Actuarial Intern Cover Letter Examples & Writing Tips

Use these Actuarial Intern cover letter examples and writing tips to help you write a powerful cover letter that will separate you from the competition.

Table Of Contents

- Actuarial Intern Example 1

- Actuarial Intern Example 2

- Actuarial Intern Example 3

- Cover Letter Writing Tips

Actuaries use mathematical and statistical methods to assess the risk of potential events, such as death, sickness, injury, or loss of property. They work in the insurance industry, but their skills are also in high demand in other industries.

To land an actuarial internship, you need a well-written cover letter. Follow these examples and tips to learn how to write an actuarial internship cover letter that will get you noticed.

Actuarial Intern Cover Letter Example 1

I am excited to be applying for the Actuarial Internship at Topdown Insurance. I believe that my skills and experience make me the perfect candidate for this position.

I have experience working in the insurance industry, and I have a strong understanding of the actuarial process. I am proficient in Excel and have experience using actuarial software. I am also comfortable working with data and am able to analyze and interpret information quickly.

I am a motivated and hardworking individual who is able to work independently as well as part of a team. I am eager to learn and am committed to developing my skills. I am confident that I have the potential to be a valuable asset to Topdown Insurance.

Thank you for your time and consideration. I look forward to hearing from you soon.

Actuarial Intern Cover Letter Example 2

I am writing in regards to the Actuarial Intern opening that I saw on your website. I am confident that I have the skills and qualifications that would make me the perfect candidate for the job.

I have been working in the actuarial industry for the past three years and have gained a great deal of experience and knowledge in the field. I have a strong understanding of the actuarial process and the various calculations that are involved. I am also familiar with the software used in the industry, including MLC, Prophet, and R.

I am a hard-working and motivated individual who is always looking for new challenges and opportunities. I am confident that I would be a valuable asset to your team and would be able to contribute to your company’s success.

If you would like to discuss this position further, or if you have any questions, please do not hesitate to contact me at your earliest convenience. I look forward to hearing from you.

Actuarial Intern Cover Letter Example 3

I am writing to express my interest in the actuarial internship position that you have posted. I believe that this position would be a great fit for me, and I would like to explain why I feel that way.

I am currently a senior at the University of Michigan, where I am pursuing a degree in Actuarial Science. My concentration is in Risk Management, and I am also minoring in Statistics. I have been working as an intern at XYZ Insurance Company since January of this year, and I will be graduating next month.

My time at XYZ has given me the opportunity to work on a variety of projects, including property and casualty insurance pricing models, life insurance policy analysis, and long-term care insurance underwriting. I have also had the chance to work with some of the best actuaries in the industry, and they have taught me so much about what it means to be an actuary.

I am very interested in pursuing a career as an actuary, and I know that there are many different paths that I could take. However, I do not want to become just another number cruncher; I want to make a difference in people’s lives by helping them understand their risk exposure. That is why I am so interested in your company’s focus on customer service.

I know that you are looking for someone who is hardworking, intelligent, and willing to learn. I believe that these qualities describe me well, and I hope that you will agree after reading my resume.

Actuarial Intern Cover Letter Writing Tips

1. show your skills.

When applying for an actuarial internship, it’s important to show employers that you have the skills they’re looking for. The best way to do this is by providing specific examples from past work experiences.

For example, if you’ve completed an actuarial science degree, mention any coursework or projects you’ve done that are related to the job you’re applying for. You can also highlight any skills you’ve developed that are relevant to the actuarial field, such as strong math skills or experience using Excel.

2. Tailor your cover letter to the job description

One of the best ways to make sure your cover letter is tailored for a specific job is by paying close attention to the details of the position. For example, if you see that an actuarial internship opening requires experience with a specific software, mention any experience you have with that software.

If there are any additional requirements or skills mentioned for that job, also list them on your application; this will help make it clear how you can meet their needs.

3. Demonstrate your passion for the actuarial field

Employers want to hire interns who are passionate about the actuarial field and are excited to learn new things. Show your passion by using phrases like “I’m eager” and “I’m looking forward” in your cover letter.

You can also talk about why you decided to pursue an actuarial science degree, and explain how you’ve developed a strong interest in the field. For example, you might have volunteered with an organization that helps seniors plan for their retirement, or you might have read a book about actuarial science that really interested you.

4. Proofread your cover letter

Proofreading your cover letter is the first step to landing an interview for an actuarial internship. As with any position, it’s important to spell-check and double-check that there are no errors in your resume or cover letter. Otherwise, you risk being disqualified before the employer even sees your qualifications.

Vehicle Inspector Cover Letter Examples & Writing Tips

Funeral assistant cover letter examples & writing tips, you may also be interested in..., healthcare consultant cover letter examples & writing tips, information specialist cover letter examples, financial service representative cover letter examples.

Senior Accountant Cover Letter Examples & Writing Tips

- Skip to main menu

- Skip to user menu

Actuary Cover Letter

Importance of an Actuarial cover letter

In a study of HR professionals and recruiters by CV Writers, we found opinions divided on the value placed on a cover letter. Whilst 2/3 of those surveyed would read a CV whether a covering letter was present or not, the other 1/3 would only read a CV if a cover letter was included as part of the application. As a job seeker you, therefore, cannot afford to take a risk and it is always best to include a cover letter.

A well-written actuarial cover letter usually focuses on:

- Keep it brief

What information to include?

Specific examples are best

- Should I include my personal circumstances?

The call to action

Keeping it brief

Three to four paragraphs are fine. If your cover letter has drifted to a second page then you may be including too much detail. It is worth remembering that a CV and cover letter are about getting an interview, not winning the job. You should elaborate on points and reinforce key strengths you feel are important for the reader to be aware of - but keep it brief

Without a doubt, the most important piece of advice is to ensure you mirror the requirements of the person specification of the job you are applying for. You will be assessed against this. It is therefore vital that you read the specification carefully and provide definitive evidence of how you meet what the employer is looking for. Focus on what you know are the key points in the specification and those that are aligned most to your achievements

It is one thing to claim you can do something. It is quite another to prove it. Your cover letter will be much more of a draw if you can use specific examples to demonstrate your skills in a particular area. Moreover, if you know what the results were in terms of business benefits and you can articulate these in facts and figures then this will be really useful

Should I include information about my personal circumstances?

In short, you should only include information that will aid your application. In the UK you are of course protected by various pieces of equal opportunities legislation so there is no need to reveal any information regarding religion, sex, race or disability. You want your application to be assessed purely on your ability to do the job so generally, it is better not to include any personal information.

The primary call to action for a covering letter is to get the recruiter to look at your CV. It’s only after reading your CV that any decision about inviting you to interview will be made so sign off by politely pointing the reader to your CV to find out more

This article is written by Neville Rose, Director of CV Writers. If you need help with your CV or LinkedIn profile CV Writers are the official partner to The Actuary Jobs and provide a CV writing service .

Related links

- Why Become an Actuary? What you need to know to decide

- Networking - making an impression to stand out

Top tips for optimising your Actuary LinkedIn profile

Share this article

Related articles

Actuaries cv writing, what is it like for your competitors?

CV Writers 5 reasons why white space is good for your CV

Latest articles, institute and faculty of actuaries, workers want employers to pick workplace pensions, paternity leave regulations unveiled.

