Founder Advice

83(b) election — what is an irs 83(b) election and where to file.

If you’re a first-time founder, you may have never heard of a section 83(b) election before. I know the first time I heard about the 83(b) filing was when our corporate lawyers told us we had 30 days to sign and mail these important documents. Between printing, signing, and shipping, I spent 2 hours carefully putting together the required materials for myself and my co-founder (you’re welcome Collin! :)).

While tedious, an 83(b) election is important to ensure you don’t get hit with a hefty tax bill down the line. This election is especially important for all founders with a large percentage of equity.

Given how much of a pain it was to handle the 83(b) election, and the number of questions we get asked at Stable from founders who have recently incorporated, we’ve written this article to break down the following questions so it’s easy to understand: 1. What is an IRS 83(b) election form?

2. What are the 83(b) tax implications?

3. How to file and where to mail 83(b) election?

4. How to confirm the IRS received your 83(b) filing?

This post is aimed for founders and entrepreneurs. If you’re an employee, I’d recommend checking in with your accountant to see if this option makes sense for you because the tax implications may be more complicated.

What is an 83(b) election?

The 83(b) election gives founders the ability to pay taxes on the total fair market value of restricted stock on the date of its grant, instead of when it vests.

Okay, but what does that actually mean?

A Simple Example

When you incorporate your company, you’ll likely issue shares for co-founders in the company. Many Delaware C-Corporations will initially issue 10 million shares with a very, very low share price. For instance, you may set a share price of $0.00001 per share at incorporation. Because the company has not generated any revenue or value yet, this share price is the lowest it’ll ever be, and founders get to reap the benefits of that.

For simplicity, If you have two co-founders who own fifty percent of the company each (in actuality, you may set aside some shares in an option pool for employees and advisors, but we’re not going to get into that), this will mean the stock is worth $50 (5,000,000 shares x $0.00001).

So, $50 becomes the “total fair market value of restricted stock on the date of its grant” and the date of the grant is the incorporation date or soon after. As a founder, you’ll “pay” $50 to the company for these shares and likely be put on a 4 year vesting schedule .

What are the 83(b) tax implications?

Now that we’ve established that you own $50 of your company valued at $100, let’s jump into how this can affect your taxes over time. First, you probably incorporated your company to generate revenue and build a meaningful business. Whether you’re aiming for your company to be worth $1 million or $1 billion dollars one day, the value of your company will affect the share price.

Let’s say your company is in fact a unicorn (yay!) one day. At a $1 billion dollar valuation, and again for simplicity assuming no additional issued shares, dilution, or additional shareholders, those shares you once paid $50 for are now worth $500 million! Woo, you’re rich!

Not so fast though, there are tax implications on that earning.

In short, receiving restricted stock requires the founder to pay the value of the stock on their individual income tax. Filing an 83(b) election enables you to pay that tax liability upfront for all shares . Otherwise you will need to pay income tax on the value as it vests every year, which is also complicated to keep track of.

Additionally, when you liquidate your shares, you will pay a capital gains tax on the earnings. This is usually less than how much your individual income tax will be, especially if it is a large amount.

Let’s look at what could happen in both scenarios:

Filed 83(b) election

- Pay income tax on the $50 (10-37%, depending on your income bracket)

- Pay capital gains tax of 20% on $499,999,950 ($50M minus the $50 you already paid as part of your income taxes)

- Therefore, you may pay an income tax of $18.50 (or ($50*0.37) † ) and capital gains tax of $99,999,990 (or $499,999,950*0.20)... which is a total of $100,000,008 in taxes

$100M is a lot of money but now let’s look at what happens if you didn’t file an 83(b) election.

Did not file 83(b) election

- Pay income tax on the $500 million as it vests (10-37%, depending on your income bracket)

- Pay capital gains tax of 20% on the difference of what you paid on the vested value and $500 million

- For this model, let’s assume when the shares vested, the shares were worth $250M

- The vested value is how much the stock was worth at the date vesting occurred, and in a way the immediate value of the stock

- In actuality, the value will likely be variable over time due to how shares vest

- Therefore, you may pay an income tax of $92.5M (or ($250,000,0000.37) † ) and capital gains tax of $50M ($250,000,000 *0.20)... which is a total of $142,500,000 in taxes

In this simplified scenario, you would save over 42 million if you had filed the 83(b) election form. Seems like a pretty good deal for only filling out a form and sending it in, eh?

In short, because capital gains tax rate is lower than income tax rate for high sums of money, this gives you a tax advantage to categorize the majority of the earnings as capital gains, instead of income.

† Note that the actual income tax would be very slightly less since you can take advantage of lower tax brackets up to ~$500K in earnings. But again, because we’re riding on simplicity and will likely have other income, we’re assuming the highest income bracket.

How to file and where to mail 83(b) election?

Now that you understand what an 83(b) election is, there are specific steps to take to file your 83(b) election and obtain proof of filing in the case that you’re ever audited by the IRS down the line.

Reminder: you have 30 days to file from the date of your stock grant to file this form

The steps for how to and where to mail 83(b) election are outlined below:

Step 1: Sign the required documents

First, you’ll need to sign the 83(b) election form typically attached to your Stock

Purchase Agreement. Your law firm or incorporation service should have generated this document for you as part of issuing stock. If not, you can use this template from the IRS .

If you signed using a wet signature, you’ll also want to scan a copy of the document for your records.

Step 2: Prepare a cover letter for the IRS

You’ll need to create a cover letter that contains the following information to send with the filing:

- Name and SSN of spouse (if applicable)

Note : Your law firm or incorporation service may provide this for you.

Step 3: Print the required documents

Print or photocopy the signed 83(b) election form and the cover letter. In total, you should have at least two copies of your 83(b) election form.

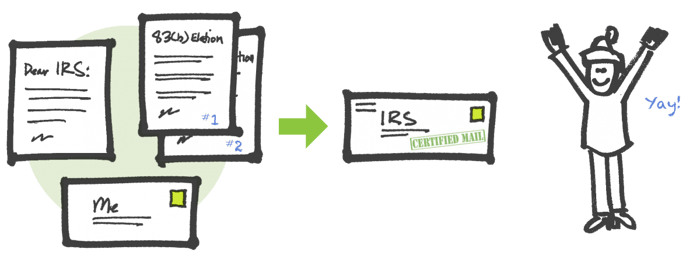

Step 4: Prepare the mailing

In a large envelope, prepare the following documents for mailing:

- Original copy of the signed 83(b) election

- Photocopy of the signed 83(b) election

- IRS cover letter

- Self-addressed and stamped envelope (see below section on how the IRS will confirm reception by mailing a stamped copy back to you)

Step 5: Mail the filing

Go to your local Post Office to mail the filing. You should mail your 83(b) election filing to the same address that you would mail your tax returns to. Depending on your state, the address may differ:

Our law firm recommends sending the 83(b) election through USPS Certified Mail in order to receive a green mailing receipt once you mail the documents. This green mailing receipt can be retained as proof that you’ve made the filing.

How to confirm the IRS received 83(b)?

When mailing in your 83(b) election, you should include a self-addressed and stamped envelope so that the IRS can mail a copy back to you. In your cover letter, you should include instructions similar to the following:

Please acknowledge receipt of the enclosed 83(b) election form by date-stamping the two additional copies enclosed of this election and returning them in the envelope provided.

By providing the additional copies of your 83(b) election, including a return envelope with postage, and clearly outlining instructions, the IRS will send back a copy of your 83(b) election in the mail to the specified address. When received, you should scan a copy of it for your records.

If you need a US address to receive the returned 83(b) election from the IRS, you can use a virtual mailbox service like Stable (50% off discount for newly incorporated businesses). With a virtual mailbox, you’ll be notified when you receive the copy of the 83(b) filing and a copy of this filing will be digitally and securely stored.

Overall, the 83(b) election can be a pain to file, but it is worth the tax benefits for a founder. Being able to take advantage of a lower tax rate for the majority of your earnings can add up in the event of an acquisition or IPO.

