Best 10 BCG Matrix Examples for Students

Discover more helpful information.

BCG Matrix is an apparatus utilized to incorporate methodology to break down specialty units or product offerings dependent on two factors: relative piece of the overall industry and the market development rate. By joining these two factors into a matrix, an organization can plot their specialty units as needs are and figure out where to dispense extra (financial) assets, where to money out, and where to strip.

The primary reason for the BCG Matrix is accordingly to settle on speculation choices on a corporate level. Contingent upon how well the unit and the business are doing, four different classification names can be credited to every group:

- Question Marks

This article covers every classification and how to utilize the BCG Matrix appropriately.

10 Examples of BCG Matrix (of famous companies)

The BCG Model depends on items as opposed to administrations, be that as it may, it applies to both. You could utilize this if checking on a scope of items, particularly before growing new ones. Here are the example list:

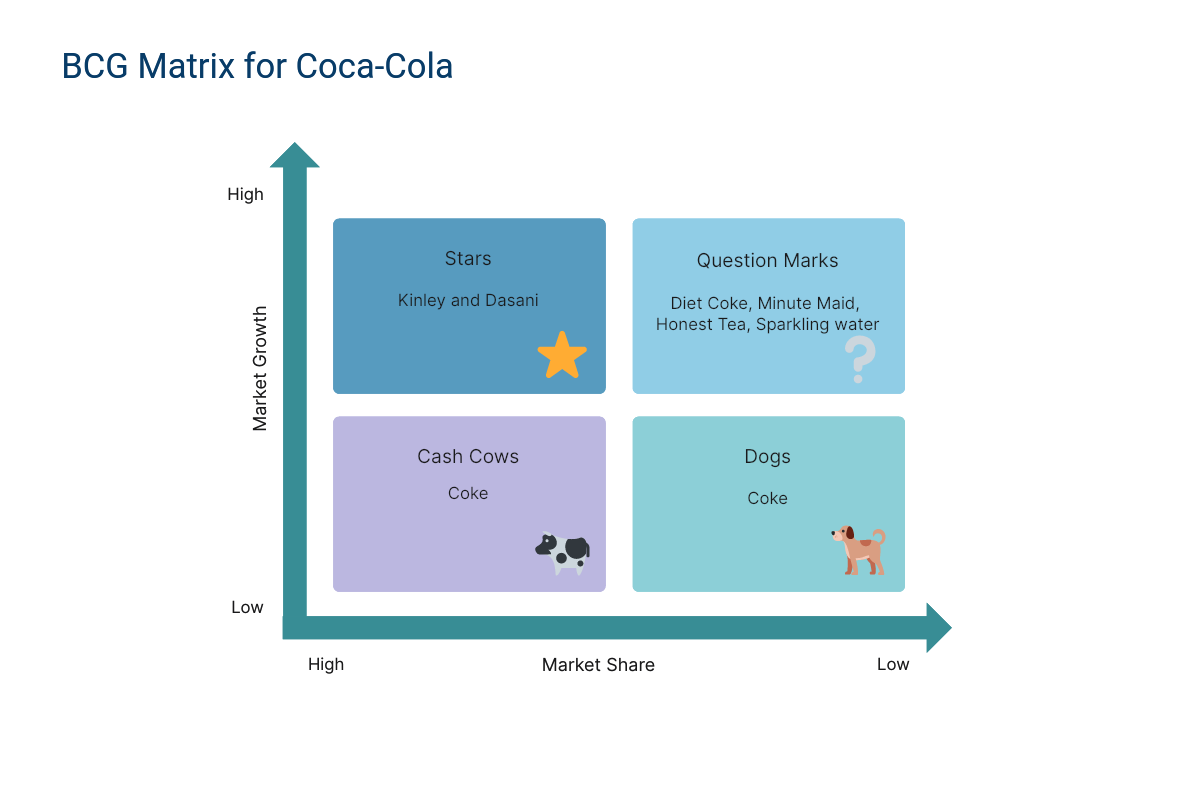

1. BCG Matrix of Coca-Cola

A world-driving ready-to-drink refreshment company, Coca-Cola Company has more than 500 soda pop brands, from Fuse Tea to Oasis to Lilt to Powerade. Yet, none of them is anyplace near the coke brand in terms of mindfulness, income, and benefit.

Stage 1. Choose the Product/Firm/Brand

We pick the firm Coca-Cola for investigation. Also, you need to identify the market, as the picked market is beverages, diet cokes, and mineral water.

Stage 2. Calculate Relative Market Share & Find out the Market Growth Rate

By and tremendous Growth rate in Coke is that it is no: in more than 200 countries.

Stage 3. Draw the Circles on a Matrix

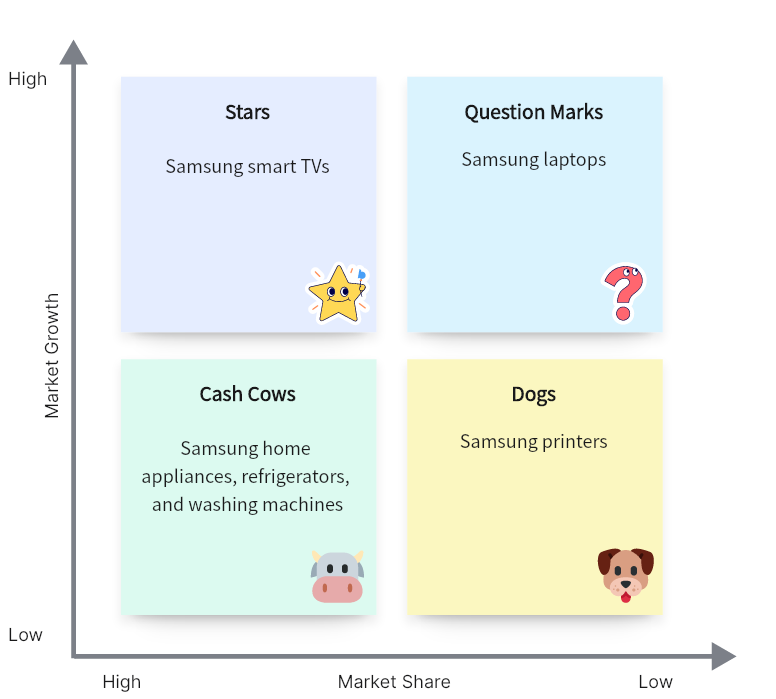

2. BCG Matrix of Samsung

Stage 1. choose the product/firm/brand.

We pick the firm Samsung for investigation.

The picked market is the consumer electronics industry which incorporates smartphones, computers, tablets, etc.

Stage 3. Calculate Relative Market Share

By and tremendous Growth rate in Samsung home appliances by making 60% of the sales.

Stage 4. Draw the circles on a matrix

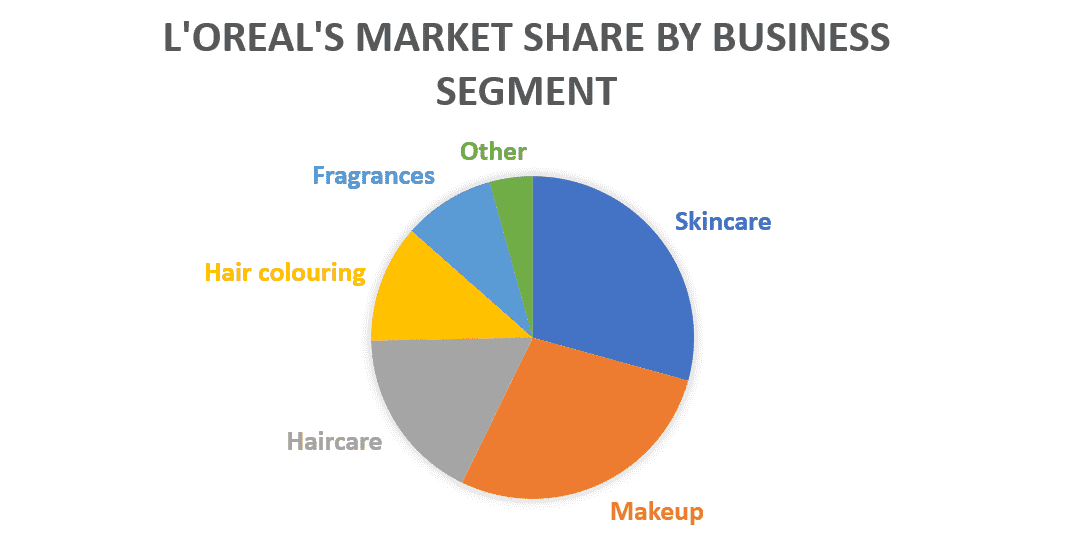

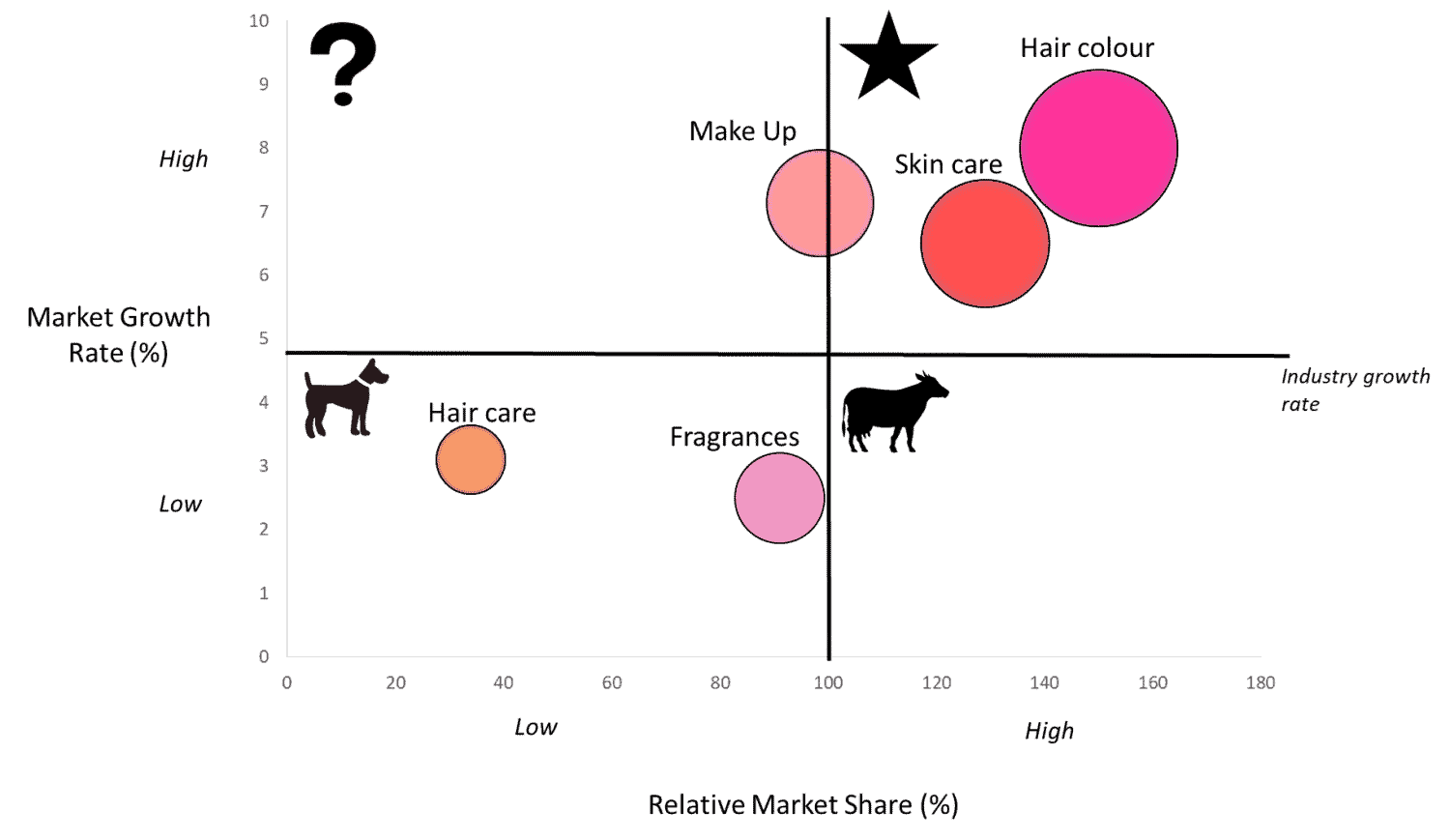

3. BCG Matrix of L'Oréal

We pick the firm L'Oréal for investigation.

Stage 2. Identify Market

The picked market is the Cosmetics Industry, which essentially incorporates Skincare, Makeup, Haircare, Hair shading, and Fragrances.

Stage 4. Find out the Market Growth rate

By and tremendous Growth rate in Cosmetics Industry (starting at 2018) = 4.8%

Stage 5. Draw the circles on a matrix

Note: Just follow the above pattern with every example and BCG matrix you will be making for your class.

