Dormant Account Activation Letter To Bank Manager

A Dormant Account Activation Letter to a Bank Manager is a formal letter written by an account holder to request the reactivation of a bank account that has been inactive for an extended period. A dormant account is an account that has not had any transactions or activity for a specified period, typically six months or more. The bank may classify an account as dormant to protect the account holder’s funds from unauthorized access or fraud.

To reactivate a dormant account, the account holder must write a Dormant Account Activation Letter to the Bank Manager and submit the required supporting documents to the bank. The letter should include key information such as the account number and name, the reason for inactivity, and any extenuating circumstances. The letter should also provide a list of required documents to reactivate the account and instructions on how to submit them. The bank will review the letter and supporting documents and then reactivate the account if all requirements are met.

Reasons for Dormant Account Status

There are several reasons why an account may become dormant, which ultimately leads to a dormant account status. Understanding the causes of dormant account status can help account holders take necessary precautions to prevent their accounts from becoming dormant in the future.

One of the primary reasons for dormant account status is account inactivity. When an account holder does not perform any financial transactions, such as deposits or withdrawals, for a specified period, the account becomes dormant. Financial institutions usually have different time frames for inactivity before an account becomes dormant, but it typically ranges from six months to one year.

Another reason for dormant account status is a change in the account holder’s personal information. If an account holder moves to a new location or changes their contact information, such as a phone number or email address, without informing the bank, they may miss important account-related notifications or communications. This can ultimately lead to an account becoming dormant.

In some cases, account holders may forget about their accounts due to various reasons, such as losing their account details, being away for an extended period, or being incapacitated. When an account holder does not access their account for an extended period, it may become dormant.

Steps to Activate a Dormant Account

Activating a dormant account requires a few essential steps. The following are some of the steps that an account holder can take to reactivate their dormant account:

Contact the bank: The first step to reactivating a dormant account is to contact the bank. The account holder can visit the bank in person, call the bank’s customer service, or send an email to the bank’s customer service. The account holder will need to provide their account information and identity verification details.

Fill out the required forms: The bank will provide the account holder with the necessary forms to reactivate their account. The account holder will need to fill out these forms and provide any necessary documents, such as a government-issued ID or a recent utility bill.

Update personal information: If the account became dormant due to a change in personal information, the account holder will need to update their information to reactivate the account. The account holder should provide their current address, phone number, and email address to ensure that they receive all account-related notifications and communications.

Make a deposit or withdrawal: Once the account holder completes the required forms and provides the necessary documents, they should make a deposit or withdrawal to reactivate the account. The amount required to reactivate the account may vary from one financial institution to another.

Wait for confirmation: After completing the necessary steps, the account holder should wait for confirmation from the bank that their account has been reactivated. This confirmation may come in the form of an email, a letter, or a phone call.

The following template can be used as a guide to writing a request letter to the bank to reactivate a dormant account.

Date : __________

From (Name of the Account holder) (Full Address) (Contact No.)

To, The Branch Manager (Bank Name) (Branch Name) (Address)

Sub .: Request to reactivate my dormant bank account.

Dear Sir/Madam,

I am writing to request the reactivation of my savings account bearing number ____________ maintained at your ____________ branch. I used to operate the account on a regular basis, but due to a financial crisis, I had to withdraw the minimum balance and the account has become dormant.

I wish to reactivate the account and deposit a sum of Rs. ____________ today. I am interested in keeping the account active and using it for my financial needs going forward.

I kindly request you to reactivate my savings account, remove the dormant status and return the account to its normal status so that I can operate it again. Kindly let me know if there are any charges applicable for reactivating my account.

Thank you for your time and assistance.

(Signature) (Name of the Account holder)

Read More: Proof of Child Support Payments Letter Sample

When submitting a Dormant Account Activation Letter to a Bank Manager, the account holder must provide supporting documents to reactivate the account. The required documents may vary depending on the bank’s policies and regulations, but here are some typical documents that may be required:

Supporting Documents

Government-issued identification: The account holder must provide a valid government-issued identification, such as a passport or driver’s license, to prove their identity.

Proof of address: The account holder must provide a document that shows their current address, such as a utility bill or bank statement.

Account statements: The account holder may be required to provide statements for the period during which the account was dormant to verify the account’s ownership and activity.

Signature verification: The bank may require the account holder to sign a document to verify their signature and prevent fraud.

Other supporting documents: Depending on the bank’s policies, the account holder may be required to provide additional supporting documents, such as tax documents or employment verification.

Tips for Writing the Letter

Here are some tips for writing an effective Dormant Account Activation Letter:

- Use formal language and a professional tone.

- Provide all required information, including the account number and name.

- Explain clearly why the account has been dormant and provide any extenuating circumstances.

- Assure the bank of your commitment to future account activity.

- Provide a list of required documents and instructions on how to submit them.

- End the letter with a message of gratitude and provide contact information for further questions or concerns.

Activating a dormant account is an important step to ensure that your finances are secure and accessible when needed. Writing a letter to your bank manager to request activation is a simple and straightforward process that can be accomplished with clear communication and proper documentation. Remember to include all necessary information, such as your account number and personal identification, and follow up with the bank to ensure that the activation process has been completed successfully. With proactive measures like this, you can stay on top of your finances and ensure that your money is available when you need it.

Similar Posts

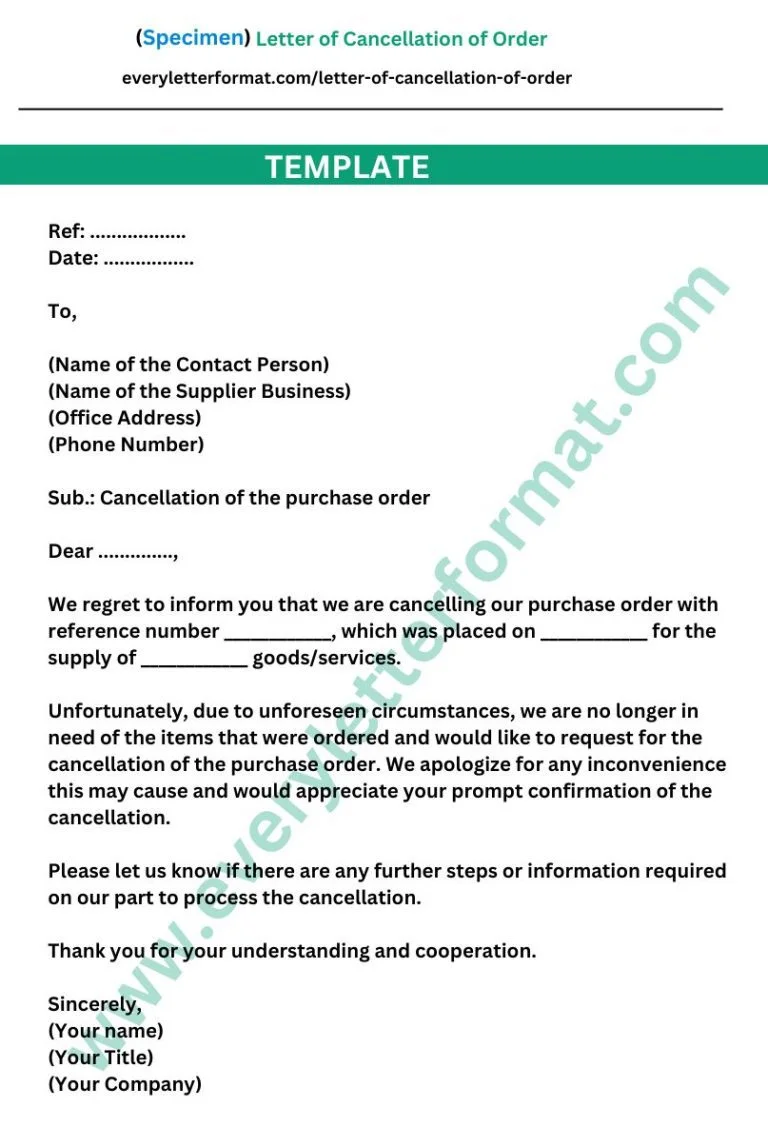

Letter of Cancellation of Order

A letter of cancellation is a formal document used to communicate the decision to cancel an order, contract, subscription, or service. It is a written record of the cancellation process and serves as proof that the cancellation was requested by the customer or client. The letter of cancellation is an important document that protects both…