These are detailed instructions to follow on how to compliantly file your 83(b) election — and remember, if you’re looking to have a safe place to receive and digitize the returned 83(b) election from the IRS, you can use a virtual mailbox service like Stable (50% off discount for newly incorporated businesses).

At Stable , we provide permanent virtual addresses and mailboxes so you never have to worry about mail or changing addresses again. We’ll digitize all mail that you receive here, and you’ll be able to scan, forward, shred, (and even deposit checks!) from anywhere in the world.

Get started with Stable here if you’d like a virtual business address + mailbox in less than 3 minutes.

Disclaimer: Stable is not a legal or accounting firm, therefore we cannot provide legal or tax advice. You should consult legal and tax professionals for advice on how to meet ongoing obligations that apply to you and your company.

Get 50% off your first year with Stable

Get 50% off our grow plan.

How To File 83(b) Election With The IRS

In the last five years I have helped almost 150 founders through the incorporation process. Time and time again I keep seeing one step of that process, create mass confusion for founders and early employees. Filing the 83(b) Election with the IRS within 30 days of receiving a stock grant or stock options.

I will keep it short on why you might want to file a 83(b) Election with the IRS and focus more on how to file it, since that is likely why you are reading this. This article from Cooley Law does a pretty good job explaining in much greater detail why making an 83(b) Election with the IRS can be beneficial, as well as this explanation from Wealthfront .

In short, an 83(b) election means you will be taxed on the value of your stock at the time of the grant , rather than as it vests . For founders & early employee’s of new company’s, whose stock is usually priced at $0.0001 per share at incorporation, it can make a lot of logical sense to pay upfront tax while the price of the company is still very low. Now on to the how to file your 83(b) election instructions.

IMPORTANT 83(b) Election Deadline: You must file your 83(b) Election with the IRS within 30 days of receiving your stock grant or stock options! The filing is officially deemed to have been made on the date the 83(b) is mailed from the post office; i.e. the postmark date.

If your stock is not subject to vesting, then you can ignore this process and move on with your day. 83(b) Elections are not required for those without a vesting schedule.

Steps To File Your 83(b) Election

Start with gathering the required 83(b) form documents:

If your lawyer has provided you with 83(b) election forms you may use those. If not, then print four copies of page 9 from the 83(b) Election IRS form here .

You also need to include a cover letter to the IRS, a template of which can be found here: IRS Cover Letter Template .

Complete and review all four copies of the 83(b) election form, review, date, manually sign and insert the taxpayer identification number for the taxpayer (and spouse, if applicable).

Look up where to send the completed forms by finding your state on the "Where to File Paper Tax Returns With or Without a Payment” page of the IRS website.

Enclose the following in an envelope to be mailed:

Two copies of your completed 83(b) election.

Completed cover letter.

A return self addressed envelope with stamps. The IRS will keep the first copy of your election and stamp the second copy. The self addressed envelope will be used to mail back to you the second stamped copy of your election, so you can keep it on file in your records.

Mail the enclosed envelope with 2 completed copies of your 83(b) election & cover letter to the IRS via USPS certified mail and request a return receipt.

Send another completed 83(b) election to your company.

Keep another completed 83(b) election for your personal records.

Thats it! Be on the lookout in the mail to receive that second stamped copy back from the IRS. And as always, be sure to keep your records someplace safe like a fireproof lock box.

Other Founder Guides you might find helpful:

How To Send Monthly Updates To Investors

How To Pay Delaware Corporation Taxes

Disclaimer: I offer this post only as helpful guidance as I am not a lawyer or certified accountant. You should still research on your own and consult your accountant or lawyer if you are uncertain of the process.

Founder Institute New York Twenty

Deepfake technology.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

83(b) Election: Why and When to File

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

The investing information provided on this page is for educational purposes only. NerdWallet, Inc. does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

Taxes are like chores. You pay what you have to, but no more than you need to.

One way to avoid overpaying is understanding the tax code and its various provisions. This can be especially true if you have a complicated tax situation, as employees or company founders with equity compensation often do. Taking advantage of the 83(b) election can help you minimize your tax outlay.

via Zoe Financial

What is the 83(b) election?

When making an 83(b) election, you request that the IRS recognize income and levy income taxes on the acquisition of company shares when granted, rather than later upon vesting. The grant date is when an employee receives a company stock or stock option award. Vesting means an employee has earned actual ownership of the company shares or stock options, usually by satisfying a certain time period of employment.

Making an 83(b) election means that you’re able to pay income taxes earlier, often before your company shares have had the opportunity to appreciate in value. If and when you sell shares for a gain down the road, you’d only be responsible for capital gains taxes as opposed to ordinary income taxes , which are taxed at a higher rate.

Holding shares for over a year prior to selling means you’d pay the more favorable long-term capital gains taxes. Filing an 83(b) also means you can start the holding period clock earlier, right after the grant date, so any capital gains accrued are eligible for the lower capital gains tax rate.

» Want to cut taxes? Explore strategies to reduce capital gains taxes

The 83(b) election can come in handy when you expect to stay with your company for the long term (since you’ll need to wait until your company shares vest to gain actual ownership), and if you expect that the value of your company shares will grow over time.

On the flip side, you could end up prepaying unnecessary taxes if you part ways with your company and never receive ownership of those company shares, or if the value of those shares decreases instead.

Who might file an 83(b) election and why

There are a few situations in which you might file an 83(b) election. If you happen to fall into either of these camps, an 83(b) election could potentially help reduce your tax burden.

Stock option holders: If you’re able to exercise your stock options early (prior to vesting), you could elect to do so and file an 83(b) election within 30 days of exercise. This way, you can potentially minimize your future tax liability if the share price of your company happens to take off.

Startup founders: In some companies, particularly startup companies, compensation for company founders or owners may include a significant amount of restricted stock (not to be confused with restricted stock units or RSUs ). Restricted stock refers to company shares that are subject to certain stipulations, such as vesting and/or forfeiture (losing your shares if you leave the company). Key employees may be awarded a handsome quantity of restricted shares that could significantly increase in value from granting to vesting. Using the 83(b) election allows these employees the chance to save by shifting their tax treatment from ordinary income taxes to capital gains taxes.

» Want to invest in startups? Learn about angel investing

When and how to file an 83(b) election

It is critical to remember to file your 83(b) election within 30 days of being granted restricted shares or within 30 days of exercising your options early. Not doing so results in your company shares being taxed upon vesting as ordinary income. But keep in mind that filing an 83(b) election is usually irreversible, so carefully consider whether you want to do so.

