Welcome to our FHA Frequently Asked Questions (FAQ) page for lenders!

As a lender, you know the significance of partnering with a trusted appraisal company to ensure the precise valuation of a property for an FHA-supported loan. Yet, the FHA appraisal process can be intricate, with distinct guidelines and requirements to adhere to. Navigating this process may prove to be challenging, but our FHA FAQ page for lenders is here to help.

Use the FAQ section of your site to answer those routine questions that always come up and need to be answered. This is a great way to tell us more about what you can offer, fill in some details that might intrigue us, and show us how knowledgeable and helpful you can be.

The Appraiser must visually observe all areas of the crawl space and notify the Mortgagee of the deficiency of Minimum Property Requirements (MPR) and Minimum Property Standards (MPS) when the crawl space does not satisfy any of the following criteria:

The floor joists must be sufficiently above ground level to provide access for maintaining and repairing ductwork and plumbing.

If the crawl space contains any system components, the minimum required vertical clearance is 18 inches between grade and the bottom of the floor joists.

The crawl space must be properly vented unless the area is mechanically conditioned.

The crawl space must be free of trash, debris, and vermin.

The crawl space must not be excessively damp and must not have any water pooling.

If moisture problems are evident, a vapor barrier and/or prevention of water infiltration must be required.

If there is evidence of a deficient condition, the Appraiser must report this condition and render the appraisal subject to inspection and repairs, if necessary. In cases where access through a scuttle is limited, and the Appraiser cannot fully enter the crawl space, For additional information see Handbook 4000.1 II.D.3.l the insertion of at least the head and shoulders of the Appraiser will suffice.

If there is no access to the crawl space but there is evidence of a deficient condition (such as water-stained subflooring or smell of mold), the Appraiser must report this condition and the Mortgagee must have a qualified third party perform an inspection. If there is no access, the Appraiser must report the lack of accessibility to the area in the appraisal report. There is no requirement to cut open walls, ceilings or floors. Not all houses (especially historic houses) with a vacant area beneath the flooring are considered to have a crawl space; it may be an intentional void, with no mechanical systems and no intention or reason for access.

The Appraiser must observe the interiors of all attic spaces. The Appraiser is not required to disturb insulation, move personal items, furniture, equipment or debris that obstructs access or visibility. If unable to view the area safely in their entirety, the Appraiser must contact the Mortgagee and reschedule a time when a complete visual observation can be performed, or complete the appraisal subject to inspection by a qualified third party. In cases where access through a scuttle is limited and the Appraiser cannot fully enter the attic, the insertion of at least the head and shoulders of the Appraiser will suffice. If there is evidence of a deficient condition (such as a water-stained ceiling, insufficient ventilation, or smell of mold), the Appraiser must report this condition, and render the appraisal subject to inspection and repairs if necessary. If there is no access or scuttle, the Appraiser must report the lack of accessibility to the area in the appraisal report. There is no requirement to cut open walls, ceilings or floors. An observation performed in accordance with these guidelines is visual and is not technically exhaustive.

For additional information see Handbook 4000.1 II.D.3.j

The appraiser must obtain a copy of the lease from the Mortgagee and must analyze and report the terms of the ground lease, including:

the amount of the Ground Rent,

the term of the lease,

if the lease is renewable,

if the lessee has the right of redemption (the right to obtain a Fee Simple title by paying the value of the Leased Fee to the lessor, thereby cancelling the ground rent), and

if the Ground Rent can increase or decrease over the life of the lease term.

In valuing the Leasehold Interest, the Appraiser must apply the appropriate techniques to each of the approaches to value included in the analysis.

In the cost approach, the value of the land reported must be its Leasehold Interest.

In the Gross Rent Multiplier (GRM) income approach, the sales used to derive the GRM factor must be based on properties under similar Ground Rent terms (or be adjusted to similar Ground Rent terms).

In the sales comparison analysis, the comparable sales must be adjusted for their lack of similarity to the subject in the “Ownership Rights” section of the Sales Comparison Approach (SCA) grid.

For additional information see Handbook 4000.1 II.D.7.c at

After Improved Value refers to the value as determined by the Appraiser based on a hypothetical condition that the repairs or alterations have been completed. The Appraiser must make the appraisal “subject to the following repairs or alterations on the basis of a hypothetical condition that the repairs or alterations have been completed.” The Appraiser must review the 203(k) consultant’s work write-up or the contractor’s proposal and cost estimates. The Appraiser must notify the Mortgagee of any health and safety issues in the property that are not addressed in the work write-up or proposal. When the consultant or contractor has modified the work write-up or proposal, the Appraiser must complete the appraisal based on the final work write-up or the contractor’s final proposal and cost estimates. The Appraiser must include the work write-up or proposal as an exhibit to the appraisal report. For additional information see Handbook 4000.1 II.D.12.c.ii at

The Mortgagee must confirm that any Overhead Electric Power Transmission Lines do not pass directly over any dwelling, structure or related property improvement, including pools. The power line must be relocated for a property to be eligible for FHA-insured financing. The residential service drop line may not pass directly over any pool, spa or water feature. If the dwelling or related property improvements are located within the Easement area, the Mortgagee must obtain a certification from the appropriate utility company or local regulatory agency stating that the relationship between the improvements and Local Distribution Lines conforms to local standards and is safe. For additional information see Handbook 4000.1 II.A.3.a.ii(B)

If the dwelling or related improvements were built on or after 1978, the Appraiser must report all defective paint surfaces on the exterior and require repair of any defective paint that exposes the subsurface to the elements.

If the dwelling or related improvements were built before 1978, the Appraiser must note the condition and location of all defective paint and require repair in compliance with 24 CFR 200.810(c) and any applicable Environmental Protection Agency (EPA) requirements. The Appraiser must observe all interior and exterior surfaces, including common areas, stairs, deck, porch, railings, windows and doors, for defective paint (cracking, scaling, chipping, peeling, or loose). Exterior surfaces include those surfaces on fences, detached garages, storage sheds, and other outbuildings and appurtenant Structures. For Condominium Units built before 1978, the Appraiser must observe the interior of the unit, common unit and exterior surfaces and appurtenant Structures of the specific unit being appraised; and address the overall condition, maintenance and appearance of the Condominium Project. The Appraiser must note the condition and location of all defective paint in the unit, common area and exterior, and require repair in compliance with 24 CFR 200.810(c) and any applicable EPA requirements. For additional information see:

Handbook 4000.1 II.D.3.i and II.D.3.m.i.

Federal Register 24CFR, 200.810

The Appraiser must state the remaining economic life as a single number or as a range for all property types, including condominiums. The Appraiser must provide an explanation if the remaining economic life is less than 30 years. The Appraiser must apply the appropriate technique to estimate the economic life of the subject and not just report a number without analysis. The Mortgagee must confirm that the term of the mortgage is less than or equal to the remaining economic life of the property. For additional information see Handbook 4000.1 II.D.4.c.iii(D) and II.A.3.a.ii(I)

Leasehold refers to the right to hold or use Property for a fixed period of time at a given price, without transfer of ownership, on the basis of a lease contract. Leasehold Interest refers to real estate where the residential improvements are located on land that is subject to long-term lease from the underlying fee owner, creating a divided estate in the Property. Forward Mortgage Requirements: A Mortgage secured by real estate under Leasehold requires a renewable lease with a term of not less than 99 years, or a lease that will extend not less than 10 years beyond the maturity date of the Mortgage. HECM Requirements: A reverse mortgage, or Home Equity Conversion Mortgage (HECM), secured by real estate under Leasehold requires a renewable lease for not less than 99 years, or a lease having a remaining period of not less than 50 years beyond the date of the 100th birthday of the youngest mortgagor. Sub-Leasehold Estates are not eligible for FHA mortgage insurance. An Appraiser must contact the Mortgagee if the Leasehold Interest does not meet this requirement. For additional information see Handbook 4000.1 II.D.3.b.i(B)(1) and II.D.3.b.i(D) at

Non-Standard House Style refers to unique Properties in the market area, including log houses, earth sheltered housing, dome houses, houses with lower-than-normal ceiling heights, and other houses that in the Appraiser’s professional opinion, are unique. The Appraiser must provide a comment that the Non-Standard House Style appears structurally sound and readily marketable and must apply appropriate techniques for analysis and evaluation. In order for such a property to be fully marketable, the Appraiser must demonstrate that it is located in an area of other similar types of construction and blend in with the landscape. The Appraiser may require additional education, experience, or assistance for these types of properties. For additional information see Handbook 4000.1 II.D.3.b.vii(C)

The Appraiser must limit required repairs to those repairs necessary to:

maintain the safety, security and soundness of the Property;

preserve the continued marketability of the Property; and

protect the health and safety of the occupants.

