Stock Assignment: Transferring Ownership Rights with Stock Power

1. introduction to stock assignment and stock power, 2. understanding ownership rights in stock, 3. the role of stock power in transferring ownership, 4. ways to obtain stock power, 5. filling out a stock power form, 6. executing a stock assignment, 7. legal considerations in stock assignment, 8. common mistakes to avoid in stock assignment, 9. conclusion and final thoughts on stock power and stock assignment.

Stock Assignment and Stock Power are two terms that are commonly used in the world of stocks and investments. They are often used interchangeably, but they refer to two different things. Stock assignment is the process of transferring ownership rights of a stock from one party to another, while Stock Power is a legal document that authorizes the transfer of ownership rights from one party to another. In this section, we will discuss in detail what Stock Assignment and Stock Power are, how they work, and why they are important.

1. What is Stock Assignment?

Stock Assignment refers to the transfer of ownership rights of a stock from one party to another. This process is typically used when an investor wants to sell their shares to someone else. The seller must sign an Assignment of Stock Certificate form, which is a legal document that transfers ownership rights to the buyer . The buyer must then present the form to the company's transfer agent, who will update the company's records to reflect the change in ownership.

2. What is Stock Power?

Stock Power is a legal document that authorizes the transfer of ownership rights from one party to another. It is typically used when an investor wants to transfer their shares to a family member or a trust. The seller must sign a stock Power form , which is a legal document that authorizes the transfer of ownership rights to the buyer. The buyer must then present the form to the company's transfer agent, who will update the company's records to reflect the change in ownership.

3. What are the differences between Stock Assignment and Stock Power?

The main difference between Stock Assignment and Stock Power is the purpose for which they are used. Stock Assignment is used when an investor wants to sell their shares to someone else, while Stock Power is used when an investor wants to transfer their shares to a family member or a trust. Another difference is the legal document that is used. Stock Assignment uses an Assignment of Stock Certificate form, while Stock Power uses a Stock Power form.

4. What are the benefits of Stock Assignment and Stock Power?

The main benefit of Stock Assignment and Stock Power is that they provide a legal framework for transferring ownership rights of a stock from one party to another. This ensures that the transfer is done legally and that the new owner has full ownership rights to the stock. It also ensures that the company's records are updated to reflect the change in ownership, which is important for tax purposes.

5. What are the risks of Stock Assignment and Stock Power?

The main risk of Stock Assignment and Stock Power is that they can be used for fraudulent purposes. For example, someone could forge an Assignment of Stock Certificate or a Stock Power form to transfer ownership rights of a stock to themselves. To mitigate this risk, it is important to use a reputable transfer agent and to verify the authenticity of the legal documents.

6. Which option is better: Stock Assignment or Stock Power?

The choice between Stock Assignment and Stock Power depends on the purpose for which they are being used. If an investor wants to sell their shares to someone else, then Stock Assignment is the better option. If an investor wants to transfer their shares to a family member or a trust, then Stock Power is the better option. It is important to use the correct legal document and to ensure that the transfer is done legally to avoid any potential risks .

Introduction to Stock Assignment and Stock Power - Stock Assignment: Transferring Ownership Rights with Stock Power

When it comes to owning stock, it's important to understand the concept of ownership rights. Ownership rights refer to the various privileges that come with owning stock, such as voting rights and the ability to receive dividends. Understanding these rights is crucial for investors who want to make informed decisions about their investments. In this section, we'll take a closer look at ownership rights in stock and what they mean for investors.

1. Voting Rights

One of the most important ownership rights in stock is the right to vote. When you own stock in a company, you are entitled to vote on certain matters that affect the company. These matters can include electing members to the board of directors, approving mergers or acquisitions, and making changes to the company's bylaws. The number of votes you have is typically based on the number of shares you own. For example, if a company has 1,000 shares outstanding and you own 100 shares, you would have 10% of the voting power.

2. Dividend Rights

Another ownership right in stock is the right to receive dividends. Dividends are payments made by a company to its shareholders, usually on a quarterly basis. The amount of the dividend is typically based on the company's profits and can vary from year to year. If you own stock in a company that pays dividends, you are entitled to a portion of those payments based on the number of shares you own.

3. Liquidation Rights

If a company goes bankrupt or is liquidated, shareholders have the right to a portion of the company's assets. This is known as liquidation rights. However, in most cases, shareholders are the last in line to receive payment after creditors and other stakeholders have been paid.

4. Preemptive Rights

Preemptive rights refer to the right of existing shareholders to purchase additional shares in a company before they are offered to the public. This allows shareholders to maintain their ownership percentage in the company and prevent dilution of their shares.

5. Transferability of Ownership Rights

Ownership rights in stock are transferable, meaning you can sell your shares to another investor. When you sell your shares, you transfer your ownership rights to the buyer. However, it's important to note that some ownership rights, such as voting rights, may be restricted for a period of time after the sale.

Understanding ownership rights in stock is crucial for investors who want to make informed decisions about their investments. Voting rights, dividend rights, liquidation rights, preemptive rights, and transferability of ownership rights are all important concepts to understand. When considering investing in a company, it's important to evaluate these ownership rights and consider the potential risks and rewards .

Understanding Ownership Rights in Stock - Stock Assignment: Transferring Ownership Rights with Stock Power

Stock power plays a crucial role in transferring ownership of stocks from one person to another. Without it, the process would be more complicated and time-consuming. In this section, we will explore the different aspects of stock power and its importance in transferring ownership.

1. Definition of Stock Power: A stock power is a legal document that authorizes the transfer of ownership of a stock from the owner (the "grantor") to another person or entity (the "grantee"). It is also known as a stock assignment or a stock power form. The stock power form contains the details of the stock being transferred, the name of the grantee, and the signature of the grantor.

2. importance of Stock power : Stock power is important because it provides proof of ownership transfer and protects both the grantor and the grantee. With a stock power, the grantor can transfer ownership of the stock without physically delivering the stock certificate. This avoids the risk of loss or theft of the stock certificate. On the other hand, the grantee can prove ownership of the stock through the stock power, which is crucial for selling the stock or receiving dividends.

3. Types of stock Power forms : There are two types of stock power forms: "blank" and "special." A blank stock power form is unsigned and does not specify the name of the grantee. It is commonly used for transferring ownership of stocks to a brokerage firm or for depositing the stocks into a trust account. A special stock power form is signed and specifies the name of the grantee. It is used for transferring ownership of stocks to a specific person or entity.

4. How to Fill Out a Stock Power Form: Filling out a stock power form is a simple process. The grantor needs to sign the form and specify the name of the grantee. The grantee also needs to sign the form to acknowledge receipt of the stock. The completed form should be sent to the transfer agent or the brokerage firm that handles the stock.

5. Alternatives to Stock Power: While stock power is the most common way to transfer ownership of stocks, there are alternatives. One option is to use a trust. The grantor can transfer the stock to a trust and name the grantee as the beneficiary. The grantee will receive the stock upon the grantor's death. Another option is to use a will. The grantor can specify in the will that the stock should be transferred to the grantee upon the grantor's death.

Stock power plays an important role in transferring ownership of stocks. It provides proof of ownership transfer and protects both the grantor and the grantee. There are different types of stock power forms, and filling them out is a simple process. While there are alternatives to stock power, it is the most common way to transfer ownership of stocks.

The Role of Stock Power in Transferring Ownership - Stock Assignment: Transferring Ownership Rights with Stock Power

When it comes to transferring ownership rights with stock power , there are various ways to obtain this crucial document. Whether you are a shareholder looking to transfer your ownership or a company seeking to issue new shares, understanding the different methods available can help streamline the process and ensure a smooth transition of ownership. In this section, we will explore some common ways to obtain stock power, providing insights from different perspectives and comparing several options to determine the best approach.

