- Resume Builder

- Resume Templates

- Resume Formats

- Resume Examples

- Cover Letter Builder

- Cover Letter Templates

- Cover Letter Formats

- Cover Letter Examples

- Career Advice

- Interview Questions

- Resume Skills

- Resume Objectives

- Job Description

- Job Responsibilities

- FAQ’s

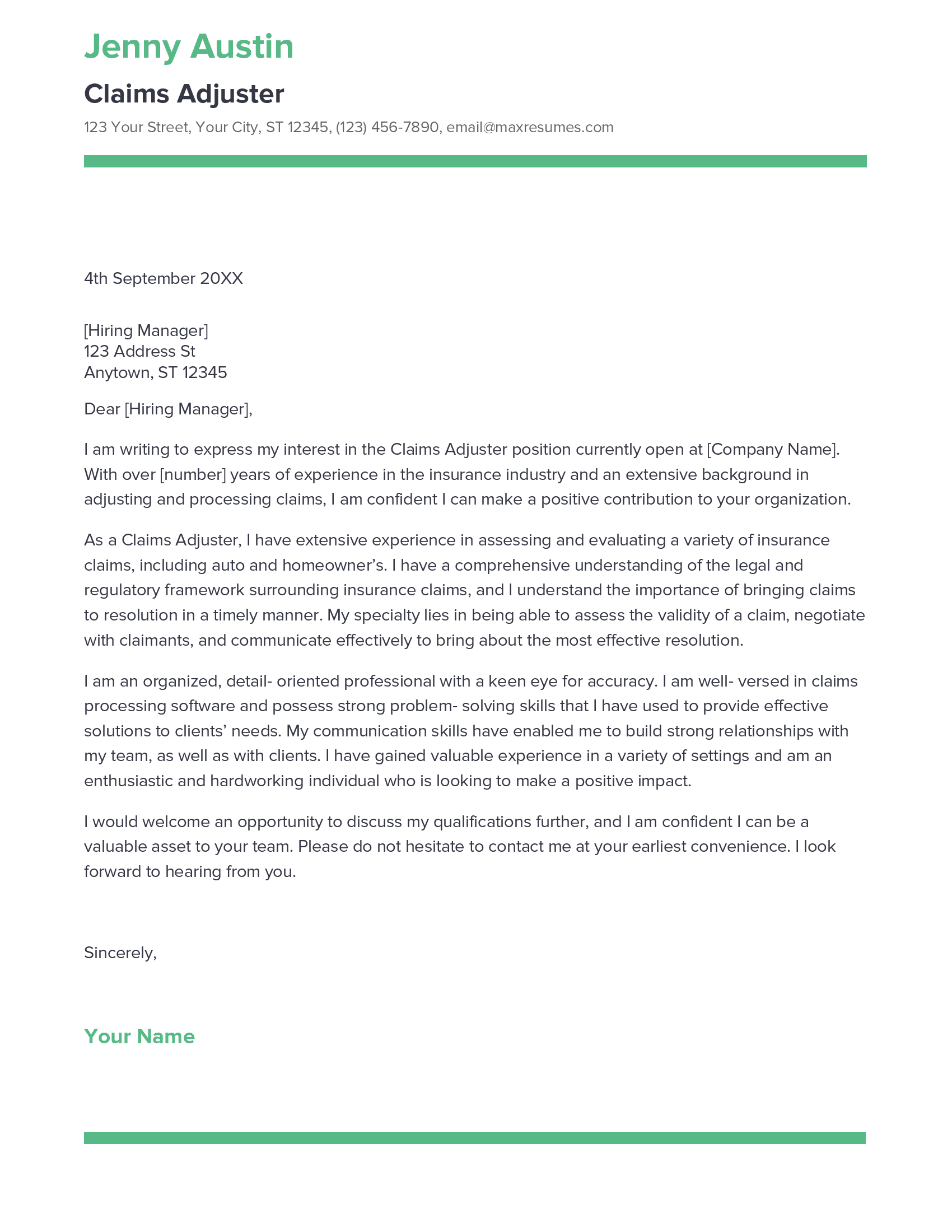

Claims Adjuster Cover Letter Example

Looking for a job in claims adjusting can be exciting, yet overwhelming. Crafting a winning cover letter is an essential part of your job search. A strong cover letter not only showcases your skills, education and experience, but can also be an effective way to demonstrate your enthusiasm and passion for the job. This guide will provide helpful tips and an example of a claims adjuster cover letter that can help you stand out to potential employers.

Download the Cover Letter Sample in Word Document – Click Below

If you didn’t find what you were looking for, be sure to check out our complete library of cover letter examples .

Start building your dream career today!

Create your professional cover letter in just 5 minutes with our easy-to-use cover letter builder!

Claims Adjuster Cover Letter Sample

Dear [Hiring Manager’s Name],

I am writing to express my interest in the Claims Adjuster position currently open at [Company Name]. With over [number] years of experience in the insurance industry and an extensive background in adjusting and processing claims, I am confident I can make a positive contribution to your organization.

As a Claims Adjuster, I have extensive experience in assessing and evaluating a variety of insurance claims, including auto and homeowner’s. I have a comprehensive understanding of the legal and regulatory framework surrounding insurance claims, and I understand the importance of bringing claims to resolution in a timely manner. My specialty lies in being able to assess the validity of a claim, negotiate with claimants, and communicate effectively to bring about the most effective resolution.

I am an organized, detail- oriented professional with a keen eye for accuracy. I am well- versed in claims processing software and possess strong problem- solving skills that I have used to provide effective solutions to clients’ needs. My communication skills have enabled me to build strong relationships with my team, as well as with clients. I have gained valuable experience in a variety of settings and am an enthusiastic and hardworking individual who is looking to make a positive impact.

I would welcome an opportunity to discuss my qualifications further, and I am confident I can be a valuable asset to your team. Please do not hesitate to contact me at your earliest convenience. I look forward to hearing from you.

[Your Name]

Create My Cover Letter

Build a profession cover letter in just minutes for free.

Looking to improve your resume? Our resume examples with writing guide and tips offers extensive assistance.

What should a Claims Adjuster cover letter include?

A claims adjuster cover letter should provide an overview of the candidate’s credentials, qualifications, and experience. It should also demonstrate the candidate’s understanding of the claims adjusting process and how their skills, knowledge, and experience can be put to use to effectively manage and handle claims. The cover letter should also include the candidate’s enthusiasm for the position and their eagerness to join the organization and contribute to its success.

Additionally, the cover letter should explain why the candidate is the ideal fit for the role and how they can benefit the organization’s overall success. It should also provide evidence of the candidate’s strong communication skills and any other relevant skills or qualifications that may be pertinent to the role. Finally, it should also explain why the candidate is passionate about the claims adjusting profession, and why they believe they would be an asset to the organization.

Claims Adjuster Cover Letter Writing Tips

A claims adjuster cover letter is an important document when applying for a job as a claims adjuster. It’s critical that your cover letter outlines the skills, experience and qualifications that make you a good fit for the position. Here are some tips for writing an effective claims adjuster cover letter:

- Make sure you include relevant information regarding your experience and qualifications. Make sure to clearly state why you are a good fit for the position and how your skills and expertise will help the company.

- Keep the letter short and to the point. A cover letter should not exceed one page.

- Use a professional tone when writing the letter. Be sure to use correct grammar, punctuation and spelling.

- Include a catchy opening line to grab the reader’s attention.

- Focus on how you can help the company. Make sure to include examples of your past experience and successes that demonstrate how you can help the company.

- Use keywords from the job description in your letter.

- Demonstrate your knowledge of the claims adjuster job. Show that you have done your research and know what the job entails.

- Ensure the format is neat and organized. Double check for any typos or errors.

- Finish your letter with a strong closing that outlines how you can be contacted.

Following these tips will help you write a strong cover letter that will give you the best chance of getting an interview. Make sure to take your time and craft a letter that is professional and showcases your qualifications. Good luck!

Common mistakes to avoid when writing Claims Adjuster Cover letter

Writing a cover letter for a Claims Adjuster role can be a daunting task. It is important to make sure your cover letter covers the key points that hiring managers are looking for in a great candidate. Here are some common mistakes to avoid while writing your Claims Adjuster cover letter:

- Not including a professional summary: A professional summary is a great way to provide a brief overview of your qualifications and experience. It should be written in the first paragraph of your cover letter and should provide an overview of your skills and experience that make you a great candidate for the role.