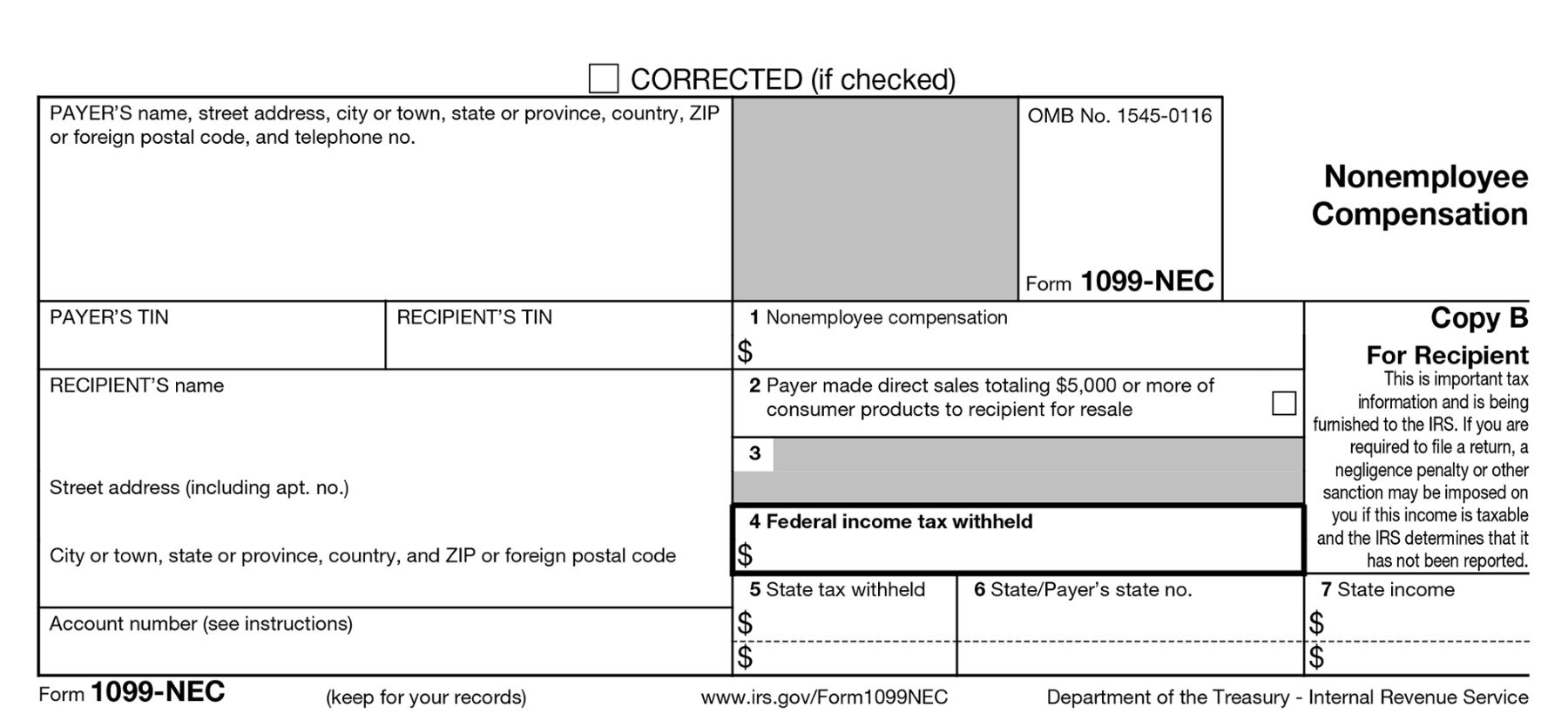

How to file an 83(b) election form

Though there are benefits and drawbacks to consider when deciding whether to file an 83(b) election, the process itself is fairly straightforward.

The employee completes and signs an IRS Section 83(b) form or letter that details certain key information:

Personal identifying information (name, address, Social Security number).

Description of the property awarded (number and type of shares of which company) along with the date received or purchased, any restrictions your shares are subject to and the fair market value of the shares on the date received or purchased.

The amount paid for the company shares.

The amount the employee will indicate as gross income on their income tax return.

The employee mails the election form or letter to their IRS Service Center and provides a copy to their employer.

Best practice is to send your election form through certified mail with a return receipt in case you need to prove that it was sent by a particular date.

If you’re not sure whether the 83(b) fits with your needs, consulting with a seasoned tax or financial advisor can help you decide whether it makes sense to move forward.

» Want a second opinion? A wealth advisor may prove useful for you

On a similar note...

Find a financial advisor

View NerdWallet's picks for the best financial advisors.

on Robinhood's website

A Guide to Section 83(b) Election for Startup Founders

For startup founders, Section 83(b) elections are certainly a topic of interest. Business founders have likely heard they should file an 83(b) election, but what exactly is this, when should you file it, and is it mandatory? We’re here to demystify the details of the 83(b) election, including how it’s filed and the process of filing.

What is an 83(b) Election?

An 83(b) election is a provision under the internal revenue code or IRC. It is filed to indicate that an elector would like their equity, typically shares of restricted stock, to be taxed at the time it is granted at its fair market value. Under 83(b) elections, the value of the entire stock is included in an individual’s gross income in the year of receipt.

The election gives startup founders and employees the option to pay taxes on their options, before they vest. It’s called an election because founders are electing, or choosing, to pay taxes early.

When do you use an 83(b) election?

For startup founders and early stage employees of the startup, it makes sense to complete an 83(b) election upon receipt of unvested shares. That is when the stock value is generally low, so the taxes will not be high.

How long do you have to make an 83(b) election?

An 83(b) election must be filed with the IRS within 30 days of the exercise. The election has to be made upon receipt of the actual shares of the stock, and not the option. Exercise first, election next. If eligible individuals receive an early exercisable stock option, the 83(b) election can be made upon receipt of the exercised shares.

What if you forget to fill out an 83(b) election?

If individuals do not meet the 30-day deadline for an 83(b) election, though limited, there may still be options. However, it is important to know, there is no way to extend that time period.

For new startups, consider cancelling the old stock grant and issuing a new one, or creating a new grant with a different vesting schedule or number of shares. It’s also possible to amend a stock grant so that the repurchase price is at fair market value.

Most commonly, the employee must recognize the stock value as income as they satisfy the vesting conditions. Unfortunately, this often happens at a time when it has appreciated in which the amount of taxable income has also increased along with it.

It is important to seek financial and legal advice before proceeding with these options.

Are 83(b)s required if you have no vesting?

Elections do not apply to vested shares, only to stock that is not yet vested. Any stock that is not early exercisable will not qualify for 83(b).

According to the IRS, if vesting restrictions are imposed on previously purchased fully vested stock, stock is treated like it was purchased at the time of original purchase. Anything that is taxable as income is measured at the time of the original purchase of shares, so there is no need to file an election.

If you are the sole founder/equity holder, you should only file an 83(b) election if the equity is subject to vesting. You do not need to make an 83(b) election when there are no restrictions on your ability to dispose of the stock. If for some reason the shares are subject to vesting, you should then consider filing an election.

How is a section 83(b) election made?

An 83(b) election is made through filing with the IRS. Make three copies of the signed and completed election form and one copy of the IRS cover letter. You will send the original form and letter, a copy of the cover letter, and a self-addressed stamped envelope to the IRS. The center to send it to is the one where you would normally file your tax return. Sending the paperwork via certified mail is highly recommended. Deliver a copy of the election form to the company. You may need to attach another copy to your income tax returns depending on your location. Keep another copy for your own records.

Who Uses an 83(b) Election?

Who files an 83(b) election.

The person who receives restricted stock in compensation for their work, in other words the taxpayer, is the one who files the 83(b) election for themselves.

Should founders file an 83(b) election?

In most cases it’s a good idea for startup founders to make an 83(b) election. The stock value is usually low at the time it is purchased, which offers the potential for tax savings in the long-run.

Can a partnership make an 83(b) election?

Each taxpayer must complete his or her own 83(b) election.

What Should You Consider Before Doing an 83(b) Election?

What are the benefits of an 83(b) election.

Filing an 83(b) election allows people to pay taxes now, in hopes that a company will be successful and stock value will appreciate. If that happens, tax liability is much more manageable, saving lots of money. Instead of being taxed at the ordinary income tax rate, any additional gain will be taxed at the lower long-term capital gains rate.

What are the risks of an 83(b) election?

The biggest risk is that share value may not appreciate, or may even depreciate. In the case of depreciation, because taxes are prepaid on a higher valuation of equity, individuals will have unnecessarily overpaid in taxes . This overpayment of taxes cannot be claimed.

An 83(b) election might also keep an employee around longer than they would like, waiting to see stock options, and not wanting to have paid taxes on shares they will never receive .

What happens if a founder does not file an 83(b) election?

What are the steps to filing an 83(b) election, what is the best way to fill out an 83(b) form.

Be sure to carefully read over the form and fill in all applicable areas. A financial and/or legal advisor can be extremely helpful in ensuring the form is completed correctly.

How to report income from an 83(b) election

Does 83(b) election need to be attached to 1040.

Your 83(b) election form no longer needs to be attached to your form 1040.

Does your spouse need to sign 83(b) election?

Generally, a spouse only needs to sign the 83(b) election form if residing in a community property state.

Where do you send an 83(b) election?

Your 83(b) election form should be sent to the IRS center where you would normally file your income taxes. Information on this can be found on the official IRS website.

How do I know if the IRS received my 83(b) election?

It is strongly recommended to send your 83(b) form as certified mail requesting a r eturn receipt . By including a self-addressed stamped envelope and a request that the IRS return forms with a date stamp, you can ideally confirm receipt.

