Law Firm Business Plan Template

Written by Dave Lavinsky

Law Firm Business Plan

You’ve come to the right place to create your Law Firm business plan.

We have helped over 1,000 entrepreneurs and business owners create business plans and many have used them to start or grow their Law Firms.

Below is a template to help you create each section of your Law Firm business plan.

Executive Summary

Business overview.

The Harris & Harris Law Firm is a startup up business that provides legal advice and services for clients located within the Scottsdale, Arizona region. The company is founded by Roger Harris and his son, Anthony. Roger Harris has been a partner in a well-established company, Foundations Law Firm, for over twenty years. Anthony Harris is a recent law school graduate who will begin his training under the scholarship of his father. With the extensive list of former clients in hand, Roger and Anthony are confident they can begin open their doors for business and grow the new law firm successfully.

Harris & Harris Law Firm will provide a comprehensive array of services for individuals or business entities who need advice and/or legal representation in court proceedings. Harris & Harris will provide a multi-prong approach to fashion specific solutions for each individual they represent; in that regard, all services are custom-packaged and provided for clients by the lawyers at Harris & Harris. This unique factor will set them above all other area lawyers, as most follow standard processes within the companies where they work.

Product Offering

The following are the services that Harris & Harris Law Firm will provide:

- Client-centric efforts in every case until resolution is found

- Unique process to fully explore client options in any dispute

- Creative and sustainable solutions on a case-by-case basis

- Prioritization of client needs above all else

- Dedication to professionalism and honesty

- Equally dedicated to securing the correct outcomes for our clients

- Team of highly-skilled lawyers who create winning solutions

Customer Focus

Harris & Harris will target the residents of Scottsdale, Arizona. They will also target medium-to-large businesses within Scottsdale, Arizona. They will target former associates and lawyers with whom they can collaborate in the future. They will target residents who have been served a summons for civil or criminal case appearances, whether as a witness, interested party or a potential defendant.

Management Team

Harris & Harris will be owned and operated by Roger Harris. He recruited his son, Anthony, to join the new firm upon Anthony’s recent graduation from law school. Within the next ten years, depending on performance, Anthony will receive incremental distributions of up to 49% of the company value in private stock. This will be based on Anthony’s performance and growth in the company as his role expands.

Roger Harris was formerly a partner in a well-established company, Foundations Law Firm, for over twenty years. He practiced law in the personal law arena, including wills and probates, trusts and other forms of personal law. He also managed the real estate law team at his former place of employment. Roger’s role in Harris & Harris will be the President, with the primary responsibility of driving new client traffic to the company. Roger has recruited Anthony, Richard Cummings, and Torey Crouch to begin their employment at Harris & Harris, as well.

Anthony Harris is a recent law school graduate who will begin his training under the scholarship of his father. Anthony will specialize in a unique processing of individual cases by creating algorithms that will specify which outcomes will best serve the client. Anthony will also represent clients in court and assist in defense appearances. With the extensive list of former clients in hand and the unique processes they’ve designed for clients going forward, Roger and Anthony are confident they can begin and grow the new law firm successfully.

Richard Cummings, a former associate of Roger Harris, will take on the role of Managing Partner in the launch of Harris & Harris. He will oversee all junior partners and staff, as the total number of lawyers grows expeditiously over the first few years.

Torey Crouch, a former law student with Anthony Cummings, will take on the role of Research & Records Manager, as she will form the background work necessary for all the other lawyers on staff.

Success Factors

Harris & Harris Law Firm will be able to achieve success by offering the following competitive advantages:

- Friendly, knowledgeable, and highly-qualified team of Harris & Harris Law Firm

- Comprehensive menu of services designed to provide specific customer-centric solutions

- Specializations in real estate, trusts, probate, civil and criminal law are all offered under this multi-pronged services of Harris & Harris Law Firm

- Harris & Harris offers family discounts and other forms of packages for clients.

- Harris & Harris offers a “monthly pay” program for clients who need to spread out payments over time.

Financial Highlights

Harris & Harris Law Firm is seeking $200,000 in debt financing to launch its Harris & Harris Law Firm. The funding will be dedicated toward securing the office space and purchasing office equipment and supplies. Funding will also be dedicated toward three months of overhead costs to include payroll of the staff, rent, and marketing costs for the print ads and marketing costs. The breakout of the funding is below:

- Office space build-out: $20,000

- Office equipment, supplies, and materials: $10,000

- Three months of overhead expenses (payroll, rent, utilities): $150,000

- Marketing costs: $10,000

- Working capital: $10,000

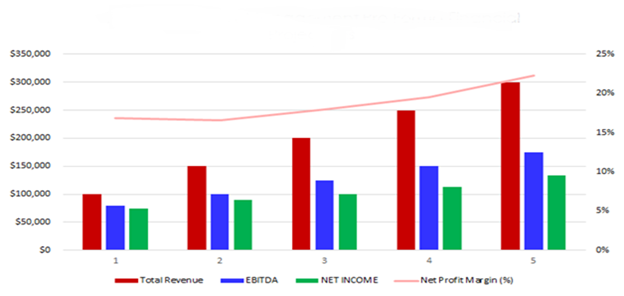

The following graph outlines the financial projections for Harris & Harris Law Firm.

Company Overview

Who is harris & harris law firm.

Harris & Harris Law Firm is a newly established, full-service law firm in Scottsdale, Arizona. Harris & Harris Law Firm will be the most reliable, solution-centric and effective choice for clients in Scottsdale and the surrounding communities. Harris & Harris Law Firm will provide a comprehensive menu of attorney services for any individual, family or business to utilize. Their full-service approach includes a comprehensive array of services that are uniquely prepared for each client.

Harris & Harris Law Firm will be able to serve the residents and businesses of Scottsdale. The team of professionals are highly qualified and experienced in all aspects of the law and several permutations of legal representation. Harris & Harris Law Firm removes all headaches and issues of securing a comprehensive law firm that is reliable and dedicated to clients, and ensures all issues are taken care of expeditiously, while delivering the best customer service.

Harris & Harris Law Firm History

Since incorporation, Harris & Harris Law Firm has achieved the following milestones:

- Registered Harris & Harris Law Firm, LLC to transact business in the state of Arizona.

- Has a contract for 10,000 square feet of office space midtown Scottsdale office buildings

- Reached out to numerous former clients and contacts to consider Harris & Harris for all their legal representation needs.

- Began recruiting a staff of five lawyers and three office personnel to work at Harris & Harris.

Harris & Harris Law Firm Services

The following will be the services Harris & Harris Law Firm will provide:

- Dedication to professionalism and honest dialogue

Industry Analysis

The law firm industry is expected to grow over the next five years to over $75 billion. The growth will be driven by an increased population requiring legal representation The growth will be driven by the increase of income for individuals, which can support the decision to hire representation. The growth will be driven by the increase in faulty or misleading documents, agreements, and certifications. The growth will be driven by legal firms who collect fees for business mergers and negotiations. Costs will likely be reduced as current technology becomes dated and new, higher-performing technological advances are employed.

Customer Analysis

Demographic profile of target market, customer segmentation.

Harris & Harris Law Firm will primarily target the following customer profiles:

- Residents of Scottsdale region

- Businesses within Scottsdale region

- Former associates and clients with whom they can collaborate

- Individuals or businesses that have been served with a summons to appear in court

Competitive Analysis

Direct and indirect competitors.

Harris & Harris Law Firm will face competition from other companies with similar business profiles. A description of each competitor company is below.