- Not addressing the role’s requirements: Make sure to look over the job description and highlight the qualifications, skills, and experience that you possess that match the position’s requirements. This way, you can demonstrate to the hiring manager that you are the best candidate for the job.

- Not showing interest in the company: Take the time to research the company so that you can write a personalized cover letter that demonstrates your knowledge of the company and your enthusiasm for the position.

- Making your cover letter too long: Make sure to edit your cover letter to make sure it is concise and to the point. A good rule of thumb is to keep your cover letter to one page or less.

- Not proofreading and editing: Make sure to read through your cover letter multiple times and have someone else review it for you. This will ensure that you have eliminated any typos or grammatical errors.

By avoiding these common mistakes, you will be able to craft an effective and professional cover letter that will make you a standout candidate for the Claims Adjuster role.

Key takeaways

A Claims Adjuster cover letter is an important aspect of your job application package as it boosts your chances of getting an interview. Therefore, you must invest your time and effort in writing an impressive cover letter. Here are some essential tips to keep in mind when writing a Claims Adjuster cover letter:

- Focus on the employer’s needs: Before you get started, take the time to research the employer and find out what they’re looking for in a Claims Adjuster. This will help you tailor your cover letter to their specific needs.

- Highlight your accomplishments: Make sure to highlight your successes and accomplishments in the Claims Adjuster field. This will demonstrate to the employer that you are a capable and competent professional.

- Showcase your skills: Use your cover letter to showcase your skills and abilities as a Claims Adjuster. Make sure to emphasize any experience you have in customer service, problem- solving, and research.

- Be concise: The key to an effective cover letter is to be concise and direct. Avoid long- winded sentences and stick to the main points.

- Proofread: Always take the time to proofread your cover letter to ensure there are no grammar or spelling errors.

Following these tips will help you write an impressive Claims Adjuster cover letter. Take the time to craft a thoughtful and well- written cover letter and you will have a much greater chance of success.

Frequently Asked Questions

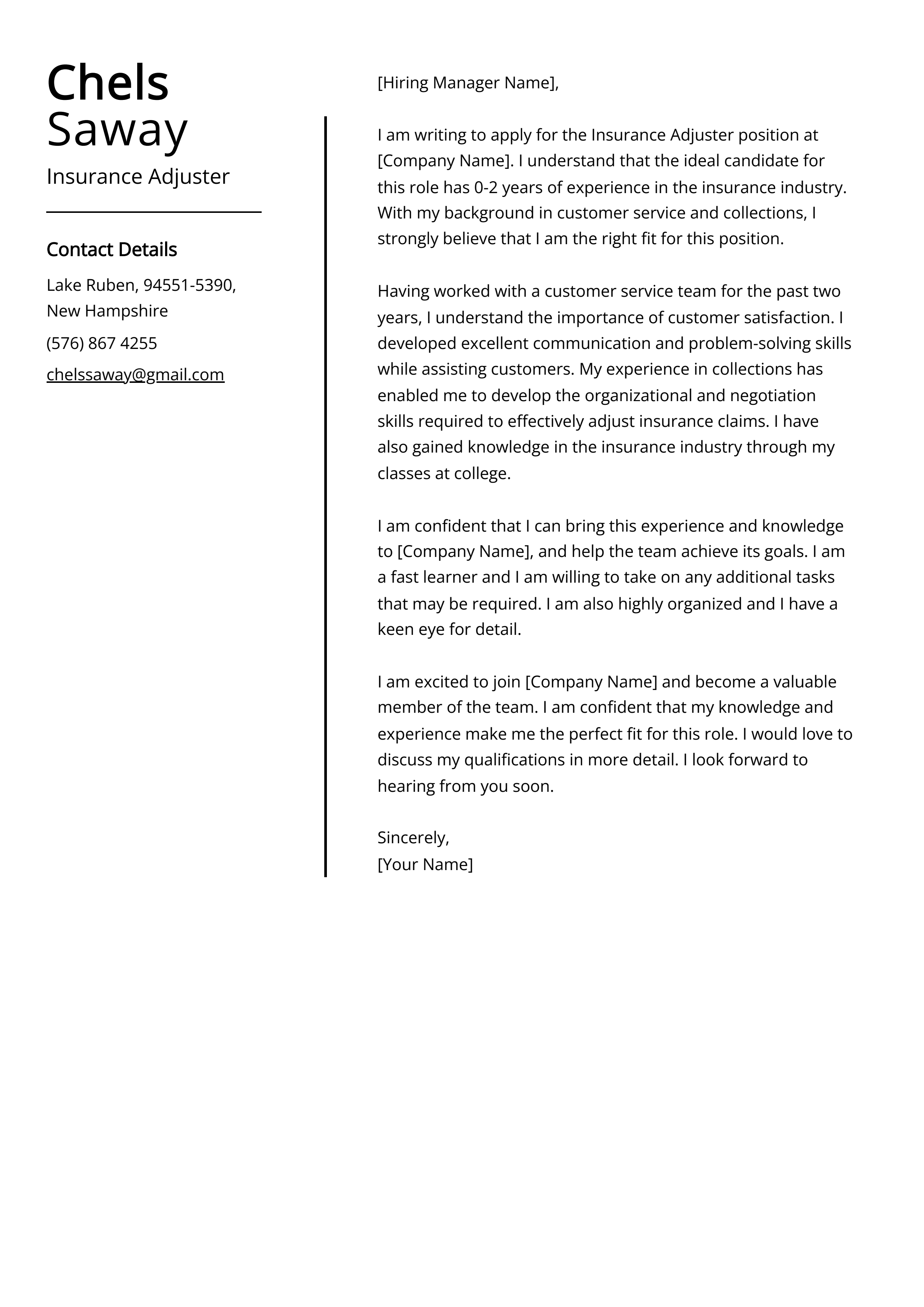

1. how do i write a cover letter for an claims adjuster job with no experience.

As a Claims Adjuster with no experience, it can be difficult to know how to write an effective cover letter. However, there are certain things you can focus on in your cover letter to make sure it stands out from the competition.

Begin your cover letter by introducing yourself and explaining your interest in the Claims Adjuster position. Next, explain your qualifications and any related experience that you have that may be relevant to the job. You might include previous customer service roles, organization, communication, and research skills that you possess.

Finally, illustrate your enthusiasm for the role, and encourage the reader to contact you for an interview. Don’t forget to check your cover letter for errors and typos.

2. How do I write a cover letter for an Claims Adjuster job experience?

If you already have Claims Adjuster experience, your cover letter should focus on the specific accomplishments you achieved in your previous roles. Begin your cover letter by introducing yourself and explaining your interest in the Claims Adjuster position.

Next, highlight your qualifications and emphasize any related experience that you have. You can mention how many years of Claims Adjuster experience you have, as well as any awards or recognition that you earned. Be sure to illustrate how your experience has prepared you for the role and make sure to emphasize your ability to work with customers, as well as your skills in research and organization.

Finally, highlight your enthusiasm for the role and encourage the reader to contact you for an interview.

3. How can I highlight my accomplishments in Claims Adjuster cover letter?

When highlighting your accomplishments in your Claims Adjuster cover letter, focus on specific achievements that are related to the position. For example, you can mention any awards or recognition that you have earned in the Claims Adjuster field.

You can also illustrate how your experience has prepared you for the role, such as your ability to research, analyze data, and create accurate and efficient solutions. Be sure to explain how your experience has helped you to excel in the Claims Adjuster field.

Finally, emphasize your enthusiasm for the role and explain why you are the ideal candidate for the position.

4. What is a good cover letter for an Claims Adjuster job?

A good cover letter for a Claims Adjuster job should focus on your relevant qualifications and experience. Begin your cover letter by introducing yourself and explaining your interest in the Claims Adjuster position.

Next, explain your qualifications and any related experience that you have. Be sure to illustrate how your experience has prepared you for the role and emphasize your ability to work with customers, as well as your skills in research and organization.

In addition to this, be sure to check out our cover letter templates , cover letter formats , cover letter examples , job description , and career advice pages for more helpful tips and advice.

Let us help you build your Cover Letter!

