. What are some examples of these services?

ERA1 and ERA2 have different requirements for housing stability services.

Under ERA1, these funds may be used to provide eligible households with case management and other services related to the COVID-19 outbreak, as defined by the Secretary, intended to help keep households stably housed.

Under ERA2, these services do not have to be related to the COVID-19 outbreak and the ERA2 statute does not restrict the provision of housing stability services to “eligible households.

For purposes of ERA1 and ERA2, housing stability services include those that enable households to maintain or obtain housing. Such services may include, among other things, eviction prevention and eviction diversion programs; mediation between landlords and tenants; housing counseling; fair housing counseling; housing navigators or promotoras that help households access ERA programs or find housing; case management related to housing stability; housing-related services for survivors of domestic abuse or human trafficking; legal services or attorney’s fees related to eviction proceedings and maintaining housing stability; and specialized services for individuals with disabilities or seniors that support their ability to access or maintain housing. Grantees using ERA funds for housing stability services must maintain records regarding such services and the amount of funds provided to them.

24. Are grantees required to remit interest earned on ERA payments made by Treasury?

No. ERA payments made by Treasury to states, territories, and the District of Columbia are not subject to the requirement of the Cash Management Improvement Act and Treasury’s implementing regulations at 31 CFR part 205 to remit interest to Treasury. ERA payments made by Treasury to local governments, Tribes, and TDHEs are not subject to the requirement of 2 CFR 200.305(b)(8)-(9) to maintain balances in an interest-bearing account and remit payments to Treasury.

25. When may Treasury recoup ERA funds from a grantee?

Treasury may recoup ERA funds from a grantee if the grantee does not comply with the applicable limitations on the use of those funds.

26. May rental assistance be provided to temporarily displaced households living in hotels or motels?

Yes. The cost of a hotel or motel room occupied by an eligible household may be covered using ERA assistance within the category of certain “other expenses related to housing” (as described in FAQ 7 ) provided that:

- the household has been temporarily or permanently displaced from its primary residence or does not have a permanent residence elsewhere;

- the total months of assistance provided to the household do not exceed the applicable time limit described in FAQ 10 ; and

- documentation of the hotel or motel stay is provided and the other applicable requirements provided in the statute and these FAQs are met.

The cost of the hotel or motel stay would not include expenses incidental to the charge for the room.

Grantees covering the cost of such stays must develop policies and procedures detailing under what circumstances they would provide assistance to cover such stays. In doing so, grantees should consider the cost effectiveness of offering assistance for this purpose as compared to other uses. If a household is eligible for an existing program with narrower eligibility criteria that can provide similar assistance for hotel or motel stays, such as the HUD Emergency Solutions Grant program or FEMA Public Assistance, grantees should utilize such programs prior to providing similar assistance under the ERA program.

27. May a renter subject to a "rent-to-own" agreement with a landlord be eligible for ERA assistance?

A grantee may provide financial assistance to households that are renting their residence under a “rent-to-own” agreement, under which the renter has the option (or obligation) to purchase the property at the end of the lease term, provided that a member of his or her household:

- is not a signor or co-signor to the mortgage on the property;

- does not hold the deed or title to the property; and

- has not exercised the option to purchase.

Homeowners may be eligible for assistance under programs using funds under the Homeowner Assistance Fund, which was established by Treasury under the American Rescue Plan Act of 2021.

28. Under what circumstances may households living in manufactured housing (mobile homes) receive assistance?

Rental payments for either the manufactured home or the parcel of land the manufactured home occupies are eligible for financial assistance under ERA programs. Households renting manufactured housing or the parcel of land the manufactured home occupies may also receive assistance for utilities and other expenses related to housing, as detailed in FAQ 7 above. This principle also applies to mooring fees for water-based dwellings (houseboats).

29. What are the applicable limitations on administrative expenses?

Under ERA1, not more than 10 percent of the amount paid to a grantee may be used for administrative costs attributable to providing financial assistance and housing stability services to eligible households. Under ERA2, not more than 15 percent of the amount paid to a grantee may be used for administrative costs attributable to providing financial assistance, housing stability services, and other affordable rental housing and eviction prevention activities.

The revised award term for ERA1 issued by Treasury permits recipients to use funds provided to cover both direct and indirect costs. A grantee may permit a subrecipient to incur more than 10 or 15 percent, as applicable, of the amount of the subaward issued to that subrecipient as long as the total of all administrative costs incurred by the grantee and all subrecipients, whether as direct or indirect costs, does not exceed 10 or 15 percent, as applicable, of the total amount of the award provided to the grantee from Treasury.

Further, the revised award term for ERA1 no longer requires grantees to deduct administrative costs charged to the award from the amount available for housing stability services. Rather, any direct and indirect administrative costs in ERA1 or ERA2 must be allocated by the grantee to either the provision of financial assistance or the provision of housing stability services. As required by the applicable statutes, not more than 10 percent of funds received by a grantee may be used to provide eligible households with housing stability services (discussed in FAQ 23 . To the extent administrative costs are not readily allocable to one or the other of these categories, the grantee may assume an allocation of the relevant costs of 90 percent to financial assistance and 10 percent to housing stability services.