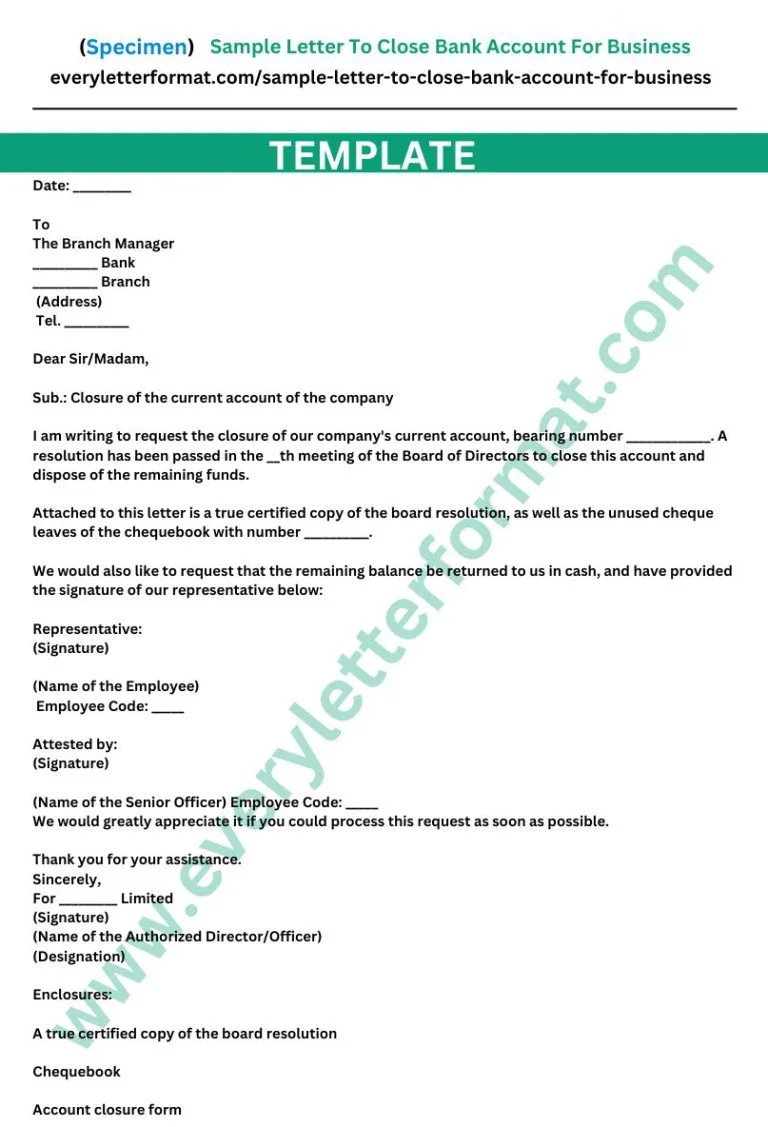

Sample Letter To Close Bank Account For Business

A sample letter to close a business bank account can be a valuable tool for business owners who need to end their relationship with a bank. This letter can provide an explicit and formal request to the bank to close the account and provide any necessary information or documentation. It can also include details about…

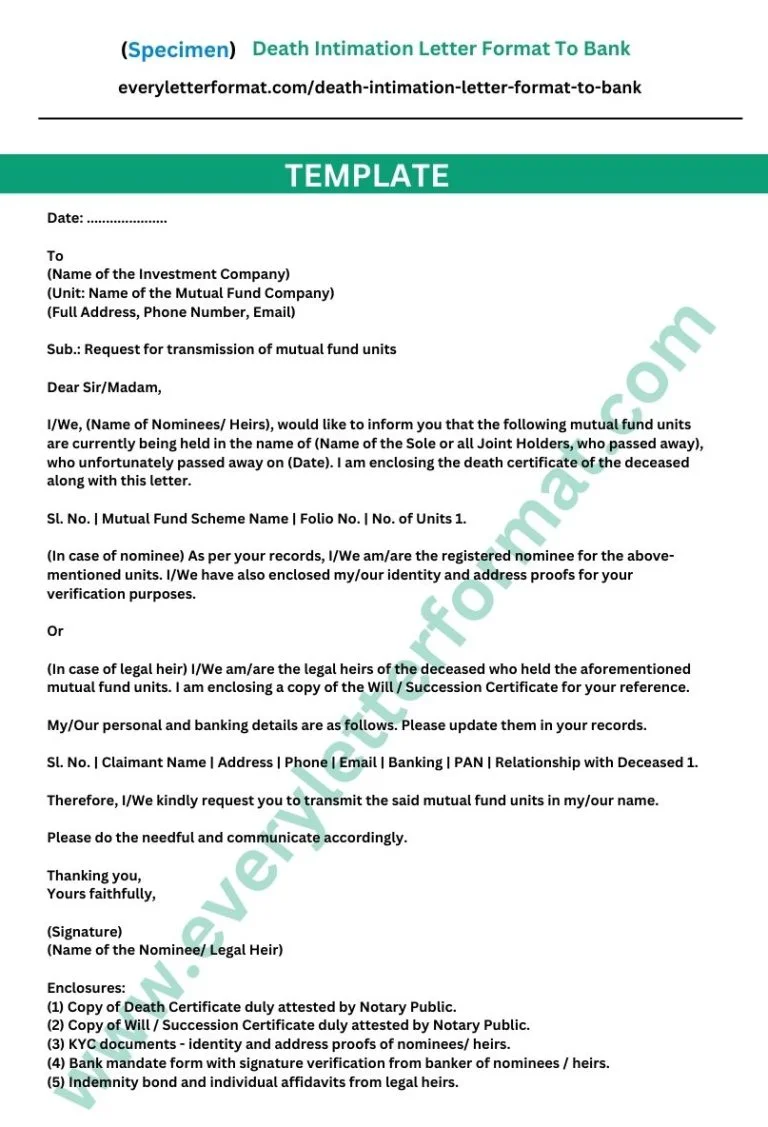

Death Intimation Letter Format To Bank

Losing a loved one is an emotional and challenging experience, and amidst the grief, it’s essential to manage the practical aspects of life, including financial matters. One such crucial task is informing the bank about the unfortunate demise of an account holder. A Death Intimation Letter to the bank is a formal communication that conveys…

Indefinite Leave Letter for Work Due to Sickness

An indefinite leave letter for work because of sickness is a serious request from an employee. They need time off from their job because they’re not well. This kind of letter is used when a person’s sickness needs long-term care. It means they can’t know exactly when they’ll be back at work. In this letter,…

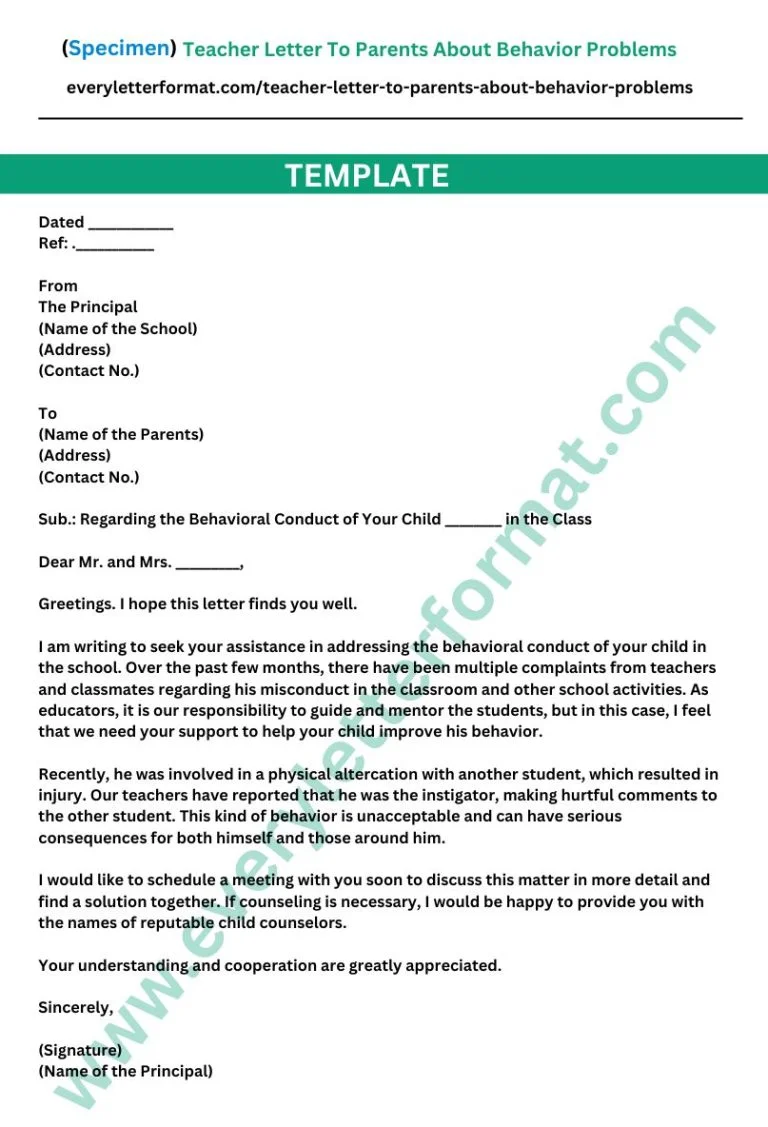

Teacher Letter To Parents About Behavior Problems

A Teacher letter to parents about behavior problems is a written communication from a teacher to the parents of a student who is exhibiting disruptive or concerning behavior in the classroom. The purpose of the letter is to inform the parents of the specific issues and to work together to find a solution. The letter…