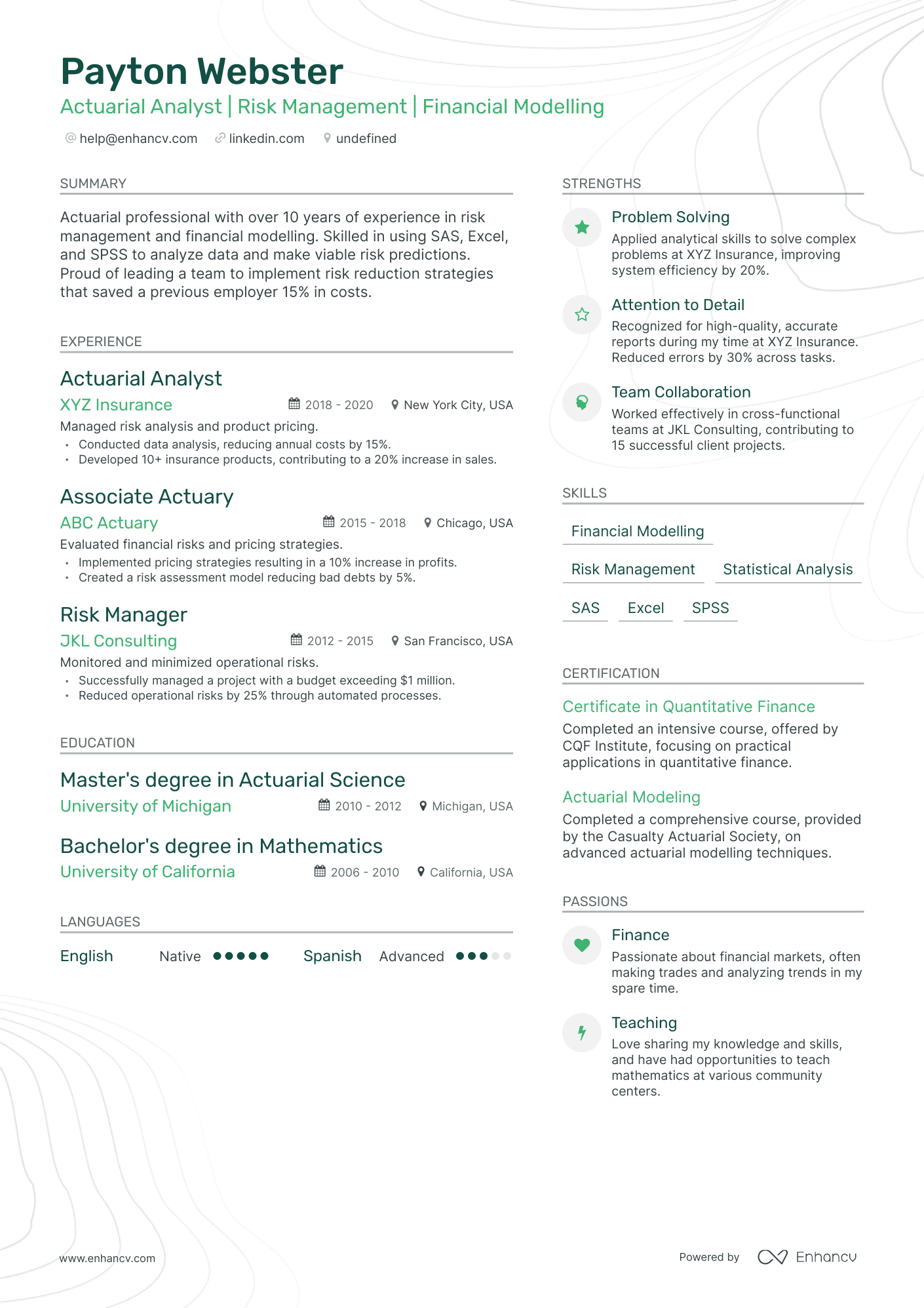

- • Conducted data analysis, reducing annual costs by 15%.

- • Developed 10+ insurance products, contributing to a 20% increase in sales.

- • Implemented pricing strategies resulting in a 10% increase in profits.

- • Created a risk assessment model reducing bad debts by 5%.

- • Successfully managed a project with a budget exceeding $1 million.

- • Reduced operational risks by 25% through automated processes.

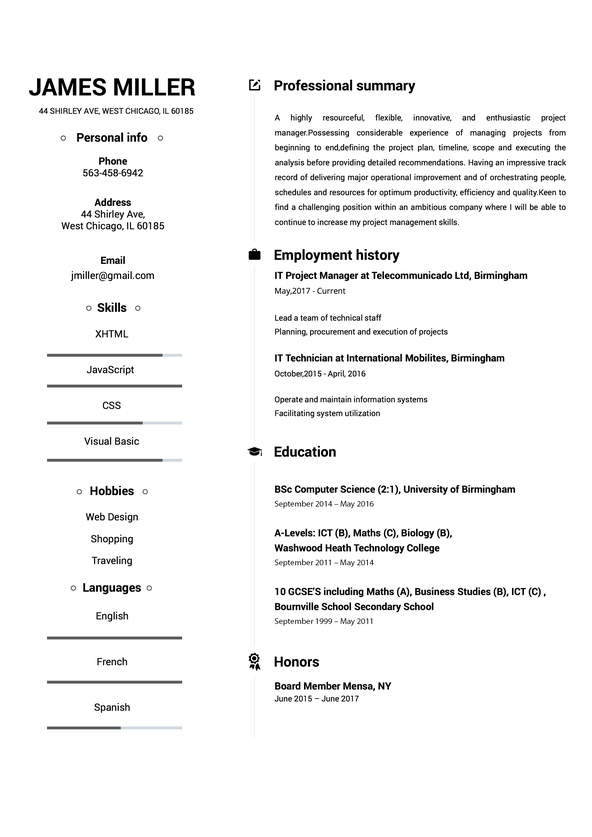

5 Actuary Internship Resume Examples & Guide for 2024

Your actuary internship resume must showcase your mathematical prowess and analytical thinking. Highlight coursework or projects that involved statistical analysis, data modeling, or risk assessment. Additionally, provide evidence of your proficiency with actuarial software and data management tools. Your resume should demonstrate your ability to apply theoretical knowledge to real-world financial situations.

All resume examples in this guide

Resume Guide

Crafting a stellar actuary internship resume format, optimizing the experience section of your actuary internship resume, creating your actuary internship resume skills section: balancing hard skills and soft skills, highlighting education and certification on your actuary internship resume, summary or objective: making your actuary internship resume shine, additional actuary internship resume sections for a personalized touch, key takeaways.

One significant challenge faced when crafting a resume for an actuary internship is articulating complex mathematical skills and relevant coursework in a way that appeals to employers. Our guide can assist by providing specific words, phrases, and examples on how to effectively communicate these technical skills and academic experiences in a succinct, professional manner.

Enhance your application for the actuary internship role with our concise guide on how to:

- Format your actuary internship resume, ensuring a balance between professionalism and creativity, in line with best practices.

- Align your resume with the actuary internship job requirements by incorporating relevant industry keywords.

- Utilize distinct resume sections to highlight your skills and achievements, making a case for why you're the top pick for the actuary internship role.

- Draw from leading actuary internship resume examples to effectively tailor your experience.

Recommended reads:

- Computer science internship resume

- Design Intern resume

- Product Manager Intern resume

- Architecture Intern resume

- Financial Analyst Intern resume

Navigating the maze of resume formatting can be challenging. But understanding what recruiters prioritize can make the process smoother.

Wondering about the optimal format, the importance of certain sections, or how to detail your experience? Here's a blueprint for a polished resume:

- Adopt the reverse-chronological resume format . By spotlighting your latest roles upfront, you offer recruiters a snapshot of your career trajectory and recent accomplishments.

- Your header isn't just a formality. Beyond basic contact information, consider adding a link to your portfolio and a headline that encapsulates a significant achievement or your current role.

- Distill your content to the most pertinent details, ideally fitting within a two-page limit. Every line should reinforce your candidacy for the actuary internship role.

- To preserve your resume's layout across different devices and platforms, save it as a PDF.

Upload your resume

Drop your resume here or choose a file . PDF & DOCX only. Max 2MB file size.

Make sure your resume is ATS compliant and catches the recruiters' attention by tailoring your experience to the specific job requirements. Quantify and highlight why you're the best candidate for the role on the first page of your resume.

Don't forget to include these six sections on your accounts payable specialist resume:

- A header for your contact details and a summary that highlight your alignment with the accounts payable specialist job you're applying for

- An experience section that explains how you apply your technical and personal skills to deliver successful results

- A skills section that further highlights how your profile matches the job requirements

- An education section that provides your academic background

- An achievements' section that mentions any career highlights that may be impressive, or that you might have missed so far in other resume sections

What recruiters want to see on your resume:

- Quantitative Skills: Proficiency in statistics, mathematics, and data analysis. Familiarity with software like R, Python, or SAS is often required.

- Experience with Actuarial Tools: Utilization of specific actuarial tools such as Excel, SQL and VBA is highly valued.

- Certifications or Exams: Completion of Society of Actuaries (SOA) or Casualty Actuarial Society (CAS) exams are prioritized. This shows dedication to the profession.

- Internship or Project Experience: Any internship, co-op, or project experience that involves risk management, insurance, or relevant fields will be extremely beneficial.

- Communication Skills: The ability to effectively communicate complex mathematical concepts to non-technical stakeholders is crucial in this role.