Grantees may apply their negotiated indirect cost rate to the award, but only to the extent that the total of the amount charged pursuant to that rate and the amount of direct costs charged to the award does not exceed 10 percent of the amount of the award.

Updated on March 26, 2021

30. Should grantees provide tenants the option to apply directly for ERA assistance, rather than only accepting applications for assistance from landlords and owners of dwellings?

For ERA1, Treasury strongly encourages grantees to provide an option for tenants to apply directly for funding, rather than only accepting applications for assistance from landlords and owners of dwellings. For ERA2, grantees are required to allow tenants to apply directly for assistance, even if the landlord or owner chooses not to participate, consistent with the statutory requirement for the funds to be used to provide financial assistance to eligible households.

See FAQ 12 for additional information on grantees providing assistance to landlords and tenants.

Added on May 7, 2021

31. How should grantees ensure that recipients use ERA funds only for permissible purposes?

Grantees should require recipients of funds under ERA programs, including tenants and landlords, to commit in writing to use ERA assistance only for the intended purpose before issuing a payment. Grantees are not required to obtain documentation evidencing the use of ERA program funds by tenants and landlords. Grantees are expected to apply reasonable fraud- prevention procedures and to investigate and address potential instances of fraud or the misuse of funds that they become aware of.

There may be instances when a landlord refuses to accept a payment from a tenant who has received assistance directly from a grantee for the purpose of paying the landlord. In these cases, the grantee may allow the tenant to use the assistance for other eligible costs in accordance with the terms of the grantee’s ERA programs.

32. Can grantees prohibit landlords from pursuing eviction for nonpayment of rent for some period after receiving ERA assistance?

With respect to landlords that receive funds under an ERA program for prospective rent or for rental arrearages, the grantee must prohibit the landlord from evicting the tenant for nonpayment of rent with respect to the period covered by the assistance.

In addition, with respect to landlords that receive funds for rental arrears, to promote the purpose of the program the grantee is encouraged to prohibit the landlord from evicting the tenant for nonpayment of rent for some period of time, consistent with applicable law.

In all cases, Treasury strongly encourages grantees to require landlords that receive funds under the ERA, as a condition of receiving the funds, not to evict tenants for nonpayment of rent for 30 to 90 days longer than the period covered by the rental assistance.

33. How can grantees work with other grantees to make their ERA programs consistent?

Treasury encourages grantees with overlapping or contiguous jurisdictions to collaborate to develop consistent or complementary terms of their ERA programs and to coordinate in their communications with the public, to minimize potential confusion among tenants and landlords regarding assistance. Treasury also encourages grantees to reduce burdens for entities seeking assistance from multiple grantees across different jurisdictions, including utility providers and landlords with properties in multiple jurisdictions.

34. Should a grantee require that a landlord initiate an eviction proceeding in order to apply for assistance under an ERA program?

35. how can era assistance be used to support an eligible household moving to a new home.

ERA funds may be used to provide assistance to eligible households to cover prospective relocation assistance, rent, and utility or home energy costs, including after an eviction. Treasury encourages grantees to provide prospective support to help ensure housing stability. See FAQ 7 (regarding qualifying relocation expenses) and FAQ 10 (regarding time limits on assistance).

Before moving into a new residence, a tenant may not yet have a rental obligation, as required by the statutes establishing ERA1 and ERA2. In those cases, Treasury encourages grantees to provide otherwise eligible households with an official document specifying the amount of financial assistance under ERA programs that the grantee will pay a landlord on behalf of the household (such as for a security deposit or rent) if the landlord and the household enter into a qualifying lease of at least six months. Such documentation may expire after a certain period, such as 60 to 120 days after the issuance date. Treasury encourages grantees to work with providers of housing stability services to help these households identify housing that meets their needs. For purposes of reporting to Treasury, grantees may consider these commitments to be an obligation of funding until their expiration.

36. What steps can ERA grantees take to prevent evictions for nonpayment of rent?

Treasury strongly encourages grantees to develop partnerships with courts in their jurisdiction that adjudicate evictions for nonpayment of rent to help prevent evictions and develop eviction diversion programs. For example, grantees should consider: (1) providing information to judges, magistrates, court clerks, and other relevant court officials about the availability of assistance under ERA programs and housing stability services; (2) working with eviction courts to provide information about assistance under ERA programs to tenants and landlords as early in the adjudication process as possible; and (3) engaging providers of legal services and other housing stability services to assist households against which an eviction action for nonpayment of rent has been filed.

Added on June 24, 2021

37. How can grantees promote access to assistance for all eligible households?

Grantees should address barriers that potentially eligible households may experience in accessing ERA programs, including by providing program documents in multiple languages, by enabling persons with disabilities to access the programs, and by conducting targeted outreach to populations with disproportionately high levels of unemployment or housing instability or that are low income.

Grantees should also provide, either directly or through partner organizations, culturally and linguistically relevant outreach and housing stability services to ensure access to assistance for all eligible households.