Diamond & Johnson Defense

Diamond & Johnson Defense is a law firm located in Phoenix, Arizona. The firm was established in 1998 and has three partners who oversee all cases: Robert Anderson, who is a lead criminal defense attorney; Lisa Martinez, who is a criminal appeals and post-conviction relief attorney, and David Collin, an investigations and trial preparation lawyer. The law firm has a total of six attorneys who specialize in criminal defense, and six office staff, who communicate directly with each lawyer on staff.

Diamond & Johnson Defense is known as “The Defendant’s Law Firm” in Scottsdale, as 99% of the law practice is focused on personal law representation in civil or criminal court cases. The law firm charges fees within the top 5% in the county for personal representation. The years of practice have proven to be winning ones for Diamond & Johnson Defense, as over 69% of their clients have been released without any prison time. The team at D & J Defense are known to be highly-skilled at investigations and trial preparation, with several team members who will take on a single case to thoroughly cover every possible defense for each client.

Legacy Law Associates

Legacy Law Associates is well-known as a “compassionate” team of attorneys, specializing in family wills and trusts. With a team of dedicated and experienced attorneys, the firm aims to provide comprehensive legal services that meet the goals of each client or family who need legal services during a difficult season of life. Legacy Law Associates consists of a partnership of two attorneys, Jonathan Dunlap and David Sessions, who established the law firm in 2005 in Phoenix after graduating from law school together. Together, the co-owners seek families who have legal needs after the death of a family member; such as estate negotiations, final documents and closures, trustee assistance, probate searches, and confidential proceedings per the will of any individual. The law firm has hired a private secretary for each partner and is housed in a small office in downtown Phoenix. The firm has not grown since 2007 and does not choose to make that a pivotal goal for their partnership, relying instead on the on-going legal processes of trusts, wills, probate and other related items.

Construction Defect Law Firm

The Construction Defect Law Firm is owned and operated by Chip Jackson and is located in Green Valley, Arizona. The focus of the law firm is to represent homeowners who have determined a new or nearly-new home contains construction defects. In most cases, the home builder has moved on from the geographic region and, even when contacted repeatedly, is unwilling to rectify the situation by repair or monetary refund.

Chip Jackson is a highly-skilled evaluator and contractor within the construction industry. He is able to determine the viability of most construction issues with merely a cursory examination and has proven over the past ten years to be a worthy adversary in the courtroom. He wins 98% of all cases he brings into the courtroom. Chip’s clients are always homeowners who have been victims of construction defects in homes that are typically new or less than ten years old. His skill set includes negotiation outside the courtroom, compelling videos of problematic construction processes, drone footage of damaged rooftops, chimneys and other areas not typically viewed by homeowners and other support graphics that demonstrate the defects of the property.

Competitive Advantage

Harris & Harris Law Firm will be able to offer the following advantages over their competition:

Marketing Plan

Brand & value proposition.

Harris & Harris Law Firm will offer the unique value proposition to its clientele:

Promotions Strategy

The promotions strategy for Harris & Harris Law Firm is as follows:

Word of Mouth/Referrals

Harris & Harris Law Firm has built up an extensive list of contacts over the years by providing exceptional service and expertise to former clients and associates. This group will follow Roger and Anthony to their new company and help spread the word of Harris & Harris Law Firm.

Professional Associations and Networking

Harris & Harris Law Firm will take an active role in all community organizations and networking events, where they can spread the word about the launch and start of their company. The law firm will offer an Open House specifically for association members to acquaint the city of Scottsdale with their new services and location.

Website/SEO Marketing

Harris & Harris Law Firm will fully utilize their website. The website will be well organized, informative, and list all the services that Harris & Harris Law Firm provides. The website will also list their contact information and list their available reservation times to meet with one of the attorney’s for an initial consultation. The website will employ SEO marketing tactics so that anytime someone types in the Google or Bing search engine “law firm services” or “lawyer near me”, Harris & Harris Law Firm will be listed at the top of the search results.

The pricing of Harris & Harris Law Firm will be moderate and on par with competitors so customers feel they receive excellent value when purchasing their services.

Operations Plan

The following will be the operations plan for Harris & Harris Law Firm. Operation Functions:

- Roger Harris will be the Owner and President of the company. He will engage and manage new client relations.

- Anthony Harris will be the Legal Outcomes & Research Manager for the company. He will work with clients to craft potential outcomes based on algorithms and research.

- Richard Cummings will take on the role of Managing Partner and, as such, will oversee junior partners and staff, as the total number of staff lawyers is expected to markedly grow in the coming five years.

- Torey Crouch will take on the role of Research & Records Manager, where she will support and provide research for all junior and senior attorney staff members. She will also oversee the office personnel.

Milestones:

Harris & Harris Law Firm will have the following milestones completed in the next six months.

- 5/1/202X – Finalize contract to lease office space

- 5/15/202X – Finalize personnel and staff employment contracts for the Harris & Harris Law Firm

- 6/1/202X – Finalize contracts for Harris & Harris Law Firm clients

- 6/15/202X – Begin networking at association meetings and industry events

- 6/22/202X – Begin moving into Harris & Harris Law Firm office

- 7/1/202X – Harris & Harris Law Firm opens its office for business

Financial Plan

Key revenue & costs.

The revenue drivers for Harris & Harris Law Firm are the fees they will charge to clients for the legal services and representation they provide.

The cost drivers will be the overhead costs required in order to staff Harris & Harris Law Firm. The expenses will be the payroll cost, rent, utilities, office supplies, and marketing materials.

Funding Requirements and Use of Funds

Harris & Harris Law Firm is seeking $200,000 in debt financing to launch its law firm. The funding will be dedicated toward securing the office space and purchasing office equipment and supplies. Funding will also be dedicated toward three months of overhead costs to include payroll of the staff, rent, and marketing costs for the print ads and association memberships. The breakout of the funding is below:

Key Assumptions

The following outlines the key assumptions required in order to achieve the revenue and cost numbers in the financials and in order to pay off the startup business loan.

- Number of Clients Per Month: 125

- Average Revenue per Month: $325,000

- Office Lease per Year: $100,000

Financial Projections

Income statement, balance sheet, cash flow statement, law firm business plan faqs, what is a law firm business plan.

A law firm business plan is a plan to start and/or grow your law firm business. Among other things, it outlines your business concept, identifies your target customers, presents your marketing plan and details your financial projections.

You can easily complete your Law Firm business plan using our Law Firm Business Plan Template here .

What are the Main Types of Law Firm Businesses?

There are a number of different kinds of law firm businesses , some examples include: Commercial Law, Criminal, Civil Negligence, and Personal Injury Law, Real Estate Law, and Labor Law.

How Do You Get Funding for Your Law Firm Business Plan?

Law Firm businesses are often funded through small business loans. Personal savings, credit card financing and angel investors are also popular forms of funding.

What are the Steps To Start a Law Firm Business?

Starting a law firm business can be an exciting endeavor. Having a clear roadmap of the steps to start a business will help you stay focused on your goals and get started faster.

1. Develop A Law Firm Business Plan - The first step in starting a business is to create a detailed law firm business plan that outlines all aspects of the venture. This should include potential market size and target customers, the services or products you will offer, pricing strategies and a detailed financial forecast.

2. Choose Your Legal Structure - It's important to select an appropriate legal entity for your law firm business. This could be a limited liability company (LLC), corporation, partnership, or sole proprietorship. Each type has its own benefits and drawbacks so it’s important to do research and choose wisely so that your law firm business is in compliance with local laws.

3. Register Your Law Firm Business - Once you have chosen a legal structure, the next step is to register your law firm business with the government or state where you’re operating from. This includes obtaining licenses and permits as required by federal, state, and local laws.