- Resume Margins

- How to Use Resume Lines

The experience section is pivotal—it bridges the gap between your qualifications and the job's requirements.

To craft an impactful actuary internship experience section, consider these guidelines:

- Review the job posting to identify key requirements and align your past roles with these needs.

- Go beyond listing skills—demonstrate their impact through quantifiable achievements.

- Exclude roles that don't enhance your application or showcase relevant skills.

- While technical expertise is crucial, also highlight soft skills that add value to your role.

- Use action verbs to articulate your accomplishments and the skills employed to achieve them.

Below, we've provided actuary internship resume samples to inspire your experience section, ensuring it adheres to industry best practices.

- Conducted statistical analysis on insurance claims data, identifying patterns and trends to improve risk assessment models.

- Collaborated with a team to develop an actuarial pricing model resulting in a 10% increase in premium revenue.

- Assisted in the preparation of financial reports, including claim reserve analysis and expense projections.

- Analyzed mortality rates and life expectancy data for life insurance products, contributing to the development of new product offerings.

- Managed a portfolio of annuity contracts, ensuring accurate policy valuations and compliance with regulatory requirements.

- Participated in the design and implementation of a risk management framework, resulting in improved solvency ratio by 15%.

- Performed financial modeling and forecasting for property and casualty insurance lines, supporting underwriting decisions.

- Collaborated with underwriters to determine appropriate premium rates based on risk analysis and loss experience data.

- Conducted research on industry trends and regulatory changes, providing recommendations for product enhancements.

- Developed and maintained actuarial models for pricing and reserving of health insurance products, ensuring accuracy and compliance.

- Led a cross-functional team in the implementation of an automated claims processing system, resulting in a 20% reduction in processing time.

- Performed audits on provider reimbursement rates, identifying cost-saving opportunities resulting in annual savings of $1 million.

- Assisted in the development of underwriting guidelines for commercial liability insurance, improving risk selection processes.

- Conducted profitability analysis of insurance products, recommending adjustments to pricing and coverage terms.

- Contributed to the implementation of a claims reserve monitoring system, reducing reserve inaccuracies by 25%.

- Collaborate with data scientists to develop machine learning algorithms for predictive modeling, enhancing actuarial forecasting accuracy.

- Conduct deep-dive analyses of large datasets to identify emerging risks, providing insights for strategic decision-making.

- Lead initiatives to implement advanced analytics techniques, such as telematics data utilization, resulting in improved risk assessment.

- Managed the valuation of pension liabilities for defined benefit plans, ensuring compliance with regulatory guidelines.

- Developed and implemented mortality improvement models, resulting in more accurate projections of long-term obligations.

- Led a team in the design and execution of a comprehensive asset-liability matching strategy, reducing funding gap by 15%.

- Conducted risk assessments for reinsurance contracts, evaluating potential catastrophic losses and determining appropriate pricing.

- Assisted in the development of catastrophe models to quantify exposure and assess capital adequacy.

- Collaborated with underwriters and brokers to negotiate reinsurance terms resulting in improved risk transfer efficiency.

- Managed the pricing of auto insurance products, incorporating telematics data to develop usage-based insurance programs.

- Conducted profitability analysis on different distribution channels, optimizing marketing strategies resulting in a 12% increase in policy sales.

- Led the implementation of an automated ratemaking system, reducing the time required for rate revisions by 50%.

- Performed reserve analysis and loss reserving for workers' compensation insurance, ensuring adequate reserves for future claims.

- Collaborated with claims adjusters to investigate large-loss claims, providing insights on liability and settlement strategies.

- Assisted in the development of a risk classification system, improving premium accuracy and reducing adverse selection.

Quantifying impact on your resume

- Include quantitative achievements from your academic projects or previous internships to demonstrate your ability to apply mathematical knowledge in practical scenarios.

- Highlight any programming languages you are proficient in, like R or Python, as these signal your ability to manipulate data and create predictive models, crucial for actuarial work.

- List specific coursework related to statistics, economics, or finance to underscore your theoretical understanding of areas relevant to actuarial science.

- Mention your score in key actuarial exams (like SOA or CAS) if you've taken them, showing your commitment to the profession and technical proficiency.

- Showcase your experience with data analysis software (like Excel, SQL, or SAS) because familiarity with these tools is vital for processing and analyzing large datasets.

- Note any past experience with risk assessment or insurance modeling to highlight your direct application of actuarial principles.

- Document any involvement in actuarial societies or clubs, providing a numerical indication of your leadership roles or length of membership, demonstrating both dedication and networking skills.

- Feature any advanced math or statistical problem-solving awards or recognition, quantifying your ranking or the number of participants, to emphasize your analytical capabilities.

Building a actuary internship resume when experience is sparse

If you're light on relevant experience, consider highlighting:

- Short-term roles or internships undertaken during your academic years.

- Contractual roles, emphasizing their relevance and the outcomes achieved.

- Alternative resume formats, such as functional or hybrid, that spotlight your skills.

- Research roles, especially if they involved significant projects or if your contribution was pivotal to the project's success.

- Can I Leave a Job I was Fired From Off my Resume

- Resume Without Work Experience

If your experience section doesn't directly address the job's requirements, think laterally. Highlight industry-relevant awards or positive feedback to underscore your potential.

Recruiters hiring for actuary internship roles are always keen on hiring candidates with relevant technical and people talents.

Hard skills or technical ones are quite beneficial for the industry - as they refer to your competency with particular software and technologies.

Meanwhile, your soft (or people) skills are quite crucial to yours and the company's professional growth as they detail how you'd cooperate and interact in your potential environment.

Here's how to describe your hard and soft skill set in your actuary internship resume:

- Consider what the key job requirements are and list those towards the top of your skills section.

- Think of individual, specific skills that help you stand out amongst competitors, and detail how they've helped you succeed in the past.

- Look to the future of the industry and list all software/ technologies which are forward-facing.

- Create a separate, technical skills section to supplement your experience and further align with the actuary internship job advert.

Find the perfect balance between your resume hard and soft skills with our two lists.

Top skills for your actuary internship resume

Statistical analysis

Data modeling

Risk assessment

Actuarial science

Quantitative finance

Insurance industry knowledge

Proficiency in programming languages (such as R, Python or SQL)

Spreadsheet proficiency

Financial forecasting

Knowledge of regulatory standards

Analytical thinking

Problem-solving

Attention to detail

Communication skills

Time management

Critical thinking

Adaptability

Decision-making

Ethical judgment

Consider dedicating a separate skills section on your actuary internship resume to showcase your technical proficiencies, especially if you want to highlight specific software expertise.

Your education section is a testament to your foundational knowledge and expertise.

- Detailing your academic qualifications, including the institution and duration.

- If you're still studying, mention your anticipated graduation date.

- Omit degrees that aren't pertinent to the job.

- Highlight academic experiences that underscore significant milestones.

For actuary internship roles, relevant education and certifications can set you apart.

To effectively showcase your qualifications:

- List all pertinent degrees and certifications in line with the job requirements.

- Include additional certifications if they bolster your application.

- Provide concise details: certification name, institution, and dates.

- If you're pursuing a relevant certification, indicate your expected completion date.

Your education and certification sections validate both your foundational and advanced knowledge in the industry.

Best certifications to list on your resume

- Canadian Institute of Actuaries (CIA) - University Accreditation Program (UAP)

- Be An Actuary - Mathematical Statistics Course

- Be An Actuary - Economics Course

- Be An Actuary - Accounting and Finance Course

If you have basic certificates, place them in the skills or experience section. This saves space for high-demand industry certificates.

- Continuing Education on Resume

- Expected Graduation Date Resume

Start your resume with a strong summary or objective to grab the recruiter's attention.

- Use a resume objective if you're newer to the field. Share your career dreams and strengths.

- Opt for a resume summary if you have more experience. Highlight up to five of your top achievements.

Tailor your summary or objective for each job. Think about what the recruiter wants to see.

Resume summary and objective examples for a actuary internship resume

With over five years of experience in risk management and quantitative analysis, I bring strong analytical problem-solving skills honed at Company X. Proficient in predictive modeling and statistical software, I have led successful initiatives that improved financial forecasting accuracy by 20%.

A mathematics graduate excited to leverage academic background into an actuarial career. Possess a deep understanding of calculus and statistics along with hands-on experience in Python and Excel. Proven aptitude for data analysis and model building during university projects.