1. Directly from the Transfer Agent:

One of the most straightforward ways to obtain stock power is by contacting the transfer agent directly. The transfer agent is responsible for maintaining the shareholder records and managing the transfer of ownership. They can provide you with the necessary stock power forms, which typically need to be completed, signed, and notarized before submitting them back to the transfer agent. This method ensures that the required documentation is obtained directly from the authorized party, reducing the risk of errors or fraudulent activity.

2. Online Stock Power Forms:

In today's digital era, many companies offer the convenience of online stock power forms. Shareholders can access these forms through the company's website or a designated platform. Online forms often include step-by-step instructions and may even provide a notary service. This option can save time and effort, as there is no need for physical paperwork or mailing documents. However, it is essential to ensure the online platform is secure and trustworthy, protecting sensitive information from potential cyber threats.

3. Brokerage Firms:

If you hold your shares through a brokerage account, you can obtain stock power through your broker. Brokerage firms typically have their own procedures for transferring ownership and may require specific forms or documentation. Contact your broker to inquire about the process and any associated fees. While this option may be convenient for shareholders who already have a brokerage account, it may not be the best choice for those who prefer a direct relationship with the transfer agent or have shares held outside of a brokerage account.

4. In-person at a Financial Institution:

Some shareholders may prefer to obtain stock power in person, either at their bank or another financial institution . This option allows for face-to-face interaction and immediate access to the necessary forms. However, not all financial institutions offer this service, so it is important to check beforehand. Additionally, consider any associated fees and potential time constraints when opting for this method.

Comparing the different ways to obtain stock power, the best option ultimately depends on your specific circumstances and preferences. If you have a direct relationship with the transfer agent, obtaining stock power directly from them ensures accuracy and eliminates potential intermediaries. On the other hand, online stock power forms can offer convenience and ease of use, particularly for tech-savvy individuals. Brokerage firms provide a viable option for those already utilizing their services, while in-person visits to financial institutions may be preferred by individuals seeking a personal touch.

Understanding the various ways to obtain stock power is crucial for shareholders and companies alike. By exploring the options available and considering the specific requirements and preferences, individuals can choose the most suitable method to transfer ownership rights efficiently and securely.

Ways to Obtain Stock Power - Stock Assignment: Transferring Ownership Rights with Stock Power

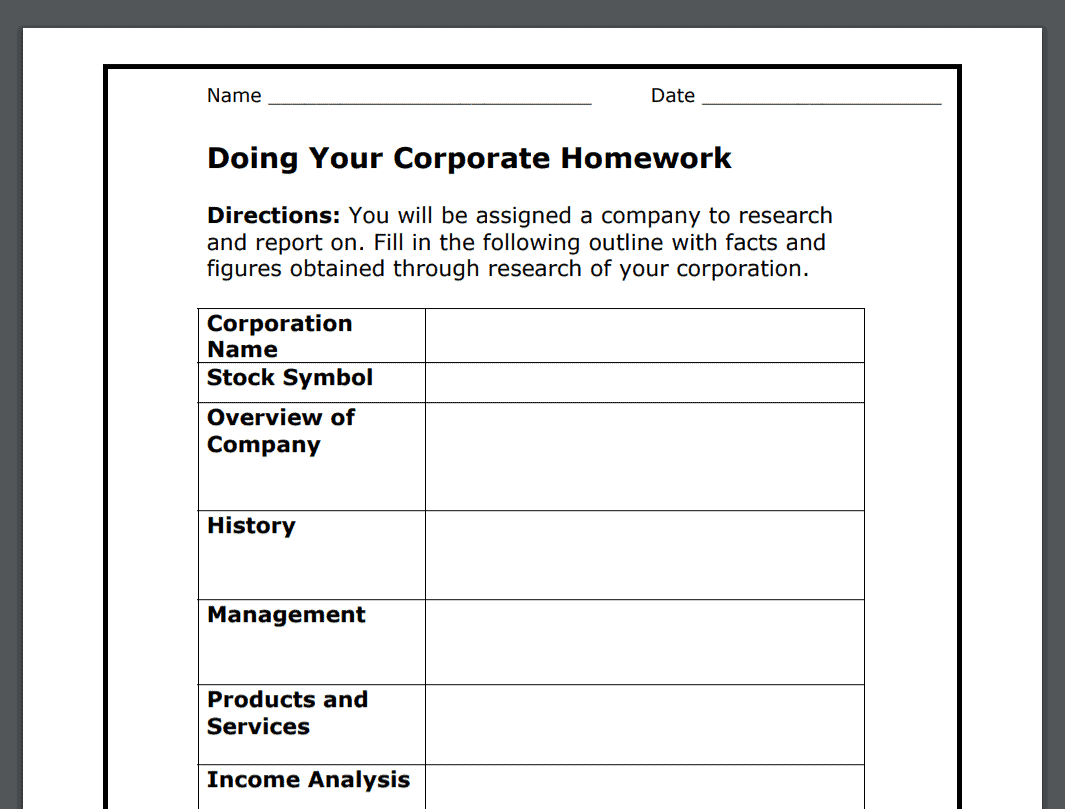

When transferring ownership rights with a stock power, there are several important steps to follow. Filling out the stock power form is one of the most crucial steps in this process, as it legally transfers ownership of the stock from one party to another. In this section, we will explore the process of filling out a stock power form, including what information is required, how to properly fill it out, and what to do after it is completed.

1. Understanding the Stock Power Form

A stock power form is a legal document that is used to transfer ownership of stock from one party to another. It is typically used in situations where the actual stock certificate is not available, such as when the stock is held in a brokerage account. The stock power form contains important information about the stock, such as the name of the company, the number of shares being transferred, and the name of the current owner.

2. Gathering the Required Information

Before filling out the stock power form, it is important to gather all of the necessary information. This may include the name of the company that issued the stock, the number of shares being transferred, and the name and contact information of the current owner. It is also important to have the recipient's information on hand, including their name and contact information.

3. Filling Out the Form

When filling out the stock power form, it is important to be accurate and thorough. The form will typically ask for the name and address of the current owner, as well as the name and address of the recipient. It may also ask for the number of shares being transferred, the date of the transfer, and other relevant information. It is important to double-check all of the information before submitting the form.

4. Submitting the Form

Once the stock power form has been filled out, it should be signed and dated by the current owner. Depending on the situation, the form may need to be notarized or witnessed by a third party. The completed form should be submitted to the appropriate parties, such as the brokerage firm or transfer agent.

5. Considerations When Filling Out a Stock Power Form

When filling out a stock power form, it is important to consider several factors. For example, if the stock is being transferred as a gift, it may be subject to gift taxes. It is also important to consider any restrictions or limitations on the transfer of the stock, such as those imposed by the company or by applicable laws and regulations.

6. Best Practices for Filling Out a Stock Power Form

To ensure that the stock power form is filled out correctly and completely, it is important to follow best practices. This may include reviewing the form carefully before submitting it, double-checking all of the information, and seeking professional advice if necessary. It is also important to keep copies of all relevant documents, such as the stock power form and any supporting documentation.

Filling out a stock power form is an important step in transferring ownership rights with a stock power. By following the steps outlined above and considering the relevant factors, it is possible to ensure that the transfer is completed correctly and legally.

