- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

What Is Overhead? What Small Businesses Need to Know

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Types of overhead

Calculating your overhead ratio, accounting reports, tips to reduce your overhead.

Overhead is a term used to describe business expenses that aren’t directly linked to creating a product, service or any other activity that contributes to a company’s income. While some business overhead is unavoidable, reducing these indirect expenses will help widen your profit margin.

Every business incurs some overhead expense, although some businesses (for example, a large retail department store) have much higher overhead costs than others (such as a freelance graphic designer working exclusively from home). A wide range of business expenses are typically considered overhead, including:

Advertising and marketing.

Utilities like electricity, climate control, water, phone and internet.

Accounting, legal and other professional services.

Property taxes.

Depreciation.

Business travel and meals.

Compensation for employees not directly involved in product production such as administrative or janitorial staff.

Office supplies and equipment.

Business rent or mortgage.

Licenses and fees.

Subscriptions to services like Zoom or Expensify.

Employee perks such as company swag, gym memberships, team-building activities and retreats, company cars, coffee and snacks.

» MORE: What is accounting? Definition and basics, explained

QuickBooks Online

Overhead expenses generally fall into one of three major categories:

Fixed overhead: These are business expenses that remain stable from month to month such as rent, insurance, subscriptions or internet service.

Variable overhead: These costs rise or fall depending on how busy your business is. Variable expenses might include your shipping costs, which increase when you sell and ship more product and decrease when you sell less — falling all the way to zero if you haven’t made any sales during a particular period.

Semi-variable overhead: Overhead costs that you pay some portion of year-round, but that increase as you get busier, are considered semi-variable. Your electric bill might be an example of semi-variable overhead since you always pay something for this utility, but your electricity consumption may increase during busy times, causing this cost to fluctuate.

Some businesses find it useful to fine-tune their accounting analysis even further by dividing their overhead expenses into sub-categories like labor overhead, administrative overhead and selling overhead.

Knowing your overhead ratio provides a clear picture of how overhead impacts your business. In general, it’s good to aim for an overhead ratio of less than 35%. To figure out yours:

Examine all your business expenses incurred during a set time period (typically a month), carefully determining which of these expenses aren’t directly linked to your product or service, and therefore qualify as overhead.

Add up all of these indirect expenses to get your total overhead expense figure.

Determine your total sales income for the period you’re working with.

Finally, apply the following formula: (Monthly overhead / monthly sales) x 100 = Percentage of overhead cost to sales.

For example, if you spent $10,000 on overhead during the month of May, and took in $40,000 in sales during that same period, your overhead ratio would be (10,000 / 40,000) x 100 = 25%.

» MORE: Basic accounting concepts every small-business owner should know

Part of any business’s accounting responsibility is to maintain good records of overhead costs. Whether these costs are fixed, variable or semi-variable, they should be entered on your company’s profit and loss statement and on its balance sheet.

Profit and loss statement: Also known as a P&L, this statement shows what your company is earning versus what it’s spending and provides insight into your cash flow, company risk and overall performance.

Balance sheet: This is a financial statement that presents a quick snapshot of your company at a specific point in time by showing assets, liabilities and shareholder equity. Overhead costs are entered as current liabilities on your balance sheet.

Since overhead takes away from your net profit without contributing anything directly to creating your product or service, it makes sense to keep these costs as low as you possibly can without harming your business. Here are some easy ways to reduce yours:

Select your team carefully

Smart hiring choices keep labor overhead costs under control and reduce the need for painful terminations over time. Choose team members with skill sets, aptitudes and work styles that fit your company, and invest in training that gives your employees the necessary knowledge and skills to master the work your company needs done. When hiring, keep in mind that not all functions need to be performed by regular W-2 employees. For seasonal or occasional tasks, it may be more cost-effective to outsource and use independent contractors.

Work with an accountant

While this may feel like an additional expense initially, bringing a skilled accountant into the mix can save you big money in the long run. You’ll discover tax deductions you’d never even considered, maintain more accurate financial records and avoid mistakes that could cost your business a bundle. Investing in good accounting software that tracks income and expenses is another way to keep your bookkeeping accurate and up-to-date, whether or not you also decide to work with an accountant.

Have employees work from home

Commercial rent or mortgage is one of the largest contributors to overhead expenses. Allowing some of your staff to work from home could significantly reduce your square footage requirements, which gives you the choice between downsizing or sub-leasing excess space to offset your costs. If you decide to relocate, you may be able to find a neighborhood with more affordable commercial real estate if leaving your current area won’t hurt your bottom line.

Go paperless

Sending out physical invoices, statements and notifications — and retaining hard copies of files — contributes significantly to your paper, ink, postage, electric and storage space expenses. Send digital correspondence and back up important stored records to a hard drive and/or the cloud. To further reduce your paper consumption, consider replacing paper towels with electric dryers in company restrooms and paper cups with reusable mugs in the break room.

Cut costs on recurring charges

Overhead expenses like phone, internet , equipment rentals, service retainers and supplies may be unavoidable, but there’s no reason to pay top dollar for them. See if you can renegotiate your contracts or switch to providers and suppliers with lower rates. Converting from a traditional PBX office system to a phone-over-internet model may reduce your phone bill significantly, for example. Take stock of your current software subscriptions and see if there are any that you could downgrade to a more affordable service tier or cancel altogether.

On a similar note...

- Search Search Please fill out this field.

- Corporate Finance

- Financial statements: Balance, income, cash flow, and equity

Overhead vs. Operating Expenses: What's the Difference?

:max_bytes(150000):strip_icc():format(webp)/Group1805-3b9f749674f0434184ef75020339bd35.jpg)

There are two main categories of expenses that a business can incur: overhead and operating expenses. Operating expenses are those that a business incurs as a result of its normal operations. Overhead expenses, on the other hand, are what it costs to run the business.

Expenses can be divided into several different types, including equipment costs, inventory , and facilities costs. These business expenses can be further divided into overhead or operating costs, each of which depends on the nature of the business being run.

Key Takeaways

- Operating expenses are the result of a business's normal operations, such as materials, labor, and machinery involved in production.

- Overhead expenses are what it costs to run the business, including rent, insurance, and utilities.

- Operating expenses are required to run the business and cannot be avoided.

- Overhead expenses should be reviewed regularly in order to increase profitability.

Operating Expenses

Operating expenses are incurred by a company through its normal business operations. That means these expenses are required and cannot be avoided because they help the business continue running. Operating expenses are also referred to as opex.

These expenses are found on the income statement and are components of operating income . Most income statements exclude interest expenses and income taxes from operating expenses.

Examples of operating expenses include materials, labor, and machinery used to make a product or deliver a service. For example, operating expenses for a soda bottler may include the cost of aluminum for cans, machinery costs, and labor costs .

Reducing operating expenses can give companies a competitive advantage . It can also increase their earnings , which can be a boon to investors. But reductions in opex can have a downside, which may hurt the company's profitability. Cutbacks in staff (and therefore, salaries) can help reduce a company's operating expenses. But by cutting personnel, the company may be hurting its productivity and, therefore, its profitability.

One way to determine the operating expenses for a particular business is to think about the costs eliminated by shutting down production for a period of time . For example, even though production for the soda bottler in the example above may shut down, it still has to pay the lease payments on the facility.

Overhead Expenses

Overhead expenses are other costs not related to labor, direct materials, or production . They represent more static costs and pertain to general business functions, such as paying accounting personnel and facility costs.

These costs are generally ongoing regardless of whether a business makes any revenue. Unlike operating expenses, these costs are fixed , meaning they can be the same amount over time.