Update: the Internal Revenue Service has announced that it would temporarily allow Section 83(b) elections to be signed digitally or electronically (through October 31, 2023).

When is it detrimental to file an 83(b) Election?

Filing an 83(b) election can be a powerful tool for those who receive restricted stock units (RSUs) or other forms of equity compensation, but there are situations where it could be detrimental. Here are some scenarios in which filing an 83(b) election might not be the best choice:

Uncertain Future Value: If you’re unsure about the future value of the company’s stock, filing an 83(b) election might not be wise. By making this election, you’re essentially prepaying taxes based on the stock’s current value. If the stock value doesn’t increase as expected or even decreases, you’ll have paid unnecessary taxes.

Immediate Tax Burden: When you file an 83(b) election, you’re required to pay taxes on the stock’s fair market value at the time of the grant, even if it’s not yet vested. This can create a significant tax burden that you might struggle to cover if you’re short on cash.

Short-Term Employment: If you’re not planning to stay with the company for the vesting period, filing an 83(b) election might not make sense. You’ll be paying taxes on stock that you may never fully own, potentially losing out on valuable tax benefits.

Lack of Funds: Paying the taxes associated with an 83(b) election can be challenging if you don’t have the cash available. Using your own funds to cover the tax bill may not be practical, and you might end up having to sell some of the stock to cover the tax liability, defeating the purpose of the election.

Complex Tax Situation: If you have a complex tax situation or are not well-versed in tax matters, it’s essential to consult with a tax professional before making an 83(b) election. Filing it incorrectly or without a full understanding of the implications can lead to costly mistakes.

In conclusion, understanding the intricacies of the Section 83(b) election is paramount for startup founders navigating the world of equity compensation. This guide has shed light on the importance, benefits, and potential drawbacks of making this election. As a founder, the decision to file for an 83(b) election should align with your unique financial situation, long-term commitment to the company, and future growth projections. It’s a powerful tool that, when used wisely, can help you optimize your tax strategy and unlock the full potential of your equity awards. Remember, seeking professional advice and carefully weighing the pros and cons are essential steps on your journey toward building a successful startup and securing your financial future. Reach out to Finvisor today, we’re ready to help!

- Last Modified

- February 5, 2024

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

FOR ANY QUESTIONS

- MAILING ADDRESS

Finvisor HQ 48 2nd St, 4th Floor San Francisco, CA 94105

- PHONE NUMBER

(415) 416-6682

- EMAIL ADDRESS

" * " indicates required fields

What Is the Section 83(b) Election? A Guide for Startup Founders

Taxes are one of the few certainties in life, but that doesn’t mean we like to think about them. One of the most common—and most costly—mistakes we see startup founders make is forgetting to account for how their equity is taxed.

On one level, this is understandable. It’s exciting to receive shares of restricted company stock and dream about how much those shares may be worth someday; it’s less exciting to think about how they’ll be taxed. But understanding how restricted stock is taxed can save you serious money, and the Section 83(b) election is central to that understanding.

A Section 83(b) election is a short letter you send to the Internal Revenue Service (IRS) to clarify how you want to be taxed on your equity . In this guide, we’ll review everything a startup founder needs to know about Section 83(b) elections—from how they work to whether you may need to file one. We’ll also show you how filing an 83(b) election could save you thousands (and maybe even more) in terms of your overall equity tax bill.

What is an 83(b) election?

How is restricted stock taxed, the tax benefits of filing an 83(b) election, potential disadvantages of filing an 83(b) election, how to fill in the section 83(b) election form, final thoughts for startup founders.

Section 83 of the Internal Revenue Code (IRC) addresses property transferred in connection with performance of services. Section 83(b) is a specific provision of the tax code that gives startup founders and employees the option to pay taxes on the fair market value of their restricted stock at the time it is granted. If you do not file an 83(b) election in time, your stock will be taxed on its fair market value at the time it vests.

In order to inform the IRS that you want to be taxed on the value of your restricted stock at the time of grant, you must file a Section 83(b) election. The Section 83(b) election is a short document that must be sent to the IRS no later than 30 days after receiving your restricted shares —so you can’t simply wait to send it in with the rest of your income tax return.

Why vesting matters

It’s important to note that the 83(b) election applies only to property subject to “a substantial risk of forfeiture.” Restricted stocks qualify because they are subject to vesting.

Vesting means that certain milestones must be met before the recipient is granted full ownership of the stock. This is a common restriction for startup equity . Typically, when a founder or employee is granted equity, they don’t get full ownership of it all at once. Instead, the stock vests based on a vesting schedule. This vesting schedule is often spread out across a period of time (e.g. four or five years) specified in the stock grant. In most cases, if the recipient leaves the company before the final vesting date, they forfeit rights to any unvested stock.

If you don’t file an 83(b) election, your restricted stock will be subject to ordinary income tax on its fair market value at the time it fully vests. Depending on your vesting schedule, it could take your stock years to fully vest. In that time, it’s certainly possible—perhaps even likely—that the fair market value of your stocks will grow.

So, waiting to pay taxes on your shares as they vest means that you will end up paying more taxes if the fair market value of your shares grows over time.

Before we go any deeper, it’s important to pause and review how restricted stock is taxed. Knowing how different tax rates work, and when they apply, can help you make a more informed decision about whether to file an 83(b) election.

Ordinary income tax vs. capital gains tax

Two different types of tax rates that may apply to equity are ordinary income and capital gains.

If you received your restricted stock as part of your normal compensation (i.e. you paid nothing extra to receive it), its fair market value will be taxed at the applicable ordinary income tax rate . It will be considered taxable income regardless of whether you file an 83(b) election or not. Filing an 83(b) election only affects when your stock will be taxed.

Capital gains tax rates apply to profits you make on assets you already own. So, if you own stock that increases in value and you sell it at a later date, you will pay capital gains tax on your profit (the price you sold the stock for minus the price you paid for it).

There are two types of capital gains tax rates that differ based on their holding period:

- Short-term capital gains rates apply to profits you earn from selling assets you’ve held for a year or less. These are typically taxed at the ordinary or regular income tax rate, so they don’t confer any benefits.

- Long-term capital gains rates apply to profits earned from selling assets you’ve held for longer than a year. Long-term capital gains tax rates are lower than ordinary income and short-term gains rates.

Since long-term capital gains rates are lower, these are the rates you want to optimize for if possible. The more your gains are taxed at the long-term capital gains rate, the lower your total tax liability.

When you file an 83(b) election, you are essentially fast-forwarding the timeline for when you will need to pay ordinary income tax on your stock.

You can’t get out of paying ordinary income tax, but paying it earlier can make a big difference. There are two beneficial tax consequences of filing an 83(b) election:

- It accelerates the clock on when you owe ordinary income tax. By paying ordinary income tax on all of your shares at the time of grant, you are essentially betting that the value of those shares will increase over time. If you pay ordinary income tax earlier and your shares then increase in value, you will only be subject to capital gains tax on your profits. Conversely, if you wait to pay ordinary income tax as your shares vest, your tax liability will be higher if the fair market value of your shares gradually increases over time. Remember: You pay tax as a percentage of fair market value, not as a set amount.

- It accelerates the clock on when short-term capital gains become long-term capital gains. An added benefit to paying ordinary income tax earlier is that the clock on your capital gains starts earlier. Holding your shares for at least a year before selling them means that your gains will be taxed at the applicable long-term capital gains rate—which is sure to be lower than the short-term rate.

To better illustrate how this all works, let’s walk through a couple of examples featuring a startup founder named Jeanne.

In both examples, Jeanne is granted a restricted stock award (RSA) of 10,000 shares that vest over four years. The vesting schedule in Jeanne’s grant stipulates that 25% of her shares vest each year, assuming she remains at the company. The fair market value of the stock over the course of those four years increases as follows:

Example of taxes owed when filing an 83(b) election

If Jeanne files an 83(b) election within 30 days of her grant, she will owe ordinary income tax on $50,000 ($5 x 10,000 shares).