4. Identify Financing Options - It’s likely that you’ll need some capital to start your law firm business, so take some time to identify what financing options are available such as bank loans, investor funding, grants, or crowdfunding platforms.

5. Choose a Location - Whether you plan on operating out of a physical location or not, you should always have an idea of where you’ll be based should it become necessary in the future as well as what kind of space would be suitable for your operations.

6. Hire Employees - There are several ways to find qualified employees including job boards like LinkedIn or Indeed as well as hiring agencies if needed – depending on what type of employees you need it might also be more effective to reach out directly through networking events.

7. Acquire Necessary Law Firm Equipment & Supplies - In order to start your law firm business, you'll need to purchase all of the necessary equipment and supplies to run a successful operation.

8. Market & Promote Your Business - Once you have all the necessary pieces in place, it’s time to start promoting and marketing your law firm business. This includes creating a website, utilizing social media platforms like Facebook or Twitter, and having an effective Search Engine Optimization (SEO) strategy. You should also consider traditional marketing techniques such as radio or print advertising.

Learn more about how to start a successful law firm business:

- How to Start a Law Firm

Law Firm Business Plan Template

Written by Dave Lavinsky

Law Firm Plan

Over the past 20+ years, we have helped over 1,000 lawyers to create business plans to start and grow their law firms. On this page, we will first give you some background information with regards to the importance of business planning. We will then go through a law firm business plan template step-by-step so you can create your plan today.

Download our Ultimate Business Plan Template here >

What Is a Business Plan?

A business plan provides a snapshot of your law firm as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategy for reaching them. It also includes market research to support your plans.

Why You Need a Business Plan

If you’re looking to start a law firm, or grow your existing law firm, you need a business plan. A business plan will help you raise funding, if needed, and plan out the growth of your law firm in order to improve your chances of success. Your law firm plan is a living document that should be updated annually as your company grows and changes.

Sources of Funding for Law Firms

With regards to funding, the main sources of funding for a law firm are personal savings, credit cards and bank loans. With regards to bank loans, banks will want to review your business plan and gain confidence that you will be able to repay your loan and interest. To acquire this confidence, the loan officer will not only want to confirm that your financials are reasonable, but they will also want to see a professional plan. Such a plan will give them the confidence that you can successfully and professionally operate a business.

Finish Your Business Plan Today!

How to write a business plan for a law firm.

If you want to start a law firm or expand your current one, you need a business plan. Below are links to each section of your law firm plan template:

Executive Summary

Your executive summary provides an introduction to your business plan, but it is normally the last section you write because it provides a summary of each key section of your plan.

The goal of your Executive Summary is to quickly engage the reader. Explain to them the type of law firm you are operating and the status. For example, are you a startup, do you have a law firm that you would like to grow, or are you operating law firms in multiple cities?

Next, provide an overview of each of the subsequent sections of your plan. For example, give a brief overview of the law firm industry. Discuss the type of law firm you are operating. Detail your direct competitors. Give an overview of your target customers. Provide a snapshot of your marketing plan. Identify the key members of your team. And offer an overview of your financial plan.

Company Analysis

In your company analysis, you will detail the type of law firm you are operating.

For example, you might operate one of the following types of law firms:

- Commercial Law : this type of law firm focuses on financial matters such as merger and acquisition, raising capital, IPOs, etc.

- Criminal, Civil Negligence, and Personal Injury Law: this type of business focuses on accidents, malpractice, and criminal defense.

- Real Estate Law: this type of practice deals with property transactions and property use.

- Labor Law: this type of firm handles everything related to employment, from pensions/benefits, to contract negotiation.

In addition to explaining the type of law firm you will operate, the Company Analysis section of your business plan needs to provide background on the business.

Include answers to question such as:

- When and why did you start the business?

- What milestones have you achieved to date? Milestones could include the number of clients served, number of cases won, etc.

- Your legal structure. Are you incorporated as an S-Corp? An LLC? A sole proprietorship? Explain your legal structure here.

Industry Analysis

In your industry analysis, you need to provide an overview of the law firm industry.

While this may seem unnecessary, it serves multiple purposes.

First, researching the law firm industry educates you. It helps you understand the market in which you are operating.

Secondly, market research can improve your strategy, particularly if your research identifies market trends.

The third reason for market research is to prove to readers that you are an expert in your industry. By conducting the research and presenting it in your plan, you achieve just that.

The following questions should be answered in the industry analysis section of your law firm plan:

- How big is the law firm industry (in dollars)?

- Is the market declining or increasing?

- Who are the key competitors in the market?

- Who are the key suppliers in the market?

- What trends are affecting the industry?

- What is the industry’s growth forecast over the next 5 – 10 years?

- What is the relevant market size? That is, how big is the potential market for your law firm? You can extrapolate such a figure by assessing the size of the market in the entire country and then applying that figure to your local population.

Customer Analysis

The customer analysis section of your law firm plan must detail the customers you serve and/or expect to serve.

The following are examples of customer segments: businesses, households, and government organizations.

As you can imagine, the customer segment(s) you choose will have a great impact on the type of law firm you operate. Clearly, households would respond to different marketing promotions than nonprofit organizations, for example.

Try to break out your target customers in terms of their demographic and psychographic profiles. With regards to demographics, include a discussion of the ages, genders, locations and income levels of the customers you seek to serve. Because most law firms primarily serve customers living in their same city or town, such demographic information is easy to find on government websites.

Psychographic profiles explain the wants and needs of your target customers. The more you can understand and define these needs, the better you will do in attracting and retaining your customers.

Finish Your Law Firm Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Competitive Analysis

Your competitive analysis should identify the indirect and direct competitors your business faces and then focus on the latter.

Direct competitors are other law firms.

Indirect competitors are other options that customers have to purchase from that aren’t direct competitors. This includes accounting firms or human resources companies. You need to mention such competition as well.

With regards to direct competition, you want to describe the other law firms with which you compete. Most likely, your direct competitors will be law firms located very close to your location.

For each such competitor, provide an overview of their businesses and document their strengths and weaknesses. Unless you once worked at your competitors’ businesses, it will be impossible to know everything about them. But you should be able to find out key things about them such as:

- What types of customers do they serve?

- What types of cases do they accept?

- What is their pricing (premium, low, etc.)?

- What are they good at?

- What are their weaknesses?

With regards to the last two questions, think about your answers from the customers’ perspective. And don’t be afraid to ask your competitors’ customers what they like most and least about them.

The final part of your competitive analysis section is to document your areas of competitive advantage. For example:

- Will you provide better legal advice and services?

- Will you provide services that your competitors don’t offer?

- Will you provide more responsive customer interactions?

- Will you offer better pricing or flexible pricing options?

Think about ways you will outperform your competition and document them in this section of your plan.

Marketing Plan

Traditionally, a marketing plan includes the four P’s: Product, Price, Place, and Promotion. For a law firm plan, your marketing plan should include the following:

Product : In the product section, you should reiterate the type of law firm company that you documented in your Company Analysis. Then, detail the specific products you will be offering. For example, in addition to in-person consultation, will you provide virtual meetings, or any other services?

Price : Document the prices you will offer and how they compare to your competitors. Essentially in the product and price sub-sections of your marketing plan, you are presenting the products and services you offer and their prices.

Place : Place refers to the location of your law firm company. Document your location and mention how the location will impact your success. For example, is your law firm located in a busy business district, office building, etc. Discuss how your location might be the ideal location for your customers.