In the scenario with the soda bottler above, the facility lease payments are still owed even if no current production takes place within the facility. Therefore, facility costs are overhead expenses. Likewise, the company still incurs other business expenses, such as insurance payments and administrative and management salaries.

They may also be semi-variable, so the amounts that need to be paid may change slightly over time. Utilities are one example. The cost of power can change based on usage. If the soda company increases production, it will have to pay more for electricity.

Overhead expenses also include marketing and other expenses incurred to sell the product. For the soda bottler, this includes commercial ads, signage in retail aisles, and promotional costs. These costs still remain if production is shut down for a short period of time.

These expenses can be categorized based on where they fit into the business. They can include:

- Administrative overhead

- General business overhead

- Research overhead

- Transportation overhead

- Manufacturing overhead

Companies must account for overhead expenses in order to determine their net profit.

Companies should review these costs regularly to determine how to increase profitability. If business becomes slow, cutting back on overhead usually becomes the easiest way to reduce expenses. Companies may review contracts for electrical consumption, Internet, and employee phone usage for reductions, or, in some cases, may even turn to contract staff instead of full-time employees, which usually costs less because benefits aren't required when hiring independent contractors .

The Bottom Line

Overhead and operating expenses are two types of costs that businesses must incur to run their business. The difference between the two is the types of costs that are classified under them. Overhead costs are related to the general business, fairly fixed, and can be reviewed often to make adjustments. Operating costs are the direct costs required to produce a product or service and are difficult to avoid.

Accounting Tools. " Examples of Operating Expenses ."

:max_bytes(150000):strip_icc():format(webp)/close-up-of-female-accountant-or-banker-making-calculations--savings--finances-and-economy-concept-980973568-03a13a494012414aaa835de128892345.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

.png)

Overhead Costs (Definition and Examples)

Bryce Warnes

Reviewed by

February 24, 2020

This article is Tax Professional approved

In simple terms, overhead is the cost of keeping your business afloat. Overhead is a summary of the costs you pay to keep your company running, and appears on your monthly income statement.

I am the text that will be copied.

When you track and categorize your overhead, you can plan around expenses, get an accurate picture of your profit margin, and find new ways to save your business money.

What costs factor into my overhead?

Overhead is what you pay to keep your business in business. However, that doesn’t include what you spend to produce goods or provide services, typically on raw materials and direct labor. These expenses are called COGS (cost of goods sold) and COS (cost of services), respectively.

When you buy ingredients for the croissants at your bakery, that expense is included in COGS. When you pay insurance for your bakery’s delivery van, that’s COS. Both these expenses are directly related to your business—you incur them in the process of making money.

However, rent for the bakery, business insurance, the cost of hiring an accountant, assorter administrative costs—all of these are overhead. These costs are not directly related to the way your bakery makes money, but they do keep your business running.

Overhead vs. operating expenses

When it comes to categorizing the ways you spend money, there’s an important distinction between overhead and operating expenses .

While overhead covers everything required to stay in business, operating expenses includes both overhead and COGS/COS. Operating expenses is a broad category, encompassing everything you spend in the course of running your business. In other words, overhead is a type of operating expense.

Overhead vs. G&A

G&A (general and administrative) expenses are expenses that apply to the whole company, and don’t necessarily have anything to do with essential business activity—the product or service the business creates. For example, the business might have general liability insurance, a business license, HR employees, office supplies, accounting and legal fees, bank fees, etc. The business has to pay these indirect costs even if they aren’t currently working on any projects.

Overhead expenses relate directly to the product or service the business produces, but not to one specific project. For example, a construction company might have a manager that oversees all of the projects the company is currently working on. Her salary would be overhead. Theoretically, if the company didn’t have any projects in the works, they could let her go and not incur the expense.

Fixed, variable, and semi-variable overhead

There are three types of overhead: fixed costs, variable costs, or semi-variable costs.

Fixed overhead

The rent for your bakery is the same amount every month. No matter how your business is performing, or what kinds of crazy market forces are at work, you’ll pay the same amount for rent every single month.

Rent is an example of fixed overhead. Fixed overhead includes:

- Property tax

- Business insurance

- Interest on mortgage payments

- Regular janitorial services

- Web hosting

- Bookkeeping services

- PO box rental

Variable overhead

Variable overhead costs are costs you incur on a regular basis with costs that fluctuate. For example if you’re running a bakery and you use gas ovens, you likely use a different amount of gas every month—it fluctuates depending on how much you need to bake. That means that, month to month, your gas bill is different.

Gas bills are an example of variable overhead. Other examples of variable overhead include:

- Electricity

- Vehicle maintenance

- Building or equipment repairs

- Hiring seasonal support staff

- Staff events

Semi-variable overhead

As expected, semi-variable overhead covers scenarios where costs fall somewhere between variable and fixed overhead. For instance, your business phone has a regular monthly rate. But when you travel internationally, or go over your data limit, you’re charged extra fees. So even though your phone plan costs a fixed monthly minimum, there’s some fluctuating cost on top of that.

This is an example of semi-variable overhead. Think of the expense as being split into two parts: the fixed overhead (the monthly cost of your phone plan) and the variable overhead (the fees for data overage and/or international travel).

Types of semi-variable expenses include:

- Staff bonuses—awarded at different times each year, such as the busy season, or near the end of the year

- Traditional bookkeepers—they charge a monthly minimum, and the rest is based on how much bookkeeping you need done

- Janitorial services—in addition to their regular duties, you may have to hire cleaners for extra messes

Further reading: Fixed vs Variable Costs (with Industry Examples)

How to categorize overhead expenses

Whatever bookkeeping solution you use, you should make sure your overhead costs are categorized. That way, you keep accurate business records, produce accurate financial statements , and see where your money is going.

Overhead is either general, or falls into a specific category. General overhead affects the whole business—rent is a good example of a type of general overhead.

Specific overhead categories apply to specific parts of your company. For instance, some of your overhead is indirectly connected with creating your product—such as the cost of kitchen utilities. Other specific overhead is a result of back office tasks—like accounting, payroll, and general business administration.

The exact categories you use for your overhead will depend on your business; to figure out which ones fit the needs of your business, your best bet is to chat with a bookkeeper .

However, the most common overhead categories include:

- Selling overhead: the cost of marketing your business (e.g., online advertising, signage, and agency fees)

- Administrative overhead: what it costs you to run your back office (e.g., bookkeeping, accounting, payroll, scheduling, and human resources)

- Research overhead: the cost of researching new products or markets (e.g., consultant fees, prototyping, research, and diagnostic software)

- Transportation overhead: the cost of travel not directly related to your product or service (e.g., gas mileage for commuting to work, travel to conferences, or meetings)

- Manufacturing overhead: the cost of running your manufacturing facilities, such as rent, janitorial services, and equipment maintenance

How to calculate overhead rate

Your overhead rate is how much money you spend on overhead compared to how much revenue you generate. For instance, you may have an overhead rate of 14%—meaning that, for every dollar your business brings in, you pay $0.14 in overhead.

Why bother calculating overhead rate?

Say you run a lemonade stand. You already know that for every $5.00 glass of lemonade you sell, you’re spending $2.00 on ingredients and labor. That’s your COGS for each glass.

You may be tempted to believe you’re earning $3.00 income for every glass sold. But that doesn’t take into account the cost of electricity (to run your top-of-the-line juicer), or the monthly rate for your accountant (who specializes in the cold beverage industry). Those are both part of overhead. And unless you factor them in, your profit will be lower than your profit projections.