The Appraiser may complete an as-is appraisal for existing Properties when minor property deficiencies, which generally result from deferred maintenance and normal wear and tear, do not affect the health and safety of the occupants or the security and soundness of the Property. Cosmetic or minor repairs are not required, but the Appraiser must report and consider them in the overall condition when rating and valuing the Property. Cosmetic repairs include missing handrails that do not pose a threat to safety, holes in window screens, cracked window glass, defective interior paint surfaces in housing constructed after 1978, minor plumbing leaks that do not cause damage (such as a dripping faucet), and other inoperable or damaged components that in the Appraiser’s professional judgment do not pose a health and safety issue to the occupants of the house. If an element is functioning well but has not reached the end of its useful life, the Appraiser should not recommend replacement because of age. The nature and degree of any noted deficiency will determine whether the Appraiser must address the deficiency in the narrative comments area of the report under “condition of the property” or “physical deficiencies” affecting livability or structural soundness.

maintain the safety, security and soundness of the Property.

The Appraiser must notify the Mortgagee and make the appraisal subject to an inspection by a qualified individual or Entity when the observation reveals evidence of a potential safety, soundness, or security issue beyond the Appraiser’s ability to assess. The Appraiser must report and describe the indication of a particular problem when requiring an inspection of any mechanical system, structural system, or other component requiring a repair.

The Mortgagee must evaluate the appraisal in accordance with the requirements for Defective Conditions. When defective conditions exist and correction is not feasible, the Mortgagee must reject the Property. The Mortgagee may only approve a Property after the Mortgagee confirms that all defects reported by the Appraiser have been corrected. If the property was made subject to inspection and either the inspection found no issues or the inspection found issues that were mitigated and approved by the inspector, then and only then can the mortgagee / lender approve the property.

For more information see Handbook 4000.1 II.A.3.a, II.A.3.a.ii(M), II.A.3.a.i and II.D.3.n at

The effective date of the appraisal cannot be before the FHA case number assignment date unless the Mortgagee certifies, via the certification field in the Appraisal Logging Screen in FHA Connection, that the appraisal was ordered for conventional lending or government guaranteed loan purposes. The Mortgagee must retain documentation in the case binder substantiating conversion of the mortgage to FHA. The Mortgagee must ensure that the appraisal was performed

by an FHA Roster Appraiser; and

in accordance with FHA appraisal reporting requirements as detailed in Handbook 4000.1 and the Appraisal Report and Data Delivery Guide.

The appraisal must be in full compliance with the Uniform Standards of Professional Appraisal Practice (USPAP), which requires that this be classified as a new assignment. The intended use of the appraisal must indicate that it is solely to assist FHA in assessing the risk of the Property securing the FHA-insured Mortgage. Additionally, FHA and the Mortgagee must be indicated as the intended users of the appraisal report. If the Appraiser determines that the scope of work is met with regard to Minimum Property Requirements, Minimum Property Standards, and USPAP compliance, and further determines that a re-inspection of the Property is not necessary, the effective date of the appraisal may be the date of the original inspection. However, if an FHA-compliant inspection is required, the date of the inspection will become the effective date of the new appraisal.

For FHA policy information see Handbook 4000.1 II.A.1.a.iii(B)(7) and II.D.1.a at

In cases where a Borrower has switched Mortgagees, the first Mortgagee must, at the Borrower’s request, transfer the appraisal to the second Mortgagee within five business days. The Appraiser is not required to provide the appraisal to the new Mortgagee. The client name on the appraisal does not need to reflect the new Mortgagee. If the original Mortgagee has not been reimbursed for the cost of the appraisal, the Mortgagee is not required to transfer the appraisal until it is reimbursed. The second Mortgagee may not request the Appraiser to re-address the appraisal. If the second Mortgagee finds deficiencies in the appraisal, the Mortgagee must order a new appraisal. For additional information see Handbook 4000.1 II.A.1.a.iii(B)(8)

The Appraiser must not include the value of leased mechanical systems and components in the Market Value of the subject Property. This includes furnaces, water heaters, fuel or propane storage tanks, solar or wind systems (including power purchase agreements), and other mechanical systems and components that are not owned by the property owner. The Appraiser must identify such systems in the appraisal report. For additional information see Handbook 4000.1 II.D.3.b.vii(G) available at

The Appraiser must notify the Mortgagee if mechanical systems do not appear:

to have reasonable future utility, durability and economy.

to be safe to operate.

to be protected from destructive elements; nor

to have adequate capacity.

The Appraiser must observe the physical condition of the plumbing, heating and electrical systems. The Appraiser must operate the applicable systems and observe their performance. If the systems appear to be damaged or do not appear to function properly, the Appraiser must condition the appraisal for repair or further inspection. If the Property is vacant, the Appraiser must note in the report whether the utilities were on or off at the time of the appraisal. If the utilities are off at the time of inspection, the Appraiser must ask to have them turned on and complete all requirements under Mechanical Component (Handbook 4000.1 II.D.3.f). However, if it is not feasible to have the utilities turned on, then the appraisal must be completed without the utilities turned on or the mechanical systems functioning. If the utilities are not on at the time of observation and the systems could not be operated, the Appraiser must:

render the appraisal as subject to re-observation;

condition the appraisal upon further observation to determine if the systems are in proper working order once the utilities are restored; and

complete the appraisal under the extraordinary assumption that utilities and mechanical systems, and appliances are in working order.

The Appraiser must note that the re-observation may result in additional repair requirements once all the utilities are on and fully functional. If systems could not be operated due to weather conditions, the Appraiser must clearly note this in the report. The Appraiser should not operate the systems if doing so may damage equipment or when outside temperatures will not allow the system to operate. Electrical, plumbing, or heating/cooling certifications may be required when the Appraiser cannot determine if one or all of these systems are working properly.

If the subject of the appraisal assignment for a new FHA-insured mortgage is a HUD Real Estate Owned (REO) Property, the requirements for the Appraiser are the same as for any other Property.

If the utilities are turned off at the time of inspection, the Appraiser must ask to have them turned on and complete all requirements under Mechanical Components in Handbook 4000.1, Section II.D.3.f. However, if it is not feasible to have the utilities turned on, then the appraisal must be completed without the utilities turned on or the mechanical systems functioning.

If the utilities are not on at the time of observation and the systems could not be operated, the Appraiser must:

render the appraisal as subject to re-observation.

The Appraiser must note that the re-observation may result in additional repair requirements once all the utilities are on and fully functional.

For more information, see Handbook 4000.1 II.D.3.f and II.D.12.e.iii(B)

An Onsite Sewage Disposal System refers to wastewater systems designed to treat and dispose of effluent on the same Property that produces the wastewater. The Appraiser must:

- note the deficiency of Minimum Property Requirements (MPR) or Minimum Property Standards (MPS) and notify the Mortgagee if the Property is not served by an off-site sewer system and any living unit is not provided with an Onsite Sewage Disposal System adequate to dispose of all domestic wastes in a manner that will not create a nuisance, or in any way endanger the public health.

- visually observe the Onsite Sewage Disposal System and its surrounding area.

- require an inspection to ensure that the system is in proper working order if there are readily observable signs of system failure.

- report on the availability of public sewer to the site.

- note the deficiency of MPR or MPS and notify the Mortgagee if there is evidence that the Onsite Sewage Disposal System is not sufficient.

The Mortgagee must confirm that a connection is made to a public or community sewage disposal system whenever feasible and available at a reasonable cost. If connection costs to the public or community system are not reasonable, the existing Onsite Sewage Disposal Systems are acceptable provided they are functioning properly and meet the requirements of the local health department. When the Onsite Sewage Disposal System is not sufficient and an off-site system is available, the Mortgagee must confirm connection to an off-site sewage system. When the Onsite Sewage Disposal System is not sufficient and an off-site system is not available, the Mortgagee must reject the Property unless the Onsite Sewage Disposal System is repaired or replaced and complies with local health department standards.