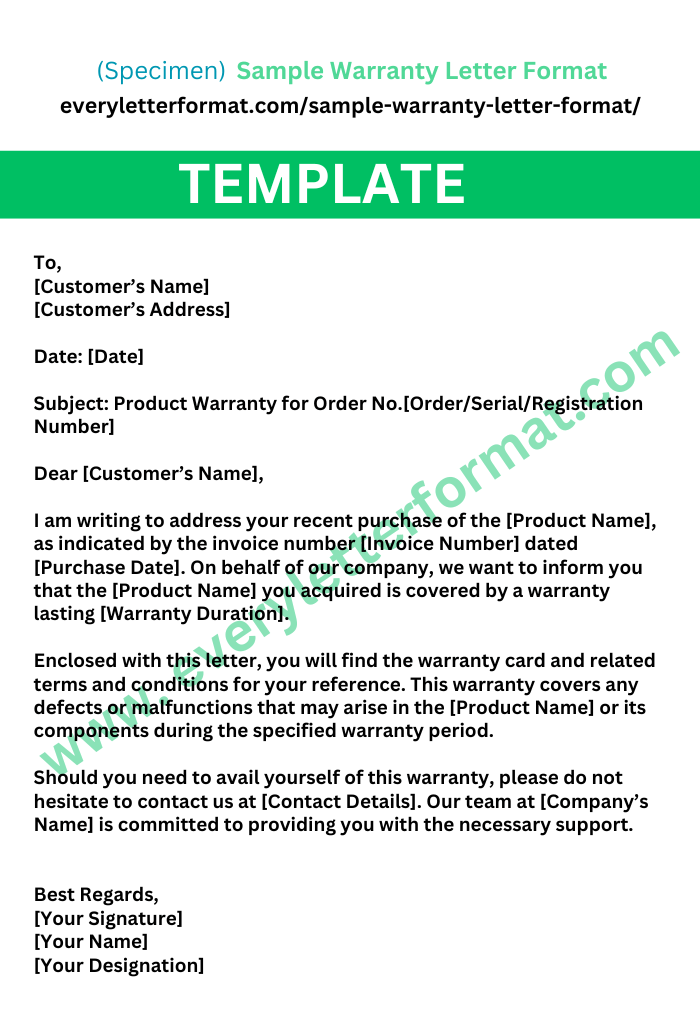

Sample Warranty Letter Format

A warranty letter is like a promise from a company when you buy something. It says, “We stand by our product, and if anything goes wrong, we’ll fix it.” It’s like a safety net for your purchase. Imagine you buy a cool gadget, like a phone. You want to be sure that if it has…

Word & Excel Templates

Printable Word and Excel Templates

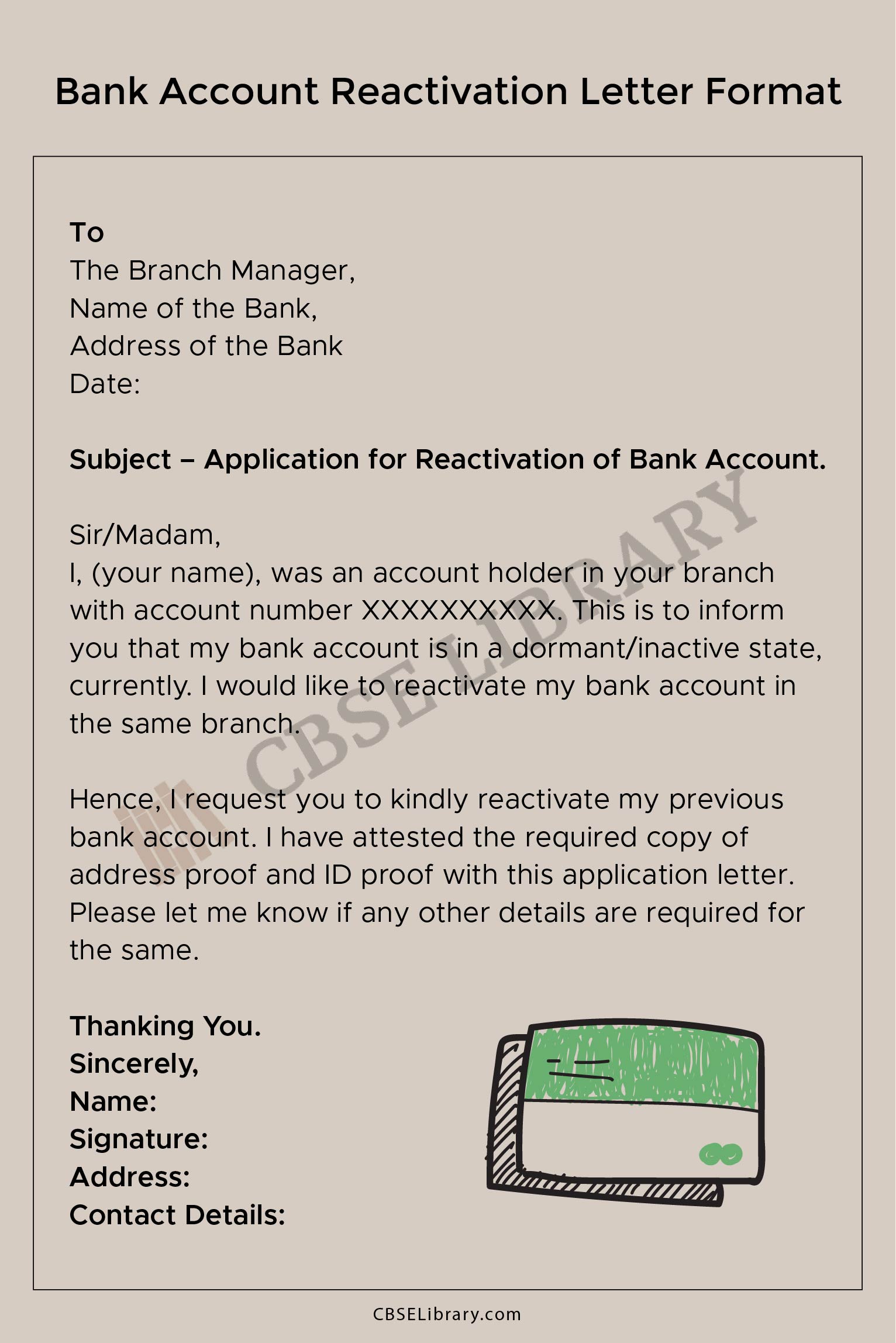

Bank Account Reactivation Letter

A bank account becomes inactive if it has not been used for any transaction for more than one year. This transaction can be in the form of a withdrawal or deposit of money. Some examples of transactions are check payments, internet banking, phone banking, use of ATM cards, fixed deposits, etc. For these transactions to be valid, they have to be initiated by the customer himself. The transactions will not be considered active if they are initiated by the bank. Bank transactions may include automated transactions such as automatic penalty deductions, bank service charges, or automatic interest payments. A transaction would also be considered valid if it was initiated by a third party.

Reasons for Account Deactivation

Before a bank account is deactivated, the bank sends a notice, at least three months prior, to inform the clients.

- An account will be in ‘dormant status’ if it has been inactive for more than 24 months.

- If a person changes his/her address and does not inform the bank, in this case, the letters and notices sent to that person by the bank might be returned, and the bank will place that account under the “pending” status. This step is purely for security and protective reasons.

- Another reason for account deactivation is that sometimes customers forget about their bank account and simply do not use it regularly.

Account Reactivation Procedure

If a person’s bank account has been deactivated, it is quite simple to reactivate it. The bank runs some checks on the client’s account and client identification. There might be some restrictions, but they vary from bank to bank. Generally, the following steps are taken:

- Submit a letter for reactivation: A letter or an application needs to be submitted to the bank authorities, such as the bank manager, to reactivate an account.

- Submit the required documents, such as the ‘Know Your Customer’ documents, which include

- Photographs

- Proof of Identity

- Proof of Address

- Old checkbook

- Deposit in the account. Any small amount of money needs to be made to activate the account.

Sample Bank Account Reactivation Letter

To: The Branch Manager, ABC Bank, D-branch Chicago, Illinois From: Michael Johns

Bank Account Number: 1111-2222-3333-4444

Main Boulevard, House 34, Chicago, Illinois 111-22332333

March 3, 20XX Dear Sir/Madam, I am Michael Johns, and I opened an account at your bank in 20XX. My bank account number is 1111-2222-3333-4444.

You are requested to kindly reactivate my account, 1111-2222-3333-4444. I have not been using this account for the past year, and yesterday I tried to make a transaction, but unfortunately, I was not able to make it. I have attached the required documents and my old checkbook along with this letter. Let me know if you need any further support for the renewal of my ATM cards as well. I would highly appreciate it if you could give me a new user ID for accessing Internet banking. I look forward to your kind assistance on this matter. Regards Michael Johns

CBSE Library

Bank Account Reactivation Letter | How to Write a Letter to a Bank for Reactivation of Account? Format and Samples

Bank Account Reactivation Letter: Bank runs frequently changing and the account holder may not have a clue about the most recent update at some point. Your saving or current record would have been suspended by the bank because of no exchange for quite a while (or over a half year). In this article, you will know how to compose a letter to the bank to reactivate your record to keep on executing with the bank. Here observe the example design.