But how much will Jeanne actually pay in taxes on her equity? The maximum ordinary income tax rate in 2022 is 37%, and the full fair market value of her stock will be subject to this tax rate. This means that she will pay 37% of $50,000, which comes out to an equity tax bill of $18,500 .

Now that Jeanne owns her stock and has paid ordinary income taxes on it, any profit she realizes will be taxed at capital gains rates when she decides to sell it.

Example of taxes owed without filing an 83(b) election

If Jeanne does not file an 83(b) election within 30 days of her grant, she will owe ordinary income tax (37%) on her shares as they vest. She won’t pay any taxes on her shares at the time of grant, but she will pay the following taxes on her shares as they vest:

- After Year 1, she will pay $9,250 ($10/share x 2,500 = $25,000) x 37%

- After Year 2, she will pay $13,875 ($15/share x 2,500 = $37,500) x 37%

- After Year 3, she will pay $18,500 ($20/share x 2,500 = $50,000) x 37%

- After Year 4, she will pay $23,125 ($25/share x 2,500 = $62,500) x 37%

Jeanne’s total tax liability without an 83(b) election comes out to a massive $64,750 . That means she’s paying $46,250 more in ordinary income tax than she would if she filed an 83(b) election. Yikes!

In some cases, it may not make sense to file an 83(b) election.

The above examples assume that the value of the stock will continue to increase over time, but this is by no means guaranteed. If you file an 83(b) election and pay taxes on all of your shares at the time of grant, you should understand the risks.

There are two scenarios in which filing an 83(b) election could end up hurting more than helping:

- If the value of your equity falls or if your company goes bankrupt, you may have paid taxes for shares that will ultimately be worth less or—in the worst case scenario— worthless .

- If you decide to leave your company before your shares are fully vested, you will have paid taxes on shares that you never receive. And the prospect of losing shares that you already paid taxes on may compel you to stay at a company even if you’re unhappy. Not a great outcome, all around.

The 83(b) election doesn’t come with a clause that allows you to reclaim any taxes you may overpay at the time of grant, so in both of the above scenarios, you’d have to just eat the cost of the taxes you “pre-pay.”

You can find the 83(b) form here .

It’s pretty quick to fill in, though you’ll need information about the fair market value of your restricted stock as well as some other information about your stock grant. A few other points to keep in mind once you’re ready to submit the form:

- Plan to make at least three copies of the signed and completed 83(b) form and one copy of the IRS cover letter.

- The original 83(b) form and cover letter go to the IRS along with a stamped and self-addressed return envelope.

- One copy of the completed 83(b) form goes to the company, and one is for your own record-keeping. You may need to attach a third copy to your state personal income tax return. Consult your tax advisor on this before sending it off, as it may not be necessary depending on where you live.

As we’ve demonstrated, the decision to file an 83(b) election is an important one that can result in substantial tax savings. And if you do decide to file an 83(b) election, make sure you do so within 30 days of receiving your stock award . Procrastination is rarely a good policy, but in this case it can make you an extra-grumpy taxpayer.

Oh, and one last thing: It’s always a good idea to consult with a tax advisor if you have questions about the 83(b) election (and even if you think you have it down pat). Some aspects aren’t the most intuitive. For example, the 83(b) election also applies when early exercising stock options, since this produces restricted shares.

If you’re interested in learning more about taxes and equity, we’d love to keep the conversation going. Schedule a call with a Pulley expert today and learn how we can help.

Let's chat about equity

Schedule a call and we'll discuss your equity and see how we can help.

- Search Search Please fill out this field.

What Is the 83(b) Election?

Understanding the 83(b) election.

- Tax Strategy

The Bottom Line

- Small Business

- Small Business Taxes

83(b) Election: Tax Strategy and When and Why to File

Julia Kagan is a financial/consumer journalist and former senior editor, personal finance, of Investopedia.

:max_bytes(150000):strip_icc():format(webp)/Julia_Kagan_BW_web_ready-4-4e918378cc90496d84ee23642957234b.jpg)

Pete Rathburn is a copy editor and fact-checker with expertise in economics and personal finance and over twenty years of experience in the classroom.

:max_bytes(150000):strip_icc():format(webp)/E7F37E3D-4C78-4BDA-9393-6F3C581602EB-2c2c94499d514e079e915307db536454.jpeg)

Investopedia / Xiaojie Liu

The 83(b) election is a provision under the Internal Revenue Code (IRC) that gives an employee, or startup founder, the option to pay taxes on the total fair market value of restricted stock at the time of granting.

Key Takeaways

- The 83(b) election is a provision under the Internal Revenue Code (IRC) that gives an employee, or startup founder, the option to pay taxes on the total fair market value of restricted stock at the time of granting.

- The 83(b) election applies to equity that is subject to vesting.

- The 83(b) election alerts the Internal Revenue Service (IRS) to tax the elector for the ownership at the time of granting, rather than at the time of stock vesting.

The 83(b) election applies to equity that is subject to vesting, and it alerts the Internal Revenue Service (IRS) to tax the elector for the ownership at the time of granting, rather than at the time of stock vesting.

The 83(b) election documents must be sent to the IRS within 30 days after the issuing of restricted shares. In addition to notifying the IRS of the election, the recipient of the equity must also submit a copy of the completed election form to their employer.

In effect, an 83(b) election means that you pre-pay your tax liability on a low valuation, assuming the equity value increases in the following years. However, if the value of the company instead declines consistently and continuously, this tax strategy would ultimately mean that you overpaid in taxes by pre-paying on higher equity valuation.

Typically, when a founder or employee receives compensation of equity in a company, the stake is subject to income tax according to its value. The tax liability is based on the fair market value of the equity at the time of the granting or transfer, minus any cost of exercising or buying the equity shares. The tax due must be paid in the actual year the stock is issued or transferred.

However, in many cases, the individual receives equity vesting over several years. Employees may earn company shares as they remain employed over time. In which case, the tax on the equity value is due at the time of vesting. If the company’s value grows over the vesting period, the tax paid during each vested year will also rise in accordance.

Example of an 83(b) Election

For example, a co-founder of a company is granted 1 million shares subject to vesting and valued at $0.001 at the time the shares are granted. At this time, the shares are worth the par value of $0.001 x number of shares, or $1,000, which the co-founder pays. The shares represent a 10% ownership of the firm for the co-founder and will be vested over a period of five years, which means that they will receive 200,000 shares every year for five years. In each of the five vested years, they will have to pay tax on the fair market value of the 200,000 shares vested.

If the total value of the company’s equity increases to $100,000, then the co-founder’s 10% value increases to $10,000 from $1,000. The co-founder's tax liability for year 1 will be deduced from ($10,000 - $1,000) x 20% i.e. in effect, ($100,000 - $10,000) x 10% x 20% = $1,800.

- $100,000 is the Year 1 value of the firm

- $10,000 is the value of the firm at inception or the book value

- 10% is the ownership stake of the co-founder

- 20% represents the 5-year vesting period for the co-founder's 1 million shares (200,000 shares/1 million shares)

If, in year 2, the stock value increases further to $500,000, then the co-founder's taxes will be ($500,000 - $10,000) x 10% x 20% = $9,800. By year 3, the value goes up to $1 million and the tax liability will be assessed from ($1 million - $10,000) x 10% x 20% = $19,800. Of course, if the total value of equity keeps climbing in Year 4 and Year 5, the co-founder’s additional taxable income will also increase for each of the years.

If at a later time, all the shares sell for a profit, the co-founder will be subject to a capital gains tax on their gains from the proceeds of the sale.

For restricted stock, you must file your 83(b) election within 30 days of receiving your shares. For stock options , you must file 83(b) within 30 days of exercising your options.

83(b) Election Tax Strategy

The 83(b) election gives the co-founder the option to pay taxes on the equity upfront before the vesting period starts. This tax strategy allows the co-founder to only pay taxes on the fair market value of the shares, minus the cost of exercising the options. If the fair market value of the shares is equal to their strike price, the taxable gain is zero.

The 83(b) election notifies the IRS that the elector has opted to report the difference between the amount paid for the stock and the fair market value of the stock as taxable income. The share value during the 5-year vesting period will not matter as the co-founder won’t pay any additional tax and gets to retain the vested shares. However, if the shares are sold for a profit, a capital gains tax will be applied.