The Appraiser must examine the foundation for readily observable evidence of safety or structural deficiencies that may require repair. If a deficiency is noted, the Appraiser must describe the nature of the deficiency and report necessary repairs, alterations or required inspections in the appraisal where physical deficiencies or adverse conditions are reported. For Manufactured Housing, the appraisal must be conditioned upon the certification of an engineer or architect that the foundation is in compliance with the Permanent Foundations Guide for Manufactured Housing (PFGMH) available at https://www.hud.gov/program_offices/administration/hudclips/guidebooks/4930.3G Basement: The Appraiser must notify the Mortgagee of the deficiency of Minimum Property Requirements (MPR) or Minimum Property Standards (MPS) if the basement is not free of dampness, wetness, or obvious structural problems that might affect the health and safety of occupants or the soundness of the Structure. The Mortgagee must confirm that all foundations will be serviceable for the life of the mortgage and adequate to withstand all normal loads imposed. Note: Finished basements are not included in the total gross living area.

The Office of Single-Family Housing’s implementation of the Department's Lead Safe Housing program will include the provision of full lead-based paint inspections (rather than only paint testing) of all HUD Real Estate Owned (REO) properties constructed before 1978 that are sold with FHA-insured financing. If the inspection identifies the presence of deteriorated lead-based paint, properties sold with FHA insurance will be subject to lead-based paint stabilization of such paint and clearance testing. HUD will only order a lead-based paint evaluation for HUD REO properties constructed before 1978 and purchased with FHA-insured financing.

In cases where a borrower has switched Mortgagees, the first Mortgagee must, at the borrower’s request, transfer the appraisal to the second Mortgagee within five business days. The appraiser is not required to provide the appraisal to the new Mortgagee. The client’s name on the appraisal does not need to reflect the new Mortgagee. If the original Mortgagee has not been reimbursed for the cost of the appraisal, the Mortgagee is not required to transfer the appraisal until it is reimbursed. The second Mortgagee may not request the appraiser to re-address the appraisal. If the second Mortgagee finds deficiencies in the appraisal, the Mortgagee must order a new appraisal. The new Mortgagee must enter the borrower’s information in FHA Connection. The new Mortgagee must collect an appraisal fee from the borrower, and send the fee to the original Mortgagee, who, in turn, must refund the fee to the original borrower. A second appraisal may only be ordered by the second Mortgagee under the following limited circumstances: • the first appraisal contains material deficiencies as determined by the underwriter for the second Mortgagee; • the Appraiser performing the first appraisal is prohibited from performing appraisals for the second Mortgagee; or • the first Mortgagee fails to provide a copy of the appraisal to the second Mortgagee in a timely manner, and the failure would cause a delay in closing and harm to the Borrower, including loss of interest rate lock, violation of purchase contract deadline, occurrence of foreclosure proceedings and imposition of late fees. For additional information see Handbook 4000.1 II.A.1.a.iii(B)(8) and (9)

No. Your state appraisal regulatory office must send an update to the National Registry in order for your status to be changed in the FHA appraiser roster. The Appraisal Subcommittee (ASC) does not independently make changes to individual records in the National Registry.

The Mortgagee must order a new appraisal for each mortgage or refinance case number assignment and may not reuse an appraisal that was performed under another case number, even if the prior appraisal is not yet more than 120 days old.

The FHA appraisal validity period is 120 days. The 120 day validity period for an appraisal may be extended for 30 days at the option of the mortgagee if: (1) the mortgagee approved the borrower or HUD issued the Firm Commitment before the expiration of the original appraisal; or (2) the borrower signed a valid sales contract prior to the expiration date of the appraisal. An appraisal update must be performed before the initial appraisal, with no extension, has expired. Where the initial appraisal is subsequently updated, the updated appraisal is valid for a period of 240 days after the effective date of the initial appraisal report that is being updated. For additional information see Handbook 4000.1 II.A.1.a.i(A)(1)(b) available at

The following guidance may be used immediately for existing cases and must be used for FHA case numbers assigned on or after January 4, 2021. The Mortgagee must provide the Appraiser with a fully executed form HUD-92541 Builder’s Certification of Plans, Specifications and Site, signed and dated no more than 30 Days prior to the date the appraisal was ordered, and

For Properties 90 percent completed or less, the Mortgagee must provide a copy of the floor plan, plot plan, and any other exhibits necessary to allow the Appraiser to determine the size and level of finish of the home they are appraising.

For Properties greater that 90 percent but less than 100 percent complete, the Mortgagee must provide the Appraiser with a list of components to be installed or completed after the date of inspection.

When New Construction is less than 90 percent complete at the time of the appraisal, the Appraiser must document the floor plan, plot plan, and exhibits necessary to determine the size and level of finish. When New Construction is 90 percent or more complete, the Appraiser must document a list of components to be installed or completed after the date of appraisal.

FHA does not require a survey of the property. However, the lender may require a survey and the borrower can be charged for a property survey.

If the Mortgagee notified the Appraiser or the Appraiser has evidence that a Property is contaminated by the presence of methamphetamine (meth), either by its manufacture or by consumption, the Appraiser must render the appraisal subject to the Property being certified safe for habitation. A Property identified as contaminated by the presence of methamphetamine (meth), either by the manufacture or consumption, is ineligible due to this environmental hazard until the Property is certified safe for habitation. If the effective date of the appraisal is prior to certification that the Property (site and dwelling) is safe for habitation, the Appraiser will complete the appraisal subject to certification that the Property is safe for habitation. If the effective date of the appraisal is after certification that the Property (site and dwelling) is safe for habitation, and the Mortgagee has provided a copy of the certification by the certified hygienist, the Appraiser must include a copy of the certification in the appraisal report. The Appraiser must analyze and report any long-term stigma caused by the Property’s contamination by meth and the impact on value or marketability. For additional information see Handbook 4000.1 II.A.3.a.ii(L) and II.D.3.m.ii

The Mortgagee must provide the appraiser with a fully executed form HUD-92541, Builder's Certification of Plans, Specifications, and Site, signed and dated no more than 30 days prior to the date the appraisal was ordered.

For properties 90 percent completed or less, the Mortgagee must provide a copy of the floor plan, plot plan, and any other exhibits necessary to allow the appraiser to determine the size and level of finish of the house they are appraising. For properties greater than 90 percent but less than 100 percent completed, the Mortgagee must provide the appraiser with a list of components to be installed or completed after the date of inspection. For additional information see Handbook 4000.1 II.A.8.i.v and II.D.1.b available at

A manufactured home must have been constructed on or after June 15, 1976, in conformance with the federal Manufactured Home Construction and Safety Standards (MHCSS), as evidenced by an affixed HUD Certification Label or a letter of label verification issued on behalf of HUD. Manufactured Homes produced prior to this date are ineligible for FHA-insured financing.

For additional information see Handbook 4000.1 II.D.5.b.

Manufactured Housing refers to structures that are transportable in one or more sections. Manufactured Housing may also be referred to as mobile housing, sectionals, multi-sectionals, double-wide, triple-wide or single-wide.

To be eligible for FHA mortgage insurance as a Single Family Title II Mortgage, all Manufactured Housing must comply with the following:

have a floor area of not less than 400 sq. feet;

be constructed on or after June 15, 1976, in compliance with the Federal Manufactured Home Construction and Safety Standards as evidenced by the affixed HUD Certification Label;

the Manufactured Home and site exist together as a real estate entity in accordance with state law (but need not be treated as real estate for purposes of state taxation);

be built and remain on a permanent chassis;

be designed to be used as a dwelling with a permanent foundation built in accordance with the Permanent Foundations Guide for Manufactured Housing (PFGMH);

have been directly transported from the manufacturer or the dealership to the site;

the finished grade elevation beneath the Manufactured Home or, if a basement is used, the grade beneath the basement floor is at or above the 100-year return frequency flood elevation; and

be designed for occupancy as a Principal Residence by single family or a lease that meets Valuation of Leasehold Interests requirements.

For additional information see Handbook 4000.1 II.A.1.b.iv(B)(7) and II.D.5.a. and b.

Manufactured units may be moved only from the manufacturer's or dealer's lot to the site on which the unit will be insured. The manufactured unit must not have been installed or occupied previously at any other site or location.