Filling out a Stock Power Form - Stock Assignment: Transferring Ownership Rights with Stock Power

Executing a stock assignment is a process that involves transferring ownership rights from one party to another. It is a crucial step in the stock transfer process, and it requires both the assignor and the assignee to follow specific procedures to ensure a smooth transfer of ownership . In this section, we will explore the steps involved in executing a stock assignment and some insights from different points of view.

1. Review the Stock Power Form

Before executing a stock assignment, it is essential to review the stock power form carefully. This document is a legal instrument that transfers ownership rights from the assignor to the assignee. It contains important information, such as the name of the assignor, the name of the assignee, the number of shares being transferred, and the date of the transfer. Both the assignor and the assignee must sign the stock power form in the presence of a notary public.

2. Choose the Right Type of Stock Assignment

There are two types of stock assignments: a full assignment and a limited assignment. A full assignment transfers all ownership rights from the assignor to the assignee, while a limited assignment transfers only specific ownership rights, such as the right to vote or receive dividends. The type of stock assignment you choose depends on your specific needs and circumstances.

3. Consider the Tax Implications

Executing a stock assignment may have tax implications for both the assignor and the assignee. The assignor may be subject to capital gains tax if the stock has appreciated in value since it was acquired. The assignee may be subject to income tax if they receive dividends or sell the stock at a profit. It is important to consult with a tax professional to understand the tax implications of executing a stock assignment.

4. Choose the Right Method of Transfer

There are several methods of transferring ownership rights, including physical delivery, book-entry transfer, and electronic transfer. Physical delivery involves the physical delivery of stock certificates from the assignor to the assignee. Book-entry transfer involves the transfer of ownership rights through an intermediary, such as a stock transfer agent . Electronic transfer involves the transfer of ownership rights through an electronic network, such as the Depository Trust Company (DTC). The method of transfer you choose depends on your specific needs and circumstances.

5. seek Professional assistance

Executing a stock assignment can be a complex process, and it is advisable to seek professional assistance. A stock transfer agent can help you navigate the transfer process and ensure that all necessary procedures are followed. A tax professional can help you understand the tax implications of executing a stock assignment. Seeking professional assistance can help ensure a smooth transfer of ownership rights.

Executing a stock assignment is an essential step in transferring ownership rights from one party to another. It requires careful consideration of the stock power form, the type of stock assignment, the tax implications, the method of transfer, and professional assistance. By following these steps, you can ensure a smooth transfer of ownership rights.

Executing a Stock Assignment - Stock Assignment: Transferring Ownership Rights with Stock Power

When transferring ownership rights with a stock power, legal considerations must be taken into account to ensure a smooth and legally valid transaction. These considerations can vary depending on the type of stock being transferred and the parties involved. Here are some of the key legal considerations to keep in mind:

1. Type of Stock: The type of stock being transferred will impact the legal requirements for the transfer . For example, transferring common stock may require different legal documentation than transferring preferred stock. It's important to understand the specific requirements for the type of stock being transferred.

2. Parties Involved: The parties involved in the transfer will also impact the legal considerations . For example, transferring stock between family members may require different documentation than transferring stock between unrelated parties. It's important to understand the legal requirements based on the parties involved.

3. Tax Implications: The transfer of stock ownership can have tax implications for both the transferor and transferee. It's important to understand the tax consequences of the transfer and to consult with a tax professional if necessary.

4. Securities Laws: The transfer of stock ownership is subject to certain securities laws, including the securities act of 1933 and the Securities Exchange Act of 1934. These laws regulate the sale and transfer of securities and may require certain disclosures or filings.

5. State Laws: State laws may also impact the transfer of stock ownership. For example, some states require specific documentation or filings for stock transfers. It's important to understand the state laws that apply to the transfer.

When considering the legal considerations for stock assignment, it's important to consult with a legal professional to ensure compliance with all applicable laws and regulations. A legal professional can also help determine the best option for transferring ownership rights with a stock power.

Options for transferring ownership rights with a stock power include:

1. Direct Transfer: A direct transfer involves transferring the stock from one party to another without the involvement of a broker or intermediary. This option may be simpler and less expensive, but may require more legal documentation and may not be available for all types of stock.

2. Broker-Assisted Transfer: A broker-assisted transfer involves using a broker to facilitate the transfer of stock ownership. This option may be more expensive, but may be easier and more efficient, particularly for larger transfers or transfers involving multiple parties.

3. Gift Transfer: A gift transfer involves transferring ownership of the stock as a gift. This option may have tax implications for the transferor and transferee and may require additional legal documentation.

Ultimately, the best option for transferring ownership rights with a stock power will depend on the specific circumstances of the transfer. Consulting with a legal professional can help determine the most appropriate option and ensure compliance with all applicable legal requirements.

Legal Considerations in Stock Assignment - Stock Assignment: Transferring Ownership Rights with Stock Power

When it comes to stock assignment, there are several mistakes that people make which can lead to legal and financial complications. It is important to understand the process of transferring ownership rights with stock power and avoid these common mistakes.

1. Failing to Complete the Stock Assignment Form Correctly

One of the most common mistakes made in stock assignment is failing to complete the stock assignment form correctly. This can lead to delays in the transfer of ownership rights and can result in legal complications. It is important to ensure that all the required fields are filled out correctly and that the form is signed and dated by the appropriate parties.

2. Not Having a Properly Endorsed Stock Certificate

Another mistake that people make is not having a properly endorsed stock certificate. This is important because the stock certificate is the physical representation of the ownership rights of the stock. It is important to ensure that the certificate is properly endorsed by the seller and that the buyer has the certificate in their possession.

3. Not understanding the Tax implications of Stock Assignment

Another mistake that people make is not understanding the tax implications of stock assignment. Depending on the circumstances, there may be tax implications for both the buyer and the seller. It is important to consult with a tax professional to understand the tax implications before completing the stock assignment.

4. Not Using a Broker or Transfer Agent

Some people try to complete the stock assignment themselves without using a broker or transfer agent. This can lead to complications and delays in the transfer of ownership rights. It is recommended to use a broker or transfer agent to ensure that the process is completed correctly and efficiently.

5. Not Verifying the Identity of the Buyer or Seller

Finally, it is important to verify the identity of the buyer or seller before completing the stock assignment. This can help to prevent fraud and ensure that the transfer of ownership rights is legitimate. It is recommended to use a reputable broker or transfer agent who can help with this process.

Stock assignment can be a complicated process, but by avoiding these common mistakes, it can be completed successfully. It is important to ensure that the stock assignment form is completed correctly, that the stock certificate is properly endorsed, that the tax implications are understood, and that a reputable broker or transfer agent is used. By following these guidelines, the transfer of ownership rights can be completed efficiently and without complications.

Common Mistakes to Avoid in Stock Assignment - Stock Assignment: Transferring Ownership Rights with Stock Power

Stock Power and Stock Assignment are important concepts in the world of finance and investment. These concepts help investors transfer ownership rights of their stocks to another party. In this blog post, we have discussed the details of these concepts and their implications. We have also analyzed the different perspectives and provided insights on how to use these concepts effectively.

1. Importance of Stock Power and Stock Assignment

Stock Power and Stock Assignment are essential tools for investors who want to transfer ownership rights of their stocks to another party. These concepts enable investors to transfer their stocks without having to go through the hassle of selling them. This is particularly useful in cases where the investor wants to gift the stocks to someone or transfer them to another account.

2. Understanding Stock Power

Stock Power is a legal document that enables the transfer of ownership rights of a stock from one party to another. It is an endorsement that is required by the brokerage firm to transfer the ownership of the stock. The stock power must be signed by the owner of the stock and must be submitted along with the certificate of the stock to the brokerage firm.