In accordance with Title VI of the Civil Rights Act of 1964 (Title VI) ERA grantees must ensure they provide meaningful access to their limited-English-proficiency (LEP) applicants and beneficiaries of their federally assisted programs, services, and activities. Denial of an LEP person’s access to federally assisted programs, services, and activities is a form of national-origin discrimination prohibited under Title VI and Treasury’s Title VI implementing regulations at 31 CFR Part 22. Meaningful access for an LEP person may entail providing language assistance services, including oral interpretation and written translation where necessary, to ensure effective communication regarding the ERA grantee’s programs, services, and activities. For more information regarding reasonable steps to provide meaningful access for LEP persons, please go to https://www.lep.gov and the ERA programs’ Promising Practices. See also Treasury’s published LEP guidance at 70 FR 6067 (Feb. 4, 2005).

38. May grantees obtain information in bulk from utility providers and landlords with multiple units regarding the eligibility of multiple tenants, or bundle assistance payments for the benefit of multiple tenants in a single payment to a utility provider or landlord?

Data-sharing agreements between grantees and utility providers or landlords with multiple units may reduce administrative burdens and enhance program integrity by providing information to validate tenant-provided information. Therefore, grantees may establish prudent information sharing arrangements with utility providers and landlords for determining household eligibility. Grantees may also establish reasonable procedures for combining the assistance provided for multiple households into a single “bulk” payment made to a utility or landlord. Grantees should ensure that any such arrangements (1) comply with applicable privacy requirements; (2) include appropriate safeguards to ensure payments are made only for eligible households; and (3) are documented in records satisfying the grantee’s reporting requirements, including, for example, the amount of assistance paid for each household.”

In addition, to speed the delivery of assistance, grantees may adopt policies and procedures enabling landlords and utility providers to receive assistance based on reasonable estimates of arrears owed by multiple households, before their application and documentation requirements are satisfied. Specifically, a grantee may provide for payments based on such estimates if (1) the landlord or utility provider certifies that its estimate is reasonable based on information available to it at the time, (2) the grantee requires the landlord or utility provider to collect all required documentation from recipient households within six months, and (3) the landlord or utility provider agrees in writing to return to the grantee any assistance the landlord or utility provider receives that the household was ineligible for or for which the required documentation is not received within six months. Grantees are encouraged to limit such payments to a portion of the landlord’s or utility provider’s estimate (for example, 50 or 75 percent of the estimated amount) to limit the risk of providing funds that are used for an ineligible purpose and subsequently must be returned. If an estimated payment is subsequently found to have been used for an ineligible household or an ineligible expense, or if the required documentation is not timely submitted, the payment will be considered an ineligible use of ERA funds by the grantee.

In the case of a bulk utility payment made in accordance with this FAQ, a grantee may provide a utility provider up to nine months from the time the bulk payment was made to satisfy all documentation requirements if a moratorium preventing the shut-off of utilities was in effect in the grantee’s jurisdiction for at least one of the six months following the payment.

39. If ERA program funds are used for a security deposit for a lease, to whom should the landlord return the security deposit at the end of the lease?

Grantees should establish a policy with regard to the payment and disposition of security deposits, which should include a reasonable limit on the amount of a security deposit to be paid using ERA program funds. The amount of a security deposit should not exceed one month’s rent, except in cases where a higher amount is reasonable and customary in the local housing market. The treatment of security deposits is generally subject to applicable law and the rental agreement. In order to mitigate risks associated with the use of ERA program funds for security deposits, grantees should establish a minimum rental period, not less than four months, before a tenant is entitled to receive a returned security deposit that was paid for with ERA funds. To the extent that the security deposit is not returned to the tenant, it should be returned to the grantee.

40. May ERA assistance be used for rental or utility arrears after the tenant no longer resides in the unit?

In order to remove barriers a household may face in accessing new housing, a grantee may, at the tenant’s request, provide assistance for rental or utility arrears after an otherwise eligible tenant has vacated a unit. In addition to not engaging in further collection efforts regarding the arrears that are paid or related fees or expenses, as a condition to receiving payment, Treasury strongly encourages grantees to require the landlord or utility provider to agree not to pursue any further collection efforts against the household and ensure that any reports to credit agencies will confirm the matter’s resolution. In addition, grantees may consider requiring the landlord or utility provider to notify the tenant that payment has been received and that there will be no further collection efforts.

Added on August 25, 2021

41. May a grantee provide additional payments to landlords that enter into leases with eligible households experiencing circumstances that make it more difficult to secure rental housing?

Grantees may use ERA funds to pay for an additional rental payment required by a landlord as a condition to entering into a lease with a “hard-to-house” household that would not qualify under the landlord’s previously established, non-discriminatory, and lawful screening or occupancy policies. “Hard-to-house” applicants are those who, during the preceding 12 months, suffered an eviction; aged out of foster care or similar arrangements; were convicted of a criminal offense or released from incarceration; or experienced homelessness. The additional payment must be documented in the written lease agreement as additional rent and may not, in the aggregate, exceed one month’s rent (excluding the additional payment). Grantees should establish reasonable safeguards to ensure these additional rental payments do not incentivize landlords to adopt more stringent leasing policies and are otherwise compliant with any rent or security deposit restrictions imposed by state or local law.