For additional information see Handbook 4000.1 II.D.5.b

If the Appraiser observes additions or structural changes to the original manufactured home, the Appraiser must condition the appraisal upon inspection by the state or local jurisdiction administrative agency that inspects manufactured housing for compliance, or a licensed structural engineer may report on the structural integrity of the manufactured dwelling and the addition if the state does not employ inspectors.

For additional information see Handbook 4000.1 II.D.5.i.

Data Plate refers to a paper document located on the interior of the property that contains specific information about the unit and its manufacturer. Manufactured homes have a data plate affixed in a permanent manner, typically adjacent to the electric service panel, the utility room or within a cabinet in the kitchen.

The appraiser must report the information on the data plate within the appraisal, including the manufacturer name, serial number, model and date of manufacture, as well as wind, roof load and thermal zone maps. If the data plate is missing or the appraiser is unable to locate it, the appraiser must report this in the appraisal and is not required to secure the data plate information from another source. For more information see Handbook 4000.1 II.D.5.g

The Mortgagee may obtain a copy of the foundation certification from a previous FHA-insured Mortgage, showing that the foundation met the guidelines published in the Permanent Foundations Guide for Manufactured Housing (PFGMH) that were in effect at the time of certification, provided there are no alterations and/or observable damage to the foundation since the original certification.

If the Appraiser notes additions or alterations to the Manufactured Housing unit, the Mortgagee must ensure the addition was addressed in the foundation certification. If the additions or alterations were not addressed in the foundation certification, the Mortgagee must obtain: • an inspection by the state administrative agency that inspects Manufactured Housing for compliance; or • certification of the structural integrity from a licensed structural engineer if the state does not employ inspectors. For more information see Handbook 4000.1 II.A.1.b.iv(B)(7)(c)(ii)

The Appraiser must include a sufficient number of sales to produce a credible value. The Appraiser must include at least two Manufactured Homes in the Sales Comparison Approach (SCA) Grid, except when the subject Manufactured Home has been certified based on the construction requirements of Fannie Mae's MH Advantage® or Freddie Mac's CHOICEHome® program — if that certification criteria is met, the appraiser must include at least two comparable sales with similar certification, when available.

Additional information related to appraisal comparable selection for Manufactured Homes that have been certified under the Fannie Mae MH Advantage® or the Freddie Mac CHOICEHome® program is available in Mortgagee Letter 2020-48 . Instructions detailing specific requirements for reporting the results of the appraisal are found in the FHA Single Family Housing Appraisal Report and Data Delivery Guide at: https://www.hud.gov/program_offices/housing/sfh/handbook_references For additional information, see: Handbook 4000.1 II.D.5.k at

The Appraiser must include a sufficient number of sales to produce a credible value. At least two of the comparable sales properties must be Manufactured Homes in the Sales Comparison Approach (SCA) Grid, except for Fannie Mae's MH Advantage® or Freddie Mac's CHOICEHome® certified homes, for which appraisers must include at least two comparable sales with similar certification, when available.

For Appraisal with effective dates on or after December 22, 2020 through December 31, 2022, for a Manufactured Home certified based on the construction requirements of Fannie Mae's MH Advantage® or Freddie Mac's CHOICEHome® program, the Appraiser must include at least two comparable sales with similar certification, when available. If less than two comparable MH Advantage® or CHOICEHome® sales are available, the Appraiser must supplement with the most appropriate sales available, which may include site-built homes, and must provide detailed explanation justifying and supporting the Appraiser’s selection of comparable properties and the adjustments made for dissimilarities to the subject Property. A Manufactured Home certified according to the construction requirements of Fannie Mae's MH Advantage® or Freddie Mac's CHOICEHome® programs must have Fannie Mae's MH Advantage® Sticker or Freddie Mac's CHOICEHome® Label affixed near the HUD Data Plate. The Appraiser must include photos of the Fannie Mae's MH Advantage® Manufacturer Sticker or Freddie Mac's CHOICEHome® Label, with clear Identification Number or CHOICEHome® Number exhibited, in the appraisal report for the Manufactured Home to meet the documentation requirement. Instructions detailing specific requirements for reporting the results of the appraisal are found in the FHA Single Family Housing Appraisal Report and Data Delivery Guide at https://www.hud.gov/program_offices/housing/sfh/handbook_references For additional information, see: Handbook 4000.1 II.D.5.k

The towing hitch and Running Gear must be removed. Running Gear refers to a mechanical system designed to allow the manufactured housing unit to be towed over public roads.

For additional information see Handbook 4000.1 II.D.5.d.

The permanent foundation of a Manufactured Home that is eligible for FHA mortgage insurance is built in accordance with the Permanent Foundations Guide for Manufactured Housing (PFGMH).

The Mortgagee must obtain a certification by an engineer or architect, who is licensed/registered in the state where the Manufactured Home is located, attesting to compliance with the PFGMH. The Mortgagee may obtain a copy of the foundation certification from a previous FHA-insured Mortgage, showing that the foundation met the guidelines published in the PFGMH that were in effect at the time of certification, provided there are no alterations and/or observable damage to the foundation since the original certification. If the Appraiser notes additions or alterations to the Manufactured Housing unit, the Mortgagee must ensure the addition was addressed in the foundation certification. If the additions or alterations were not addressed, the lender must obtain:

an inspection by the state administrative agency that inspects Manufactured Housing for compliance; or

certification of the structural integrity from a licensed structural engineer if the state does not employ inspectors.

For New Construction, the space beneath the house must be enclosed by a continuous foundation type construction designed to resist all forces to which it is subject without transmitting forces to the building superstructure. The enclosure must be adequately secured to the perimeter of the house and be constructed of materials that conform, accordingly, to HUD MPS (such as concrete, masonry or treated wood) and the PFGMH for foundations. For Existing Construction, if the perimeter enclosure is non-load-bearing skirting comprised of lightweight material, the entire surface area of the skirting must be permanently attached to backing made of concrete, masonry, treated wood or a product with similar strength and durability. For more information see Handbook 4000.1 II.A.1.b.iv(B)(7)(b) and II.A.1.b.iv(B)(7)(c)(ii) and II.D.5.c

Skirting refers to a non-structural enclosure of a foundation crawl space intended to ensure the crawl space is free from exposure to the elements and free from vermin, trash, and debris. Typically, but not always, it is a lightweight material such as vinyl or metal attached to the side of the Structure, extending to the ground (generally, not installed below frost depth).

Skirting, when applicable, must extend from the bottom of the Manufactured Home to the permanent foundation, or to the perimeter enclosure, whichever is appropriate for the situation. This skirting must be permanently affixed to both the Manufactured Home and the foundation or perimeter enclosure, as appropriate. Perimeter enclosure refers to a continuous wall that is adequately secured to the perimeter of the unit and allows for proper ventilation of the crawl space. If the perimeter enclosure of Existing Construction for Manufactured Housing is non-load-bearing skirting comprised of lightweight material, the entire surface area of the skirting must be permanently attached to backing made of concrete, masonry, treated wood or a product with similar strength and durability. The Appraiser must notify the Mortgagee and report a deficiency of Minimum Property Requirements (MPR) or Minimum Property Standards (MPS) if the Manufactured Housing unit is not properly enclosed or the skirting is not properly affixed and/or is not serving its intended purpose. The Appraiser must call for repairs or further inspection, when warranted. For additional information see Handbook 4000.1 II.D.5.c and II.D.5.e

Stationary storage tanks that contain flammable or explosive material pose potential hazard to housing, including hazards from fire and explosions.

If the subject property line is within 300 feet of an aboveground, stationary storage tank with a capacity of 1,000 gallons or more of flammable or explosive material, then the Property is ineligible for FHA insurance. Additionally, the Appraiser must notify the Mortgagee and consider the effect of excessive smoke, chemical fumes, noxious odors, stagnant ponds or marshes, poor surface drainage or excessive dampness threaten the health and safety of the occupants or the marketability of the Property. The Appraiser must consider the effect of the condition in the valuation of the Property if the conditions exist but do not threaten the occupants or marketability. If the conditions described above exist, the Appraiser must notify the Mortgagee of the deficiency of Minimum Property Requirements (MPR) or Minimum Property Standards (MPS), so the Mortgagee can determine the eligibility. For additional information see Handbook 4000.1 II.D.3.b.iii(C)(6)-(7)

When an Individual Water Supply System is present, the Appraiser must report on the availability of connection to a public and/or Community Water System and any jurisdictional conditions requiring connection. When the Appraiser obtains evidence that any of the water quality requirements are not met, the Appraiser must notify the Mortgagee and provide an estimated cost to cure. The Mortgagee must confirm that a connection is made to a public or Community Water System whenever feasible and available at a reasonable cost. If connection costs to the public or community system are not reasonable, the existing onsite systems are acceptable, provided they are functioning properly and meet the requirements of the local health department. When an Individual Water Supply System is present, the Mortgagee must ensure that the water quality meets the requirements of the health authority with jurisdiction. If there are no local (or state) water quality standards, then water quality must meet the standards set by the Environmental Protection Agency (EPA), as presented in the National Primary Drinking Water regulations in 40 CFR §§ 141 and 142.