Promotions : The final part of your law firm marketing plan is the promotions section. Here you will document how you will drive customers to your location(s). The following are some promotional methods you might consider:

- Advertising in local papers and magazines

- Reaching out to local websites

- Social media marketing

- Local radio advertising

Operations Plan

While the earlier sections of your business plan explained your goals, your operations plan describes how you will meet them. Your operations plan should have two distinct sections as follows.

Everyday short-term processes include all of the tasks involved in running your law firm, including filling and filing paperwork, researching precedents, appearing in court, meeting with clients, etc.

Long-term goals are the milestones you hope to achieve. These could include the dates when you expect to file your 100th lawsuit, or be on retainer with 25 business clients, or when you hope to reach $X in revenue. It could also be when you expect to expand your law firm to a new city.

Management Team

To demonstrate your law firm’ ability to succeed, a strong management team is essential. Highlight your key players’ backgrounds, emphasizing those skills and experiences that prove their ability to grow a company.

Ideally you and/or your team members have direct experience in managing law firms. If so, highlight this experience and expertise. But also highlight any experience that you think will help your business succeed.

If your team is lacking, consider assembling an advisory board. An advisory board would include 2 to 8 individuals who would act like mentors to your business. They would help answer questions and provide strategic guidance. If needed, look for advisory board members with legal experience or with a track record of successfully running small businesses.

Financial Plan

Your financial plan should include your 5-year financial statement broken out both monthly or quarterly for the first year and then annually. Your financial statements include your income statement, balance sheet and cash flow statements.

Income Statement : an income statement is more commonly called a Profit and Loss statement or P&L. It shows your revenues and then subtracts your costs to show whether you turned a profit or not.

In developing your income statement, you need to devise assumptions. For example, will you file 25 lawsuits per month or sign 5 retainer contracts per month? And will sales grow by 2% or 10% per year? As you can imagine, your choice of assumptions will greatly impact the financial forecasts for your business. As much as possible, conduct research to try to root your assumptions in reality.

Balance Sheets : Balance sheets show your assets and liabilities. While balance sheets can include much information, try to simplify them to the key items you need to know about. For instance, if you spend $50,000 on building out your law firm, this will not give you immediate profits. Rather it is an asset that will hopefully help you generate profits for years to come. Likewise, if a bank writes you a check for $50,000, you don’t need to pay it back immediately. Rather, that is a liability you will pay back over time.

Cash Flow Statement : Your cash flow statement will help determine how much money you need to start or grow your business, and make sure you never run out of money. What most entrepreneurs and business owners don’t realize is that you can turn a profit but run out of money and go bankrupt.

In developing your Income Statement and Balance Sheets be sure to include several of the key costs needed in starting or growing a law firm:

- Location build-out including design fees, construction, etc.

- Cost of licensing, software, and office supplies

- Payroll or salaries paid to staff

- Business insurance

- Taxes and permits

- Legal expenses

Attach your full financial projections in the appendix of your plan along with any supporting documents that make your plan more compelling. For example, you might include your office location lease or your certificate of admission to the bar.

Putting together a business plan for your law firm is a worthwhile endeavor. If you follow the template above, by the time you are done, you will truly be an expert and know everything you need about starting a law firm business plan; once you create your plan, download it to PDF to show banks and investors. You will really understand the law firm industry, your competition, and your customers. You will have developed a marketing plan and will really understand what it takes to launch and grow a successful law firm.

Law Firm Business Plan FAQs

What is the easiest way to complete my law firm business plan.

Growthink's Ultimate Business Plan Template allows you to quickly and easily complete your Law Firm Business Plan.

What is the Goal of a Business Plan's Executive Summary?

The goal of your Executive Summary is to quickly engage the reader. Explain to them the type of law firm you are operating and the status; for example, are you a startup, do you have a law firm that you would like to grow, or are you operating a chain of law firms?

Don’t you wish there was a faster, easier way to finish your Law Firm business plan?

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success. Click here to see how Growthink’s professional business plan consulting services can create your business plan for you.

Other Helpful Business Plan Articles & Templates

Get Your Employment Law Business Essentials Today!

Foster growth with 250+ time-saving, business-specific templates. Swift designs, easy tools, all in one place.

Embarking on an Employment Law Venture

Starting an Employment Law business is an exhilarating journey that combines the precision of legal practice with the thrill of entrepreneurship. It requires not just a profound understanding of employment laws but also an unwavering commitment to advocating for workplace fairness and equity. Aspiring entrepreneurs must immerse themselves in the latest legislative developments and judicial interpretations to offer unparalleled service. Crafting a robust business plan that outlines your niche, services, and target clientele is crucial in this highly competitive field. Networking with industry professionals and building a reliable team are essential steps to creating a foundation for success. Above all, it's imperative to foster an environment of trust and professionalism where clients feel their rights are vigorously protected.

Understanding the Legal Landscape

Embarking on the journey to start an employment law business is akin to setting sail on a vast sea filled with both opportunity and challenge. The first hurdle many encounter is grasping the complex legal landscape that governs employment law. This isn't just about knowing the law; it's about understanding how it applies in diverse situations. Businesses must navigate through federal, state, and local regulations, which are often a tangled web of complexity. Staying updated with the latest legal changes and interpretations is crucial, as they can significantly impact your clients and your practice.

Finding Your Niche in Employment Law

The world of employment law is vast, covering everything from discrimination to wrongful termination. Finding your niche within this expanse can set your business apart and make it more successful. This requires a deep dive into what areas you're most passionate about and where you can offer the most value. It's not just about choosing a path but about identifying where your expertise can truly make a difference. Once you've determined your niche, you'll find it easier to target your marketing efforts and build a reputation as an expert in that area.

Building a Strong Client Base

One of the greatest challenges when stepping into the arena of starting an employment law business is building a strong client base. It's not merely about finding clients; it's about finding the right clients--those who need your specific expertise. This means understanding who benefits most from your services and reaching out to them through strategic marketing and networking. Relationship building is key here; trust takes time to develop but is fundamental for repeat business and referrals. Additionally, providing exceptional service is paramount, as satisfied clients are more likely to recommend your services to others.

Establishing an Online Presence

In today's digital world, having a strong online presence is no longer optional for legal businesses; it's essential. This encompasses more than just setting up a website. It involves creating content that showcases your expertise, engaging with potential clients on social media, and optimizing for search engines to ensure you're found by those in need of your services. Your online platforms should reflect the professionalism and quality of service you offer, acting as a digital front door for prospective clients. Furthermore, regular updates and active engagement online help build credibility and trust even before the first conversation happens.

Navigating Financial Management

Another critical aspect how to start and run any business successfully is mastering financial management. For an employment law business, this means budgeting effectively, keeping meticulous records for billing purposes, and managing cash flow efficiently. Unexpected expenses can arise, particularly in litigation cases that may extend over long periods. Planning for these eventualities by maintaining a reserve fund can safeguard against financial strain. Additionally, using accounting software tailored to law firms can streamline financial administration, freeing up valuable time for client-focused activities.

Boost campaigns with 250+ editable templates. Save, reuse, and wield design tools for business growth.

Maintaining Compliance with Ethical Standards

The legal profession is steeped in ethical responsibilities; starting an employment law business is no exception. Maintaining unwavering adherence to these standards not only protects you legally but also enhances your reputation among clients and peers. This involves everything from client confidentiality to conflict of interest checks. Regularly attending continuing legal education (CLE) courses on ethics helps keep these principles at the forefront of one's practice. Most importantly, integrating ethical considerations into every facet of your business operations ensures long-term success built on integrity.