3. Understanding Stock Assignment

Stock Assignment is a process where the ownership rights of a stock are transferred from one party to another. The process involves filling out a transfer form and submitting it to the brokerage firm. The transfer form must be signed by the owner of the stock and must be submitted along with the certificate of the stock.

4. pros and Cons of stock Power and Stock Assignment

Stock Power and Stock Assignment have their own advantages and disadvantages. Stock Power is a simpler process that requires the submission of a single document, whereas Stock Assignment involves filling out a transfer form. However, Stock Power can only be used if the certificate of the stock is in the possession of the owner, whereas Stock Assignment can be used even if the certificate is lost or misplaced.

5. Best Option

The best option depends on the situation. If the certificate of the stock is in the possession of the owner, Stock Power is the best option. However, if the certificate is lost or misplaced, Stock Assignment is the better option. In any case, it is important to consult with the brokerage firm to determine the best option.

Stock Power and Stock Assignment are important concepts that enable investors to transfer ownership rights of their stocks. These concepts have their own advantages and disadvantages, and the best option depends on the situation. It is important to consult with the brokerage firm to determine the best option.

Conclusion and Final Thoughts on Stock Power and Stock Assignment - Stock Assignment: Transferring Ownership Rights with Stock Power

Read Other Blogs

Hijjama Center Community is a network of entrepreneurs, mentors, investors, and experts who share a...

Equity financing and equity swaps are two essential components of alternative funding solutions in...

Why Mentorship Matters for Junior Companies For junior companies, having a mentor can be the...

Loyalty programs have become an integral part of modern business strategies, aiming to foster...

First aid is not only a moral obligation, but also a legal one for businesses. According to the...

1. Economic indicators play a crucial role in understanding the overall health and performance of...

When it comes to investment, there are various options available out there. One of them is tontine...

One of the most crucial factors that determines the success or failure of an entrepreneurial...

Embarking on the journey of establishing a motorbike repair business is akin to preparing for a...

- Search Search Please fill out this field.

- Options and Derivatives

- Strategy & Education

Assignment: Definition in Finance, How It Works, and Examples

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. She has worked in multiple cities covering breaking news, politics, education, and more. Her expertise is in personal finance and investing, and real estate.

:max_bytes(150000):strip_icc():format(webp)/YariletPerez-d2289cb01c3c4f2aabf79ce6057e5078.jpg)

What Is an Assignment?

Assignment most often refers to one of two definitions in the financial world:

- The transfer of an individual's rights or property to another person or business. This concept exists in a variety of business transactions and is often spelled out contractually.

- In trading, assignment occurs when an option contract is exercised. The owner of the contract exercises the contract and assigns the option writer to an obligation to complete the requirements of the contract.

Key Takeaways

- Assignment is a transfer of rights or property from one party to another.

- Options assignments occur when option buyers exercise their rights to a position in a security.

- Other examples of assignments can be found in wages, mortgages, and leases.

Uses For Assignments

Assignment refers to the transfer of some or all property rights and obligations associated with an asset, property, contract, or other asset of value. to another entity through a written agreement.

Assignment rights happen every day in many different situations. A payee, like a utility or a merchant, assigns the right to collect payment from a written check to a bank. A merchant can assign the funds from a line of credit to a manufacturing third party that makes a product that the merchant will eventually sell. A trademark owner can transfer, sell, or give another person interest in the trademark or logo. A homeowner who sells their house assigns the deed to the new buyer.

To be effective, an assignment must involve parties with legal capacity, consideration, consent, and legality of the object.

A wage assignment is a forced payment of an obligation by automatic withholding from an employee’s pay. Courts issue wage assignments for people late with child or spousal support, taxes, loans, or other obligations. Money is automatically subtracted from a worker's paycheck without consent if they have a history of nonpayment. For example, a person delinquent on $100 monthly loan payments has a wage assignment deducting the money from their paycheck and sent to the lender. Wage assignments are helpful in paying back long-term debts.

Another instance can be found in a mortgage assignment. This is where a mortgage deed gives a lender interest in a mortgaged property in return for payments received. Lenders often sell mortgages to third parties, such as other lenders. A mortgage assignment document clarifies the assignment of contract and instructs the borrower in making future mortgage payments, and potentially modifies the mortgage terms.

A final example involves a lease assignment. This benefits a relocating tenant wanting to end a lease early or a landlord looking for rent payments to pay creditors. Once the new tenant signs the lease, taking over responsibility for rent payments and other obligations, the previous tenant is released from those responsibilities. In a separate lease assignment, a landlord agrees to pay a creditor through an assignment of rent due under rental property leases. The agreement is used to pay a mortgage lender if the landlord defaults on the loan or files for bankruptcy . Any rental income would then be paid directly to the lender.

Options Assignment

Options can be assigned when a buyer decides to exercise their right to buy (or sell) stock at a particular strike price . The corresponding seller of the option is not determined when a buyer opens an option trade, but only at the time that an option holder decides to exercise their right to buy stock. So an option seller with open positions is matched with the exercising buyer via automated lottery. The randomly selected seller is then assigned to fulfill the buyer's rights. This is known as an option assignment.

Once assigned, the writer (seller) of the option will have the obligation to sell (if a call option ) or buy (if a put option ) the designated number of shares of stock at the agreed-upon price (the strike price). For instance, if the writer sold calls they would be obligated to sell the stock, and the process is often referred to as having the stock called away . For puts, the buyer of the option sells stock (puts stock shares) to the writer in the form of a short-sold position.

Suppose a trader owns 100 call options on company ABC's stock with a strike price of $10 per share. The stock is now trading at $30 and ABC is due to pay a dividend shortly. As a result, the trader exercises the options early and receives 10,000 shares of ABC paid at $10. At the same time, the other side of the long call (the short call) is assigned the contract and must deliver the shares to the long.

:max_bytes(150000):strip_icc():format(webp)/novation.asp-final-f5904e1fe68047ba9d8b6feaf53c1736.png)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Company Filings | More Search Options

Company Filings More Search Options -->

- Commissioners

- Reports and Publications

- Securities Laws

- Commission Votes

- Corporation Finance

- Enforcement

- Investment Management

- Economic and Risk Analysis

- Trading and Markets

- Office of Administrative Law Judges

- Examinations

- Litigation Releases

- Administrative Proceedings

- Opinions and Adjudicatory Orders

- Accounting and Auditing

- Trading Suspensions

- How Investigations Work

- Receiverships

- Information for Harmed Investors

- Rulemaking Activity

- Proposed Rules

- Final Rules

- Interim Final Temporary Rules

- Other Orders and Notices

- Self-Regulatory Organizations

- Staff Interpretations

- Investor Education

- Small Business Capital Raising

- EDGAR – Search & Access

- EDGAR – Information for Filers

- Company Filing Search

- How to Search EDGAR

- About EDGAR

- Press Releases

- Speeches and Statements

- Securities Topics

- Upcoming Events

- Media Gallery

- Divisions & Offices

- Public Statements

Fast Answers

Security power.

Sept. 14, 2005

A "security power," often called a stock power or bond power, is a legal document – separate from a securities certificate – that investors can use to transfer or assign ownership to another person. Securities powers typically are used either: (1) as a matter of convenience when an owner cannot sign the actual certificates; or (2) for safety (such as sending unsigned certificates in one envelope and signed powers in another). Physically, a securities power looks like the back side of a securities certificate, and it can be completed in the same manner. Market professionals typically attach a customer's signed powers to the related unsigned certificates for processing purposes.