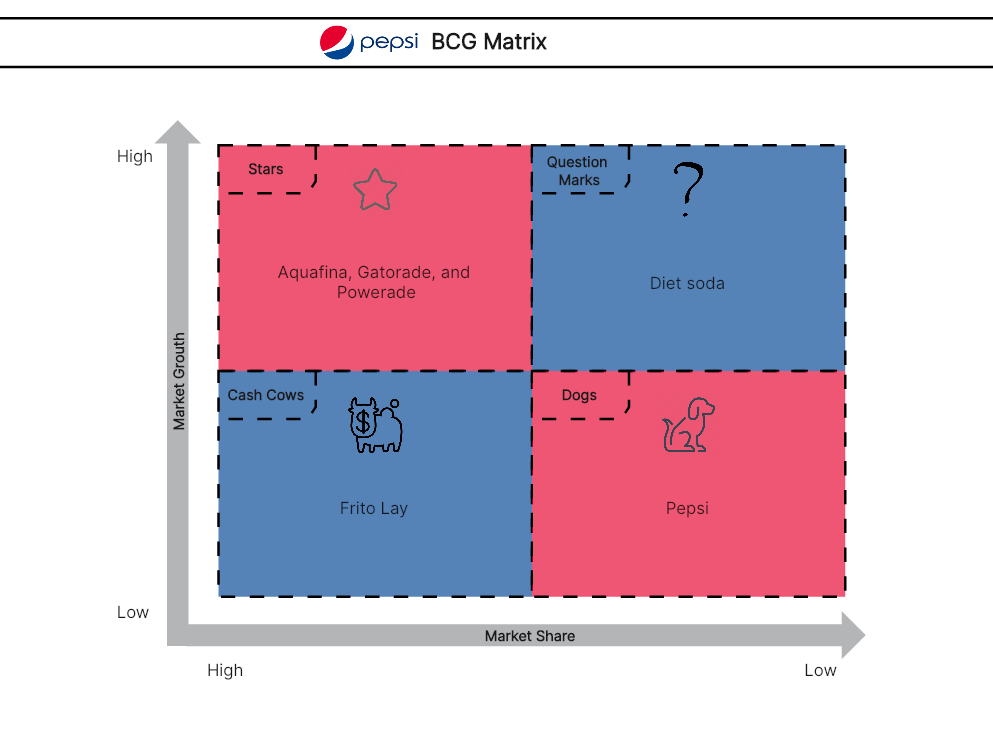

4. BCG Matrix of PepsiCo

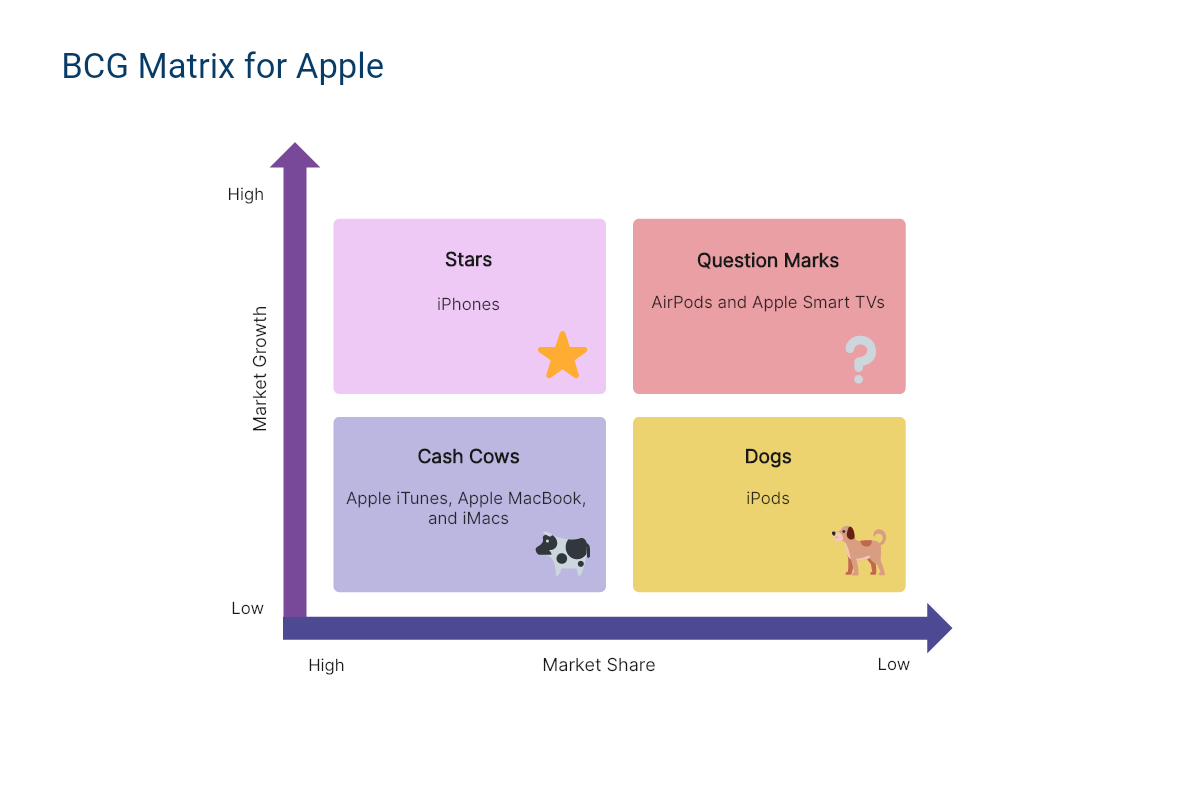

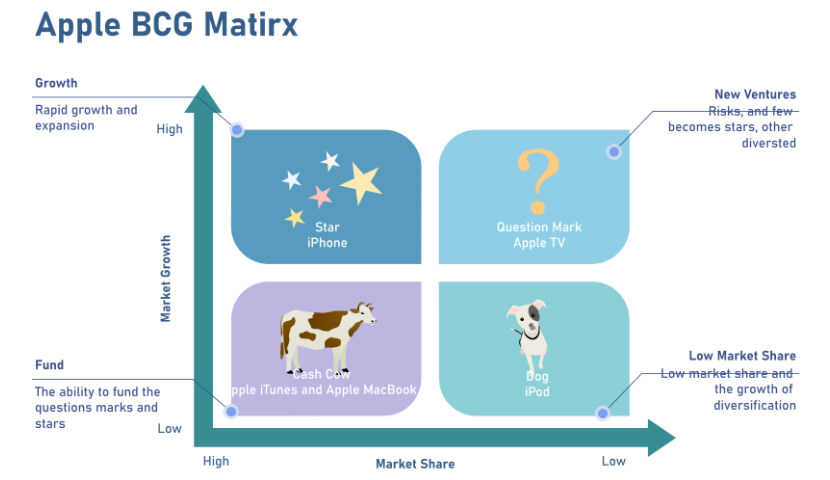

5. BCG Matrix of Apple

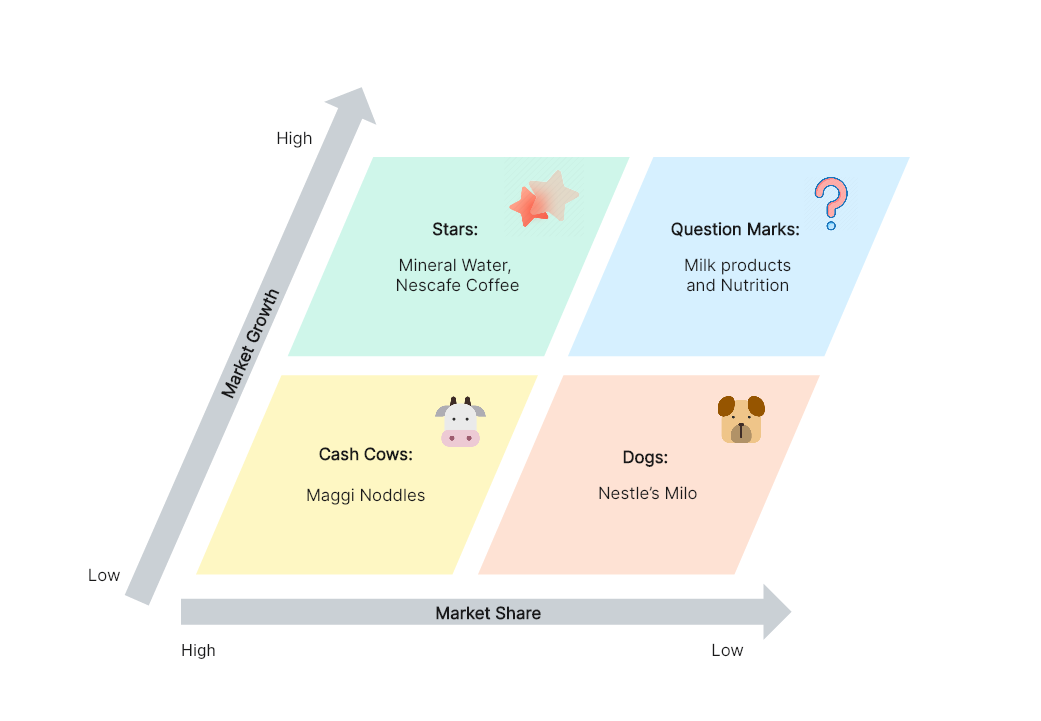

6. BCG Matrix of Nestle

7. BCG Matrix of Unilever

8. BCG Matrix of McDonalds

9. BCG Matrix of KFC

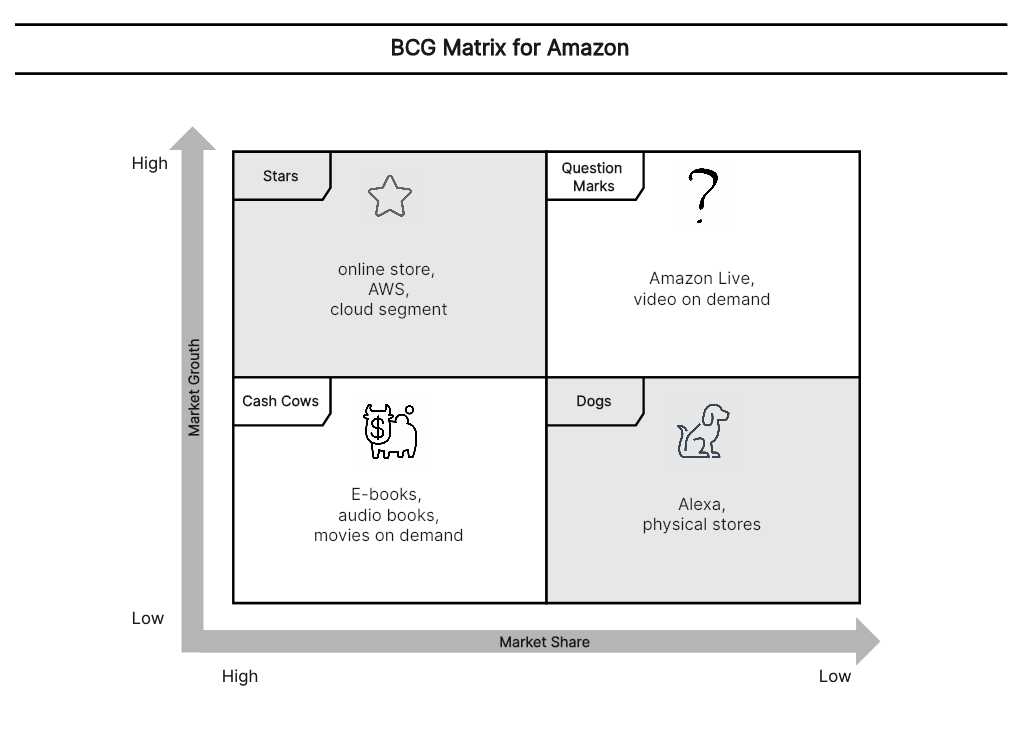

10. BCG Matrix of Amazon

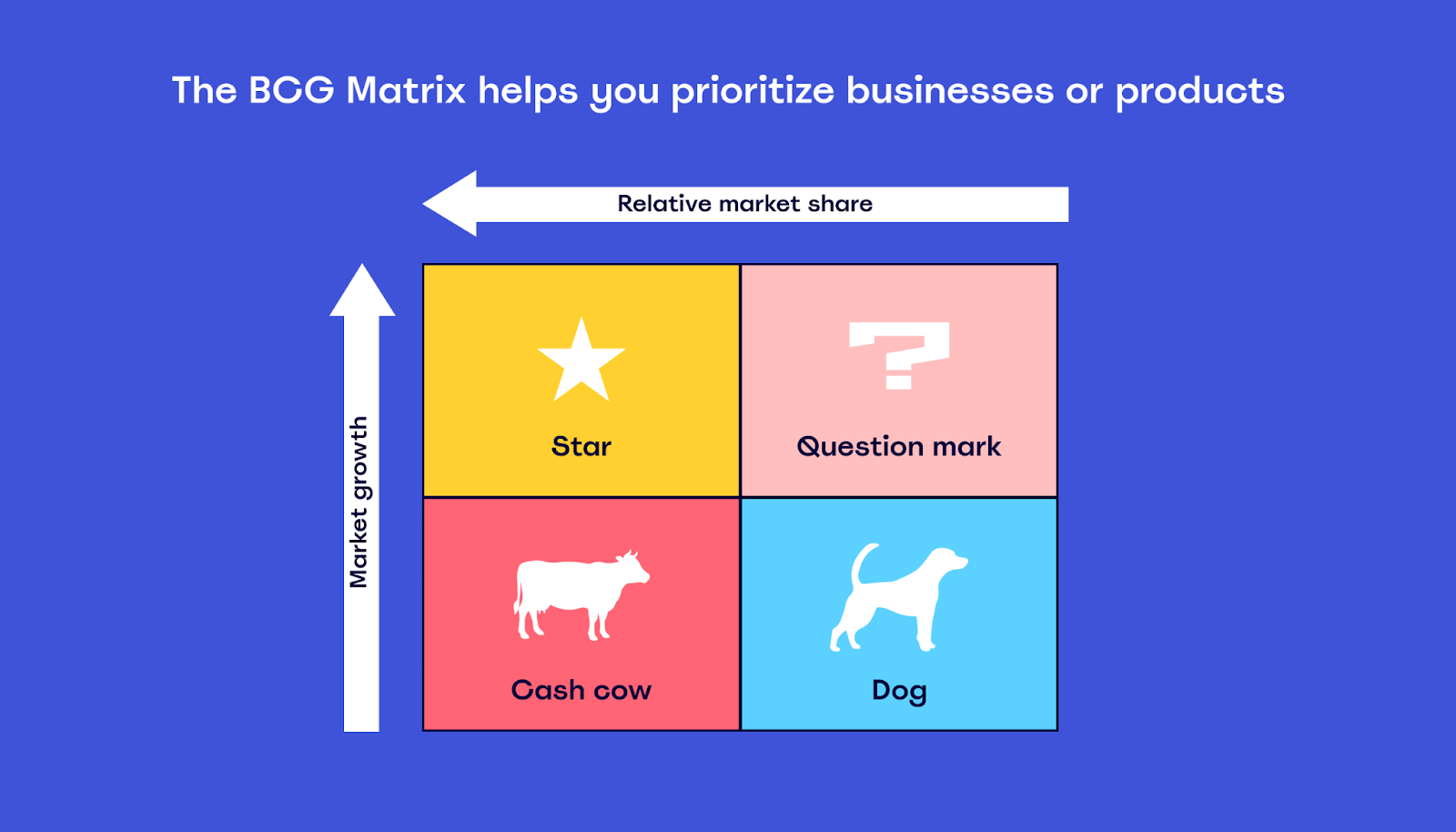

What is BCG Matrix?

The Boston Consulting Group's item portfolio matrix ( BCG matrix ), otherwise called the Growth/Share Matrix, is a vital arranging device that enables a business to consider development openings by inspecting its arrangement of items to choose where to contribute to suspend or create things. It's otherwise called the Growth/Share Matrix. The Matrix is separated into four quadrants dependent on an investigation of market development and the relative peace of the overall industry.

It depends on the mix of market development and the overall industry comparative with the following best contender.

High Growth, High Market Share

Star units are pioneers in the classification. Items situated in this quadrant are appealing as they are located in a hearty class, and these items are exceptionally serious in the classification.

2. Question Marks

High Growth, Low Market Share

Like the name proposes, the future capability of these items is dubious. Since the development rate is high here, with the correct systems and ventures, they can become Cash cows and, at last, Stars if they have a flat piece of the overall industry so that off-base ventures can downsize them to Dogs significantly after loads of speculation.

3. Cash Cows

Low Growth, High Market Share

In the long run, if you are working for quite a while working in the business, advertising development may decay, and incomes deteriorate. At this stage, your Stars are probably going to change into Cash Cows. Since they despise everything that has a substantial relative piece of the overall industry in a deteriorating (developed) market, benefits and cash streams are relied upon to be high. As a result of the lower development rate, ventures required ought to likewise below. Along these lines, cash cows ordinarily produce cash in an overabundance of the measure of money expected to keep up the business. This 'overabundance cash' should be 'drained' from the Cash Cow for interests in different specialty units (Stars and Question Marks). Cash Cows eventually carry parity and security to a portfolio.

Low Growth, Low Market Share

Dogs hold a flat piece of the overall industry contrasted with contenders. Neither do they create cash, nor do they require huge cash. As a rule, the resources are not worth putting into because they create low or negative cash returns and may need enormous entireties of money to help. Because of the flat piece of the pie, these items face cost inconveniences.

How to Make a BCG Matrix Diagram?

So far, we realize products are ordered in four sorts. Presently we will see on what premise and how that order is done. We will comprehend the five procedures of improving a BCG matrix by making one for L'Oréal in the areas to follow.

Stage 1. Choose the Product

BCG matrix can be utilized to operate Business Units, separate brands, products, or firms as a unit itself. The decision of the group impacts the entire investigation. Along these lines, characterizing the unit is essential.