42. May a grantee provide ERA funds to another entity for the purpose of making payments more rapidly?

To speed the delivery of assistance, grantees may enter into a written agreement with a nonprofit organization to establish a payment fund for the sole purpose of delivering assistance using ERA funds while a household’s application remains in process. A grantee may use such a process if:

- The process is reserved for situations in which an expedited payment could reasonably be viewed as necessary to prevent an eviction or loss of utility services that precludes employing the grantee’s standard application and payment procedures on a timely basis.

- The nonprofit organization has the requisite financial capacity to manage the ERA funds, such as being a certified community development financial institution.

- The nonprofit organization deposits and maintains the ERA funds in a separate account that is not commingled with other funds.

- The grantee receives all required application and eligibility documentation within six months.

- The nonprofit organization agrees in writing to return to the grantee any assistance that the household was ineligible for or for which the required documentation is not received within six months.

- Any funds not used by the nonprofit organization are ultimately returned to the grantee.

If a payment made by the nonprofit organization is subsequently found to have been used for an ineligible household or an ineligible expense, or if the required application and eligibility documentation are not timely submitted, the payment will be considered an ineligible use of ERA funds by the grantee. Any administrative expenses attributable to a payment fund should be considered in accordance with FAQ 29 .

43. Are landlords offered ERA payments subject to source-of-income protection laws?

A landlord’s failure to accept payments made using ERA funding might violate state or local source-of-income protection laws, depending on the jurisdiction’s laws.

Added on July 6, 2022

44. May ERA grantees impose additional eligibility criteria, including employment or job-training requirements, as a condition of providing ERA assistance to households?

The statutes that authorize the ERA1 and ERA2 programs provide specific criteria for establishing a household’s eligibility. These eligibility requirements include financial hardship, risk of homelessness or housing instability, qualifying income, and an obligation to pay rent. While the statutes authorizing the ERA programs and Treasury’s policy guidance afford grantees discretion in structuring their programs, grantees do not have the authority to augment the ERA eligibility requirements by conditioning assistance on a tenant’s employment status, compliance with work requirements, or acceptance of employment counseling, job-training, or other employment services. To the extent that grantees would impose other eligibility criteria or would require tenants to be employed, accept employment services, or comply with work requirements, such additional requirements are not permissible.

45. If two grantees learn that they both provided rental or utility assistance to a household intended to cover the same months’ expenses, is one grantee required to recover its assistance payments from the household, landlord, or utility provider?

Grantees with overlapping or contiguous jurisdictions are encouraged coordinate to avoid duplicating assistance. However, there may be cases in which a grantee discovers that a household has received ERA assistance from multiple grantees intended to cover the same period of rent, utilities, rental arrears, or utility arrears. In such cases, the grantee may decline to recover its payment and instead recharacterize it as assistance covering a different period of eligible rental or utility expenses, if:

- the grantee documents, in accordance with ERA records requirements, which expenses its funds ultimately covered; and

- the grantee confirms that the household was eligible for all assistance it received, including ensuring that the total number of months of financial assistance received by the household does not exceed statutory limits, as described in FAQ 10.

For example, if a state grantee and a local grantee both provided assistance to the same household intended to cover rental arrears arising from January and February, either the state grantee or the local grantee could recharacterize its assistance as covering rental arrears arising from March and April, if such grantee documents the rental arrears ultimately covered by its payment and confirms that the household was eligible for assistance with respect to all four months of arrears.

Added on July 6, 2022

46. What are eligible “other affordable rental housing and eviction prevention purposes” under the statute establishing ERA2?

The statute establishing ERA2 provides that a grantee may use any of its ERA2 funds that are unobligated on October 1, 2022, for “affordable rental housing and eviction prevention purposes, as defined by the Secretary, serving very low-income families (as such term is defined in section 3(b) of the United States Housing Act of 1937 (42 U.S.C. 1437a(b))).” 1 However, in accordance with the ERA2 statute, prior to obligating any funds for such purposes, the grantee must have obligated at least 75 percent of the total ERA2 funds allocated to it for financial assistance to eligible households, eligible costs for housing stability services, and eligible administrative costs. These requirements are described below. 2

Eligible Uses of ERA2 Funds

Eligible Affordable Rental Housing Purposes. Eligible “affordable rental housing purposes” are expenses 3 for:

- the construction, rehabilitation, or preservation of affordable rental housing projects serving very low-income families;

- the acquisition of real property for the purpose of constructing, rehabilitating, or preserving affordable rental housing projects serving very low-income families;

- predevelopment activities that enable the construction, rehabilitation, or preservation of affordable rental housing projects serving very low-income families, including architectural and engineering design, planning, permitting, surveys, appraisals, and environmental review associated with an eligible project; and

- the operation of affordable rental housing projects serving very low-income families that were constructed, rehabilitated, or preserved using ERA2 funds. 4

For purposes of the definition above, affordable rental housing projects serve very low-income families only if:

- the household income of occupants of units funded by ERA2 funds is limited to the maximum income applicable to very low-income families, as such term is defined in section 3(b) of the United States Housing Act of 1937 (42 U.S.C. 1437a(b)); and

- such income limitation is imposed through a covenant, land use restriction agreement (LURA), or other enforceable legal requirement for a period of at least 20 years.