A well water test is required for, but not limited to, Properties:

that are newly constructed;

where an Appraiser has reported deficiencies with a well or the well water;

where water is reported to be unsafe or known to be unsafe;

located in close proximity to dumps, landfills, industrial sites, farms (pesticides) or other sites that could contain hazardous wastes; or

where the distance between the well and septic system is less than 100 feet.

All testing must be performed by a disinterested third party. This includes the collection and transport of the water sample collected at the water supply source. The sample must be collected and tested by the local health authority, a commercial testing laboratory, a licensed sanitary engineer, or other party that is acceptable to the local health authority. At no time will the Borrower/owner or other Interested Party collect and/or transport the sample. The following provides the minimum requirements for water wells: NEW CONSTRUCTION

Lead-free piping;

Wells must deliver a continuous water flow of five gallons per minute over at least a four-hour period.

EXISTING CONSTRUCTION

Existing wells must deliver a continuous water flow at a minimum of three gallons per minute;

No exposure to environmental contamination;

Continuing supply of safe and potable water;

Domestic hot water; and

Water quality must meet requirements of local jurisdiction or the EPA if no local standard.

For additional information see:

Handbook 4000.1, Sections II.A.3.a.ii(O)(1)–(2), and II.D.3.o.v-vii

The following guidance may be used immediately for existing cases and must be used for FHA case numbers assigned on or after January 4, 2021.

New Construction refers to Proposed Construction, Properties Under Construction, and Properties Existing Less than One Year as defined below:

Proposed Construction refers to a Property where no concrete or permanent material has been placed. Digging of footing is not considered permanent.

Under Construction refers to the period from the first placement of permanent material to 100 percent completion with no Certificate of Occupancy (CO) or equivalent.

Existing Less than One Year refers to a Property that is 100 percent complete and has been completed less than one year from the date of the issuance of the CO or equivalent. The Property must have never been occupied.

FHA treats the sale of an occupied Property that has been completed less than one year from the issuance of the CO or equivalent as an existing Property.

The following property types are eligible for New Construction Financing:

Site Built Housing (one- to four-units);

Condominium units in Approved Projects or Legal Phases;

Manufactured Housing

For additional information see Handbook 4000.1 II.A.8.i.i and II.A.8.i.ii

The Appraiser must notify the Mortgagee of the deficiency of Minimum Property Requirements (MPR) or Minimum Property Standards (MPS) if the roof covering does not prevent entrance of moisture or provide reasonable future utility, durability and economy of maintenance and does not have a remaining physical life of at least two years.

The Appraiser must observe the roof to determine whether there are deficiencies that present a health and safety hazard or do not allow for reasonable future utility. The Appraiser must identify the roofing material type and the condition observed in the “Improvements” section of the report. The Appraiser must report if the roof has less than two years of remaining life, and make the appraisal subject to inspection by a professional roofer. When the Appraiser is unable to view the roof, they must explain why the roof is unobservable and report the results of the assessment of the underside of the roof, the attic, and the ceilings. For additional information see Handbook 4000.1 II.D.3.g

The appraiser must analyze and report if close proximity to heavily traveled roadways or railways has an effect on the marketability and value of a site because of excess noise and safety issues.

For additional information see Handbook 4000.1 II.D.3.b.iii(C)(1)

A borrower must be a native Hawaiian who is at least 18 years of age and certified as eligible to hold a Hawaiian Home Lands Lease, or possesses a lease of Hawaiian Home Lands issued under Section 207(a) of the Hawaiian Homes Commission Act, 1920, that has been certified by the Department of Hawaiian Home Lands (DHHL) as being a valid current lease, and not in default.

Native Hawaiian means a descendant of not less than 50 percent part of the blood of the races inhabiting the Hawaiian Islands before January 1, 1778 (or, in the case of an individual who succeeds a spouse or parent in an interest in a lease of Hawaiian Home Lands, such lower percentage as may be established for such succession under Section 209 of the Hawaiian Homes Commission Act, 1920, or under the corresponding provision of the constitution of the State of Hawaii adopted under Section 4 of the Act entitled, “An Act to provide for the admission of the State of Hawaii into the Union,” approved March 18, 1959). 12 U.S.C. § 1715z-12(d)(1). Certificates of Eligibility are issued by DHHL and certify that the Borrower possesses a homestead lease in good standing (not canceled or in default). The mortgagee must verify and obtain documentation that the borrower has a Certificate of Eligibility for an existing Hawaiian Home Land lease issued by DHHL, or possesses a lease of Hawaiian Home Lands issued under Section 207(a) of the Hawaiian Homes Commission Act, 1920 (42 Stat. 110). To obtain a Certificate of Eligibility, the mortgagee must submit a Request for Certification of Eligibility form to the DHHL. DHHL will issue the Certification of Eligibility to the mortgagee. For additional information see Handbook 4000.1 II.A.8.h

The Uniformed Standards Professional Appraiser Practice (USPAP), requires appraisers to analyze all prior sales of the subject property within the past three (3) years for all types of real property (including one-to-four family), if such information is available in the normal course of business. Except under limited circumstances, a re-sale within 90 days of the last sale is not eligible for an FHA-insured Mortgage. The temporary waiver of FHA's regulation that prohibits the use of FHA financing to purchase single family properties that are being resold within 90 days of the previous acquisition, expired on December 31, 2014.

For policy information see Handbook 4000.1 Section II.A.1.b.iv(A)(3) and II.D.4.c.iii

Property Flipping is indicative of a practice whereby recently acquired property is resold for a considerable profit with an artificially inflated value.

The term Property Flipping refers to the purchase and subsequent resale of a property in a short period of time. The eligibility of a property for a Mortgage insured by FHA is determined by the time that has elapsed between the date the seller acquired title to the property and the date of execution of the sales contract that will result in the FHA-insured Mortgage. FHA defines the seller’s date of acquisition as the date the seller acquired legal ownership of that property. FHA defines the resale date as the date of execution of the sales contract by all parties intending to finance the Property with an FHA-insured Mortgage.

Resales Occurring within 90 Days or Fewer After Acquisition: A property that is being resold within 90 days or fewer following the current owner’s date of acquisition is not eligible for an FHA-insured Mortgage. Resales Occurring Between 91-180 Days After Acquisition: A Mortgagee must obtain a second appraisal by another appraiser if:

the resale date of a property is between 91 and 180 days following the acquisition of the property by the seller's; and

the re-sale price is 100 percent “over the purchase price” paid by the seller to acquire the property.

The required second appraisal from a different appraiser must include documentation to support the increased value.

If the second appraisal supports a value of the property that is more than 5 percent lower than the value of the first appraisal, the lower value must be used as the property value in determining the adjusted value. The cost of the second appraisal may not be charged to the borrower. The Mortgagee must obtain a 12-month chain of title documenting compliance with time restrictions on resales.

Exceptions to FHA property flipping restrictions are made for:

properties acquired by an employer or relocation agency in connection with the relocation of an employee;

resales by HUD under its real estate owned (REO) program;

sales by other U.S. government agencies of Single Family Properties pursuant to programs operated by these agencies;

sales of properties by nonprofits approved to purchase HUD-owned Single Family properties at a discount with resale restrictions;

sales of properties that are acquired by the seller by inheritance;

sales of properties by state and federally-chartered financial institutions and Government-Sponsored Enterprises (GSE);

sales of properties by local and state government agencies; and

sales of properties within Presidentially Declared Major Disaster Areas (PDMDA), only upon issuance of a notice of an exception from HUD.