Navigating a transition from a software engineering role at Company Y, bringing six years of expertise in data-driven decision making and algorithm development. Fluent in multiple programming languages, I've developed complex systems that enhanced operational efficiency by 30%.

An economist eager to transfer a decade-long finance career into the actuarial space. Skilled in financial modeling and econometrics, having managed portfolios totaling $500 million at Local Bank Z. Expert in SAS and advanced Excel functionalities.

Aspiring actuary seeking to apply rigorous mathematical training and passion for analyzing and interpreting data patterns. Equipped with a deep understanding of probability theory and exposure to coding using R, I aim to contribute towards better financial planning and decision making.

Enthusiastic about entering the actuarial profession. Armed with a master's degree in Statistics and hands-on experience in database management and SQL, my goal is to leverage these skills to generate insightful data-driven solutions for financial risks and uncertainties.

To further personalize your actuary internship resume, consider adding sections that reflect your unique qualities and achievements.

Popular choices include:

- Projects to showcase significant work achievements.

- Languages to indicate proficiency levels.

- Awards to celebrate industry recognitions.

- Hobbies and Interests to share personal passions.

- Effective actuary internship resumes are well-structured, weaving a compelling career narrative.

- Choose between a resume summary or objective based on your experience and the impression you aim to create.

- If lacking in direct experience, leverage other roles, such as internships or contract positions, to demonstrate alignment with the actuary internship role.

- Be discerning in listing hard and soft skills, ensuring relevance and showcasing outcomes.

- Always tailor your resume for each actuary internship application, ensuring alignment with job requirements.

Looking to build your own actuary internship resume?

- Resume Examples

Updating Your LinkedIn Profile: Why, When, and How to Add Your New Job?

How to answer "what are your hobbies and interests" interview question, does a resume need a cover letter, what is a cover letter definition, structure, purpose, types & meaning, overqualified for a job tips to overcome this hurdle, the best resume structure: examples, templates & tips.

- Create Resume

- Terms of Service

- Privacy Policy

- Cookie Preferences

- Resume Templates

- AI Resume Builder

- Resume Summary Generator

- Resume Formats

- Resume Checker

- Resume Skills

- How to Write a Resume

- Modern Resume Templates

- Simple Resume Templates

- Cover Letter Builder

- Cover Letter Examples

- Cover Letter Templates

- Cover Letter Formats

- How to Write a Cover Letter

- Resume Guides

- Cover Letter Guides

- Job Interview Guides

- Job Interview Questions

- Career Resources

- Meet our customers

- Career resources

- English (UK)

- French (FR)

- German (DE)

- Spanish (ES)

- Swedish (SE)

© 2024 . All rights reserved.

Made with love by people who care.

Resume Worded | Career Strategy

14 actuarial analyst cover letters.

Approved by real hiring managers, these Actuarial Analyst cover letters have been proven to get people hired in 2024. A hiring manager explains why.

Table of contents

- Actuarial Analyst

- Senior Actuarial Analyst

- Entry-Level Actuarial Analyst

- Alternative introductions for your cover letter

- Actuarial Analyst resume examples

Actuarial Analyst Cover Letter Example

Why this cover letter works in 2024, analyzing data sets.

In this cover letter, the applicant showcases their ability to interpret complex data sets and identify patterns. This is a crucial skill for an Actuarial Analyst, and mentioning it early on helps set the tone for the rest of the letter.

Effective Communication

Highlighting the importance of effective communication when presenting findings to a diverse team is a great way to show that the applicant is not only skilled in data analysis but also understands the need to communicate results in a clear and concise manner.

Implementing New Systems

By mentioning a specific accomplishment - implementing a risk modeling system that increased revenue - the applicant demonstrates their ability to make a significant impact in their previous role. This is a strong selling point for any job seeker.

Showcase of Achievements

What strikes me about this is your self-assuredness in highlighting your accomplishments. You've nicely quantified your success, stating that your risk models led to a 15% increase in policyholder profitability. Employers love to see results, and you've delivered them with tangible numbers.

Highlighting Strengths in Key Skills

You've done well in pointing out your strong mathematical skills and ability to identify trends and patterns. This gives me a sense of your strengths and how they've played a part in your achievements. It sends a clear message that these are your key skills, and they've contributed to your success.

Expressing Genuine Interest

Employers want to feel that you want the job, not just any job. You've made it clear why you're interested in this role specifically - wanting to work on a larger scale and have a more significant impact. It really shows you've thought about why this role could be a good fit for you.

Show genuine interest in the company

This cover letter immediately stands out because it shows a deep connection and interest in the company. When you specifically mention why you're attracted to the company, it tells me that you're not just applying for any job, you're applying for this job at this company. It demonstrates that you know what we're about and that you're passionate about the same things.

Highlight your quantifiable achievements

Showing me your quantifiable achievements, just like you did here, is a really effective way of demonstrating your skills and potential. It tells me exactly what you've accomplished and it makes me think about what you could potentially do for us. Plus, it shows me that you're about action and results, not just talk.

Express your excitement for specific opportunities

When you mention specific projects or opportunities at our company that excite you, it shows me that you've done your homework. It tells me that you're informed about what we do and that you're genuinely interested in contributing to our efforts. It also shows that you're not just looking for any job, but the right job where you can make an impact.

Emphasize your alignment with company's values

Showing me that you identify with our company's values and mission, like you did in this cover letter, is a real plus. It tells me that you're not just about the paycheck, but about making a meaningful contribution to our team. And that's the type of person we want to hire.

End on a strong, positive note

Ending your cover letter by thanking me for considering your application and expressing your eagerness to contribute to our team's success leaves a lasting positive impression. It shows me that you're keen, motivated, and genuinely interested in the job. Always leave them wanting more.

Show your early passion for actuarial tasks

Telling a story about your early interest in math and prediction makes your application memorable and shows your genuine passion for the actuarial field.

Quantify your internship achievements

Detailing specific results you achieved during your internship, like a 15% reduction in losses, demonstrates your ability to impact real-world business outcomes.

Highlight your skills in data analysis

Discussing your role in creating reports for senior management showcases your analytical skills and your ability to contribute to important business decisions.

Emphasize your communication abilities

Stating your skill in explaining complex concepts in simple terms highlights an essential skill for actuarial analysts, who must often present their findings to non-technical stakeholders.

Express eagerness to learn and contribute

Your closing statement should reinforce your interest in the role and your readiness to bring your skills to the team, inviting a discussion on how you can align with their needs.

Does writing cover letters feel pointless? Use our AI

Dear Job Seeker, Writing a great cover letter is tough and time-consuming. But every employer asks for one. And if you don't submit one, you'll look like you didn't put enough effort into your application. But here's the good news: our new AI tool can generate a winning cover letter for you in seconds, tailored to each job you apply for. No more staring at a blank page, wondering what to write. Imagine being able to apply to dozens of jobs in the time it used to take you to write one cover letter. With our tool, that's a reality. And more applications mean more chances of landing your dream job. Write me a cover letter It's helped thousands of people speed up their job search. The best part? It's free to try - your first cover letter is on us. Sincerely, The Resume Worded Team

Want to see how the cover letter generator works? See this 30 second video.

Start with a personal connection

Talking about how a personal experience led you to this career path makes your cover letter memorable and personal. It helps us understand your motivation.

Quantify your achievements

Using percentages to show how your work led to significant improvements gives us concrete evidence of your skills. It's exactly the kind of result-driven mindset we value.

Highlight your relevant experiences

Mentioning specific skills you've developed through your experiences, like statistical analysis and problem-solving, directly ties your background to what we're looking for in a candidate.

Show enthusiasm for the team’s mission

When you express excitement about working with our team and contributing to our mission, it shows us that you're not just looking for a job, but a place where you can belong and grow.

End with a forward-looking statement

A closing that anticipates future discussions about how you can contribute to our success leaves a positive, proactive impression. It's a good note to end on.

Talking about your admiration for the company's work helps me see that you've done your homework and really care about joining us. This makes your application feel more personal and thoughtful.

Highlight actuarial project experience

Describing a specific project where you used your actuarial skills shows me exactly what you're capable of. It's good to see real-world applications of your knowledge.

Point out key actuarial skills

Mentioning your analytical skills and the ability to explain complex ideas in simple terms is crucial for an actuarial role. It tells me you're not just smart, but you can also help others understand the data.

Emphasize ongoing learning

Knowing that you're keeping up with the latest in actuarial science through conferences and exams tells me you're committed to your professional growth. This is a great trait in a potential hire.