In addition, to be considered an affordable rental housing purpose serving very low-income families, an affordable rental housing project funded, in whole or in part, with ERA2 funds must conform to and meet the program regulations and other requirements of one or more of the types of assistance listed below. In other words, uses of ERA2 funds for an affordable rental housing purpose must be aligned with at least one of the following programs and must meet the requirements of that program along with the other conditions specifically set forth in this FAQ: 5

- Low-Income Housing Tax Credit (Treasury);

- HOME Investment Partnerships Program (U.S. Department of Housing and Urban Development (HUD));

- HOME-ARP Program (HUD);

- Housing Trust Fund Program (HUD);

- Public Housing Capital Fund (HUD);

- Indian Housing Block Grant Program (HUD);

- Section 202 Supportive Housing for the Elderly (HUD);

- Section 811 Supportive Housing for Persons with Disabilities (HUD);

- Farm Labor Housing Direct Loans and Grants (U.S. Department of Agriculture (USDA));

- Multifamily Preservation and Revitalization Program (USDA).

Eligible Eviction Prevention Purposes. Eligible “eviction prevention purposes” are defined in the same manner as housing stability services under FAQ 23; however, services provided with funds made available for eviction prevention purposes must serve very low-income families.

Cost Allocation . Grantees may use ERA2 funds as part of the financing for a mixed-income housing project if the total financing made up of ERA2 award funds does not exceed the total development costs attributable to affordable rental housing units serving very low-income families. 6 For example, if 25 percent of a project’s units will be reserved for very low-income families and 20 percent of the total costs of all housing units in the project are attributable to such reserved units, then ERA2 funds may be used to pay for up to 20 percent of the total development costs.

Form of Provision of Funds and Time of Obligation . Grantees that use ERA2 funds for an eligible affordable rental housing purpose may provide such funds in the form of loans (including no-interest loans and deferred-payment loans), interest subsidies, grants, or other financial arrangements. ERA2 funds may not be used to establish, provide financial support to, or invest in revolving loan funds or other structured funds.

Under the ERA2 statute, grantees may obligate funds only until September 30, 2025, and all obligations must be liquidated by the closeout date of the award in accordance with the Uniform Guidance, i.e., no later than 120 calendar days after September 30, 2025. 7 ERA2 funds are considered to be obligated upon the grantee’s approval 8 of the loan, interest subsidy, grant, or other financial arrangement, and such obligations are considered to be liquidated for the purpose of award closeout upon the grantee’s disbursement of the ERA2 funds. Any proceeds or income a grantee receives after September 30, 2025, from loans, interest subsidies, or other similar financial arrangements made with ERA2 funds must be used for affordable rental housing purposes or eviction prevention purposes in accordance with this FAQ.

Obligation of 75 Percent of Allocated Funds

Treasury will calculate the 75 percent obligation threshold as (i) the total amount of ERA2 funds the grantee has obligated 9 for financial assistance to eligible households, eligible costs for housing stability services, and eligible administrative costs, divided by (ii) the grantee’s total ERA2 allocation, including any amounts reallocated to and excluding any amounts recaptured from the grantee. For example, if a grantee voluntarily reallocated 50 percent of its total initial ERA2 allocation, and did not experience any other reallocation, it must obligate 75 percent of its post-reallocation amount (or 37.5 percent of its initial ERA2 allocation) to use its remaining ERA2 funds for eligible affordable rental housing and eviction prevention purposes. If a grantee reaches the 75 percent threshold after October 1, 2022, it may begin using ERA2 funds for eligible affordable rental housing and eviction prevention purposes once it reaches the threshold.

Administrative Costs Attributable to Affordable Rental Housing and Eviction Prevention Purposes

The statute establishing ERA2 permits each grantee to use up to 15 percent of the total amount of ERA2 funds paid to it for eligible administrative costs. Consistent with FAQ 29, any direct and indirect administrative costs must be allocated by the grantee to the provision of financial assistance, housing stability services, or other affordable rental housing and eviction prevention purposes. Thus, a grantee’s administrative costs with respect to affordable rental housing and eviction prevention purposes may be paid with ERA2 funds only in an amount up to 15 percent of the grantee’s expenditures for these purposes.

1 As of the date of this FAQ, the definition of “very low-income families” in 42 U.S.C. 1437a(b) is “low-income families whose incomes do not exceed 50 per centum of the median family income for the area, as determined by the Secretary [of Housing and Urban Development] with adjustments for smaller and larger families, except that the Secretary may establish income ceilings higher or lower than 50 per centum of the median for the area on the basis of the Secretary’s findings that such variations are necessary because of unusually high or low family incomes.” All references to “very low-income families” in this FAQ incorporate this definition. The Department of Housing and Urban Development annually updates its calculations relevant to the definition of “very low-income families” at https://www.huduser.gov/portal/datasets/il.html .

2 Treasury’s reporting guidance will address the specific reporting and certification requirements associated with the uses of ERA2 funds described in this FAQ.

3 ERA2 award funds used for affordable rental housing and eviction prevention purposes will be subject to the applicable requirements set forth in the Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards (Uniform Guidance), 2 CFR Part 200. Specifically, ERA2 grantees are required to comply with the applicable procurement standards set forth in 2 CFR §§ 200.317 through 200.327 when procuring goods and services for these eligible purposes, and the allowability of expenses related to affordable rental housing and eviction prevention purposes will be subject to the Cost Principles set forth in 2 CFR Part 200, Subpart E.