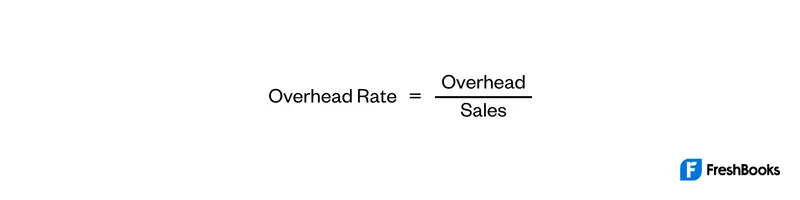

The formula for overhead rate

Luckily, overhead rate is quite simple to calculate. This formula handles it:

Overhead Cost / Sales = Overhead Rate

For the formula to work, you need to use numbers from a single period, like one month.

If you make $13,000 in sales in a typical month and you spend $1,600 on overhead, you get the following calculation:

1,600 / 13,000 = 0.123

Your overhead rate is 12.3%, or about 12 cents overhead for every dollar earned.

Finding your average overhead and sales

If you run a lemonade stand year-round, you probably make fewer sales in December than in August.

And, since some of your overhead is variable and semi-variable—such as the electricity bill—your overhead will be variable, too.

This is when comprehensive financial records are useful. Looking at your past overhead and sales numbers for a defined period—say, the previous financial year—you can calculate your average sales and overhead per month.

In this example, you’d add up all the sales figures for your lemonade stand the previous year, and divide that number by 12 (for 12 months). Then, do the same for overhead.

When you plug these numbers into the overhead rate formula, you’ll get a fairly accurate picture of how much you spend on overhead, versus how much you earn. The larger the time period you use to calculate your average, the more accurate your average overhead rate will be.

Overhead tax deductions

You may think keeping track of your overhead—the cost of staying in business—is a pain. The good news? Some of that money can probably be deducted from your taxes.

Keeping track of tax deductions quickly becomes routine, once you’re familiar with what can and can’t be deducted. Crunch the numbers with help from our guide on small business tax deductions .

Overhead is the cost of staying in business—not including COGS and COS, which (respectively) each go directly into the product or service you offer. The sooner you figure out your overhead, and see how it relates to your revenue, the sooner you get a realistic portrait of your business—and the info you need to start planning for the future.

- Owner’s Equity: What It Is and How to Calculate It

- How to Calculate and Use Year-Over-Year (YOY) Growth

- What Are Liabilities in Accounting? (With Examples)

- What is a Chart of Accounts? A How-To with Examples

- Owner’s Draw vs. Salary: How to Pay Yourself

- How to Calculate Net Income (Formula and Examples)

- Cash Flow Statement: Explanation and Example

- The Best Apps for Managing Receipts [2023]

Join over 140,000 fellow entrepreneurs who receive expert advice for their small business finances

Get a regular dose of educational guides and resources curated from the experts at Bench to help you confidently make the right decisions to grow your business. No spam. Unsubscribe at any time.

Subscribe for Free Business and Finance Resources

What is business overhead operating expenses and key definitions.

If you're interested in breaking into finance, check out our Private Equity Course and Investment Banking Course , which help thousands of candidates land top jobs every year.

What is Business Overhead?

Business overhead costs refer to ongoing expenses that are not directly tied to creating a product or service.

Overhead , also known as operating expenses, are the routine costs incurred by a business that isn't directly tied to a specific business activity . Unlike direct costs, which can be directly traced to a product or service, overheads encompass all the behind-the-scenes expenses that keep the business wheels turning.

These overhead costs are usually split into three types:

Fixed Overheads

These are expenses that remain constant regardless of the level of output . Think of them as the unavoidable costs of doing business. They include rent, insurance, and salaries of permanent staff. A company such as Apple, for instance, pays for the rental of its retail stores. No matter how many iPhones are sold, the rent doesn't change.

Variable Overheads

These expenses fluctuate in direct proportion to output levels . In other words, the more you produce, the higher these costs become. They include utilities, raw material costs, and direct labor costs. Consider a restaurant such as McDonald's, which would experience an increase in utility costs (like electricity and water) as it serves more customers. On the flip side, if business slows down, so do these costs.

Semi-variable Overheads

These costs have both fixed and variable components . An example is a cell phone bill with a fixed base charge and additional costs based on usage. An e-commerce company like Amazon could be a good example, which pays for server space (fixed cost) but also experiences variable costs as website traffic and sales increase.

Importance of Overheads in Business Operations

Understanding overheads is not just a theoretical exercise. These costs directly influence pricing decisions and profitability . A business with high overhead costs may need to price its goods or services higher to maintain a profit margin. This decision could have far-reaching impacts on the business's competitive positioning and customer demand.

Overheads also significantly impact financial statements, shaping key ratios that investors and creditors closely watch. For instance, high overheads would depress the operating margin, a ratio often used to assess operational efficiency. In a scenario where two companies have the same revenue, the one with lower overheads would have a higher operating margin, making it more attractive to stakeholders .

Overhead Analysis

Accurate overhead allocation is critical for understanding product profitability, guiding pricing decisions, and designing cost control strategies. Overhead analysis is the process of examining how these costs behave and allocating them to different business activities .

Consider the Activity-Based Costing (ABC) method used by many manufacturing firms like General Motors. Instead of allocating overheads based on a single measure such as direct labor hours, ABC assigns costs to specific activities involved in producing a product.

This approach provides a more nuanced understanding of cost distribution, enabling more accurate product pricing and identifying opportunities for cost savings.

Strategies for Managing Overheads

Keeping overheads in check is key to maintaining profitability and ensuring financial stability . This often requires a combination of strategic cost control techniques and operational efficiency measures. These can include:

Outsourcing Non-core Activities

Non-core functions that are not part of a company's competitive advantage can often be performed more efficiently and cost-effectively by external providers. IBM, for example, after conducting a value analysis, decided to outsource its PC manufacturing to Lenovo, leading to significant savings in overhead costs.

Renegotiating Supplier Contracts

Periodic renegotiation of contracts can result in reduced prices, improved terms, or additional services. This is a particularly effective strategy for businesses that have significant bargaining power with suppliers.

Optimizing Energy Use

With energy costs often making up a significant portion of variable overheads, adopting energy-efficient practices can result in substantial savings. Google, known for its large data centers, has made a considerable investment in renewable energy and energy-efficient technologies, significantly reducing its energy costs.

Regular Overhead Audits

These audits can identify areas of waste, inefficiency, and overpayment, leading to actionable insights for cost reduction.

Overheads and Business Scalability

The relationship between overheads and business growth cannot be overstated. Companies with a low overhead cost structure can scale more rapidly and profitably . Conversely, high overheads can become a significant barrier to growth, as the business would need to generate a much higher volume of sales to cover these costs and achieve profitability.

Tech giants like Google and Facebook provide a striking example of the advantages of a low-overhead business model. Their business operations rely heavily on digital infrastructure , which can be scaled up with relatively low incremental costs. This enables them to expand rapidly while maintaining high profit margins.

By strategically scaling overheads in line with business expansion, businesses can avoid overstretching their resources and ensure sustainable growth.

Technology and Overhead Management

Technological advancements have provided powerful tools for tracking and managing overheads. Cloud-based accounting software and AI-powered cost analysis tools enable businesses to monitor these costs in real time , gain insights into cost trends, and make proactive cost management decisions.

Microsoft , for example, leverages AI for predictive analysis of cost trends. This allows them to anticipate cost increases, identify cost-saving opportunities, and make informed decisions about resource allocation and cost management.