Express eagerness to contribute

Ending your letter by inviting further discussion shows me you're genuinely interested in the role and ready to talk about how you can help the company. It sets the stage for the next step in the hiring process.

Senior Actuarial Analyst Cover Letter Example

Display of leadership and skill development.

Leadership is a sought-after trait, particularly for senior roles. You've wonderfully highlighted your experience leading a team of junior analysts, demonstrating not just your technical skills but also your leadership capabilities. Additionally, stating how you've honed your skills in predictive modeling and risk assessment gives a positive impression of your commitment to continuous learning.

Emphasizing Impact of Your Actions

I love that you've connected your actions to tangible outcomes - reduction in financial risks and an increase in policy sales. This helps me understand the kind of impact you can make. Remember, employers are always looking for problem solvers who can deliver results and your cover letter shows that you're one of them.

Alignment with Company's Mission

Your eagerness to contribute to MetLife's mission is palpable in your letter. Expressing your interest in the company's focus and how your skills align with it, helps paint a picture of how you can fit within the organization and contribute to its objectives. This is a very effective way of showing your enthusiasm for the role.

Connect your interests to the company

When you connect your personal interests to our company's work, like you did here, it tells me that you're not just looking for a job, but a mission that aligns with your passions. This shows me that you're likely to be more engaged and productive, and that's the kind of candidate we're looking for.

Prove your impact with concrete outcomes

When you talk about your achievements, try to include the concrete outcomes that resulted from your actions. Not only does it make your achievement more tangible, but it also gives me a glimpse of what you could potentially do for our company. This kind of detail can really make a difference.

Show enthusiasm for the role

Showing me your enthusiasm for the role, like you did here, really grabs my attention. It tells me that you're genuinely excited about the opportunity and that you're likely to bring that energy to your work. This is always a good sign.

Express alignment with company's mission

When you express your alignment with our mission and goals, it reassures me that we're on the same page. It tells me that you're not just looking for any job, but specifically this job, at this company. That's the kind of commitment we value.

Offer to discuss your skills further

Offering to discuss your skills and how they can benefit our company, like you did here, shows me that you're confident in your abilities and eager to make a difference. It also leaves a window open for further conversation, which is always a good move.

Connect your passion with the job

When you talk about how a field excites you, you show me you're not just looking for any job. You want this one. That's important to us.

Show your actuarial analyst impact

Telling us about a time you improved profitability and reduced risk by a specific percentage makes your achievement real and measurable. We look for impact like that.

Demonstrate your foundational skills

By discussing your core skills and how they were useful in past roles, you help us understand your professional foundation. We need people who have a strong base to build upon.

Highlight your leadership and innovation

Leadership and the ability to innovate are key. If you can show us how you've led teams to create new solutions, you're showing us exactly what we're looking for.

A closing statement that looks forward to discussing how you fit into our team adds a personal touch and shows you're genuinely interested in the role.

Highlight your successful actuarial experience

Starting with your achievements sets a strong precedent. It grabs attention and immediately showcases your value.

Demonstrate impact with numbers

Quantifying your achievements makes your experience tangible and relatable. It helps hiring managers understand the scale of your contributions.

Emphasize leadership and innovation

Leadership skills are key for a senior role. Highlighting your ability to lead and innovate shows you're ready for more responsibility.

Show excitement for the company's future

Demonstrating knowledge of and enthusiasm for the company's direction can align your goals with theirs, making you a more attractive candidate.

Request a conversation

Asking to discuss your potential contributions further shows initiative and a genuine interest in adding value to the team.

Show your enthusiasm for the senior actuarial analyst role

When you express excitement about the role and admiration for the company, it shows that you have a true interest in joining their team and understand their values. This can make your application memorable.

Talking about specific results, like saving a client $10M, demonstrates the tangible impact of your work. It gives a clear picture of what you can bring to the table. This is especially important in a data-driven field like actuarial analysis.

Highlight alignment with company values

Mentioning your alignment with the company’s global reach and innovation focus shows that you’ve done your homework. It suggests that you’re not just looking for any job, but a place where you can truly fit in and contribute.

Emphasize your leadership and communication skills

Pointing out your ability to manage teams and communicate complex ideas effectively signals that you’re ready for a senior role. It’s crucial in a senior actuarial analyst position, where collaboration and clarity are key.

Express your interest in further discussion

Closing by inviting further discussion shows openness and eagerness to engage with the hiring team. It’s a polite and proactive way to finish your cover letter, indicating your enthusiasm for the opportunity.

Entry-Level Actuarial Analyst Cover Letter Example

Connect your degree to your career choice.

Explaining how your academic background fuelled your interest in becoming an actuarial analyst provides a solid foundation for your application, demonstrating a clear path to your career choice.

Showcase academic projects with real impact

Detailing a project that improved prediction accuracy by 20% not only highlights your academic achievements but also your potential to contribute valuable insights in a professional setting.

State your motivation for joining the company

Expressing excitement about contributing to the company's mission adds a personal touch to your application, showing that you have done your research and are genuinely interested in the role.

Summarize your key strengths

In your conclusion, reiterating your analytical skills, creativity, and ability to work well in teams succinctly wraps up why you are a good fit for the actuarial analyst position.

End with a call to action

Inviting a discussion about how you can contribute to the team’s success leaves the door open for further communication, signaling your eagerness to move forward in the application process.

Show your enthusiasm for the actuarial analyst role

Explain your strong interest in the field and the company. This shows you have done your research and are not just applying randomly.

Detail your project experience

Talk about specific projects that highlight your skills. This gives a clear example of your ability to apply theory to real life, which is crucial for an actuarial role.

Express eagerness to learn from experienced actuaries

Showing that you value learning and growth opportunities demonstrates your commitment to your professional development.

Thank the hiring manager

Always end with a thank you. It shows good manners and respect for the person reading your application.

Invite further discussion

Encouraging a conversation about how you can contribute adds a proactive touch to your application, making you seem more engaged and interested.

Link degree to job relevance

Making a clear connection between your degree in actuarial science and the job shows me you have the educational background needed. It's a good start to showing you're a fit for the role.

Detail collaborative project experience

Sharing your experience working in a team on an actuarial project gives me a peek into how you tackle problems and work with others. Teamwork is key in our work environment.

Express attraction to company values

Your reason for being drawn to the company gives me insight into what you value professionally. It helps me understand why you think you'd be a good match for us.

Emphasize soft skills and creativity

Highlighting your communication, teamwork, and positive approach tells me you're not just about numbers. These soft skills are just as important as your technical abilities in our collaborative work environment.

Show readiness to contribute

Asking to discuss your qualifications further shows you're proactive and eager. This tells me you're not just looking for any job, but are interested in making a meaningful contribution to our team.

Alternative Introductions

If you're struggling to start your cover letter, here are 6 different variations that have worked for others, along with why they worked. Use them as inspiration for your introductory paragraph.

Cover Letters For Jobs Similar To Actuarial Analyst Roles

- Actuarial Analyst Cover Letter Guide

- Actuarial Manager Cover Letter Guide

- Chief Actuarial/Risk Officer Cover Letter Guide

- Senior Actuarial Analyst Cover Letter Guide

Other Data & Analytics Cover Letters

- Business Analyst Cover Letter Guide

- Data Engineer Cover Letter Guide

- Data Scientist Cover Letter Guide

- Data Specialist Cover Letter Guide

- Director of Analytics Cover Letter Guide

- Intelligence Analyst Cover Letter Guide

- Program Analyst Cover Letter Guide

- Reporting Analyst Cover Letter Guide

- SQL Developer Cover Letter Guide

- Supply Chain Planner Cover Letter Guide

Thank you for the checklist! I realized I was making so many mistakes on my resume that I've now fixed. I'm much more confident in my resume now.

Actuarial Internship Cover Letter

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Your Email Address]

[Your Phone Number]

[Employer's Name]

[Company Name]

[Company Address]

Dear [Employer's Name],

I am writing to express my strong interest in the Actuarial Internship position at [Company Name], as advertised on [where you found the job posting]. With a solid foundation in mathematics, a passion for problem-solving, and a strong desire to apply my analytical skills in a professional setting, I am excited about the opportunity to contribute to your team and learn from experienced actuaries.