We may at some point get the SMS or email or letter or an alternate warning from the Bank that our financial record has been suspended due to defective for a long term. The Bank sends it because of different reasons and one of them is that they might want to know the status from you on the bank exchange and updates or to close the record forever on the off chance that assuming there is no reaction from the worry for a long time. We overlook the message from the Bank because of an alternate responsibility or no opportunity to circle back to them. At the point when we want a similar Bank to represent the exchange, we come to realize that our record is suspended/lethargic impermanent because of no exchange for a long span. Thus, incapable to store or pull out and so forth.

Get Other Types of Letter Writing like Formal, Informal and Different Types of Letter Writing Samples.

Now, how to reactivate the Bank account? The main techniques are, moving toward the bank, filling the Bank structure with expected reports to reactivate it or composing a letter to save money with their structure and expected certification to reactivate the record for future exchange.

How to Write Bank Account Reactivation Letter?

We can reactivate an inactive bank account by writing a formal letter to the branch manager or bank manager. The reactivation of the bank account will differ from one bank to another. You can just go to your bank branch and request the application form for the reactivation of your bank account.

While writing the application letter to reactivate your bank account make sure to mention all the required details. Banks will strictly check all the provided details before reactivating the account. The procedure of closing the bank account will also be the same.

For the reactivation of bank account the account holder need to be physically present in the bank along with required documents such as Aadhar card, PAN card, and previous bank passbook. We have provided a format of bank account reactivation letter for you which can be used as an application letter. You just need to fill the required details in it.

Bank Account Reactivation Letter Format

Bank account reactivation letter sample, application letter to reactivate bank account.

- FAQ’s on Bank Account Reactivation Letter

Present a letter for Reactivation: A letter or an application should be submitted to the bank specialists like the bank administrator, to reactivate a record.

- Present the necessary archives, for example, the ‘Know Your Customer’ records, which incorporate

- Evidence of Identity

- Evidence of Address

- Old checkbook

- Set aside some installment in the record: Any limited quantity of cash store should be made, to enact the record.

FAQs on Bank Account Reactivation Letter

Question 1. How to reactivate a bank account?

Answer: You can reactivate your dormant bank account by basically visiting your home branch and giving a composed solicitation to reactivate your account. Then, at that point, in a couple of days, your record will be reactivated.

Question 2. What is the format to write a bank account reactivation letter?

Answer: First and foremost you need to ask them the justification for your account deactivation and afterwards compose a resume application in light of your explanation. You need to give your financial balance subtleties first in the application. Then, at that point, indicate the justification behind shutting your financial balance, and afterwards deferentially demand your bank director to resume your account.

Question 3. Is it possible to reopen a bank account?

Leave a Comment Cancel reply

Search This Blog

Search letters formats here, application letter to bank for mobile banking activation sample.

submit your comments here

Thank you sirs and madams for helping us old people to write these application letters easily.

Thanks ! It helped me a lot .

Thanks it help me a lot

Thanks this really helped me

Post a Comment

Leave your comments and queries here. We will try to get back to you.

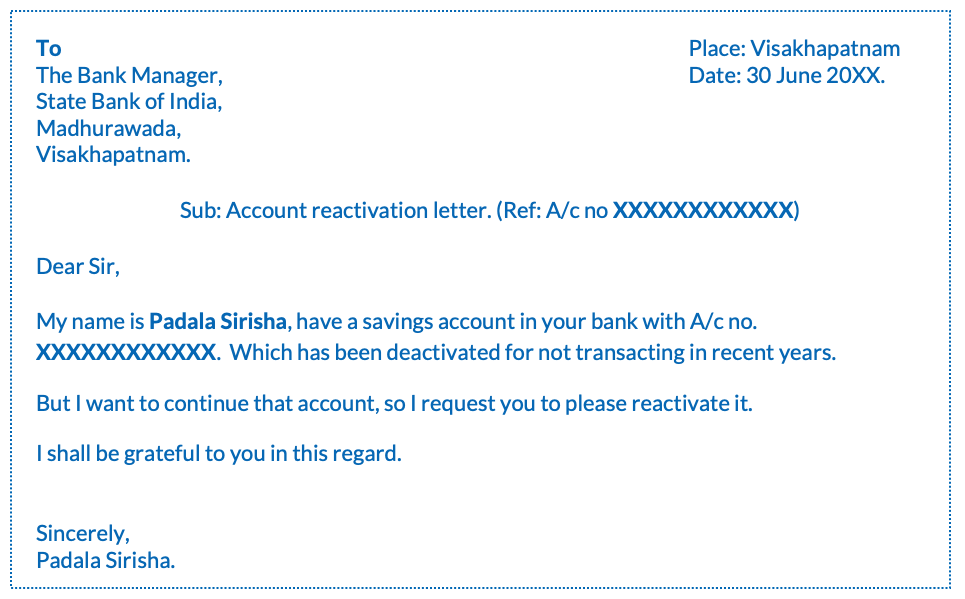

SBI Inoperative Account Activation Letter

If you don’t use your SBI bank account for a long time then your account will become inactive. To reactivate your dormant account, write a request letter to the bank manager and submit it along with your KYC like Aadhar and PAN copies.

Not only for SBI, but even for other banks like HDFC Bank, ICICI, Kotak, Canara, Punjab National Bank, Bank of Baroda, etc. for all those banks the process is almost the same.

Here you can find sample dormant account activation letters in Word format.

SBI Inoperative Account Activation Letter

To The Bank Manager, State Bank of India, Madhurawada, Visakhapatnam.

Sub: Account reactivation letter. (Ref: A/c no XXXXXXXXXXX )

My name is Padala Sirisha , have a savings account in your bank with A/c no. XXXXXXXXXXX. Which has been deactivated for not transacting in recent years.

But I want to continue that account, so I request you to please reactivate it.

I shall be grateful to you in this regard.

Regards, Padala Sirisha.

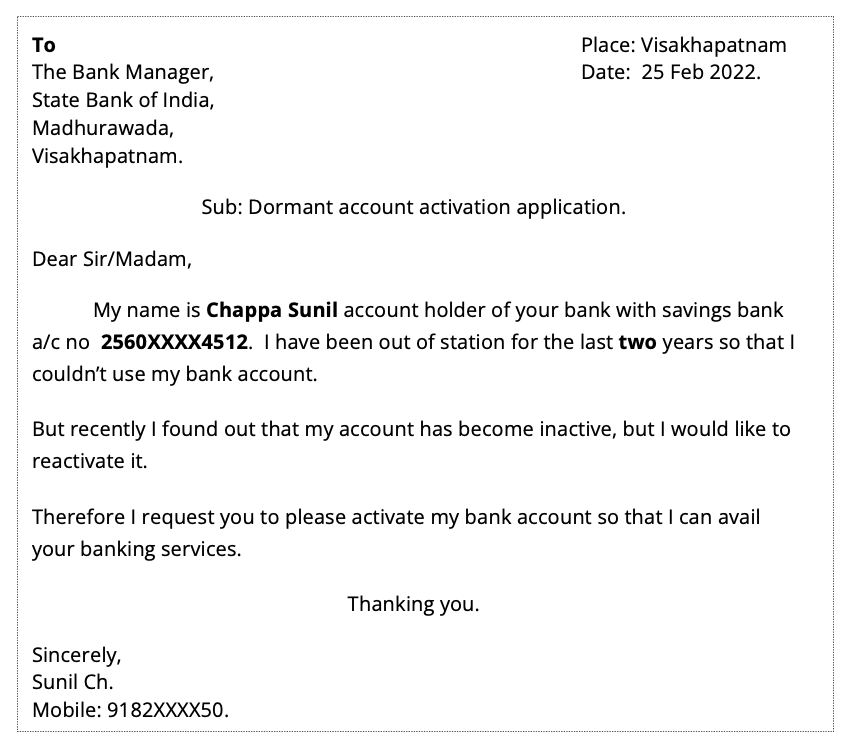

To The Bank Manager, State Bank of India, Address.

Sub: Dormant account activation application.

Dear Sir/Madam,

My name is [your name] account holder of your bank with savings bank a/c no [XXXXXXXXX] . I have been out of station for the last __ years so that I couldn’t use my bank account.

But recently I found out that my account has become inactive, but I would like to reactivate it.

Therefore I request you to please activate my bank account so that I can avail your banking services.

Thanking you.

Sincerely, Your name.