Understanding and effectively managing overheads is a vital skill for any financial professional. These costs can significantly influence a business's profitability, competitiveness, and growth potential. By integrating effective cost-control techniques and leveraging technology, businesses can not only stay profitable but also scale sustainably.

- Business 101

Recent Posts

COGS Uncovered: What are Cost of Goods Sold and How do they Impact Profitability?

What is Strategic Planning and Why is it Important in Business?

What is Business Process Outsourcing (BPO)?

Be Stress Free and Tax Ready 🙌 70% Off for 4 Months. BUY NOW & SAVE

70% Off for 4 Months Buy Now & Save

Wow clients with professional invoices that take seconds to create

Quick and easy online, recurring, and invoice-free payment options

Automated, to accurately track time and easily log billable hours

Reports and tools to track money in and out, so you know where you stand

Easily log expenses and receipts to ensure your books are always tax-time ready

Tax time and business health reports keep you informed and tax-time ready

Automatically track your mileage and never miss a mileage deduction again

Time-saving all-in-one bookkeeping that your business can count on

Track project status and collaborate with clients and team members

Organized and professional, helping you stand out and win new clients

Set clear expectations with clients and organize your plans for each project

Client management made easy, with client info all in one place

Pay your employees and keep accurate books with Payroll software integrations

- Team Management

FreshBooks integrates with over 100 partners to help you simplify your workflows

Send invoices, track time, manage payments, and more…from anywhere.

- Freelancers

- Self-Employed Professionals

- Businesses With Employees

- Businesses With Contractors

- Marketing & Agencies

- Construction & Trades

- IT & Technology

- Business & Prof. Services

- Accounting Partner Program

- Collaborative Accounting™

- Accountant Hub

- Reports Library

- FreshBooks vs QuickBooks

- FreshBooks vs HoneyBook

- FreshBooks vs Harvest

- FreshBooks vs Wave

- FreshBooks vs Xero

- Free Invoice Generator

- Invoice Templates

- Accounting Templates

- Business Name Generator

- Estimate Templates

- Help Center

- Business Loan Calculator

- Mark Up Calculator

Call Toll Free: 1.866.303.6061

1-888-674-3175

- All Articles

- Productivity

- Project Management

- Bookkeeping

Resources for Your Growing Business

What is overhead cost and how to calculate it.

We have all heard the saying, “you have to spend money to make money,” a true statement when running a company. Everything from renting an office to hiring staff generates overhead costs you need to account for when starting your business.

So what is overhead in accounting terms? Figuring out the overhead as a percentage of your sales will tell you how much your business spends on it, which can help you decide on pricing.

Key Takeaways

- Overhead costs are all of the indirect costs of running a business

- Raw materials and labor are not included in overhead costs

- To determine the overhead cost a business incurs for the month, simply add up all indirect operating costs of running your business in one month

- Allocation of overheads is essential in figuring out the total cost of manufacturing a product, which will determine how much you will want to sell it for to make a profit

- Without calculating overhead and careful monitoring, overhead amounts can drain business funds and reduce profit margins

- A business owner can reduce overhead by evaluating workplace efficiency, and making sure you are using the most cost-effective resources to run your business

What this article covers:

What Is Overhead Cost?

Types of overhead costs.

- What Are Overhead Cost Examples?

How to Calculate Overhead Cost?

How do you allocate overhead costs.

- How To Reduce Overhead Cost?

- Frequently Asked Questions

NOTE: FreshBooks Support team members are not certified income tax or accounting professionals and cannot provide advice in these areas, outside of supporting questions about FreshBooks. If you need income tax advice, please contact an accountant in your area.

Overhead costs refer to all indirect expenses of running a business. These ongoing payments support your business but are not directly linked to creating a product or service.

It is important to research overhead for budgeting and determine how much the business should charge for a service or product to make a profit. For example, if you have a service-based business, then apart from the direct costs of providing the service, you will also incur overhead costs such as rent, utilities, shipping costs, and insurance.

Fixed Overhead

These costs remain constant regardless of production and business profit, like administrative costs, insurance costs, or rent.

Variable Overhead

These variable costs change depending on the production volume or the number of services you provide. This may include gas for an oven, maintenance on your vehicles, and shipping or utility costs like heat and water that vary depending on how much you use them.

Semi-Variable Overhead

This includes semi-variable cost items like sales commissions on top of staff salaries or phone service with additional roaming charges added due to travel for work. Any bills or costs may start at a predictable base amount but vary if use is high.

What Are Overhead Cost Examples?

While overhead expenses are not directly linked to profit generation, they are still necessary as they provide critical support for profit-making activities. The overhead fees depend on the nature of the business. For example, a retailer’s overhead will be widely different from a freelancer’s.

Some examples of overhead include:

- Rent for your business space

- Utility bills

- Office Supplies

- Advertising expenses

- Administration cost

- Accounting

- External legal expenses and legal fees

- Professional services

- Salaries and wages

- Transportation overhead

- Depreciation

- Government fees and licenses

- Property taxes

Overhead costs can include fixed monthly and annual expenses such as rent, salaries, and insurance or variable costs such as advertising that can vary month-on-month based on the level of business activity.

Some organizations also split these into manufacturing overheads, selling overheads, and administrative overhead costs. While administrative overhead includes front office administration and sales, manufacturing overhead is all of the costs that a manufacturing facility incurs, other than direct costs.

Costs required to create products and services, such as direct labor and materials, are excluded from overhead.

Businesses have to consider both overhead costs and direct expenses to calculate long-term product and service prices. Doing so allows the business to earn profits on a long-term basis.

If you have been wondering how to calculate overhead costs, it is simple. You just need to categorize each overhead expense of your business for a specific time period, typically by breaking them down by month. While all indirect expenses are overheads, you must be careful while categorizing them.

For example, most businesses categorize legal expenses as overhead. However, if you own a law firm, these expenses do not count as examples of overhead as they directly contribute to the production and are part of your direct costs.

Once you’ve categorized the expenses, add all the overhead expenses for the accounting period to get the total overhead cost.

You can now find out the overhead percentage as a percentage of sales. An overhead percentage tells you how much your business spends on overhead and how much is spent on making a product or service.

Calculate Overhead Rate

To calculate the overhead rate, divide the total overhead costs of the business in a month by its monthly sales. Multiply this number by 100 to get your overhead rate.

For example, say your business had $10,000 in overhead costs in a month and $50,000 in sales.

Overhead Rate Formula

The overhead rate is $10,000 / $50,000 = .2 or 20%

This means the business spends twenty cents on overhead for every dollar it makes.

It’s not difficult to keep track of all expenses and costs when you get help from software like FreshBooks expense software . This type of service allows your business to track expenses in one place, making it easier to monitor and control overhead costs for your business. Click here to find out more.

Allocation of overhead expenses is essential in calculating the total cost of manufacturing a product or service, hence setting a profitable selling price.

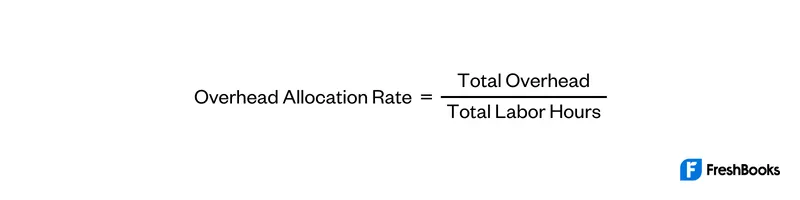

Calculate the Overhead Allocation Rate

You first need to calculate the overhead allocation rate to allocate the overhead costs. This can be done in many different ways depending on your business. Some might be done by dividing total overhead by the number of products sold or by dividing total overhead by the number of direct labor hours.