4 Expenses for transitional housing (i.e., any dwelling that is intended to provide temporary housing to formerly homeless persons for a period up to 24 months) or emergency shelters are not considered “affordable rental housing projects” and therefore are not eligible “affordable rental housing purposes.”

5 For purposes of determining whether any expenses constitute affordable rental housing purposes under ERA2, in the event of a direct conflict between ERA2 requirements and requirements of a listed program to which a grantee will conform its affordable rental housing project, ERA2 requirements will prevail with respect to any portion of the project funded by ERA2 funds. A direct conflict between program requirements occurs only when it is impossible to comply with the requirements of ERA2 and of the other program. In contrast, if two sets of income or affordability-period requirements apply to the same units, there is no direct conflict; grantees must satisfy both by applying the more stringent requirements.

6 The specific units within a mixed-income housing project subject to the applicable income limitation may vary over time depending on operational needs, provided the units subject to the income limitation at any point do not materially differ from units funded by ERA2 funds.

7 See 2 CFR § 200.344.

8 Such approval occurs at the time of the execution of a written agreement or other legal instrument providing for the disbursement of ERA2 funds.

9 To determine whether a grantee has obligated ERA2 funds, Treasury will rely on the criteria set forth in section II.A of the ERA1 Reallocation Guidance originally published on October 4, 2021 and updated on March 30, 2022, available at https://home.treasury.gov/system/files/136/Updated-ERA1-Reallocation-Guidance%203-30-%202022.pdf .

Updated on March 5, 2024

Added on July 27, 2022

- Skip to Nav

- Skip to Main

- Skip to Footer

COVID Rent Relief: Already Applied and Still Waiting? Here's What You (and Your Landlord) Can Do Now

Please try again

Leer en español

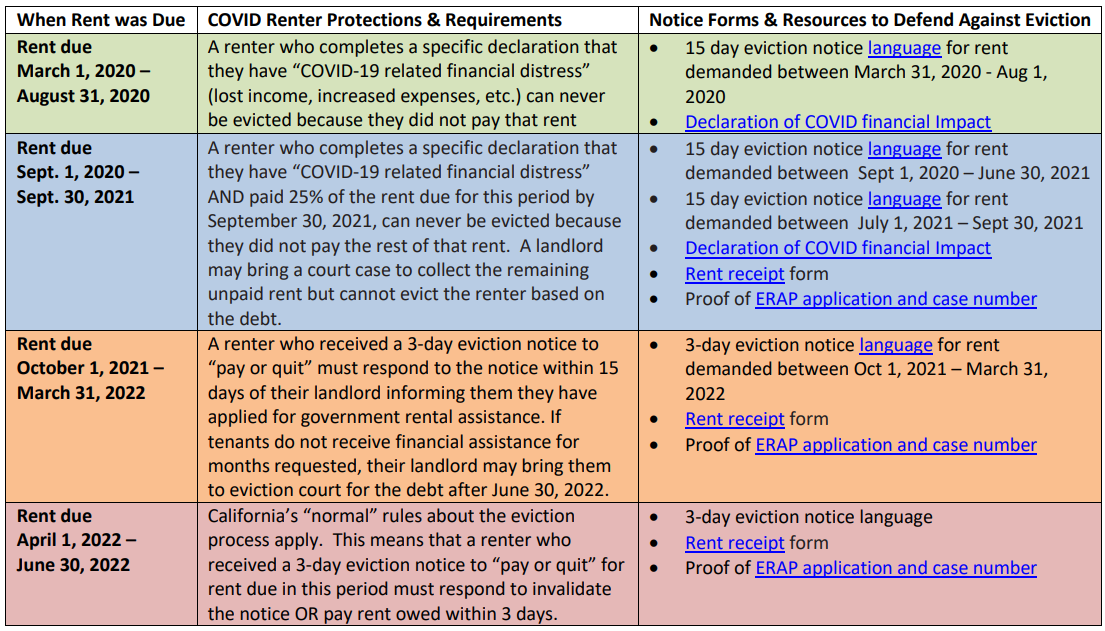

At the very last minute, California extended eviction protections for people who applied for the state's COVID-19 Rent Relief program by the deadline of March 31.

This means that if you're a tenant who applied for the program to receive help with your back rent — either in partnership with your landlord, or by yourself — the fact that you've applied will technically continue to protect you against eviction through June 30.