Currently pursuing a [Your Degree] in [Your Major] at [Your University], I have developed a deep understanding of statistical analysis, data modeling, and risk assessment. My coursework has equipped me with the technical expertise needed for actuarial work, and I am eager to apply these skills in a real-world context. I am particularly drawn to [Company Name] because of its reputation for innovative solutions and commitment to excellence in the field.

During my academic journey, I have demonstrated my dedication to learning and achieving excellence. I consistently maintain a high GPA, and my involvement in [Relevant Student Organizations] has allowed me to collaborate effectively in team environments, communicate complex ideas, and manage time efficiently. These experiences have honed my ability to work collaboratively and contribute meaningfully to a team's success.

What sets me apart as a candidate is my proactive approach to continuous learning and my determination to excel in the actuarial profession. I am a fast learner, and I thrive in dynamic, fast-paced environments that require adaptability and critical thinking. My proficiency in programming languages such as [Relevant Programming Languages] further enhances my ability to analyze data and develop accurate models.

I am enthusiastic about the opportunity to apply my skills and knowledge in a practical setting, and I am confident that my dedication, attention to detail, and strong work ethic align well with [Company Name]'s values and objectives. I am excited about the prospect of contributing to your team's success and gaining insights from industry experts during my internship.

Thank you for considering my application. I have attached my resume for your review. I would welcome the opportunity to discuss how my background and aspirations align with [Company Name]'s needs in more detail. Please feel free to contact me at [Your Phone Number] or [Your Email Address] to schedule a conversation.

[Attachment: Resume]

Actuarial Intern Cover Letter Example

An Actuarial Intern is a temporary role in the field of Actuarial Science. This position typically involves assisting Actuaries with their day-to-day work and gaining related experience.

Writing a cover letter for your dream job is a difficult task. Luckily, writing an Actuarial Intern Cover Letter is super easy with our sample cover letter. Our Proprietary easy-to-use generator makes short work of all your cover letter needs and will aid you to accomplish your goals. An actuarial intern is responsible for providing support to the actuarial team in the areas of pricing, reserving, and capital modeling. This includes researching and analyzing data, developing actuarial models and reports, and preparing presentations.

- Cover Letters

- Accounting & Finance

The intern will also provide support to senior actuarial staff in the development of advanced actuarial models. They will review and analyze existing actuarial models and recommend changes as needed. They may also be asked to review internal and external documents to ensure accuracy.

What to Include in a Actuarial Intern Cover Letter?

Roles and responsibilities.

- Researching and analyzing data related to various actuarial topics.

- Developing financial models and using software programs to evaluate and analyze actuarial data.

- Assisting in the development of actuarial pricing models and other financial models.

- Assisting with the development of actuarial marketing materials and presentations.

- Assisting with the development of actuarial reports and studies.

- Gathering and organizing actuarial data and information.

- Developing actuarial projections and calculations.

- Participating in team meetings and strategy sessions.

- Helping to develop and implement actuarial strategies.

- Assisting in the development of actuarial processes and procedures.

- Assisting in the development and review of actuarial policies and procedures.

- Attending industry conferences and seminars as necessary.

Education & Skills

Actuarial intern skills:.

- Strong analytical and problem-solving skills.

- Excellent mathematical and statistical abilities.

- Ability to work independently and as part of a team.

- Ability to interpret and explain complex data.

- Proficiency in software such as Excel and Access.

- Knowledge of actuarial science and actuarial principles.

Actuarial Intern Education Requirements:

- Bachelor’s degree in actuarial science, mathematics, statistics, or a related field.

- Working towards professional accreditation or certification in the field of actuarial science.

- Working knowledge of financial and risk management principles.

- Previous experience in the insurance or financial services industry.

- Previous internship or work experience in actuarial science.

- Familiarity with actuarial software applications such as PolySystems, GGY-AXIS, or Prophet.

Actuarial Intern Cover Letter Example (Text Version)

Dear Mr./Ms.

I am writing to express my interest in the Actuarial Intern position at [Company Name]. I am confident that my education, experience, and enthusiasm for the actuarial profession make me an ideal fit for this role.

I am currently completing a Bachelor of Science in Mathematics with a major in Actuarial Science at [University Name]. I have successfully completed coursework in financial mathematics, probability, and statistics, as well as insurance and risk management. My coursework and academic accomplishments have prepared me to be successful in an actuarial environment.

My background includes:

- Obtaining Associate of the Society of Actuaries (ASA) designation in 2020.

- Participating in a summer actuarial internship with [Company Name] where I successfully managed and completed projects on time.

- Achieving and maintaining a 3.9 GPA throughout college.

- Demonstrating strong analytical and problem-solving skills.

- Possessing strong attention to detail and excellent communication skills.

I am knowledgeable in actuarial software including [software name] and have considerable experience with Excel and Microsoft Office. I am eager to contribute to the success of your organization through my research, analysis, and problem-solving skills.

I am confident that my enthusiasm and commitment to the actuarial profession would be a great asset to [Company Name].I would welcome the opportunity to discuss my qualifications in further detail. Thank you for your time and consideration.

Sincerely, [Your Name]

When writing a cover letter for an actuarial intern position, be sure to emphasize your relevant skills, education, and experience. Highlight any internships or other professional experiences that have prepared you for the role. Additionally, make sure to express your enthusiasm and interest in the position and demonstrate why you would be a great fit for the job. Refer to our extensive range of Actuarial Intern Resume Samples for help with your resume writing.

Customize Actuarial Intern Cover Letter

Get hired faster with our free cover letter template designed to land you the perfect position.

Related Accounting & Finance Cover Letters

- ResumeBuild

- Actuarial Intern

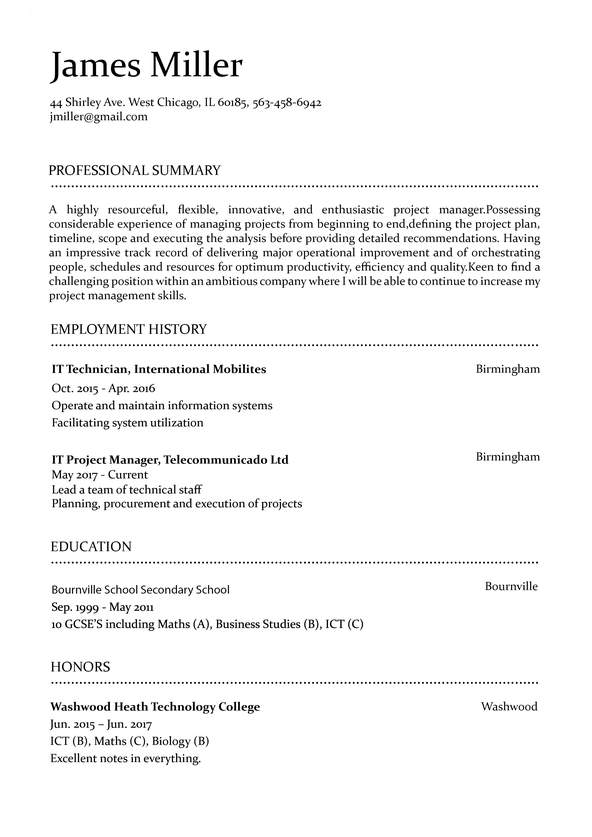

5 Amazing actuarial intern Resume Examples (Updated 2023) + Skills & Job Descriptions

Build your resume in 15 minutes, actuarial intern: resume samples & writing guide, employment history.

- Assist in the development of rate filings and other regulatory documents

- Analyze and interpret data for various insurance products

- Prepare and analyze financial statements and other reports

- Support actuarial audits and examinations

- Prepare actuarial analyses and develop models to support pricing and reserving

- Assist in the development of actuarial assumptions

- Prepare actuarial reports and presentations

- Analyze financial data and develop actuarial projections

Do you already have a resume? Use our PDF converter and edit your resume.

Vincent Foster

Professional summary.