For example, if the total overhead for making a product is $500 and the total direct labor hours is 150 hours, the overhead allocation rate is:

$500/150 = $3.33

This means for every hour needed to make a product; you need to allocate $3.33 worth of overhead to that product.

Allocate Overhead Costs

Apply the overhead by multiplying the overhead allocation rate by the number of direct labor hours needed to make each product.

If product X requires 50 hours, you must allocate $166.5 of overhead (50 hours x $3.33) to this product.

It is important that businesses monitor their overhead expenses as they can drain business funds unnecessarily when not properly controlled. As they are not directly related to income, these expenses can become a larger share of the total costs and become a burden.

How To Reduce Overhead Cost

Some ways you can reduce your business overhead include:

- Evaluate your workspace and think about shifting to working remotely or moving into a shared office space to reduce rent costs if possible

- Ensure your processes are as time-saving as possible, automating for efficiency, eliminating excess employee hours, and supply use where feasible.

- Check out the competitors to your usual vendors and see if you can find a lower price for your materials, etc., or work to consolidate vendor services if they offer price breaks.

- Calculate whether purchasing supplies in bulk will save you money

- Making sure your business software is working for you, as monthly subscription fees can add up quickly

- Reduce your paper consumption using (free) digital services to save on administrative expenses, like emailing invoices and paying employees through direct deposit.

There will always be some cost to running a business, and it is important to factor in your fixed overhead costs, as well as variable and semi-variable costs, into your monthly bookkeeping to ensure you are allocating enough of your profits to pay these necessary costs and operating expenses.

FreshBooks offers a variety of tools that can assist with a company’s overhead management, ensuring your books are balanced and your business needs are met so you can focus on other factors of running your company.

FAQs on Overhead Cost

What is overhead vs. direct costs.

Direct costs are also called operating costs, and these are the costs that go into purchasing materials or paying worker salaries, whereas overhead is the money being paid out for costs that don’t translate directly into production and revenue for the business, like insurance, rent, software, etc.

What is usually included in overhead?

Overhead includes everything it costs to run a functioning business, from rent to payroll to business licenses to accounting fees and many other costs that vary from business to business. These costs are necessary to run the business but do not directly contribute to producing goods or services.

What expenses are not overhead?

Any costs that are directly related to manufacturing and selling a product are not considered overhead, including labor, materials, and production costs, are not overhead. These are called “direct costs” or “operating costs.”

What are the 4 types of overhead?

The four overhead types are:

- Long-run capacity fixed overhead includes costs like machinery and facilities that are used over a long period of time

- Operating fixed overhead is the costs that pay to run the long-run capacity assets like power, heat, insurance, rent, property taxes, etc. These expenses do not change no matter how busy you are

- Variable overhead figures change as production increases or decreases. For example, if you are a delivery company, the cost of fuel and maintenance for company cars will vary depending on how much you drive.

- Semi-variable overhead includes costs that stay fixed up to a certain level of production and then fluctuate, like paying bookkeepers a monthly rate but needing to increase their rate when more work needs to be done.

What is COGS vs. overhead?

The cost of goods sold (COGS) refers to the direct costs of producing goods the company sells. This cost includes raw materials and direct labor costs of producing the products. The overhead is the indirect costs of doing business.

For example, if you were manufacturing ladders, the COGS would include the metal and labor costs of building the ladders, while overhead would include factory rent, power costs, the charges for shipping the ladders to retailers, etc.

About the author

Jami Gong is a Chartered Professional Account and Financial System Consultant. She holds a Masters Degree in Professional Accounting from the University of New South Wales. Her areas of expertise include accounting system and enterprise resource planning implementations, as well as accounting business process improvement and workflow design. Jami has collaborated with clients large and small in the technology, financial, and post-secondary fields. Check out what she’s up to on linkedin: https://www.linkedin.com/in/jami-gong/.

RELATED ARTICLES

Save Time Billing and Get Paid 2x Faster With FreshBooks

Want More Helpful Articles About Running a Business?

Get more great content in your Inbox.

By subscribing, you agree to receive communications from FreshBooks and acknowledge and agree to FreshBook’s Privacy Policy . You can unsubscribe at any time by contacting us at [email protected].

👋 Welcome to FreshBooks

To see our product designed specifically for your country, please visit the United States site.

- How it Works

- Professional Advisors

- Companies & Individuals

- Advanced Knowledge Base

- Lite Knowledge Base

- Samples & Publications

- User Support

Managing Overhead Costs for Small Business

Recent Posts

- Mastering the Art of Marketing: An Introduction to Marketing Plans

- How Can SMEs Leverage Artificial Intelligence (AI) to Drive Growth?

- 6 Cost-Effective Marketing Hacks

- How Small Businesses Can Stay the Course on the Road to Success

- Managing Inflation: Tips For Your Small Business

Controlling cash flow is crucial to running a profitable small business. At the most basic way, this means that there is more money coming in than going out. The money that leaves a small business is often eaten up by overheads that are needed for day-to-day operations. Small business performance can be made simpler if these overheads can be reduced.

What is ‘overheads’ in business world? The term ‘overheads’ is used to describe the costs associated with running a business. This can include managing inventory, materials, personnel, office supplies, and facilities. Understanding how to cut overheads costs is important for avoiding unnecessary and unsustainable expenditures. However, it also aids both large and small business owners in their profits and developing a strong and stable company with the agility and endurance to succeed when times are good and persevere when times are rough.

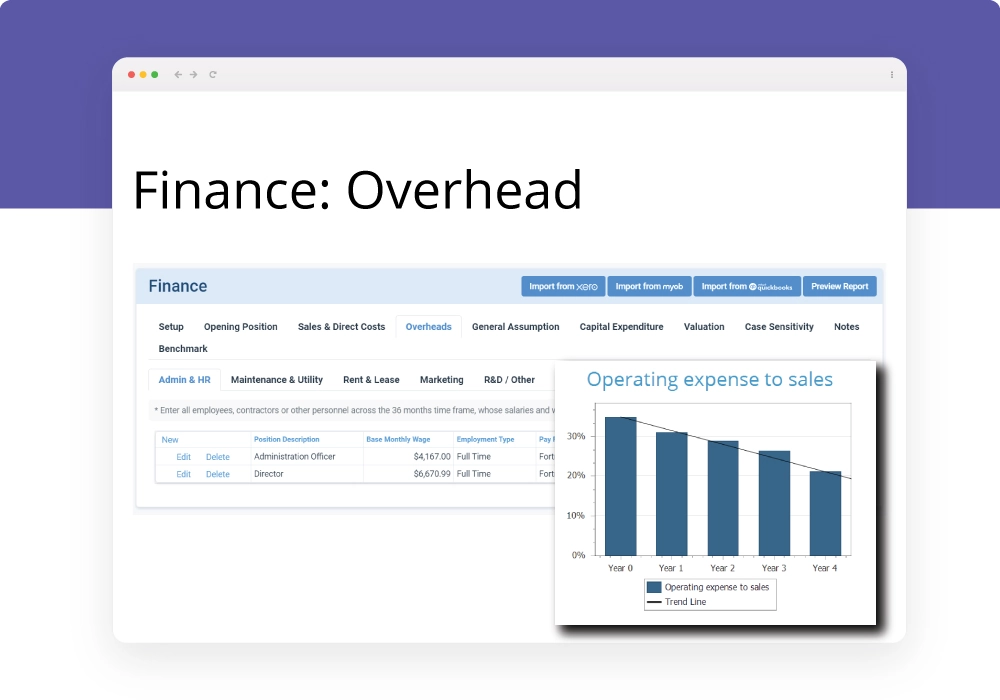

The following are examples of typical overhead costs:

- Admin and H&R – include salary costs on an ongoing basis (wages and benefits); computers, copiers, and other office supplies and equipment

- Maintenance & Utility – include services such as electricity, gas, water, sewer, phone, and internet. If your company depends on vehicles or specialised equipment, maintenance and repair costs will add up quickly. Businesses that offer distribution facilities, landscaping, or equipment rental are examples.