The restrictions listed above and those in 24 CFR 203.37a do not apply to a builder selling a newly built house or building a house for a borrower planning to use FHA-insured financing.

FHA's property flipping regulation 24 CFR 203.37a is available at: https://www.ecfr.gov/ For more information see Handbook 4000.1 II.A.1.b.iv(A)(3)

No. Property flipping is a practice whereby a recently acquired property is resold, often for a considerable profit. If there is a partial continuity of ownership, a quit claim deed transaction is not a sale and is not subject to the rules prohibiting property flipping. The use of a quit claim will not be deemed a flip as long as at least one of the original owners retains an ownership interest in the property after the quitclaim is recorded.

FHA's property flipping regulation 24 CFR 203.37a is available at https://www.ecfr.gov/ For more information see Handbook 4000.1 II.A.1.b.iv(A)(3)

The eligibility of a Property for a Mortgage insured by FHA is determined by the time that has elapsed between the date the seller has acquired title to the Property and the resale date.

FHA defines the Seller’s Date of Acquisition as the date the seller acquired legal ownership of that Property. FHA defines the Resale Date as the date all parties have executed the sales contract that will result in the FHA-insured Mortgage for the resale of the Property. FHA's property flipping regulation 24 CFR 203.37a is available at http://www.ecfr.gov/ For more information see Handbook 4000.1 II.A.1.b.iv.(A)(3)(b)(i)

Defective Conditions

The appraiser must identify defective conditions that are curable and will make the property comply with MPR, and provide an estimated cost to cure.

Defective conditions include:

defective construction,

evidence of continuing settlement,

excessive dampness,

leakage, decay, termites

environmental hazards, OR

other conditions affecting health/safety of occupants, collateral security, or structural soundness of the dwelling.

The appraiser must also provide photographic documentation in the report.

Encroachments

An encroachment may cause a property to be ineligible. The appraiser must identify any encroachments of:

the subject’s dwelling, garage, or other improvement onto an adjacent property, right-of-way, utility easement, or AND

a neighboring dwelling, garage, or other physical structure or improvements on the subject property.

The appraiser must notify the mortgagee if it appears an encroachment affects the subject property.

For additional information see Handbook 4000.1 II.A.3.a.ii(A)

Excess and Surplus Land

A highest and best use analysis must be included to support the appraiser’s

conclusion of excess land. Surplus land must be included in the valuation.

If the subject contains

two or more legally conforming platted lots under one legal description and

ownership, and

the second vacant lot is capable of being divided and/or developed as a

separate parcel,

the second lot

is treated as excess land, and

the value of the second lot must be excluded from the final value conclusion.

The appraiser must provide a value of the principal site and improvements under a

hypothetical condition

For additional information see Handbook 4000.1 II.D.3.vi (A)

Heating and Cooling Systems

The property must have a permanently installed heating system that automatically heats the living areas of the house to a minimum of 50 degrees F in all GLAs, and

is safe to operate and provides healthful and comfortable heat

relies upon a fuel source that is readily obtainable with the subject’s

geographic area

has market acceptance within the subject’s marketplace; and

operates without human intervention for extended periods of time.

Air conditioning is not required, but,

if installed, must be operational.

For additional information see Handbook 4000.1 II.D.3. f.i.

Required Analysis and Reporting for Individual Water Supply Systems

The appraiser must be familiar with the minimum distance requirements between private wells and sources of pollution, and comment on them, if discernable.

The appraiser is

not required to sketch or note distances between the well, property lines,

septic tanks, drain fields, or building structures, but

may provide estimated distances where they are comfortable doing so.

If available, the homeowner or mortgagee should provide the appraiser with a

copy of a survey, or other documents attesting to the separation distances

between the well and septic system or other sources of pollution.

If the Property has a septic system, the Appraiser must visually observe it for any signs of failure or surface evidence of malfunction. If there are readily observable deficiencies, the Appraiser must require repair or further inspection.

For additional information see Handbook 4000.1 II.D.3.iii, C.

Call or Text: (800) 900-8569

Email Us: [email protected]

What is an FHA Case Number on FHA Home Loans

This blog will cover and discuss the FHA case number on new FHA mortgage applications. We will also discuss transfers from one lender to a new lender. FHA loans are the most popular loan program in the U.S. Borrowers with lower prior bad credit scores can benefit from FHA loans compared to conventional loans. Not all lenders have the same lending guidelines. Mortgage lenders can have lender overlays.

Lenders will consider your debt-to-income ratio on your ability to repay your mortgage loan. HUD guidelines generally allow for a higher debt-to-income ratio than other loan programs.

HUD, the parent of FHA, created and launched FHA loans so first-time homebuyers and buyers with less than-perfect credit can qualify for a home loan. HUD’s mission is to promote homeownership to hard-working American families by making homeownership affordable. In the following paragraphs, we will cover what the FHA case number is and how the FHA case number process works.

Table of contents "Click Here"

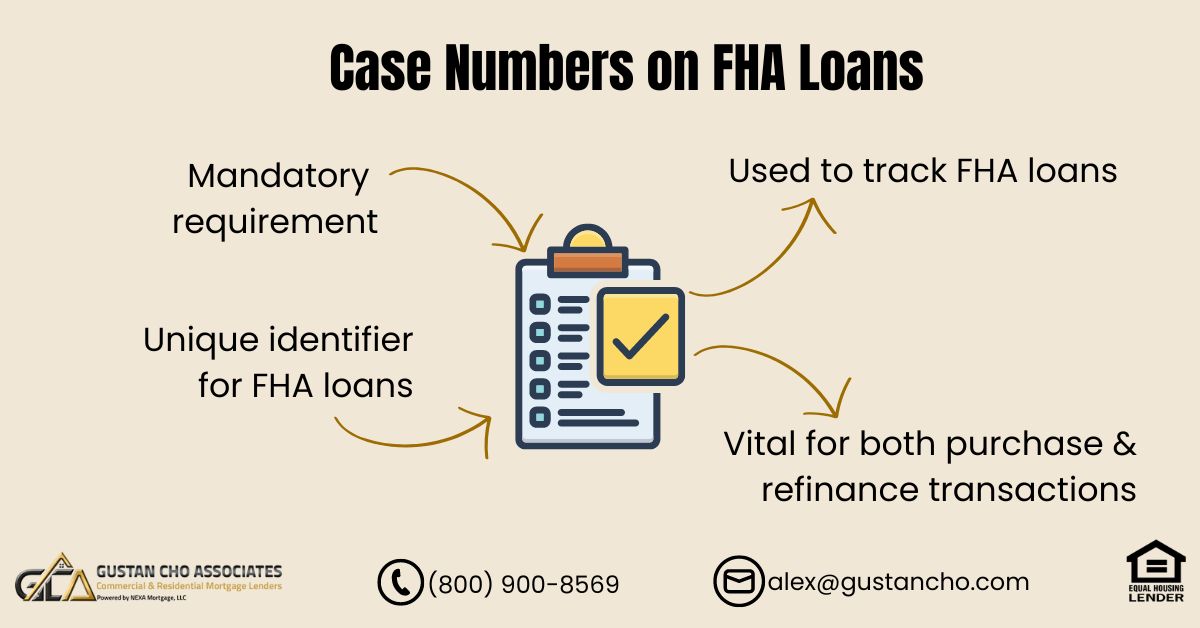

What is the Definition of an FHA Case Number

An FHA case number is a unique identifier assigned to a specific FHA-insured mortgage loan. The Federal Housing Administration (FHA) uses case numbers to track and manage the various loans it insures. When a borrower applies for an FHA-insured home loan, the lender initiates the loan process by obtaining an FHA case number. The FHA case number is crucial for tracking and managing the loan. It is used in various documents and systems related to the FHA-insured loan, including endorsements, claims, and other administrative processes.

Speak With Our Loan Officer for Getting Mortgage Loans

How Does the FHA Case Number Process Work

Here’s how the FHA case number process generally works: The borrower applies for an FHA-insured mortgage loan through a HUD-approved lender. The lender submits the necessary information of the borrower and the loan to the FHA for approval. This includes details such as borrower information, property details, and terms.

Once HUD receives the loan information, it assigns a unique case number to that specific loan application. HUS reviews the loan application and, if everything meets its requirements, provides approval for the loan.