Stage 2. Define the Market

A mistakenly characterized market can prompt a weak characterization of products. For instance, if we investigate Daimler's Mercedes-Benz vehicle brand in the traveler vehicle market, it would wind up as a dog (it holds under 20% relative market share). However, it would be a cash cow in the extravagant vehicle market. Characterizing the market is a significant pre-imperative for a better understanding of the portfolio position.

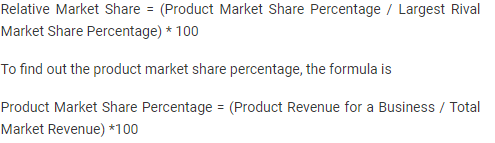

Stage 3. Calculate the Relative Market Share

Market share is the level of the entire market taken into account by your company, estimated either in income terms or unit volume terms.

We utilize Relative Market Share in a BCG matrix, contrasting our product deals and the main adversary's sales for a similar product.

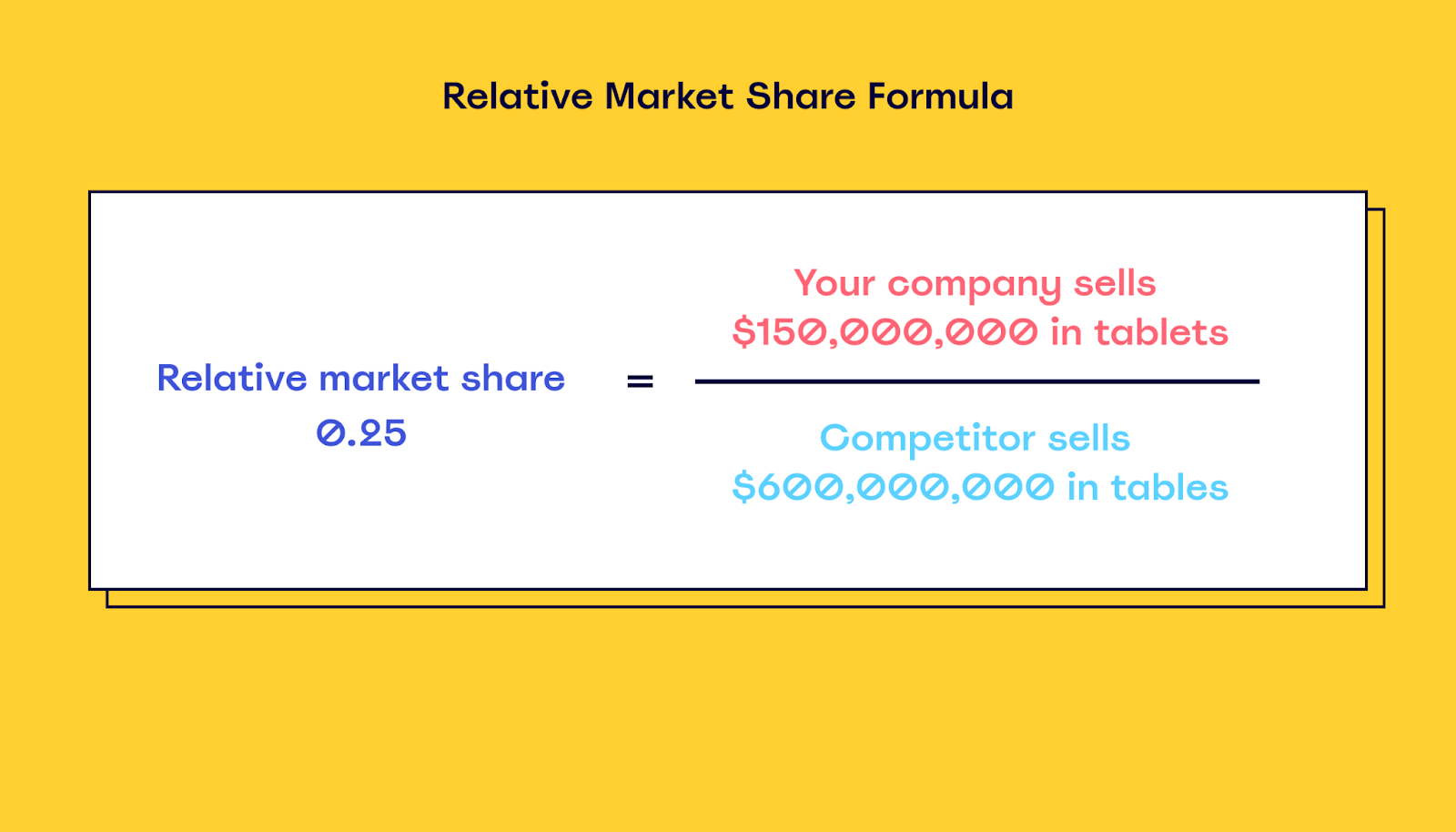

Relative Market Share = Product's business this year/Leading opponent's business this year

For instance, if your rival's market share in the vehicle business was 25% and your association's image market share was 10% around the same time, your relative market share would be just 0.4. The relative market share is given on the x-axis.

Stage 4. Find out the Market Development Rate

The business development rate can be effortlessly found through free online sources. It can likewise be determined by deciding the healthy income development of the leading firms. The market development rate is estimated in rate terms.

Market development rate was typically given side-effects (business this year – Product's business a year ago)/Product's business a year ago.

Markets with high development are ones where the total market share accessible is growing, so there are a lot of chances for all organizations to bring in cash.

Stage 5. Draw the Circles on a Matrix

Having determined the above measures, you have to plot the brands on the Matrix simply on EdrawMind desktop version. It has the premade templates for BCG. All you have to do is put up the data just like we did with every example.

The x-axis shows the relative market share, and the they-pivot shows the business development rate. You can plan a hover for every unit/brand/product, the size of which ought to relate to the extent of income created by it in a perfect world.

Taken these variables together, you can attract the perfect way to follow the BCG Matrix, from start-up to market pioneer. Question Marks and Stars should be financed with ventures produced with Cash Cows. What's more, Dogs should be stripped or exchanged to let loose cash with minimal potential and use it somewhere else. At long last, you will require a reasonable arrangement of Question Marks, Stars, and Cash Cows to guarantee positive cash streams later on.

[2023] Story Summary Examples

7 Types of Organizational Charts (With Examples)

Sunburst Chart: Explained with Examples & Templates

Story Outline Examples

To-Do List Mind Map Template

B2U – Business-to-you.com

THE place that brings real life business, management and strategy to you

BCG Matrix: Portfolio Analysis in Corporate Strategy

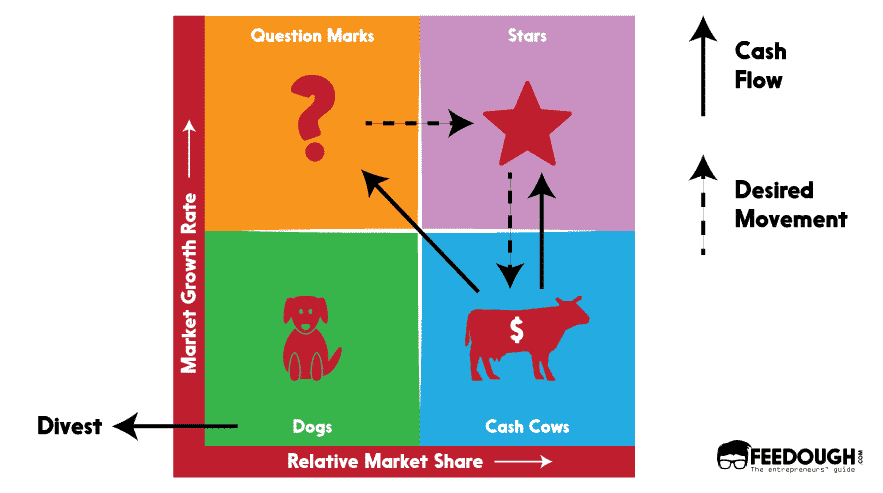

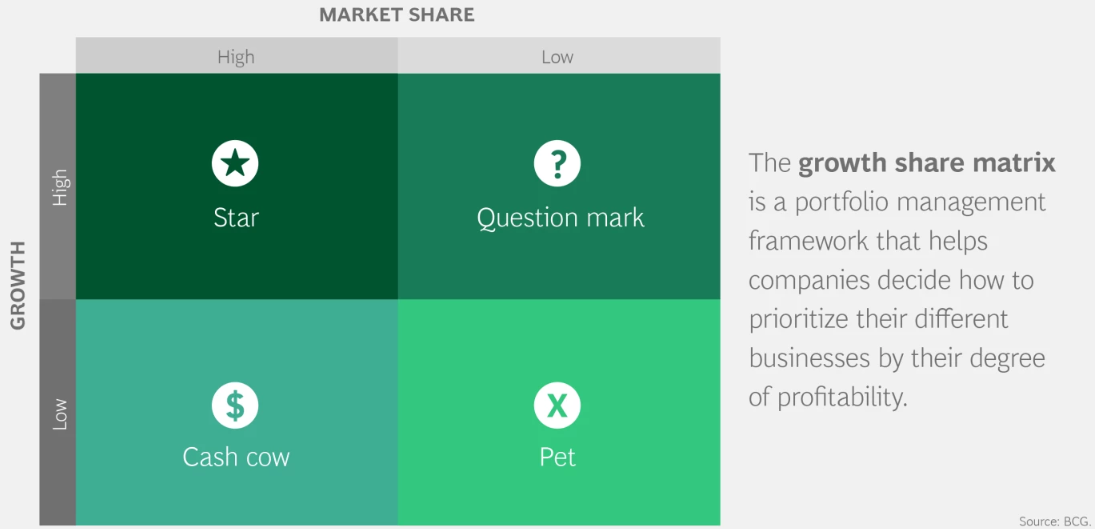

BCG Matrix (also known as the Boston Consulting Group analysis, the Growth-Share matrix, the Boston Box or Product Portfolio matrix) is a tool used in corporate strategy to analyse business units or product lines based on two variables: relative market share and the market growth rate. By combining these two variables into a matrix, a corporation can plot their business units accordingly and determine where to allocate extra (financial) resources, where to cash out and where to divest. The main purpose of the BCG Matrix is therefore to make investment decisions on a corporate level. Depending on how well the unit and the industry is doing, four different category labels can be attributed to each unit: Dogs, Question Marks, Cash Cows and Stars. This article will cover each of these categories and how to properly use the BCG Matrix yourself.

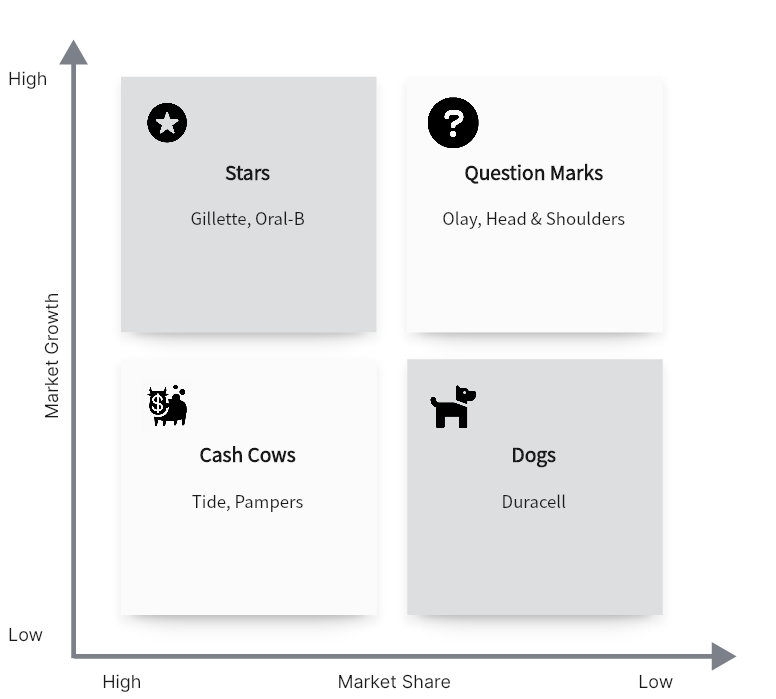

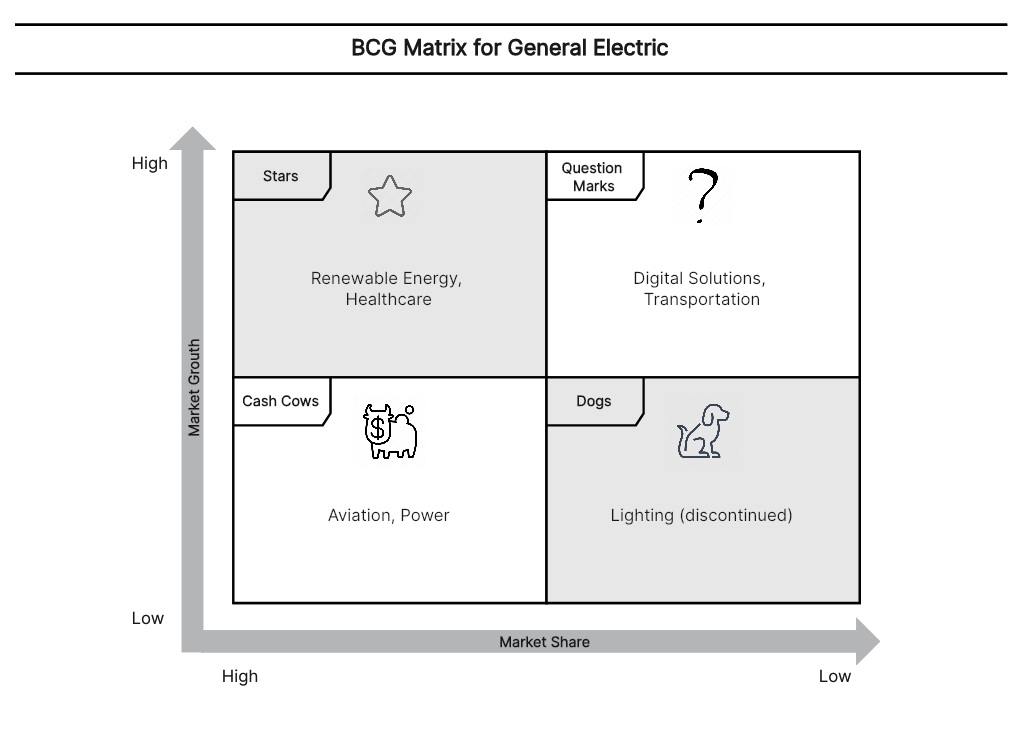

Figure 1: BCG Matrix

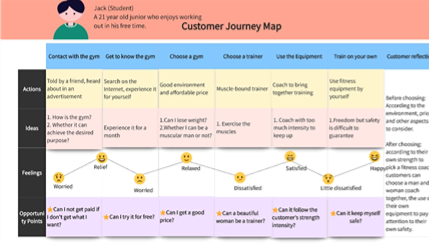

BCG Matrix Example: Samsung’s Product Portfolio

Samsung is a conglomerate consisting of multiple strategic business units (SBUs) with a diverse set of products. Samsung sells phones, cameras, TVs, microwaves, refrigerators, laundry machines, and even chemicals and insurances. This is a smart corporate strategy to have because it spreads risk among a large variety of business units. In case something might happen to the camera industry for instance, Samsung is still likely to have positive cash flows from other business units in other product categories. This helps Samsung to cope with the financial setback elsewhere. However even in a well balanced product portfolio, corporate strategists will have to make decisions on allocating money to and distributing money across all of those business units. Where do you put most of the money and where should you perhaps divest? The BCG Matrix uses Relative Market Share and the Market Growth Rate to determine that.