Make your cover letter more organized and attractive with our Cover Letter Builder

Insurance Claims Adjuster Cover Letter Examples & Writing Guide

- Updated August 30, 2023

- Published July 23, 2023

Are you looking for an Insurance Claims Adjuster cover letter example? Read our ultimate Insurance Claims Adjuster cover letter writing guide and learn from tips, examples, and proven strategies to land a job interview.

Insurance claims adjusters play a crucial role in the insurance industry, as they are responsible for evaluating and settling insurance claims made by policyholders. They are tasked with determining the validity and amount of a claim, conducting investigations, and negotiating settlements with claimants. A cover letter is an essential component of an applicant’s job application, as it provides an opportunity to showcase one’s qualifications and express their interest in the position.

A well-written cover letter can make all the difference when applying for an insurance claims adjuster job. It should highlight your relevant skills, experience, and achievements in the field. The cover letter should also demonstrate your understanding of the insurance industry and the role of claims adjusters. It should be tailored specifically to the position being applied for and grab the hiring manager’s attention, highlighting your unique qualities and making them stand out from other candidates.

What does an Insurance Claims Adjuster do?

An Insurance Claims Adjuster is a professional who investigates insurance claims to determine the extent of coverage and the appropriate settlement amount. They work for insurance companies and are responsible for assessing the validity of insurance claims, analyzing policy details, and verifying the cause and extent of the reported loss or damage.

Insurance Claims Adjusters conduct interviews with policyholders, witnesses, and relevant parties to gather information and evidence for their evaluation. They may also visit accident scenes or damaged properties to assess the extent of the loss. Based on their investigations, they negotiate and settle claims with claimants or their representatives. Additionally, Claims Adjusters maintain detailed records, prepare reports, and work with legal and medical experts when necessary to accurately assess and resolve claims in a timely manner.

Insurance Claims Adjuster Cover Letter

Below we discuss some essential points to focus on when writing your cover letter.

- Insurance Knowledge and Expertise : In your cover letter, highlight your understanding of insurance policies and claim procedures. Showcase any relevant certifications or training in insurance adjusting and your experience in the insurance industry.

- Investigative and Analytical Skills : Claims Adjusters need to be detail-oriented and possess strong investigative and analytical skills. Illustrate your ability to gather and evaluate information, assess damages, and make fair and accurate claim assessments.

- Communication and Negotiation Abilities : Claims Adjusters interact with claimants and various stakeholders, so effective communication and negotiation skills are crucial. Emphasize your ability to handle challenging conversations and negotiate settlements professionally and courteously.

- Time Management and Prioritization : Claims Adjusters often handle multiple claims simultaneously. Showcase your time management skills and your ability to prioritize tasks to ensure prompt and efficient claim resolution.

In summary, an Insurance Claims Adjuster investigates insurance claims, assesses damages, and negotiates settlements to ensure fair compensation for policyholders. When writing a cover letter for an Insurance Claims Adjuster position, highlight your insurance knowledge and expertise, investigative and analytical skills, communication and negotiation abilities, and time management and prioritization capabilities.

Tailor your cover letter to the specific insurance company, expressing your genuine interest in contributing your expertise to accurately and efficiently resolve claims and supporting the company’s commitment to excellent customer service and claim handling.

Insurance Claims Adjuster Cover Letter Example 1

Dear [Hiring Manager],

I am writing to express my keen interest in the Insurance Claims Adjuster position at [Company Name]. With a strong background in insurance claims processing and a passion for providing exceptional customer service, I am confident that my skills and experience align perfectly with the requirements of the role.

As a detail-oriented professional with [number of years] of experience in the insurance industry, I have a proven track record of accurately evaluating and settling claims efficiently. I possess an in-depth understanding of insurance policies, regulations, and industry best practices, which enables me to handle complex claims with precision and fairness.

Throughout my career, I have demonstrated excellent communication and negotiation skills, allowing me to work collaboratively with clients, attorneys, and other stakeholders to reach fair and satisfactory claim resolutions. I take pride in my ability to provide empathetic support to policyholders during challenging times, earning their trust and loyalty.

I am excited about the opportunity to contribute my expertise and dedication to the success of [Company Name]. I believe my strong analytical mindset, adaptability, and commitment to excellence make me a valuable asset to your claims team.

Thank you for considering my application. I am eager to discuss how my skills can benefit [Company Name]’s mission and look forward to the possibility of joining your team as an Insurance Claims Adjuster.

Insurance Claims Adjuster Cover Letter Example 2

As a seasoned insurance professional with a passion for accuracy and customer satisfaction, I am excited to apply for the Insurance Claims Adjuster position at [Company Name]. With a successful track record of [number of years] years in claims assessment and resolution, I am confident in my ability to contribute effectively to your team.

Throughout my career, I have honed my skills in evaluating, investigating, and settling claims, ensuring fair and prompt resolution for policyholders. My comprehensive understanding of insurance policies and regulations has enabled me to handle diverse claim scenarios with meticulous attention to detail.

I thrive in fast-paced environments and have a proven ability to manage a high volume of claims without compromising quality. Moreover, my strong communication and negotiation skills have been instrumental in fostering positive relationships with clients, colleagues, and external stakeholders.

At [Company Name], I see an opportunity to align my expertise with a dynamic organization known for its commitment to excellence. I am eager to contribute my problem-solving abilities and dedication to superior customer service to further enhance your claims department’s effectiveness.

Thank you for considering my application. I am eager to discuss my qualifications further and learn more about the exciting opportunities at [Company Name] as an Insurance Claims Adjuster.

Insurance Claims Adjuster Cover Letter Example 3

I am writing to express my strong interest in the Insurance Claims Adjuster role at [Company Name]. With a background in insurance claims management and a proven ability to deliver efficient and fair claim resolutions, I believe I would be a valuable addition to your team.

Having worked in the insurance industry for [number of years] years, I possess a comprehensive understanding of policy coverage and claim processing procedures. My exceptional attention to detail and analytical skills allow me to assess claims accurately and expedite the settlement process while maintaining compliance with industry regulations.

I take pride in my ability to communicate clearly and empathetically with policyholders during challenging times, ensuring a positive customer experience throughout the claims process. Furthermore, my strong negotiation skills have resulted in successful resolutions and minimized financial losses for both clients and the company.

I am impressed by [Company Name]’s commitment to excellence and dedication to serving its customers with integrity. I am enthusiastic about the opportunity to contribute my expertise to your reputable organization and help maintain your high standards of customer satisfaction.

Thank you for considering my application. I would welcome the chance to discuss how my skills and experience align with [Company Name]’s goals as an Insurance Claims Adjuster in more detail.

Related : What Does an Insurance Advisor Do?

Insurance Claims Adjuster Cover Letter Example 4

I am writing to express my keen interest in the Insurance Claims Adjuster position at [Company Name]. With a proven track record of [number of years] years in effectively handling insurance claims, I am eager to bring my expertise and dedication to your esteemed organization.

Throughout my career, I have demonstrated a strong ability to assess and analyze complex claims, ensuring accurate and timely settlements for policyholders. My thorough knowledge of insurance policies, combined with my attention to detail, allows me to navigate through intricate claim scenarios with efficiency and fairness.

Customer satisfaction is at the forefront of my approach. I am skilled in providing compassionate and professional assistance to policyholders, making them feel supported and valued throughout the claims process. My communication and negotiation abilities have facilitated positive outcomes while maintaining positive relationships with all stakeholders involved.

Thank you for considering my application. I would welcome the opportunity to further discuss my qualifications and how I can contribute to the success of [Company Name] as an Insurance Claims Adjuster.

Related : Aflac Interview Questions & Answers

Insurance Claims Adjuster Cover Letter Example 5

I am excited to apply for the Insurance Claims Adjuster position at [Company Name], as advertised. With a solid background in insurance claims handling and a passion for delivering exceptional service, I am confident that my skills align perfectly with the requirements of the role.

As an experienced Insurance Claims Adjuster with [number of years] years in the industry, I have honed my expertise in evaluating, investigating, and resolving a wide range of claims. I am well-versed in interpreting insurance policies and ensuring adherence to regulatory guidelines throughout the claims process.

My ability to efficiently analyze claims data and apply fair settlement practices has consistently resulted in positive outcomes for both policyholders and the company. I possess strong communication skills, allowing me to build rapport with clients and collaborate effectively with colleagues and external partners.