- Participate in the development of actuarial processes and procedures

- Participate in the development of actuarial pricing strategies

- Monitor and analyze industry trends

- Develop actuarial pricing models and support rate filings

- Assist in the development and implementation of actuarial models

Frank Allen

- Participate in the development of new products and services

Nate Taylor

- Perform ad-hoc analysis and research projects

Not in love with this template? Browse our full library of resume templates

Table of Content

- Introduction

- Resume Samples & Writing Guide

- Resume Example 1

- Resume Example 2

- Resume Example 3

- Resume Example 4

- Resume Example 5

- Jobs Description

- Jobs Skills

- Technical Skills

- Soft Skills

- How to Improve Your Resume

- How to Optimize Your Resume

- Cover Letter Example

actuarial intern Job Descriptions; Explained

If you're applying for an actuarial intern position, it's important to tailor your resume to the specific job requirements in order to differentiate yourself from other candidates. Including accurate and relevant information that directly aligns with the job description can greatly increase your chances of securing an interview with potential employers. When crafting your resume, be sure to use action verbs and a clear, concise format to highlight your relevant skills and experience. Remember, the job description is your first opportunity to make an impression on recruiters, so pay close attention to the details and make sure you're presenting yourself in the best possible light.

actuarial intern

- Compiled information from company databases using SAS

- Checked accuracy of actuarial memorandum and quarterly rate filings

- Performed beginning level analyses for utilization in rate determination for different lines of business

- Communicated key observations and trends to actuarial manager for consideration

- Experience analysis

- Collected and analyzed data to be used in company reports

- Prepared and verified factors and data utilized in rate analyses

- Financial Reviews for pension funds and reporting – giving an assessment of the financial position of a fund

- Assisting on the Actuarial valuation exercises – specifically data checks, liability calculation, sensitivity analysis

- Lapse analysis – calculating and analyzing lapse rates

- Calculation of Group Life Assurance, Funeral and Ill-Health rates

- Capital and annuity value calculations

- Monthly unit pricing and reporting for investment products

- Monthly expense analysis and reporting – involved calculation of expense ratios and indices

- Understanding life insurance product specifications

- Breaking down cashflow to calculate statutory reserve in excel model

- Policy value calculations and preparation of the investment statements

- Assistance on the commission of inquiry exercise

- Analyzing the motor insurance data by calculating the IR and claim severity month on month basis using the tools like MS Excel, R and Tableau,

- Preparing run-off triangles to model claims experience and predict future claims based on some assumptions.

- Working closely with underwriters to learn about travel and health product pricing, coverage and modification of policy documents.

- Collect and analyze travel data of other companies to compare and review our product.

- Reviewed production and activity loss reports.

- Performed data manipulations using Microsoft Excel.

- Prepared accurate financial statements at end of quarter.

- Created ad hoc reports on various data.

- Used graphical and quantitative analysis to analyze pricing models.

actuarial intern Job Skills

For an actuarial intern position, your job skills are a key factor in demonstrating your value to the company and showing recruiters that you're the ight fit for the role. It's important to be specific when highlighting your skills and ensure that they are directly aligned with the job requirements, as this can greatly improve your chances of being hired. By showcasing your relevant skills and experience, you can make a compelling case for why you're the best candidate for the job.

How to include technical skills in your resume:

Technical skills are a set of specialized abilities and knowledge required to perform a particular job effectively. Some examples of technical skills are data analysis, project management, software proficiency, and programming languages, to name a few. Add the technical skills that will get hired in your career field with our simple-to-use resume builder. Select your desired resume template, once you reach the skills section of the builder, manually write in the skill or simply click on "Add more skills". This will automatically generate the best skills for your career field, choose your skill level, and hit "Save & Next."

- Data Analysis

- Project Management

- Quality Assurance

- Database Management

- Risk Management

- Technical Writing

- Business Analysis

- Statistical Analysis

- Programming

- Actuarial Mathematics

- Financial Modeling

- Microsoft Excel

- SAS Programming

- Insurance Industry Knowledge

- Regulatory Compliance

- R Programming

- Financial Analysis

How to include soft skills in your resume:

Soft skills are non-technical skills that relate to how you work and that can be used in any job. Including soft skills such as time management, creative thinking, teamwork, and conflict resolution demonstrate your problem-solving abilities and show that you navigate challenges and changes in the workplace efficiently. Add competitive soft skills to make your resume stand-out to recruiters! Simply select your preferred resume template in the skills section, enter the skills manually or use the "Add more skills" option. Our resume builder will generate the most relevant soft skills for your career path. Choose your proficiency level for each skill, and then click "Save & Next" to proceed to the next section.

- Communication

- Interpersonal

- Time Management

- Problem Solving

- Decision Making

- Critical Thinking

- Adaptability

- Organization

- Public Speaking

- Negotiation

- Conflict Resolution

- Attention to Detail

- Self-Motivation

- Stress Management

- Collaboration

- Strategic Thinking

- Emotional Intelligence

- Flexibility

- Reliability

- Professionalism

- Computer Literacy

- Customer Service

- Presentation

- Written Communication

- Social Media

- Troubleshooting

- Supervisory

- Documentation

- Financial Management

- Visualization

- Business Acumen

- Process Improvement

- Relationship Management.

How to Improve Your actuarial intern Resume

Navigating resume pitfalls can mean the difference between landing an interview or not. Missing job descriptions or unexplained work history gaps can cause recruiters to hesitate. Let's not even talk about the impact of bad grammar, and forgetting your contact info could leave your potential employer hanging. Aim to be comprehensive, concise, and accurate.

Frank Brown

Include your contact information and job descriptions, missing job descriptions lessens your chances of getting hired..

- Employers want to know what you've accomplished, so make sure to include descriptions for all of your previous jobs.

- Keep job descriptions short but don't just list your jobs.

- Never copy-paste a job description to post on your resume. Get inspired and use tools to help you write customized descriptions.

How to Optimize Your actuarial intern Resume

Keep an eye out for these resume traps. Neglecting to detail your job roles or explain gaps in your career can lead to unnecessary doubts. Grammar blunders can reflect negatively on you, and without contact information, how can employers reach you? Be meticulous and complete.

Leonard Vaughn

- Assist in the developing of actuarial assumtions.

- Prepear and anaylze financial statments and other reportss.

- Par-ticipate in the develop-ment of new prod-ucts and serv-ices.

- Analize financail data and develop actuaral projections.

- Mointor and anaylze industry trends.

- Develp actuail priicing models nd suport rate filngs.

- Assist in the developement of actuarial assumtions.

- Assist in the developement and implimentation of actuarial models.

- Pariticpate in the developement of actuarail pricing stratagies.

Correct Grammar and Address Gap Years in Your Resume

Don't leave unexplained gaps in your work history..

- When explaining gaps in your employment section, start by being honest.

- Elaborate on the gap and show that you never stopped learning.

- Explain and elaborate any gap in your work history by highlighting new skills.

actuarial intern Cover Letter Example

A cover letter can be a valuable addition to your job application when applying for an actuarial intern position. Cover letters provide a concise summary of your qualifications, skills, and experience, also it also gives you an opportunity to explain why you're the best fit for the job. Crafting a cover letter that showcases your relevant experience and enthusiasm for the Accounts Payable role can significantly improve your chances of securing an interview.

To the respected Farmers Insurance Recruitment Team

I am a highly motivated Actuarial Intern with 6 years of experience in Insurance. I am excited to submit my application for the Jr. Actuarial Intern position at Farmers Insurance, where I believe my skills and expertise would be an excellent fit.

Throughout my life, I have pursued my passion for Risk Management and sought out opportunities to learn and grow. My experience in Insurance has given me valuable skills such as Teamwork and Financial Management that have allowed me to improve professionally and personally. I am excited to bring these skills and my passion as a Actuarial Intern to the position and work with a team of like-minded individuals to achieve our common goals.

Thank you for considering my application for the Jr. Actuarial Intern position. With my skills and the amazing team at this organization, I am assured that I can contribute to your organization's success and make a meaningful impact. Looking forward to a future where we can work together.

Showcase your most significant accomplishments and qualifications with this cover letter. Personalize this cover letter in just few minutes with our user-friendly tool!

Related Resumes & Cover Letters

Contemporary

Professional

Looking to explore other career options within the Insurance field?

Check out our other resume of resume examples.

- F&i Manager Resume

- Insurance Verification Specialist Resume

- Insurance Broker Resume

- Insurance Claims Processor Resume

- Insurance Coordinator Resume

- Insurance Claims Specialist Resume

- Insurance Manager Resume

- Insurance Consultant Resume

- Insurance Sales Agent Resume

- Insurance Underwriter Resume

- Life Insurance Underwriter Resume

- Insurance Claims Adjuster Resume

- Pension Administrator Resume

- Licensed Insurance Agent Resume

- Pension Analyst Resume

- Life Insurance Agent Resume

- Real Estate Professional Resume

- Trial Attorney Resume

- Workers Compensation Claims Adjuster Resume

- F&i Manager Resume

- Claims Supervisor Resume

- Actuarial Intern Resume

- Advisor Resume

- Agent Resume

- Claim Adjuster Resume

- Associate Creative Director Resume

- Claims Analyst Resume

- Claims Manager Resume

- Claims Specialist Resume

FIND EVERYTHING YOU NEED HERE.