Following our example above, if the co-founder makes an 83(b) election to pay tax on the value of the stock upon issuance, the tax assessment will be made on the difference between the shares' strike price and their fair market value .

If the stock is sold after, say, ten years for $250,000, the taxable capital gain will be on $249,000 ($250,000 - $1,000 = $249,000).

The 83(b) election makes the most sense when the elector is sure that the value of the shares is going to increase over the coming years. Also, if the amount of income reported is small at the time of granting, an 83(b) election might be beneficial.

In a reverse scenario where the 83(b) election was triggered, and the equity value falls or the company files for bankruptcy, then the taxpayer overpaid in taxes for shares with a lesser or worthless amount. Unfortunately, the IRS does not allow an overpayment claim of taxes under the 83(b) election. For example, consider an employee whose total tax liability upfront after filing for an 83(b) election is $50,000. Since the vested stock proceeds to decline over a 4-year vesting period, they would have been better off without the 83(b) election, paying an annual tax on the reduced value of the vested equity for each of the four years, assuming the decline is significant.

Another instance where an 83(b) election would turn out to be a disadvantage will be if the employee leaves the firm before the vesting period is over. In this case, they would have paid taxes on shares that would never be received. Also, if the amount of reported income is substantial at the time of stock granting, filing for an 83(b) election will not make much sense.

When Is It Beneficial to File 83(b) Election?

An 83(b) election allows for the pre-payment of the tax liability on the total fair market value of the restricted stock at the time of granting. It is beneficial only if the restricted stock's value increases in the subsequent years. Also, if the amount of income reported is small at the time of granting, an 83(b) election might be beneficial.

When Is It Detrimental to File 83(b) Election?

If an 83(b) election was filed with the IRS and the equity value falls or the company files for bankruptcy, then the taxpayer overpaid in taxes for shares with a lesser or worthless amount. Unfortunately, the IRS does not allow an overpayment claim of taxes under the 83(b) election.

Another instance is if the employee leaves the firm before the vesting period is over then the filing of 83(b) election would turn out to be a disadvantage as they would have paid taxes on shares they would never receive. Also, if the amount of reported income is substantial at the time of the stock granting, filing for an 83(b) election will not make much sense.

What Is Profits Interest?

Profits interest refers to an equity right based on the future value of a partnership awarded to an individual for their service to the partnership. The award consists of receiving a percentage of profits from a partnership without having to contribute capital. In effect, it is a form of equity compensation and is used as a means of incentivizing employees when monetary compensation may be difficult due to limited funds, such as with a start-up limited liability company (LLC). Usually, this type of worker compensation requires an 83(b) election.

An 83(b) election allows someone to pay taxes on their stock awards at the time that they are granted, rather than at the time of vesting. This tax law is of particular benefit to startup employees, who may receive a large part of their compensation in the form of restricted stock or stock options. Since startups hope that their share value will increase rapidly, an 83(b) election allows these employees to reduce their tax burden in the long term.

Correction: June 14, 2023— An older version of this article incorrectly stated that someone making an 83(b) election would be taxed according to the cost of exercising their shares. In fact, the tax is based on the difference between the fair market value of the shares and the exercise price.

Internal Revenue Service. " 26 CFR 1.83-2: Election to include in gross income in year of transfer ," Pages 1-3.

Internal Revenue Service. " Internal Revenue Bulletin: 2016-33 ."

Internal Revenue Service. " 26 CFR 1.83-2: Election to include in gross income in year of transfer ," Pages 1-6.

Internal Revenue Service. " Topic No. 427 Stock Options ."

Internal Revenue Service. " 26 CFR 1.83-2: Election to include in gross income in year of transfer ," Page 6.

Internal Revenue Service. " Topic No. 409 Capital Gains and Losses ."

JPMorgan Chase. " Stock-Based Compensation and the 83(b) Election ."

:max_bytes(150000):strip_icc():format(webp)/GettyImages-655242786-038f5688f69840899bc4f35415351106.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

83(b) Election - What to File and When?

Scott Orn leverages his extensive venture capital experience from Lighthouse Capital and Hambrecht & Quist. With a track record of over 100 investments ranging from seed to Series A and beyond in startups, including notable deals with Angie’s List and Impossible Foods, Scott brings invaluable insights into financing strategies for emerging companies. His strategic role in scaling Kruze Consulting across major U.S. startup hubs underscores his expertise in guiding startups through complex financial landscapes.

Today I’m answering the question, what is an 83(b) election , and how and when to file? If you want to save on your business taxes, this is a must-read.

What is an 83(b) Election?

The 83(b) election is a formal letter that you send into the IRS telling the IRS that you are electing to buy your stock immediately, even if it hasn’t all vested yet, and you are looking to lock in a low tax basis.

Therefore, all appreciation after you’ve filed an 83(b), and after you bought that stock, is going to be taxed at a capital gains rate, which is about 20%.

If your company IPOs someday, you are going to have a huge gain, and will only have to pay capital gains tax.

Why Should You File an 83(b) Election?

This election is named after Section 83(b) of the Internal Revenue Code. When a founder or employee is granted restricted stock by a startup, it means they receive shares subject to certain rules. These restrictions may include a vesting schedule or other conditions that must be met for the shares to become fully transferable or non-forfeitable. Without making an 83(b) election, those founders or employees would typically be taxed on the value of the stock when it vests.

The 83(b) election can be a strategic tax planning tool, offering the potential for lower tax liability and the opportunity to optimize your tax position based on your expectations for the company’s growth.

An 83(b) Election Can Reduce Your Future Tax Liability - Sometimes Dramatically

By making an 83(b) election, you’re choosing to recognize the income associated with the restricted stock at the time of grant, even before it vests. This means you’re opting to pay taxes on the stock’s fair market value now, in exchange for a better tax rate later when your stock vests. So if you believe the value of your startup is going to increase significantly, you may find making an 83(b) election advantageous.

It’s important to note that an 83(b) election involves some risk. If the startup doesn’t succeed or the value of the stock decreases, you may have paid taxes on a higher value than the stock eventually proves to be worth. Founders should carefully consider their specific circumstances and consult with tax professionals before making this election.

What Do You Need to File?

Filing an 83(b) election isn’t that complicated, but it does have to be done in a timely manner, within 30 days of receiving your stock grant. So here are the steps you need to follow to complete the form. Below you’ll find information on how you actually need to file your election. It’s always a good idea to consult with your personal tax advisor or CPA; use this information and form at your own risk.

- Start by downloading this IRS Section 83(b) Election Form . You’re going to need some information to fill out the form, including the fair market value of the shares you’re receiving and the total amount of income that will be added to your gross income. There’s also a sample cover letter for you to include when you mail in your form.

- If you live in Florida, Georgia, North Carolina, or South Carolina send your form to Department of the Treasury, Internal Revenue Service, Atlanta, GA 39901-0002 .

- If you live in Arkansas, Connecticut, Delaware, District of Columbia, Maine, Maryland, Massachusetts, Missouri, New Hampshire, New Jersey, New York, Ohio, Pennsylvania, Rhode Island, Vermont, Virginia, or West Virginia, send your form to Department of the Treasury, Internal Revenue Service, Kansas City, MO 64999-0002 .

- If you live in Alabama, Kentucky, Louisiana, Mississippi, Tennessee, or Texas, send your form to Department of the Treasury, Internal Revenue Service, Austin, TX 73301-0002 .

- If you live in Alaska, Arizona, California, Colorado, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Utah, Washington, Wisconsin, or Wyoming, send your form to Department of the Treasury, Internal Revenue Service, Fresno, CA 93888-0002 .

- If you live in a foreign country, American Samoa, or Puerto Rico (or are excluding income under Internal Revenue Code section 933) or use an APO or FPO address, or file Form 2555, 2555-EZ, or 4563, or are a dual-status alien or nonpermanent resident of Guam or the Virgin Islands, send your form to Department of the Treasury, Internal Revenue Service, Austin, TX 73301-0215 .