I am drawn to [Company Name] for its reputation as a leader in the insurance industry and its commitment to client satisfaction. I am eager to contribute my skills to a dynamic team that values excellence and continuous improvement.

Thank you for considering my application. I look forward to the opportunity to discuss how my qualifications and dedication make me a strong fit for the Insurance Claims Adjuster position at [Company Name].

Related : What Does an Insurance Specialist Do?

Insurance Claims Adjuster Cover Letter Writing Tips

Below, you will find some general and specific tips that you can use to your advantage when writing your cover letter.

General Tips:

- Customize the cover letter to the specific position you are applying for.

- Address the letter to the hiring manager or the person in charge of the hiring process.

- Use a clear, concise, and professional tone throughout the letter.

- Avoid using any slang or colloquial language.

- Be sure to proofread your cover letter to avoid any spelling or grammar mistakes.

Specific Tips:

- Start by highlighting your experience in the insurance industry, specifically in claims adjusting.

- Mention any relevant training or certifications you have received.

- Explain how your experience and qualifications make you an ideal candidate for the role.

- Highlight your problem-solving skills and ability to assess claims efficiently and effectively.

- Provide examples of how you have successfully handled claims in the past, highlighting your attention to detail and ability to work under pressure.

- Emphasize your ability to communicate effectively and work well with clients and other stakeholders.

- Conclude by expressing your interest in the position and your enthusiasm for the opportunity to join the company.

Related : New York Life Interview Questions & Answers

Related posts:

- Museum Guide Cover Letter Examples & Writing Guide

- Accountant Cover Letter Examples & Writing Guide

- Water Technician Cover Letter Examples & Writing Guide

- Office Assistant Cover Letter Examples & Writing Guide

- Clinical Research Associate Cover Letter Examples & Writing Guide

Rate this article

Your page rank:

MegaInterview Company Career Coach

Step into the world of Megainterview.com, where our dedicated team of career experts, job interview trainers, and seasoned career coaches collaborates to empower individuals on their professional journeys. With decades of combined experience across diverse HR fields, our team is committed to fostering positive and impactful career development.

You may also be interested in:

- Cover Letter

Lineman Cover Letter Examples & Writing Guide

Logistics officer cover letter examples & writing guide, maintenance worker cover letter examples & writing guide, medical sales cover letter examples & writing guide, interview categories.

- Interview Questions

- Interview Tips

Megainterview/Contact

- Career Interview Questions

- Write For Megainterview!

- Editorial Policy

- Privacy Policy / GDPR

- Terms & Conditions

- Contact: [email protected]

Sign-up for our newsletter

🤝 We’ll never spam you or sell your data

Popular Topics

- Accomplishments

- Adaptability

- Career Change

- Career Goals

- Communication

- Conflict Resolution

- Creative Thinking

- Critical Thinking

- Cultural Fit

- Customer Service

- Entry-Level & No Experience

- Growth Potential

- Honesty & Integrity

- Job Satisfaction

- Negotiation Skills

- Performance Based

- Phone Interview

- Problem-Solving

- Questions to Ask the Interviewer

- Salary & Benefits

- Situational & Scenario-Based

- Stress Management

- Time Management & Prioritization

- Uncomfortable

- Work Experience

Popular Articles

- What Is The Most Challenging Project You Have Worked On?

- Tell Me About a Time You Had to Deal With a Difficult Customer

- What Have You Done To Improve Yourself In The Past Year?

- Interview Question: How Do You Deal With Tight Deadlines?

- Describe a Time You Demonstrated Leadership

- Tell Me About a Time When You Took Action to Resolve a Problem

- Job Interview Questions About Working in Fast-Paced Environments

- Job Interview: What Areas Need Improvement? (+ Answers)

- Tell Me About a Time You Were On a Team Project That Failed

- Tell Me About a Time You Managed an Important Project

Our mission is to

Help you get hired.

Hofplein 20

3032 AC, Rotterdam, the Netherlands

Turn interviews into offers

Every other Tuesday, get our Chief Coach’s best job-seeking and interviewing tips to land your dream job. 5-minute read.

Claims Adjuster Cover Letter Examples & Writing Tips

Use these Claims Adjuster cover letter examples and writing tips to help you write a powerful cover letter that will separate you from the competition.

Table Of Contents

- Claims Adjuster Example 1

- Claims Adjuster Example 2

- Claims Adjuster Example 3

- Cover Letter Writing Tips

Claims adjusters are responsible for investigating and resolving insurance claims. They must be able to handle difficult situations and have a strong understanding of insurance policies.

To show hiring managers that you’re the right person for the job, you need a cover letter that highlights your skills and experience.

Check out the examples and tips below to learn how to write a cover letter for a claims adjuster position.

Claims Adjuster Cover Letter Example 1

I am excited to be applying for the Claims Adjuster position at Topdown Insurance. I have more than five years of experience as a Claims Adjuster and have a proven track record of efficiently and effectively resolving claims. I am confident that I have the skills and experience to be a valuable member of the Topdown Insurance team.

In my previous role at ABC Insurance, I was responsible for handling a caseload of property and casualty claims. I was able to successfully resolve 95% of my claims within the first 30 days. I have a deep understanding of the insurance claims process and the various laws and regulations that impact claims. I am also proficient in the use of insurance software and have experience working with both internal and external stakeholders.

Most importantly, I have a passion for helping people. I take pride in my ability to provide excellent customer service to my clients and to work collaboratively with my team to resolve claims quickly and fairly.

Thank you for your time and consideration. I look forward to speaking with you about the Claims Adjuster position at Topdown Insurance. I am confident that I have the skills and experience to be a valuable member of your team.

Claims Adjuster Cover Letter Example 2

I am writing to apply for the Claims Adjuster position that was recently advertised on your company website. I am confident that I have the skills and qualifications that you are looking for, and I am eager to put my experience to work for your company.

As a Claims Adjuster for the past three years, I have successfully handled a wide range of claims. I have a deep understanding of the insurance industry and the laws and regulations that govern it. I am also an expert at investigating and assessing claims, and I have a proven track record of being able to settle claims quickly and fairly.

In addition to my experience and skills, I am also a highly motivated and driven individual. I am always looking for new challenges and opportunities to learn and grow. I am confident that I have the skills and qualifications to be a valuable asset to your company, and I am eager to put my experience to work for you.

I would like to thank you for your time and consideration, and I look forward to hearing from you soon.

Claims Adjuster Cover Letter Example 3

I am writing to express my interest in the Claims Adjuster position that you have posted. I believe that my experience as a claims adjuster, coupled with my education and training, makes me an excellent candidate for this position.

I have been working as a claims adjuster for the past five years. My experience has given me the opportunity to work on a variety of different types of claims, ranging from property damage to personal injury. I have worked on both small and large claims, which has given me the chance to develop my skills in all areas of claims adjusting. I have also had the opportunity to work on some very high-profile cases, which has given me valuable experience in dealing with the media and public scrutiny.

My experience has also given me the chance to work with a wide range of people. I have worked with clients who have suffered injuries or lost their property, as well as with insurance companies and other professionals involved in the claims process. This has given me the chance to develop my interpersonal skills, which are essential for any claims adjuster.

I am confident that my education and training make me an ideal candidate for this position. I am also confident that my experience will allow me to hit the ground running when it comes to handling your current caseload. I am available at your convenience to answer any questions you may have about my resume or qualifications. I look forward to hearing from you soon.

Claims Adjuster Cover Letter Writing Tips

1. highlight your customer service skills.

Since the main responsibility of a claims adjuster is to provide excellent customer service, it’s important to highlight this skill in your cover letter. Some great ways to do this include:

- Describing a situation where you had to go above and beyond to help a customer resolve a problem.

- Mentioning any awards or recognition you’ve received for providing excellent customer service.

- Explaining how you’ve helped to reduce the number of complaints from customers.

2. Customize your cover letter

Since every company has different needs, it’s important to customize your cover letter to match the specific job you’re applying for. For example, if the job listing asks for someone with experience in workers’ compensation, be sure to highlight any relevant experience you have in that area.

3. Showcase your problem-solving skills

As a claims adjuster, you’ll be faced with a variety of problems on a daily basis. To show hiring managers that you’re capable of handling these challenges, highlight your problem-solving skills in your cover letter.

Some ways of doing this include:

- Describing a time when you had to come up with a solution to a difficult problem.

- Outlining the steps you took to solve a problem.