Assignment of Stock - Free Legal Form

Check our free sample assignment of stock legal form. 1 min read updated on February 01, 2023

Assignment of Stock Form

For good and valuable consideration, receipt of which is hereby acknowledged, I, [Name] the undersigned, residing at [Address] hereby sell, assign and transfer to [Name], residing at [Address], [Number] shares of the stock of [Name of Corporation] (the "Corporation") standing in my name on the books of the Corporation, represented by Certificate No. [Certificate Number], and hereby irrevocably constitute and appoint [Name], attorney-in-fact to transfer the stock on the books of the within named Corporation, with full power of substitution in the premises.

Dated: [Month, Day, Year] In the presence of: ________________________ Signature of Witness ________________________ Signature

Hire the top business lawyers and save up to 60% on legal fees

Content Approved by UpCounsel

- What is Stock Corporation?

- Are Stock Certificates Required

- How to Get a Stock Certificate

- How to Transfer Shares of Stock Within a Corporation?

- Stock Corporation

- Agreement to Execute Lease - Free Legal Form

- Who Can Sign a Share Certificate?

- S Corp Shareholder Requirements

- S Corp Stock

- S Corp Shares

To speak with an attorney or ask a question please complete the information below.

- Probate & Trust Litigation

- Wills and Trusts

- Trustee & Estate Administration

- Business Entities

2372 Morse Ave , Irvine , CA 92614

9777 Wilshire Blvd. #400 , Beverly Hills , CA 90210

12526 High Bluff Dr #300 , San Diego , CA 92130

1 Sansome St #3500 , San Francisco , CA 94104

- Stock Assignments

Legal “assignment” is the transfer of an individual’s rights or property to another person or business. Essentially, assignment is the transfer of ownership. An example of an assignment agreement is when a person sells his or her car, thereby “assigning” the title to another. If you are moving stocks to a living trust or assigning them to an organization or to an individual, you’ll need to do it with the legal assistance of an experienced Orange County stock assignment attorney at the Citadel Law Corporation. An experienced stock assignment attorney will be familiar with stock assignment contracts and with stock assignment contract law, so you may be certain that your assignment of stock is a legal contract in full compliance with federal and state law.

WE HELP YOU UNDERSTAND THE REGULATIONS

A stock assignment contract can operate in several ways, depending upon whether the securities are held by you or by your securities broker, or if you’ve invested in a mutual fund. A stock certificate must be assigned through a contract of assignment, which must be sent to the transfer agent – a person or company responsible for keeping track of the securities issued by a corporation or government – along with the stock certificate. If the stock is publicly traded – that is, bought and sold to the public through a stock exchange – the stockholder’s signature must be guaranteed on the assignment document by a commercial bank or by a stock brokerage firm. Such a guarantee is comparable to having the signature notarized.

EXPERIENCED LEGAL HELP IS HERE

The assignment of brokerage accounts is handled by sending a request to your brokerage firm. The firm will need documentation of the trustee’s powers to deal with securities. Similarly, most mutual funds firms require your guaranteed signature on a letter requesting assignment. The stock assignment attorneys at the Citadel Law Corporation offer experienced legal guidance. Contact an experienced Orange County stock assignment attorney at the Citadel Law Corporation to discuss your legal needs. Call 949-852-8181 to schedule an appointment with an attorney today.

Receive fast answers on any legal question from real lawyers.

- Buy – Sell Agreements

- Incorporation

- Deferred Compensation Agreements

- Limited Liability Companies (LLC)

- Partnerships

- Sole Proprietors

- Advanced Healthcare Directives / Living Wills

- Asset Protection Trust

- Beneficiary Mediation/Agreements

- Charitable Trust

- Grantor Retained Income Trust

- HIPAA Authorization Forms

- Irrevocable Life Insurance Trust (ILIT)

- Living Trusts

- Organization Of Assets

- Pourover Wills

- Power Of Attorney

- Qualified Personal Residence Trust (QPRT)

- Revocable Living Trusts

- Special Needs Trust

- Spousal Petitions

- Tax Exempt Charitable Foundations

- Beneficiary Representation

- Irrevocable Trusts

- Charitable Remainder Trust (CRT)

- Dynasty Trusts

- Estate Litigation

- Heggstad Petitions

- Petition to Modify Irrevocable Trust

- Petitions to Remove or Compel Trustee

- Probate Petitions for Wills

- Will And Trust Contests

- Elder Abuse

- A/B Trust Divisions

- Certification Of Trust

- Estate Tax Returns

- Notifications By Trustee

- Trust Administration

- Trust Accounting

- Trustee & Beneficiary Mediation

- Trustee Counseling

- Trustee Defense

- Child Custody

- Child Support

- Co-Habitation Agreements

- Prenuptial Agreements

- Spousal Support

We are here to answer all of your legal questions!

Our attorneys are waiting to help you

Stock Assignment Separate from Certificate Transferring Stock to Revocable Trust | Practical Law

Stock Assignment Separate from Certificate Transferring Stock to Revocable Trust

Practical law standard document w-036-2266 (approx. 9 pages).

- Find a Branch

- Schwab Brokerage 800-435-4000

- Schwab Password Reset 800-780-2755

- Schwab Bank 888-403-9000

- Schwab Intelligent Portfolios® 855-694-5208

- Schwab Trading Services 888-245-6864

- Workplace Retirement Plans 800-724-7526

... More ways to contact Schwab

Chat

- Schwab International

- Schwab Advisor Services™

- Schwab Intelligent Portfolios®

- Schwab Alliance

- Schwab Charitable™

- Retirement Plan Center

- Equity Awards Center®

- Learning Quest® 529

- Mortgage & HELOC

- Charles Schwab Investment Management (CSIM)

- Portfolio Management Services

- Open an Account

The Risks of Options Assignment

Any trader holding a short option position should understand the risks of early assignment. An early assignment occurs when a trader is forced to buy or sell stock when the short option is exercised by the long option holder. Understanding how assignment works can help a trader take steps to reduce their potential losses.

Understanding the basics of assignment

An option gives the owner the right but not the obligation to buy or sell stock at a set price. An assignment forces the short options seller to take action. Here are the main actions that can result from an assignment notice:

- Short call assignment: The option seller must sell shares of the underlying stock at the strike price.

- Short put assignment: The option seller must buy shares of the underlying stock at the strike price.

For traders with long options positions, it's possible to choose to exercise the option, buying or selling according to the contract before it expires. With a long call exercise, shares of the underlying stock are bought at the strike price while a long put exercise results in selling shares of the underlying stock at the strike price.

When a trader might get assigned

There are two components to the price of an option: intrinsic 1 and extrinsic 2 value. In the case of exercising an in-the-money 3 (ITM) long call, a trader would buy the stock at the strike price, which is lower than its prevailing price. In the case of a long put that isn't being used as a hedge for a long stock position, the trader shorts the stock for a price higher than its prevailing price. A trader only captures an ITM option's intrinsic value if they sell the stock (after exercising a long call) or buy the stock (after exercising a long put) immediately upon exercise.

Without taking these actions, a trader takes on the risks associated with holding a long or short stock position. The question of whether a short option might be assigned depends on if there's a perceived benefit to a trader exercising a long option that another trader has short. One way to attempt to gauge if an option could be potentially assigned is to consider the associated dividend. An options seller might be more likely to get assigned on a short call for an upcoming ex-dividend if its time value is less than the dividend. It's more likely to get assigned holding a short put if the time value has mostly decayed or if the put is deep ITM and close to expiration with a wide bid/ask spread on the stock.

It's possible to view this information on the Trade page of the thinkorswim ® trading platform. Review past dividends, the price of the short call, and the price of the put at the call's strike price. While past performance cannot be relied upon to continue, this information can help a trader determine whether assignment is more or less likely.