- Rent & Lease – lease costs of the business premises (or mortgage costs if purchased).

- Marketing – all costs associated with selling the product or service, including sales personnel salaries, benefits, and incentive incentives, promotional materials, ads, and trade show costs.

- R&D / Other – expenses are associated directly with the research and development of a company’s goods or services and any intellectual property generated in the process.

When starting a new business, you need to be able to forecast overheads expenses and include them into your business plan. With the help of business planning software like Planium Pro , you can easily plan, forecast and evaluate the upcoming expenses.

If you’re looking for ways to cut costs and raise profits, we’ve put together a list of suggestions below.

Reduce Location Costs

A company premises is the most expensive overheads for many small companies. If your small business is failing or you want to drastically reduce your overheads, you should decide whether you still need a business location. Is it possible for you to run your company from the comfort of your own home? Consider if you are having the best value for money in the premises you are currently selling from if your company depends on passing trade and a business premises is inevitable. May you rent a smaller space with more foot traffic for the same amount of money?

With the global economy splitting its opportunities between cyberspace and the real world, now is a good time to rethink your physical office space requirements. Indeed, the new normal has made it both possible and lucrative for businesses to accept remote employees as a way to keep doing business during the coronavirus pandemic and save money by reducing or removing the need for commercial space, as well as the rent, utilities, insurance, and supply costs that come with it.

Reduce Software Costs and Review Software Subscriptions

Computers have become an integral part of almost any company, accounting for a significant portion of operating expenses. Examining your current software setup, including the office apps you use, to decide their effect on daily tasks, will help you save money on your machine.

Besides, cloud storage and communications services are frequently free these days, and they can significantly reduce IT costs. Get rid of pricey data storage plans, phone systems, and servers in favour of free and low-cost software services like G suite, Slack, Xero, and G talk. Shop around for the most cost-effective and practical online solutions for your business, but don’t skimp on quality – it’s not worth it.

Although it may not seem to be a huge cost, paper and ink can easily add up, particularly if your company deals with a variety of documents. Look for alternatives to conventional business methods that aren’t paper-based. Besides, going paperless reduces the carbon footprint and consequently saves your business money on the costs of making, storing, using, and protecting paper documents.

Reduce Marketing Costs and Revise Your Marketing Strategy

Using current customers as brand ambassadors will help you save money on ads and promotions. Offer discounts or free services in exchange for recommendations or social media feedback to encourage them to support your company.

Request one- or two-sentence testimonials from your customers for use on your website or in newsletters. And in this digital era, word of mouth continues to be an effective marketing tool. Collaborate with businesses that sell similar goods to yours and split advertising costs and activities like trade shows.

Even if you are trying to cut costs, you must be able to set aside some money for marketing in order to develop your company. However, before going forwards with your marketing plan, you can determine each channel and its return on investment. Get a good estimate of how much money you’re spending and how much money you’re making from what marketing channel. Test and calculate various channels, then re-allocate.

For ideas on marketing strategies and costs during the pandemic see: 5 Strategies to Adjust Your Marketing Plan During the Pandemic

Reduce Staff Overheads

Wages are a major overheads for most businesses – typically they account for 70% of overhead costs and pose a significant cost-cutting opportunity. Downsizing your staff is, of course, a viable choice, but you can add value as well as save money by changing your recruiting procedures to insure your team has a varied skill set and the ability to take on new challenges. This will help you cover all of your business’s critical functions without incurring high labour costs or placing your workers under excessive stress. Tasks that don’t need a full-time employee may also be outsourced (or their wages). It pays in the long run to carefully assess labour suppliers (contract workers) and build good, strategic relationships with them, just as it does with any other supplier.

Negotiate Terms With Suppliers

With the current difficult economic environment, don’t be afraid to contact your suppliers and vendors and request flexible monthly payment schedules or discounts. They are always able to assist and give small and medium-sized business clients a break.

Final Thoughts

Make sure that each item on your list of business overhead expenses is completely important as you go through it. You must be confident that each cost adds value to your company. If an expense isn’t helping you expand or profit, get rid of it.

These key ways to cut overheads should be considered when beginning a business or when a company is experiencing financial difficulties. It is vital for any business, however, to keep an eye on the balance sheet and make adjustments as required for the good of the company.

Need to plan and forecast your overhead costs? Trial Planium Pro .

Leave a Reply Cancel Reply

Your email address will not be published.

Save my name, email, and website in this browser for the next time I comment.

Planium Pro

For professional & advanced users

Planium Pro Lite

For startup entrepreneur or small business users

Available at the following online bookstores:

Overhead Costs: What Are They and How Do You Calculate Them?

5 minute read

By Devon Taylor

Overhead costs are ongoing business expenses that are not directly attributed to creating a product or service. Calculating and keeping track of overhead is important for any business. Not only does it make budgeting easier, but it’s also used to determine how much they should charge for their products in order to turn a profit.

To quickly summarize, overhead is any expense incurred to support a business while not being directly related to a specific product or service. Overhead costs often include employee perks, health benefits, rent, and technology such as computers, printers, or photocopiers. Almost every business has some form of overhead associated with their ongoing operations.

Overhead Explained

Companies pay overhead on an ongoing basis, regardless of how much money they earns in a particular month or quarter. Overhead costs are usually fairly fixed. That means they remain mostly constant from month-to-month.

A service-based business with a physical office usually has monthly overhead costs like rent, utilities, and insurance. They have to pay those costs in addition to the direct costs of providing their service. Those costs could include materials, supplies, and manpower expenses.

Some types of overhead expenses can be variable. That means the expense might increase or decrease depending on the business’s activity level. For example, a business’s rent payment is likely to be fixed. However, its shipping and mailing costs may vary from month-to-month.

How Overhead Is Calculated

Expenses related to overhead appear on a company’s income statement. They directly affect the overall profitability of the business. The company must account for overhead expenses to determine its net income, also referred to as its “bottom line.”

Net income is calculated by subtracting all production-related and overhead expenses from the company’s net revenue. (Also referred to as its top line revenue.) In some cases, overhead expenses can be known as “semi-variable.”

Semi-variable means that a company incurs some portion of the expense no matter what. The other portion depends on the level of business activity. Utility costs can vary depending on the amount of power used in a certain time frame, for example.

Calculation Formula

There are a number of different ways of calculating overhead . The general rule is: Overhead rate = Indirect costs/ allocation measure. The indirect costs are the overhead costs. Meanwhile the allocation measure would include labor hours or direct machine costs, which is how the company measures its production.

Overhead expenses can be found on a company’s income statement. Then they are subtracted from its income to arrive at a net income figure. Analyzing overhead is critical to showing the profitability of a company. It’s required on most quarterly and annual financial statements.

Types of Overhead

As mentioned, there are many different types of overhead that a company must manage and pay for. Some common examples of overhead costs include rent, utilities, administrative costs, insurance, and employee payments and perks.