- Mentioning any courses or training you’ve taken that have helped you develop your problem-solving skills.

4. Proofread your cover letter

Since claims adjusters are responsible for reviewing and approving claims, it’s important that your cover letter is free of any errors. Hiring managers will be looking for someone who is detail-oriented and can pay close attention to the small details. Make sure to proofread your cover letter multiple times to avoid any mistakes.

School Superintendent Cover Letter Examples & Writing Tips

Peer support specialist cover letter examples & writing tips, you may also be interested in..., public relations specialist cover letter examples, policy advisor cover letter examples & writing tips, youth advocate cover letter examples & writing tips, virtual teacher cover letter examples & writing tips.

Resume Worded | Career Strategy

14 entry level claims adjuster cover letters.

Approved by real hiring managers, these Entry Level Claims Adjuster cover letters have been proven to get people hired in 2024. A hiring manager explains why.

Table of contents

- Entry Level Claims Adjuster

- Senior Claims Adjuster

- Claims Analyst

- Junior Claims Adjuster

- Claims Adjuster Trainee

- Property Claims Adjuster Trainee

- Alternative introductions for your cover letter

- Entry Level Claims Adjuster resume examples

Entry Level Claims Adjuster Cover Letter Example

Why this cover letter works in 2024, internship experience.

Starting the second paragraph with the mention of internship experience immediately establishes credibility and shows that the candidate has relevant industry knowledge.

Improved Efficiency

Sharing a specific example of how the candidate improved the claims processing time demonstrates their ability to make a positive impact on the company's operations.

Fraud Detection Success

Highlighting a tangible achievement like assisting in the recovery of fraudulent claims showcases the candidate's skills in investigation and collaboration, which are valuable in a claims adjuster role.

Commitment to Employee Development

Emphasizing the company's focus on employee development in the third paragraph shows genuine interest in the company's values and makes the candidate more appealing.

Excitement for the Role

Ending the cover letter by expressing excitement for the position and gratitude for the opportunity to apply leaves a positive impression on the hiring manager.

Expressing Genuine Interest in Company Values

See how the writer isn’t just chasing any Claims Adjuster job, but specifically at Allstate. The reason? A past experience showed that Allstate values customer service and care, and that’s something the writer truly cares about too. If you share similar values with a company, it's worth mentioning. It shows you're not just looking for a paycheck, but you're looking for a place where you belong, and that's powerful.

Align Your Skills with the Company's Values

In this sentence, the writer not only highlights their skills but also shows how those skills align with the company's values and goals. This is a smart move because it shows the hiring team that you understand what they're looking for and that you're already thinking about how you can add value.

Specific Achievements Bolster Your Credibility

Quantifying an impact you've had at a previous company, especially one directly relevant to the job you're applying for, can massively boost your credibility. In this case, the candidate clearly states their ability to analyze complex information quickly and accurately, and illustrates this with a concrete achievement.

Show Your Long-Term Vision

This sentence indicates that the writer is not just looking for a job, but is committed to a career in the industry. By emphasizing their commitment to continuous learning and adaptation, they show that they are ready to grow with the company and contribute in the long run.

Highlight Your Passion for the Company's Mission

Showing enthusiasm for the company's mission can make your cover letter stand out. It proves that you've done your homework and that you're applying not just because you need a job, but because you genuinely want to work there.

Connect with personal stories

Telling a story about how you became interested in claims adjusting makes your cover letter memorable and shows your genuine passion for the job.

Show your analytical and communication strengths

Highlighting these essential skills for a claims adjuster role demonstrates your readiness to handle the job's demands effectively.

Detail your hands-on experience

Discussing your direct experience with claims shows you have practical knowledge and an understanding of the importance of empathy and professionalism.

Express enthusiasm for innovation

Showing excitement about the company's approach to technology indicates you're a forward-thinking candidate who embraces new tools and systems.

End with a strong closing statement

A well-crafted closing not only thanks the reader but also reiterates your interest in discussing how your skills align with the company's goals.

Does writing cover letters feel pointless? Use our AI

Dear Job Seeker, Writing a great cover letter is tough and time-consuming. But every employer asks for one. And if you don't submit one, you'll look like you didn't put enough effort into your application. But here's the good news: our new AI tool can generate a winning cover letter for you in seconds, tailored to each job you apply for. No more staring at a blank page, wondering what to write. Imagine being able to apply to dozens of jobs in the time it used to take you to write one cover letter. With our tool, that's a reality. And more applications mean more chances of landing your dream job. Write me a cover letter It's helped thousands of people speed up their job search. The best part? It's free to try - your first cover letter is on us. Sincerely, The Resume Worded Team

Want to see how the cover letter generator works? See this 30 second video.

Connect personal inspiration to your claims adjuster ambition

Mentioning your uncle's influence as a claims adjuster connects your personal life to your career choice. It adds a personal touch that recruiters remember.

Detail internship experience in claims adjustment

Explaining how you shadowed experienced adjusters and streamlined processes shows practical skills and initiative. This hands-on experience is exactly what makes you stand out as a candidate.

Showcase problem-solving and empathy

Highlighting your analytical skills and ability to empathize with clients proves you're well-suited for the challenges of claims adjusting. These are key traits for succeeding in the role.

Align with the company's customer service goals

Expressing admiration for the company's commitment to customer service and innovation indicates you share their values. Companies look for candidates who fit into their culture and mission.

End with a strong, forward-looking closing statement

Ending your cover letter by thanking the recipient and expressing eagerness to discuss your role indicates professionalism and enthusiasm. It's a respectful way to close and invites further conversation.

Connect personal passion with professional goals

Your early interest in insurance claims shows a deep-rooted passion, making you a more motivated candidate.

Highlight hands-on industry experience

Sharing specific learning experiences from your internship demonstrates your proactive approach to gaining relevant skills.

Show your claims adjuster impact

Mentioning the financial savings you achieved for your company proves you can deliver tangible results.

Emphasize compassion in your junior claims adjuster role

Expressing a desire to help people in difficult times adds a human touch to your technical skills and qualifications.

Express eagerness to join the team

Your polite request for a discussion shows initiative and genuine interest in the position.

Senior Claims Adjuster Cover Letter Example

Detailing relevant skills learned in past experiences.

Internships can be gold mines for learning experiences. The writer here didn’t just say they interned at a tech company, but they went into detail about what they did that’s relevant to the job they're applying for. They developed analytical skills and learned to handle high-pressure situations. So, be sure to put your past experiences to work for you when you write your cover letter. Show how you've previously dealt with situations that are likely to come up in the job you're applying for.

Claims Analyst Cover Letter Example

Elaborate on your past experience.

In this line, the candidate connects their past experience with the job they're applying for. They also hint at the potential positive impact they can have at the new company. It's a smart way of showing the hiring manager you can replicate past successes.

Quantify Your Achievements

When you quantify your achievements, you're providing concrete proof of your skills. Here, the candidate shows they're not only good at what they do, but that they can also deliver measurable results. This makes you more credible and attractive to hiring managers.

Look Beyond the Job Description

This sentence suggests that the candidate is interested in more than just meeting the job requirements. They understand the company's broader goals and they're keen on contributing to those. This holistic approach can make you more appealing to employers.

Express Enthusiasm for the Company's Innovations

Showing that you're excited about the company's initiatives and that you want to contribute to them is a great way to show enthusiasm and commitment. It's not just about being a good fit for the job but also being aligned with where the company is headed.

Junior Claims Adjuster Cover Letter Example

Relate through a personal experience.

Sharing a personal story about how insurance has impacted your life provides a strong emotional foundation for your interest in becoming a claims adjuster.

Highlight your caseload management skills

Mentioning your ability to manage a significant number of claims showcases your organizational skills and attention to detail.

Show excitement for technological advancements

Expressing eagerness to contribute to a company known for its innovative approaches demonstrates you're a progressive candidate.

Emphasize your communication skills

Stressing your strength in communication and interpersonal skills highlights your ability to provide excellent customer service.

Illustrate teamwork and recognition

Sharing that your abilities have been recognized by supervisors and peers underscores your teamwork skills and likability as a colleague.

Show personal motivation in claims adjuster journey

When you share a personal story about why you chose this career, it shows me your genuine interest and passion. This helps you connect on a human level.