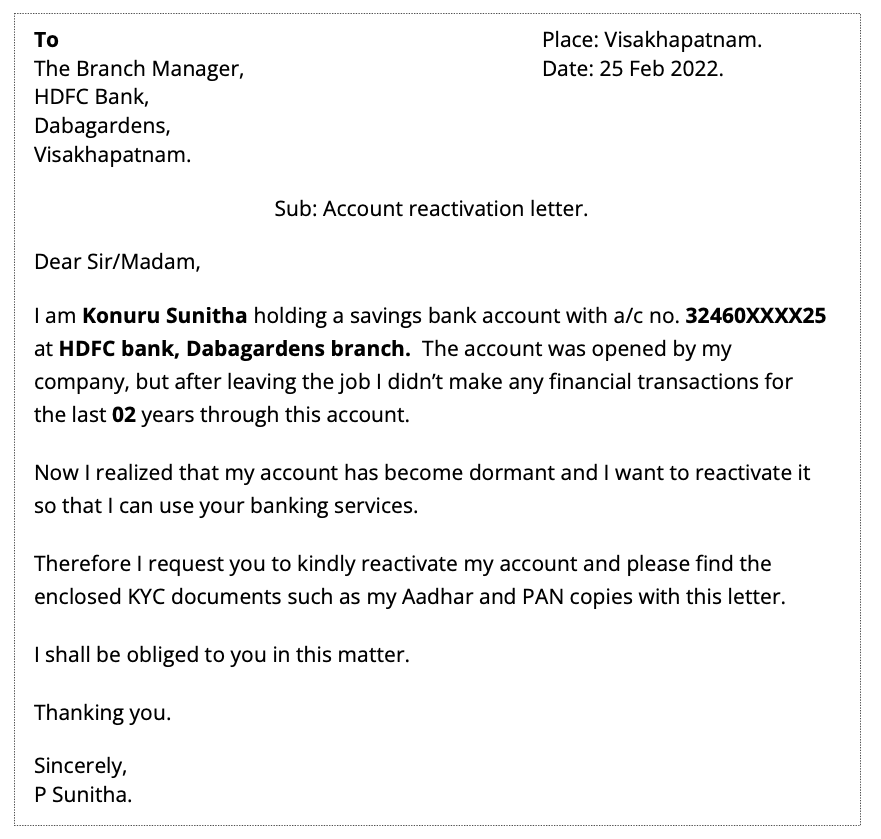

Dormant Account Activation Letter to Bank

To The Branch Manager, Bank name, Address.

Sub: Account reactivation letter.

I am [your name], holding a savings bank account with a/c no. [XXXXXXXXX] at [bank name] . The account was opened by my company, but after leaving the job I didn’t make any financial transactions for the last __ years through this account.

Now I realized that my account has become dormant and I want to reactivate it so that I can use your banking services.

Therefore I request you to kindly reactivate my account and please find the enclosed KYC documents such as my Aadhar and PAN copies with this letter.

I shall be obliged to you in this matter.

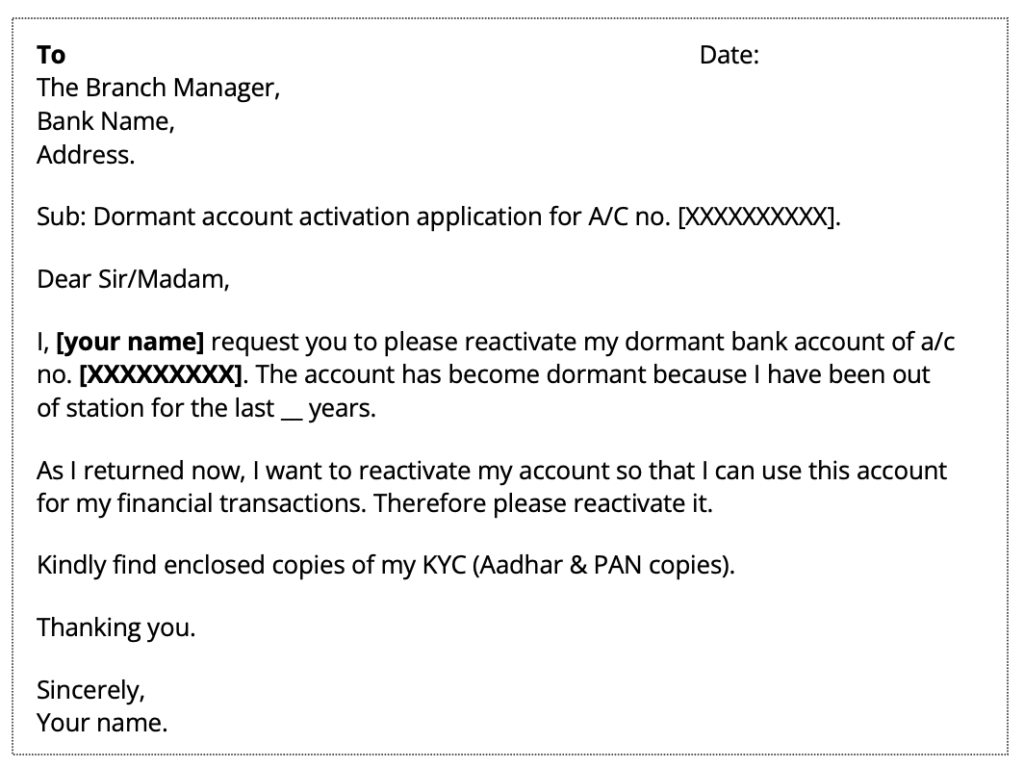

Dormant Account Activation Application Format

To The Branch Manager, Bank Name, Address.

Sub: Dormant account activation application for A/C no. [XXXXXXXXXX].

I, [your name] request you to please reactivate my dormant bank account of a/c no. [XXXXXXXXX] . The account has become dormant because I have been out of station for the last __ years.

As I returned now, I want to reactivate my account so that I can use this account for my financial transactions. Therefore please reactivate it.

Kindly find enclosed copies of my KYC (Aadhar & PAN copies).

After how many years the bank accounts will become dormant/inoperative?

In 2 years, most banks will make your account dormant if you don’t use it for any financial transactions and also if the minimum balance is not maintained.

How much time will it take to reactivate my dormant bank account?

If you submit a written request letter to the bank, then within 1-2 days your account will become active.

Can I activate my dormant account online?

No, you cannot do it online, you have to visit your bank’s branch directly.

Can banks charge to activate dormant accounts?

No, there is no need to pay any charges to activate a dormant bank account.

- Authorization letter to claim money from the bank.

- Home loan foreclosure letter formats in Word.

1 thought on “SBI Inoperative Account Activation Letter”

My account inactive ho gya is active kar

Leave a Comment Cancel reply

- Learn English

- Universities

- Practice Tests

- Study Abroad

- Knowledge Centre

- Ask Experts

- Study Abroad Consultants

- Post Content

- General Topics

- Articles/Knowledge Sharing

- Sample Letters and Letter Formats

How to write a letter to Bank to reactivate the bank account

Bank rules often changing and account holder may not know the latest update sometime. Your saving or current account would have suspended by then bank due to no transaction for some time (or above six months). In this article, you will know how to write a letter to bank to reactivate your account to continue to transact with the bank. Here find the sample format.

Related Articles

How to create a bank account, procedure for change in bank account signatory of a company, how to open sbi savings bank account, format of letter to close bank account - sample letter, sample letter format for changing contact number of bank account, how to register dbtl scheme and link aadhar and bank account number to get subsidy on lpg cylinder, details of pahal scheme direct benefit transfer for lpg gas subsidy into bank accounts, additional advantages of a savings bank account, sample letter to close a bank account, sample letter to close bank account.

More articles: Bank Account

- Do not include your name, "with regards" etc in the comment. Write detailed comment, relevant to the topic.

- No HTML formatting and links to other web sites are allowed.

- This is a strictly moderated site. Absolutely no spam allowed.

Top Contributors

- Partha K. (6)

- DrIqbalkhan M.D... (5)

- Umesh (288)

- DR.N.V. Sriniva... (184)

- Neeru Bhatt (167)

About IndiaStudyChannel.com

Being the most popular educational website in India, we believe in providing quality content to our readers. If you have any questions or concerns regarding any content published here, feel free to contact us using the Contact link below.

- Admissions Consulting

- Adsense Revenue

- Become an Editor

- Membership Levels

- Winners & Awards

- Guest Posting

- Help Topics

STUDY ABROAD

- Study in Foreign Universities

- Study in Germany

- Study in Italy

- Study in Ireland

- Study in France

- Study in Australia

- Study in New Zealand

- Indian Universities

- Nursing in Mangalapuram

- BDS in Mangalore

- MBA in Bangalore

- Nursing admissions in Mangalore

- Distance MBA

- B Pharm in Mangalore

- MBBS in Mangalore

- BBA in Mangalore

- MBA Digital Marketing

- Privacy Policy

- Terms of Use

Promoted by: SpiderWorks Technologies, Kochi - India. ©

Affidavitformhub.com

Affidavit format, notary forms, legal forms, affidavit forms, sample affidavit.

Home » Bank » General Documents » Application for Reactivation of Inactive Bank Account

Application for Reactivation of Inactive Bank Account

The _________ Manager, _________ Bank, __________________

Subject: Application of Savings/Current Account No. _________.

I have to state that I am maintaining Savings/Current Account No. _________ in your Branch that due to _________, I could not operate the account.

You are therefore, requested to activate the account from Inactive to Active.