Reducing the risk associated with assignment

If a trader has a covered call that's ITM and it's assigned, the trader will deliver the long stock out of their account to cover the assignment.

A trader with a call vertical spread 4 where both options are ITM and the ex-dividend date is approaching may want to exercise the long option component before the ex-dividend date to have long stock to deliver against the potential assignment of the short call. The trader could also close the ITM call vertical spread before the ex-dividend date. It might be cheaper to pay the fees to close the trade.

Another scenario is a call vertical spread where the ITM option is short and the out-of-the-money (OTM) option is long. In this case, the trader may consider closing the position or rolling it to a further expiration before the ex-dividend date. This move can possibly help the trader avoid having short stock on the ex-dividend date and being liable for the dividend.

Depending on the situation, a trader long an ITM call might decide it's better to close the trade ahead of the ex-dividend date. On the ex-dividend date, the price of the stock drops by the amount of the dividend. The drop in the stock price offsets what a trader would've earned on the dividend and there would still be fees on top of the price of the put.

Assess the risk

When an option is converted to stock through exercise or assignment, the position's risk profile changes. This change could increase the margin requirements, or subject a trader to a margin call, 5 or both. This can happen at or before expiration during early assignment. The exercise of a long option position can be more likely to trigger a margin call since naked short option trades typically carry substantial margin requirements.

Even with early exercise, a trader can still be assigned on a short option any time prior to the option's expiration.

1 The intrinsic value of an options contract is determined based on whether it's in the money if it were to be exercised immediately. It is a measure of the strike price as compared to the underlying security's market price. For a call option, the strike price should be lower than the underlying's market price to have intrinsic value. For a put option the strike price should be higher than underlying's market price to have intrinsic value.

2 The extrinsic value of an options contract is determined by factors other than the price of the underlying security, such as the dividend rate of the underlying, time remaining on the contract, and the volatility of the underlying. Sometimes it's referred to as the time value or premium value.

3 Describes an option with intrinsic value (not just time value). A call option is in the money (ITM) if the underlying asset's price is above the strike price. A put option is ITM if the underlying asset's price is below the strike price. For calls, it's any strike lower than the price of the underlying asset. For puts, it's any strike that's higher.

4 The simultaneous purchase of one call option and sale of another call option at a different strike price, in the same underlying, in the same expiration month.

5 A margin call is issued when the account value drops below the maintenance requirements on a security or securities due to a drop in the market value of a security or when buying power is exceeded. Margin calls may be met by depositing funds, selling stock, or depositing securities. A broker may forcibly liquidate all or part of the account without prior notice, regardless of intent to satisfy a margin call, in the interests of both parties.

Just getting started with options?

More from charles schwab.

Today's Options Market Update

Options Expiration: Definitions, a Checklist, & More

Weekly Trader's Outlook

Related topics.

Options carry a high level of risk and are not suitable for all investors. Certain requirements must be met to trade options through Schwab. Please read the options disclosure document titled Characteristics and Risks of Standardized Options before considering any options transaction. Supporting documentation for any claims or statistical information is available upon request.

With long options, investors may lose 100% of funds invested.

Spread trading must be done in a margin account.

Multiple leg options strategies will involve multiple commissions.

Commissions, taxes and transaction costs are not included in this discussion, but can affect final outcome and should be considered. Please contact a tax advisor for the tax implications involved in these strategies.

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

Great, you have saved this article to you My Learn Profile page.

Clicking a link will open a new window.

4 things you may not know about 529 plans

Important legal information about the email you will be sending. By using this service, you agree to input your real email address and only send it to people you know. It is a violation of law in some juristictions to falsely identify yourself in an email. All information you provide will be used solely for the purpose of sending the email on your behalf. The subject line of the email you send will be “Fidelity.com”.

Thanks for you sent email.

Exercising your options

Managing an options trade is quite different from that of a stock trade. Essentially, there are 4 things you can do if you own options: hold them, exercise them, roll the contract, or let them expire. If you sell options, you can also be assigned.

If you are an active investor trading options with some percentage of your overall investment funds, here’s how you can evaluate the available choices for an options trade.

Holding your options

During the life of an options contract you’ve purchased, you can simply hold them (i.e., take no action). Suppose you own call options (which grant the right, but not the obligation, to buy a specified amount of an underlying stock at a specified strike price up and until a specified expiration date) and you believe the underlying stock price will rise within the time remaining until expiration. In this scenario, you would hold the option so that they increase in value over time.

The primary objective of this approach is potential appreciation of the option (based on the underlying stock rising and/or an increase in expected volatility for the underlying stock using our example of buying a call), in addition to delaying additional cost of buying the stock or any tax implications after you exercise the options.

To exercise an option means to take action on the right to buy or sell the underlying position in an options contract at the predetermined strike price, at or before expiration. The order to exercise your options depends on the position you have. For example, if you bought to open call options, you would exercise the same call options by contacting your brokerage company and giving your instructions to exercise the call options (to buy the underlying stock at the strike price).

There are a variety of reasons why you might choose to exercise options before they expire (assuming they are in the money, which means they have value). In addition to wanting to capture realized gains on your options, you may want to exercise:

Be aware that closing out an options position triggers a taxable event, so you would want to consider the tax implications and the timing of closing a trade on your specific situation. You should consult your tax advisor if you have additional questions.

In sum, there are many scenarios that might cause you to want to exercise your options before expiration, and they depend primarily on your outlook for the underlying stock and your objectives/risk constraints.

Employee stock plan options

There are additional choices you can make when exercising employee stock plan options . 1 These include:

- Exercise-and-hold (cash-for-stock)

- Exercise-and-sell-to-cover

- Exercise-and-sell

Rolling your options

Before expiration—and, more commonly, near the end of the contract—you can also choose to roll the contract. This involves closing out your existing options position (by selling to close a long position or buying to close a short position) that is about to expire and simultaneously purchasing a substantially similar options position, only with a later expiration date. You might want to roll out your position if you want to have the same options exposure after your contract is set to expire.

In a covered call position, for example, you can also roll up, roll down, or roll out. This involves closing out your existing short options position that is about to expire, and simultaneously selling another options position, typically with a later expiration date. While there are differences among these choices, the objective is the same: to obtain similar exposure to an existing position.

If you sell an option, you have an obligation to sell stock if you are short a call, and an obligation to buy stock if you are short a put. The owner of call or put options has the right to assign the contract to the seller. This is known as assignment.

Assignment occurs when the buyer exercises an options contract on or before expiration, and the seller must fulfill the obligation by either buying or selling the underlying security at the exercise price. As a seller of options, you can be assigned at any time prior to expiration regardless of the underlying share price—meaning you might have to receive or deliver shares of the underlying stock.

Depending on your position, settlement can occur in a variety of ways. If you are assigned on a covered call, for example, the shares you own will be sold automatically.

Let the options expire

Remember, options have an expiration date. They either have intrinsic value (for calls, the stock is above the strike price, and for puts, the stock is below the strike price) or they will expire worthless. If the options have intrinsic value, you should plan to exercise at or before expiration, or anticipate having it automatically exercised at expiration if in the money. If they do not have intrinsic value, you can simply let your options expire. Of course, letting options expire can also have tax consequences.

Research options

Get new options ideas and up-to-the-minute data on options.

More to explore

5 steps to develop an options trading plan, discover more options strategies, subscribe to fidelity viewpoints ®, looking for more ideas and insights, thanks for subscribing.