BCG Matrix Video Tutorial

Relative Market Share

The creator of the BCG Matrix used this variable to actually measure a company’s competitiveness . The exact measure for Relative Market Share is the focal company’s share relative to its largest competitor. So if Samsung has a 20 percent market share in the mobile phone industry and Apple (its largest competitor) has 60 percent so to speak, the ratio would be 1:3 (0.33) implying that Samsung has a relatively weak position. If Apple only had a share of 10 percent, the ratio would be 2:1 (2.0), implying that Samsung is in a relatively strong position, which might be reflected in above average profits and cash flows. The cut-off point here is 1.0, meaning that the focal company should at least have a similar market share as its largest competitor in order to have a high relative market share. The assumption in this framework is that an increase in relative market share will result in an increase in the generation of cash , since the focal company benefits from economies of scales and thus gains a cost advantage relative to its competitors.

Market Growth Rate

The second variable is the Market Growth Rate , which is used to measure the market attractiveness . Rapidly growing markets are what organizations usually strive for, since they are promising for interesting returns on investments in the long term. The drawback however is that companies in growing markets are likely to be in need for investments in order to make growth possible. The investments are for example needed to fund marketing campaigns or to increase capacity. High or low growth rates can vary from industry to industry, but the cut-off point in general is usually chosen around 10 percent per annum. This means that if Samsung would be operating in an industry where the market is growing 12 percent a year on average, the market growth rate would be considered high.

Question Marks

Ventures or start-ups usually start off as Question Marks . Question Marks (or Problem Children) are businesses operating with a low market share in a high growth market. They have the potential to gain market share and become Stars (market leaders) eventually. If managed well, Question Marks will grow rapidly and thus consume a large amount of cash investments. If Question Marks do not succeed in becoming a market leader, they might degenerate into Dogs when market growth declines after years of cash consumption. Question marks must therefore be analyzed carefully in order to determine whether they are worth the investment required to grow market share.

Stars are business units with a high market share (potentially market leaders) in a fast-growing industry. Stars generate large amounts of cash due to their high relative market share but also require large investments to fight competitors and maintain their growth rate. Successfully diversified companies should always have some Stars in their portfolio in order to ensure future cash flows in the long term. Apart from the assurance that Stars give for the future, they are also very good to have for your corporate’s image.

Eventually after years of operating in the industry, market growth might decline and revenues stagnate. At this stage, your Stars are likely to transform into Cash Cows . Because they still have a large relative market share in a stagnating (mature) market, profits and cash flows are expected to be high. Because of the lower growth rate, investments needed should also be low. Cash cows therefore typically generate cash in excess of the amount of cash needed to maintain the business. This ‘excess cash’ is supposed to be ‘milked’ from the Cash Cow for investments in other business units (Stars and Question Marks). Cash Cows ultimately bring balance and stability to a portfolio.

Business units in a slow-growth or declining market with a small relative market share are considered Dogs. These units typically break even (they neither create nor consume a large amount of cash) and generate barely enough cash to maintain the business’s market share. These businesses are therefore not so interesting for investors. Since there is still money involved in these business units that could be used in units with more potential, Dogs are likely to be divested or liquidated.

Figure 2: Cash Flows and Desired Movement in BCG Matrix

BCG Matrix and the Product Life Cycle

The BCG matrix has a strong connection with the Product Life Cycle . The Question Marks represent products or SBU’s that are in the introduction phase. This is when new products are being launched in the market. Stars are SBU’s or products in their growth phase. This is when sales are increasing at their fastest rate. Cash Cows are in the maturity phase: when sales are near their highest, but the rate of growth is slowing down due to saturation in the market. And Dogs are in the decline phase: the final stage of the cycle, when sales begin to fall.

Figure 3: BCG Matrix and Product Life Cycle

BCG Matrix In Sum

Taken all of these factors together, you can draw the ideal path to follow in the BCG Matrix, from start-up to market leader. Question Marks and Stars are supposed to be funded with investments generated by Cash Cows. And Dogs need to be divested or liquidated to free up cash with little potential and use it elsewhere. In the end, you will need a balanced portfolio of Question Marks, Stars and Cash Cows to assure positive cash flows in the future. If you want to know more about HOW to spend these investments in order to grow a business unit, you might want to read more about the Ansoff Matrix . Besides the BCG Matrix, there are other portfolio management frameworks you might want to have a look at such as the GE McKinsey Nine Box Matrix .

Further Reading:

- Henderson, B. (1970). Growth-Share Matrix. BCG Perspectives.

- https://www.bcgperspectives.com/content/articles/corporate_strategy_portfolio_management_strategic_planning_growth_share_matrix_bcg_classics_revisited/

- https://www.bcg.com/publications/1970/strategy-the-product-portfolio.aspx

Share this:

- Click to share on Facebook (Opens in new window)

- Click to share on LinkedIn (Opens in new window)

- Click to share on WhatsApp (Opens in new window)

- Click to share on Reddit (Opens in new window)

- Click to share on Pinterest (Opens in new window)

- Click to share on Telegram (Opens in new window)

- Click to share on X (Opens in new window)

- ← Marketing Funnel: Visualizing the Customer Journey

- Value Chain Analysis: An Internal Assessment of Competitive Advantage →

10 thoughts on “ BCG Matrix: Portfolio Analysis in Corporate Strategy ”

Simple, easy to follow and moreover Clear and Perfect presentation Sir.

impressing thank you so much……well articulated easily understandable tutorial/lecture.

Thank you, all the videos have helped me with my studies and progress in my MBA

Great videos, really helps

Great video it was really easy to follow!!

From ILOVEADIAN

This is a great video. Explained BCG matrix succinctly

Fantastic breakdown of the BCG matrix. greatly simplified!

What a powerful presantation of the BCG Matrix. You are simply the best.

Great website. It helps to add further clarity and more context to my textbook.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

- Search Search Please fill out this field.

- BCG Growth-Share Matrix

- How It Works

- Limitations

The Bottom Line

- Corporate Finance

- Corporate Finance Basics

Understanding the BCG Growth Share Matrix and How to Use It

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

Investopedia / Laura Porter

What Is a BCG Growth-Share Matrix?

The Boston Consulting Group (BCG) growth-share matrix is a planning tool that uses graphical representations of a company’s products and services in an effort to help the company decide what it should keep, sell, or invest more in.

The matrix plots a company’s offerings in a four-square matrix, with the y-axis representing the rate of market growth and the x-axis representing market share. It was introduced by the Boston Consulting Group in 1970.

Key Takeaways

- The BCG growth-share matrix is a tool used internally by management to assess the current state of value of a firm's units or product lines.

- BCG stands for the Boston Consulting Group, a well-respected management consulting firm.

- The growth-share matrix aids the company in deciding which products or units to either keep, sell, or invest more in.

- The BCG growth-share matrix contains four distinct categories: dogs, cash cows, stars, and question marks.

- The matrix helps companies decide how to prioritize their various business activities.

Understanding a BCG Growth-Share Matrix

The BCG growth-share matrix breaks down products into four categories, known simply as dogs, cash cows, stars, and question marks. Each category quadrant has its own set of unique characteristics.

Dogs (or Pets)

If a company’s product has a low market share and is at a low rate of growth, it is considered a dog and should be sold, liquidated, or repositioned. Dogs , found in the lower right quadrant of the grid, don't generate much cash for the company since they have a low market share and little to no growth. Because of this, dogs can turn out to be cash traps, tying up company funds for long periods of time. For this reason, they are prime candidates for divestiture .

Products that are in low-growth areas but for which the company has a relatively large market share are considered cash cows, and the company should thus milk the cash cow for as long as it can. Cash cows, seen in the lower left quadrant, are typically leading products in markets that are mature .

These products generally generate returns that are higher than the market's growth rate and sustain itself from a cash flow perspective. These products should be taken advantage of for as long as possible. The value of cash cows can be easily calculated since their cash flow patterns are highly predictable. In effect, low-growth, high-share cash cows should be milked for cash to reinvest in high-growth, high-share stars with high future potential .

The matrix is not a predictive tool; it takes into account neither new, disruptive products entering the market nor rapid shifts in consumer demand.

Products that are in high-growth markets and that make up a sizable portion of that market are considered stars and should be invested in more. In the upper left quadrant are stars, which generate high income but also consume large amounts of company cash. If a star can remain a market leader, it eventually becomes a cash cow when the market's overall growth rate declines.

Question Marks

Questionable opportunities are those in high growth rate markets but in which the company does not maintain a large market share. Question marks or "problem children" are in the upper right portion of the grid. They typically grow fast but consume large amounts of company resources. Products in this quadrant should be analyzed frequently and closely to see if they are worth maintaining.

Limitations of the Matrix

One thing to note is that the matrix is a decision-making tool. This means that it does not necessarily take into account all the factors that a business ultimately must face. For example, increasing market share may be more expensive than the additional revenue gained from new sales. Because product development may take years, businesses must plan for contingencies carefully.

Since the matrix only classifies businesses as low and high, it does leave mid-sized businesses out of the mix. These types of companies often make up a big part of the market, so leaving them out means that the business environment isn't truly reflected.

The BCG matrix assumes that all businesses operate independently of one another. But that isn't always necessarily true. Certain players in the market, such as dogs, may end up giving others a boost—sometimes unintentionally.

Bruce Henderson, who founded BCG, created the concept of the growth matrix in 1970.

Example of a BCG Growth Matrix

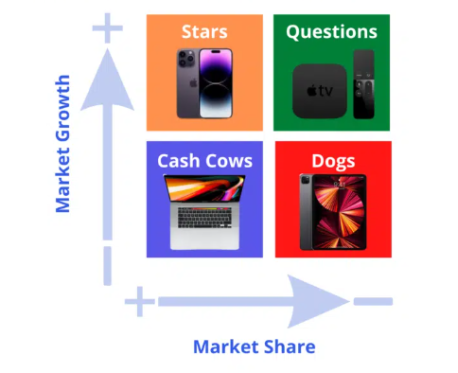

There are many companies that we can apply the growth matrix to in the real world. Apple ( AAPL ) is a great candidate. Let's take a look at the products Apple has on the market according to the matrix categories:

- Star: iPhone

- Cash Cow: Macbook

- Question Mark: Apple TV

In 2022, the company earned $394.33 billion in net sales , out of which almost $316.2 billion was attributed to its products section. The remaining $78.13 billion came from its services division:

- There's no doubt that the majority of Apple's sales come from its most popular product. The iPhone brought in $205.49 billion in sales for the year. In this case, it's considered the company's star.

- The cash cow for the company is its Mac products—notably the Macbook laptop, which is one of the most popular in this group. Sales for Mac products came in at $40.18 billion for the fiscal year (FY) .

- One of the question marks for Apple is its Apple TV streaming service, which falls under the Services category. The competition in the streaming world is intense, with traditional services like Netflix , Hulu, Disney+ dominating the market. But others like YouTube and Vimeo are also eating away at market share. In 2022, Apple's Services division earned $78.13 billion in sales.

- Once a darling of the company, the iPad is now considered a dog. Apple's tablet continues to show low growth, as sales continue to decline. Sales for the year came in at $29.29 billion, compared to $31.86 billion in 2021.

What Are the 4 Quadrants of the BCG Matrix?

The BCG Growth-Share Matrix uses a 2x2 grid with growth on one axis and market share on the other. Each of the four quadrants represents a specific combination of relative market share and growth:

- Low Growth, High Share: Companies should milk these cash cows for cash to reinvest elsewhere.

- High Growth, High Share: Companies should significantly invest in these stars as they have high future potential.

- High Growth, Low Share: Companies should invest in or discard these question marks, depending on their chances of becoming stars.

- Low Share, Low Growth: Companies should liquidate, divest, or reposition these pets .

How Does the BCG Matrix Work?

The BCG Growth-Share Matrix considers a company's growth prospects and available market share via a 2x2 grid. By assigning each business to one of these four categories, executives can then decide where to focus their resources and capital to generate the most value, as well as where to cut their losses.

Is the BCG Matrix Used in the Real World?

According to BCG, at the height of its success, the growth share matrix was used by about half of all Fortune 500 companies; today, it is still central in business school teachings on business strategy.

The BCG Growth-Share Matrix is a business management tool that allows companies to identify the aspects of their business that should be prioritized and which might be jettisoned. By constructing a 2x2 table along the dimensions of growth and market share, a company's businesses can be categorized into one of four classifications: stars, pets, cash cows, and question marks.

Boston Consulting Group. " BCG Classics Revisited: The Growth Share Matrix ."

Boston Consulting Group. " What Is the Growth Share Matrix? "

Apple. " CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited) ," Page 1.

:max_bytes(150000):strip_icc():format(webp)/investing17-5bfc2b8fc9e77c00519aa64c.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

New User? Start here.

Business Studies 101: Inside the BCG Matrix

Table of Contents

The BCG Matrix is a growth-share matrix developed by the Boston Consulting Group in 1968. The BCG matrix is an exceptionally effective tool for interpreting a company’s growth share. The design of the growth-share matrix was a collaborative effort by Alan Zakon, BCG’s first CEO and his colleagues. The popularity of the BCG growth matrix rose through the roof after BCG founder Bruce Henderson wrote about its usage and usefulness in an essay in 1970.

The BCG Matrix has been and is still used by nearly every major corporation across industries. Nearly every Fortune 500 company implements improved business portfolio & resource management.

So, what makes the BCG matrix so useful? What are its features & how to interpret one? This article answers all such questions and more with clear explanations & examples.

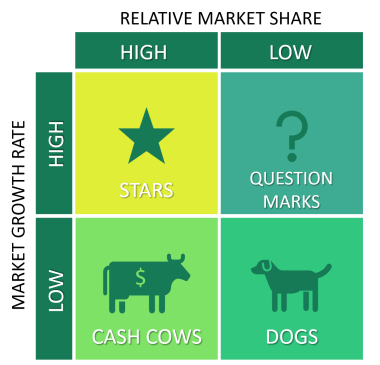

What is the BCG Matrix?

The BCG matrix, by definition, is a powerful framework for business portfolio management. The matrix helps businesses understand what is working and what is not. They can thus re-prioritise and make better decisions about different investments & subsidiaries. BCG matrices provide vital info about brand/product performance and competition, thereby, aiding in better resource allocation, strategies, and ROI.

Here is what a typical BCG matrix looks like.

As can be seen, the entire matrix is divided into four quadrants and has two referential axes. The horizontal axis is the market share, and the vertical axis denotes growth.

- Businesses with low growth and high market share are called cash cows. The Boston Consulting Group suggests companies ‘ milk these cash cows’ for money.

- Business portfolios with high growth and high market share are the According to BCG, these have huge potential and are the company’s flagships.

- The subsidiaries with high growth and low market share are the question marks. There is no surety how they might perform soon. The low market share, and high competition, can eat away at the high growth. BCG analysts leave it to the company heads to invest further or discard the question marks.

- Finally, businesses with low growth and low market share are called These businesses eat up resources without bringing much of a return. Boston Consulting Group advises divestment, repositioning, or liquidation.

Let us dig in a bit deeper.

Understanding The Components of a BCG Matrix

The original BCG Matrix of 1968 defines four different product categories. Each of these possesses unique features.

- Question marks are products or services in markets that are growing fast. However, these are not market leaders and do not even have a large portion of the share.

With the right strategies, there is a chance to overcome competitors and grab a large share. But to do that, a company must invest resources heavily.

Question marks are the wild cards. A company must decide whether to take advantage of the high growth or discard it. If a company decides to invest further, it is aim should be to make the best use of high growth and capture major market share.