Demonstrate practical claims adjuster skills

Highlighting your experience in data analysis and customer service tells me you have the skills needed for the job. It's good to know you can handle the tasks required.

Highlight soft skills for a junior claims adjuster

Mentioning your communication, empathy, and problem-solving abilities shows me you're well-rounded. These skills are crucial for dealing with policyholders.

Express interest in company innovation

Your excitement about our focus on improving the claims process tells me you're eager to learn and contribute. This is what we look for in new team members.

Close with enthusiasm for the junior claims adjuster role

Ending your letter by reiterating your interest in the role and team shows me you're serious about the job. It leaves a positive last impression.

Share a personal connection to the insurance field

Describing your family’s experience with an adjuster provides a unique, relatable reason for your career choice.

Demonstrate teamwork in claims processing

Detailing your collaboration skills and how you contribute to team efforts showcases your ability to work well with others.

Illustrate initiative and leadership

Creating a training manual not only shows your capability to lead but also your commitment to improving organizational efficiency.

Highlight problem-solving and adaptability

Stating your enjoyment of fast-paced, challenging situations indicates that you’re a resilient and versatile candidate.

Show enthusiasm for contributing to the company

Expressing eagerness to support the company’s mission and impact policyholders positively illustrates your dedication and forward-thinking mindset.

Claims Adjuster Trainee Cover Letter Example

Show real-world experience in your claims adjuster trainee cover letter.

Talking about your volunteer experience at a community center shows you understand the real impact of this work. It's good to share personal stories that connect you to the job.

Highlight relevant internship for the claims adjuster role

Describing your internship experience shows you have a basic understanding of the claims process. This is what recruiters look to find: evidence you can handle the job's day-to-day tasks.

Express enthusiasm for learning in claims adjusting

When you mention being drawn to the company's training program, it shows your willingness to learn. This is a key quality recruiters seek in trainee roles.

Emphasize empathy in customer interactions

Stating that you are empathetic and customer-focused indicates you will handle claims with care. This skill is crucial in supporting policyholders through tough situations.

Highlight communication skills and relationship building

Showing you can listen, communicate clearly, and build positive relationships is essential in a claims adjuster role. This demonstrates you're a team player who values good service.

Connect personal experiences to claims adjuster role

Sharing how volunteering shaped your career path makes your application stand out. It shows you're driven by a purpose.

Emphasize educational background in claims adjusting

Telling me about your degree and project experience demonstrates you have a solid foundation. This is reassuring, especially for a trainee position.

Showcase key traits for a claims adjuster trainee

Your focus on analytical skills, attention to detail, and teamwork indicates you have the right qualities for success in this field.

Match personal values with company mission

Your attraction to our innovative and customer-focused approach indicates you align with our values. This tells me you'll fit in with our culture.

Express eagerness to join the claims team

Concluding your letter with a strong statement of intent to contribute positively to our team shows me you're motivated and ready to start.

Property Claims Adjuster Trainee Cover Letter Example

Show your passion for the insurance industry.

Talking about your interest in the insurance field and its importance in aiding recovery from unforeseen events sets a strong foundation. It signals to a hiring manager that you see beyond the job to its impact on people's lives.

By mentioning your direct involvement in critical tasks like on-site inspections and communication with policyholders, you make it clear you're not starting from zero. Such experiences are valuable in the property claims adjuster trainee role, where practical skills are crucial.

Highlight efficiency improvements you've made

Initiating and successfully digitizing claim files to boost department efficiency demonstrates your ability to identify and solve operational problems. This trait is attractive to employers looking for proactive trainees who can bring fresh perspectives to their processes.

Emphasize your adaptability and problem-solving skills

Claiming yourself as a quick learner with a commitment to excellence suggests you're prepared for the dynamic challenges in the property claims field. These qualities are essential for adjusting to new information and scenarios effectively.

Express eagerness to contribute and learn

Your closing statement reinforces your enthusiasm about the role and the company, while also showing humility and the desire to grow. It leaves a positive, lasting impression, indicating you're not just looking for any job but are genuinely interested in becoming part of their team.

Alternative Introductions

If you're struggling to start your cover letter, here are 6 different variations that have worked for others, along with why they worked. Use them as inspiration for your introductory paragraph.

Cover Letters For Jobs Similar To Entry Level Claims Adjuster Roles

- Claims Adjuster Cover Letter Guide

- Claims Analyst Cover Letter Guide

- Claims Processor Cover Letter Guide

- Entry Level Claims Adjuster Cover Letter Guide

Other Finance Cover Letters

- Accountant Cover Letter Guide

- Auditor Cover Letter Guide

- Bookkeeper Cover Letter Guide

- Cost Analyst Cover Letter Guide

- Credit Analyst Cover Letter Guide

- Finance Director Cover Letter Guide

- Finance Executive Cover Letter Guide

- Financial Advisor Cover Letter Guide

- Financial Analyst Cover Letter Guide

- Financial Controller Cover Letter Guide

- Loan Processor Cover Letter Guide

- Payroll Specialist Cover Letter Guide

- Purchasing Manager Cover Letter Guide

- VP of Finance Cover Letter Guide

Thank you for the checklist! I realized I was making so many mistakes on my resume that I've now fixed. I'm much more confident in my resume now.

Privacy preference center

We care about your privacy

When you visit our website, we will use cookies to make sure you enjoy your stay. We respect your privacy and we’ll never share your resumes and cover letters with recruiters or job sites. On the other hand, we’re using several third party tools to help us run our website with all its functionality.

But what exactly are cookies? Cookies are small bits of information which get stored on your computer. This information usually isn’t enough to directly identify you, but it allows us to deliver a page tailored to your particular needs and preferences.

Because we really care about your right to privacy, we give you a lot of control over which cookies we use in your sessions. Click on the different category headings on the left to find out more, and change our default settings.

However, remember that blocking some types of cookies may impact your experience of our website. Finally, note that we’ll need to use a cookie to remember your cookie preferences.

Without these cookies our website wouldn’t function and they cannot be switched off. We need them to provide services that you’ve asked for.

Want an example? We use these cookies when you sign in to Kickresume. We also use them to remember things you’ve already done, like text you’ve entered into a registration form so it’ll be there when you go back to the page in the same session.

Thanks to these cookies, we can count visits and traffic sources to our pages. This allows us to measure and improve the performance of our website and provide you with content you’ll find interesting.

Performance cookies let us see which pages are the most and least popular, and how you and other visitors move around the site.

All information these cookies collect is aggregated (it’s a statistic) and therefore completely anonymous. If you don’t let us use these cookies, you’ll leave us in the dark a bit, as we won’t be able to give you the content you may like.

We use these cookies to uniquely identify your browser and internet device. Thanks to them, we and our partners can build a profile of your interests, and target you with discounts to our service and specialized content.

On the other hand, these cookies allow some companies target you with advertising on other sites. This is to provide you with advertising that you might find interesting, rather than with a series of irrelevant ads you don’t care about.

Claim Adjuster Cover Letter Example

Get more job offers & learn how to improve your cover letter with this downloadable Claim Adjuster cover letter example. Copy and paste this cover letter example for free or revise it in our online cover letter maker.

Related resume guides and samples

How to build a jaw-dropping attorney resume

How to build a great resume for a legal counselor position

Write the ideal law clerk resume with this quick guide

The ultimate guide to writing a resume as a lawyer

Optimize your legal administrative assistant resume with this quick guide

Key steps to writing a legal secretary resume

Claim Adjuster Cover Letter Example (Full Text Version)

Svenn Sahlberg

Dear Human Resources Manager,

As a Claims Adjuster with 3 years of experience in financial services, I apply with enthusiasm for this position.

I am currently a Claims Adjuster at SPAGO Group, where I ensure that professional claims by commercial and government payers are submitted and paid in a timely manner. Mirroring your requirements, I:

- Handle pre-adjudication, resolution, and follow-up tasks for approximately 200 claims per month

- Ensure claims are complete and compliant with applicable regulations/payer requirements

- Negotiate settlement of claims with insureds, claimants, and others up to a $1m limit

- Participate in examinations under oath, depositions, mediations, and testimony during litigation

- Am very familiar with financial services, health, government, and corporate terminology

In addition to my experience, I hold a Bachelor of Accounting & Finance and have successfully passed security and background checks. I have strong problem-solving and issue resolution skills, as well as superb attention to detail and very effective communication and interpersonal skills. I also have strong knowledge of local, state, and federal insurance-related policies.