IF YOU HAVE QUESTIONS, WE HAVE ANSWERS.

4 Ways a Career Test Can Jump-Start Your Future (and Help Your Resume)

If you’re looking for a fresh path or a new passion, a career test could help you find it. You can take these tests online, in the comfort of your...

Avoid These 3 Resume Mistakes at All Costs

Your resume is your first impression for a prospective employer. The way you present yourself in that little document can make or break you – it can clinch you an...

Resume Design Tips and Tricks

Creating a resume that stands out from the rest doesn’t have to be rocket science. With just a few tips and tricks, you can make your professional resume a shining...

Build your Resume in 15 minutes

Sample cover letter for Internship position at Aon

Actuarial intern, got the job yes.

Dear Sir or Madam,

I am an undergraduate at the University of XXX writing to apply for the Actuarial Intern position. I am confident that my quantitative skills, rigorous research experience, and my eagerness to learn make me an optimal candidate for this opportunity.

My experiences and abilities are a strong match for this position. Having taken a lot of computer science, math, economics and statistics classes, I am highly sensitive to numbers and probability, and love solving problems with knowledge I learned. My strong quantitative analytic skills assisted me excel in data-based national business simulations, and in topping the business competition held by MassMutual Asian Ltd with an excellent promotion plan for their insurance products. In addition, I keep full major GPAs in all three majors while doing three jobs on campus, which not only demonstrates my academic ability but also my ability to manage time and finish tasks efficiently.

Please contact me at xxx-xxx-xxxx or xxx@xxx .edu . I really appreciate the opportunity to talk with you further about this position. Thank you for your consideration.

- Resume Builder

- Resume Templates

- Resume Formats

- Resume Examples

- Cover Letter Builder

- Cover Letter Templates

- Cover Letter Formats

- Cover Letter Examples

- Career Advice

- Interview Questions

- Resume Skills

- Resume Objectives

- Job Description

- Job Responsibilities

- FAQ’s

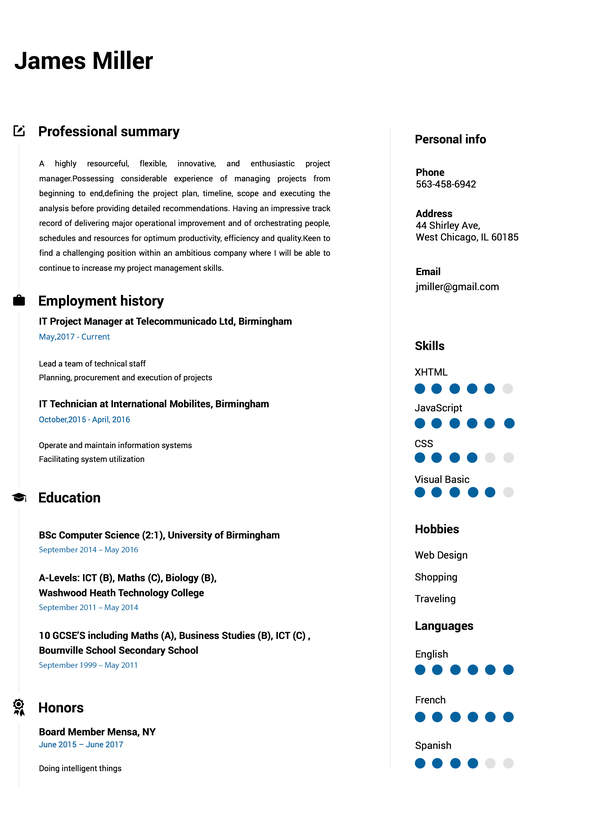

Actuarial Intern Resume Examples

Writing a resume for an actuarial intern position can be a daunting task. With so many job seekers vying for the same position and the tight competition, it’s important to make sure your resume stands out from the rest. In this blog post, we’ll provide you with an actuarial intern resume writing guide that will cover everything you need to know about creating a professional and impactful resume for an actuarial intern position. We’ll also provide you with examples of actuarial intern resumes to help you get started. With this guide, you’ll be able to craft the perfect resume that will get you noticed and help you land the job you want.

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples .

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Actuarial Intern

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: [email protected]

I am a highly motivated actuarial intern with excellent analytical and problem- solving skills. I possess knowledge of mathematics, probability, statistics and finance and have cultivated strong communication and presentation skills. Through my educational courses and past work experiences, I have developed a strong understanding of the insurance and risk management sector. My combination of skills and experience makes me an ideal candidate for an actuarial intern role.

Core Skills :

- Probability & Statistics

- Mathematics

- Data Analysis

- Risk Management

- Financial Modelling

- Software & Programming

- Microsoft Office Suite

Professional Experience : Actuarial Intern, ABC Insurance Company, May 2020 – Present

- Conducted data analysis and financial modelling for pricing and budgeting

- Gained experience in the development of actuarial models and the implementation of risk management principles

- Participated in the implementation of pricing models

- Developed new actuarial methods and techniques to improve the existing pricing models

Education : Bachelor of Science in Actuarial Science, XYZ University, 2016 – 2020

- GPA: 3.9/4.0

Create My Resume

Build a professional resume in just minutes for free.

actuarial intern Resume with No Experience

Recent college graduate with an actuary major looking to gain experience in the insurance industry through an actuarial internship. Possess strong analytical and quantitative skills and a dedication to excellence.

- Ability to analyze complex data

- Strong attention to detail

- Working knowledge of actuarial principles

- Familiarity with Microsoft Excel and PowerPoint

- Excellent written and verbal communication skills

- Ability to work within tight deadlines

Responsibilities :

- Perform data analysis and generate reports

- Assist in developing actuarial models and pricing tools

- Develop and maintain actuarial databases

- Develop assumptions and input data into actuarial models

- Assist in the development of actuarial strategies and reports

- Prepare presentations based on actuarial results

- Monitor competitive environment and trends

Experience 0 Years

Level Junior

Education Bachelor’s

actuarial intern Resume with 2 Years of Experience

Recent college graduate with a Bachelor’s in Actuarial Science and 2 years of experience in the insurance industry. Demonstrated knowledge in pricing, underwriting, and risk management, and have a proven history of taking initiative and working independently. Seeking an entry- level actuarial internship role to utilize knowledge and experience while gaining insight into the field.

- Underwriting and Risk Management

- Mathematics and Financial Modeling

- Insurance Pricing and Regulation

- Communication and Interpersonal Skills

- Problem- solving and Decision- making

- Conducted research to determine appropriate risk levels and premiums for insurance policies

- Developed financial models to quantify the risk levels of insurance policies and estimate future trends

- Analyzed data to identify trends and patterns in insurance claims and premiums

- Recommended and implemented changes to insurance policies based on research findings

- Provided technical advice to underwriting and sales teams regarding insurance policies and regulations

- Assisted in the development of risk management strategies for insurance companies

- Researched and evaluated industry trends and regulations to ensure compliance with standards

Experience 2+ Years

actuarial intern Resume with 5 Years of Experience

Seasoned actuarial professional with five years of experience in the insurance industry. A detail- oriented problem- solver with expertise in maintaining accurate financial reports for both public and private companies. Experienced in producing financial forecasts and preparing reports for both internal and external stakeholders. Skilled in conducting cost- benefit analysis, pricing and risk assessments, and developing financial models. Highly organized, efficient, and dependable with a strong ability to think logically and analyze information.

- Actuarial Analysis

- Financial Modeling

- Risk Assessment

- Cost- Benefit Analysis

- Pricing Analysis

- Financial Forecasting

- Insurance Industry Expertise

- Report Writing

- Analyzed and prepared pricing and financial models for various insurance products.

- Developed cost- benefit analysis models and conducted risk assessments.

- Generated financial reports and forecasts for internal and external stakeholders.

- Led actuarial analysis projects and prepared detailed reports on results.

- Identified and monitored trends to ensure financial goals and objectives were met.

- Provided guidance and support to management in all actuarial- related matters.

- Conducted data analysis to identify problem areas and develop remedial solutions.

Experience 5+ Years

Level Senior

actuarial intern Resume with 7 Years of Experience