A good BCG matrix question mark example can be Apple’s Apple TV or Google’s Drive and Workspace.

- Pets are products that are neither growing nor above the competition. They do not generate much money and, if not taken care of, can tie up resources without giving much return. Pets should be let go as quickly as possible since they can lead to losses.

Low market share and growth mean lower profits. This usually reflects poor quality, marketing, and high prices.

- Stars are flagship products that enjoy a large market share and swift growth. If these can maintain a high market share, they become cash cows when growth slows. Staying ahead of the competition in every sense is key and requires heavy investments.

These are the rising market leader due to high demand and increasing popularity. Stars can make large profits but require heavy investments due to high market growth. Growing markets means more demand and more competition. To rise above the competition, stars need solid support and major resources.

When growth slows, rising stars that have maintained market superiority become cash cows.

- Cash cows enjoy a large market share, but their markets have saturated. These products have left behind the competition and produced large cash flows. Though their market has slowed, cash cows control most of it and thus generate solid returns.

They are kings of a market and, thus, produce money in excess. Their markets are stable; thus, cash cows do not need major investments. Profit margins are high, and cash flows are strong. However, innovation is necessary to maintain a major market share.

Do note that the BCG matrix can only prescribe, not predict. It tells companies what decisions to make, where to invest & divest, etc. but does not tell anything about what might happen. The matrix also does not consider any rapid market changes or major disruptions.

To go through different BCG matrices based on company examples, look at the examples section of this guide.

Once created, it is important to understand exactly what the matrix shows.

Interpreting The BCG Matrix

The idea and logic behind the matrix are simple – businesses that lead a market rake in bigger bucks. They gain a cost advantage over rivals and, thus, enjoy a huge market share. This automatically leads to high growth potential.

Relative market share and the growth rate are two key indicators that reveal two of the most important investment factors – competitiveness and market attractiveness .

- Market attractiveness is the extent to which a market offers opportunities for a business to turn a profit and sustain itself. This factor is considered concerning the total market size, growth rate, and competition.

- Competitiveness or business competitiveness is the ability of a business to generate better profits than its market rivals.

Products or businesses that grab a large market share before growth slows down become cash cows. To do so, it must provide higher quality-to-cost ratios than its rivals. If it can grab the lion’s market share before growth slows down, it can become a cash cow.

Realistically, growth in any business sector is bound to slow down as the market saturates. Businesses should aim to turn their stars and question marks into cash cows. Cash cows provide the money to turn question marks into stars &, eventually, into newer cash cows.

It is time we looked at how to create a BCG matrix.

Make Strategic Planning Easy with Accurate BCG Matrix Samples at Your Fingertips

Studying business or management can often be challenging. And the difficulty increases even more when you have to write flawless papers on the BCG matrix. No worries. Refer to our clearly illustrated BCG matrix examples to enhance your understanding and solve complicated problems accurately.

Check This BCG Matrix Example

How To Create A BCG Matrix?

To create a BCG Growth-Share matrix, a company needs to do careful market research and analyses all its products, services, subsidiaries, etc. How is a product performing? How does it compare to the competition? What is the consumer perception?

Armed with all such information, a company should start working on the framework using the following steps. Below is an example of a BCG matrix process.

- Step 1: Choosing A Product

Pick the product or service to be checked.

- Step 2: Understand the Market Deeply

The major rivals, the factors affecting the growth rate, the trends, market size, market features, the nature of consumers, the economics, etc. – all these market aspects are vital. In-depth market analysis is THE MOST crucial part of this process. Wrongly defined markets will lead to grossly incorrect results.

Detailed market research and analysis are the only to make accurate decisions.

- Step 3: Determine the Relative Market Share

Market analyses will reveal how much a product’s share compares to others. There’s a formula that shows market share relative to the largest competitor

Relative Market Share = (Product Market Share Percentage / Largest Rival Market Share Percentage) * 100

To find out the product market share percentage, the formula is

Product Market Share Percentage = (Product Revenue for a Business / Total Market Revenue) *100

- Step 4: Work Out the Market Growth Rate

The growth rate of a market is given by the following equation

((Current total market sales – Total market sales in the previous year) / Total sales in the previous year) *100

- Step 5: Use Data to Place the Product/Service in the BCG Matrix

Use any BCG matrix template with an example, such as the ones at MyAssignmenthelp.com, to classify & place products.

Well, that was the gist of how to develop a BCG matrix. Now, let’s look at how businesses use this tool in real-life scenarios.

Real World Applications

As may be intuitive, BCG matrices come in handy when a company needs to take stock & rejig its business structure. Complete market research & analyses of every offering reveal where each stands with respect to the other and the competitors. The BCG matrix then helps to segregate, prioritise, and make better decisions.

Here’s how Fortune 500 companies like Apple, Coca-Cola, Pepsi, and Google use BCG matrices.

- When focused on innovating and diversifying, companies increase investments in stars and question marks. This can increase market share, help grab new growth opportunities, and leave rivals in the dust.

- During cash crunches, cash cows come to the rescue. Cash cows require less effort to maintain, but complacency is a major no-no. Major disruptions and sudden trend changes can appear at any time.

Companies reduce investments if a product has been doing well for years and has become the market leader. Examples are Apple’s iPhone and Coca-Cola’s primary soft drink.

- Divesting money from pets and using it elsewhere is another useful strategy during cash crunches.

- Question marks become the focus if a company is hopeful about a product and sees good opportunities. Investing in these products leads to more R & D and marketing expenses, new tactics & strategies, heavy resource usage & direct costs, etc.

- Focusing on stars can boost cash flow and capture greater market share. However, heavy investments and innovation are necessary to defeat rivals.

- BCG matrices suggest the best way to invest and divert. They can help companies save time, money, and resources. In these uncertain and competitive times, these tools can be very handy.

Markets are ever-changing. And so are consumer preferences. For the best results, a company must routinely conduct thorough market analyses and revise their BCG matrices. Though effective, BCG matrices do have drawbacks.

Advantages and Limitations of the BCG Matrix

- Simple and intuitive

- Allows quick screening of the best investment opportunities

- Helps understand the biggest and smallest cash flow sources

- A system for effective resource allocation

- Enables comparative portfolio analysis

- Classifies only based on relative market share and market growth rate

- Does not account for costs

- Does not consider market changes and disruptions

- Cannot tell anything about profitability or success

- Ignores brand synergy and relations

- Does not consider small but rapidly-growing competitors

We wrap things up with our expert BCG matrix analysis of Apple and Alphabet(Google), two of the richest companies in 2023.

Two Examples: BCG Growth Matrices of Apple & Google

Here are two examples of BCG matrix on these two tech giants.

Star iPhone is undoubtedly the rising star, the flagship product. The demand is high among the rich & elite, and honestly, there’s no consistent competition for the iPhone in its category. Yet, the luxury phone segment is quite a niche, and Samsung is always coming up with something to challenge Apple.

Cash Cows The Appel MacBook, the successor of the hugely successful Apple Computer, is widely recognised and sells. It is a leader in the laptop market.

Question Marks Digital television is a fast-expanding domain but has major competitors. The Apple TV is not a market leader, sells low, and has stiff competition from Amazon Fire Stick and Google Chromecast.

Pets The iPad, the once popular tablet, raked in lower amounts in fiscal year 2022 than in 2021. The tablet market itself has been in a steady decline even before the 2020 Covid-19 pandemic.

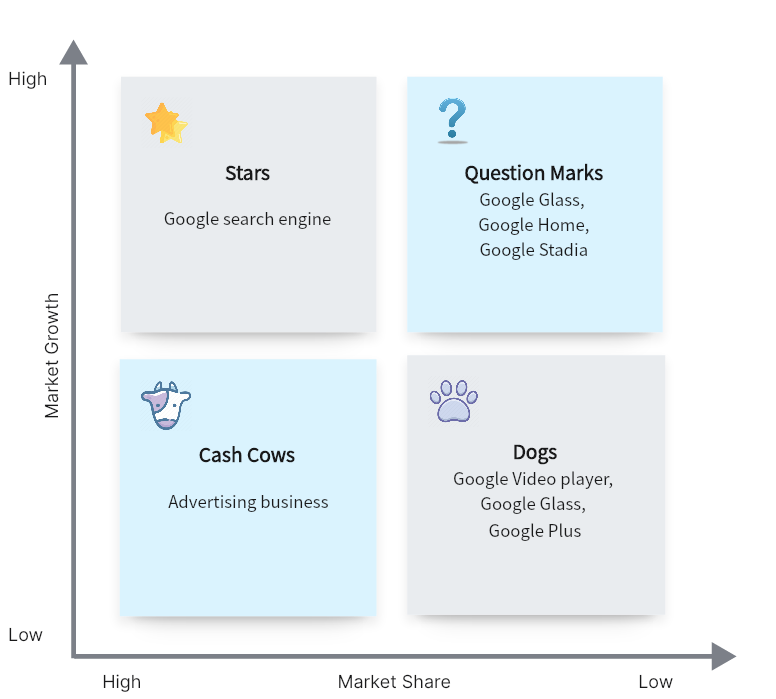

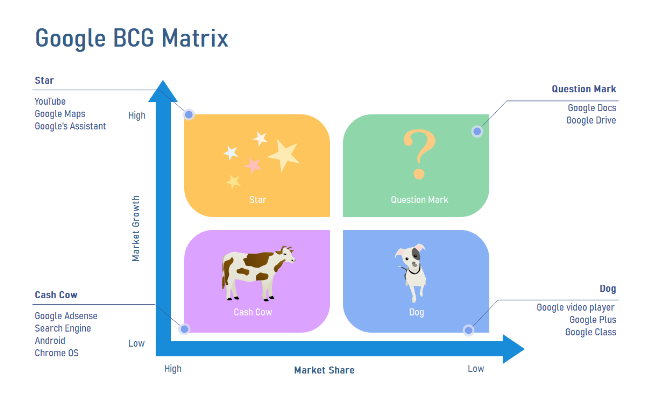

Alphabet/Google

Cash Cows Google Search, Android OS, Google Chrome, and Google Advertising dominate their respective markets. These alone have consumed most of the market share and driven it to saturation. If all else fails, Google Search will still keep Alphabet as one of the tech giants.

Stars YouTube was already a cash cow and a leader in the online streaming market. The rise of streaming services like NetFlix, Amazon Prime, Disney+, etc. rejuvenated the market and increased opportunities. Competition increased, but YouTube is still the winner in streaming content.

Google Assistant is going toe-to-toe with the like of Amazon’s Alexa, Apple’s Siri, and Microsoft’s Cortana.

Question Marks Google Drive and Workspace reap the benefits of a growing market for digital workspace. But, Microsoft 365, Slack, Dropbox, and Zoom hold major portions of the market share.

Pets Google Plus, Google Glass, and the age-old Google Video Player never took off. Google + was Google’s answer to Facebook; it raised more questions about Google’s ideas & strategies for social networking & a behemoth like Facebook.

And that finally brings us to the end of this write-up. Here’s hoping this was an interesting and informative read for everyone.