Please find attached my resume for your consideration. Thank you very much for your time. I look forward to hearing from you regarding next steps.

Yours faithfully,

Milan Šaržík, CPRW

Milan’s work-life has been centered around job search for the past three years. He is a Certified Professional Résumé Writer (CPRW™) as well as an active member of the Professional Association of Résumé Writers & Careers Coaches (PARWCC™). Milan holds a record for creating the most career document samples for our help center – until today, he has written more than 500 resumes and cover letters for positions across various industries. On top of that, Milan has completed studies at multiple well-known institutions, including Harvard University, University of Glasgow, and Frankfurt School of Finance and Management.

Edit this sample using our resume builder.

Don’t struggle with your cover letter. artificial intelligence can write it for you..

Similar job positions

Legal Secretary Law Clerk / Legal Clerk Legal Administrative Assistant Lawyer / Advocate Counselor Attorney

Related legal resume samples

Related legal cover letter samples

Let your resume do the work.

Join 5,000,000 job seekers worldwide and get hired faster with your best resume yet.

Claims Adjuster Cover Letter Example

Claim Adjusters evaluate insurance claims to determine who is liable. These executives work with insurance companies, government organizations, health insurance carriers.

When planning to apply for this position, check out the Claims Adjuster Cover Letter sample that shall help you to understand the different responsibilities and duties that are to be necessarily executed in the course of the job.

- Cover Letters

- Accounting & Finance

What to Include in a Claims Adjuster Cover Letter?

Roles and responsibilities.

Job Responsibilities of a Claims Adjuster:

- Investigation of the damage caused to the property or personal damage.

- Doing personal inquiry.

- Collecting relevant information from as many resources as possible like police reports and analyzing the information to determine insurance liability.

- Preparing reports to be used by Claims Examiners .

- Inspection of questionable claims.

- Consulting with relevant professionals like engineers, lawyers, physicians , and architects to

- Compiling investigation findings reports.

- Supporting barrister and various other professionals when defending the company against contestation

- Examining physical injuries.

- Developing and processing of claims reports mentioning the event and the damage associated with the claim clearly.

- Negotiation of payments with claimants or their legal teams.

- Interview the witnesses and claimants.

- Measure the amount of damage covered by insurance policies and accordingly calculate payments .

- Review claim liability.

- Estimating benefits.

- Evaluating videos from vigilance cameras or audio, police repowers if possible to understand the event.

- Evaluated the amount of repairing the damage.

Education & Skills

Skills Required in a Claims Adjuster:

- Outstanding communication skills.

- Ability to analyze complex claims properly.

- Ability to pay attention to details.

- Powerful writing skills.

- Ability to negotiate well.

- Ability to communicate well in a second language.

- Proficient in using computers.

- Quick Learner.

- Maintain Professionalism.

- Time Management Skills.

- Good Listening Skills.

- Compassionate.

- Resilient personality.

- Good mathematical skills.

- Excellent interpersonal skills.

Qualifications Required in a Claims Adjuster:

- High School Diploma.

- A bachelor’s degree in the field of finance, Insurance, or another related field is preferred.

- Work experience of a minimum of one year in a relevant field.

Claims Adjuster Cover Letter Example (Text Version)

Dear Mr./Ms.,

This letter is regarding my interest in applying for the post of a Claims Adjuster at [XXXYYYY organization]. My …… years of working in the same position at [XXXXYYY organization] match well with the specifications required for this job.

With a strong network of professional, educational qualifications, and passion in calculating claim liability – I am sure to deliver positive outcomes as per your organization’s needs. My experience in the role helped me understand various procedures and guidelines surrounding the field like –

- Drafting Impactful claim reports.

- Examining damages to the property.

- Estimating claim liability.

- Interviewing claimants as other specialists.

- Gathering Information effectively from various primary and secondary sources.

Given an opportunity, I assure you to give my best to this job and become an asset to your organization.

Looking forward to hearing from you soon.

Sincerely, [Your Name]

Check out this cover letter and know how you can showcase your skills and qualifications in the best way to enhance your chances of getting hired. Also, check the Claims Adjuster Resume Sample here to ensure it leaves a positive impact on the recruiters.

Customize Claims Adjuster Cover Letter

Get hired faster with our free cover letter template designed to land you the perfect position.

Related Accounting & Finance Cover Letters

Insurance Adjuster Cover Letter: Sample & Guide (Entry Level & Senior Jobs)

Create a standout insurance adjuster cover letter with our online platform. browse professional templates for all levels and specialties. land your dream role today.

Are you ready to take the next step in your career as an insurance adjuster? A well-crafted cover letter can make all the difference in landing your dream job in the insurance industry. Whether you're a seasoned professional or just starting out, our guide will provide you with the essential tips and advice to create a standout cover letter that will impress potential employers. Let's get started on crafting a cover letter that will set you apart from the competition.

We will cover:

- How to write a cover letter, no matter your industry or job title.

- What to put on a cover letter to stand out.

- The top skills employers from every industry want to see.

- How to build a cover letter fast with our professional Cover Letter Builder .

- Why you should use a cover letter template

Related Cover Letter Examples

- District Attorney Cover Letter Sample

- Claims Investigator Cover Letter Sample

- Bankruptcy Paralegal Cover Letter Sample

- Contract Negotiator Cover Letter Sample

- Privacy Officer Cover Letter Sample

- Contract Attorney Cover Letter Sample

- Trust Officer Cover Letter Sample

- Court Reporter Cover Letter Sample

- Government Contractor Cover Letter Sample

- Intellectual Property Attorney Cover Letter Sample

- Policy Advisor Cover Letter Sample

- Priest Cover Letter Sample

- Litigation Legal Assistant Cover Letter Sample

- Real Estate Paralegal Cover Letter Sample

- Experienced Lawyer Cover Letter Sample

- Funeral Director Cover Letter Sample

- Real Estate Attorney Cover Letter Sample

- Legal Advisor Cover Letter Sample

- Legal Secretary Cover Letter Sample

- Litigation Attorney Cover Letter Sample

Insurance Adjuster Cover Letter Sample

John Smith 123 Main Street Anytown, USA 12345 (555) 555-5555 [email protected]

ABC Insurance Company 456 Oak Avenue Another Town, USA 54321

Dear Hiring Manager,

I am writing to express my interest in the Insurance Adjuster position at ABC Insurance Company. I have a solid background in insurance claims and a proven track record of accurately assessing and processing claims in a timely manner. With my strong attention to detail and excellent communication skills, I am confident that I would be a valuable asset to your team.

During my previous role at XYZ Insurance, I was responsible for investigating and evaluating insurance claims, negotiating settlements, and maintaining detailed records of all claim activities. I consistently exceeded performance metrics and received recognition for my exceptional customer service and ability to handle complex claims efficiently. My experience includes working with a diverse range of policyholders and collaborating with legal and medical professionals to ensure fair and accurate claim resolutions.

I am highly skilled in utilizing industry-specific software and tools to analyze data and make informed decisions. I am adept at interpreting policy language and applying it to real-world scenarios, and I am committed to staying updated on relevant regulations and industry best practices to ensure compliance and ethical conduct in all claim processing activities.

Furthermore, I am known for my strong work ethic, problem-solving abilities, and dedication to providing exceptional service to policyholders. I thrive in a fast-paced environment and am adept at prioritizing tasks and managing high caseloads while maintaining a high level of accuracy and attention to detail.

I am excited about the opportunity to bring my skills and expertise to ABC Insurance Company and contribute to the continued success of your claims department. I am confident that my professional background and passion for the insurance industry make me a strong candidate for this position. Thank you for considering my application. I am looking forward to the opportunity to discuss how I can contribute to your team in more detail.

Why Do you Need a Insurance Adjuster Cover Letter?

- It introduces you to the potential employer: A cover letter allows you to personalize your application and capture the attention of the hiring manager.

- It highlights your qualifications: In your cover letter, you can showcase your relevant skills, qualifications, and experience that make you a strong candidate for the insurance adjuster position.

- It demonstrates your communication skills: Writing a cover letter gives you the opportunity to articulate your interest in the position and explain how your background aligns with the company's needs.

- It shows your attention to detail: A well-crafted cover letter demonstrates your ability to carefully review job requirements and tailor your application to the specific role.