Let’s take a deeper dive into various types of overhead expenses. We’ll discuss how they can impact a business, in both the short- and long-term. While all businesses have some type of overhead, not all businesses incur the same overhead expenses.

Rent and Utilities

Rent is the cost associated with maintaining an office or manufacturing space. Most companies still require some sort of physical location. (And even if the company buys the space instead of renting it, mortgage costs would replace the rent expense.) Another expense of maintaining a physical location is utilities. Gas, water, power, internet, and phone services are all classified as overhead costs.

Additional costs associated with rent and utility might include items such as a subscription to virtual meeting platforms such as Zoom or Microsoft Teams. It could also include subscriptions to industry magazines, newspapers, and other publications.

Administrative Costs

Companies that have more than one employee (or are not sole proprietorships) tend to have administrative costs. These costs are frequently one of the most expensive types of overhead.

Administrative costs include expenses such as stocking the office with supplies, salaries for office associates, and external legal and accounting fees. Administrative costs can range from buying toilet paper for the washroom to hiring an external accounting firm to audit the company’s finances.

Depending on the type of business, a company might be required to hold many different types of insurance. Insurance can include basic property insurance to protect an organization’s property and physical assets from fire, flood, or theft. It could also include professional liability insurance, health insurance for employees, and even car insurance for any company-owned vehicles.

While none of these costs are directly related to generating revenue for the company (by providing a good or service), businesses are often legally required to purchase different types of insurance, depending on their local laws and regulations.

Employee Perks

In addition to salaries, many companies offer a range of benefits and perks to their employees. It helps retain their talent and keeps them engaged and motivated. These types of perks include everything from keeping offices stocked with coffee and snacks, to paying for gym memberships or happy hour outings.

Other types of employee perks include hosting company retreats, providing access to a corporate vehicle, and subsidizing health and wellness treatments like massages. All perks and benefits are considered overhead, as they have no direct impact on the goods or services being produced.

Other Types of Overhead

Other types of overhead expenses include the need for human resources staff and office receptionists. Selling overhead relates to activities involved in marketing, like billboards, online advertisements, or television commercials.

Depending on the nature of the business, other types of overhead might also be incurred. This could include research, maintenance, manufacturing, and transportation costs. Overhead expenses can grow or retract over time, depending on the operational pace of a business.

Special Considerations

Overhead is viewed as a “general expense.” That means it applies directly to a company’s operations. It’s commonly accumulated as a lump sum, at which point it may then be allocated to a specific project or department.

For example, using activity-based costing, a service-based business may allocate overhead expenses based on the activities completed within each department, such as printing or office supplies. Most businesses spread overhead costs around between various departments.

The Bottom Line

Overhead costs are an essential component of most business operations. As a rule, overhead includes all expenses related to the operation of a business that are not directly attributed to creating a product or service. It would be rare for a company to not have any overhead expenses at all.

Tracking and calculating overhead is important, since it allows businesses to assess their expenses and determine their profitability. Most publicly traded companies are required to track and report their overhead expenses as part of their quarterly financial obligations.

Share this article

Devon Taylor

Managing Editor

Devon is an experienced writer and a father of three young children. He's simultaneously trying to build college funds and plan for an eventual retirement. He's been in online publishing since 2013 and has a degree from the University of Guelph. In his free time, he loves fanatically following the Blue Jays and Toronto FC, camping with his family, and playing video games.

Frugal Living: It’s A State of Mind (Not Just What You Buy)

Being frugal isn’t so much about what you buy. Really, it’s more of a state of mind. A different way of living. Too often, we get caught up in penny pinching in a way that isn’t healthy for our finances – or our sanity. If you’ve been trying (and failing) to get your budget balanced […]

8 minute read

Is Overspending Impacting Your Relationship?

Money is a topic that comes up regularly in almost any relationship. No matter your situation, there is a good chance that you have been talking about money with your life partner. Unfortunately, money is often a sore spot. Many studies have indicated that money is the number one issue that people in a relationship […]

7 minute read

How To Plan Your 2021 Christmas Budget

As much as I love gift-giving and the holiday season in general, I often find that it sneaks up on me. If you’re anything like me, you often find yourself in mid-December scrambling to get presents bought, wrapped, and even mailed. That last minute scramble often means paying more for gifts than you intended, since […]

Do You Think You’ll Ever Get Out Of Debt?

It can be difficult to feel good about your financial situation and even the rest of your life when you are in debt. Unfortunately, debt itself can be difficult to completely eliminate from your life. If you have debt, you might have a hard time paying it off if your finances are strained. And if […]

Why Your Budget Keeps Failing (And How To Fix It)

We all know that one of the cornerstones of financial success is getting the details right. Even with good intentions and managing the general money basics like we should, the reality is that we can still fail, financially speaking. One of the main reasons is simply human psychology, when our brains convince us to defy […]

Stop Living Paycheck to Paycheck With These Helpful Tips

Living paycheck to paycheck is not an unusual situation. Many Americans live in that reality every single day of their lives. Modern life is expensive. For most families, it’s easy for a string of bad luck to force their finances into the red. If you’re one of the many Americans who worry about paying their […]

Effective Ways To Practice Self-Care on a Budget

Self-care is defined by the World Health Organization as “the ability of individuals, families and communities to promote health with or without the support of a healthcare provider.” More broadly, self-care is described as an individual nurturing their spiritual, emotional, and physical health. It’s an important part of keeping your mental health in a healthy […]

Important Financial Advice Every New Parent Should Follow

Becoming a parent will totally change your life in so many ways. If there wasn’t enough enough for brand new parents to worry about, the financial decisions alone can be daunting. Making the transition from a couple to a family can have lasting repercussions on your budgets. Taking the time to put your financial ducks […]

9 minute read

The WG Community

- Get expert vetted financial advice catered to your financial goals

- Learn about ways you can grow your savings

- Explore ways to save money and enjoy the fruits of your labor

Join Our Newsletter

Monthly advice that matters to your retirement dreams.

By clicking "Sign Up" you are agreeing to our privacy policy and confirming that you are 13 years old or over.

Plan Projections

ideas to numbers .. simple financial projections

Home > Calculators > Business Overhead Cost Calculator

Business Overhead Cost Calculator

This business overhead cost calculation worksheet will help you in calculating the overhead costs of your business for use in the Financial Projections Template .

They are the support costs of a business which are not directly attributable to the goods the business is producing.

The Excel overhead cost analysis template, available for download below, helps in calculating costs by entering the amount under the relevant category for each of the five years.

It is important to realize that although the calculator lists a number of typical costs, the type of costs are very much dependent on the nature of the business. Consequently it may be necessary to amend the list of overheads shown in the calculator.

Business Overhead Cost Calculator Download

About the author.

Chartered accountant Michael Brown is the founder and CEO of Plan Projections. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University.

You May Also Like

- Starting a Business

- Growing a Business

- Business News

- Science & Technology

- Money & Finance

- Subscribers For Subscribers

- ELN Write for Entrepreneur

- Store Entrepreneur Store

- Spotlight Spotlight

- United States

- Asia Pacific

- Middle East

- South Africa

Copyright © 2024 Entrepreneur Media, LLC All rights reserved. Entrepreneur® and its related marks are registered trademarks of Entrepreneur Media LLC

By Entrepreneur Staff

Overhead Definition:

The indirect costs or fixed expenses of operating a business (that is, the costs not directly related to the manufacture of a product or delivery of a service) that range from rent to administrative costs to marketing costs

Overhead refers to all non-labor expenses required to operate your business. These expenses are either fixed or variable:

Fixed expenses. No matter what your sales volume is, fixed costs must be met every month. Fixed expenses include rent or mortgage payments, depreciation on fixed assets (such as cars and office equipment), salaries and associated payroll costs, liability and other insurance, utilities, membership dues and subscriptions (which can sometimes be affected by sales volume), and legal and accounting costs. These expenses don't change, regardless of whether a company's revenue goes up or down.