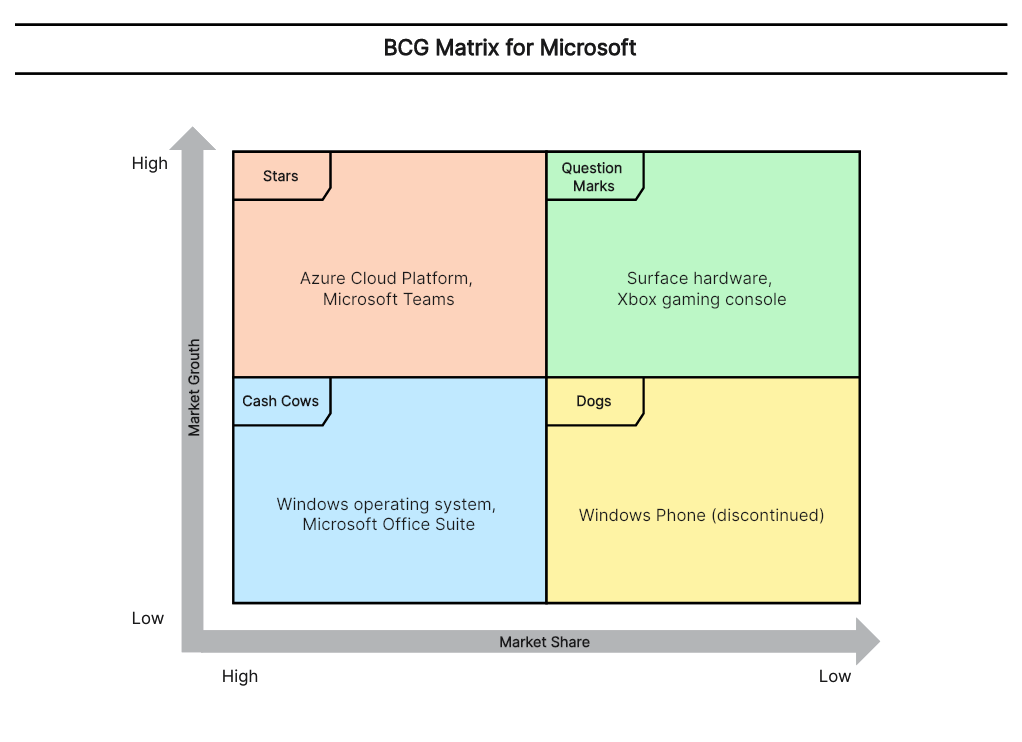

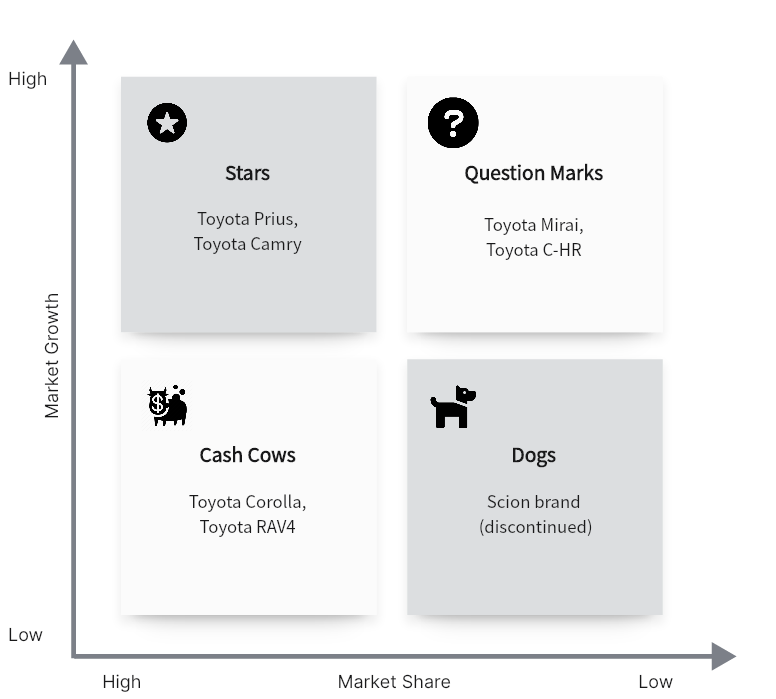

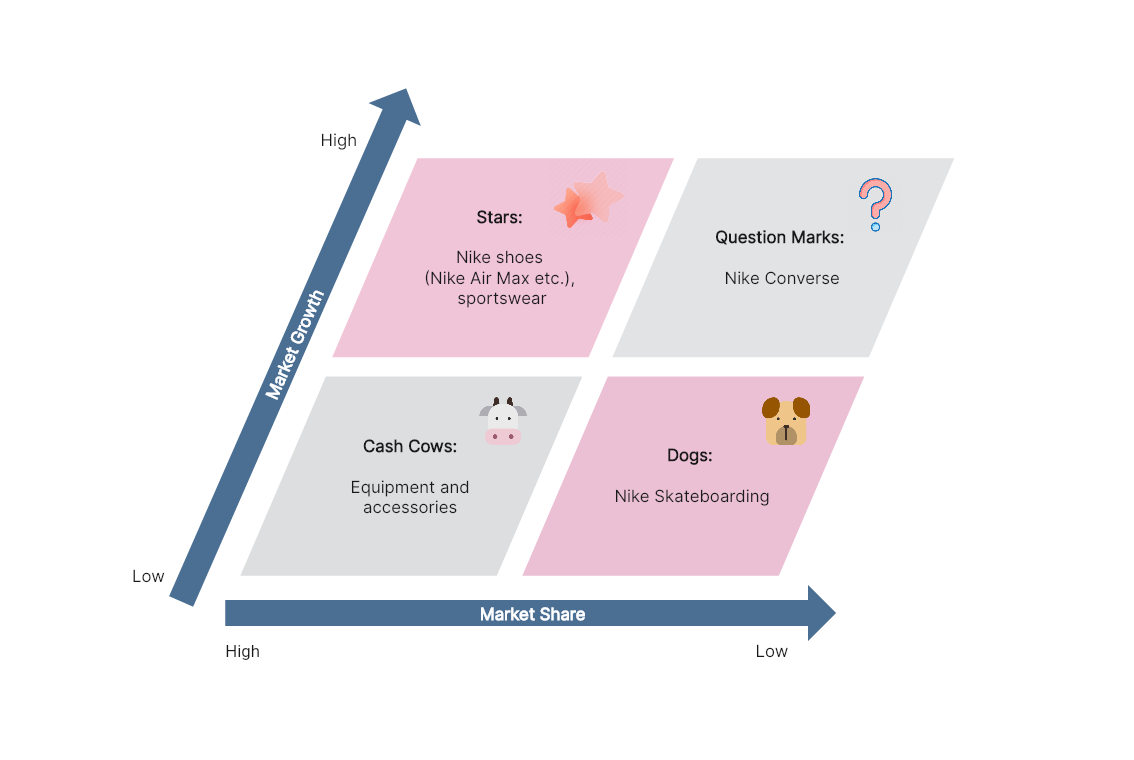

Go through the well-researched BCG matrix on Starbucks, Coca-Cola, Microsoft, General Motors, Amazon, Hyundai, etc., here at MyAssignmenthelp.com. And, if you need some expert help while working on the BCG matrix assignment, connect with us anytime!

Call, mail, or drop a message at our live chat portal.

Most Frequently Asked Questions:

What is the bcg matrix an example of.

Ans: The BCG matrix is an example of a business planning and prescriptive portfolio management tool.

What are the 4 categories of the Boston Matrix?

Ans: The four categories are Stars, Cash Cows, Question Marks, and Pets .

What is the BCG matrix for startups?

Ans: The BCG matrix is a great way for investors to determine where and how to invest.

What is the full form of BCG company?

Ans: BCG is an acronym for Boston Consulting Group Inc., one of the USA’s oldest global management consulting firms.

What is the BCG matrix used for?

Ans: The matrix requires companies to do deep market research & analysis. It then helps companies conduct a comparative analysis of their product portfolios, judging market growth & determining market share concerning the biggest competitors.

What is a cash cow in the BCG matrix?

Ans: Cash cows are established market leaders that generate continual, heavy cash flows. They act as continual sources of steady cash flow for a company and do not consume many resources.

How do you write a BCG matrix?

Ans: The steps to write a BCG matrix are as follows:

- Identify a product to classify

- Do a detailed market analysis on it.

- Calculate its relative market share.

- Calculate its market growth rate.

- Use market share and growth data to place the product in the correct BCG matrix segment.

What is the market growth rate in the BCG matrix?

Ans: The market growth rate is the percentage by which a market has grown in a specific time period

Lucy Wilson

Hi, my name is Lucy Wilson. I am 26, a successful digital marketer, lifestyle blogger, and a Literature writing expert based in Melbourne. I have loved social media and writing since my teenage days. I am a certified digital marketer with a Masters degree in Literature. Sounds quite wierd? Well, that’s because I can’t be less or more enthusiastic about either of my passions. Additionally, I work part-time as a writing expert for myassignmenthelp.com. When I am not working, I am probably partying with my friends or listening to my kind of music or simply lazing around.

Related Post

Writing Get your essay and assignment written from scratch by PhD expert

Rewriting: Paraphrase or rewrite your friend's essay with similar meaning at reduced cost

Editing: Proofread your work by experts and improve grade at Lowest cost

Enter phone no. to receive critical updates and urgent messages !

Please upload all relevant files for quick & complete assistance.

Get original papers written according to your instructions and save time for what matters most.

What is a BCG Matrix and how to get the most out of it?

Trying to make high-level decisions about the future of your company can feel overwhelming. Trust us — we know first-hand what that feels like here at Miro. Companies often set up special committees that take months — or even years — and dozens of meetings before committing to a path.

But in the 21st century, the first mover’s advantage is more crucial than ever. You need to prioritize fast without letting biases affect how you invest your capital and effort.

That’s where the BCG (Boston Consulting Group) Matrix comes in. It’s a portfolio management tool that helps your company prioritize different businesses or products to get the best long-term results.

Let’s dive into everything you need to know about a BCG Matrix.

Try Miro’s BCG Matrix Template

- BCG Matrix definition: What is a Growth Share Matrix?

The Growth Share Matrix, also known as the BCG Matrix, is a portfolio management framework developed by the Boston Consulting Group’s founder in 1968.

It divides a company’s business units into categories based on their respective market shares and market sizes. To help you roughly estimate the profitability of a business, the matrix uses the two metrics of relative market share and market growth rate.

- Relative market share: Your share of the market compared to your largest competitor.

- Market growth rate: The rate at which a certain market grows in revenues compared to the previous year.

Based on these two metrics, you divide your company’s businesses or products into four categories:

- Stars: High market share in a high-growth market.

- Cash cow: High market share in a mature market.

- Dogs (or pets): Low market share in a market with a slow growth rate.

- Question marks: Currently low market share in a fast-growing market.

The different categories help you simplify complex decision-making about investment and business focus. Companies use the framework to decide which businesses or products to invest in to maximize growth potential and profitability.

While first created to manage product lines for manufacturing companies in the ‘60s and ‘70s, it’s equally relevant for tech startups that offer a variety of digital services. Just because you deal in pixels doesn’t mean you’re immune to regular business mistakes like overspending on a product with little potential.

The BCG Matrix can help you make sense of your portfolio of products and make smarter decisions about future investments in both R&D and marketing. If you’re struggling to visualize it, don’t worry. Below, we’ll cover a real example and showcase how the different categories work.

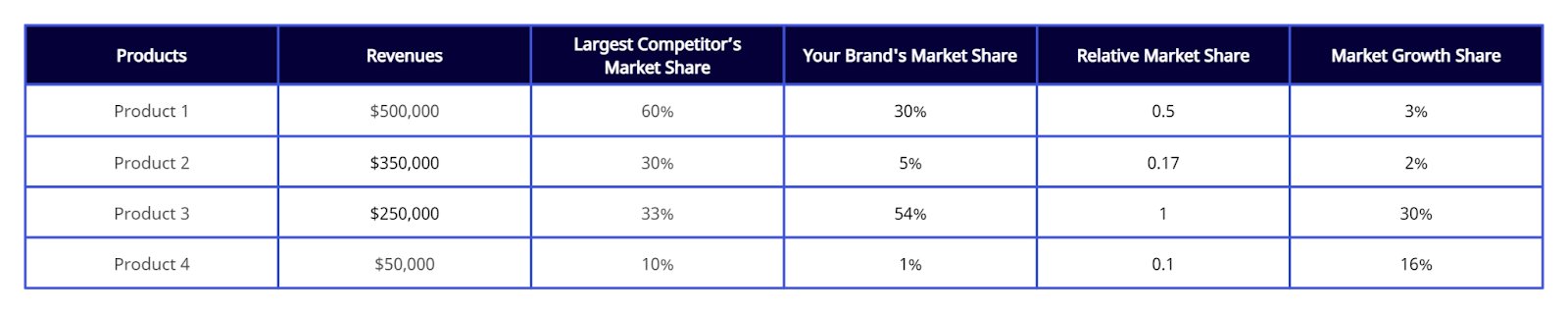

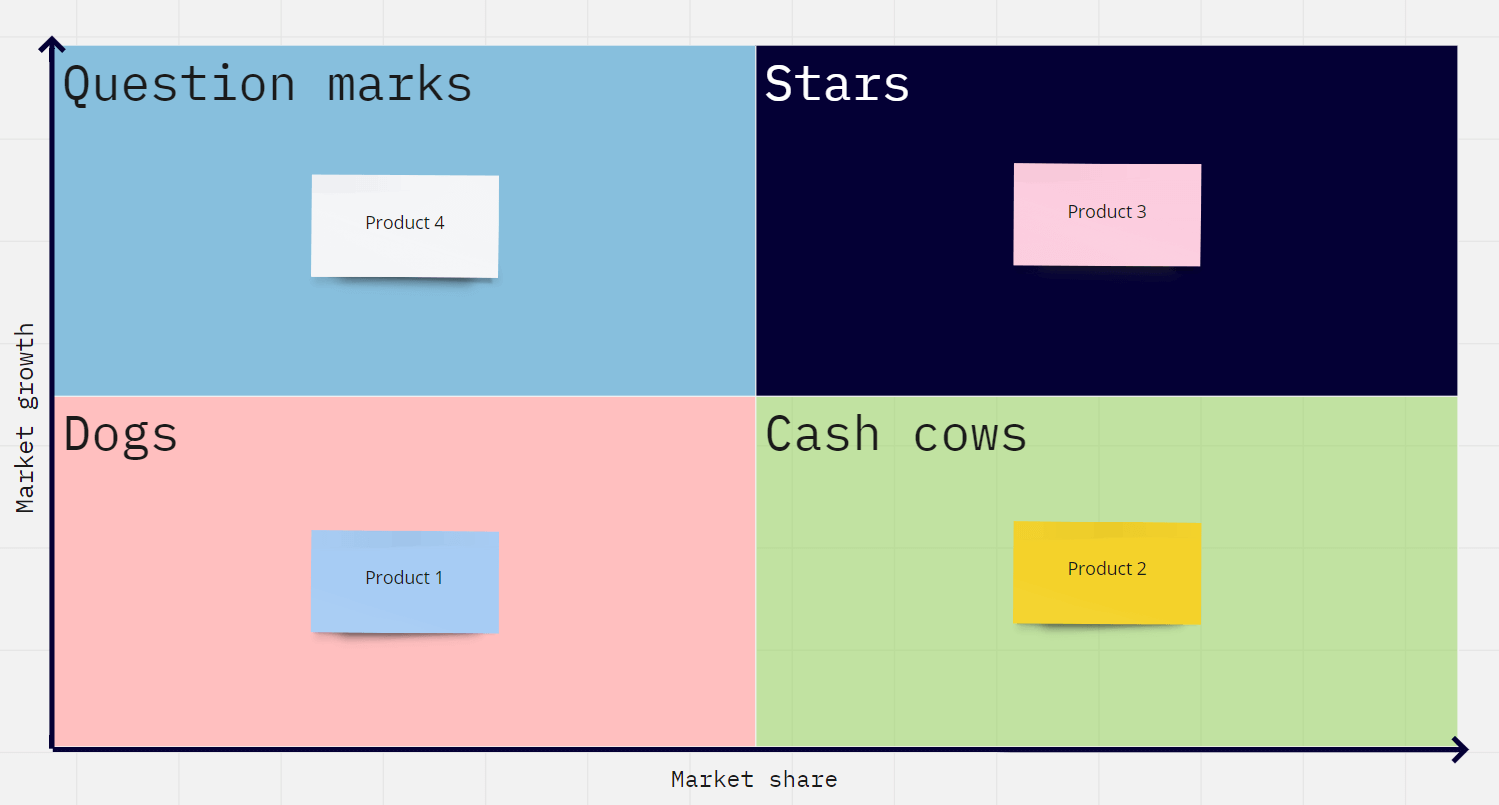

- BCG Matrix example

The table below shows a fictitious company’s product line, including necessary metrics for using the BCG Matrix.

It includes the revenues, the largest competitor’s market share — the local market leader — the product’s market share, and the market growth rate.

If we put these products through the BCG Matrix, #1 is a dog, #2 a cash cow, #3 a star, and #4 a question mark.

As you can see, the quadrants have nothing to do with the objective revenue numbers. It’s all about where the market is going and how your product’s doing within that market.

But before you dive in and create your own, you should understand the benefits and your ultimate goal for creating a BCG Matrix in the first place.

Why you should use a BCG Matrix — key benefits

You should use a BCG Matrix because it helps you prioritize business and products, cut waste, and create a robust portfolio.

Let’s break down these benefits.

Prioritize the right business or product quickly to establish a first-mover advantage

Instead of focusing on dying products or cash cows that sustain themselves without much effort, your company can focus on creating new winning products and businesses.

For example, your star product has the lion’s share of the market in a marketplace that’s growing at a rapid pace. Focusing on this business unit would be the smart move going forward.

Eliminate wasteful spending by cutting your losses

A dog product or product line can weigh down your company’s capital and manpower when you’d be better off selling it off and focusing on your winners.

By identifying a business as a dog — something with limited growth potential — you can cut your losses by selling the business or even, if it’s not profitable, simply closing it down.