Leveraging Technology for Efficiency

The use of technology can be a game-changer in how effectively you manage your employment law business. From case management software that streamlines workflow to digital marketing tools that automate client outreach, technology offers myriad ways to enhance efficiency. More so, adopting secure communication channels ensures confidentiality while facilitating smoother client interactions. Even something as simple as cloud storage can revolutionize document management, allowing easy access anytime, anywhere while saving physical space. Embracing technological solutions not only saves time but also significantly reduces operational costs.

Promoting Your Services Creatively

In a sea of competition, standing out requires creativity in how you promote your services. Traditional advertising methods are no longer sufficient on their own; today's environment demands innovative approaches that capture attention and resonate with potential clients. Utilizing storytelling in marketing materials can convey the impact of your work more compellingly than statistics alone ever could. Moreover, participating in community events or offering free seminars can showcase your expertise while contributing positively to public awareness around employment rights issues. Lastly, leverage tools like Desygner for crafting visually appealing promotional materials that grab attention while conveying professionalism.

As we delve deeper into strategies like promoting our services creatively or establishing an online presence, tools such as Desygner become invaluable assets in our toolkit. Its ability to help create professional-looking designs effortlessly means we can focus more time on what we do best--navigating the intricacies of employment law for our clients--while still ensuring our branding catches the eye in all the right ways.

Concluding Thoughts on Starting an Employment Law Business

In conclusion, the journey to starting a successful employment law business is both challenging and rewarding. It requires a deep understanding of the legal landscape, as well as an entrepreneurial spirit that drives you to serve your clients with dedication and excellence. As we've explored the intricacies of establishing this type of business, it's clear that success hinges on several key factors.

Firstly, gaining specialized knowledge in employment law cannot be overstated. This forms the foundation of your practice, enabling you to provide valuable advice and representation. Coupled with this, developing strong interpersonal skills will enhance your ability to connect with clients and understand their needs deeply.

Beyond the expertise and soft skills, the operational aspects of running a business are equally critical. From selecting an appropriate business structure to managing finances wisely, these steps ensure the sustainability and growth of your venture. Furthermore, marketing your services effectively will attract the right clients and establish your reputation in the field.

To encapsulate our discussion:

- Deepen your expertise in employment law.

- Build strong relationships with clients.

- Choose a suitable business structure.

- Mindful financial planning is crucial.

- Invest in effective marketing strategies.

- Leverage technology for efficiency.

- Understand the importance of continual learning.

- Consider using Desygner for your branding needs.

In summary, launching an employment law business is a significant undertaking that demands attention to detail, a steadfast commitment to excellence, and a passion for justice. By adhering to these principles and embracing tools like Desygner for your branding efforts, you're well-positioned to create a thriving practice that makes a real difference. Remember, success is within reach -- all it takes is the right approach and determination. Consider signing up at Desygner today to elevate your brand as you embark on this exciting journey.

Revolutionizing Your Employment Law Business Through Strategic Marketing

Crafting Compelling Content for Employment Law Professionals

UNLOCK YOUR BUSINESS POTENTIAL!

Get every material you need for your business in just a few clicks

What Is Employment Law?

Employment law governs every detail of the relationship between employee and employer. It is designed to protect employees and their employers through regulations that guarantee workplace safety, protect against child labor, ensure a fair and equitable hiring process , and address family and medical leave. Employment law also regulates the hours an employee can work and sets wages.

It is important that employees and employers understand the basic elements of employment law in order to avoid legal action. For example, if an employee makes false statements that harm an employer’s business or reputation, they may face a lawsuit — even if their statement doesn’t cause any monetary loss.

5 Critical Employment Laws to Know

Family and medical leave act (fmla).

- The Americans With Disabilities Act (ADA)

The Fair Labor Standards Act (FLSA)

Occupational safety and health act (osh), employee retirement income security act (erisa).

More People Management Basics What Are Compensation and Benefits?

Why Is Employment Law Important?

If an employer breaks an employment law, they may fall under investigation or incur penalties including extensive fines. Examples of employer misconduct include failing to pay mandatory overtime, denying paid leave, wrongful termination or asking prohibited questions on job applications. Employment law is structured so that both employer and employee are treated fairly, which in turn keeps a business running properly. These regulations ensure that businesses can focus on productivity instead of directing resources to resolving disputes.

For example, employers have the right to terminate an employee if they are not properly performing their duties. They also have the right to terminate an employee if the company can no longer afford to keep them on staff, or for more obvious reasons such as theft or defamation. Employment laws ensure that employees fulfill their contract with their employer, thereby protecting employers from bad faith actors.

Harassment in the Workplace

There are limits to the protections offered by employment laws. For example, harassment is illegal, but “petty teasing” is not. According to the U.S. Equal Employment Opportunity Commission (EEOC) , harassment is unwelcome conduct that is based on race, color, religion, sex, national origin, older age, disability or genetic information. Harassment becomes unlawful when enduring the offensive conduct becomes a condition of continued employment, or the conduct is severe or pervasive enough to create a work environment that a reasonable person would consider intimidating, hostile or abusive.

Petty teasing doesn’t qualify as unlawful, unless it creates a work environment that is intimidating, hostile or offensive. Offensive conduct may include, but is not limited to, offensive jokes, slurs, epithets or name calling, physical assaults or threats, intimidation, ridicule or mockery, insults or put-downs, offensive objects or pictures, and interference with work performance.

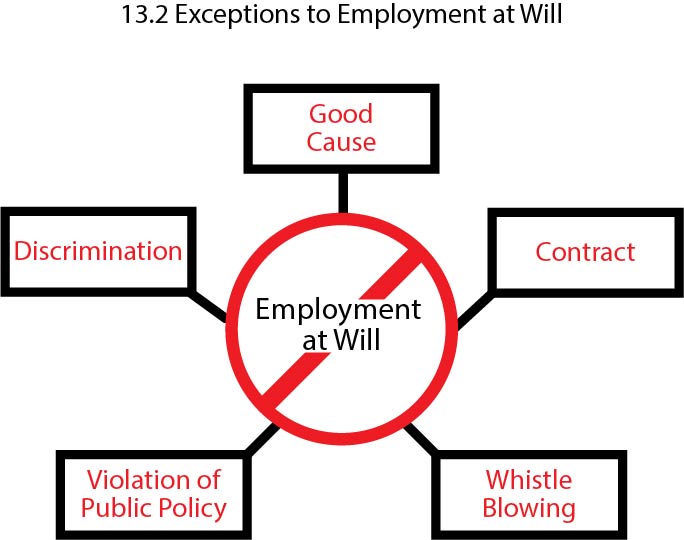

Who Is Exempt From Employment Laws?

Employment law also doesn’t protect all businesses equally. For example, some small businesses may be exempt from certain requirements, and managers may not have all the same wage protections as hourly workers. Additionally, most states offer “at-will” employment, which means an employer can terminate your employment for any reason as long as it’s not unlawful.

While employment laws don’t fully protect against all manner of workplace abuse, they do protect against many areas that were historically difficult to regulate. The Fair Labor Standards Act of 1938 restricts the hours that children under age 16 are allowed to work, placing limits on child labor. However, children 12 and younger can still legally work on farms, despite risks from heavy machinery and heat-related illnesses from sun exposure.

Related Reading How to Write Inclusive Job Descriptions

What Are the Main Characteristics of Employment Law?

Employment law is an extensive, relatively young branch of law that’s constantly changing. It allows employees to understand their rights and is often divided into areas such as wages and benefits, health and safety, and employment discrimination. Other key areas include family and medical leave, labor relations, unemployment compensation, employee contracts, immigration, the hiring process , pensions, social security and wrongful termination. The U.S. Department of Labor administers and enforces most federal employment laws.

What Are the Key U.S. Employment Laws?