- Tell us the topics you want to learn more about

- View content you've saved for later

- Subscribe to our newsletters

We're on our way, but not quite there yet

Oh, hello again, thanks for subscribing to looking for more ideas and insights you might like these too:, looking for more ideas and insights you might like these too:, fidelity viewpoints ® timely news and insights from our pros on markets, investing, and personal finance. (debug tcm:2 ... decode crypto clarity on crypto every month. build your knowledge with education for all levels. fidelity smart money ℠ what the news means for your money, plus tips to help you spend, save, and invest. active investor our most advanced investment insights, strategies, and tools. insights from fidelity wealth management ℠ timely news, events, and wealth strategies from top fidelity thought leaders. women talk money real talk and helpful tips about money, investing, and careers. educational webinars and events free financial education from fidelity and other leading industry professionals. fidelity viewpoints ® timely news and insights from our pros on markets, investing, and personal finance. (debug tcm:2 ... decode crypto clarity on crypto every month. build your knowledge with education for all levels. fidelity smart money ℠ what the news means for your money, plus tips to help you spend, save, and invest. active investor our most advanced investment insights, strategies, and tools. insights from fidelity wealth management ℠ timely news, events, and wealth strategies from top fidelity thought leaders. women talk money real talk and helpful tips about money, investing, and careers. educational webinars and events free financial education from fidelity and other leading industry professionals. done add subscriptions no, thanks. options trading entails significant risk and is not appropriate for all investors. certain complex options strategies carry additional risk. before trading options, please read characteristics and risks of standardized options . supporting documentation for any claims, if applicable, will be furnished upon request. there are additional costs associated with option strategies that call for multiple purchases and sales of options, such as spreads, straddles, and collars, as compared with a single option trade. greeks are mathematical calculations used to determine the effect of various factors on options. 1. this is a complex decision with potentially significant tax consequences and requires careful analysis and, ideally, the involvement of a tax and/or financial planning professional. past performance is no guarantee of future results. fidelity brokerage services llc, member nyse, sipc , 900 salem street, smithfield, ri 02917 939787.2.0 mutual funds etfs fixed income bonds cds options active trader pro investor centers stocks online trading annuities life insurance & long term care small business retirement plans 529 plans iras retirement products retirement planning charitable giving fidsafe , (opens in a new window) finra's brokercheck , (opens in a new window) health savings account stay connected.

- News Releases

- About Fidelity

- International

- Terms of Use

- Accessibility

- Contact Us , (Opens in a new window)

- Disclosures , (Opens in a new window)

Trading Education Guides Options Trading

Stock Assignment With Options

- By Lucien Bechard

- Updated May 12, 2023

SHARE THIS ARTICLE

Are you at risk for stock assignment with options? That’s a question new options traders focus on. The thought of being assigned sounds scary, but it’s not. While rare, it’s important to be aware of how the assignment process works. You have no control on when options assignment takes place. If you don’t have the funds then your broker will automatically close the trade for you. If you are assigned shares of the stock and you don’t want them, then you can just sell them. Nothing to worry about!

Table of Contents

When Will I Get Assigned

Selling options and your risk of stock assignment, are you at risk for stock assignment when selling a naked call, two key things to be aware of, call/put spread, what are the two ways to prevent assignment, key takeaways, how trade options smarter, what is stock assignment with options.

When I talk to traders, especially those interested in options trading , one of their biggest fears is getting assigned stock. To refresh your memory, when you buy/sell an option, you control 100 shares of that option’s stock. Even more unsettling is the options traders who never think about assignment as a possibility until it happens to them. So are you at risk for stock assignment? It’s like a pop quiz at school – generally unexpected and typically jarring if you haven’t factored in the assignment.

Even more so if you’re running a multi-leg strategy like long or short spreads, and usually it’s not a good feeling!

Well, I’m hoping to help you put some of that anxiety to rest with this post. Let’s start with the 3 most common questions we get asked here at the Bullish Bears stock trading service :

- In what situations would I get assigned stock?

- How do I prevent being assigned stock?

- If I am assigned, what do I need to do?

Are you at risk for stock assignment? As an options seller, you have no control over an assignment.

First things first, let’s tackle the most obvious question, “when will I get assigned share of stock?”. In our experience, the easiest way to be assigned stock is if you short (sell) an option that expires in the money.

On the flip side, when you buy an option -either a call or a put, you cannot be assigned stock unless you decide to exercise your option(s).

As the purchaser of an option contract, you are in control. And by control I mean you, and you alone will always have the choice to exercise the option .

Do you see how I wrote a choice? Yes, you have the choice but not the obligation to do so.

Let’s say you bought a Facebook (ticker symbol FB) option a few weeks ago and it is set to expire today. Right now, since the option is in the money – there is never a risk of assignment. Because of this, you have two choices, you can:

- Let the option expire in the money to collect the profit, or…

- Decide to exercise the option and collect the 100 shares of stock

That said, let’s circle back to the most common way to get assigned stock – selling options. Make sure to take our options strategies course to learn how to safely sell options.

Are you at risk for stock assignment? Put simply, you will be assigned stock if you sell an option that is in the money at expiration.

It boils down to this: as the options seller; you have no control over an assignment, or when it could happen. Typically the risk of assignment increases as the expiration date gets closer. With that said, an assignment can still occur at any time.

Let’s say you sold an AAPL ( ticker symbol for Apple) option a couple of weeks ago. Your option is set to expire today and its in the money.

If this happens, you are automatically assigned 100 shares of stock. So if you sold a call, you would be assigned, and if you sold a put, you would be assigned.

In both cases, it’s 100 shares of stock for each one contract. Check out our trade room where we talk options.

When you buy a naked call, you have control over what you do with the option. But, when you’re the seller of a naked call option, you have no control over assignment if your call expires in the money.

And, it only has to be $.01 in the money for the assignment to happen. If you find yourself in this situation, you automatically will be forced to sell 100 shares of stock to the person who bought your option.

Hypothetically, let’s say you sell a FB call option to your friend Amanda at a strike price of $525. Amanda then decides to exercise her option because it’s in the money.

You then have to turn around and sell her 100 FB shares for each option contract at $525/share. Even if you do not own FB stock, you will still have to sell Amanda the shares. Now you find a situation in which you are short 100 shares of FB stock.

- Assignment and commission fees. If you do not close the trade out or roll it before expiration and have to sell the shares, you’ll have fees to pay.

- Dividends. Be wary when a company has upcoming dividends because this will increase your assignment risk. You need to be on high alert if the extrinsic value on an ITM short call is LESS than the dividend amount. And why? Well, it would only make sense that the ITM call owner would want to exercise their option in order to benefit from the dividend associated with owning the stock

Once again, similar to selling a naked call, when you sell a naked put, if your option expires in the money at expiration, you do not have control over an assignment.

What does this mean for you? You will be assigned 100 shares of stock at the options strike price if your short put is in the money at expiration. And don’t forget the assignment fee and commissions.

Like the example above with your friend Amanda, if you sell her a naked put that is expiring in the money, she has options.

If Amanda chooses to exercise those options, you need to buy 100 shares of FB stock for each of her option contracts, at $525 a share – even if you don’t have the money in your account!

Our stock watch lists have options trades on there with alert setups.

Assignment risk happens when your short strike expires in the money.

If you sell a put or call spread , the assignment risk stems from your short strike expiring in the money at expiration. If this scenario happens, you will be forced to sell 100 shares to the buyer for each option contract they purchased.

Likewise, if you sell a put spread you will be assigned 100 shares of stock per contract if the short strike is in the money at expiration.

On the flip side, however, if both strikes expire in the money, they will cancel each other out. Even though the short strike is assigned, you can turn around and exercise the long strike.