With FHA approval, the lender can proceed with processing and underwriting the loan. If the loan is approved and closes, it becomes an FHA-insured loan, and the FHA case number remains associated with that loan throughout its life. Borrowers and lenders use the FHA case number for reference when communicating with the FHA or accessing loan information. It helps ensure that all parties can easily identify and track the specific FHA-insured loan.

Benefits of FHA Loans

HUD established mortgage guidelines that are accommodating in terms of down payments and credit requirements. As the overseeing entity of the FHA, HUD aims to enable diligent Americans to achieve homeownership. FHA loans prove advantageous for those with limited funds for a down payment, lower credit scores, higher debt-to-income ratios, bankruptcy or a prior housing event.

Thanks to the government guarantee, lenders have the flexibility to provide FHA loans for home purchases with a minimal 3.5% down payment.

Homebuyers need a credit score as low as 580, all while offering attractive mortgage rates. FHA loans are popular among homebuyers, especially those with less-than-perfect credit and lower credit scores. Remember that guidelines may be subject to change, so it’s essential to verify the latest update on the HUD 4000.1 FHA Handbook with a mortgage professional.

HUD Down Payment Requirements on FHA Loans

The down payment requirement on FHA loans differs depending on the credit score. If you have at least a 580 credit score, the down payment required is 3.5% of the purchase price. If your credit scores fall under 580 and down to 500, a 10% down payment is required on FHA loans. The low down payment requirement makes it possible for renters with a small down payment to become homeowners.

HUD Mortgage Insurance Premium (MIP)

FHA loans require borrowers to pay an upfront mortgage insurance premium (UFMIP) at closing and an annual mortgage insurance premium (MIP) throughout the life of the loan. This is to protect the lender in case of default. FHA loan limits vary by county and are adjusted annually. There are limits on the maximum loan amount you can borrow based on the property’s location.

FHA 203(k) Rehabilitation Loans

HUD offers acquisition and renovation loans for one to four units of owner-occupant homers. HUD offers a 203(k) program that allows borrowers to finance a home’s purchase and rehabilitation costs in one loan. FHA loans do not have prepayment penalties, allowing borrowers to pay off the mortgage early without incurring additional fees.

We highly recommend you contact multiple lenders to compare their requirements and terms is recommended if you’re considering an FHA loan.

It’s crucial to note that individual lenders may have additional requirements or overlays beyond the basic HUD guidelines. You should check the official HUD website or consult a mortgage professional familiar with FHA loan guidelines for the most current and accurate information. Remember that these guidelines may have been updated or changed without notice.

HUD Agency Guidelines on FHA Loans

Borrowers applying for an FHA loan will be assigned an FHA Case Number. Borrowers will need to meet the minimum agency mortgage guidelines on FHA loans. HUD allows homebuyers to purchase a home with a 3.5% down payment and a 580 credit score.

Borrowers with under 580 down to 500 credit scores can qualify for FHA loans. However, any borrower with under 580 credit scores will need a 10% versus 3.5% down payment.

Borrowers can qualify for an FHA loan with a prior bankruptcy or foreclosure if they meet the minimum waiting period requirements. Outstanding collections and charged-off accounts do not have to be paid to qualify for FHA loans. HUD’s role is to promote homeownership for homebuyers of all types. All FHA borrowers will need an FHA case number. You can only have one FHA case number.

Speak With Our Loan Officer for FHA Loans

Importance of Case Numbers on FHA Loans

A mandatory requirement for all FHA loans is the inclusion of Case Numbers. The FHA Case Number, a distinctive 10-digit identifier, is allocated to each borrower’s loan file. The assignment of the Case Number is carried out through the case number assignment on FHA Connection . The term “case” refers to the specific FHA loan to which this number is assigned. Irrespective of whether it is a purchase or refinance, the Case Number is obligatory for every FHA loan and is assigned when a borrower applies for such loans.

How To Read FHA Case Number

The initial three digits of an FHA case number indicate the geographical area, including the county and state. The concluding three digits correspond to the ACT sections where FHA Insurance was issued for each property.

You can find the case number at the top of each page in a completed FHA home appraisal.

When a borrower utilizes an FHA loan to purchase a home, the assigned case number pertains to the purchased property. While case numbers can be transferred from one borrower to another, they cannot be transferred from one property to another.

How HUD Case Number Connections Work

Once a home buyer, pre-approved for an FHA loan, initiates the FHA loan process, the lender must acquire a Case Number for the property specified in the buyer’s contract. Nevertheless, the Case Number becomes null and void if the buyer opts not to proceed with the home purchase.

Getting a New FHA Case Number

If a borrower opts to acquire an additional property, obtaining a new Case Number for the second property becomes necessary. In the given scenario, should a different homebuyer wish to buy the initial property previously canceled by the initial borrower, the only requirement is for the new homebuyer to have the Case Number for the initially canceled property transferred to them. In cases where multiple lenders are involved, it can lead to delays in the mortgage process. Lenders holding the original case numbers must facilitate the release of the case Numbers to the new lender.

Qualify For FHA Loans, Click Here

How Long Is The FHA Case Number Valid

If an FHA loan with an assigned case number does not close within six months, the initial FHA case number will be voided. In the scenario where FHA modifies the HUD 4000.1 FHA Handbook, replacing it with a revised HUD Handbook that includes changes such as an increase in FHA MIP.

The changes on the updated revised HUD 4000.1 FHA Handbook, the alterations become effective for case numbers assigned on or after the date of the updated FHA programs and guidelines.

FHA case numbers assigned before this date will continue to be underwritten based on the guidelines before the changes as long as the FHA Loan closes within six months.

Qualifying For FHA Loans

FHA loans are the most popular loan program in the U.S. FHA loans are popular with first-time home buyers, home buyers with outstanding collections and charge-offs, buyers with higher debt-to-income ratios, and homebuyers with little to no credit. Here are the basic HUD guidelines on FHA loans:

- 580 FICO credit score

- 3.5% down payment

- 46.9% front end and 56.9% back end DTI

- Non-Occupant Co-Borrowers allowed

- 100% of the down payment can be gifted

- No Closing Costs: Closing Costs can be covered with seller concessions or lender credit

HUD requires that the property meets HUD agency standards and will be habitable to be eligible for an FHA loan. The HUD appraiser will assess the property to ensure it meets HUD’s minimum property requirements. To qualify for an FHA loan, don’t hesitate to contact us at Gustan Cho Associates at 1-800-900-8569 or text us for a faster response. Or email us at [email protected] . The Gustan Cho Associates Mortgage Group team is available 7 days a week, evenings, weekends, and holidays.

FAQs: What is an FHA Case Number on FHA Home Loans

What is an FHA Case Number, and why is it important? An FHA Case Number is a unique identifier assigned to a specific FHA-insured mortgage loan. It is crucial for tracking and managing the loan throughout its life. The case number is used in various documents and systems related to FHA-insured loans, including endorsements, claims, and administrative processes.

How does the FHA Case Number process work? The borrower applies for an FHA-insured mortgage through a HUD-approved lender. The lender submits necessary information to the FHA for approval, and a unique case number is assigned upon approval. This number remains associated with the loan, helping parties easily identify and track the specific FHA-insured loan.

What are the benefits of FHA loans? FHA loans are advantageous for those with limited funds for a down payment, lower credit scores, and higher debt-to-income ratios. They offer a minimal 3.5% down payment requirement, lower credit score thresholds, and flexibility for borrowers with past financial challenges.

What are the down payment requirements for FHA loans? The down payment requirement on FHA loans varies based on credit score. A credit score of at least 580 requires a 3.5% down payment, while scores below 580 to 500 require a 10% down payment. The low down payment makes homeownership accessible for those with limited funds.

What is the HUD Mortgage Insurance Premium (MIP)? FHA loans require borrowers to pay an upfront mortgage insurance premium (UFMIP) at closing and an annual mortgage insurance premium (MIP) throughout the loan’s life. This insurance protects lenders in case of default.

How are FHA Case Numbers connected to property purchases? The assigned case number pertains to the property purchased using an FHA loan. While case numbers can be transferred from one borrower to another, they cannot be transferred from one property to another.

How long is an FHA Case Number valid? If an FHA loan with an assigned case number does not close within six months, the initial case number becomes void. Changes in FHA guidelines or programs after the case number assignment date will only apply to loans closing after six months.