The U.S. Department of Labor oversees an extensive range of employment laws, but there are other agencies that monitor the workplace as well. The U.S. Equal Employment Opportunity Commission (EEOC) enforces many of the laws protecting workers from discrimination, working with Fair Employment Practices Agencies (FEPAs) to manage charges of employment discrimination at the state and local levels.

Additionally, the National Labor Relations Board (NLRB) oversees the law that controls the relationship between unions and their members. Finally, the U.S. Department of Justice administers the Americans with Disabilities Act , which protects people with disabilities in many areas of life, including the workplace.

Here’s an overview of key U.S. employment laws.

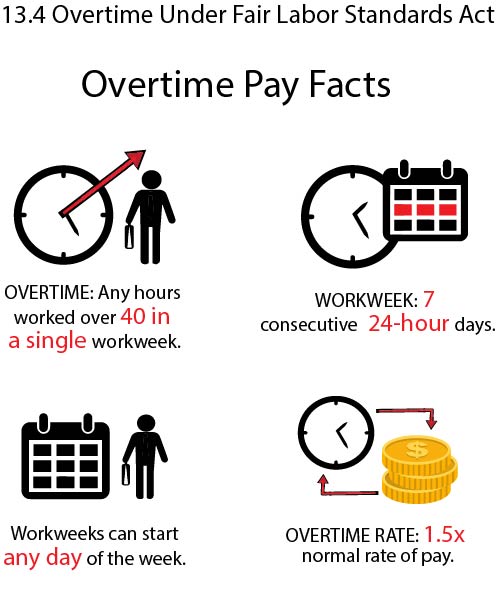

The Fair Labor Standards Act (FLSA) of 1938 prescribes standards for wages and overtime pay, which affect most private and public employment. The FLSA requires employers to pay employees who are not otherwise exempt at least the federal minimum wage and overtime pay of 1.5 times the regular rate of pay. (An exempt employee is salaried, and does not receive overtime pay or qualify for minimum wage.) The FLSA also restricts the hours that children under age 16 are allowed to work and prohibits the employment of children under age 18 in jobs considered too dangerous.

The OSH Act of 1970 is administered by the Occupational Safety and Health Administration (OSHA). Covered employers must comply with OSHA’s regulations as well as their health and safety standards. Under the OSH Act, employers must also provide employees with a workplace free from recognized, serious hazards, which include everything from workplace violence to hazardous material spills. OSHA enforces the law through workplace inspections and investigations.

While the U.S. Department of Labor oversees federal employee compensation, it has no oversight of state workers’ compensation programs . State government or private company employees should contact the workers’ compensation program from their state for more information.

More From This Expert What Is Employee Relations?

One of the most well-known and often-used labor laws is the Family and Medical Leave Act (FMLA) of 1993, which requires employers to provide up to 12 weeks of unpaid, job-protected leave to eligible employees for the birth or adoption of a child or for the serious illness of the employee or the employee’s spouse, child or parent.

The Employee Retirement Income Security Act of 1974 (ERISA) regulates employers who offer pension or welfare benefit plans for their employees. Certain employers and plan administrators must fund an insurance system to protect specific retirement benefits and pay premiums to the federal government.

The federal government also has labor laws governing:

- Construction and transportation industries

- Mine safety

- Migrant and seasonal agricultural workers

- Manufacturing plant closings and layoffs

- Recipients of government contracts, grants or financial aid

- Wage garnishment

- Unions and union members

A more obscure law is the Employee Polygraph Protection Act , which prohibits most employers from using lie detectors on employees but permits polygraph tests in specific circumstances.

Common Causes of Action in Employment Law

Employees can take legal action against their employer as individuals or as a union. While it’s more difficult, employers can also sue their employees. It’s important for both parties to be proactive and know their rights and responsibilities to avoid running afoul of the law.

When Can Employees Sue Their Employers?

- Inconsistent discipline/discrimination : Employers must ensure they’re applying disciplinary measures uniformly across employees. If an employee gets away with something for which their coworker was fired, the terminated employee could claim discrimination and pursue legal action.

- Workplace harassment : This is a type of discrimination that violates federal or state anti-discrimination laws. Harassment can prompt legal action if a workplace becomes hostile, abusive or intimidating.

- Wrongful termination : Firing an employee for illegal reasons or in a way that breaches a contract constitutes wrongful termination. Examples include an employer making an employee’s work so difficult that they quit on their own, an employee getting fired due to discrimination or an employee reporting an employer for illegal activity and getting fired (retaliation).

- Wage law violations : Employers can face legal action for denial of overtime pay, errors in the calculation of hours and overtime, and misclassifying employees as independent contractors.

More From Our Company Culture Experts How to Handle Layoff Announcements

When Can Employers Sue Their Employees?

- Negligence: If an employee causes injury to another person or property, the employer may be able to sue.

- Defamation: If an employee knowingly makes false statements that harm the employer’s business or reputation, the employer may pursue legal action. Even if the statement doesn’t cause any monetary loss, if it is harmful to the employer’s reputation they may face a lawsuit.

- Violating a non-compete clause: Many employment contracts prevent an employee from working in a specific field within a set geographic area for a certain time post-employment. Certain states no longer enforce non-compete clauses, but many still uphold the agreements if they find that they were reasonable and made in good faith.

Built In’s expert contributor network publishes thoughtful, solutions-oriented stories written by innovative tech professionals. It is the tech industry’s definitive destination for sharing compelling, first-person accounts of problem-solving on the road to innovation.

Great Companies Need Great People. That's Where We Come In.

How to Write a Law Firm Business Plan + Free Sample Plan PDF

Elon Glucklich

6 min. read

Updated April 3, 2024

Free Download: Sample Law Firm Business Plan Template

It’s a dynamic time to be in the legal industry. Over 63,000 new attorneys have started practicing in the U.S. in the past decade, and they’re joining law firms that are increasingly leveraging new technologies like AI to work more efficiently.

Owning your own law practice offers numerous advantages, from greater control of your caseloads to flexibility in setting billing rates.

But running a successful firm requires more than a deep knowledge of the law.

You need to market yourself, understand potential clients’ motivations and desires, and clearly explain to them why they should hire you over another firm. All of which you can figure out by going through the process of writing a business plan.

- What should you include in a law firm business plan?

Here are a few sections we recommend including in any law firm business plan:

Executive summary

Market analysis, marketing plan, company overview, financial plan.

The details of your plan will vary based on factors like the size of your legal practice and whether or not you need funding

If you’re seeking a bank loan or investment, you’re best off following the traditional approach to writing a business plan . Otherwise, don’t feel bound to writing a full plan. You can just focus on the business plan sections that are most relevant to your situation.

The executive summary is your opening pitch to the reader. Although it comes first in a business plan, you should write it last, since it distills your entire plan into a concise, one- to two-page overview.

Start by outlining your law firm’s focus and current status. Are you:

- A newly founded practice

- An established firm seeking expansion

- A multi-location enterprise

Then, summarize your practice areas and target clientele. Describe the issues you’re solving for potential clients, and why they should choose you over competitors.

Maybe your team has experience that’s relevant to your ideal client, or you offer an appealing fee structure. Anyone who reads the executive summary should be able to understand what makes your law firm unique .

Your executive summary briefly touches on your law firm’s area of focus. But the services section is where you give readers a detailed look at the expertise your legal practice offers, and how you address specific client needs.

What are your core practice areas? Do you represent:

Businesses: Contract disputes, regulatory compliance, employment law issues

Individuals: Personal injury claims, divorce proceedings, estate planning

Simply list all of your legal services. If you run an existing law practice, you can mention your existing client base. Also, specify if your law firm specializes in courtroom litigation, drafting contracts, or legal advisory services.