- If you are a permanent resident of Guam, send your form to Department of Revenue and Taxation, Government of Guam, PO Box 23607, GMF, GU 96921 .

- If you are a permanent resident of the Virgin Islands, send your form to VI Bureau of Internal Revenue, 9601 Estate Thomas, Charlotte Amalie, St. Thomas, VI 00802 .

- Section 1 : Write your name, address, and Social Security Number on the appropriate lines.

- Section 2 : Provide the number of shares and a description of the shares for which you’re making the 83(b) election.

- Section 3 : Insert the calendar year during which you were granted your restricted stock.

- Section 4 : Describe the restrictions on your stock award. You can find this information in your stock award agreement.

- Section 5 : Note the closing price of your company’s stock on the grant date.

- Section 6 : Note the amount you paid for your stock award. If you didn’t pay anything, state that no amount was paid for your shares.

- Sign and date the form. You’ll need three copies (see below for more details on filing your election).

What if you don’t file an 83(b)?

If you forget or just don’t send in an 83(b) election form, you will have to pay income tax on the delta of appreciation every year as the stock vests. So if a stock goes up in value after the first year or two, you are going to have to pay income tax on that appreciation. And income tax rates are somewhere between 30 and 40%.

So there’s a really big delta there. You are talking about a lot of money, especially if your company gets bought or IPOs.

Additionally, you are setting the clock for your capital gains taxation period. Basically, if you hold your stock for long enough, when the company is sold or you sell the stock after it goes public, you either, personally, pay income tax or capital gains tax. In the US, long-term capital gains taxes are much, much lower. So you want to get that clock running as soon as possible so that you maximize the amount of gains that you get to claim as long-term capital gains.

When and How to File an 83(b) Election:

You only have 30 days to elect an 83(b) so do it right away, ideally the day your company is incorporated. Your trusted tax professionals can help you.

Fill out that 83(b) election form that was provided to you, and mail it in to the IRS with certified mail to have proof that you sent it in. Note the certified mail part - more on that in a bit - but it’s really the only way to confirm that the IRS actually got your election.

More detail on how to actually file the election

- Prepare Your 83(b) Election Form: Ensure that your form is accurately filled out and includes all the necessary information.

- Make 3 copies of the form - one for yourself (keep this in a safe place), one to give to your startup, and one to send to the IRS.

- Visit Your Local Post Office: You cannot send certified mail from your home mailbox; it needs to be processed at a post office.

- Request Certified Mail Service: At the post office, inform the clerk that you want to send your envelope via certified mail. You’ll be given a certified mail form to fill out.

- Attach the Certified Mail Form: The form has a barcode for tracking and a perforated receipt. Attach the form to the front of your envelope, as directed.

- Pay for Postage and Fees: Certified mail costs slightly more than regular postage. Pay the required amount, which will include the postage and a small fee for the certified service.

- Obtain a Mailing Receipt: After processing, you’ll receive a mailing receipt. Keep this as it’s your proof of mailing.

- Track Your Mail: Use the tracking number on your receipt to monitor the delivery status online through the USPS website.

- Wait for Delivery Confirmation: Once delivered, you’ll receive an electronic confirmation of the date and time of delivery and the recipient’s signature.

- Ask your personal tax CPA if you need to append a copy of the form to your state tax returns - some states have specific rules, so consulting with your tax person.

How do you confirm with the IRS that they got your 83(b) election?

Really, the only way to confirm that the IRS got your election is to send the election using certified mail. When you send something by certified mail, you’ll receive a mailing receipt and a unique tracking number. Additionally, the IRS or any recipient must sign upon delivery, providing you with an electronic verification that the document was received. This is proof that they got your filing - keep it so that if there are any problems down the line you have the proof!

In closing, filing an 83(b) form is worth it. Again, make sure to file within the allotted time frame. This will ensure that your company gets favorable tax treatment.

Contact Us for a Free Consultation

Get the information you need

Startup CEO Salary Calculator

US Based Companies that have raised under $100M

Top Articles

Pre-Seed Funding + Top 20 Funds

eCommerce Accounting

Accounts Receivable Loans

What is the 2% and 20% VC fee structure?

How much does a 409A valuation cost?

What are Your VC’s Return Expectations Depending on the Stage of Investment?

Fractional CFOS

How much can your startup save in payroll taxes?

Estimate your R&D tax credit using our free calculator.

Signup for our newsletter

Popular pages

SaaS accounting 101

Best accounting software

Top banks for startups

How to account for convertible note

Average CEO Pay

Startup Tax Returns

Best VC Pitch Decks

83B HR Cap Table

What is a Secondary Stock Transaction?

Startup Operations Cap Table

How to Handle a Co-Founder Departure

Startup Operations HR

What Does the VP of Ops or COO At a Startup Do?

Startup Operations 83B Cap Table

How to Legitimize a Handshake Equity Agreement Between Founders

Kruze is a leader in accounting services for startups

With over $10 billion in funding raised by our clients, Kruze is a leader in helping funded startups with accounting, tax, finance and HR strategies.

Your request has been submitted. We will contact you shortly.

Tax Resources

- Startup Taxes

- Startup Tax Deadlines

- Startup Tax Returns 101

Tax Credits

- Startup Tax Credits

- Research Tax Credit

- California R&D Tax Credit

Tax Calculators

- Tax Return Calculator

- R&D Tax Credit Calculator

- DE Franchise Tax Calculator

Tax Form Help

- Startup 1099 Forms

Important Tax Dates for Startups

- C-Corp Tax Deadlines

- Atlanta Tax Deadlines

- Austin Tax Deadlines

- Boston Tax Deadlines

- Chicago Tax Deadlines

- Dallas Tax Deadlines

- Miami Tax Deadlines

- Mountain View Tax Deadlines

- New York City Tax Deadlines

- Palo Alto Tax Deadlines

- Salt Lake City Tax Deadlines

- San Francisco Tax Deadlines

- San Jose Tax Deadlines

- Santa Monica Tax Deadlines

- Seattle Tax Deadlines

- Washington DC Tax Deadlines

Is the content on this page useful?

Your feedback is very important.

United States: What Is A Section 83(B) Election And Why Should You File One?

Update: on April 15, 2021, the Internal Revenue Service announced that it would temporarily (through December 31, 2021) allow Section 83(b) elections to be signed digitally or electronically, instead of requiring handwritten signatures.

Many founders come to us with questions about Section 83(b) elections . They have often heard in startup circles that they need to file these, but may not understand when it makes sense to do so or what problem the Section 83(b) election solves. This article seeks to clear up some of the confusion about Section 83(b) elections.

So what is a Section 83(b) election? It's a letter you send to the Internal Revenue Service letting them know you'd like to be taxed on your equity , such as shares of restricted stock, on the date the equity was granted to you rather than on the date the equity vests. Put simply, it accelerates your ordinary income tax. Please note that Section 83(b) elections are applicable only for stock that is subject to vesting, since grants of fully vested stock will be taxed at the time of the grant.

A Little Background on Taxes

To provide some simple tax background, there are different types of tax rates. The maximum ordinary income tax rate in 2020 is 37%, whereas the maximum long-term capital gains rate in 2020 is 20%. Because the United States uses graduated tax rates (meaning the rates vary based on your income), you may actually be subject to lower rates, but in each case the long-term capital gains rate will be lower than the ordinary income tax rate.

Assuming you paid nothing for your restricted stock, you will be taxed on the value of your restricted stock as determined at grant (if a Section 83(b) election is filed), or at vesting (if no Section 83(b) election is filed), in each case at the applicable ordinary income tax rate. When you later sell your stock, assuming it's been more than one year from the date of grant (if a Section 83(b) election is filed), or more than one year from the date of vesting (if no Section 83(b) election is filed), the additional gain will be taxed at the applicable long-term capital gains rate. Because the long-term capital gains rate will be lower, the goal here is to get as much of your gain as possible taxed using that rate, rather than the ordinary income tax rate.