- It sets you apart from other candidates: Including a cover letter with your application can make you stand out among other applicants who may have only submitted a resume.

A Few Important Rules To Keep In Mind

- Address the cover letter to the specific hiring manager or recruiter

- Use a professional and formal tone

- Showcase your relevant experience, skills, and accomplishments

- Highlight any certifications or training related to insurance adjusting

- Explain why you are interested in the position and company

- Personalize the cover letter for each job application

- Proofread for grammar and spelling errors

- Keep the cover letter concise and to the point

- Include a strong closing statement expressing your interest in further discussing your qualifications

- Provide your contact information for follow-up purposes

What's The Best Structure For Insurance Adjuster Cover Letters?

After creating an impressive Insurance Adjuster resume , the next step is crafting a compelling cover letter to accompany your job applications. It's essential to remember that your cover letter should maintain a formal tone and follow a recommended structure. But what exactly does this structure entail, and what key elements should be included in a Insurance Adjuster cover letter? Let's explore the guidelines and components that will make your cover letter stand out.

Key Components For Insurance Adjuster Cover Letters:

- Your contact information, including the date of writing

- The recipient's details, such as the company's name and the name of the addressee

- A professional greeting or salutation, like "Dear Mr. Levi,"

- An attention-grabbing opening statement to captivate the reader's interest

- A concise paragraph explaining why you are an excellent fit for the role

- Another paragraph highlighting why the position aligns with your career goals and aspirations

- A closing statement that reinforces your enthusiasm and suitability for the role

- A complimentary closing, such as "Regards" or "Sincerely," followed by your name

- An optional postscript (P.S.) to add a brief, impactful note or mention any additional relevant information.

Cover Letter Header

A header in a cover letter should typically include the following information:

- Your Full Name: Begin with your first and last name, written in a clear and legible format.

- Contact Information: Include your phone number, email address, and optionally, your mailing address. Providing multiple methods of contact ensures that the hiring manager can reach you easily.

- Date: Add the date on which you are writing the cover letter. This helps establish the timeline of your application.

It's important to place the header at the top of the cover letter, aligning it to the left or center of the page. This ensures that the reader can quickly identify your contact details and know when the cover letter was written.

Cover Letter Greeting / Salutation

A greeting in a cover letter should contain the following elements:

- Personalized Salutation: Address the hiring manager or the specific recipient of the cover letter by their name. If the name is not mentioned in the job posting or you are unsure about the recipient's name, it's acceptable to use a general salutation such as "Dear Hiring Manager" or "Dear [Company Name] Recruiting Team."

- Professional Tone: Maintain a formal and respectful tone throughout the greeting. Avoid using overly casual language or informal expressions.

- Correct Spelling and Title: Double-check the spelling of the recipient's name and ensure that you use the appropriate title (e.g., Mr., Ms., Dr., or Professor) if applicable. This shows attention to detail and professionalism.

For example, a suitable greeting could be "Dear Ms. Johnson," or "Dear Hiring Manager," depending on the information available. It's important to tailor the greeting to the specific recipient to create a personalized and professional tone for your cover letter.

Cover Letter Introduction

An introduction for a cover letter should capture the reader's attention and provide a brief overview of your background and interest in the position. Here's how an effective introduction should look:

- Opening Statement: Start with a strong opening sentence that immediately grabs the reader's attention. Consider mentioning your enthusiasm for the job opportunity or any specific aspect of the company or organization that sparked your interest.

- Brief Introduction: Provide a concise introduction of yourself and mention the specific position you are applying for. Include any relevant background information, such as your current role, educational background, or notable achievements that are directly related to the position.

- Connection to the Company: Demonstrate your knowledge of the company or organization and establish a connection between your skills and experiences with their mission, values, or industry. Showcasing your understanding and alignment with their goals helps to emphasize your fit for the role.

- Engaging Hook: Consider including a compelling sentence or two that highlights your unique selling points or key qualifications that make you stand out from other candidates. This can be a specific accomplishment, a relevant skill, or an experience that demonstrates your value as a potential employee.

- Transition to the Body: Conclude the introduction by smoothly transitioning to the main body of the cover letter, where you will provide more detailed information about your qualifications, experiences, and how they align with the requirements of the position.

By following these guidelines, your cover letter introduction will make a strong first impression and set the stage for the rest of your application.

Cover Letter Body

I am writing to express my keen interest in the insurance adjuster position at your company. With a strong background in insurance and a solid track record of successfully investigating and evaluating insurance claims, I am confident in my ability to make a significant contribution to your team.

- Introduction: Begin with a brief introduction, expressing your interest in the position and the company.

- Experience and Skills: Highlight your relevant experience and skills, such as experience in investigating and evaluating insurance claims, knowledge of insurance policies and regulations, attention to detail, excellent communication and negotiation skills.

- Education: Mention your education and any relevant certifications or training in insurance adjusting.

- Achievements: Provide examples of any notable achievements, such as high claim settlement rates or recognition for exceptional customer service.

- Why You're a Good Fit: Explain why you are a good fit for the role and how your experience and skills align with the company's needs.

- Thank You: Express gratitude for the opportunity to be considered for the position and reiterate your enthusiasm for the role and the company.

- Closing: Close the letter with a professional sign-off and your contact information.

I am excited about the opportunity to bring my expertise to your team and contribute to the ongoing success of your company. Thank you for considering my application. I look forward to the possibility of discussing this exciting opportunity with you further.

Sincerely, [Your Name]

Complimentary Close

The conclusion and signature of a cover letter provide a final opportunity to leave a positive impression and invite further action. Here's how the conclusion and signature of a cover letter should look:

- Summary of Interest: In the conclusion paragraph, summarize your interest in the position and reiterate your enthusiasm for the opportunity to contribute to the organization or school. Emphasize the value you can bring to the role and briefly mention your key qualifications or unique selling points.

- Appreciation and Gratitude: Express appreciation for the reader's time and consideration in reviewing your application. Thank them for the opportunity to be considered for the position and acknowledge any additional materials or documents you have included, such as references or a portfolio.

- Call to Action: Conclude the cover letter with a clear call to action. Indicate your availability for an interview or express your interest in discussing the opportunity further. Encourage the reader to contact you to schedule a meeting or provide any additional information they may require.

- Complimentary Closing: Choose a professional and appropriate complimentary closing to end your cover letter, such as "Sincerely," "Best Regards," or "Thank you." Ensure the closing reflects the overall tone and formality of the letter.

- Signature: Below the complimentary closing, leave space for your handwritten signature. Sign your name in ink using a legible and professional style. If you are submitting a digital or typed cover letter, you can simply type your full name.

- Typed Name: Beneath your signature, type your full name in a clear and readable font. This allows for easy identification and ensures clarity in case the handwritten signature is not clear.

Common Mistakes to Avoid When Writing an Insurance Adjuster Cover Letter

When crafting a cover letter, it's essential to present yourself in the best possible light to potential employers. However, there are common mistakes that can hinder your chances of making a strong impression. By being aware of these pitfalls and avoiding them, you can ensure that your cover letter effectively highlights your qualifications and stands out from the competition. In this article, we will explore some of the most common mistakes to avoid when writing a cover letter, providing you with valuable insights and practical tips to help you create a compelling and impactful introduction that captures the attention of hiring managers. Whether you're a seasoned professional or just starting your career journey, understanding these mistakes will greatly enhance your chances of success in the job application process. So, let's dive in and discover how to steer clear of these common missteps and create a standout cover letter that gets you noticed by potential employers.

- Not addressing the cover letter to a specific person

- Using generic language and not tailoring the cover letter to the specific job

- Not highlighting relevant experience or skills

- Focusing too much on what you want from the position, rather than what you can offer

- Not proofreading for grammar and spelling errors

- Being too informal in tone and language

- Not including a strong opening and closing statement

- Exaggerating or lying about qualifications and experience

- Overloading the cover letter with too much information

- Not following the employer's instructions for submitting the cover letter

Key Takeaways For an Insurance Adjuster Cover Letter

- Demonstrate strong communication skills

- Showcase experience in investigating and evaluating insurance claims

- Highlight knowledge of insurance regulations and policies

- Emphasize ability to negotiate fair settlements

- Illustrate proficiency in documentation and report writing

- Display expertise in using insurance claims software and tools

Insurance Claims Adjuster Cover Letter Example: 4 Templates