When writing out your services, consider what sets your firm apart. Maybe you provide free or low-cost initial consultations or specialize in areas underserved by competitors. Any services that might give you a competitive advantage are worth mentioning.

Understanding your potential client base is vital. Do you know the size of your market ? What are their characteristics?

To conduct a market analysis , start by profiling your ideal client. Consider basic demographic information , like their:

- Income level

- Geographic location

Take their life circumstances into account as well. Are they navigating events like:

- Recovering from an injury

- Being charged with a crime

- Running a business

- Planning an estate

Depending on their circumstances, you’ll need to research relevant trends in your area to determine whether there’s a growing demand for the services you offer.

Document who your competitors are as well. What other law firms might potential clients turn to? Note their strengths and weaknesses and compare them to your own in your market analysis.

This research will help you develop a unique value proposition—something only your firm offers that you can emphasize in your marketing strategy.

The marketing and sales plan is where you describe how you will stand out and attract clients.

Where are your potential clients seeking out legal information? Common channels for law firms to market their services include:

- Television and radio commercials

- Print and online advertisements

- Company website

You’ll likely want to consider a combination of these tactics.

But before spending your marketing budget, take some time in your business plan to determine how you’ll position yourself. If you’ve determined your law practice’s unique value proposition , it should be incorporated into all of your messaging.

Say you offer a unique combination of legal services in your market, such as financial compliance services for businesses and high-net-worth individuals. Your marketing plan is where you develop engaging messaging around your services that are tailored to your ideal client and the medium you’re promoting your services on.

Examples could include:

- Hiring a video production team to film a commercial for your legal practice

- Ensuring your law firm’s website is optimized for visibility on search engines.

- Creating pamphlets highlighting your service to distribute at business networking events or places where high net worth individuals frequent, like upscale health clubs or financial advisory offices.

One key point to remember is that the legal profession has specific marketing restrictions, to ensure law firms are promoting their services in an honest, ethical way. Make sure your plans adhere to the bar association’s guidelines .

The company overview isn’t an exhaustive history of your firm’s experience. It’s meant to quickly give the reader an understanding of your background, experience, and the structure of your firm.

Start with the basics:

Founding date: When was the firm established?

Legal structure: Is it a partnership, LLC, corporation, or other structure?

Location(s): List the communities your firm serves

Provide some detail about you and your team as well:

Founding partners: Summarize their legal experience, specializations, and any notable accomplishments.

Key Associates & staff: Briefly outline their roles and credentials

If your legal practice is already established, note any milestones you’ve achieved, such as major cases or community recognition. But even if you’re just starting, listing milestones like securing office space or building an initial client base are worth noting here as well.

Your law firm’s financial plan is crucial to determining if you have a strategy for running a viable business over the long term.

Here’s a breakdown of what you need:

Sales forecast : Project revenue based on billable hours, retainer fees, contingency cases (if applicable), and any other income sources. Be realistic, especially in the early stages.

Expense budget : List all of your costs, including:

- Salaries and benefits:

- Rent and office expenses

- Malpractice insurance and bar dues

- Technology (i.e. case management software)

- Marketing and client development

Profit & Loss (P&L) : Your income minus your expenses, showing if you expect to be profitable.

Cash flow statement : Predicts when cash comes in and goes out of your business. Cash flows are crucial to ensure you can cover bills and payroll.

Balance sheet : An overview of your law practice’s financial health, listing assets (cash, accounts receivable), liabilities (loans), and equity.

If you’re seeking outside financing to start your legal practice, list startup costs like office build-outs, initial marketing, and technology investments separately from your expenses, since these are areas you’ll be looking to fund with lender or investor funds.

Additionally, be clear about assumptions you’re making when forecasting your revenue streams (case volume, hourly rates, etc.). Researching similar law firms can help you ensure your projections are reasonable.

- Download your free law firm sample business plan

Download our law firm sample business plan for free right now and use it for reference as you write your own plan. You can even copy and paste sections from the sample plan and customize them for your business. Just make sure you’re taking the time to do your own research.

You can also view other legal business plans , or browse the full Bplans library of over 550 sample business plans across numerous industries.

See why 1.2 million entrepreneurs have written their business plans with LivePlan

Elon is a marketing specialist at Palo Alto Software, working with consultants, accountants, business instructors and others who use LivePlan at scale. He has a bachelor's degree in journalism and an MBA from the University of Oregon.

Table of Contents

Related Articles

9 Min. Read

Free Etsy Business Plan Template [2024 PDF + Sample Plan]

11 Min. Read

How to Write a Business Plan for a SaaS Startup

12 Min. Read

How to Write a Food Truck Business Plan (2024 + Template)

Free Amazon FBA Business Plan PDF [2024 Template + Sample Plan]

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

Tax Season Savings

Get 40% off LivePlan

The #1 rated business plan software

Discover the world’s #1 plan building software

Log in to Lawyerist.com

Not a Subscriber yet? Register here. (It's free!)

Username or Email Address

Remember Me

Forgot your password? Reset it here.

Subscribe to Lawyerist

Back to login.

- Hidden Date MM slash DD slash YYYY

- Name * First Last

- Password * Enter Password Confirm Password

- United States

- Which state is your firm's primary location? * Pick one. Alabama Alaska American Samoa Arizona Arkansas California Colorado Connecticut Delaware District of Columbia Florida Georgia Guam Hawaii Idaho Illinois Indiana Iowa Kansas Kentucky Louisiana Maine Maryland Massachusetts Michigan Minnesota Mississippi Missouri Montana Nebraska Nevada New Hampshire New Jersey New Mexico New York North Carolina North Dakota Northern Mariana Islands Ohio Oklahoma Oregon Pennsylvania Puerto Rico Rhode Island South Carolina South Dakota Tennessee Texas Utah U.S. Virgin Islands Vermont Virginia Washington West Virginia Wisconsin Wyoming Armed Forces Americas Armed Forces Europe Armed Forces Pacific State

- Which province is your firm's primary location? * Pick one. Alberta British Columbia Manitoba New Brunswick Newfoundland and Labrador Northwest Territories Nova Scotia Nunavut Ontario Prince Edward Island Quebec Saskatchewan Yukon Province

- What is the size of your firm? * Pick one. Solo practice Small firm (2–15 lawyers) Medium or large firm (16+ lawyers) I do not work at a law firm

- What is your role at your firm? * Pick one. Owner/partner Lawyer Staff Vendor (web designer, consultant, etc.) I do not work at a law firm

- What is your primary practice area? * Pick one. Bankruptcy Civil litigation (non-PI) Class Action Collections Corporate Criminal Education Employment Estate planning, probate, or elder Family General practice Immigration International Landlord/Tenant Mediation/ADR Personal injury Real estate Small business Sports/Entertainment Tax Trademark/IP Other I do not work in law

- Legal Technology Products and Services

- Building a Healthy Firm

- Email This field is for validation purposes and should be left unchanged.

You have read all five of your free articles this month. To read this article, log in or register.

- Phone This field is for validation purposes and should be left unchanged.

Legal product reviews and business guidance from industry experts.

19 Mar 2020

How to Write Your Law Firm Business Plan

By Cari Twitchell

News Articles Healthy Strategy

Every new law practice needs a business plan . This is a guide to creating one.

Here is what should go in your business plan once you’ve decided about your law firm business model.

Section One: Executive Summary

This section provides a succinct overview of your full plan. It should also include the following:

- Mission statement. This statement should be one or two sentences at most, so you can quickly state it off the top of your head at any given moment. It should clearly state your value and offer inspiration and guidance, while being plausible and specific enough to ensure relevancy. For further direction on how to write a mission statement, read this Entrepreneur article .