Thanking You,

Name: _________ Address: _________ Contact No.: _________

Incoming Search Terms:

- Inactive Account Activation Letter

- Inactive Account Activation Letter To Bank

- Inactive Account Activation Application

- Application For Inactive Account

- Request For Activation of Inactive Account

Post navigation

Application for New ATM Card Activation (with Samples & PDFs)

I have listed sample templates to help you craft an effective and professional application for new atm card activation.

Also, I would like to point out that you can also download a PDF containing all the samples at the end of this post.

Application for Activation of Newly Issued ATM Card

First, find the sample template for application for new atm card activation below.

To, The Branch Manager, [Bank Name], [Branch Address],

Subject: Application for New ATM Card Activation

Dear Sir/Madam,

I, [Your Full Name], am a customer of your bank, holding Savings Account number [Your Account Number] at your esteemed branch. I recently received a new ATM card from the bank and I am writing this letter to request the activation of the same.

As per the instructions received, I understand that the card needs to be activated before I can use it. Therefore, I kindly request you to activate my new ATM card at the earliest. The last four digits of my new ATM card are [Last 4 digits of your ATM Card].

I assure you that all the necessary details related to the card have been carefully checked and verified by me. I understand the importance of safeguarding my Personal Identification Number (PIN) and other confidential details and assure you that I will adhere to the bank’s guidelines regarding ATM card usage.

I kindly request you to process this application as soon as possible. If there are any additional procedures to be followed or forms to be completed, please let me know. You can reach me at my registered mobile number or email address for any further information or clarification.

Thank you for your attention to this matter and I look forward to your prompt response.

Yours faithfully, [Your Full Name] [Your Contact Number] [Your Email Address] [Current Date]

Below I have listed 5 different sample applications for “application for new atm card activation” that you will certainly find useful for specific scenarios:

Application for New ATM Card Activation due to Loss of Original Card

To, The Branch Manager, [Bank Name], [Bank Branch Address], [City, State, PIN]

Subject: Request for Activation of New ATM Card Due to Loss of Original

I am writing this letter to inform you that I have lost my ATM card and would like to request a new one. I am an account holder in your bank with the account number: [Account Number]. The ATM card linked to this account has unfortunately been misplaced, and despite my best efforts, I have been unable to locate it.

I understand the risks associated with a lost ATM card and to prevent any unauthorized access or fraudulent activity, I have already reported the loss to your customer service and requested them to block my ATM card immediately.

I kindly request you to issue a new ATM card for my account at the earliest. I understand that there will be charges for issuing a new card, and I authorize you to deduct those charges from my account.

Please let me know if there are any forms or documents I need to submit to proceed with this request. I am ready to visit the branch and complete any formalities, if required.

I would be very grateful if you could expedite this process as I depend on the ATM card for my day-to-day transactions.

Thank you for your prompt attention to this matter.

Yours sincerely,

[Your Name] [Your Address] [City, State, PIN] [Contact Number] [Email Address] [Date]

Application for New ATM Card Activation following Expiry of Previous Card

To, The Branch Manager, [Bank Name], [Bank Branch Address],

Subject: Request for Activation of New ATM Card

Respected Sir/Madam,

I, [Your Full Name], am a valued customer of your bank holding a savings account with the number [Your Account Number]. I have been associated with [Bank Name] for a considerable period now and have always admired the services provided by your esteemed institution.

Recently, I received a new ATM card from your bank as my previous card had expired. I request your kind assistance in activating this new ATM card. The last four digits of my new ATM card are [Last Four Digits of Your New ATM Card].

I understand that for security reasons, the bank does not send active ATM cards to their customers. Hence, I am writing this letter to formally request the activation of my new ATM card.

I assure you that all the necessary steps will be taken from my end to ensure the safe and proper usage of this ATM card. I also understand that any misuse of the card will be my sole responsibility.

I kindly request you to expedite this process as I regularly use my ATM card for various transactions.

Thank you for considering my request. I am looking forward to your prompt response.

[Your Full Name] [Your Contact Number] [Your Email ID] [Your Residential Address]

Date: [Date of Application] Place: [Your City]

Application for Activating New ATM Card after Damage to Old Card

Subject: Application for Activating New ATM Card due to Damage to Old Card

I, [Your Name], am a customer of your bank, holding a savings account with the account number [account number]. I am writing this letter to inform you that my ATM card linked to the said account has been damaged and is not functioning properly.

I tried to use my ATM card recently at various ATMs, but each time, it was unable to process the transaction. I believe the magnetic strip of the card has been damaged, rendering it unusable. I have not shared my ATM card or PIN with anyone and always ensured its safekeeping. The damage seems to be due to regular wear and tear.

Therefore, I humbly request you to kindly deactivate my current ATM card to secure my account and issue me a new one at the earliest convenience. I understand that there could be a nominal fee for the new ATM card, and I am willing to bear the same.

I would highly appreciate your prompt attention to this matter. If there are any formalities or documents required, kindly let me know, and I will provide them promptly.

Thank you for your understanding and cooperation.

[Your Full Name] [Your Address] [Your Contact Number] [Your Email Address] [Today’s Date]

Application for New ATM Card Activation after Switching Banks

I, [Your Full Name], am writing this letter to bring to your attention that I have recently switched my account from [Previous Bank Name] to [Current Bank Name]. I have received my ATM card issued by your bank, but it is currently not activated and I am unable to use it.

Therefore, I kindly request you to activate my ATM card at the earliest. My account details are as follows:

Account Holder’s Name: [Your Full Name] Account Number: [Your Account Number] ATM Card Number: [Your ATM Card Number]

Please let me know if there are any formalities or procedures that I need to complete from my end to facilitate this process. I am eager to start using the ATM card for my daily transactions as soon as possible.

I thank you in advance for your prompt attention to this matter. Your assistance in this regard would be highly appreciated.

Yours sincerely, [Your Full Name] [Contact Details]

Date: [Date] Place: [Place]

Application for Activation of New ATM Card for a Joint Account Holder

To, The Branch Manager, [Bank Name], [Branch Address], [City], [State], [PIN Code]

Subject: Application for Activation of New ATM Card for Joint Account Holder

I, [Your Full Name], have recently received a new ATM card in association with my joint account (Account Number: [Account Number]) held at your esteemed bank. I am writing this letter to kindly request the activation of this new ATM card at the earliest convenience.

As a joint account holder with [Other Account Holder’s Full Name], I am aware that both parties must provide consent for this activation. Please find enclosed with this letter, a written consent from [Other Account Holder’s Full Name] as well.

It is important for me to have this ATM card activated promptly as it is essential for my daily financial transactions. I assure that all the details provided by me are true to the best of my knowledge and I will comply with all the terms and conditions provided by the bank regarding the use of the ATM card.

I kindly request you to process this application as soon as possible. Please let me know if any further information or action is required from my end.

Thank you for your attention to this matter.

Enclosure: Consent letter from [Other Account Holder’s Full Name]

How to Write Application for New ATM Card Activation

Some writing tips to help you craft a better application:

- Start with your name, account number, and address.

- Include the current date.

- Mention the subject line, like ‘Request for New ATM Card Activation’.

- State that you have received a new ATM card and want to activate it.

- Provide the card number and the date you received it.

- Request the bank to activate the card at the earliest.

- Express your willingness to provide any additional information they may need.

- End with a thank you note.

- Sign off with your name and contact details.

Related Topics:

- Application to Reactivate Blocked ATM Card

- Application for Accreditation

- Application for Staff Quarters Accommodation

View all topics →

I am sure you will get some insights from here on how to write “application for new atm card activation”. And to help further, you can also download all the above application samples as PDFs by clicking here .

And if you have any related queries, kindly feel free to let me know in the comments below.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Leave Application

Leave Application for School, College and Office

Application for Bank Account Reopen

Post by Mita Maji

Hey, are you looking for an application for bank account Reopen samples? if your answer is YES, then you are in the right place. Here you will get 15+ best bank account reactivation letter samples & PDF.

Currently, we all have at least two or three bank accounts in our name. However, due to the fact that we have multiple accounts, it becomes a little difficult to manage them. So, sometimes the bank closes these accounts for not managing them properly.

That’s why we need to write a bank account reopen or reactivate letter to the bank.

How to Reactivate/Reopen an Inactive Bank Account?

If you want to reactivate your inactive bank account, the reactivation process is different for each bank. But a common procedure of all banks is that for this you have to write a bank account reopen application.

Simply visit your home branch and provide a written request application for bank account reopen/reactivation. Banks are very strict when it comes to verifying customer credentials before the reactivation of accounts.

The account holder needs to physically present themselves with valid address proof and valid identity proof (E.G. Aadhaar card, Voter ID, PAN card ). Usually, banks reactivate your account within 5 days to 10 days.

Here you will get 15+ bank account reactivation letter samples given below, but you ensure that you replace your correct/real details, Like- name, date, account no, contact details, address, etc.

Simple Application For Bank Account Reopen

To The Branch Manager, [Bank Name], [Branch Address], [Date]

Subject- Application for Reopen Bank Account.