Are you at risk for stock assignment? You don’t want to be hurt financially if the assignment happens. So it’s wise to avoid this situation to the best of your ability. In my opinion, you have two avenues to avoid assignment:

- You close the trade before it expires which means you take any profits or losses

- You can simply roll the trade to extend the days to expiration. What this does is give you more time for the trade to be profitable.

Despite your best efforts to avoid unwanted assignment, it can occasionally still happen. So if you find yourself in this situation, here’s what to do…

Don’t panic.

There are two things you can do if you sold an option that has expired in the money.

- You can hold the long or short stock or buy/sell the shares back for a profit or loss. In this scenario, you will need the money in your account to pay for the shares.

- If you were assigned shares and didn’t have the money to cover the shares you were assigned (a.k.a. a margin call), immediately buy/sell back the shares. Before the end of the trading day, your broker will do it for you if you don’t.

- As an options seller, you have no control over the assignment or its timing

- The options buyer controls when an assignment happens.

- If you do not have enough money in your account to cover either your long or short stock position, be wise and immediately close your position. Your broker will do it for you if you fail to.

- Spreads are one way to have protection against being assigned, but, BOTH legs need to be in the money if you are to be protected.

- Additional assignment risk happens if you have a short call position that is in the money at the time of the dividend.

The best defense against early assignment is a good offence; so be prepared and factor it into your thinking early.

Otherwise, it can cause you to make defensive, in-the-moment decisions that are less than logical. This is because the assignment can happen pretty easily if you are not monitoring your positions regularly. Sometimes it can even happen if you are.

If you’re anything like me, you get busy during the day and don’t get a chance to check your positions. Worse yet, you’re trading options on an illiquid underlying.

You might find yourself in a position without any buyers/sellers available so you cannot close your position. So my point is this; monitor your positions closely and watch liquidity closely.

If you need more help, take our options trading course .

Related Articles

Options put call ratio meaning.

Options traders and those frequently observing the markets often speak about the Put-Call ratio. Although you might be able to determine what it means by

Option Flow Data Explained

Are you an options trader or looking to get into trading options? Options can be overwhelming and seem over-complicated to those just starting. One tool

IV Rank Options Strategy

IV Rank is something that can help find big market moves. As a result, we have some custom indicators you can use in TOS to

What Are 0DTE Options When Trading?

Nowadays, everyone on social media seems to be talking about 0DTE Options. To most investors, options are an advanced trading strategy that requires risk and

Options Strategies Explained

The world of options strategies can be very difficult for traders new to the industry. Calls and puts are the basic building blocks of options.

Free Trading Courses

- We want to teach you

- Learn day trading, swing trading, options, futures, and price action

- Rated Best Value Courses by Investopedia

If you do not agree with any term of provision of our Terms and Conditions, you should not use our Site, Services, Content or Information. Please be advised that your continued use of the Site, Services, Content, or Information provided shall indicate your consent and agreement to our Terms and Conditions.

If you would like to contact the Bullish Bears team then please email us at bbteam[@]bullishbears.com and we will get back to you within 24 hours.

BullishBears.com, 60 Pinney St, Ellington, CT. 06029 United States

Disclaimer: We’re not licensed brokers or advisors. You’re 100% responsible for any trades that you make. Please read our full disclaimer.

Trading contains substantial risk and is not for every investor. An investor could potentially lose all or more of their initial investment. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not indicative of future results. Testimonials appearing on this website may not be representative of other clients or customers and is not a guarantee of future performance or success.

© 2023 by Bullish Bears LLC.

Stock trading service.

Our chat rooms will provide you with an opportunity to learn how to trade stocks, options, and futures. You’ll see how other members are doing it, share charts, share ideas and gain knowledge.

Our traders support each other with knowledge and feedback. People come here to learn, hang out, practice, trade stocks, and more. Our trade rooms are a great place to get live group mentoring and training.

TRADE ALERTS “SIGNALS”

The Bullish Bears trade alerts include both day trade and swing trade alert signals. These are stocks that we post daily in our Discord for our community members.

These alert signals go along with our stock watch lists. Our watch lists and alert signals are great for your trading education and learning experience.

We want you to see what we see and begin to spot trade setups yourself.

REAL-TIME STOCK ALERTS SERVICE

We also offer real-time stock alerts for those that want to follow our options trades. You have the option to trade stocks instead of going the options trading route if you wish.

Our stock alerts are simple to follow and easy to implement. We post entries and exits.

Also, we provide you with free options courses that teach you how to implement our trades as well.

STOCK TRAINING DOESN’T NEED TO BE HARD

Stock training doesn’t need to be hard. But it sure feels hard when you don’t know where to turn for legitimate knowledge. There are tons of places to learn, but what makes us different?

Well, for starters, we’re just real everyday people who like trade stocks. We’re not gurus portraying a fancy lifestyle of cars and jets and beaches. Can you obtain those things with what we teach you? Sure you can. Is that what motivates us when teaching you how to trade?

Nope. What we really care about is helping you, and seeing you succeed as a trader. We want the everyday person to get the kind of training in the stock market we would have wanted when we started out.

WHY WE’RE DIFFERENT

What else makes us different? When it comes to the stock market, we’ve won, we’ve lost, we’ve lived, and learned. We’ve been through the ups and downs in the market and figured out what really matters. The Charts…Candlesticks = PRICE ACTION! We’ve created a site that passes all this knowledge on to you.

We don’t charge you an arm and a leg for the stock training we give you. We charge a modest amount that goes towards running our day-to-day operations and paying for our invaluable team moderators that are passionate about teaching YOU!

That’s about it. We could charge more, but we have a pay it forward, give back mentality. It’s not about the money. The best and most important thing for us is YOU. We want to feel good about what we do, and the results and reviews speak for themselves.

Those emails we get, the feedback, the success we see. That is what our educational trading community is all about. We hold no secrets back. Our trading edge is your trading edge.

STOCK TRAINING DONE RIGHT

We don’t care what your motivation is to get training in the stock market. If it’s money and wealth for material things, money to travel and build memories, or paying for your child’s education, it’s all good. We know that you’ll walk away from a stronger, more confident, and street-wise trader.

In our stock trading community, you’re going to get it all. Futures, options trading, and stocks. Not just penny stocks either. Small, mid, and large caps. Each day we have several live streamers showing you the ropes, and talking the community though the action.

There’s no catch, no smoke or mirrors. What you see is what you get. If you’re looking to change your life, or someone else’s, we’re here to help you reach that goal. Get started learning day trading, swing trading, options, or futures trading today!

Click Here to start your 7-day free trial.

TRADING STOCKS IN THE BULLISH BEARS COMMUNITY

Yes, we work hard every day to teach day trading, swing trading, options futures, scalping, and all that fun trading stuff. But we also like to teach you what’s beneath the Foundation of the stock market.

Tell you the TRUTH about how the market works. The importance of controlling your emotions and having a proper mindset when trading. We’re really passionate about teaching you this stuff!

Money isn’t our #1 priority in life. YOU are. Our members come first. Making sure you get comfortable with trading is our priority.

We have members that come from all walks of life and from all over the world. We love the diversity of people, just like we like diversity in trading styles. It creates an environment much like a university or college.

TRADING ROOMS AND LIVE STOCK TRAINING

Each day our team does live streaming where we focus on real-time group mentoring, coaching, and stock training. We teach day trading stocks, options or futures, as well as swing trading. Our live streams are a great way to learn in a real-world environment, without the pressure and noise of trying to do it all yourself or listening to “Talking Heads” on social media or tv.