What are the basic HUD guidelines for qualifying for FHA loans? Basic HUD guidelines for FHA loans include a minimum FICO credit score of 580, a 3.5% down payment, front-end DTI of 46.9%, back-end DTI of 56.9%, allowance for non-occupant co-borrowers, and the option for 100% gifted down payment.

Can FHA loans be used for property rehabilitation? Yes, FHA offers a 203(k) rehabilitation program that allows borrowers to finance a home’s purchase and renovation costs in one loan.

We Work Weekends, Click Here For Contact Us

This blog about What is an FHA Case Number on FHA Home Loans was updated on January 25th, 2024.

Gustan Cho NMLS 873293 is the National Managing Director of NEXA Mortgage, LLC dba as Gustan Cho Associates NMLS 1657322. Gustan Cho and his team of loan officers are licensed in multiple states. Over 75% of the borrowers of Gustan Cho Associates (Gustan Cho Associates) are folks who could not qualify at other lenders due their lender overlays on government and conventional loans. Many mortgage borrowers and real estate professionals do not realize a mortgage company like Gustan Cho Associates exists. We have a national reputation of being a one-stop mortgage company due to not just being a mortgage company with no lender overlays but also offering dozens of non-QM and alternative financing loan programs. Any non-QM mortgage loan program available in the market will be offered by the team at Gustan Cho Associates. Our team of support and licensed personnel is available 7 days a week, evenings, weekends, and holidays.

Similar Posts

How Long is a Pre-Approval Valid When Shopping For a Home

Share on X (Twitter) Share on Facebook Share on Pinterest Share on LinkedIn Share on Email Share on Reddit How…

Bankruptcy Mortgage Guidelines on Waiting Period

Share on X (Twitter) Share on Facebook Share on Pinterest Share on LinkedIn Share on Email Share on Reddit In…

Bad Credit Mortgage Guidelines On Home Purchase And Refinance

Share on X (Twitter) Share on Facebook Share on Pinterest Share on LinkedIn Share on Email Share on RedditThis Article…

Recorded Date In Foreclosure Versus Surrender Date Of Home

Share on X (Twitter) Share on Facebook Share on Pinterest Share on LinkedIn Share on Email Share on RedditIn this…

Easy Online Mortgage Pre Approval Letter For Home Buyers

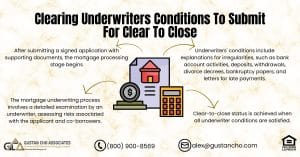

Clearing Underwriters Conditions To Submit For Clear To Close

Case number 091 4211637 what the status my mom passed away 03 03 2021 i submit all information to novad 04 2020 i have heras from them. I m her son contact aulkien mcgriff

Please contact us with your contact information at [email protected] . Or call us at 262-716-8151 or text us for a faster response.

My mother passed away in SEP 15-2021, my brother is the trustee to the trust of MARY L. GAY estate, he has kept me out of the loop such as reverse mortgage monthly statement. this is the case #044-4319571-952-34526, 37371807 second deed of trust. my Email is [email protected]

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

US Department of Housing and Urban Development

- Knowledge Base

- Submit A Question

- Display All Subcategories

- Appraisal Procedures

- Appraiser Approval/Eligibility

- Appraiser Roster Changes

- Documentation Requirements

- Electronic Appraisal (EAD)

- Manufactured Housing

- Property Eligibility

- Property Flipping

- Property Inspections

- System Support

- Allowable Closing Costs/Fees

- Case Binder Submission

- Case Cancellation

- Case Processing Status

- Case Reinstatement

- Case Transfer

- Lender Insurance

- MIC Correction Submission

- Mortgage Insurance

- Notice of Return (NOR)

- Title Issues

- Condominium Project Approval

- Condominium Project Approval Status

- Single Unit Approval (SUA)

- Energy Efficiency

- Find a Lender

- Forms and Publications

- General Purchase Info

- General Refinance Info

- Grant Programs

- Housing Counseling

- Mortgage Limits

- Spanish Language

- Appraisal Property Analysis

- Closing and Insuring

- COVID-19 Indemnification

- Credit Underwriting

- HUD NSC Loss Mitigation

- HUD NSC Servicing

- HUD Owned Properties

- Lender Approval / Eligibility

- LSC HECM Servicing

- Quality Control Compliance

- Rehabilitation Programs

- Assets/Funds to Close

- Automated Underwriting/Total

- Borrower Eligibility

- Credit Alert (CAIVRS)

- Credit History/Credit Report

- Employment and Income

- Liabilities

- Mortgage Calculation

- Purchase Transactions

- Refinance Transactions

- Secondary Financing

- Case Number Assignment

- Consumer Information

- Foreclosure/Conveyance

- HECM Servicing

- Rental Assistance

- Borrower Validation

- FHA Catalyst – Authorized Registration Form

- FHA Catalyst General Info

- FHA Catalyst: Case Binder Module

- FHA Catalyst: Claims Module

- FHA Catalyst: EAD Module

- FHA Catalyst: Mortgagee Admin

- FHA Catalyst: Multiple Modules

- FHA Catalyst: Servicing Module

- FHA Catalyst: SFDMS Module

- FHA List Serv

- General User Assistance

- ID/Password Issues

- Servicing Issues

- Escrow/Taxes/Insurance/HOA

- Loss Mitigation

- Preservation & Protection/Repairs/Inspections

- Treasury Homeowner Assistance Fund (HAF) Program

- Agent/Broker Information

- Asset Control Areas

- Bid Information

- Discount Programs

- Maintenance Issues

- Property Listings

- Annual Recert Requirements

- Branch Offices

- DE Mortgagee Approval

- Employee Requirements

- FHA Lender Lists

- Lender Application Procedures

- Lender Application Status

- Lender Approval Changes

- Lender Sanctions

- Operation Requirements

- Originating FHA Loans

- EHLP/Hardest Hit

- Federal Consumer Protection

- Federal Housing Programs

- FHA Loss Mitigation

- HASP/MHA Programs

- Mortgage Insurance Refunds

- Multifamily/Hospital Info

- Title I Servicing/Asset Mgt.

- 203(k) Consultant Updates/Recertification

- 203(k) Consultants Application/Eligibility

- DE Underwriters

- HCS Password Reset

- Housing Counseling Agencies

- Nonprofit Agencies/Governmental Entities

- Training Opportunities

- Compliance Issues

- Loan Review System (LRS)

- Neighborhood Watch

- Permissable Payments

- Quality Control Plan

- Reporting Fraud

- Test Case/Post Endorsement Loan Review

- Basic Eligibility Requirements

- Escrow Accounts

- Counseling Requirements

- HECM Collateral Assessment

- Processing Guidelines

- an inspection by the state administrative agency that inspects Manufactured Housing for compliance; or

- certification of the structural integrity from a licensed structural engineer if the state does not employ inspectors.

IMAGES

VIDEO

COMMENTS

Title I Manufactured Housing Loans menu is used to process cases (loans) related to purchasing a manufactured home/lot. Its menu options are described in the table below. Allows a lender to establish a case in HUD's Title I Insurance and Claims System (TIIS/F72) and obtain an FHA case number. Once the case number is assigned, it is used to ...

On the Case Number Assignment menu (Figure 1), click Update an Existing Case, and the Case Number Assignment - Update Existing Case page (Figure 8a) appears. Enter the case number assigned to the mortgage loan in the. Click to submit for processing. FHA Case Number field.

Case Detail, available on the Single Family Servicing (Monthly Premiums) menu, provides current information for all FHA cases, both endorsed and non-endorsed, based on the status of the requested case. If the case has not been insured, case information is retrieved from CHUMS, and CHUMS Last Action is displayed as the key status field.

Enter the nine-digit identifier issued through the FHA Connection for the completed Certificate of HECM Counseling, form HUD-92902.When the Case Number Assignment page is processed, the date HECM counseling was completed is displayed in the HECM Counsel Date field on the subsequent Case Number Assignment Results page.: Note: Click to the right of the field to display the pop-up HECM Counseling ...

numbers, including requesting an FHA case number, and requesting case number before appraiser assignment case numbers on sponsored originations NMLS ID for case number assignment, and requirements for obtaining case numbers. Change Date March 1, 2011 4155.2 1.D.3.a Requesting an FHA Case Number Lenders should request and cancel case numbers in ...