Requested Sir/Madam,

My name is _____ [Your Name], & I want to inform you that my account number ________ [Mention Your A/C Number] in your branch is in a dormant/inactive state. Kindly do the needful in reactivation of the same.

I hope my application would be considered for its approval.

Thanking You.

Yours Truly, [Name], [Your Address], [Contact Details].

Read Also: Application For Transfer Bank Account

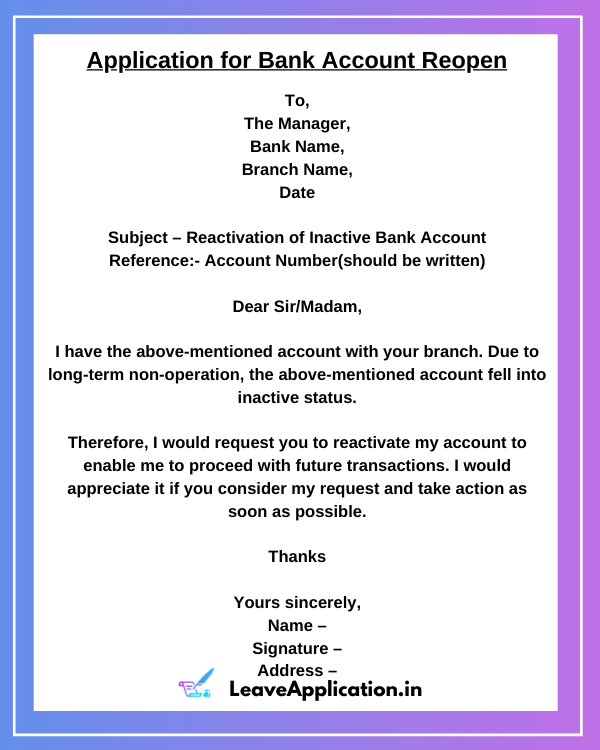

Bank Account Reactivation Letter Sample

To, The Bank/Branch Manager, [Bank Name], [Branch Name], [Date]

Subject – Reactivation of Inactive Bank Account. Reference:- ________(Account Number)

Dear Sir/Madam,

I have the above-mentioned account with your branch. Due to long-term non-operation, the above-mentioned account fell into inactive status.

Therefore, I would request you to reactivate my account to enable me to proceed with future transactions. I would appreciate it if you consider my request and take action on it as soon as possible.

Yours Sincerely, [Your Signature], [Your Address], [Mobile No & Email ID].

Bank Account Reopen Letter In English

To, The Bank Manager, [Bank Name], [Branch Address], [City with Pincode], [Date]

Subject- Request for Application of Saving Bank Account Ref: A/c Holder-________ . A/c No-__________ .

With due respect, I am informing you that my above-referred saving bank account has been deactivated because of the discontinuance of transactions for a period of 7/8 months. Now, I want to continue transactions in the above-mentioned savings bank account with your esteemed bank.

Therefore, I would request you to activate the said account with immediate effect. I am providing you with the necessary documents along with this letter, also if you need any more documents you can let me know at the number given below.

Your kind co-operation in the matter will be highly appreciated.

Yours Faithfully, [Your Name], [Your Address], [Contact Details].

Read ALso: Application For Mobile Number Change In Bank Account

Application For Reactivate Bank Account

To The Bank Manager [Name of Bank], [Bank Address], [Date].

Subject- Reopen/Reactivation of Inactive Bank Account Reference- _______ (Account Number)

This is to inform you that my account number ______ ( mention your bank account number) in your branch is in an inactive state. Due to long-term non-operation, the above-mentioned account fell into inactive status.

Therefore, I would request you to reopen my account to enable me to proceed with feature transactions. I hope my application would be considered for this approval.

Thanking you,

Yours Sincerely, [Your Name], [Your Address], [Mobile No].

Read Also: Address Change Letter To Bank

Reopen Bank Account Application

To The Chief/Senior/Branch Manager, [Bank Name],, [Branch Name], [Location], [Date].

Subject- Bank Account Reactivation Letter

With due respect, it is stated that I ______ [Your Name] maintaining a current account in your branch. My account number is _________ [A/c Number]. I haven’t used it for a long time. Due to that, it has become inactive. Now I need to activate my account to use on regular basis.

Therefore, kindly activate my account as soon as possible & do the needful. Your cooperation in this regard will be highly appreciated.

Yours Truly, [Your Name], [Phone Number], [Email Address].

Application For Reopen Bank Account in English

From, [Account Holder Name], [Account Number], [Type of Account] (Current/Saving), [Address],

To, [The Bank Manager], [Name of the Bank], [Address of the Bank], [Date].

Subject – Reopen Bank Account Application

I am having a savings bank account with your branch and currently, it is marked as inactive. Since I was not in the country for the last two years. I could not be able to perform any transaction.

I humbly request you to re-active my account as soon as possible.

Thank you in advance.

Yours Truly, [Your Name], [Account Number], [Contact Details], [Address]

Bank Account Reopen Application

To The Bank Manager [Bank Name], [Branch Address], [Date]

Subject- Bank Account Reopen Latter.

Account Details- A/c Holder- A/c Number- Branch-

With due respect, I would like to inform you that, I am an account holder of the above-mentioned details. I have a savings account in your bank for the last 4 years.

Sir/Madam my account has been inactivated due to my lack of timely transactions for a long time. For this now I am facing a lot of problems in banking transactions.

I, therefore, request you to kindly re-activate my account, so that I get again the past opportunity. I am hopeful for your sympathetic consideration.

Yours Faithfully, [Name], [Signature], [Address].

Read Also: Leave Request Mail To Manager For Vacation

Application To Bank Manager For Reopen Account

To The Bank Manager, [Bank Name], [Branch Name], [Branch Address],

Date – day/month/year.

Subject: Request for Reopen Bank Account.

This is ______ [Your name]. I am a bank account holder in your branch. My bank account number ______ [Your Bank Account Number], which has present status as inactive, as there has not been any transaction from the last few years.

Now I want to activate my account may please reopen it so that I can perform bank transactions again. Your cooperation is highly appreciated.

Thanking you in anticipation.

Best Regards, [Your Signature], [Account Details], [Contact Details].

Application For Reopen Bank Account In SBI

To, The Branch Manager, [Bank Name], [Branch Name], [Branch Address],

Date:__/__/__

Subject- Prayer for Reactivation of Inactive Bank Account.

Respected Sir/Mam,

This is _____ [Your Name] holding an account in your branch with account number ______ [A/c Number] and currently stands under the status of dormancy due to the long-term non-operation of the above-mentioned account.

Therefore, I request you to reactivate my account as early as possible. Therefore, I earnestly pray that your honor would be gracious enough to consider my prayer sympathetically. For which act of your kindness, I shall be ever grateful to you.

Yours Truly, [Your Name], [Signature], [Contact Details]

Bank Account Reactivation Letter Sample PDF

[ Download Image Format ]

[ Download PDF Format ]

What is Inactive/Dormant Bank Account?

If your saving or current account hasn’t witnessed any transactions (credit/debit except interest credited to the bank, deduction of service charges) for more than 1 year, the account is rendered inactive. On exceeding 2 years, the account is declared dormant /inoperative.

Best Tips to Keep Bank Account Active

Any customer-induced transaction is enough for this purpose. Like credit or debit transactions done by the account holder in this account, keeps it active. Some of them have been listed below –

- Deposit of cash.

- Transactions through cheque.

- Cash withdrawal.

- Deposit through ATM.

- Deposit through cheque.

- Internet banking transactions.

- Online Transactions.

- Online Purchase through ATM.

FAQs On Application For Bank Account Reopen

1) How can I reactivate my bank account? You can reactivate your inactive bank account by simply visiting your home branch and providing a written request for reactivation of your account. Then in a few days, your account will be reactivated.

2) How do I write an application to reactivate my bank account? Firstly you have to ask them the reason for your account deactivation and then write reopen application based on your reason. You have to give your bank account details first in the application. Then specify the reason for closing your bank account, and then respectfully request your bank manager to reopen your bank account.

3) Can a closed savings account be reopened? Yes, it is possible and it can be re-opened very easily. Using the reopen bank account application samples given above, you can re-launch it by writing an application letter to your bank.

4) Can I withdraw money from a frozen account? No, you can’t withdraw money from your frozen account. Not just withdraw money, you will not be able to make any purchases or transfer money through this frozen account. But, if you want you can deposit money in this account.

5) How long does it take to close a bank account? It totally depends on your bank. Such banks as ICICI, SBI, Kotak 811, HDFC can open the account much sooner. But usually, it takes five to ten business days.

Read More Banking Related Request Letter –

- Application For Character Certificate

- Bank Account Close Application In Hindi

- Application For Remission Of Fine

Sample letter to reactivate dormant bank account

Application for inoperative account activation letter to bank, 1. bank account activation letter.

The Branch Manager Dated : 10/03/2019 Bank of India, North Lakhimpur Lakhimpur

Subject: Letter to bank manager to activate account

Dear Sir/Madam

I am writing to request the activation of my inoperative account with your bank. My account number is [Account Number], and it has been inactive for a certain period of time.