- Core values. Your core values outline the strategy that underpins your business. When written well, they help potential employees and clients understand what drives you every day. When written incorrectly, they include meaningless platitudes that become yet another thing forgotten or ignored during practice. To pack the most punch into your core values, write them as actionable statements that you can follow. And keep them to a minimum: two to four should do just fine. You can read more about writing core values at Kinesis .

- What sets you apart. If you are like every other attorney out there, how will you stand out? This is known as your unique selling proposition (USP). What is it that will convince clients to turn to you instead of your competition? By clearly stating your USP, you identify what it is about your firm that will ensure your success.

Are you feeling slightly overwhelmed by all of this? Then write this section last, as you’ll find much of what you write here is a summary of everything you include in subsequent sections.

Section Two: Company Description

Write a succinct overview of your company. Here is what it should cover:

- Mission statement and values. Reiterate your mission statement and core values here.

- Geographic location and areas served. Identify where your offices are located and the geographic areas that you serve.

- Legal structure and ownership. State whether you are an LLC, S-Corp or other legal entity. If you are something other than a sole proprietor, identify the ownership structure of your firm. How does your law firm business model influence the ownership type?

- Firm history. If you are writing or updating a plan for a law firm already in existence, write a brief history that summarizes firm highlights and achievements.

This section is often the shortest. Do not spend much time or space here. Touch on the major points and move on.

Section Three: Market Analysis

Done correctly, a well thought out market analysis will help you identify exactly what your potential clients are looking for and how much you should charge for your services. It also enables you to identify your competitors’ weaknesses, which in turn helps you best frame your services in a way that attracts your preferred clientele. You probably already considered some of these subjects when deciding on the small law firm business model, but you need to document them.

Elements of a market analysis include:

- Industry description. Draft up a summary that encompasses where your particular legal niche is today, where it has been, and which trends will likely affect it in the future. Identify everything from actual market size to project market growth.

- Target audience. Define your target audience by building your ideal client persona. Use demographics such as location, age, family status, occupation and more. Map out the motivations behind their seeking your services and then how it is you are best able to satisfy their requirements.

- Competitive analysis. This is where you dive into details about your competitors. What do they do well? Where do they fall short? How are they currently underserving your target market? What challenges do you face by entering legal practice in your field of choice?

- Projections. Provide specific data on how much your target audience has to spend. Then narrow that down to identify how much you can charge per service.

A proper market analysis includes actual data to support your analysis. If you are unsure of where to find data, Bplans has a great list of resources for you to use. And if you would like to read further about conducting a market analysis, check out this article from the Small Business Administration.

Section Four: Organization & Management

This section goes into detail about you and any others who may have ownership interest in the firm. The small law firm business model section here should incorporated into the management documentation. Do not be afraid to brag a bit!

- What is your educational background?

- What experience do you currently have?

- Why are you the right person to run your firm?

If there are other individuals involved, it is a good idea to insert your organizational chart here. Visuals help quickly convey information and break up otherwise blocky text.

Section Five: Services

The Services section is the heart of your law firm business model plan. It is where you dive into all aspects of your services, including:

- The problem(s) you are addressing. What pain points do your preferred clients experience? What can they do right now to alleviate those pain points? Answer these questions, and then take the extra step to explain how those current solutions fail to adequately address their problems.

- The solution(s) you are providing. This describes how your solutions better resolve your prospective market’s needs. This not only includes the actual work you do, but the benefits that each client will receive based on your work.

- An overview of your competition. Describe your competition here. For instance, which other solo attorneys and firms provide the same solutions as you? What are your advantages over these competitors? What do you differently when providing your solutions? How will clients gain additional benefits by seeking out your services instead of working with your competitors?

Section 6: Marketing Strategy

Your marketing strategy section needs to address the three P’s:

- Positioning. How will you position your law firm and your services? What will you say to present your practice in the best light? What short statements can you use to entice a potential client to pursue your services?

- Pricing. How much will you charge? How does that fit within the legal industry? Within your niche industry? What do clients receive for that price?

- Promotion. Which sales channels and marketing activities will you pursue to promote your practice? Who is in charge of these activities? Even if you plan to build your law firm on the basis of word-of-mouth referrals, you must remember that most referrals will still look for information about you before contacting you. Know where they will look and ensure you are there.

Section Seven: Financials

Last comes the financials section. It is the key component to your plan if you are going to seek funding to get your practice off the ground. It is imperative that you complete this section even if you are not seeking funding, however, as you need to paint a clear financial picture before opening your doors.

Two main items make up this section: budgeting and forecasting (sales and cash flow). Answer these questions to help you address these items:

- How much starting capital do you need?

- How much money will it cost to keep your practice operating on a month-to-month basis?

- How many cases will you need to close each month to break even?

- How many cases would you need to close to make a profit?

- What is your projected profit and loss for the year?

This section often incorporates graphs and other images, including profit-and-loss and cash-flow tables. The more specific you get with your numbers, the more likely you are to succeed!

One final note: If your goal is to submit your business plan to potential funders, you want to do everything you can to make sure your plan stands out. One good way to do this is to work with a designer to artfully format your plan. Great presentation can take you a long way.

Originally published 2017-09-23. Republished 2020-07-31.

Cari Twitchell

About the Author

@CariTwitchell

/in/caritwitchell/

Website: https://www.customcontentllc.com

Share Article

Last updated October 7th, 2022

Learn the Latest from Our Partners and Community

11 Jan 2023

On The Lawyerist Podcast: Top Episodes of 2022

By Kyle Harrington

Lawyerist News News Articles Healthy Clients Healthy Owner Healthy Strategy Healthy Team

Everett Hosts Interactive Strategic Planning Session at Alaska...

Lawyerist News News Articles Healthy Strategy

Lawyerist Media Launches Redesigned Website to Better Help...

By the Lawyerist editorial team

Lawyerist News News Articles Healthy Strategy Law Firm Finances Law Firm Websites Lawyerist News Starting a Law Firm

27 May 2022

Lawyerist Values: Grow as People

Lawyerist News News Articles Healthy Strategy Lawyerist Values

Lawyerist’s Seek Candor Value Is More Than...

Develop a healthy strategy, how to competently reinvent your practice.

By Megan Zavieh

31 Dec 2019

Year-End Law Practice Checklist

19 Dec 2019

How to Use Aged A/R Reports

By Mary Juetten

News Articles Healthy Strategy Law Firm Finances

26 Nov 2019

Small Firm Roadmap Stories: Vision and Values

News Articles Healthy Strategy Lawyerist Lab Roadmap Starting a Law Firm

18 Oct 2019

Design Thinking for Lawyers

By Marshall Lichty

News Articles Healthy Strategy Healthy Systems

19 Aug 2019

Strategic Planning for Law-Firm Success and Growth

25 Oct 2018

How to Promote a Unique Value Proposition to...

By Karin Conroy

News Articles Healthy Strategy Law Firm Clients

23 Jan 2018

Rethinking Law-Firm Productivity Measurement for the Post Billable...

By Jordan Furlong

23 Mar 2017

How to Calculate Client Acquisition Cost

- Product Reviews

The original content within this website is © 2024. Lawyerist, Lawyerist Lab, TBD Law, Small Firm Dashboard, and

The Small Firm Scorecard are trademarks registered by Lawyerist Media, LLC.

Privacy policy // XML sitemap // Page ID: 83157

SNY Business Law

Behind the success of a Law firm

Understanding Employment Law: A Guide for Business Owners