Variable expenses. Most so-called variable expenses are really semi variable expenses that fluctuate from month to month in relation to sales and other factors, such as promotional efforts, change of season, and variations in the prices of supplies and services. Fitting into this category are expenses for telephone, office supplies (the more business, the greater the use of these items), printing, packaging, mailing, advertising, and promotion. When estimating variable expenses, use an average figure based on an estimate of the yearly total.

More from Operations

Capital equipment.

Equipment that you use to manufacture a product, provide a service or use to sell, store and deliver merchandise. This equipment has an extended life so that it is properly regarded as a fixed asset.

Fulfillment

The process of receiving, packaging and shipping orders for goods

The process of bringing goods from one country for the purpose of reselling them in another country

Depreciation

An expense item set up to express the diminishing life expectancy and value of any equipment (including vehicles). Depreciation is set up over a fixed period of time based on current tax regulation. Items fully depreciated are no longer carried as assets on the company books.

Latest Articles

The remote side hustle a 43-year-old musician works on for 1 hour a day earns nearly $3,000 a month: 'all from the comfort of home'.

Sam Ziegler wanted to supplement his income as a professional drummer — then his tech skills and desire to help people came together.

'Elon Is Mad at Me': Don Lemon Says Elon Musk Canceled His New Talk Show After Controversial Interview

"The Don Lemon Show" was set to air exclusively on X.

Ever Wonder Why Certain Websites Rank Higher Than Yours? This SEO Expert Reveals The Secret to Dominating Search Results

It's often the smart use of SEO, now supercharged with AI, particularly in keyword optimization.

Overhead Rate: An In-Depth Look at Business Expenses Management

✅ All InspiredEconomist articles and guides have been fact-checked and reviewed for accuracy. Please refer to our editorial policy for additional information.

Overhead Rate Definition

The overhead rate is a financial metric that measures the total indirect costs associated with running a business, expressed as a percentage of the direct costs or revenues. It can be used to understand the proportion of spending that goes towards operating expenses, such as utilities, rent, or administrative costs, as opposed to direct production costs.

Understanding How Overhead Rate Affects Profit Margin

The relationship between overhead rate and profit margin is an essential aspect to consider in managing the financial health of a company. Profit margin signifies the level of profitability of a business. To compute it, you subtract the total costs, which include overhead expenses, from the total revenue and divide the result by the total revenue. Thus, overhead rates play a crucial part in the calculation of profit margins.

In a scenario where the business manages to reduce its overhead rate, opportunities for increasing the profit margin arise. This is due to the direct inverse relationship between company costs and profits—when costs or expenses decrease, profits will invariably increase given that everything else remains constant. Lower overhead expenses result in lower total costs and consequently, a better profit margin.

Let's look at an example. If a company’s total revenue is $500,000 and it has an overhead rate of 20%, the overhead expenses would be $100,000. If these overhead expenses are reduced by 10% to $90,000, the company can save $10,000, effectively increasing the profit margin.

Moreover, the overhead rate has a profound effect on the pricing strategy of a business. An understanding of the overhead rate is integral to setting prices that cover costs and ensure profitability. Lower overhead rates allow for more competitive pricing, since a company can afford to lower prices while still covering costs and securing profit. However, it’s crucial to consider that while lower prices may attract customers and improve sales volumes, they may also lower the perceived value of a product or service.

Knowing the overhead rate and its implications on profit margins is a necessary financial parameter. It provides insights into the operational efficiency of a business and informs sound strategic pricing decisions. Furthermore, it ensures a company can maintain profitability while meeting market needs and expectations.

Types of Overhead Costs

Overhead costs play a major role in deriving the overhead rate for any business or organization. These expenses are essential for its operation and significantly affect its financial position. Usually, there are several different types of overheads which need to be considered while determining this rate.

Indirect Labor

Indirect labor represents the cost of labor that isn't directly tied to the production of goods or services, but is essential for the overall operation of the organization. This can include operations and maintenance staff, supervisors, and other staff who provide essential support services within the company.

Rent is the cost incurred for using space for business operation, whether that be an office building, manufacturing plant, or retail store. It consists of the regular payment made by the tenant to the landlord for using the space.

Utility costs cover charges for necessary services that keep the business up and running. They include electricity, water, heating, air conditioning, and internet. Some utilities may fluctuate throughout the year, affecting the overall overhead rate.

Insurance costs are another substantial portion of overhead expenses. Businesses often have several different types of insurance policies, ranging from liability insurance to property insurance or worker's compensation. These insurance costs help protect the business from various risks, and their costs should be factored into overhead expenses.

Understanding these categories of overhead costs is crucial for accurately calculating a business's overall overhead rate. They are also key in budgeting and prospective financial planning, allowing businesses to operate more efficiently. Notice that these costs are typically ongoing – paid monthly or annually – which underscores their importance in long-term operational planning.

Calculation of Overhead Rate

Calculating the overhead rate involves understanding two primary components: the overhead cost and the allocation base.

Formula and Components

The formula for calculating the overhead rate is as follows:

Overhead Costs

Overhead costs include all ongoing business expenses not related directly to creating a product or providing a service. They are necessary for the business to continue operations. Examples include rent, utilities, insurance, office supplies, and salaries of administrative personnel.

Allocation Base

The allocation base could take several forms. It could be direct labor hours, direct labor cost, machine hours, or even units produced. The choice of allocation base largely depends on what drives the overhead cost. For instance, if power consumption drives overheads, then machine hours might be an appropriate base.

Regular Adjustment of Overhead Rate

Attaining an accurate overhead rate is essential for many reasons. Firstly, it influences pricing decisions. If the overhead rate is underestimated, products or services might be underpriced, leading to potential losses for the company. Conversely, overestimation might lead to overpricing, causing customers to opt for cheaper competitors.

Moreover, the overhead rate influences the valuation of product inventories and, in turn, affects reported profit levels in financial statements. An inaccurately high overhead rate could inflate the value of inventory lowering the cost of goods sold and, consequently, overstate profit. On the other hand, an inaccurate understatement could understate profit levels.

Finally, regularly updating and refining the overhead rate improves business performance. Over time, changes in the market, new technologies, and changes in the scale of production can cause overhead costs and the allocation base to shift. By periodically updating the overhead rate, management can detect and react to changes in operational efficiency.

Remember, an accurate overhead rate enables better planning, cost control, and decision-making. However, the selection of an allocation base and allocation methods depends on the company specifics. Thus, no one-size-fits-all approach exists, and individual tailoring to the company's circumstances is essential.

Overhead Rate in Different Industries

Moving deeper into the subject, it's crucial to note that the overhead rate can differ considerably from one industry to another, predominantly due to the varying nature of costs across different sectors.

Manufacturing

The manufacturing industry tends to have a high overhead rate compared to other sectors. This is particularly due to the extensive range of fixed costs involved, such as rent or mortgage for factory spaces, machinery, and equipment depreciation, utility bills, insurance, and maintenance costs. Based on the complexity of the manufacturing processes, the overhead costs can average between 15% and 35% of the labor cost. This higher overhead rate reflects the significant investment capital required to maintain efficient manufacturing processes.