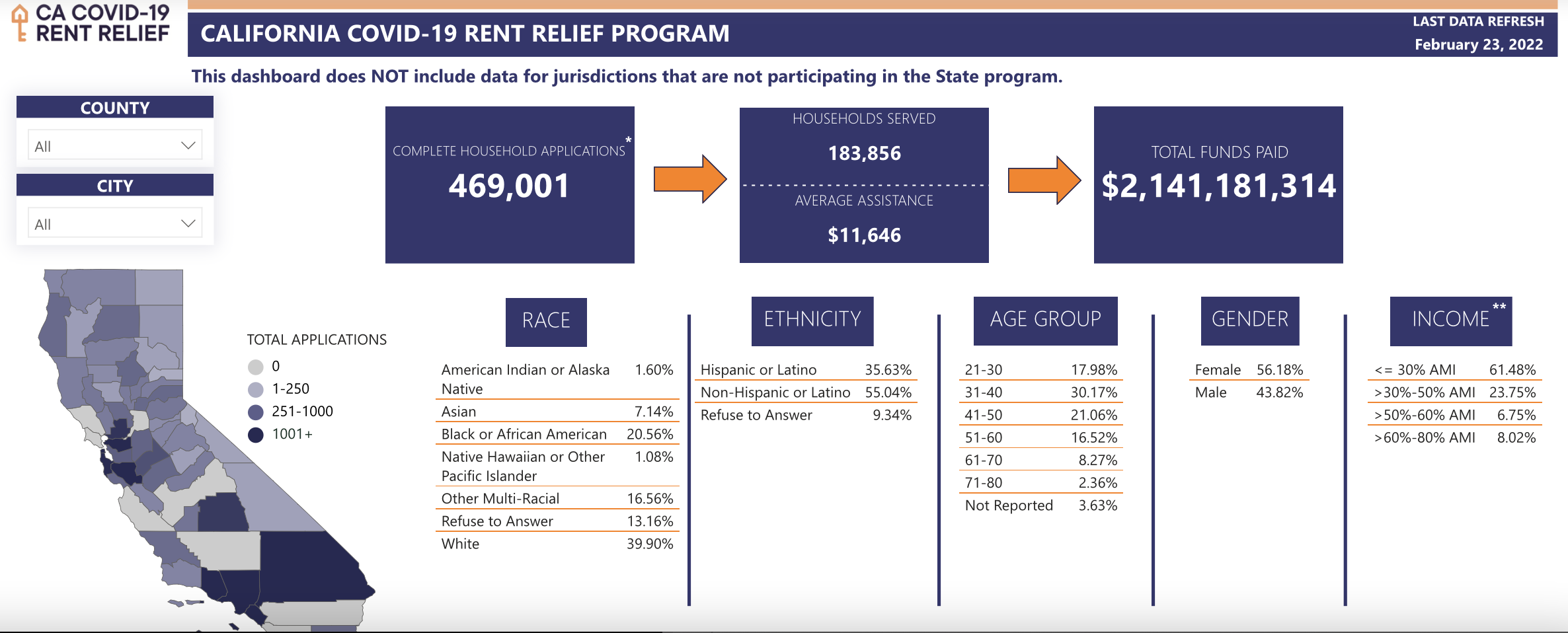

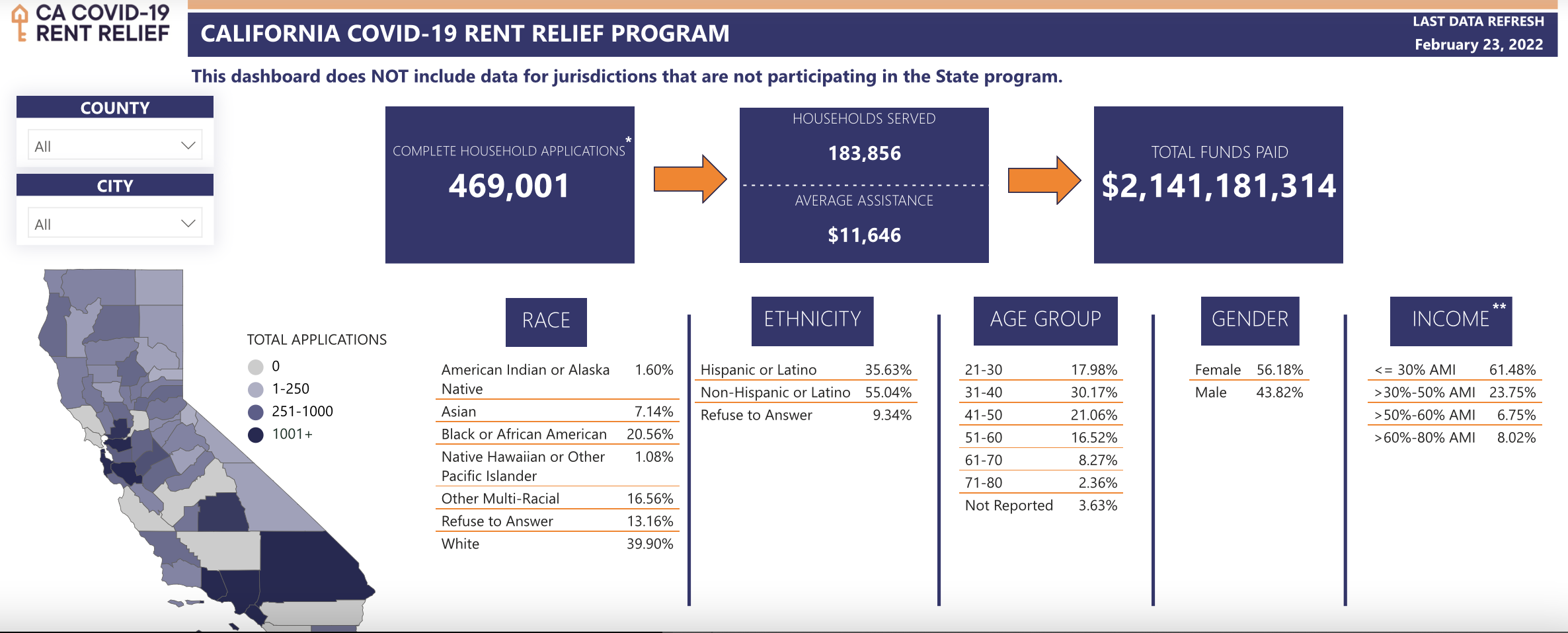

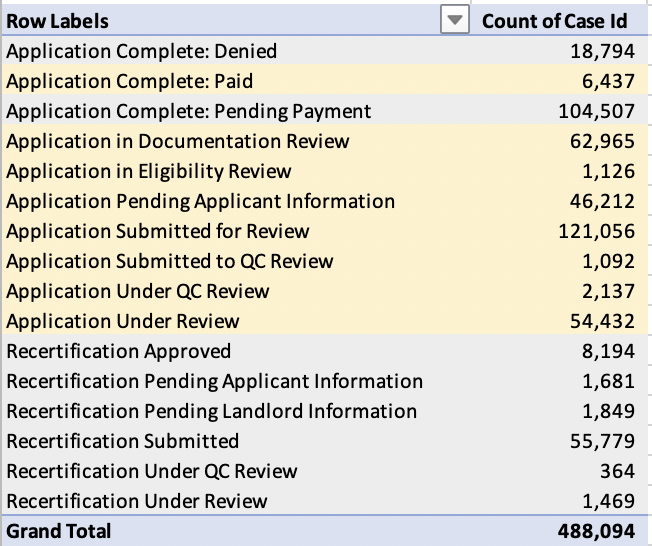

But more than half a million people have applied to the state’s emergency rent relief program — called Housing Is Key — since it launched in March 2021, and fewer than half of those applicants have received payments , according to the state’s own dashboard.

So if you're one of those who've applied and are still waiting on your money, what can you practically do during this time? And what can your landlord do while you're waiting for news on your application? Read on.

Does this extension of eviction protections mean there's a statewide eviction moratorium again?

No. California's statewide moratorium on evictions expired last fall, on Sept. 30, 2021.

But the state's COVID Rent Relief program has afforded its own kind of eviction protections, which started on Oct. 1, 2021. That's because, since that date, any landlord wanting to evict a tenant for failing to pay rent as a result of COVID hardship needs to first apply for rental relief before continuing with an eviction lawsuit. And renters affected by COVID hardship can prevent an eviction from moving forward if they show they've applied for the rent relief program as a defense in court.

These protections would have expired on March 31 , but now have been extended through June 30 by California's new legislation — although that's only for people who applied for the rent relief program by March 31.

Several cities and counties across the state had their own rent-related eviction moratoriums that stayed in place after the state moratorium expired. See if your Bay Area county still has an eviction moratorium.

I applied for rent relief before March 31. Am I guaranteed to get the money?

The state says that " all eligible applications received on or before March 31, 2022, for rent or utilities owed between April 1, 2020 through March 31, 2022, will be paid. "

But, although the Department of Housing and Community Development maintains that their goal is to turn applications around in 30 days, the average wait time is much longer — four months, on average , according to a recent report by the National Equity Atlas.

The state says as long as you've submitted your application by March 31, you'll still be able to access your application after that date "to check the status, respond to tasks, and provide additional information requested by your case manager."