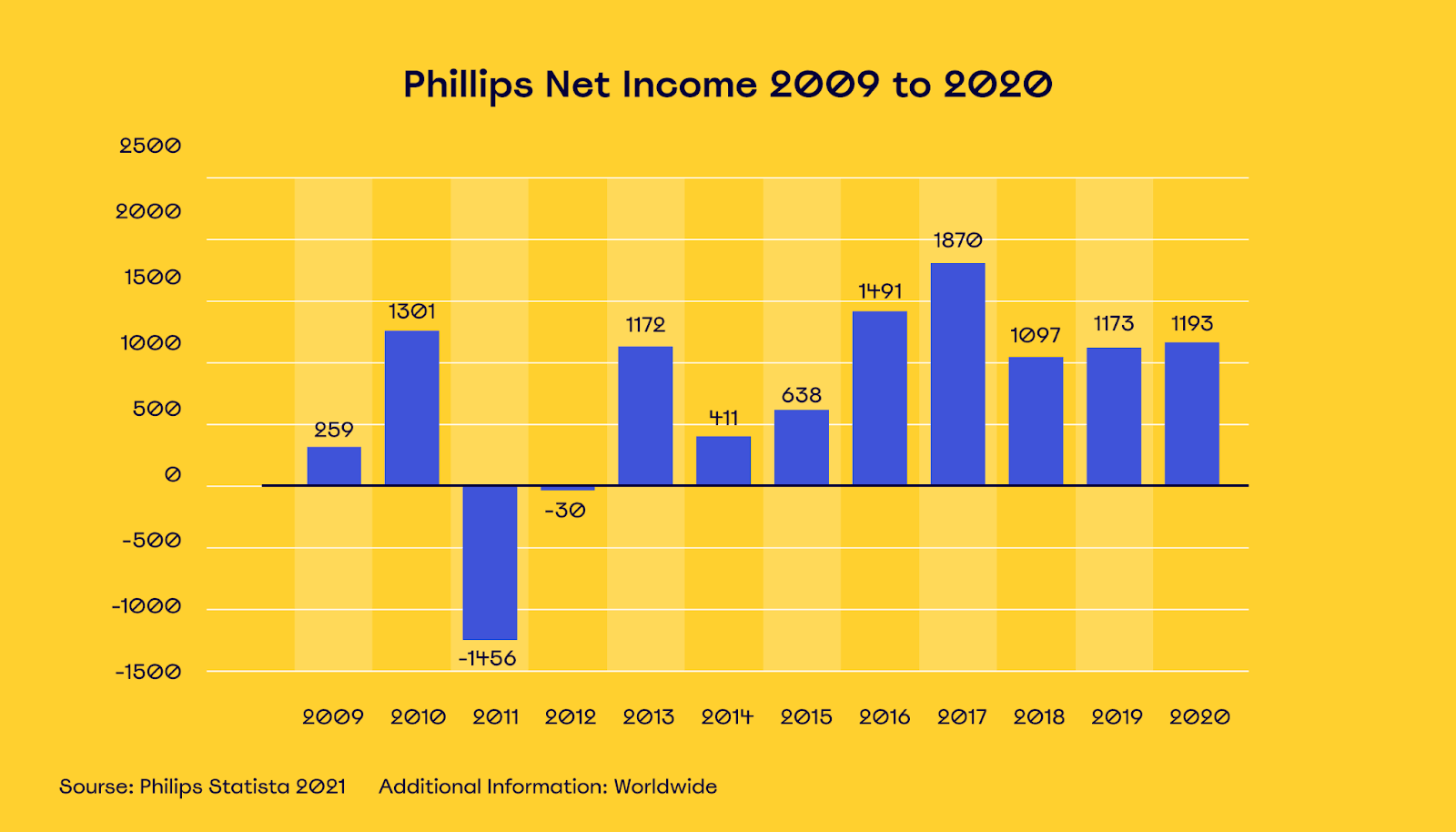

For example, realizing that its TV business was a dog, Phillips decided to sell off its TV business unit in 2012. The company was coming off record deficits in 2011 and decided to cut its losses.

Since that decision, the company has refocused on other areas and regained healthy profitability.

It is one of the most iconic success stories of selling off and divesting from a “dog” product line in modern history.

Create a more robust and balanced portfolio

Ultimately, the goal isn’t to succeed in one area but to better balance your company’s investment of capital and effort across your entire portfolio. By placing bets on high-growth markets while maintaining healthy cash cows, you can future-proof your company.

If you’re looking for a similar tool to help you plan the journey of a single product, you could try impact mapping .

- What are the four quadrants of the BCG Matrix?

The four quadrants of the BCG Matrix are stars, dogs, cash cows, and question marks.

While we’ve roughly covered them above, let’s explore each category a bit closer, using real product examples.

A cash cow is a well-established business with stable brands in a mature market.

An example of a cash cow business is the domestic soft drink business in the U.S. for Coca-Cola, where the company maintains a 44% share of all revenue.

The market has long since matured and is growing at a fairly slow rate at about 5.1% , which is currently lower than the U.S. rate of inflation.

So, it’s a low-growth market with little potential for future growth, but the business is a winner — AKA a cash cow.

An example of a star is Amazon’s Amazon Web Services business that provides cloud services to B2B customers. The company has a 32% market share, and the public cloud industry is growing rapidly, forecasted to grow 21% in 2021 alone.

This type of market-leading product in an industry that’s virtually exploding is what we call a star .

Phillips’ television business — which we covered earlier — is an example of a dog, where the company had a low market share in a mature marketplace.

Question mark

Kia’s electric vehicle business is a good example of a question mark. Although it currently has a small market share of around 2.1% , the EV market is rapidly growing globally, at an expected average rate of 24.3% in the U.S. until 2028.

Because of the rapid growth of the market, there’s plenty of opportunity for new players to establish themselves.

- How to calculate relative market share in the BCG Matrix

Before you can categorize your businesses, you need real data to see where they stand in the marketplace. The relative market share is one of the key metrics you use in the BCG Matrix.

Let’s break down how to calculate it.

Find a reliable source for up-to-date marketplace data

There are a plethora of market research firms that sell industry data of varying levels of accuracy online.

Either find a firm that specializes in your industry and locations and offers the most accurate data, or establish your own in-house research team.

The important thing is to find a reliable source of the latest, up-to-date market information. Without accurate data, your product portfolio decisions are going to be more luck than judgment.

Identify your largest competitor’s market share

Examine the marketplace data and find your largest competitor for the specific product you’re researching.

Try to find its latest revenue numbers. The company may release revenue data by sector or even product in its quarterly reports. Get as specific as possible to use accurate numbers on the actual business area you want to compare.

Divide your market share by the largest competitor’s market share

The formula to find your relative market share is super simple — just divide your market share (or revenues) by that of your largest competitor.

For example, if your main competitor sells $600,000,000 in tablets and you sell $150,000,000 worth of tablets per year, your relative market share is 0.25.

The relative market share focuses on the importance of “owning” a market, which typically means stable income even without large marketing efforts.

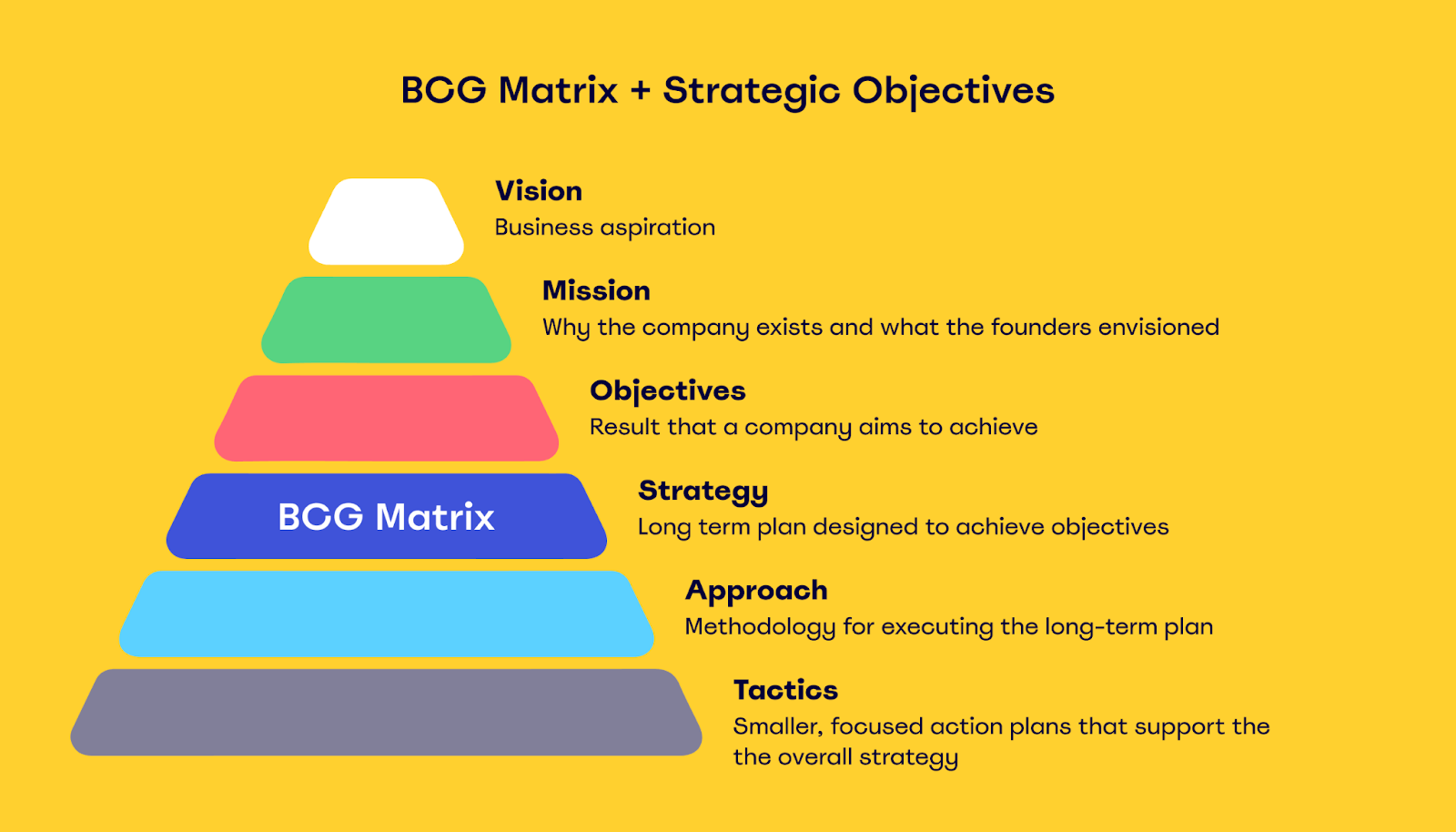

- The role of the BCG Matrix in strategic management

Strategic management is the process of using objectives, procedures, and initiatives to make a company more competitive.

Instead of vague guesswork and thinking, you use formalized processes and real data to come up with objectives and strategies.

For example, this could be investing in researching competitors to explore where your products stand in the marketplace.

The BCG Matrix in itself isn’t the end-all-be-all of strategic management. It’s only a single tool in a larger process.

Start with a planning workshop and creating a big-picture strategy

Don’t try to create a BCG Matrix in a vacuum. Before your company will get anything of value out of it, you need the big picture figured out.

You wouldn’t try to build a house without setting up a robust foundation. So first, you should come up with a vision and strategic objectives for your company based on real data like market research.

A practical way to do this is to arrange a planning workshop with executives and key stakeholders involved with your entire portfolio.

Using a framework like OKR (Objective & Key Results) makes it easier to avoid wild guessing and personal biases.

Combine with strategic objectives to prioritize investments

If your objective is to focus on innovation, double down on stars and question mark businesses in rapidly growing markets, and move some of the marketing and R&D budgets away from stable cash cows.

If it’s to expand globally, focus on the market expansion of an existing cash cow product.

Revise and adapt as circumstances change

It’s important to understand that you’re not going to perfectly predict the path to bombastic success for your company in a single planning workshop and your first BCG Matrix.

As markets and competitors change, you need to adapt your plan and revise your BCG Matrix and priorities.

For example, as market growth peters off, a previous question mark could quickly become a dog, with no real prospects of becoming a winning product for your company.

- How to use the BCG Matrix to improve your marketing strategy

The BCG Matrix can also help you optimize your marketing strategy and grow your business with better promotions.

Let’s look at how.

Re-adjust budgets based on the growth Matrix quadrants

The first step is to use the BCG Matrix to recalibrate your marketing budget.

Ideally, you’d do this in a live meeting with every key stakeholder on board. Of course, if everyone doesn’t work in the same office, which is often the case, this can be difficult. But with our BCG Matrix Template , your team can remotely collaborate on a virtual board in real-time.

With a visual representation of where the products are in their market, it’s easier to accurately distribute the budget.

If you want to be more aggressive, you can focus on question marks and star products with growth potential rather than the safe and steady cash cows.

Adjust your marketing message based on the state of the market and your brand

If you’re pushing an up-and-coming product, you can’t use the same message as you use for markets where you’re already the go-to brand.

You need to adjust based on your place in the market. For example, Avis had a legendary marketing campaign where the company pointed out that it wasn’t the market leader.

By making the argument that “we work harder since we’re second,” Avis experienced rapid growth and established itself as a strong contender to Hertz in the rental car market.

The average consumer tends to default to familiar products and market leaders because it’s a “safe choice.” Find a unique angle to turn your underdog status into a perceived benefit, not a risk.

- Disadvantages of using the BCG Matrix

Just because you can use the BCG Matrix in various areas of your business doesn’t mean you should trust it blindly.

This framework has a number of limitations and issues that make it an imperfect tool for strategic planning.

A high market share doesn’t equal profitability

Just because your product has a high market share doesn’t mean it’s a profitable business. It could be a cut-throat market with high costs, leaving you with bad margins and poor cash generation.

Depending on variations in market size and product type, dogs can actually earn more than cash cows.

It doesn’t account for external factors

The BCG Matrix doesn’t leave room to account for crucial external factors outside the market. For example, the Covid-19 pandemic decimated the tourism sector as a whole, with over one trillion dollars in lost revenue in 2020.

If your company had a plan to expand your tour bus offerings, it’s probably a good idea to put that on hold, even if you could win market share.

Lack of middle ground — only classified low or high

The BCG Matrix tends to deal in extremes — a product either has a low market share or high, with no in-between.

But that’s an overly simplistic outlook on marketplace dynamics. For example, could you truly describe PepsiCo’s share of the U.S. beverage market as low? That’s what you’d have to do if you followed the BCG Matrix formula.

The model is simply too simple

Market growth rates and your relative market shares are important metrics, sure. But on their own, that’s not enough data to make a solid investment or other business decisions.

To make a truly educated decision about your company’s future, you must also consider overall market size, profit margins, operating costs, cash flow, and much more.

So for best results, use it in combination with other frameworks and data when planning budgets and marketing campaigns.

- Use the BCG Matrix as a starting point to make better long-term strategic decisions

The BCG Matrix alone isn’t a complete framework that will help you predict the future and always make the right business decisions.

But it’s a great starting point to help you live up to your strategic objectives over the long term.

It forces you to dig up data on your competition and put your products into context, which can help you identify new marketing opportunities.

It’s not a solution on its own, but it can become a valuable tool in your strategic management toolbox.

Are you ready to build your own BCG Matrix?

Use our bcg matrix template to get started., miro is your team's visual platform to connect, collaborate, and create — together..

Join millions of users that collaborate from all over the planet using Miro.

- Why you should use a BCG Matrix — key benefits

Keep reading

How to streamline processes to make your org more efficient.

From chaos to clarity: How project workflows lead to success

Your guide to understanding (and improving) organizational efficiency

BCG Matrix: Definition, Chart, Explanation With Examples

BCG stands for Boston Consulting Group; also called ‘Growth/Share Matrix/ BCG Matrix’; developed by Boston Consulting Group, a world-renowned management consulting firm located in the USA. It is a useful tool for analyzing a diversified company’s business portfolio.

In the BCG matrix, SBU(Strategic Business Unit) is a unit of the company that has a separate mission and objectives that can be planned independently from other company businesses. Diversified companies having several SBUs (Strategic Business Units) use the BCG Matrix. These SBUs form the ‘business portfolio’ of the company. Companies use the BCG matrix is as a portfolio planning tool.

This matrix has four steps:

- Dividing the business-organization. into several (at least two) SBUs

- Determining the prospects of each SBU of the organization

- Comparing each SBU against other SBUs with the help of a matrix (two-dimensional)

- Setting strategic objectives for each SBU.

What is the Strategic Business Unit (SBU)?

In the BCG matrix, SBU(Strategic Business Unit) is a company that has a separate mission and objectives and can be planned independently from other company businesses.

For example, a company division, a product line within a division, or sometimes a single product or brand.

A strategic business unit (SBU) is a relatively autonomous unit of a firm. In a diversified company, each business unit is an SBU. A division of a company may also be treated as Strategic Business Units (SBUs).

According to Pearce and Robinson, Strategic Business Units (SBUs) must have certain characteristics:

- A unique business mission

- An identifiable set of competitors

- The SBU strategic manager can make or implement a strategic decision relatively independent of other SBUs

- Crucial operating decisions can be made within the SBU.

An SBU is responsible for its products, services ‘and markets and, therefore, it is also responsible for developing its strategy. Generally, an SBU rs independent in business operations has its managerial resources and has all its assets under its control.