Two Simple Examples

In each of the below examples, assume you receive 100,000 shares subject to vesting, worth $.01 per share at the time of grant, $1.00 per share at the time of vesting, and $5.00 per share when sold more than one year later. We'll also assume you are subject to the maximum ordinary income tax rate and long-term capital gains rate. For simplicity, we will not discuss employment tax or state tax consequences.

Example 1 – 83(b) Election

In this example you timely file a Section 83(b) election within 30 days of the restricted stock grant, when your shares are worth $1,000. You pay ordinary income tax of $370 (i.e., $1,000 x 37%). Because you filed a Section 83(b) election, you do not have to pay tax when the stock vests, only on the sale. On the sale (which occurs more than one year after the date of grant) you recognize a taxable gain of $4.99 per share (not $5.00, because you get credit for the $.01 per share you already took into income), and pay additional tax of $99,800 (i.e., $499,000 x 20%). Your economic gain after tax? $399,830 (i.e., $500,000 minus $370 minus $99,800).

Example 2 – No 83(b) Election

In this example you do not file a Section 83(b) election. So you pay no tax at grant (because the shares are unvested), but instead recognize income of $100,000 when the shares vest and thus have ordinary income tax of $37,000. On the sale (which occurs more than one year after the date of vesting) you recognize a taxable gain of $4.00 per share (not $5.00, because you get credit for the $1.00 per share you already took into income), and pay additional tax of $80,000 (i.e., $400,000 x 20%). Your economic gain after tax? $383,000 (i.e., $500,000 minus $37,000 minus $80,000).

So in the above example, filing a Section 83(b) election would have saved you $16,830 .

Filing a Section 83(b) election also has two other benefits. It would have prevented you from having a $37,000 tax hit when the stock vested, which may have been at a time you may not have had cash to pay the tax, and it also starts your long-term capital gains (and qualified small business stock) holding period clock earlier – meaning that you get the long-term capital gains rate as long as the sale of your shares occurs more than a year after grant, rather than a year after vesting (and, in the case of qualified small business stock, you can avoid federal tax entirely if the sale occurs more than five years after grant and certain other conditions are met). For more information on qualified small business stock, please see this article .

So, you may ask, "if Section 83(b) elections are so beneficial, why doesn't everyone file one?" If you receive restricted stock worth a nominal amount, it virtually always makes sense to file one. However, what if instead of receiving 100,000 shares of restricted stock worth $.01 per share, you received 100,000 shares of restricted stock worth $1.00 per share? Filing a tax code Section 83(b) election would immediately cause you tens of thousands of dollars of tax. And if the company subsequently fails, and in particular if it fails before your stock vests, you likely would have been economically better off to not have filed a Section 83(b) election.

Bottom line – discuss with your individual tax advisor, but remember that the filing must be made (if at all) within 30 days after the grant date of your restricted stock, as that is an absolute deadline that cannot be cured. And note that the grant date of your restricted stock is usually the date the board approves the grant, even if you don't receive the restricted stock paperwork until later – so sometimes you need to act fast in making this decision and filing the correct paperwork.

Instructions for Filing a Section 83(b) Election

The instructions below are intended for individual US-based purchasers based on regulations issued in July 2016. You should contact your tax professional to review your Section 83(b) election before filing with the IRS. Other purchasers, including corporate or trust purchasers, should contact legal and tax professionals licensed in their jurisdiction.

Please note that the election must be filed with the IRS within 30 days of the date of your restricted stock grant . Failure to file within that time will render the election void and you may recognize ordinary taxable income as your vesting restrictions lapse.

- Make three copies of the completed and signed election form and one copy of the IRS cover letter.

- Send the original completed and signed election form and cover letter, the copy of the cover letter, and a self-addressed stamped return envelope to the Internal Revenue Service Center where you would otherwise file your tax return. Even if an address for an Internal Revenue Service Center is already included in the forms below, it is your obligation to verify such address. This can be done by searching for the term "where to file" on www.irs.gov or by calling 1 (800) 829-1040. Sending the election via certified mail, requesting a return receipt, with the certified mail number written on the cover letter is also recommended.

- Deliver one copy of the completed election form to the Company.

- Applicable state law may require that you attach a copy of the completed election form to your state personal income tax return(s) when you file it for the year (assuming you file a state personal income tax return). Please consult your personal tax advisor(s) to determine whether or not a copy of this Section 83(b) election should be filed with your state personal income tax return(s).

- Retain one copy of the completed election form for your personal permanent records.

Note: an additional copy of the completed election form must be delivered to the transferee (recipient) of the property if the service provider and the transferee are not the same person.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

© Mondaq® Ltd 1994 - 2024. All Rights Reserved .

Login to Mondaq.com

Password Passwords are Case Sensitive

Forgot your password?

Why Register with Mondaq

Free, unlimited access to more than half a million articles (one-article limit removed) from the diverse perspectives of 5,000 leading law, accountancy and advisory firms

Articles tailored to your interests and optional alerts about important changes

Receive priority invitations to relevant webinars and events

You’ll only need to do it once, and readership information is just for authors and is never sold to third parties.

Your Organisation

We need this to enable us to match you with other users from the same organisation. It is also part of the information that we share to our content providers ("Contributors") who contribute Content for free for your use.

How To Do an 83(b) Election

By AJ Ayers, CFP®, EA, CEP

Reader, I have failed you. I could not come up with a clever analogy for an 83(b) election. This elusive and often misunderstood tax rule is straightforward, but due to its extremely tight deadlines, is feared by many.

In its simplest terms, an 83(b) election is a declaration to the IRS that you would like to pay taxes NOW on shares in a company that may go up in value in the future. An 83(b) election literally freezes the taxes and fixes the amount of income that may or may not show up on your tax return. Remember, anytime you receive payment for work you did, the IRS will collect tax on that income. In this case - the difference in price between the grant price of stock or options issued to founders and the current fair market value (often referred to as the spread) of that stock is taxable income.

In other words: ask the IRS to get taxed on your shares when the company is practically worthless (because it hasn’t been built yet) and only pay capital gains taxes on those shares when you sell them in the future.

Most shares in a company, whether issued by the founders to themselves, or to employees later as part of an employee ownership stock plan, are subject to some sort of vesting schedule.

Vesting means that you receive shares over time as long as certain conditions are met. The most common condition is that you still work at the company.

When a company is formed, shares are often issued to the owners at a minuscule value of say, $0.001 per share. If a founder gets 1,000,000 of those shares, they would recognize income of $1,000.

Why Vesting?

Imagine there are three co-founders of a software company, and they own the company exactly equally – in our example, there are 3 million shares. For some reason, they did not put a vesting schedule in place and all of their stock vested immediately. They each pay tax on $1,000 of income (no problem) for their 1 million shares. Now let’s say founder A decides that she doesn’t want to work at the company anymore, let’s say her parent passed away and she feels an obligation to go run the family business. Now that’s obviously very sad and we wish her all the best, except now we have two founders who are working 80- hour work weeks to get this company off the ground and founder A is no longer involved at all. Now they must hire someone to replace founder A who left, and by the way still very much legally and rightfully owns 1/3rd of the company. That’s why we have vesting schedules folks.

Now let’s take that same example above but put in a vesting schedule – meaning that the owners can only actually receive the shares of stock at predetermined times as long as they meet the requirement that they still work at the company.

Let’s assume a simplified 4-year vesting schedule – meaning 1/4th of the shares vest at the one-year anniversary of the grant, 2 year anniversary, and so on. So, employee A bailed six months in and didn’t get squat.

Employees B and C are there to receive their shares on their one-year anniversary and they are stoked. They each get 1/4th of their 1,000,000 shares – so 250,000 shares apiece. So they should just have to pay tax on $250 (250,000 shares times the minuscule par value of $0.001 per share) EXCEPT ONE PROBLEM: this software company is legit and attracted the attention of a major VC firm who already valued their IP at $10 million dollars which means that those 3 million shares have increased in value to $3.33. That’s great news, except now as their shares vest, the IRS wants them to be taxed at the Fair Market Value. This means founders B and C now have a major tax problem: $832,500 (250,000 shares x $3.33) is going to be taxed at ordinary income tax rates (as high as 37%).

How could they have avoided this?