I understand that my account may have been marked as inactive due to a lack of transactions or account activity. However, I would like to request that my account be reactivated as I would like to resume using it.

Please let me know what steps I need to take to reactivate my account, and if any additional documentation is required. I would appreciate it if you could provide me with the necessary information as soon as possible.

Thank you for your attention to this matter.

Sincerely, [Your Name]

2 . Reactivate bank account letter

The Branch Manager Bank of India, North Lakhimpur Lakhimpur

Dear [Bank Name],

I am writing to request the reactivation of my account [Account Number] with your bank. I believe my account has been marked as inactive due to a lack of transactions or account activity.

I apologize for the lack of activity in my account, as it was due to unforeseen circumstances. However, I would like to resume using my account, and I request you to reactivate it as soon as possible.

I have attached all the necessary documents and identification for your review. If there are any other steps or requirements that need to be completed to reactivate my account, please let me know, and I will fulfill them promptly.

I appreciate your assistance with this matter and thank you for your time.

3. Application for reactivate bank account

The Branch Manager State Bank of India, North Lakhimpur Lakhimpur

Subject: Application for reactivate bank account

Dear Sir/Madam,

I am writing to request the activation of my inoperative account with your bank. My account number is [Account Number], and it has been inactive for a certain period of time. However, I would like to request that my account be reactivated as I would like to resume using it.

Leave a Comment Cancel Reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Home » Letters » Bank Letters » Letter to Branch Manager for Internet Banking Facility Activation – Sample Letter to Bank Requesting Activation of Internet Banking Facility

Letter to Branch Manager for Internet Banking Facility Activation – Sample Letter to Bank Requesting Activation of Internet Banking Facility

To, The Branch Manager, ________ (Bank Name), ________ (Branch Address)

Date: __/__/____

Subject- Request for the activation of internet banking service for savings account number ________.

I __________ (Name) holding a ________ (savings/current) account in your branch. The Account Number for the same is ____________.

I need to get the internet banking service so that I can make most of the banking transactions online without the hassle of going to the Branch. Currently, I do not carry this facility for my account.

Kindly, activate the internet banking facility and provide user id and password for transaction service as soon as possible. I am hereby enclosing the internet banking application form, customer request form, and KYC documents along with the application. Looking forward to your positive response.

Yours truly, ________ (Name), ________ (Address), ________ (Contact Number)

Incoming Search Terms:

- how to write a letter to bank manager for internet banking

- application letter to bank for internet banking

- letter to bank manager for internet banking facility

By letterskadmin

Related post, loan application letter | sample application letter to bank manager for loan.

Complaint Letter to Bank for Amount Deduction as Processing Charge – Sample Complaint Letter Regarding Unexplained Deduction from Bank Account

Letter to bank for non-payment of loan – sample explanation letter for delay in loan payment, leave a reply cancel reply.

You must be logged in to post a comment.

Internship Request Letter – How to Write an Application for Internship | Sample Letter

Salary increment request letter – sample request letter for salary increment, application for half day leave – sample leave application to principal for half day leave, simple leave application in office – sample request letter for leave of absence, privacy overview.

IMAGES

VIDEO

COMMENTS

Note: For Dormant / Inactive Bank account activation, Bank may ask for additional documents like KYC, ID / Address proof, photo, Bank customer request form (CRF) along with the request letter. For dormant account activation please contact your Bank Branch. application dormant account activation letter to bank format; dormant account activation ...

The general details included in a letter to the manager to activate the bank account are: Date. Details of the account holder. Issue of the dormant account. Request for the activation of the account. Request for swift processing. Mention the attached documents. State availability for contact.

To, The Branch Manager, [Bank's Name], [Branch's Address], Subject: Request for Reactivation of Account. Dear Sir/Madam, I, [Your Name], a holder of a savings account in your esteemed bank, am writing this letter to bring to your attention that my account has been inactive for the past few months. My account number is [Your Account Number].

A Dormant Account Activation Letter to a Bank Manager is a formal letter written by an account holder to request the reactivation of a bank account that has been inactive for an extended period. A dormant account is an account that has not had any transactions or activity for a specified period, typically six months or more.

House 34, Chicago, Illinois. 111-22332333. March 3, 20XX. Dear Sir/Madam, I am Michael Johns, and I opened an account at your bank in 20XX. My bank account number is 1111-2222-3333-4444. You are requested to kindly reactivate my account, 1111-2222-3333-4444. I have not been using this account for the past year, and yesterday I tried to make a ...

How to Write Bank Account Reactivation Letter? We can reactivate an inactive bank account by writing a formal letter to the branch manager or bank manager. The reactivation of the bank account will differ from one bank to another. You can just go to your bank branch and request the application form for the reactivation of your bank account.

Attach relevant documents, such as identity proof and address proof. Mention the date of the last transaction made in your account. Request the bank to update your contact details, if necessary. Include a declaration of abiding by the bank's terms and conditions. Keep the tone of the application formal and polite.

Once the bank activates the mobile banking services for the customer's account, the customer is given a MPIN, which is short for 'Mobile banking Personal Identification number'. It is just like an ATM PIN which is used for authentication purposes to approve a transaction.

Request Letter Format for Dormant Account Activation - Free download as Word Doc (.doc / .docx), PDF File (.pdf), Text File (.txt) or read online for free. Bank request letter

To, The Branch Manager, ________ (Bank Name), ________ (Branch Address) Date: __/__/____ Subject- Request for the activation of corporate internet banking of current ...

To. The Branch Manager, Bank Name, Bank Address. Sub: Request to unblock my bank account. Dear Sir/Madam, My name is ___________ (your name), account holder of your bank for the last 2 years with a/c no ____________ (bank a/c no). Unfortunately, my bank account was blocked for not making any transactions and not maintaining the minimum balance ...

Subject: Request for Service Activation on Bank Account. Respected Sir/Madam, My name is _____ (Name), and I maintain a _____ (savings/current/other) account with your branch, having the account number _____ (account number). ... Loan Application Letter | Sample Application Letter to Bank Manager for Loan. lettersdadmin April 10, 2024. Join Our ...

Your account will be activated after one working day. Signatures of account holder(s) required as per mode of operation of the account. If cheque or cash is not deposited into the account, then any one financial transaction is mandatory for activation of account, for example., funds sent by inward remittance, cash withdrawal, Fixed Deposit ...

However, the basic format for this letter consists of the following key elements: The bank's address. The bank's name. The recipient's title, e.g. 'to The Branch Manager'. An appropriate subject. The body. Personal information i.e., your name and address. Your contact information e.g., your email address and phone number.

To The Branch Manager, Bank Name, Address. Sub: Dormant account activation application for A/C no. [XXXXXXXXXX]. Dear Sir/Madam, I, [your name] request you to please reactivate my dormant bank account of a/c no. [XXXXXXXXX].The account has become dormant because I have been out of station for the last __ years.

Authorised Signatory (Authorised Signatory to sign the letter with stamp) ... mandatory for activation of account. Kotak Mahindra Bank Ltd. CIN: L65110MH1985PLC038137, Registered Office: 27 BKC, C 27, G Block, Bandra Kurla Complex, Bandra (E), Mumbai 400051, www.kotak.com . Author: Gloria Dias (Consumer Bank, KMBL) Created Date:

Address: (to be mentioned matching the bank account). (Mobile Number) Dear Sir / Madam, I am (Bank account holder's name [or guardian's name in case it is a minor account]), have opened the Saving / Current account in your bank with the account number (mention the a/c number). You are requested to please reactivate my Savings / Current Account ...

You are therefore, requested to activate the account from Inactive to Active. Thanking You, Name: _____ Address: _____ Contact No.: _____ Incoming Search Terms: Inactive Account Activation Letter; Inactive Account Activation Letter To Bank; Inactive Account Activation Application; Application For Inactive Account

First, find the sample template for application for new atm card activation below. To, The Branch Manager, [Bank Name], [Branch Address], Subject: Application for New ATM Card Activation. Dear Sir/Madam, I, [Your Full Name], am a customer of your bank, holding Savings Account number [Your Account Number] at your esteemed branch. I recently ...

Transaction request (Cash Deposit / Cash Withdrawal / Funds Transfer / RTGS / NEFT) to be executed from my / our. account for activation. Consent to Debit & credit my / our account for Re. 1/- for account activation. I/We further confirm that (Select anyone option):

Here you will get 15+ bank account reactivation letter samples given below, but you ensure that you replace your correct/real details, Like- name, date, account no, contact details, address, etc. Simple Application For Bank Account Reopen

Subject: Letter to bank manager to activate account. Dear Sir/Madam. I am writing to request the activation of my inoperative account with your bank. My account number is [Account Number], and it has been inactive for a certain period of time. I understand that my account may have been marked as inactive due to a lack of transactions or account ...

Currently, I do not carry this facility for my account. Kindly, activate the internet banking facility and provide user id and password for transaction service as soon as possible. I am hereby enclosing the internet banking application form, customer request form, and KYC documents along with the application. Looking forward to your positive ...