For example, PNG has 21 business units for the production of textile products, ceramics, pharmaceutical products, etc. Each of these units is treated as an SBU.

They, however, work under the Tesla corporate management. In a diversified company, all the business-units constitute its business portfolio. Each business unit or SBU is treated as a standalone profit center.

A business portfolio approach is commonly followed in a diversified company for corporate strategic analysis .

A corporate strategy for each SBU is set in such a way that it becomes consistent with the resource capabilities of the overall company.

Each unit is assessed as a separate entity after a portfolio approach is followed.

As remarked by Hili and Jones, the portfolio approach is a visual way of identifying and evaluating alternative strategies for the generation and allocation of corporate resources.

One of the most widely used portfolio approaches is the Boston Consulting Group (BCG) Matrix.

How to Use the BCG Matrix in Practice?

To use this matrix, the SBUs of the company are plotted on a two- dimensional chart.

One dimension of the chart (vertical dimension or Y-axis) represents future market growth (growth rate of SBU’s industry ), and the other dimension (horizontal dimension or X-axis) represents an SBU’s relative market share.

The growth rate is measured concerning the economy of the country. The growth rate of an SBUs industry may be faster or slower than the economy’s growth rate.

As postulated by BCG Matrix, a favorable competitive environment exists in an industry when the growth rate is faster in the industry. On the other hand, relative market share is ‘the ratio of an SBU’s market share to the market, the share held by the largest rival company in its industry.

If SBU X has a market share of 10 percent and its largest rival has a market share of 30 percent, SBU X’s relative market share is 10/30 or 0.3.

If an SBU is a market leader in its industry, it will have a relative market share greater than 1.0.

For example, if SBU Y has a market share of 40 percent and its largest rival has a market share of 10 percent, then SBU Y’s relative market shareis40/l0 or 4 0.

When an SBU’s relative market share is greater than you can assume that it has a significant cost advantage over its competitors.

In the Figure, you will find that the market growth rate is placed on the left-hand side (Y-axis), and the relative market share is placed at the bottom (X-axis), below the horizontal line.

The chart is divided into 4 Quadrants.

- quadrant 1 shows the star SBUs,

- quadrant 2 shows the ‘question mark’ SBUs,

- quadrant 3 shows’ cash cow’ SBUs, and

- quadrant 4 shows’ dogs’ SBUs.

Two pieces of information are required to plot and SBU in the matrix

- an estimate of the future rate of growth in the market and

- An estimate of the relative market share of the business unit.

Any business that is to the left of the dark violet is dominant in the market.

Any business to the right of the start point is nondominant.

Separate high growth from low growth markets common cut point is GDP + 3%. Markets growing faster than these are considered high growth; markets going slower than these are considered slow growth.

Both cut points are somewhat arbitrary.

For example, a business with its share of 1.01 may be the leader, but it is scarcely in a commanding position compared to the next largest competitor.

Using the classic Boston Consulting Group (BCG) approach, a company classifies all its SBUs according to the growth-share matrix, as shown in Figure.

On the vertical axis, the market growth rate provides a measure of market attractiveness.

On the horizontal axis, relative market share serves as a measure of company strength in the market. The growth-share matrix defines 4 types of SBUs.

4 Strategic Business Units (SBUs) of BCG Matrix

Using the Boston Consulting Group (BCG) approach, a company classifies all its SBUs according to the growth-share matrix.

On the vertical axis, the market growth rate provides a measure of market attractiveness. On the horizontal axis, relative market share serves as a measure of company strength in the market.

By dividing the growth-share matrix as indicated, 4 types of SBUs of BCG Matrix are;

- Question Marks,

Stars: High Growth, High Share Businesses

Stars are high-growth, high-share businesses or products. They often need heavy investments to finance their rapid growth. Eventually, their growth will slow down, and they will turn into cash cows.

An SBU with high market growth and a high relative market share is considered as a star business-unit. It is a profitable business. It has attractive long-term profit opportunities.

Stars are in the high growth rate and, therefore, highly competitive markets. They have the potential to be the cash cows only if they can consolidate their competitive position.

They generate as well as consume revenue. Their net contribution to the kitty of the organization is not very substantive.

Cash Cows: Low-Growth, High-Share Businesses

From the matrix, it is clear that these businesses operate in the industries which are in the maturity stage and hold a very strong competitive position in their respective industry.

They generate far more cash than they consume. The surplus cash can be used to nurture those businesses that are in the star quadrant or the question mark quadrant.

Cash cows are low-growth, high-share businesses or products. These established and successful Strategic Business Units (SBUs) need less investment to hold its market share.

Thus, they produce a lot of the cash that the company uses to pay its bills and support other Strategic Business Units (SBUs) that need investment.

A Strategic Business Unit (SBU) is considered a question mark when it has high market growth and low market share.

It is relatively weak in competitive terms. A question mark business-unit is risky due to the inherent uncertainty in a high-growth market and weak market share position.

However, such a unit is considered to have a future. It may offer-opportunities for long-term profit. If more cash is poured down into this SBU and properly nurtured, it may become a star Strategic Business Unit (SBU).

Question Marks: Low-Share Business Units in High-Growth Markets

Question marks are low-share business units in high-growth markets. They require a lot of cash to hold their share, let alone increase it.

Management has to think hard about which question marks it should try to build into stars and which should be phased out.

An SBU is considered as a cash cow when it has low market growth and high market share.

It is a highly profitable firm and generates a substantial amount of cash. Since this Strategic Business Unit (SBU) has a lack of opportunity for future expansion, more cash should not be injected.

Question marks lie in the high business growth rate segment with a weak competitive position.

This means that the organization has to develop some competencies to make the best use of high growth rates. To sustain these business resources, the organization has to be committed to developing them in the select areas.

Dogs: Low-Growth, Low-Share Businesses

Dogs are low-growth, lo,w-share businesses, and products. They may generate enough cash to maintain themselves but do not promise to be large sources of cash.

An SBU with low market growth and low market share is treated like a dog. It has a weak competitive position in a low-growth industry. It cannot generate cash, and also, it has a dim prospect.

The corporate head office has to decide about its future. It may be divested or liquidated or turned around if there are sufficient reasons for its revival.

Dogs are in the low attractiveness, low competitiveness (low relative market share) quadrant. They are not generating revenue, nor does it make sense to develop them as their competitive position would remain weak. It is best to divest these businesses.

Understanding BCG Matrix

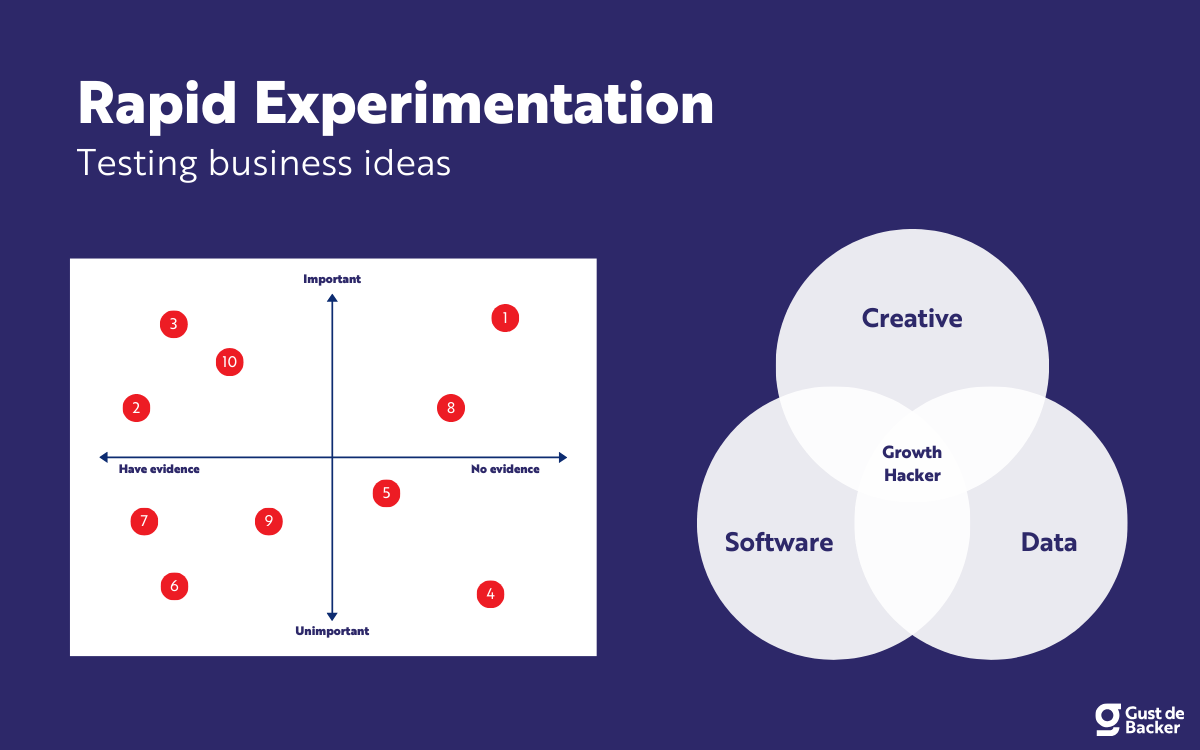

The chart below shows the ten circles in the growth-share matrix represent a company’s ten current SBUs. The company has two stars, two cash cows, three question marks, and three dogs.

The areas of the circles are proportional to the SBU’s dollar sales. This company is in fair shape, although not in good shape. It wants to invest in the more promising question marks to make them stars and maintain the stars to become cash cows as their markets mature.

Fortunately, it has two good-sized cash cows whose income helps finance the company’s question marks, stars, and dogs. The company should take some decisive action concerning its dogs and its question marks. The picture would be worse if the company had no stars, if it had too many dogs, or if it had only one weak cash cow.8

Once it has classified its SBUs, the company must determine what role each will play in the future.

One of the four strategies can be pursued for each SBU. The company can invest more in the business unit to build its share. Or it can invest just enough to hold the SBU’s share at the current level.

It can harvest the SBU, milking its short-term cash flow regardless of the long-term effect. Finally, the company can divest the SBU by selling it or phasing it out and using the resources elsewhere.9

As time passes, SBUs change their positions in the growth-share matrix. Each SBU has a life cycle. Many SBUs start as question marks and move into the star category if they succeed. They later become cash cows as market growth falls, then finally die off or turn into dogs toward the end of their life cycle. The company needs to add new products and units continuously so that some of them will become stars and, eventually, cash cows that will help finance other SBUs.

BCG recommends several things based on the grid;

- The stars should be nurtured with the surplus cash flows from the cash cows. The long-term objective should be to consolidate the star SBU’s position.

- The question marks should be provided supports from the surplus of the cash cows. However, if a question mark SBU’s long-term prospect is uncertain, it should be divested.

- To make a diversified company’s business- portfolio more attractive, the corporate head office should have an objective of turning the favored question mark SBUs into stars.

- The company should seriously think about getting rid of dog SBUs.

- The corporate management should consider making the company an organization of a balanced portfolio with enough number of stars, question marks, and cash cows.

Strategic Considerations of BCG Matrix

The portfolio matrix gives the company an idea about the health of its businesses. If there are too many dogs or question marks or too few cash cows and starts, the company’s portfolio can be called an imbalanced one.

After getting the portfolio’s picture, the company should then decide on each SBU’s objective, strategy, and budget . With regards to this, it can pursue one of the following strategies:

The building strategy is designed to improve market positions in spite of possible short-run damage to profitability. Building strategies are most appropriate when a firm wants to move question marks into the star category. A building approach can also be used to convert small stars into bigger stars. To ensure success, both of these building strategies require significant commitments of company resources.

A holding strategy, on the other hand, is a defensive strategy designed to preserve market positions. Holding is most commonly used to keep cash cows productive.

Cash cows are often vulnerable to newer competitors, and marketing programs need to promote new versions and applications to maintain customer interest.

Harvesting strategies are aimed at making as much money off a product as possible . The idea is to cut promotion and production costs to the bone and mine the product for its cash flow.

This approach focuses on extracting cash from a project at the expense of the business’s long-run survival. Harvesting is a ruthless strategy that is best suited to weakening cash cows, dogs, and some question marks.

A strategy of divestment attempts to sell or liquidate businesses to generate cash so it can be better used in other areas. Divestment is employed on question marks and dogs that the firm cannot finance into better growth positions.

Candidates for divestment include businesses that have little room for cost savings and those that just break-even or operate at a loss. Sometimes divestment can work to the advantage of both the seller and the buyer.

The market share/growth matrix implies a preference for high market growth and the need to maintain a firm’s cash balance. Neither the theoretical nor the empirical work exists to support such a preference conclusively.

Moreover, the feasibility of a strategy is dependent on more factors than simply share and market growth. You should appreciate that SBUs change their positions in the growth-share matrix with the elapse of time.

Like a product, SBUs have a life cycle starting with question marks, becoming stars, turning to cash cows, and end up as dogs. That is why companies should examine the businesses’ future positions side by side with the current position analysis.

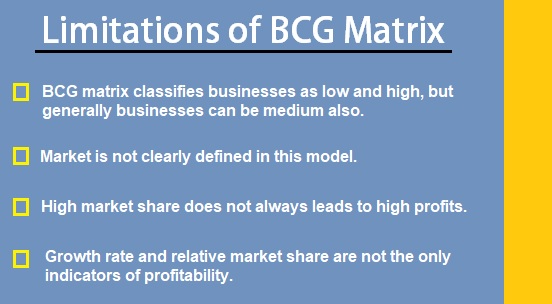

Limitations of BCG Matrix

BCG matrix has certain flaws. Because of these flaws, it should be used cautiously.

- BCG matrix is criticized as a very simplistic model. An ABU is affected not only by market share and growth rate. Many other relevant factors, such as product differentiation^niche market possibility, etc. affect the business operations of the SBU BCG matrix and do not take into account all these factors.

- BCG matrix suggests a straight-forward Hnkage relative market Share’ and cost savings. In reality, cost advantage may not accrue to an SBU simply due to high maShaS Depending on the industry, an SBU with low simple, low-cost technology.

- Cash cow SBUs are supposed to generate substantial cash Sows because of their high market share. It may not always be in some businesses; the capital investments needed to remain competitive are so high that an SBU classified as a cash cow may find it very difficult to yield substantial cash flows.

Resource Allocation with BCG Matrix

In a multi-business, different businesses have different resource requirements. Some businesses are net resource generators, and some are resource consumers.

To construct a visual depiction of its various businesses, the organization uses the Portfolio matrices.

The portfolio matrix plots the different businesses on two axes: one that shows the attractiveness of the industry the business is into the strength of the business based on a chosen indicator such as relative market share (in case of the BCG matrix as shown above and Business Strengths in the nine-cell GE Matrix).

The decision-maker must assess the resource requirement of the different businesses plotted on the matrix to allocate resources.

The portfolio has to be balanced in terms of those businesses that generate revenue and are likely to generate revenue versus their resource consumption.

The use of the BCG Matrix lies in estimating which businesses are the net cash generators and which are the net cash consumers. The businesses that are the cash consumers must also exhibit the potential to be the leaders in their business with a highly competitive position so that they can contribute enough cash to nurture future businesses in the future.

Strategic choices are concerned with resource allocation among businesses so that the ones with potential are nurtured and the ones without are divested. The decisions to retain and divest are top management decisions.

What should an ideal portfolio of business be like? An ideal business portfolio developed using the GE nine-cell matrix with industry attractiveness and business strengths as the two measures.