If I applied by the deadline, is there any chance my landlord could still try to evict me?

When the law is working as it should, if you filled out an application and hit “submit” on or before March 31, you should be protected from eviction under this law. But, that doesn’t mean the law always works as it should.

Some tenant attorneys and advocates have reported clients who submitted an application that was still under review but received an eviction notice anyway. Usually, this is because the landlord either was not aware the tenant had applied or was falsely claiming their tenant hadn't filed all the required documentation for the application.

In late March, the state attorney general’s office sent warning letters to 91 law firms representing landlords across the state, reminding them that filing false declarations is against the law.

“Filing false averments in court violates multiple state laws,” wrote Deputy Attorney General Hunter Landerholm, “as does maintaining such a case after learning that the declaration used to initiate it is false.”

The letter encouraged those law firms to “review” the eviction cases on file to “ensure that they comply with the law.”

Evictions are still happening, said Madeline Howard, senior attorney at the Western Center on Law and Poverty, “because the protections are imperfect. And it's really hard to enforce them without an attorney.”

Typically, a lawyer can help a tenant combat these claims. So, if you applied for rent relief on or before March 31 and the application is still pending, but you’re getting an eviction notice, contact a lawyer. Find a legal aid office near you.

If your landlord is asking for proof that you've applied to the rent relief program, Howard advises that you download your application document on the Housing Is Key website, and send that to them, to “make it very clear that you have applied.”

A key thing to remember: For most tenants in California, starting April 1, landlords will still be able to take their tenants to court and start eviction proceedings over missed rent. That's because this new state legislation means a landlord can't evict you for not paying rent you owed before March 31 — but it doesn't protect you from eviction for not paying rent after that date.

My city lets me apply for rent relief after March 31. Could I be evicted while waiting for funds?